International Flavors & Fragrances PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

International Flavors & Fragrances Bundle

Navigate the complex external forces shaping International Flavors & Fragrances's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for this industry leader. Gain the strategic foresight needed to make informed decisions and secure your competitive advantage. Download the full PESTLE analysis now for actionable intelligence.

Political factors

International Flavors & Fragrances (IFF) navigates a complex web of government regulations concerning ingredients, impacting everything from food additives to fragrances. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued its scrutiny of food additives, with potential updates to GRAS (Generally Recognized As Safe) status for certain compounds that could affect IFF's flavor formulations.

Similarly, the European Food Safety Authority (EFSA) plays a critical role, and in late 2024, EFSA published revised guidance on the safety assessment of flavorings, which could necessitate reformulation or additional testing for some of IFF's products to maintain market access in the EU. These global regulatory shifts directly influence product development, labeling requirements, and the overall cost of compliance for IFF's extensive portfolio.

Global trade policies and tariffs are a significant concern for International Flavors & Fragrances (IFF) due to its extensive international operations. These policies directly affect IFF's supply chain, influencing the cost of raw materials and the competitiveness of its finished products across different markets.

For example, IFF has estimated its exposure to global tariffs to exceed $100 million for 2025, with a notable impact on trade with China. Such tariff impositions can alter pricing strategies and necessitate adjustments in sourcing and distribution networks to mitigate increased costs.

Changes in trade agreements or the imposition of new tariffs can lead to unpredictable fluctuations in IFF's operating expenses and profit margins. This requires continuous monitoring and strategic adaptation to maintain market position and profitability.

Geopolitical stability is a cornerstone for International Flavors & Fragrances (IFF) operations, directly impacting its extensive manufacturing and distribution infrastructure across the globe. Unforeseen political instability or escalating international conflicts in key markets can severely disrupt supply chains, leading to increased operational costs and diminished demand in affected regions. For instance, in 2023, ongoing geopolitical tensions in Eastern Europe impacted raw material sourcing and logistics for many global manufacturers, a challenge IFF would also navigate.

Promotion of Sustainable Initiatives

Government policies and incentives encouraging the use of sustainable and natural ingredients present a significant influence on International Flavors & Fragrances (IFF). These political directives can foster opportunities for IFF by rewarding investments in eco-conscious sourcing and product development. For instance, in 2024, the European Union continued to advance its Farm to Fork strategy, aiming for a more sustainable food system, which directly impacts ingredient sourcing for companies like IFF.

IFF can capitalize on these trends by highlighting its commitment to conscious sourcing and sustainable innovation. By aligning its business practices with government agendas that prioritize environmental responsibility, IFF can strengthen its market position and appeal to a growing consumer base that values sustainability. This strategic alignment can translate into a competitive advantage, particularly as regulations around ingredient sourcing and environmental impact become more stringent globally.

- Government Incentives: Many governments offer tax breaks or grants for companies investing in sustainable agricultural practices and renewable ingredient sourcing, a trend that is expected to continue and expand in 2024-2025.

- Regulatory Alignment: IFF's proactive approach to sustainable ingredient sourcing aligns with increasing global regulatory pressures, such as those seen in the EU's push for reduced chemical footprints in consumer products.

- Consumer Demand Driven by Policy: Political promotion of sustainability indirectly fuels consumer demand for natural and ethically sourced products, creating a favorable market environment for IFF's portfolio.

International Relations and Market Access

The current geopolitical climate significantly impacts International Flavors & Fragrances (IFF) by shaping its market access and operational capabilities. Favorable international relations, such as trade agreements and diplomatic stability, can unlock new growth opportunities and streamline operations in key regions. Conversely, escalating trade tensions or political instability can erect barriers, leading to increased tariffs or restricted market entry, directly affecting IFF's global supply chain and sales. For instance, ongoing trade disputes between major economies could influence the cost of raw materials and finished goods for IFF, a company that generated approximately $13.4 billion in net sales in 2023.

IFF's extensive network of strategic partnerships and its global footprint are intrinsically linked to the prevailing political landscapes. The company's ability to forge and maintain alliances with local distributors and manufacturers in diverse markets, including its significant presence in Europe which accounted for a substantial portion of its revenue in recent years, is directly influenced by the stability and nature of intergovernmental relationships. Political shifts can necessitate adjustments in market entry strategies or even lead to divestments in regions experiencing significant political upheaval, impacting IFF's overall business model and revenue streams.

- Trade Agreements: Favorable trade pacts, like the USMCA or ongoing EU trade negotiations, can reduce tariffs and simplify customs procedures for IFF's ingredients and finished products, potentially boosting sales in North America and Europe.

- Geopolitical Stability: Regions experiencing political stability, such as certain Asian markets where IFF has invested in manufacturing capabilities, offer more predictable operating environments and consumer demand.

