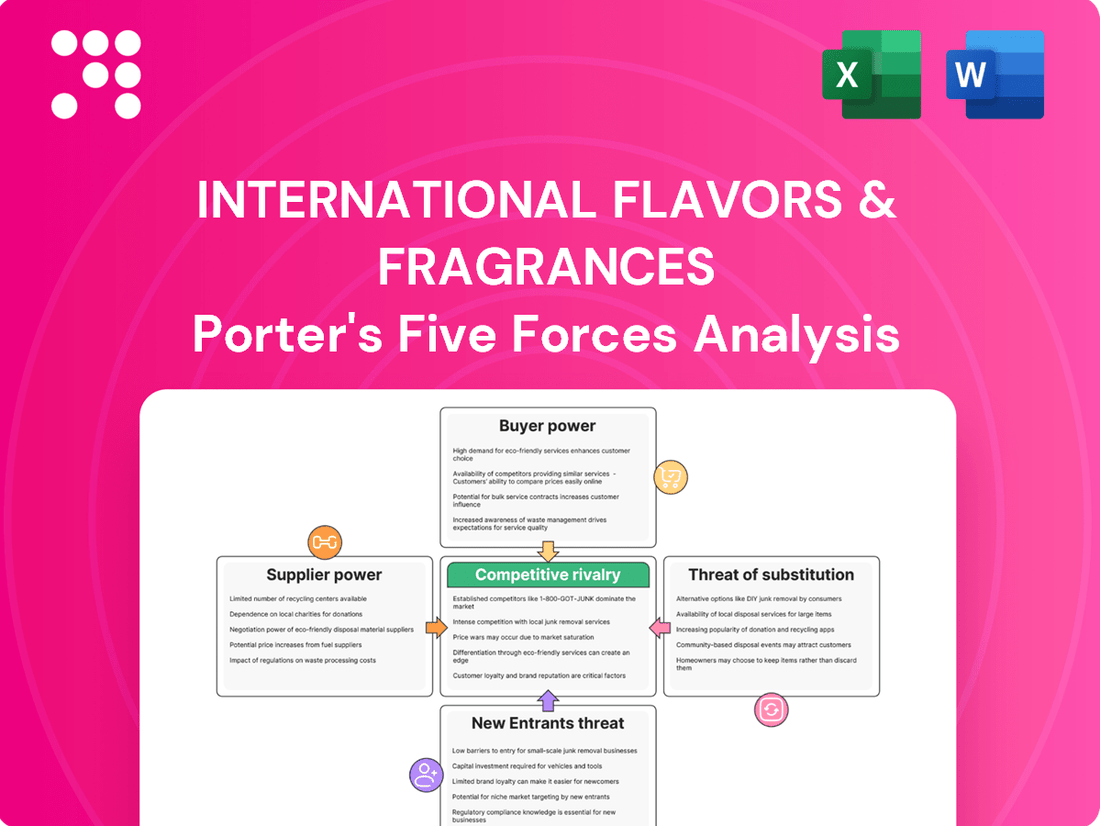

International Flavors & Fragrances Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

International Flavors & Fragrances Bundle

International Flavors & Fragrances operates in a dynamic industry shaped by powerful competitive forces. Understanding the intensity of buyer and supplier power, the threat of new entrants and substitutes, and the rivalry among existing competitors is crucial for strategic planning.

The complete report reveals the real forces shaping International Flavors & Fragrances’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

International Flavors & Fragrances (IFF) sources its materials from around 2,400 suppliers globally. While a broad supplier base for many standard ingredients dilutes individual supplier influence, the situation shifts for specialized natural extracts.

For these unique or highly specific natural components, a smaller pool of suppliers can significantly amplify their bargaining power. This concentration means IFF may face fewer alternatives, potentially leading to higher costs or less favorable terms for these critical raw materials.

While many raw materials are commodities, some specialized ingredients, particularly those with unique sensory profiles or specific functionalities, may have limited suppliers for International Flavors & Fragrances (IFF). Switching costs for these unique inputs can be high due to the need for reformulation, re-testing, and regulatory approvals, thereby increasing supplier power.

