Hostelworld Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hostelworld Bundle

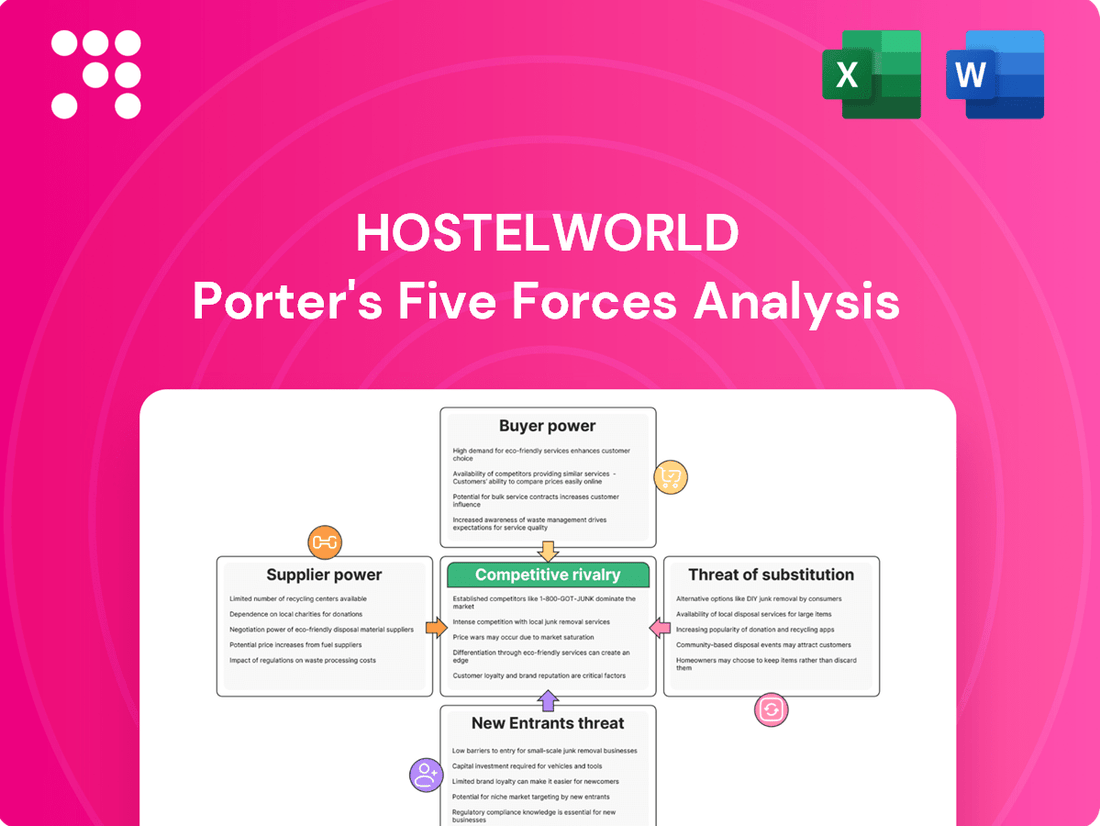

Hostelworld faces moderate rivalry from online travel agencies and direct bookings, while buyer power is significant due to the ease of price comparison. The threat of new entrants is relatively low due to brand loyalty and network effects, but the threat of substitutes, like Airbnb, is a growing concern.

The full analysis reveals the real forces shaping Hostelworld’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hostelworld's reliance on a diverse inventory of hostels means individual accommodation providers hold some bargaining power, particularly those offering unique or highly sought-after properties. This dependence, however, is tempered by Hostelworld's expansive global reach, connecting hostels with a vast customer base across more than 180 countries.

The company's ongoing efforts to broaden its market presence, achieving 77% coverage in 2024, significantly bolster its negotiating position. This increasing scale effectively diminishes the leverage any single hostel supplier can wield against the platform.

Hostelworld's commission structure is a key factor in its bargaining power with suppliers. As an Online Travel Agent (OTA), Hostelworld earns revenue through commissions on bookings made via its platform. These rates directly impact hostel profitability.

