Hyatt Hotels Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyatt Hotels Bundle

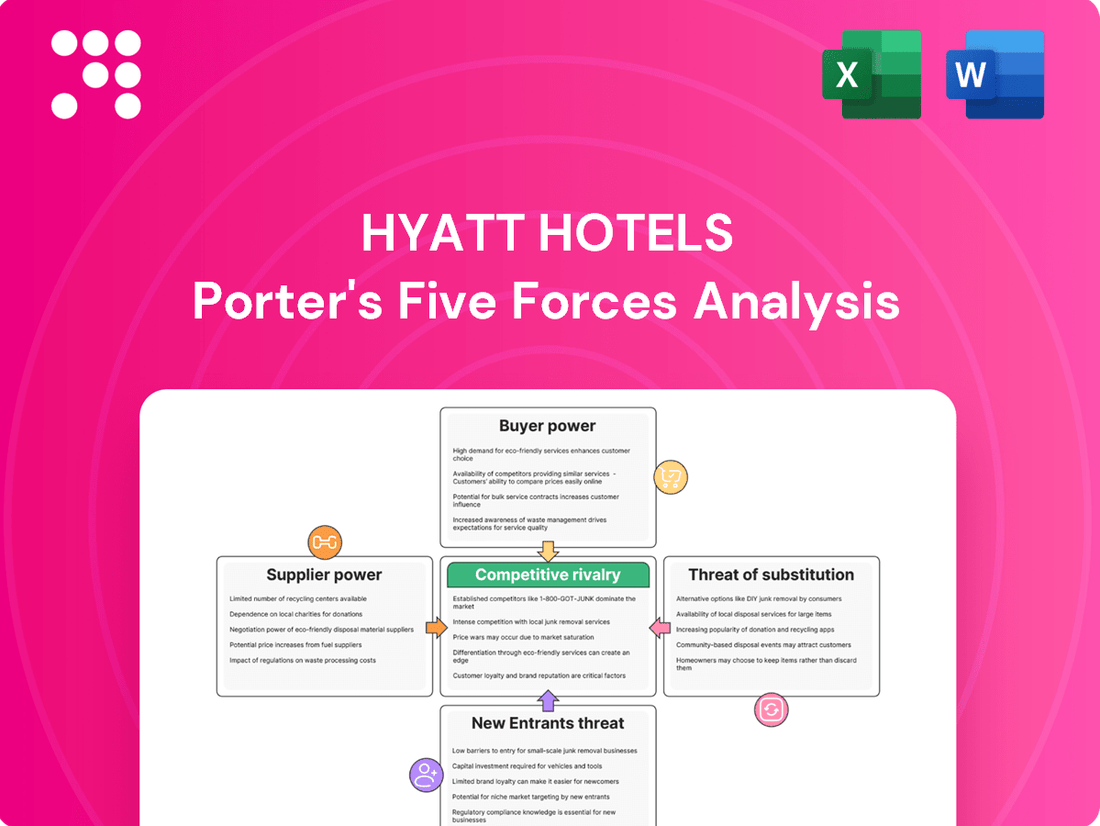

Hyatt Hotels operates in a dynamic hospitality landscape shaped by several key forces. Understanding the intensity of buyer power, the threat of new entrants, and the bargaining power of suppliers is crucial for navigating this competitive environment. Furthermore, the availability of substitutes and the level of rivalry among existing players significantly impact Hyatt's strategic positioning and profitability.

The complete report reveals the real forces shaping Hyatt Hotels’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for critical inputs significantly impacts their leverage over Hyatt Hotels. For instance, specialized technology systems or unique luxury amenities might be sourced from a limited number of providers. If there are only a few companies capable of supplying these essential components, they gain considerable power to dictate terms and pricing, potentially increasing costs for Hyatt.

Hyatt's ability to switch between suppliers significantly impacts its bargaining power. High switching costs, such as the expense and time involved in retraining staff for new property management systems or reconfiguring supply chains for different amenities, naturally empower suppliers. For instance, if a new housekeeping supply vendor requires extensive on-site training for hundreds of employees across multiple properties, Hyatt faces a substantial hurdle to change.

