Hyatt Hotels Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyatt Hotels Bundle

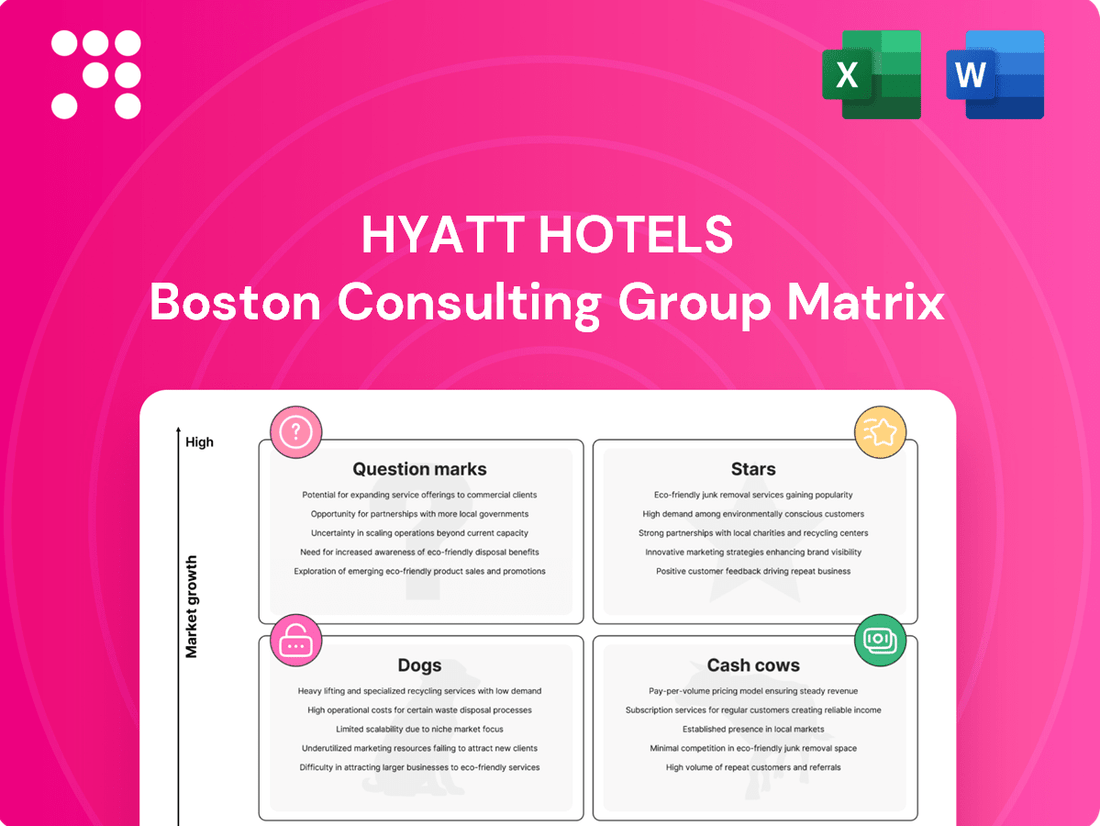

Hyatt Hotels, like any diversified hospitality giant, can be analyzed through the BCG Matrix to understand its brand portfolio's market share and growth potential. Imagine identifying which Hyatt brands are booming market leaders (Stars), which reliably generate consistent revenue with low growth (Cash Cows), which are struggling in declining markets (Dogs), and which have high growth potential but currently low share (Question Marks). This strategic framework offers a powerful lens for understanding Hyatt's current competitive landscape.

Dive deeper into Hyatt Hotels' BCG Matrix and gain a clear view of where its brands stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Hyatt's luxury and lifestyle brands are a key growth driver, with a remarkable expansion of luxury rooms doubling and lifestyle rooms quintupling globally since 2017. This aggressive growth is fueled by a strong development pipeline, anticipating over 50 new luxury and lifestyle hotels by 2026.