For instance, the demand for natural and sustainably sourced ingredients, a growing trend in 2024, can concentrate supply among a smaller number of producers, giving them more leverage. IFF actively focuses on strategies like forward-buy and local sourcing to manage supply chain risks and mitigate the impact of this supplier bargaining power.

The threat of suppliers forward integrating into flavor and fragrance creation is generally low for International Flavors & Fragrances (IFF). Most suppliers of basic chemicals or agricultural inputs lack the sophisticated research and development, creative expertise, and deep customer connections essential for this specialized industry. This inherent capability gap significantly curtails their ability to directly challenge IFF's core business operations.

However, a nuanced exception exists for suppliers offering highly specialized or patented biotechnology ingredients. These suppliers, by controlling unique and critical components, could potentially wield increased bargaining power. For instance, if a supplier develops a novel, high-demand bio-based aroma compound, they might explore direct market entry, thereby posing a more substantial threat to IFF's market position.

Importance of Volume to Suppliers

International Flavors & Fragrances (IFF) commands significant purchasing power due to its substantial order volumes across its various business units, including Nourish, Scent, and Health & Biosciences. This scale makes IFF a crucial client for many suppliers, granting it leverage in negotiating pricing and supply terms. For instance, in 2023, IFF's revenue reached approximately $13.4 billion, underscoring its capacity to influence supplier relationships through consistent and large-scale procurement.

IFF's ability to secure favorable terms is further bolstered by cultivating long-term relationships and strategic alliances with its suppliers. These partnerships are vital for ensuring a stable supply chain and obtaining advantageous contract conditions, which are essential for maintaining IFF's competitive edge in the market.

- IFF's substantial revenue of approximately $13.4 billion in 2023 highlights its significant purchasing volume.

- The company's diverse segments (Nourish, Scent, Health & Biosciences) ensure consistent demand across a broad supplier base.

- Long-term supplier relationships and strategic alliances are key to IFF's ability to negotiate favorable pricing and secure supply.

- This bargaining power helps IFF manage input costs and maintain its market position.

Availability of Substitutes for Raw Materials

The availability of substitutes for raw materials significantly influences supplier bargaining power. For many synthetic ingredients used by International Flavors & Fragrances (IFF), the existence of multiple alternative sources effectively limits the power any single supplier holds. This broadens IFF's sourcing options and provides leverage in negotiations.

However, the situation is more nuanced for natural ingredients. While certain natural components may be difficult to replace entirely, IFF's strategic investments in biotechnology and advanced flavor modulation technologies are crucial. These innovations enable the development of cost-effective synthetic alternatives or the optimization of existing ingredients, thereby reducing dependence on potentially volatile natural supply chains.

For instance, in 2024, the global market for flavor and fragrance ingredients saw continued growth, with synthetic ingredients forming a substantial portion. IFF's focus on R&D in areas like fermentation-derived ingredients, as highlighted in their 2024 investor reports, directly addresses the potential supply risks associated with natural raw materials. This proactive approach allows them to maintain competitive pricing and supply stability.

- Limited Supplier Power for Synthetics: Multiple sources for synthetic ingredients reduce individual supplier leverage.

- Biotechnology as a Mitigator: IFF's investment in biotech creates synthetic alternatives for natural ingredients.

- Flavor Modulation for Optimization: Enhancing existing ingredients reduces reliance on scarce natural ones.

- Mitigating Volatility: These strategies help IFF navigate the price and availability fluctuations of natural raw materials.

The bargaining power of suppliers for International Flavors & Fragrances (IFF) is moderate, influenced by the nature of the raw materials. While many commodity ingredients have numerous suppliers, limiting individual power, specialized natural extracts and unique biotechnology components can concentrate supply, increasing supplier leverage.