- Regulatory Alignment: Harmonization of regulations across different countries, often facilitated by strong international relations, can ease IFF's product development and market approval processes, reducing compliance costs.

- Supply Chain Resilience: Strained international relations can disrupt global supply chains, impacting IFF's access to critical raw materials and increasing logistical costs, as seen with disruptions in shipping routes in 2024.

Government policies and trade agreements significantly shape International Flavors & Fragrances (IFF) operations, influencing market access and operational costs. For instance, in 2024, the U.S. continued to assess tariffs on goods from various nations, potentially impacting IFF's raw material procurement and finished product pricing in those markets.

IFF's strategic alignment with government initiatives promoting sustainability, such as the EU's Farm to Fork strategy, offers opportunities for growth and market differentiation, particularly as consumer demand for natural ingredients rises. This regulatory environment necessitates continuous adaptation in sourcing and product development to maintain compliance and competitive advantage across its global operations.

Geopolitical stability is crucial for IFF's extensive manufacturing and distribution network, with political shifts potentially disrupting supply chains and impacting demand in key regions. For example, in 2023, geopolitical tensions in Eastern Europe led to increased logistics costs for many global manufacturers, a challenge IFF would also have to navigate.

What is included in the product

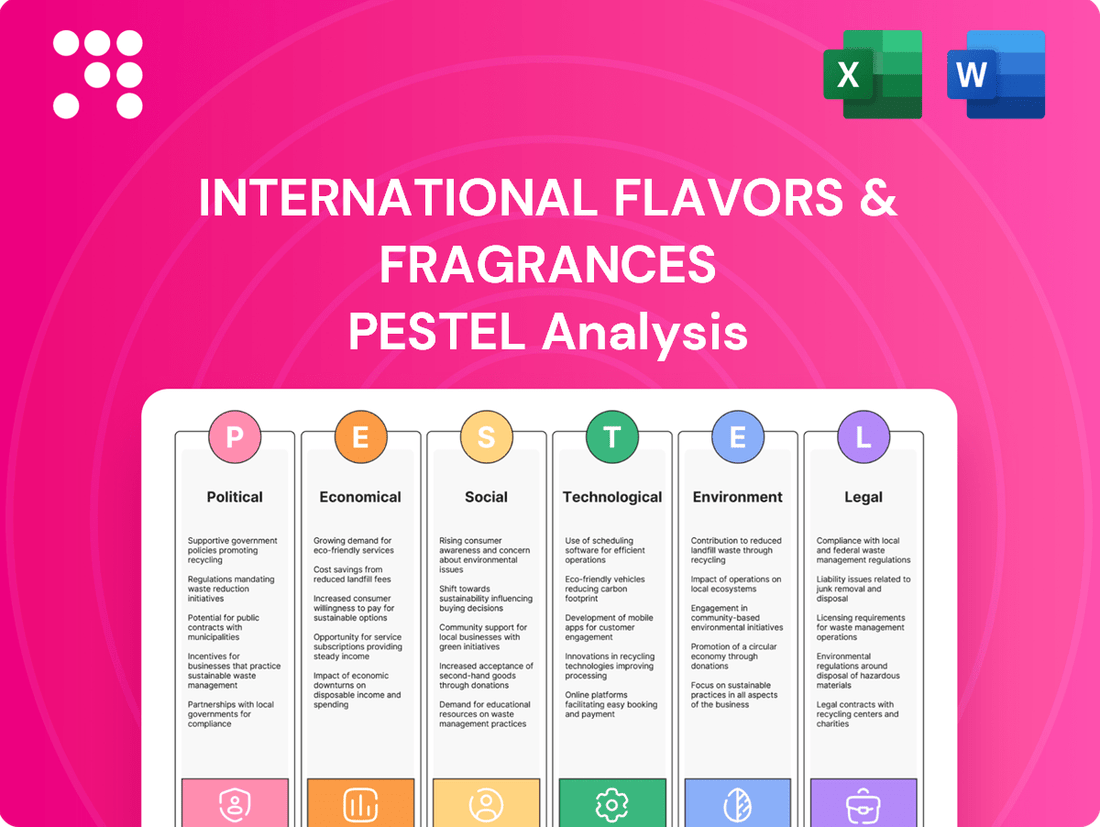

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting International Flavors & Fragrances, providing a comprehensive understanding of the external landscape.

It offers actionable insights for strategic decision-making by highlighting key trends and potential challenges and opportunities for the company.

A concise PESTLE analysis for International Flavors & Fragrances that highlights key external factors impacting the industry, helping to proactively address potential challenges and capitalize on emerging opportunities.

Economic factors

International Flavors & Fragrances (IFF) is highly sensitive to global economic growth and consumer spending patterns. When economies are strong, people tend to spend more on consumer goods like food, beverages, and personal care items, which directly benefits IFF's sales. For example, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight slowdown from previous years but still indicating expansion.