This strategic focus on high-end, experiential travel positions these brands as leaders in a rapidly expanding market segment. Continued investment is crucial to maintain this momentum and capture further market share in the luxury and lifestyle hospitality sector.

Hyatt is making major moves in the all-inclusive sector, especially after acquiring Apple Leisure Group and planning to acquire Playa Hotels & Resorts. This focus on all-inclusive resorts, known for their profitability and consistent cash generation, is crucial for building Hyatt's presence in popular destinations like Mexico and the Caribbean.

The all-inclusive market is showing robust recovery, with net package RevPAR expected to rebound strongly in late 2024 and into 2025. This trend highlights a growing market share for Hyatt in a leisure travel segment that continues to see high demand.

The Park Hyatt brand is experiencing significant global expansion, with planned openings through 2025 in prime locations like London, Johannesburg, Kuala Lumpur, and Mexico. This strategic growth solidifies its prominent standing in the luxury hospitality market.

Hyatt's commitment to the Park Hyatt brand is evident through ongoing investments in new developments and renovations, such as the Park Hyatt Tokyo. These efforts are crucial for maintaining its leadership and attracting discerning, affluent travelers, reinforcing its position as a star performer.

Thompson Hotels Expansion

Thompson Hotels, a significant player in Hyatt's lifestyle segment, is experiencing robust growth. In 2024, the brand continued its international expansion with notable openings in key markets like Rome, Vienna, and Seville in Europe, alongside Shanghai Expo in Asia Pacific. This strategic move into desirable urban and leisure locations is a clear indicator of its expanding market presence.

The brand's success is fueled by its distinctive design ethos and a focus on immersive guest experiences, which resonate strongly with younger demographics. This approach is not just attracting travelers but is also positioning Thompson Hotels for sustained future growth within the competitive lifestyle hospitality sector.

- Market Share Growth: Thompson Hotels is actively increasing its footprint in the lifestyle segment, a high-demand area for modern travelers.

- International Expansion: New openings in 2024 across Europe and Asia Pacific highlight a focused strategy on global market penetration.

- Brand Appeal: The brand's commitment to unique design and experiential offerings is a key driver for attracting and retaining a younger, discerning clientele.

The Standard International Integration

Hyatt Hotels' acquisition of Standard International, encompassing The Standard and Bunkhouse Hotels, is a major play in the rapidly expanding lifestyle segment. This integration adds 22 operational hotels and a pipeline of over 30 future properties to Hyatt's portfolio. The move is designed to solidify Hyatt's leadership in this premium market. By bringing these established brands into the Hyatt fold, the company anticipates faster gains in market share within a highly sought-after and growing sector.

This strategic acquisition bolsters Hyatt's presence in the upscale and luxury lifestyle hotel market. The Standard brand, known for its design-forward approach and vibrant atmosphere, aligns perfectly with the growing consumer demand for unique travel experiences. Bunkhouse Hotels, with its focus on authentic local culture and community, further diversifies Hyatt's lifestyle offerings. These additions are expected to drive incremental revenue and enhance brand loyalty among a key demographic.

- Brand Expansion: The deal adds The Standard and Bunkhouse Hotels, increasing Hyatt's lifestyle brand count.

- Property Growth: It brings 22 open hotels and over 30 future development projects into the Hyatt system.

- Market Position: This acquisition strengthens Hyatt's competitive standing in the fast-growing lifestyle hotel segment.

- Revenue Potential: Integration is projected to accelerate market share gains and boost overall revenue.

Hyatt's luxury and lifestyle brands are performing exceptionally well, acting as significant growth engines for the company. These segments are characterized by strong demand and strategic expansion, positioning them as key "Stars" in Hyatt's BCG Matrix. The aggressive growth in these areas, including a doubling of luxury rooms and a quintupling of lifestyle rooms globally since 2017, underscores their market leadership and potential for continued high returns.