However, Hostelworld's ability to deliver substantial booking volumes and provide access to a vast international traveler network often makes these commissions a justifiable expense for hostels. In 2024, the continued reliance on online booking platforms for reaching global markets means hostels are willing to cede a portion of their revenue for guaranteed customer acquisition.

Furthermore, Hostelworld's social media and marketing initiatives aim to reduce individual marketing costs for hostels. By fostering direct engagement with travelers on its platform, Hostelworld enhances its value proposition, making it a more attractive and cost-effective distribution channel compared to independent marketing efforts.

Hostelworld's provision of value-added services, such as its property management software, significantly strengthens its relationship with suppliers. This integration creates potential switching costs, making it less likely for hostels to move to competing platforms. For instance, in 2024, Hostelworld reported a substantial increase in the adoption of its management tools by partner hostels, indicating a growing reliance on its ecosystem.

Fragmented Supplier Base

The global hostel market's highly fragmented nature, with countless independent and chain hostels operating worldwide, significantly dilutes supplier bargaining power. This fragmentation means no single supplier or small group of suppliers can easily dictate terms to a large Online Travel Agency (OTA) like Hostelworld, which benefits from aggregating demand from a vast customer base. Many hostel operators are local or regional businesses, further decentralizing the supplier landscape and limiting their ability to form cohesive bargaining units.

This fragmented supplier base is a key factor in keeping the bargaining power of suppliers relatively low for Hostelworld. For instance, as of early 2024, the global hostel market features tens of thousands of individual properties, with a significant portion being small, independent establishments. This sheer volume of options available to travelers through Hostelworld means that individual hostels have limited leverage to demand higher commission rates or more favorable terms. Their reliance on the OTA for bookings often outweighs their ability to negotiate from a position of strength.

- Fragmented Market: The global hostel sector is characterized by a vast number of independent operators alongside smaller chains, preventing any single entity from dominating supply.

- Limited Supplier Leverage: This wide distribution of suppliers means individual hostels have minimal power to negotiate terms with large OTAs like Hostelworld.

- Regional Diversity: The presence of numerous local and regional hostel providers further atomizes the supplier base, diminishing collective bargaining potential.

Competition for Visibility

Hostels, acting as suppliers on Hostelworld, also engage in intense competition for visibility and bookings within the platform itself. This internal rivalry among hostels diminishes their individual bargaining power, as they are fundamentally dependent on Hostelworld's extensive reach to connect with potential travelers.

Hostelworld’s platform features, such as integrated social connections and user reviews, play a significant role in shaping a hostel’s perceived appeal to travelers. For instance, in 2024, hostels with higher average ratings and more positive social interactions often saw increased booking volume, demonstrating the platform's influence over supplier success.

- Internal Competition: Hostels compete against each other for traveler attention on the Hostelworld platform, diluting individual supplier leverage.

- Platform Dependence: Suppliers rely on Hostelworld's user base and marketing efforts for bookings, limiting their ability to dictate terms.

- Feature Influence: Hostelworld's platform features, like social proof and booking incentives, directly impact a hostel's visibility and attractiveness to customers.

The bargaining power of suppliers, primarily hostels, is relatively low for Hostelworld. This is largely due to the highly fragmented nature of the global hostel market, with tens of thousands of independent operators as of early 2024. This fragmentation means no single hostel or small group can dictate terms, as Hostelworld aggregates demand from a vast international customer base. Furthermore, hostels depend on Hostelworld's reach for bookings, making them less inclined to negotiate aggressively.

| Factor | Impact on Hostelworld | Supporting Data (2024) |

|---|---|---|

| Supplier Fragmentation | Low Bargaining Power | Tens of thousands of independent hostels globally. |

| Hostel Dependence on Platform | Low Bargaining Power | Hostels rely on Hostelworld for access to international travelers. |

| Competition Among Hostels | Low Bargaining Power | Hostels compete for visibility and bookings on the platform. |

What is included in the product

This analysis dissects Hostelworld's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing players.

Instantly identify and address competitive threats by visualizing the intensity of each Porter's Five Force, allowing for proactive strategy adjustments.