Conversely, economic downturns can significantly impact IFF. Reduced consumer purchasing power during recessions leads to lower demand for discretionary items, affecting IFF's revenue. In 2023, while many economies showed resilience, persistent inflation in some regions did put pressure on consumer budgets, a trend that analysts expected to continue influencing spending habits into 2024.

Inflationary pressures and the escalating cost of raw materials present a substantial hurdle for International Flavors & Fragrances (IFF). For instance, the producer price index for chemicals and allied products saw a notable increase in late 2023 and early 2024, directly impacting IFF's input costs.

IFF must continuously refine its pricing strategies and enhance supply chain efficiencies to counteract these rising expenses. The company's ability to pass on increased costs while maintaining competitive pricing is vital for its financial health.

Successfully navigating these cost pressures is paramount for preserving healthy gross profit margins across IFF's diverse business segments, including its scent, taste, and health divisions.

Currency exchange rate fluctuations present a significant challenge for International Flavors & Fragrances (IFF) given its extensive global operations. These movements directly influence how the company's international earnings translate back into its reporting currency, impacting key financial metrics.

For instance, in the first quarter of 2025, IFF explicitly noted that currency headwinds had a negative effect on its reported net sales and adjusted operating EBITDA. This highlights the tangible impact that even seemingly small currency shifts can have on the company's top and bottom lines.

While IFF actively utilizes hedging strategies to mitigate this foreign exchange risk, substantial and unexpected currency movements can still create volatility and affect overall financial performance. The company's ability to navigate these fluctuations remains a critical factor in its global financial management.

Interest Rates and Access to Capital

Fluctuations in interest rates directly impact International Flavors & Fragrances (IFF) by altering its cost of borrowing and the ease with which it can access capital for crucial investments and managing existing debt. For instance, a rising interest rate environment would increase the expense of servicing IFF's debt obligations, potentially hindering its ability to fund growth initiatives.

IFF's ongoing commitment to deleveraging is significantly influenced by interest rate dynamics. Higher rates can make debt reduction more challenging, as the cost of carrying that debt increases. Conversely, a more favorable interest rate environment could accelerate the company's deleveraging targets.

Strategic actions, such as the divestiture of its Pharma Solutions segment, are designed to strengthen IFF's capital structure and reduce its overall debt burden. This move is intended to improve financial flexibility, making the company less susceptible to adverse interest rate movements and better positioned to manage its financial health.

- Deleveraging Efforts: IFF's focus on reducing its debt-to-equity ratio is a key strategic priority, directly affected by borrowing costs.

- Divestiture Impact: The sale of Pharma Solutions in 2023, valued at approximately $7.3 billion, was a significant step towards this deleveraging goal.

- Capital Access: Higher interest rates, as seen with the Federal Reserve's tightening cycle through 2023 and into early 2024, can increase the cost of new debt issuance for IFF.

- Financial Flexibility: By reducing debt, IFF aims to enhance its financial resilience and capacity for future strategic investments or acquisitions.

Disposable Income Levels

Disposable income levels are a crucial driver for International Flavors & Fragrances (IFF), directly influencing consumer spending on its products. When consumers have more discretionary income, they tend to purchase more premium goods that utilize IFF's innovative flavors and captivating fragrances.

For example, in 2024, many developed economies are seeing a moderate increase in disposable income, which bodes well for IFF's consumer-facing segments. Conversely, economic downturns or periods of high inflation can lead consumers to cut back on non-essential items, impacting demand for fine fragrances and specialty food ingredients. The global average disposable income growth is projected to be around 2.5% in 2024, a figure that supports continued consumer spending on IFF's offerings.

- Consumer Spending Power: Rising disposable incomes in key markets like North America and Europe support demand for IFF's premium fragrance and flavor solutions.

- Impact on Discretionary Goods: Higher disposable income fuels consumer willingness to spend on products such as fine perfumes, gourmet foods, and enhanced personal care items, all of which rely on IFF's ingredients.

- Economic Sensitivity: Fluctuations in disposable income, particularly in emerging markets, can create volatility in demand for IFF's more discretionary product categories.

Global economic growth directly fuels demand for International Flavors & Fragrances (IFF) products, as increased consumer spending on food, beverages, and personal care items translates to higher sales. The IMF projected global growth around 3.2% for 2024, indicating continued expansion despite some slowdowns. However, persistent inflation in various regions during 2023 and into 2024 has put pressure on consumer budgets, potentially impacting discretionary spending on IFF's premium offerings.

Rising raw material costs, evidenced by increases in producer prices for chemicals in late 2023 and early 2024, directly challenge IFF's profitability. The company must strategically manage pricing and supply chains to maintain healthy gross profit margins across its scent, taste, and health divisions.

Fluctuations in currency exchange rates, as seen with negative impacts on IFF's reported net sales and EBITDA in Q1 2025, add another layer of financial complexity for the globally operating company. Additionally, higher interest rates, like those from the Federal Reserve's tightening cycle through 2023-2024, increase borrowing costs and affect IFF's deleveraging efforts, despite strategic moves like the $7.3 billion divestiture of its Pharma Solutions segment in 2023 to strengthen its capital structure.