The Park Hyatt brand, in particular, is a shining example of a Star performer, with significant global expansion planned through 2025 in prime locations. This commitment to developing and enhancing its luxury offerings, like the Park Hyatt Tokyo, ensures it attracts affluent travelers and maintains its premium positioning. Thompson Hotels also demonstrates Star-like qualities with its robust international expansion in 2024 and strong appeal to younger demographics, driven by its unique design and experiential focus.

The recent acquisition of Standard International, bringing The Standard and Bunkhouse Hotels into the Hyatt portfolio, further solidifies Hyatt's strength in the lifestyle segment. This move adds 22 operational hotels and a pipeline of over 30 future properties, enhancing market share and revenue potential in a highly sought-after sector. These lifestyle acquisitions are critical for capturing younger, experience-seeking travelers and driving sustained growth.

| Brand Segment | BCG Category | Key Growth Drivers | 2024/2025 Outlook |

|---|---|---|---|

| Luxury (e.g., Park Hyatt) | Star | Global expansion, premium locations, ongoing investment in brand experience. | Continued strong demand, new openings in key global cities. |

| Lifestyle (e.g., Thompson Hotels, The Standard) | Star | International expansion, unique design, experiential offerings, appeal to younger demographics. | Robust growth, acquisition synergies, increasing market share in a growing segment. |

What is included in the product

The Hyatt Hotels BCG Matrix analyzes its portfolio, categorizing brands to guide investment and divestment strategies.

A clear Hyatt Hotels BCG Matrix overview eliminates the pain of uncertainty by visually placing each business unit, easing strategic decision-making.

Cash Cows

Hyatt Regency Core Operations are a classic example of Cash Cows within Hyatt Hotels' BCG Matrix. These hotels are strategically located in established urban centers and popular resort destinations worldwide, consistently delivering high-quality, full-service experiences to guests.

These mature properties benefit from strong brand recognition and customer loyalty, leading to consistently high occupancy rates and average daily rates. For instance, in 2023, Hyatt's full-service brands, which include Hyatt Regency, generally saw RevPAR (Revenue Per Available Room) growth, reflecting their stable performance in key markets.

The reliable cash flow generated by Hyatt Regency hotels requires minimal incremental investment for expansion, allowing Hyatt to allocate capital to other strategic growth areas. Their mature market position and operational efficiency make them a dependable revenue engine for the company.

The Grand Hyatt brand exemplifies a classic Cash Cow for Hyatt Hotels, boasting a robust market share in key global metropolises and sought-after resort locales. These substantial, upscale properties are consistent high performers, generating significant revenue and profit margins, largely due to their established reputation for luxury and comprehensive guest services.

Operating within mature market segments where brand loyalty and market presence are deeply entrenched, Grand Hyatt hotels provide a reliable and substantial contribution to Hyatt's overall financial performance. For instance, in 2024, Hyatt reported strong performance across its luxury portfolio, with brands like Grand Hyatt driving significant RevPAR (Revenue Per Available Room) growth, reflecting their enduring appeal and consistent demand.

The World of Hyatt loyalty program functions as a significant cash cow for Hyatt Hotels. By late 2024, it boasted around 54 million members, a testament to its maturity and effectiveness in fostering customer loyalty and driving direct bookings.

This program generates substantial, high-margin revenue. It achieves this by encouraging more frequent guest stays and decreasing the reliance on costly third-party booking sites, making it a highly efficient revenue generator for the company.

Asset-Light Management and Franchise Fees

Hyatt's strategic pivot to an asset-light management model, with a target of over 90% asset-light earnings by 2027, firmly establishes management and franchise fees as its primary cash cows.

These fees are generated from Hyatt's extensive network of managed and franchised hotels, providing a lucrative and consistent stream of recurring revenue. This approach allows Hyatt to capitalize on its strong brand equity while minimizing the capital outlay and operational risks associated with direct property ownership.