Suppliers offering highly unique or proprietary products and services, like custom-designed furniture or patented guest-facing technology, hold significant sway. Hyatt's reliance on these distinctive elements is crucial for upholding its brand reputation and delivering a memorable guest experience, directly impacting its ability to negotiate favorable terms.

Supplier's Importance to Hyatt's Business

Hyatt's reliance on specific suppliers for critical operational components or unique guest experiences significantly influences supplier bargaining power. For example, a provider of a proprietary hotel management software or a unique, high-demand amenity like a specific luxury bedding brand could wield considerable leverage.

The bargaining power of suppliers for Hyatt is influenced by several factors:

- Supplier Concentration: If a small number of suppliers provide essential goods or services, their power increases. For instance, a limited number of providers for specialized hotel technology systems could command higher prices.

- Uniqueness of Input: Suppliers offering differentiated or proprietary products and services that are crucial for Hyatt's brand image or operational efficiency have greater bargaining power.

- Switching Costs: High costs associated with changing suppliers for critical systems, such as integrated reservation platforms or loyalty program software, empower existing suppliers.

- Availability of Substitutes: The presence of readily available substitutes for a supplier's offering diminishes their bargaining power. If Hyatt can easily source comparable goods or services from multiple vendors, supplier influence is reduced.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into the hospitality sector themselves significantly bolsters their bargaining power against Hyatt Hotels. If a key supplier, like a major food distributor or a technology provider for hotel operations, could credibly enter the hotel management business, Hyatt would be forced to consider less favorable contract terms to mitigate this potential competition. For instance, a large-scale furniture manufacturer could potentially leverage its production capacity to directly operate hotels, bypassing existing management companies.

This forward integration threat can manifest in various ways, impacting Hyatt's operational costs and strategic flexibility. Suppliers might use the prospect of entering the market as leverage to secure better pricing on their existing products or services. For example, a prominent hotel amenities supplier, if it possesses the capital and expertise, could threaten to launch its own branded hotel chain, thereby pressuring Hyatt to accept higher supply costs to maintain a stable relationship.

- Supplier Capability: Suppliers with strong brand recognition or proprietary technology are better positioned for forward integration.

- Industry Attractiveness: High profit margins in the hospitality sector incentivize suppliers to consider direct market entry.

- Hyatt's Reliance: Heavy dependence on a few key suppliers increases their leverage and the credibility of their forward integration threat.

The bargaining power of suppliers is a significant force for Hyatt Hotels, driven by supplier concentration and the uniqueness of their offerings. For example, in 2024, the global hotel supplies market, while vast, sees pockets of consolidation for specialized items like advanced property management software or unique, high-quality linens, giving key providers considerable leverage. Hyatt’s reliance on these specific inputs, which are often critical for maintaining brand standards and guest satisfaction, means that suppliers of these differentiated products can command higher prices and more favorable contract terms. The cost and complexity of switching these specialized suppliers, such as re-implementing a new reservation system, further entrench supplier power.

| Factor | Impact on Hyatt Hotels | Example (2024 Context) |

|---|---|---|

| Supplier Concentration | Increases supplier leverage | Limited providers for specialized hotel technology systems can dictate terms. |

| Uniqueness of Input | Enhances supplier bargaining power | Proprietary management software or unique luxury amenities crucial for brand image. |

| Switching Costs | Empowers existing suppliers | High costs to change critical systems like integrated reservation platforms. |

| Forward Integration Threat | Bolsters supplier leverage | A major food distributor could leverage its scale to potentially enter hotel operations. |

What is included in the product

This Porter's Five Forces analysis for Hyatt Hotels examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes within the hospitality industry.

Effortlessly identify and address competitive threats by visualizing the intensity of each force, allowing for targeted strategic responses.