Disposable income levels are critical, with moderate increases in developed economies in 2024 supporting demand for IFF's premium products. Global average disposable income growth of approximately 2.5% in 2024 is expected to bolster consumer spending, though economic downturns or high inflation can shift spending towards essentials, impacting demand for IFF's more discretionary ingredients.

| Economic Factor | Impact on IFF | 2024/2025 Data Point | Strategic Implication | Key Metric Affected |

| Global Economic Growth | Drives consumer spending on IFF products | IMF projects 3.2% global growth in 2024 | Positive for sales, especially in resilient economies | Net Sales |

| Inflation & Raw Material Costs | Increases input costs, pressures margins | Producer Price Index for chemicals rose late 2023/early 2024 | Requires pricing adjustments and supply chain efficiency | Gross Profit Margin |

| Interest Rates | Affects borrowing costs and debt management | Fed tightening cycle through 2023-2024 | Impacts deleveraging efforts and capital access costs | Interest Expense, Debt-to-Equity Ratio |

| Disposable Income | Influences spending on premium and discretionary goods | Global disposable income growth ~2.5% in 2024 | Supports demand for fine fragrances and specialty foods | Consumer Spending, Segment Revenue |

Full Version Awaits

International Flavors & Fragrances PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of International Flavors & Fragrances provides deep insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Dive into the detailed breakdown of each element to understand the strategic landscape.

Sociological factors

Consumers are increasingly seeking out products with natural ingredients and clear labeling, a trend that significantly impacts companies like IFF. This heightened demand for "clean label" options means IFF must prioritize innovation in natural sourcing and sustainable ingredient development to meet evolving market expectations. For instance, the global natural food ingredients market was valued at approximately $60 billion in 2023 and is projected to grow substantially, underscoring the financial opportunity in this space.

This preference extends to a desire for transparency in how products are made and where ingredients come from. Consumers want authentic stories behind their food and beverages, pushing IFF to not only provide natural solutions but also to communicate their origins and ethical sourcing practices effectively. Reports from 2024 indicate that over 70% of consumers consider ingredient transparency a key factor in their purchasing decisions.

Shifting dietary trends, particularly the growing preference for plant-based foods, reduced sugar content, and ingredients offering health benefits, are significantly shaping demand within IFF's Nourish segment. This evolution is prompting substantial investment in biotechnology, enabling IFF to develop innovative and sustainable flavor solutions tailored for these expanding alternative food categories, including crucial flavor masking for plant-based proteins.

Consumers are increasingly seeking out products made with sustainable and ethically sourced ingredients, a trend that significantly influences companies like International Flavors & Fragrances (IFF). This growing demand pressures IFF to enhance transparency and responsibility throughout its supply chain.

IFF's commitment to this area is evident in its 2024 Do More Good Report. The report details achievements such as securing ECOCERT's For Life certification for a range of its natural ingredients. Additionally, IFF has reinforced its dedication to responsible palm oil sourcing, aligning with global sustainability standards.

Cultural Influences on Taste and Scent

Cultural norms profoundly shape how consumers perceive and appreciate flavors and scents. International Flavors & Fragrances (IFF) actively taps into this by using extensive consumer research to tailor its product development for distinct global preferences. For instance, in 2024, IFF noted a growing demand in Southeast Asia for bolder, spicier flavor profiles, a direct reflection of local culinary traditions.

IFF's strategy involves understanding these nuances to create offerings that resonate deeply within specific cultural contexts. This means going beyond basic taste adaptation to embrace the desire for unique, multi-sensory experiences that are culturally relevant. The company's 2025 innovation pipeline includes several projects focused on replicating authentic regional food experiences, such as traditional fermented flavors popular in East Asian cuisines.

- Regional Palate Adaptation: IFF's ability to customize flavor and scent profiles to match diverse cultural tastes is a key differentiator, evidenced by its successful expansion in markets with distinct culinary histories.

- Demand for Authenticity: Consumers increasingly seek authentic sensory experiences, driving IFF to invest in understanding and recreating traditional flavor and fragrance elements.

- Exotic and Novelty Preferences: Cultural exploration fuels a demand for exotic ingredients and novel scent combinations, which IFF actively incorporates into its product innovation.

- Multi-Sensory Experiences: Beyond taste and smell, cultural trends are pushing for integrated sensory experiences, a growing area of focus for IFF's research and development efforts.

Focus on Wellness and Functional Ingredients

Societal shifts are strongly influencing consumer demand for products that actively contribute to health and well-being. This translates into a growing preference for ingredients that provide tangible functional benefits, moving beyond simple taste or aroma. For instance, the global wellness market was valued at over $5.6 trillion in 2023 and is projected to continue its robust growth, with a significant portion driven by health-focused food and beverage consumption.