The high profit margins associated with these fees, coupled with the stability of recurring income, make them a cornerstone of Hyatt's profitability strategy.

- Asset-Light Focus: Hyatt aims for over 90% asset-light earnings by 2027.

- Revenue Streams: Management and franchise fees are the core cash cows.

- Profitability: These fees offer high margins and stable, recurring revenue.

- Brand Leverage: The model allows brand power utilization with reduced ownership risk.

Hyatt Place and Hyatt House in Key Urban Markets

Hyatt Place and Hyatt House properties in major urban and suburban markets are quintessential cash cows for Hyatt Hotels. These select-service brands consistently generate robust revenue streams due to their efficient operations and widespread appeal to both business and leisure travelers. Their high occupancy rates in established markets translate into dependable, predictable cash flow, forming a stable financial foundation for the company.

These brands are anchors in mature markets, providing a reliable base of operations that bolsters overall financial stability. For instance, in 2024, Hyatt reported significant contributions from its select-service portfolio, with brands like Hyatt Place and Hyatt House demonstrating strong performance in urban centers. This segment often boasts high RevPAR (Revenue Per Available Room) due to consistent demand.

- Consistent Revenue Generation: Hyatt Place and Hyatt House brands in urban markets are reliable income generators within the select-service segment.

- Steady Cash Flow: Despite moderate growth rates, their efficient operations and broad traveler appeal ensure predictable cash flow.

- High Occupancy: These properties benefit from high occupancy rates in established urban and suburban locations, contributing to financial stability.

- Financial Stability: They represent a stable operational base, underpinning Hyatt's overall financial health.

Hyatt's asset-light strategy, targeting over 90% asset-light earnings by 2027, positions management and franchise fees as its primary cash cows. These fees, derived from its vast network of managed and franchised hotels, deliver a consistent and high-margin recurring revenue stream.

This model allows Hyatt to leverage its brand strength while minimizing capital investment and operational risk. The predictable income from these fees is crucial for funding growth initiatives and enhancing overall profitability.

The World of Hyatt loyalty program is another significant cash cow, boasting approximately 54 million members by late 2024. This program drives direct bookings and guest loyalty, generating high-margin revenue by reducing reliance on third-party booking channels.

Hyatt Regency and Grand Hyatt properties, as well as Hyatt Place and Hyatt House brands in established markets, continue to be strong performers. In 2023, Hyatt's full-service brands like Hyatt Regency saw RevPAR growth, demonstrating their stable performance. Similarly, in 2024, brands like Grand Hyatt drove significant RevPAR increases, reflecting enduring demand and brand appeal.

| Brand/Segment | BCG Category | Key Characteristics | 2023/2024 Performance Indicator |

|---|---|---|---|

| Hyatt Regency | Cash Cow | Established urban/resort locations, high brand recognition, consistent RevPAR growth. | RevPAR growth in full-service brands (2023). |

| Grand Hyatt | Cash Cow | Major global cities, luxury positioning, strong market share, high revenue generation. | Significant RevPAR growth (2024). |

| World of Hyatt Program | Cash Cow | Loyalty program, ~54 million members (late 2024), drives direct bookings, high-margin revenue. | High member engagement and direct booking contribution. |

| Management & Franchise Fees | Cash Cow | Asset-light model, recurring revenue, high profit margins, reduced capital risk. | Targeting >90% asset-light earnings by 2027. |

| Hyatt Place & Hyatt House | Cash Cow | Select-service, urban/suburban markets, high occupancy, predictable cash flow. | Strong performance in urban centers, high RevPAR (2024). |

What You’re Viewing Is Included

Hyatt Hotels BCG Matrix

The Hyatt Hotels BCG Matrix preview you are viewing is the definitive document you will receive upon purchase. This comprehensive analysis, detailing Hyatt's portfolio across Stars, Cash Cows, Question Marks, and Dogs, is presented in its final, unwatermarked form, ready for immediate strategic application.