Customers Bargaining Power

Hostelworld's customer base, primarily budget travelers, exhibits significant price sensitivity. This means they actively compare prices and readily switch to competitors offering lower rates, directly impacting Hostelworld's ability to command premium pricing.

The trend of travelers seeking out lower-cost destinations intensified in 2024, further pressuring Hostelworld's average booking values. For instance, reports indicated a 15% increase in bookings to Eastern European destinations in early 2024, known for their affordability compared to Western European counterparts.

Customers wield considerable bargaining power due to the sheer volume of booking channels. Travelers can readily access numerous online travel agencies (OTAs), direct booking sites, and other accommodation platforms, making price comparison effortless.

This abundance, exemplified by major players like Booking.com and Expedia, allows consumers to easily find the best deals, thereby limiting Hostelworld's ability to set higher prices. In 2024, the online travel market continued to be highly competitive, with OTAs actively vying for customer loyalty through aggressive pricing and loyalty programs.

The internet has dramatically shifted the balance of power towards customers in the accommodation sector. Travelers now have unprecedented access to information, allowing them to easily compare prices, amenities, and locations across numerous hostels. For instance, by mid-2024, platforms like Hostelworld itself reported millions of user reviews, giving potential guests deep insights into the quality and value offered by different establishments.

This ease of information access, fueled by peer reviews and ratings, significantly reduces information asymmetry. Customers can quickly identify the best deals and accommodations that match their specific needs and preferences, directly impacting a hostel's ability to command premium pricing or retain customers without offering competitive value. The transparency fostered by online platforms empowers informed decision-making, giving customers greater leverage.

Hostelworld's Social Strategy Impact

Hostelworld's innovative social strategy directly addresses the bargaining power of customers by building a community within its app. This fosters loyalty and reduces the likelihood of customers seeking lower prices elsewhere.

By connecting travelers and creating a sticky user experience, Hostelworld encourages repeat bookings. This is evident as 80% of bookings in fiscal year 2024 were made by social members.

- Community Building: Hostelworld's app-based social network connects travelers, fostering a sense of belonging and encouraging platform loyalty.

- Increased Engagement: The social features aim to keep users engaged with the platform, making them less likely to switch to competitors for price alone.

- Repeat Business: The strategy has proven effective, with a significant portion of bookings originating from its social user base.

Changing Travel Preferences

Travelers' tastes are shifting, with a notable rise in solo trips and a strong desire for genuine, local experiences. This empowers customers to be more selective, actively searching for accommodations that match their evolving needs, like those offering unique social interactions or cultural immersion.

Hostelworld, as a platform, benefits from these trends by connecting travelers with hostels that often provide these sought-after communal and authentic atmospheres. However, if a particular hostel doesn't meet a customer's specific expectations, the sheer volume of alternative lodging options available means customers can easily find another provider.

- Solo travel growth: In 2023, solo travel accounted for approximately 30% of bookings on Hostelworld, up from 25% in 2022, indicating a significant trend.

- Demand for authenticity: Surveys show over 70% of Gen Z travelers prioritize authentic experiences over luxury, a key driver for hostel choices.

- Platform choice: With numerous online travel agencies and direct booking options, customers have a wide array of alternatives if Hostelworld or its listed hostels don't perfectly align with their preferences.

The bargaining power of customers for Hostelworld is substantial, driven by price sensitivity and the ease of comparing options across numerous platforms. Travelers in 2024 continued to prioritize value, with a reported 15% increase in bookings to more affordable Eastern European destinations, directly impacting average booking values.

The proliferation of online travel agencies (OTAs) and direct booking sites, including major players like Booking.com and Expedia, empowers customers with effortless price comparison. This intense competition in 2024, characterized by aggressive pricing strategies from OTAs, limits Hostelworld's pricing flexibility.