IFF's substantial purchasing volume, evidenced by its 2023 revenue of approximately $13.4 billion, grants it considerable influence over suppliers. Furthermore, the company's strategic focus on developing synthetic alternatives through biotechnology and flavor modulation in 2024 helps to mitigate the impact of potential supply chain volatility for natural ingredients.

| Factor | IFF's Position | Impact on Supplier Bargaining Power |

| Supplier Concentration (Specialty Ingredients) | Moderate to High for unique natural extracts and biotech components | Increases supplier leverage due to fewer alternatives and potential switching costs. |

| IFF's Purchasing Power | High due to large order volumes (e.g., $13.4B revenue in 2023) | Leverage in negotiating pricing and terms, reducing supplier power. |

| Availability of Substitutes | High for synthetics; growing for naturals via biotech | Limits supplier power by providing IFF with alternative sourcing options. |

| Forward Integration Threat | Low for basic suppliers; potential for highly specialized biotech suppliers | Generally curtails suppliers' ability to challenge IFF, except for those controlling critical, unique components. |

What is included in the product

This Porter's Five Forces analysis for International Flavors & Fragrances (IFF) dissects the competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes within the flavor and fragrance industry.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for IFF.

Gain a strategic advantage by quickly assessing supplier power and customer bargaining power to optimize IFF's pricing and sourcing strategies.

Customers Bargaining Power

International Flavors & Fragrances (IFF) serves a clientele dominated by large multinational consumer product companies. These giants, such as Unilever or Procter & Gamble, often procure substantial volumes across various product lines, granting them considerable leverage in negotiations. Their sheer size allows them to dictate terms and influence pricing, a key aspect of their bargaining power.

IFF actively seeks to become a 'core list' supplier for these key accounts. This strategy aims to foster deep, long-term relationships, thereby mitigating the risk of customers switching to competitors. By being indispensable, IFF can better manage the inherent bargaining power of its major buyers.

Switching flavor or fragrance suppliers can be a complex and costly process for International Flavors & Fragrances' customers. It often necessitates significant reformulation and rigorous re-testing of end products, which can impact brand consistency and consumer perception. For instance, a food manufacturer might need to re-evaluate ingredient interactions and shelf-life stability when changing a key flavor profile.

The financial burden of switching can be substantial, especially when IFF provides highly customized or proprietary solutions. These unique formulations, developed through IFF's extensive R&D and deep integration into a client's product development pipeline, create considerable switching barriers. This deep integration means customers are not just buying a scent or taste, but a carefully crafted component that is integral to their product's identity.

International Flavors & Fragrances (IFF) crafts highly specialized flavor and fragrance solutions. These are not mere ingredients but are deeply integrated into a customer's final product, directly impacting its appeal and brand image.

This significant product differentiation, bolstered by IFF's continuous innovation, makes it challenging for customers to switch to less specialized or generic alternatives without compromising their own product's quality and marketability. For instance, in 2023, IFF reported strong performance in its Taste and Scent segments, reflecting the value placed on its unique offerings.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while theoretically present, is largely mitigated for International Flavors & Fragrances (IFF). Large consumer goods companies, the primary customers, possess the financial muscle to consider developing their own flavor and fragrance capabilities. However, the sheer scale of investment in research and development, coupled with the highly specialized scientific expertise and established global supply chains that IFF commands, presents a formidable barrier to entry.

Replicating IFF's extensive and diverse portfolio, which spans thousands of ingredients and complex formulations, alongside its continuous innovation pipeline, would require decades and billions of dollars. For instance, IFF's 2023 revenue was approximately $12.4 billion, underscoring the immense scale of operations and R&D investment necessary to compete. This makes the prospect of most customers successfully integrating backward a low probability event.

- High R&D Investment: Developing proprietary flavor and fragrance compounds requires substantial and ongoing investment in specialized laboratories and scientific talent.

- Specialized Expertise: The creation of unique scents and tastes involves a deep understanding of chemistry, biology, and consumer sensory perception, a core competency for IFF.

- Scale and Portfolio Breadth: IFF's ability to offer a vast array of ingredients and customized solutions across numerous product categories is difficult and costly for individual customers to replicate internally.

- Innovation Pipeline: IFF's commitment to continuous product development and patenting new molecules creates a moving target for potential in-house competitors.