International Flavors & Fragrances (IFF) is strategically aligning with this trend by innovating in functional ingredients. They are developing solutions designed to support specific health areas such as improved cognitive function, digestive health, and general vitality. These ingredients are then incorporated into a wide array of consumer goods, including foods, beverages, and personal care items, meeting the evolving needs of health-conscious individuals.

- Consumer Demand for Wellness: A significant percentage of consumers, often upwards of 70% in developed markets, actively seek out products with demonstrable health benefits.

- Functional Ingredient Market Growth: The market for functional ingredients is expanding rapidly, with projections indicating double-digit annual growth rates through 2027, driven by innovation in areas like probiotics, prebiotics, and adaptogens.

- IFF's Strategic Focus: IFF's investment in research and development for ingredients supporting cognitive health and gut wellness reflects a direct response to market insights showing these as key consumer priorities.

Societal attitudes towards health and wellness are profoundly influencing consumer choices, driving demand for products with functional benefits. This trend is particularly evident in the growing market for ingredients that support cognitive function and digestive health, areas where IFF is actively innovating. By 2024, consumer surveys indicated that over 65% of individuals are willing to pay a premium for food and beverage products offering tangible health advantages.

IFF's strategic response includes developing specialized ingredients that cater to these wellness-focused demands, reflecting a significant shift in consumer priorities. The company's investment in research for areas like gut wellness and cognitive support aligns with market data showing strong growth in these functional ingredient segments, with projections suggesting continued double-digit expansion through 2027.

Cultural norms and evolving dietary preferences, such as the rise of plant-based diets and a desire for reduced sugar, are reshaping the food and beverage landscape. IFF is adapting by focusing on natural ingredients and transparent sourcing, directly addressing consumer calls for "clean label" products. The global natural food ingredients market, valued at approximately $60 billion in 2023, highlights the significant opportunity in this area.

| Sociological Factor | Consumer Trend | IFF's Response/Impact | Market Data/Evidence |

|---|---|---|---|

| Health & Wellness Consciousness | Demand for functional ingredients (cognitive, digestive) | Innovation in specialized ingredients; R&D focus on gut wellness | 65%+ consumers willing to pay premium for health benefits (2024); Functional ingredient market projected double-digit growth through 2027 |

| Dietary Shifts & Natural Preferences | Plant-based, reduced sugar, "clean label" | Prioritization of natural sourcing, transparent labeling, biotechnology for plant-based solutions | Global natural food ingredients market ~$60 billion (2023); 70%+ consumers consider ingredient transparency key (2024) |

| Cultural Norms & Authenticity | Desire for authentic, culturally relevant flavors/scents | Tailoring products to regional tastes; focus on multi-sensory experiences | Growing demand for bolder flavors in Southeast Asia (2024); Innovation pipeline includes traditional fermented flavors |

Technological factors

Biotechnology and synthetic biology are transforming how International Flavors & Fragrances (IFF) creates its products. These advancements enable the development of sustainable and entirely new flavors, fragrances, and ingredients that were previously impossible to produce. This is a significant shift towards more environmentally friendly sourcing and manufacturing processes.

Breakthroughs like Designed Enzymatic Biomaterials (DEB) are particularly noteworthy. DEB technologies offer a path to high-performance biomaterials that can effectively substitute for traditional petrochemical-based materials. This innovation is crucial for IFF as it seeks to reduce its reliance on fossil fuels and offer more sustainable options to consumers and clients.

The integration of digitalization and AI is revolutionizing IFF's research and development. AI's predictive capabilities are crucial for identifying emerging consumer preferences in the dynamic flavor and fragrance market. For instance, in 2024, IFF continued to invest heavily in digital platforms to analyze vast datasets, aiming to shorten the time from concept to market for new products.

AI is accelerating ingredient discovery and enabling the creation of highly personalized sensory experiences. By analyzing consumer data, including health metrics and even emotional responses, IFF can tailor flavor profiles with unprecedented precision. This advanced approach is expected to drive significant growth in their customized solutions segment through 2025.

Technological advancements in how flavors and fragrances are delivered are a significant area of focus for International Flavors & Fragrances (IFF). The goal is to create sensory experiences that are not only more potent but also linger longer, enhancing product appeal and consumer satisfaction.

A prime example of this innovation is IFF's ENVIROCAP™ technology, specifically developed for fabric care applications. This new system represents a leap forward in sustainable scent delivery, being ECHA-compliant, biodegradable, and suitable for vegan formulations, directly addressing the growing consumer demand for environmentally responsible and high-performing products.

New Extraction and Synthesis Technologies

The development of novel extraction and synthesis technologies is a significant technological factor for International Flavors & Fragrances (IFF). These advancements empower IFF to create ingredients with greater efficiency and sustainability, often resulting in higher purity levels. For instance, in 2024, IFF highlighted its progress in enzymatic synthesis, which reduces chemical waste and energy consumption compared to traditional methods. This focus on cleaner production aligns with growing consumer demand for natural and ethically sourced components.