Customers Bargaining Power

The price sensitivity of travelers, a key segment for Hyatt Hotels, directly influences their bargaining power. This includes everyone from budget-conscious leisure travelers to corporate clients negotiating bulk rates. For instance, a significant portion of Hyatt's revenue comes from corporate accounts, where price is often a primary consideration in booking decisions.

In competitive lodging markets, especially during periods of economic slowdown, customers are naturally more inclined to seek out the best deals. This increased price focus empowers them to negotiate for lower room rates or request added amenities, putting pressure on Hyatt to offer competitive pricing and demonstrate superior value to retain their business.

The sheer number of alternative lodging choices significantly boosts customer bargaining power. Travelers can easily opt for other major hotel chains, boutique hotels, or even short-term rental platforms like Airbnb, which saw a substantial increase in bookings in 2024 as travel rebounded robustly.

This abundance of substitutes compels Hyatt to maintain competitive pricing and service levels. For instance, the average daily rate (ADR) for hotels globally is influenced by the competitive landscape, and Hyatt must ensure its offerings are attractive compared to these alternatives.

Hyatt's World of Hyatt loyalty program is a key strategy to curb customer bargaining power. By offering tiered benefits, points for free nights, and exclusive experiences, Hyatt increases the cost for customers to switch to a competitor. For instance, in 2023, World of Hyatt members accounted for a significant portion of Hyatt's room revenue, demonstrating the program's effectiveness in fostering loyalty and reducing price sensitivity.

Volume of Purchases by Customers

The volume of purchases by customers significantly influences bargaining power within the hotel industry. Large corporate clients, group event organizers, and online travel agencies (OTAs) that book substantial numbers of rooms wield considerable influence.

These high-volume customers can leverage their purchasing power to negotiate better rates, demand tailored services, and secure more favorable contract terms. For instance, major corporations often secure corporate rates that are significantly lower than publicly advertised prices, and these rates are frequently reviewed and adjusted based on annual spending. In 2023, corporate travel spending was projected to reach over $1.3 trillion globally, indicating the substantial leverage these buyers have.

- Large corporate clients: Negotiate volume-based discounts and dedicated account management.

- Group event organizers: Can bundle room bookings with meeting space and catering for better package deals.

- Online Travel Agencies (OTAs): Aggregate demand from numerous travelers, allowing them to negotiate commission rates and preferred placement on their platforms.

- Loyalty program members: High-tier members often receive preferential treatment and discounts, increasing their bargaining power through repeat business.

Information Availability to Customers

The internet has dramatically shifted the balance of power towards customers by making information readily accessible. Travelers can now effortlessly compare prices, amenities, and guest reviews across numerous hotel brands, including Hyatt. This transparency forces hotels to offer competitive pricing and maintain high service standards to attract and retain guests.

For instance, as of early 2024, travel booking sites and review platforms like TripAdvisor and Google Reviews provide extensive data that customers use to make informed decisions. Hyatt's ability to differentiate itself through loyalty programs and unique guest experiences becomes crucial in this environment. The ease with which customers can switch between providers, armed with comprehensive information, significantly amplifies their bargaining leverage.

- Information Accessibility: Online platforms provide widespread access to pricing, reviews, and competitor analysis.

- Price Transparency: Customers can easily compare Hyatt's offerings with other hotels, driving competitive pricing.

- Enhanced Bargaining Power: Easy comparison empowers customers to negotiate better deals or choose alternative providers.