Dogs

Hyatt Hotels has been aggressively shedding underperforming assets as part of its strategic shift towards an asset-light model, exceeding its ambitious $2 billion disposition target. For instance, properties like the Hyatt Regency Orlando and Hyatt Regency O'Hare Chicago are prime examples of assets slated for sale due to their underperformance and non-strategic fit within the company's portfolio.

These divested properties often exhibit low market share within their specific geographic areas and contribute little to the company's overall growth trajectory. By selling these assets, Hyatt aims to unlock capital that can be reinvested in more promising ventures or used to strengthen its core business operations.

Older, undifferentiated select-service properties, like some Hyatt Place or Hyatt House locations that haven't been updated, can find themselves in a tough spot. If they're in markets that are either overcrowded with hotels or seeing fewer travelers, their share of the market and revenue per available room (RevPAR) can really suffer.

These hotels can turn into money pits. They might need a lot of cash for renovations, but there's no guarantee they'll win back enough business or become significantly more profitable. In 2024, for instance, select-service hotels in secondary markets that lagged in renovations saw RevPAR growth lag behind their more updated counterparts, with some reporting RevPAR increases as low as 2-3% compared to 5-7% for renovated properties.

Generally, these types of hotels don't offer great returns when the economy is growing slowly. They often require consistent investment to maintain their current, albeit low, performance levels, making them less attractive in a sluggish economic climate.

Hyatt's portfolio may include experimental ventures that haven't gained significant traction, fitting the Dogs category. These could be niche concepts or small acquisitions that, while innovative, failed to capture substantial market share or demonstrate robust growth. For instance, if a pilot program for a unique boutique concept launched in 2023 with only a handful of locations and low occupancy rates, it might represent a Dog. Such ventures, though potentially resource-intensive, offer little return and can hinder overall portfolio performance.

Properties in Geographically Challenged Markets

Properties situated in geographically challenged markets, experiencing persistent economic slowdowns or substantial shifts in travel trends, often fall into the 'Dog' category within the BCG Matrix. These locations might face an oversupply of hotel rooms, making it difficult to attract guests or command premium rates. Consequently, these individual Hyatt properties can exhibit both low market growth and a low relative market share.

For instance, a Hyatt property in a region heavily reliant on a single industry that has recently declined might struggle. In 2024, areas dependent on industries facing significant disruption, such as certain fossil fuel-dependent regions or those impacted by geopolitical instability, could see reduced business and leisure travel. This directly impacts occupancy rates and revenue per available room (RevPAR).

- Low Demand: Properties in markets with declining tourism or business travel, perhaps due to infrastructure issues or safety concerns, will struggle to maintain occupancy.

- Oversupply Impact: In markets where new hotel development outpaces demand growth, existing properties like Hyatt's may face intense price competition, eroding profitability.

- Strategic Divestment: Hyatt may opt to sell off underperforming assets in these challenged markets to reallocate capital to more promising ventures, a common strategy for 'Dogs'.

- Limited Future Potential: Without significant market recovery or a unique value proposition, these properties are unlikely to generate substantial returns or growth.

Legacy Vacation Ownership Properties with Stagnant Demand

Hyatt's legacy vacation ownership properties, while including the Hyatt Residence Club brand, may represent a segment facing stagnant demand. These older properties could be burdened by high maintenance costs and a declining appeal to younger demographics, placing them in a challenging position within the competitive vacation ownership market. Their limited growth potential necessitates a careful review of their long-term strategic fit within the broader Hyatt portfolio.

These legacy assets might exhibit characteristics of a "cash cow" or potentially a "dog" in the BCG matrix, depending on their specific financial performance and market position. While the Hyatt Residence Club brand itself may still hold appeal, individual legacy properties could be underperforming due to factors like outdated amenities or less desirable locations.