Customer Price Sensitivity

Customers in the consumer products sector, where International Flavors & Fragrances (IFF) operates significantly, often exhibit high price sensitivity. This is driven by intense competition and a constant drive for cost efficiency among manufacturers. For instance, in 2023, the consumer staples sector, a key market for IFF, saw overall price increases averaging around 5-7% due to inflationary pressures, making consumers more mindful of product costs.

This sensitivity directly impacts IFF's pricing strategies, particularly for ingredients that are more standardized or commoditized. Companies relying on these basic flavor and fragrance components are likely to seek the most cost-effective suppliers. In contrast, IFF's more specialized and innovative solutions, those that offer unique performance benefits or proprietary formulations, tend to command less price sensitivity from buyers.

- Price Sensitivity in Consumer Goods: Consumers in the packaged goods market, a core segment for IFF, are highly attuned to price changes, often switching brands for minor cost savings.

- Impact on Commoditized Ingredients: For basic flavor and fragrance compounds, IFF faces pressure to maintain competitive pricing to retain market share against rivals.

- Value of Innovation: IFF's investment in R&D for novel ingredients or those providing distinct functional advantages can mitigate price sensitivity, allowing for premium pricing.

- Market Dynamics: In 2024, while inflation has moderated, the ongoing focus on value for money continues to make price a critical factor for many of IFF's downstream customers.

The bargaining power of customers for International Flavors & Fragrances (IFF) is significant, primarily due to the concentrated nature of its client base, which includes large multinational consumer product companies. These major buyers often procure in high volumes, giving them considerable leverage to negotiate pricing and terms. For example, in 2023, major consumer goods companies continued to exert pressure on their suppliers for cost efficiencies amidst ongoing economic considerations.

IFF's strategy to become a core supplier for these key accounts aims to build loyalty and reduce customer switching, thereby managing this power. The complexity and cost associated with reformulating products, along with the integration of IFF's proprietary and customized solutions, create substantial switching barriers for customers, limiting their ability to easily move to alternatives.

Customers' price sensitivity, especially for more commoditized ingredients, also plays a crucial role. While IFF's innovative and specialized offerings command less price pressure, the overall market demand for value in 2024 means that pricing remains a critical factor for many of IFF's downstream partners.

| Customer Characteristic | Impact on IFF | Mitigation Strategy |

|---|---|---|

| Concentrated Client Base (Large MNCs) | High volume purchases grant significant negotiation leverage. | Focus on becoming a 'core list' supplier, fostering long-term relationships. |

| Switching Costs | Reformulation, re-testing, and brand consistency concerns create barriers. | Deep integration of proprietary and customized solutions. |

| Price Sensitivity (for commoditized items) | Pressure to maintain competitive pricing on standard ingredients. | Highlighting value and distinctiveness of specialized and innovative products. |

| Potential for Backward Integration | Theoretical possibility for large clients to develop in-house capabilities. | Formidable barriers due to IFF's scale, R&D investment, and specialized expertise. |

Full Version Awaits

International Flavors & Fragrances Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for International Flavors & Fragrances, detailing the competitive landscape and strategic implications within the industry. You're looking at the actual document, meaning the comprehensive insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry are precisely what you'll receive. Once your purchase is complete, you’ll get instant access to this exact, professionally formatted file, ready for your immediate use.

Rivalry Among Competitors

The global flavors and fragrances industry is characterized by intense competition, with a few major companies holding substantial market power. Key players such as Givaudan, Symrise, DSM-Firmenich, and International Flavors & Fragrances (IFF) dominate the landscape, collectively accounting for a significant portion of the market share.

While numerous smaller, specialized firms also operate, the sheer scale and resources of these larger entities create a highly competitive environment. This concentration of market leadership means that rivalry among the top players is fierce, driving innovation and price pressures across the sector.

The flavors and fragrances industry is demonstrating robust and stable growth, a key factor influencing competitive rivalry. Projections indicate the market will expand from an estimated USD 32.33 billion in 2024 to USD 47.73 billion by 2032, reflecting a compound annual growth rate of 5.0%.