The bargaining power of customers for Hyatt Hotels is significantly influenced by the availability of numerous substitutes and the ease of price comparison. With a vast array of lodging options, from major hotel chains to independent establishments and short-term rentals, customers possess considerable leverage to seek out the best value. This is further amplified by online platforms that offer transparent pricing and detailed reviews, empowering travelers to make informed decisions and negotiate for better rates or additional perks.

| Factor | Impact on Hyatt | Supporting Data (2024 Estimates/Trends) |

|---|---|---|

| Availability of Substitutes | High | Continued growth in alternative accommodations like Airbnb, with bookings in 2024 showing a strong rebound in leisure travel. |

| Price Sensitivity | Moderate to High | Corporate travel budgets are closely scrutinized, with many companies aiming for cost savings in 2024. |

| Information Accessibility | High | Over 80% of travelers use online travel agencies and review sites to compare options before booking. |

| Loyalty Program Effectiveness | Moderate | World of Hyatt members represent a significant portion of revenue, but new members are still actively comparing options. |

Full Version Awaits

Hyatt Hotels Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Hyatt Hotels, detailing the competitive landscape and strategic implications. The document you see here is the exact, fully formatted analysis you'll receive immediately after purchase, offering immediate insights into Hyatt's industry position. You can confidently expect to download this complete, professionally written report without any alterations or placeholders.

Rivalry Among Competitors

Hyatt Hotels operates in a highly competitive landscape, facing a multitude of rivals ranging from global giants like Marriott International and Hilton Worldwide to numerous regional brands and independent boutique hotels. This sheer volume of players, estimated in the hundreds of thousands globally, means intense competition for prime locations, customer loyalty, and bookings. For instance, as of early 2024, Marriott alone boasted over 8,000 properties worldwide, illustrating the scale of the competitive set Hyatt navigates.

A slower industry growth rate significantly fuels competitive rivalry within the hotel sector, including for companies like Hyatt. When the overall market isn't expanding rapidly, businesses must aggressively vie for market share, often leading to price wars and intensified marketing efforts. This dynamic is particularly evident in mature segments where growth is typically achieved by taking business away from rivals.

Hyatt actively cultivates brand differentiation through its diverse portfolio, encompassing luxury (Park Hyatt), lifestyle (Thompson Hotels), and select-service (Hyatt Centric) segments. This strategic segmentation aims to capture different traveler needs and preferences, thereby fostering loyalty and reducing the inclination for customers to switch based solely on price. The Hyatt's loyalty program, World of Hyatt, reported over 40 million members as of early 2024, incentivizing repeat stays and providing valuable customer data.

High Fixed Costs and Perishable Inventory

The hotel industry, including players like Hyatt Hotels, faces intense competitive rivalry largely due to its substantial fixed costs and the perishable nature of its core product: hotel rooms. Significant investments in property, infrastructure, and a consistent staffing model create a high cost base that must be covered regardless of occupancy. This financial pressure is amplified because unsold rooms cannot be stored or sold later, making them a lost revenue opportunity. For instance, in 2024, the average occupancy rate for hotels globally hovered around 65-70%, meaning a substantial portion of available inventory goes unsold each night.

This dynamic forces hotels into aggressive pricing strategies to ensure at least some revenue generation. Even if a room is sold at a price barely above its variable cost, it contributes towards covering those hefty fixed expenses. This often leads to price wars, particularly during off-peak seasons or in markets with oversupply. For example, during the early months of 2024, many leisure destinations saw average daily rates (ADR) drop by 10-15% compared to peak periods to stimulate demand and mitigate losses from empty rooms.

- High Fixed Costs: Properties, staffing, and maintenance represent substantial ongoing expenses for hotel chains like Hyatt.

- Perishable Inventory: Unoccupied hotel rooms on any given night represent lost revenue that can never be recovered.

- Price Competition: To cover fixed costs, hotels often reduce rates, especially during low demand periods, leading to intense price wars.

- Impact on Profitability: The need to fill rooms can drive down profit margins, as hotels prioritize occupancy over maximizing per-room revenue.

Exit Barriers in the Industry

Hyatt Hotels, like many in the hospitality sector, faces significant exit barriers. These include the substantial capital tied up in specialized assets like hotel properties, which are not easily repurposed or sold. Long-term leases and management contracts also create commitments that are difficult and costly to break, forcing companies to stay operational even when returns are low.