For example, a hypothetical legacy property might have seen its occupancy rates dip by 15% in 2023 compared to 2020, while maintenance costs have risen by 10% annually. Such trends would indicate a need for strategic decisions regarding investment, divestment, or repositioning to counter declining appeal and ensure profitability.

- Stagnant Demand: Older vacation ownership properties may struggle to attract new buyers or retain existing ones, leading to lower occupancy and resale values.

- High Maintenance Costs: Legacy properties often require significant ongoing investment for upkeep and modernization, impacting profitability.

- Declining Demographic Appeal: Features and amenities that once appealed to vacationers may no longer resonate with current or future generations.

- Limited Growth Potential: Due to market saturation or inherent property limitations, these assets might offer minimal opportunity for expansion or increased revenue.

Hyatt's 'Dogs' are properties in markets with low growth and low relative market share, often requiring significant investment with uncertain returns. These might include older, undifferentiated select-service hotels in less desirable locations or experimental ventures that haven't gained traction. In 2024, select-service hotels in secondary markets that lagged in renovations saw RevPAR growth of only 2-3%, significantly lower than renovated properties.

These assets can drain capital without contributing meaningfully to Hyatt's growth. For example, a property in a region experiencing an economic downturn due to industry decline might see reduced occupancy and RevPAR. Hyatt's strategy often involves divesting such underperforming assets to reallocate capital to more promising areas.

Legacy vacation ownership properties can also fall into this category if they face stagnant demand and high maintenance costs. Properties with declining demographic appeal and limited growth potential require careful strategic review, as they may offer minimal opportunity for expansion or increased revenue.

Hyatt's aggressive disposition of underperforming assets, exceeding its $2 billion target, highlights its approach to managing 'Dogs'. Properties like the Hyatt Regency Orlando, identified as underperforming, exemplify assets being shed to improve overall portfolio performance and unlock capital for reinvestment.

Question Marks

Hyatt Studios is positioned as a Question Mark in the BCG Matrix for Hyatt Hotels. As a new upper-midscale extended-stay brand launching its first property in Q1 2025, it operates in a growing market but currently has negligible market share. Significant investment is needed for development and marketing to gain traction.

Caption by Hyatt is a newer, fast-growing lifestyle brand from Hyatt, focusing on flexible and efficient guest experiences. Its expansion is evident with recent openings like Caption by Hyatt Namba Osaka in the second quarter of 2024.

While the lifestyle segment it targets is experiencing robust growth, Caption by Hyatt's market share remains modest when compared to Hyatt's more established brands. This positions it as a potential Star in the BCG matrix, needing strategic investment to climb.

Significant ongoing investment is crucial for Caption by Hyatt to enhance brand awareness and expand its global presence. This investment is key to moving it from a question mark to a more dominant position within the competitive hotel landscape.

Miraval The Red Sea, scheduled to open in late 2025, signifies Hyatt's ambitious expansion into the high-end wellness tourism sector within a new international market. This venture positions Miraval as a Question Mark within the BCG Matrix due to its anticipated low initial market share in this burgeoning region, despite the segment's considerable growth potential.

New Market Entries for Luxury Brands (e.g., Park Hyatt in Mexico)

When established luxury brands like Park Hyatt venture into new, high-growth markets, such as their entry into Mexico with Park Hyatt Los Cabos at Cabo del Sol, this strategic move is classified as a Question Mark within the BCG Matrix framework for that specific market. The brand’s global recognition is a significant asset, but its initial penetration and market share in these nascent territories are inherently low. This necessitates substantial, targeted investment to effectively capture local demand and establish a competitive foothold.

The success of such an entry hinges on the brand's ability to differentiate itself and build market share rapidly. For instance, the luxury hospitality sector in Mexico has seen robust growth, with international tourist arrivals to Mexico increasing significantly. In 2023, Mexico welcomed over 42 million international tourists, a notable rise from previous years, indicating a strong appetite for premium travel experiences. This environment presents both opportunity and challenge for Park Hyatt Los Cabos, as it must compete with existing luxury offerings to transition from a Question Mark to a potential Star in the Mexican market.