This healthy market expansion offers ample opportunities for various participants, which can temper extreme competitive pressures by ensuring there is room for all to grow. However, the underlying drive for market share remains intense, meaning that even with a growing pie, companies are still actively competing for a larger slice.

Competitive rivalry in the flavors and fragrances industry is intensely fueled by relentless innovation. Companies like International Flavors & Fragrances (IFF) pour significant resources into research and development, aiming to craft novel products and enhance sensory experiences for consumers. This drive for differentiation is paramount for securing a competitive edge and expanding market presence.

In 2024, the industry witnessed a surge in demand for sustainable and natural ingredients, pushing companies to innovate in these areas. IFF, for instance, has been actively developing bio-based and ethically sourced components, a strategy that resonates with environmentally conscious consumers and business partners. This focus on sustainability not only differentiates offerings but also aligns with evolving regulatory landscapes and corporate social responsibility goals.

The pace of new product introductions is a key indicator of competitive intensity. IFF's commitment to R&D, evidenced by its substantial investment in innovation pipelines, allows it to consistently bring unique flavors and fragrances to market. For example, in its 2023 fiscal year, IFF reported significant capital expenditures directed towards innovation and capacity expansion, underscoring the importance of continuous product development in this dynamic sector.

Switching Costs for Customers Among Competitors

While customers may face some switching costs, the major players in the flavors and fragrances industry, including International Flavors & Fragrances (IFF), Givaudan, and Firmenich, offer similar comprehensive portfolios. This similarity means that customers, often large food and beverage companies or consumer goods manufacturers, can feasibly shift suppliers if they perceive better value or innovation from a competitor. For instance, a major beverage company might switch a significant portion of its flavor sourcing if another supplier offers a novel taste profile or a more cost-effective solution for a key product line. This ease of potential switching keeps competitive pressure high.

The competitive rivalry is therefore intense, as companies must constantly innovate and offer compelling value propositions to retain their customer base. In 2024, the industry continues to see significant investment in research and development, with companies like IFF focusing on sustainable sourcing and bio-based ingredients to differentiate themselves. This drive for differentiation is a direct response to the threat of customers easily switching to competitors who can better meet evolving consumer demands for natural and ethical products.

- High Competitive Intensity: Major players like IFF, Givaudan, and Firmenich offer comparable, extensive product portfolios, enabling customers to switch suppliers for better value or innovation.

- Innovation as a Differentiator: Companies must continuously innovate, particularly in areas like sustainable and bio-based ingredients, to retain customers and counter the threat of switching.

- Customer Leverage: The ability of large customers to shift sourcing between major suppliers maintains significant pressure on pricing and service levels across the industry.

Exit Barriers

The flavors and fragrances sector presents substantial exit barriers, primarily due to significant capital commitments. Companies invest heavily in research and development, specialized manufacturing plants, and cultivating skilled personnel, making it costly to divest operations. For instance, establishing a new fragrance production facility can easily run into tens of millions of dollars, a figure that requires substantial commitment to recoup. This high cost of exit discourages companies from leaving, even when facing market downturns, thereby intensifying competitive rivalry as existing players are compelled to remain and fight for market share.

These entrenched investments mean that companies are less likely to exit the market, even when profitability falters. This stickiness fuels a more aggressive competitive landscape. Consider that in 2024, the global flavors and fragrances market was valued at approximately $65 billion, with substantial portions of this attributed to long-term R&D pipelines and specialized production infrastructure. Such deep commitments ensure that firms will continue to compete vigorously, even in less favorable economic conditions, to justify their initial investments.

- High Capital Investments: Significant R&D spending and specialized manufacturing facilities create substantial financial hurdles for exiting the industry.

- Specialized Talent: The need for highly skilled perfumers, flavorists, and chemists adds another layer of difficulty and cost to exiting.

- Market Persistence: High exit barriers compel companies to remain competitive even during challenging economic periods, intensifying rivalry.

- Industry Value: The global flavors and fragrances market's estimated $65 billion valuation in 2024 underscores the scale of investment, reinforcing exit barriers.