These high exit barriers contribute directly to intense competitive rivalry. When companies find it hard to leave the market, they often remain, leading to persistent overcapacity. For instance, in 2024, the global hotel occupancy rates, while recovering, still presented challenges in certain markets, making it harder for underperforming hotels to exit gracefully.

- Specialized Assets: Hotel properties represent a large portion of sunk costs, with limited alternative uses.

- Long-Term Contracts: Leases and management agreements bind companies to the market for extended periods.

- Sunk Costs: Investments in branding, staff training, and property development are difficult to recover.

- Overcapacity: The inability to exit easily sustains a higher number of competitors than market demand might ideally support, intensifying price competition and service innovation efforts.

The competitive rivalry within the hotel industry, impacting Hyatt Hotels, is fierce due to a crowded market and the perishable nature of rooms, driving aggressive pricing. High fixed costs and exit barriers further compel companies to compete intensely, even in less profitable scenarios. For example, in 2024, the global hotel industry faced ongoing pressure to fill rooms, with occupancy rates fluctuating, making price adjustments a common tactic to manage revenue.

| Factor | Description | Impact on Hyatt |

|---|---|---|

| Market Saturation | Numerous global and regional brands compete for market share. | Requires differentiation and loyalty programs to retain customers. |

| Perishability of Rooms | Unsold rooms represent lost revenue. | Drives dynamic pricing and promotional offers to maximize occupancy. |

| High Fixed Costs | Significant investment in property and operations. | Pressures hotels to maintain occupancy, potentially leading to price wars. |

| Exit Barriers | Difficulty in divesting specialized assets and contracts. | Keeps more competitors in the market, intensifying rivalry. |

SSubstitutes Threaten

The rise of platforms like Airbnb and Vrbo presents a substantial threat of substitution for traditional hotels. These alternatives often cater to travelers seeking unique experiences or longer stays, offering amenities and pricing structures that differ from standard hotel offerings. For instance, in 2024, the short-term rental market continued its robust growth, with Airbnb reporting over 1.5 million active listings in the US alone, directly competing for leisure and extended-stay travelers.

The cost-effectiveness of substitute options presents a significant threat to Hyatt Hotels. For instance, vacation rental platforms like Airbnb often offer lower per-night rates, especially for extended stays or group bookings, making them a more attractive choice for budget-conscious leisure travelers. In 2024, the global vacation rental market was projected to reach over $100 billion, indicating a substantial segment of the travel industry where price is a primary driver.

Changing travel preferences represent a significant threat of substitutes for Hyatt Hotels. Travelers increasingly seek unique, localized experiences over standardized hotel stays, and a growing segment prefers self-catering accommodations like Airbnb or vacation rentals for greater flexibility and perceived value. For instance, in 2024, the global vacation rental market was projected to reach over $100 billion, demonstrating the scale of this alternative.

Impact of Virtual Communication Technologies

The rise of virtual communication technologies presents a significant threat to Hyatt Hotels, particularly impacting its business travel segment. Platforms like Zoom and Microsoft Teams have become increasingly sophisticated, offering immersive experiences that can substitute for in-person meetings and conferences.

This shift directly affects corporate bookings, a crucial revenue stream for hotels. For instance, a significant portion of Hyatt's revenue historically comes from business travelers and group events. The ongoing trend towards hybrid and remote work models, accelerated in recent years, means fewer companies are prioritizing physical travel for internal meetings or smaller client engagements.

Consider the impact on business travel spending. While business travel spending is projected to recover, it may not reach pre-pandemic levels in the same way, with some of the gains from virtual alternatives being permanent. For example, in 2024, while business travel spending is expected to show robust growth, the nature of that travel is evolving, with a greater emphasis on essential trips rather than routine meetings.

- Virtual Meeting Platforms: Increased adoption of video conferencing reduces the need for face-to-face business meetings.

- Remote Work Trends: The prevalence of remote and hybrid work models diminishes the necessity for business travel.

- Impact on Corporate Bookings: This technological substitution directly affects revenue from corporate clients and conferences.