The internet has democratized information, giving travelers unprecedented access to reviews and ratings, which reduces information asymmetry. By mid-2024, platforms like Hostelworld itself hosted millions of user reviews, enabling informed decisions and strengthening customer leverage.

| Factor | Impact on Hostelworld | Supporting Data (2024 Trends) |

|---|---|---|

| Price Sensitivity | High | Increased bookings to budget destinations (e.g., Eastern Europe) |

| Availability of Alternatives | High | Numerous OTAs and direct booking sites |

| Information Access | High | Millions of user reviews and ratings available |

Full Version Awaits

Hostelworld Porter's Five Forces Analysis

This preview showcases the complete Hostelworld Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape within the online accommodation booking sector. The document you see here is precisely what you will receive immediately after purchase, ensuring transparency and immediate access to this valuable strategic tool.

Rivalry Among Competitors

Hostelworld operates in an intensely competitive online travel agency (OTA) landscape. It faces formidable rivals such as Booking.com and Expedia, alongside a multitude of smaller, specialized booking platforms. This crowded market necessitates constant efforts in pricing, marketing, and service enhancement.

The fierce competition among OTAs directly impacts customer acquisition costs, driving up expenses for businesses like Hostelworld. In 2024, the global OTA market continued to see significant marketing investments, with major players allocating billions to remain visible and attract bookings in a saturated digital space.

Hostels are increasingly pushing for direct bookings via their own websites, aiming to cut out Online Travel Agency (OTA) commissions and foster direct customer loyalty. This trend puts pressure on platforms like Hostelworld to prove their worth to both travelers and hostel owners, as they compete with these direct channels for market share.

The rise of direct booking initiatives means Hostelworld needs to continually enhance its value proposition. This includes offering competitive pricing, superior booking experiences, and effective marketing reach that hostels might struggle to achieve independently. For instance, in 2024, many hostels reported a significant portion of their bookings coming directly through their own platforms, a trend that has been steadily growing.

Hostelworld thrives by differentiating through a powerful social strategy, connecting travelers within hostels and cities. This focus on community building and enriching the overall travel experience, rather than just booking accommodation, sets it apart from broader online travel agencies.

This unique approach has proven effective in managing costs, contributing to a notable reduction in marketing expenses. For instance, in 2023, Hostelworld reported a significant improvement in its net margin, partly attributable to the success of its community-focused initiatives.

Fragmented Global Hostel Market

The global hostel market is highly fragmented, meaning there are many small and independent players alongside larger online travel agencies (OTAs) like Hostelworld. This fragmentation creates intense competition. For instance, while Hostelworld is a dominant force in hostel bookings, it still contends with numerous regional booking sites and direct bookings made through individual hostel websites. The market's projected growth, with an estimated CAGR of 6.5% from 2024 to 2030, is expected to draw in even more participants, further intensifying rivalry.

This competitive landscape is characterized by:

- Numerous independent hostels: Many hostels operate without relying solely on large OTAs, maintaining their own booking channels.

- Emergence of niche booking platforms: Smaller, specialized platforms cater to specific traveler segments or geographic regions.

- Direct booking initiatives: Hostels increasingly encourage direct bookings to reduce commission fees paid to OTAs.

- Price sensitivity: The fragmented nature often leads to price-based competition, impacting margins for all players.

Constant Innovation Requirement

Hostelworld faces intense rivalry, driven by the constant need for technological advancement. To stay competitive, the company must continuously pour resources into its platform, enhancing app features and the overall user journey. This commitment to innovation is crucial in a digital world where traveler preferences shift rapidly.

The evolving digital landscape and changing expectations of travelers mean Hostelworld must consistently innovate to outpace competitors and maintain the loyalty of both its customers and the hostels listed on its site. For instance, in 2024, Hostelworld announced plans to further invest in technology and social engagement features, aiming to boost user growth and retention.

- Technological Investment: Hostelworld’s ongoing investment in its digital platform is essential to counter rivals.

- User Experience Focus: Enhancing app features and user interface is key to retaining customers.

- Competitive Necessity: Continuous innovation is required to keep pace with the rapidly changing travel tech sector.

- Growth Strategy: Future investments are targeted at technology and social features to drive expansion.