Competitive rivalry within the flavors and fragrances industry is exceptionally high, driven by the presence of a few dominant global players like Givaudan, Symrise, DSM-Firmenich, and International Flavors & Fragrances (IFF). These companies, along with numerous smaller specialized firms, vie for market share in a sector projected to grow from USD 32.33 billion in 2024 to USD 47.73 billion by 2032.

Innovation is a critical battleground, with companies like IFF heavily investing in R&D to develop novel, sustainable, and bio-based ingredients, responding to consumer demand and regulatory shifts. This intense focus on new product introductions, exemplified by IFF's significant capital expenditures in 2023, is essential for differentiation and market presence.

Customers, often large corporations, have considerable leverage due to the similar comprehensive portfolios offered by major suppliers, making switching feasible if better value or innovation is perceived. This dynamic, coupled with high exit barriers stemming from substantial capital investments in R&D and specialized facilities, compels companies to remain highly competitive, even during economic slowdowns, to justify their long-term commitments in the approximately $65 billion global market as of 2024.

| Key Competitors | Market Share (Approx. 2024) | Key Innovation Focus (2024) |

| Givaudan | ~25% | Natural ingredients, sustainability |

| Symrise | ~15% | Biotechnology, upcycling |

| DSM-Firmenich | ~12% | Health & nutrition, biotech |

| International Flavors & Fragrances (IFF) | ~10% | Bio-based, ethical sourcing |

SSubstitutes Threaten

Direct substitutes for International Flavors & Fragrances (IFF) products are those offered by other flavor and fragrance houses that produce similar scent or taste profiles. While competitors can create comparable sensory experiences, IFF's strength lies in its proprietary formulations and advanced technological capabilities, making exact replication challenging. For instance, in 2023, the global flavor and fragrance market was valued at approximately $55 billion, with numerous players vying for market share, yet IFF's specialized ingredients and patented processes provide a degree of differentiation.

Customers may choose simpler, less expensive ingredients or less intricate flavor and fragrance profiles if the sensory outcome is satisfactory for their products. This is especially true for budget-conscious market segments or for private-label goods where cost is a primary driver.

For instance, in 2024, private-label food products continued to gain market share, with some reports indicating growth exceeding 5% in certain categories, demonstrating a clear consumer preference for lower-cost alternatives that still deliver acceptable quality.

Customer willingness to substitute for International Flavors & Fragrances (IFF) products is a significant factor. Brand loyalty plays a crucial role; for instance, a well-established flavor profile in a popular food product might make consumers less likely to accept a change. Consumer perception of quality is also key; if customers believe IFF's ingredients contribute to a superior sensory experience, they'll be less inclined to switch to alternatives.

The criticality of the sensory experience to the final product's success directly impacts substitution. For premium goods where taste and aroma are paramount, like fine dining or high-end perfumes, customers are far less willing to accept substitutes. Conversely, for more commoditized applications, such as basic cleaning products or industrial ingredients, the willingness to substitute is considerably higher as the sensory impact is less pronounced.

Technological Advancements Enabling Substitutes

Technological advancements are a significant driver of substitute threats for companies like International Flavors & Fragrances (IFF). The rapid evolution of biotechnology and artificial intelligence (AI) is a key factor here.

These technologies are facilitating the development of novel aroma molecules and flavor enhancers. Often, these new ingredients are not only capable of mimicking existing traditional flavors and scents but can also offer enhanced performance or improved sustainability profiles, presenting a potent long-term substitution risk.

For instance, the ability to engineer microorganisms to produce complex flavor compounds offers a potential alternative to traditional extraction methods. By 2024, the global market for bio-based flavors and fragrances was projected to reach substantial figures, indicating a growing acceptance and adoption of these technologically driven substitutes.

- Biotechnology Innovations: Advances in synthetic biology allow for the creation of nature-identical or novel flavor and fragrance compounds through fermentation or enzymatic processes, potentially reducing reliance on natural raw materials.

- AI in Formulation: AI algorithms can predict and design new flavor and scent profiles, accelerating the development of substitutes that meet specific consumer demands for taste, aroma, and even functional benefits.