- Long-Term Threat: The sustained shift towards virtual interactions poses a persistent challenge to traditional hotel business models reliant on travel.

Ease of Switching to Substitutes

The threat of substitutes for traditional hotel accommodations, like those offered by Hyatt, is significant and growing. Travelers can easily switch to alternative lodging options, often with minimal effort thanks to online booking platforms. This ease of switching is a key factor amplifying the threat.

Online platforms have dramatically reduced the friction associated with exploring and booking alternative accommodations. Travelers can now compare prices, amenities, and locations across a wide range of options, including vacation rentals and unique stays, all within a few clicks. For instance, platforms like Airbnb and Vrbo have made it incredibly simple for consumers to find and book non-hotel stays, directly impacting the hotel industry.

- Increased Accessibility of Alternatives: Online travel agencies and direct booking sites for vacation rentals provide readily available and easily comparable alternatives to hotels.

- Price Sensitivity: Many travelers, particularly for leisure trips, are highly price-sensitive, making them more likely to opt for potentially cheaper substitute accommodations. In 2023, the average nightly rate for a hotel room in the US was around $150, while many vacation rental options can be found at lower price points for longer stays or larger groups.

- Diverse Offerings: Substitutes offer a wider variety of experiences, from private homes and apartments to unique glamping sites, catering to diverse traveler preferences beyond standard hotel amenities.

- Digital Convenience: The seamless digital experience of booking and managing stays through apps and websites for substitute accommodations mirrors and sometimes surpasses the convenience offered by traditional hotel booking systems.

The threat of substitutes for hotels like Hyatt is substantial, driven by the growing popularity of alternative lodging. These substitutes, such as vacation rentals and unique accommodations, offer different value propositions that appeal to various traveler segments. For example, in 2024, the global short-term rental market continued its significant expansion, with platforms like Airbnb and Vrbo providing a vast array of options that directly compete with traditional hotel stays.

The appeal of these substitutes often lies in their perceived value and the unique experiences they offer. Many travelers are now prioritizing authenticity and local immersion over standardized hotel services, making alternatives highly attractive. In 2024, the vacation rental market was projected to exceed $100 billion globally, underscoring the significant demand for these non-traditional lodging options.

Furthermore, the increasing sophistication of online booking platforms has made it easier than ever for consumers to discover and reserve substitute accommodations. This ease of access, combined with competitive pricing, particularly for longer stays or group bookings, presents a persistent challenge to hotel revenue streams. For instance, the average nightly rate for a hotel room in the US in 2023 hovered around $150, while many vacation rental options could offer more competitive per-night pricing for extended periods.

| Substitute Type | Key Appeal | 2024 Market Indicator |

|---|---|---|

| Vacation Rentals (e.g., Airbnb, Vrbo) | Unique stays, local experience, cost-effectiveness for groups/long stays | Global market projected to exceed $100 billion |

| Short-Term Rentals (Managed Properties) | Hotel-like services with apartment-style living | Continued growth in specialized platforms |

| Virtual Meetings/Remote Work | Reduced need for business travel | Significant impact on corporate bookings and conferences |

Entrants Threaten

The substantial capital needed to develop or purchase hotel properties, especially for full-service brands like Hyatt, presents a significant barrier. For instance, constructing a new full-service hotel can easily cost tens of millions of dollars, sometimes exceeding $500,000 per room in major markets. This high upfront investment deters many potential new competitors.

Established brands like Hyatt Hotels leverage significant brand recognition and deeply ingrained customer loyalty, making it a formidable barrier for newcomers. These established players have cultivated trust over years, often supported by robust loyalty programs that encourage repeat business. For instance, Hyatt's World of Hyatt program boasts millions of active members, a testament to its strong customer retention capabilities.

Hyatt Hotels, like other established players, benefits from deeply entrenched relationships with key distribution channels. These include major online travel agencies (OTAs) such as Expedia and Booking.com, where Hyatt enjoys preferential placement and established customer traffic. Furthermore, years of building trust with corporate travel managers secure a steady stream of business bookings. In 2024, OTAs continued to represent a significant portion of hotel bookings globally, underscoring the importance of these established partnerships.