These cutting-edge technologies are vital for IFF’s ability to source complex natural ingredients, which can be challenging due to variability in raw materials. Simultaneously, they enable the creation of sophisticated synthetic molecules that precisely match desired flavor and fragrance profiles. IFF's investment in research and development for these technologies, estimated to be in the hundreds of millions of dollars annually, directly supports its strategy to meet evolving product specifications and the increasing consumer preference for transparent, clean-label products.

Key impacts of these technological advancements include:

- Enhanced Efficiency: New methods reduce processing time and resource utilization, lowering production costs.

- Improved Sustainability: Technologies like biocatalysis minimize environmental impact and waste generation.

- Greater Purity and Precision: Advanced synthesis allows for the creation of highly specific molecules with consistent quality.

- Innovation in Natural Sourcing: Enables the extraction of valuable compounds from diverse botanical sources previously untapped.

Development of Novel Functional Ingredients

Technological advancements are fueling the creation of new functional ingredients, allowing IFF to develop products offering distinct health and wellness advantages. This innovation extends to ingredients designed for mood improvement, cognitive enhancement, and better texture or stability across different product categories, directly supporting the growing focus on holistic well-being.

For instance, the global market for functional food ingredients was projected to reach $274.7 billion in 2024, with a compound annual growth rate (CAGR) of 8.5% expected through 2029, highlighting the significant demand for such innovations.

- Mood Enhancement: Development of ingredients impacting neurotransmitter activity for improved emotional well-being.

- Cognitive Support: Focus on ingredients that boost memory, focus, and overall brain health.

- Texture and Stability: Innovations in ingredients that enhance sensory experiences and product longevity.

- Holistic Health Trend: Alignment with consumer demand for products addressing multiple aspects of health and wellness.

Technological advancements in biotechnology and AI are fundamentally reshaping how International Flavors & Fragrances (IFF) operates, driving innovation in product development and operational efficiency. The company is leveraging these tools to create novel, sustainable ingredients and personalize sensory experiences for consumers, a trend that saw significant investment in digital platforms in 2024 to accelerate market entry for new products.

Breakthroughs like Designed Enzymatic Biomaterials (DEB) are enabling IFF to substitute petrochemical-based materials with high-performance biomaterials, reducing reliance on fossil fuels. Furthermore, AI-driven predictive analytics are crucial for identifying emerging consumer preferences, with IFF's R&D investments in 2024 and continuing into 2025 focusing on harnessing vast datasets to shorten product development cycles.

IFF's ENVIROCAP™ technology exemplifies innovation in scent delivery, offering biodegradable and ECHA-compliant solutions for fabric care, aligning with consumer demand for eco-friendly products. The company's commitment to advanced synthesis and extraction technologies, including enzymatic processes, enhances ingredient purity and sustainability, reducing waste and energy consumption, a key driver in the growing market for clean-label products.

The global market for functional food ingredients, a key area for IFF's innovation, was projected to reach $274.7 billion in 2024, with an expected CAGR of 8.5% through 2029, underscoring the demand for ingredients offering health and wellness benefits.

| Technological Area | Impact on IFF | Market Relevance (2024-2025) |

|---|---|---|

| Biotechnology & Synthetic Biology | Development of sustainable and novel flavors, fragrances, and ingredients. | Enables eco-friendly sourcing and manufacturing, reducing reliance on traditional methods. |

| AI & Digitalization | Accelerated R&D, predictive analytics for consumer trends, personalized sensory experiences. | Shortened time-to-market for new products; enhanced consumer engagement. |

| Advanced Delivery Systems (e.g., ENVIROCAP™) | Improved scent potency and longevity, eco-friendly formulations. | Meets consumer demand for sustainable and high-performing product attributes. |

| Functional Ingredient Innovation | Creation of ingredients for health, wellness, mood enhancement, and cognitive support. | Capitalizes on the growing global market for functional food ingredients, projected for significant growth. |

Legal factors

International Flavors & Fragrances (IFF) must navigate a complex web of food safety and labeling regulations globally. Agencies like the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) set strict standards for ingredient approval, allowable usage levels, and detailed disclosure on product labels. These rules are paramount for IFF's Nourish segment, directly impacting product development and market access, ensuring consumer trust and safety.

Compliance with these evolving regulations is a significant operational factor. For instance, the FDA's Food Safety Modernization Act (FSMA) places a greater emphasis on preventive controls throughout the food supply chain. Similarly, EFSA's rigorous scientific assessments for novel food ingredients can influence the pace of innovation and market entry for IFF's flavor and ingredient solutions.

Protecting its intellectual property (IP) and securing patent protection for unique formulations, processes, and technologies is crucial for International Flavors & Fragrances (IFF). This legal framework is essential for safeguarding IFF's competitive edge and fostering ongoing investment in research and development, ensuring their innovations remain exclusive.