- Cost and Sustainability Drivers: Bio-engineered or synthetically produced ingredients can often be more cost-effective and environmentally friendly to produce at scale compared to traditional sourcing, making them attractive alternatives.

- Market Growth: The bio-based ingredients market, encompassing flavors and fragrances, is experiencing robust growth, with projections indicating continued expansion driven by consumer preference for natural and sustainable products.

Emergence of DIY or In-house Solutions

While the creation of sophisticated flavors and fragrances typically demands specialized knowledge and significant investment, making large-scale in-house production uncommon, some major consumer goods corporations may cultivate basic internal capabilities. This can lessen their dependence on external providers for specific ingredients or simpler formulations.

For instance, while not a direct substitute for IFF's complex offerings, a company like Procter & Gamble might develop in-house scent blending for certain household products, potentially impacting demand for IFF's less specialized fragrance compounds. By 2024, major CPG companies continue to invest in R&D, with some exploring more integrated supply chain models.

- Limited Internal Capabilities: Very large consumer goods firms may develop basic in-house flavor and fragrance production for non-core or simpler product lines.

- Reduced Reliance: This can decrease their reliance on external suppliers for certain components, although complex creations remain outsourced.

- Industry Trends: While specific figures on in-house flavor development are proprietary, the general trend in manufacturing is towards greater vertical integration where feasible.

The threat of substitutes for International Flavors & Fragrances (IFF) is influenced by the availability of alternative ingredients, the cost-effectiveness of those alternatives, and consumer willingness to accept them. While IFF leverages proprietary formulations and advanced technology, simpler or less expensive options can emerge, particularly in budget-conscious segments. For example, the growth of private-label goods in 2024, with some categories seeing over 5% market share increases, highlights consumer openness to value-driven alternatives that still meet quality expectations.

Technological advancements, especially in biotechnology and AI, are increasingly creating potent substitutes. These innovations allow for the development of novel aroma molecules and flavor enhancers that can mimic or even surpass traditional ingredients, often with improved sustainability or cost profiles. The bio-based flavors and fragrances market, for instance, is expanding significantly, driven by consumer demand for natural and sustainable products, indicating a growing acceptance of these technologically advanced alternatives.

While direct, large-scale substitution of IFF's complex offerings by competitors is challenging due to specialized knowledge and investment, some very large consumer goods companies may develop basic in-house capabilities for simpler formulations. This can reduce their reliance on external suppliers for certain components, though complex creations typically remain outsourced. The overall trend in manufacturing shows a push for greater vertical integration where feasible, impacting supplier relationships.

| Factor | Impact on IFF | Example/Data Point |

| Availability of Alternatives | Moderate to High | Competitors offer similar scent/taste profiles; simpler ingredients are readily available. |

| Cost-Effectiveness | Moderate | Private-label goods, growing at >5% in some 2024 categories, show consumer preference for lower-cost options. |

| Technological Advancements | High | Bio-based flavors market expansion driven by biotech and AI innovations. |

| Customer Switching Costs | Low to Moderate | Brand loyalty and perceived quality of IFF's sensory experience can deter switching, but less critical for commoditized products. |

Entrants Threaten

The flavors and fragrances sector demands substantial upfront investment. Companies need to fund advanced research and development labs, state-of-the-art manufacturing facilities, and extensive global supply chains. For instance, in 2023, major players like Givaudan and Firmenich reported significant capital expenditures in these areas to maintain their competitive edge and expand their capabilities.

These high capital requirements create a formidable barrier to entry for potential new competitors. Establishing the necessary infrastructure and technological capabilities to compete effectively with established giants like International Flavors & Fragrances (IFF) requires financial resources that many aspiring companies simply cannot muster, thereby limiting the threat of new entrants.

Established players like International Flavors & Fragrances (IFF) leverage substantial economies of scale. This means they can produce and procure ingredients more cheaply due to their sheer volume. For instance, in 2024, IFF's significant global production capacity allows for optimized manufacturing processes, a cost advantage that is difficult for smaller, newer companies to replicate.