New hotel brands entering the market find it difficult to replicate this level of access and visibility. Gaining prominent placement on OTAs requires substantial marketing spend and often involves paying higher commission rates, impacting profitability from the outset. Building direct booking platforms that rival the user experience and marketing reach of established brands also demands considerable investment in technology and customer acquisition.

Regulatory Hurdles and Zoning Laws

The hospitality industry, including major players like Hyatt Hotels, faces significant barriers to entry due to the intricate network of local zoning laws, stringent building codes, and the necessity of obtaining numerous permits. Navigating these complex regulatory landscapes demands considerable time, specialized knowledge, and substantial financial investment, effectively deterring many potential new competitors from entering the market.

These regulatory requirements are not static; they evolve and vary significantly by location. For instance, in 2024, cities across the United States continued to implement or revise zoning ordinances impacting hotel development, often focusing on density, environmental impact, and community character. This constant flux adds another layer of complexity and cost for any new entrant aiming to establish a physical presence.

- Zoning Restrictions: Many prime locations are subject to strict zoning laws that limit or prohibit new hotel construction, forcing entrants to consider less desirable or more expensive areas.

- Building Codes and Permits: Compliance with diverse and often updated building codes, fire safety regulations, and accessibility standards requires significant upfront capital and ongoing adherence.

- Environmental Regulations: Environmental impact assessments and compliance with sustainability mandates, which are increasingly prevalent in 2024, can add substantial costs and delays to new hotel projects.

- Permitting Process: The lengthy and often unpredictable permitting process across different municipalities can tie up capital and delay revenue generation for new entrants.

Operational Complexity and Expertise

Operating a hotel, particularly a full-service or luxury establishment like many Hyatt properties, is inherently complex. This complexity stems from managing a diverse workforce, from housekeeping to specialized F&B staff, and implementing sophisticated revenue management systems to optimize occupancy and pricing. For instance, in 2024, the hospitality industry continued to grapple with labor shortages, making efficient staff management a critical differentiator. New entrants often struggle to replicate the deep operational expertise that established players like Hyatt have cultivated over years, creating a significant hurdle.

The accumulated knowledge in areas like guest relations, supply chain management for perishables, and maintaining brand-specific service standards is not easily acquired. Hyatt, for example, benefits from decades of experience in training and retaining talent, a crucial element in delivering consistent guest experiences. This expertise directly translates into operational efficiency and customer loyalty, making it difficult for newcomers to compete on service quality and cost-effectiveness without significant investment and learning curves. In 2024, the average tenure of a hotel manager in the US was around 5-7 years, highlighting the experience gap new entrants face.

- Operational Complexity: Hotels require intricate management of diverse departments, from front desk and F&B to housekeeping and maintenance.

- Revenue Management Expertise: Sophisticated dynamic pricing and occupancy forecasting are crucial, demanding specialized knowledge.

- Service Standards: Maintaining consistent, high-quality guest service across all touchpoints is a significant barrier for new entrants.

- Labor Management: Effectively managing and retaining staff in a demanding industry requires accumulated expertise, a challenge highlighted by 2024 labor market conditions.

The threat of new entrants for Hyatt Hotels is generally considered moderate to low, primarily due to substantial barriers. These include the immense capital required for property acquisition and development, which can run into hundreds of millions of dollars for a single full-service hotel. Furthermore, established brands like Hyatt benefit from strong customer loyalty, built over years through programs like World of Hyatt, which has millions of active members. These factors combined make it exceptionally challenging for newcomers to gain a foothold in the market.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hyatt Hotels is built on a foundation of robust data, including Hyatt's annual reports and SEC filings, alongside industry-specific market research from firms like Statista and IBISWorld. We also incorporate macroeconomic data and reports from financial analysts to provide a comprehensive view of the competitive landscape.