- Market Entry Strategy: Park Hyatt's expansion into Mexico, exemplified by the Park Hyatt Los Cabos at Cabo del Sol, represents a classic Question Mark scenario in the BCG Matrix due to its low initial market share in a high-growth region.

- Investment Requirement: Significant capital infusion is typically required to build brand awareness, establish operational excellence, and capture market share in a competitive luxury segment.

- Growth Potential: Mexico's burgeoning tourism sector, with international arrivals showing strong recovery and growth post-pandemic, provides a fertile ground for luxury hospitality brands to expand. For example, tourism receipts in Mexico reached approximately $28 billion in 2023, underscoring the economic potential.

- Strategic Objective: The ultimate goal is to leverage the brand's global prestige to achieve a dominant market position, transforming the new market entry from a Question Mark into a Star.

Recently Acquired Niche Lifestyle/Boutique Brands

Hyatt's recent acquisitions, particularly those from Standard International and the Mr & Mrs Smith platform, represent niche lifestyle and boutique brands. These brands are positioned for high growth in specialized luxury segments. For instance, the acquisition of Mr & Mrs Smith in 2023 brought over 1,500 properties across more than 20 countries, significantly expanding Hyatt's luxury and lifestyle footprint.

While these brands offer considerable growth potential, their individual market share within Hyatt's extensive global portfolio is currently minimal. This low market share, coupled with high growth expectations, places them in the 'Question Mark' category of the BCG matrix. For example, many of the smaller, recently integrated brands may have only a handful of properties initially, contributing a small fraction to Hyatt's overall room count.

Strategic investment is crucial for these brands to transition from Question Marks to Stars. Hyatt needs to focus on effective integration and scaling to capitalize on their niche appeal. Without targeted marketing and operational support, these promising brands risk becoming Dogs, characterized by low market share and low growth.

- High Growth Potential: Niche lifestyle and boutique brands offer significant upside in specialized luxury markets.

- Low Initial Market Share: Acquired brands, like those from Mr & Mrs Smith, start with a small presence within Hyatt's overall portfolio.

- Strategic Investment Required: Integration and scaling efforts are vital to nurture these brands' growth.

- Risk of Becoming Dogs: Insufficient investment could lead to underperformance and stagnation.

Question Marks in Hyatt's portfolio represent brands or ventures with low market share in high-growth sectors, demanding significant investment to potentially become Stars. These are often new brands or expansions into emerging markets. For example, Hyatt Studios, set to debut in early 2025, is a new extended-stay brand with negligible market share but operating in a growing segment, requiring substantial capital for development and marketing to capture market share.

Miraval The Red Sea, opening in late 2025, also fits this category. It targets the expanding wellness tourism market in a new international location, meaning it starts with minimal market share but has high growth potential. Similarly, Hyatt's acquisition of niche lifestyle brands like Mr & Mrs Smith in 2023 brought a portfolio with high growth expectations but initially low individual market share within Hyatt's broader operations, necessitating strategic investment for integration and scaling.

The Park Hyatt brand's entry into new markets, such as Park Hyatt Los Cabos in Mexico, exemplifies a Question Mark. Despite the brand's global strength, its initial penetration in a new territory is low. Mexico's tourism sector is robust, with over 42 million international tourists in 2023, offering a growth opportunity, but requiring investment to build market share against established luxury competitors.

These Question Marks require careful strategic investment to nurture their growth. Without adequate resources for brand building, operational expansion, and market penetration, they risk stagnating and becoming Dogs. The objective is to identify those with the strongest potential to evolve into Stars, contributing significantly to Hyatt's future market leadership.

BCG Matrix Data Sources

Our Hyatt Hotels BCG Matrix is constructed using comprehensive data from internal financial reports, global market research, and competitor performance analysis.