In 2023, IFF continued to actively manage its patent portfolio, a key asset in the highly competitive flavor and fragrance industry. While specific numbers on patent filings are proprietary, the company's consistent investment in R&D, which reached $672 million in 2023, directly correlates with the ongoing need to protect its innovations through patents and other IP measures.

Compliance with chemical safety regulations like Europe's REACH and the US's TSCA is paramount for International Flavors & Fragrances (IFF), especially impacting its Scent and Health & Biosciences divisions. These frameworks dictate how chemicals are registered, assessed, approved, and restricted, directly influencing IFF's product innovation cycles and ability to enter new markets.

For instance, REACH, fully implemented by 2018, requires extensive data submission for substances manufactured or imported into the EU, a process IFF navigates to ensure market access for its diverse ingredient portfolio. Similarly, TSCA reform in the US, particularly the Lautenberg Chemical Safety Act of 2016, mandates EPA risk evaluations for existing chemicals, creating an ongoing compliance landscape for IFF's raw material sourcing and product formulations.

Advertising and Marketing Regulations

International Flavors & Fragrances (IFF) faces stringent advertising and marketing regulations globally, particularly concerning health and sustainability claims. Companies must ensure all marketing materials are truthful and substantiated by robust scientific evidence to prevent consumer deception. For instance, in 2024, the US Federal Trade Commission (FTC) continued its focus on environmental marketing claims, reinforcing the need for clear and verifiable sustainability information. Failure to comply can result in significant fines and reputational damage.

Navigating these diverse legal landscapes requires IFF to maintain meticulous oversight of its promotional activities. Regulations vary significantly by region; for example, the European Union's Advertising Standards Authority (ASA) has strict rules against unsubstantiated health claims in food and beverage advertising, a sector where IFF's ingredients are prevalent. IFF’s commitment to transparency in 2025 will be crucial, especially as consumer scrutiny of product origins and environmental impact intensifies.

- Truthful Claims: Advertising must be accurate and avoid misleading consumers about product benefits or ingredients.

- Substantiation: All performance or health-related claims must be supported by credible scientific evidence.

- Regional Compliance: Marketing strategies must adapt to the specific advertising laws and consumer protection standards of each operating country.

- Environmental Marketing: Claims related to sustainability must be specific, verifiable, and avoid "greenwashing."

Data Privacy Laws

Data privacy regulations are increasingly impacting how companies like International Flavors & Fragrances (IFF) manage customer information. With the rise of digitalization, laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States dictate how IFF can collect, store, and utilize data. This is particularly relevant for IFF's research and development, marketing campaigns, and efforts to personalize consumer experiences. For instance, a 2023 report indicated that over 70% of consumers are concerned about how their data is used by companies.

Compliance with these stringent data privacy laws is not just a legal obligation but a critical component of maintaining consumer trust and brand reputation. Failure to adhere to these regulations can result in significant financial penalties and reputational damage. IFF must ensure robust data governance frameworks are in place to handle personal data responsibly, which can involve significant investments in technology and training. The global regulatory landscape is constantly evolving, with new privacy laws being enacted regularly, requiring ongoing vigilance and adaptation.

- GDPR Fines: Companies can face fines of up to 4% of their annual global turnover or €20 million, whichever is higher.

- CCPA Impact: The CCPA grants consumers rights to know what personal data is collected, to request its deletion, and to opt-out of its sale.

- Consumer Trust: A 2024 survey revealed that 65% of consumers are more likely to do business with companies they trust to protect their data.

- Data Management Costs: Implementing comprehensive data privacy measures can add an estimated 5-15% to IT operational costs for businesses.

International Flavors & Fragrances (IFF) operates within a legal framework that mandates rigorous adherence to food safety and labeling standards set by global bodies like the FDA and EFSA. These regulations directly influence product formulation and market access, particularly for the Nourish segment, and are crucial for maintaining consumer confidence. The company's commitment to compliance, as seen in its 2023 R&D investments of $672 million, underscores the importance of safeguarding innovations through patents and other intellectual property measures.

IFF must also navigate complex chemical safety regulations such as REACH in Europe and TSCA in the US, which impact its Scent and Health & Biosciences divisions by dictating chemical registration and risk assessment processes. Furthermore, stringent advertising laws, including the FTC's focus on environmental claims in 2024, require IFF to ensure all marketing is truthful and scientifically substantiated, with regional variations demanding tailored compliance strategies.

Data privacy laws like GDPR and CCPA are increasingly critical for IFF, affecting how customer data is managed for R&D and marketing, a concern echoed by over 70% of consumers in a 2023 survey regarding data usage. Adherence to these laws is vital for consumer trust, with potential fines up to 4% of global turnover for GDPR violations and significant impacts on business practices, as 65% of consumers in a 2024 poll favored data-protecting companies.