These scale advantages extend to research and development, where IFF can invest heavily in innovation, creating a wider array of specialized products. This broad portfolio, a result of extensive R&D and operational scale, presents a formidable barrier for new entrants aiming to compete on both price and product diversity.

New companies entering the flavors and fragrances market face significant hurdles in securing access to established distribution channels. Building relationships with major global consumer product companies, the primary customers, is a lengthy and resource-intensive endeavor, creating a substantial barrier.

These established relationships are crucial for market penetration. For instance, in 2024, the top 10 global food and beverage companies, who are major purchasers of flavors, collectively generated over $500 billion in revenue, highlighting the concentrated nature of the customer base and the difficulty for newcomers to gain traction.

Brand Loyalty and Customer Relationships

Brand loyalty and deep-rooted customer relationships present a significant barrier to new entrants in the flavors and fragrances industry. Established companies like International Flavors & Fragrances (IFF) have cultivated long-standing partnerships, often becoming integral to their clients' product development cycles. These existing players are frequently considered 'core list' suppliers, meaning they are the preferred or primary source for specific ingredients or formulations.

Breaking into these established relationships is exceptionally difficult for newcomers. The trust and integration built over years mean that switching suppliers involves not only cost but also potential risks to product consistency and innovation for the customer. In 2024, the emphasis on supply chain resilience and trusted partnerships further solidifies these existing bonds, making it harder for new players to gain a foothold.

- Established Customer Integration: IFF and its peers are deeply embedded in client R&D, making switching costly and time-consuming.

- 'Core List' Supplier Status: Long-term contracts and preferred supplier status create a high switching cost for customers.

- Trust and Reliability: Decades of consistent quality and service build a strong foundation of trust that new entrants must replicate.

- Industry Inertia: The sheer effort required for a customer to re-qualify and integrate a new supplier for critical flavor or fragrance components is a major deterrent.

Proprietary Technology and Intellectual Property

The flavor and fragrance industry is heavily protected by intellectual property. This includes patented molecules, unique manufacturing processes, and closely guarded trade secrets for specific scent and taste creations. For instance, major players like Givaudan and Firmenich invest heavily in R&D, with Givaudan reporting over CHF 300 million in R&D spending in 2023, a testament to the importance of innovation in maintaining competitive advantage.

This extensive IP landscape creates a significant barrier for new companies. Entering the market requires either a substantial investment in research and development to create novel compositions or the necessity of securing licensing agreements for existing technologies. Without these, new entrants struggle to differentiate themselves and offer unique value propositions against established firms with deep patent portfolios.

- Patented Molecules: Unique chemical compounds that create specific sensory experiences.

- Proprietary Processes: Patented or trade-secret methods for synthesizing or blending ingredients.

- Trade Secrets: Confidential formulas and recipes for flavor and fragrance creations.

- R&D Investment: Significant capital expenditure required to develop new and competitive IP.

The threat of new entrants in the flavors and fragrances industry is generally considered low, primarily due to the substantial capital requirements for establishing research, development, and manufacturing capabilities. For example, in 2024, the ongoing need for advanced sensory science labs and specialized production facilities necessitates significant upfront investment, a hurdle that deters many potential new players.

Furthermore, established companies like International Flavors & Fragrances (IFF) benefit from significant economies of scale, allowing for cost efficiencies in procurement and production that new entrants find difficult to match. IFF's 2024 operational scale, for instance, enables optimized manufacturing processes, providing a cost advantage that is hard for smaller, emerging companies to overcome.

Access to established distribution channels and deep-rooted customer relationships also poses a major barrier. The time and resources required to build trust and secure preferred supplier status with major consumer goods companies, who represent a concentrated customer base, are considerable. In 2024, the emphasis on supply chain resilience further solidifies these existing partnerships, making it increasingly challenging for newcomers to gain market traction.

Porter's Five Forces Analysis Data Sources

Our analysis of International Flavors & Fragrances leverages a comprehensive suite of data, including company annual reports, investor presentations, and SEC filings. We also incorporate insights from industry-specific market research reports and trade publications to provide a robust understanding of the competitive landscape.