Environmental factors

The environmental footprint of raw material sourcing is a critical consideration for International Flavors & Fragrances (IFF). The company's commitment to conscious sourcing and robust supply chains directly addresses concerns about deforestation and ethical practices, especially for high-volume ingredients such as palm oil. IFF aims to enhance traceability throughout its supply chain to mitigate these environmental impacts.

International Flavors & Fragrances (IFF) is actively enhancing its waste management and recycling programs across its global manufacturing sites. This focus is a key component of their commitment to operational excellence and achieving ambitious circularity goals, aiming to minimize their environmental impact.

In 2023, IFF reported a significant reduction in landfill waste, diverting 75% of its waste from landfills through recycling and reuse programs. Their initiatives include optimizing packaging materials and implementing advanced sorting technologies to maximize material recovery, aligning with their 2025 sustainability targets which aim for an 80% waste diversion rate.

Climate change presents significant threats to International Flavors & Fragrances' (IFF) supply chains, impacting the availability and price of key natural ingredients. Shifting weather patterns and increased resource scarcity, driven by global warming, directly affect agricultural yields and the quality of raw materials IFF relies on, as seen in the volatility of vanilla bean harvests in Madagascar due to unpredictable rainfall.

IFF is actively working to enhance the resilience of its supply chains through regenerative agriculture practices and by diversifying its sourcing strategies. This proactive approach aims to mitigate the financial and operational risks associated with climate-related disruptions, ensuring a more stable and sustainable supply of its essential components for the 2024-2025 period and beyond.

Water Usage and Wastewater Treatment

Water usage and wastewater treatment are significant environmental factors for International Flavors & Fragrances (IFF), impacting its operational footprint and sustainability goals. IFF is actively engaged in optimizing its water consumption across its global manufacturing sites, recognizing water as a vital resource.

The company's commitment to water stewardship involves implementing advanced technologies and processes to reduce water intensity and ensure responsible wastewater discharge. This focus aligns with broader industry trends and regulatory expectations for environmental performance.

- Water Efficiency Initiatives: IFF has set targets to reduce water withdrawal intensity by 15% by 2025 compared to a 2019 baseline, with a focus on water-stressed regions.

- Wastewater Management: The company invests in robust wastewater treatment systems to meet or exceed local discharge regulations, minimizing the impact on aquatic ecosystems.

- Circular Economy Principles: IFF explores opportunities for water reuse and recycling within its operations, contributing to a more circular approach to resource management.

- Reporting and Transparency: IFF regularly reports on its water performance metrics in its sustainability reports, providing stakeholders with insights into its progress and challenges.

Carbon Footprint Reduction Targets

International Flavors & Fragrances (IFF) is committed to reducing its environmental impact, with a strong focus on its carbon footprint. The company has established ambitious targets for decreasing its Scope 1, 2, and 3 greenhouse gas emissions, aligning with global climate action efforts.

IFF's sustainability strategy extends to enabling its customers to achieve their own emission reduction goals. Through innovative product development, IFF helps clients avoid substantial CO2e emissions, showcasing a broader commitment to climate stewardship beyond its direct operational boundaries.

For instance, by 2025, IFF aims to achieve a 15% reduction in absolute Scope 1 and 2 GHG emissions from a 2020 baseline. Furthermore, the company is working to reduce the carbon intensity of its value chain, with a target of a 30% reduction in Scope 3 emissions intensity by 2030.

- Scope 1 & 2 Emissions: Targeting a 15% reduction by 2025 (vs. 2020 baseline).

- Scope 3 Emissions Intensity: Aiming for a 30% reduction by 2030.

- Customer Impact: IFF's innovations help customers avoid significant CO2e emissions.

- Renewable Energy: Investing in renewable energy sources to power operations and reduce reliance on fossil fuels.

IFF's commitment to environmental stewardship is evident in its proactive approach to resource management and emissions reduction. The company is actively working to minimize its ecological footprint through enhanced waste management, water efficiency, and a clear focus on reducing greenhouse gas emissions across its operations and value chain.

| Environmental Focus Area | 2023/2024 Actions & 2025 Targets | Impact/Goal |

|---|---|---|

| Waste Management | 75% waste diverted from landfill in 2023; Aiming for 80% by 2025. | Minimizing landfill impact, maximizing material recovery. |

| Water Usage | Implementing advanced water treatment and reuse technologies. Target: 15% reduction in water withdrawal intensity by 2025 (vs. 2019). | Conserving water resources, ensuring responsible discharge. |

| Greenhouse Gas Emissions | Target: 15% reduction in absolute Scope 1 & 2 GHG emissions by 2025 (vs. 2020 baseline). | Reducing operational carbon footprint and supporting climate action. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for International Flavors & Fragrances is built on a robust foundation of data from leading global economic institutions, environmental protection agencies, and reputable market research firms. We meticulously gather insights from industry-specific reports, regulatory updates, and technological trend analyses to ensure comprehensive coverage.