The competitive rivalry within the online travel agency (OTA) sector, particularly for hostel bookings, is a dominant force impacting Hostelworld. This rivalry stems from a highly fragmented market populated by numerous independent hostels and a growing number of specialized booking platforms. Major global OTAs like Booking.com and Expedia also exert significant competitive pressure, forcing Hostelworld to continuously invest in its platform and user experience to remain relevant.

The drive for direct bookings by hostels is a key aspect of this rivalry. In 2024, many hostels reported a substantial portion of their bookings coming through their own websites, a trend that directly challenges OTA market share. This necessitates Hostelworld proving its added value through superior reach, technology, and community features. The global hostel market's projected growth, with an estimated CAGR of 6.5% from 2024 to 2030, is expected to attract even more competitors, further intensifying the landscape.

Hostelworld's strategy to differentiate through social engagement and community building is a direct response to this intense competition. This focus helps mitigate some of the cost pressures associated with traditional marketing. For instance, Hostelworld reported improved net margins in 2023, partly due to the success of these community-focused initiatives.

| Competitive Factor | Impact on Hostelworld | 2024 Data/Trend |

|---|---|---|

| Market Fragmentation | Intense competition from numerous small players and direct bookings. | Global hostel market projected to grow at 6.5% CAGR (2024-2030), attracting more participants. |

| Major OTA Rivals | Need for continuous investment in platform and user experience. | Booking.com and Expedia continue to dominate broad travel bookings, influencing user expectations. |

| Direct Booking Trend | Pressure to demonstrate value beyond commission-based bookings. | Many hostels saw increased direct bookings in 2024, impacting OTA reliance. |

| Technological Advancement | Essential for staying competitive and meeting evolving traveler needs. | Hostelworld announced further investment in technology and social features in 2024 to boost growth. |

SSubstitutes Threaten

Budget hotels and midscale hotels represent a significant threat of substitutes for Hostelworld. These alternatives are increasingly competitive on price, especially as they improve their amenities and target the same budget-conscious traveler. For instance, in 2024, the average daily rate for a budget hotel room globally remained highly competitive, often only slightly higher than a premium hostel bed, with many offering private rooms at prices comparable to shared hostel dorms.

These midscale and budget options can lure customers away from hostels by offering greater privacy, more consistent service levels, and a broader range of facilities, such as private bathrooms and on-site dining. The budget hotel sector itself saw robust growth in 2023, with occupancy rates in many regions exceeding 70%, indicating a strong and expanding market that directly competes for Hostelworld's core customer base.

Beyond traditional hotels, a growing array of alternative accommodation options, including guesthouses, bed and breakfasts, serviced apartments, and particularly short-term rentals like Airbnb, present a significant threat of substitutes for Hostelworld. These alternatives cater to a broader spectrum of traveler preferences, from those desiring enhanced privacy to individuals seeking authentic local immersion or extended stays, thereby siphoning potential customers away from the traditional hostel model.

The burgeoning popularity of platforms like Airbnb, which saw its revenue reach approximately $10.3 billion in 2023, directly competes for budget-conscious travelers and those seeking unique lodging experiences. This trend is further amplified by the rise of digital nomads, a demographic increasingly favoring flexible and affordable long-term accommodation solutions that often fall outside the typical hostel offering.

Travelers increasingly bypass online travel agencies like Hostelworld by booking directly with hostels or hotels, a trend that intensified in 2024. This direct booking bypasses the intermediary, representing a significant substitution for Hostelworld's core service. For instance, many hostels actively promote their own websites and loyalty programs to capture these direct bookings, thereby reducing their reliance on OTAs.

Emergence of Hybrid Models

The rise of hybrid hostels, blending dormitory beds with private rooms and hotel-like amenities, directly challenges traditional hostel offerings. These evolving models attract a wider audience, including couples and business travelers, effectively blurring the distinction between hostels and hotels and thus broadening the competitive set.

This trend is particularly impactful as it caters to travelers seeking a balance between budget-friendly communal experiences and the privacy and comfort of hotel rooms. For instance, by mid-2024, a significant portion of new hostel openings incorporated private room options, reflecting this market shift.

- Hybrid hostels offer diverse accommodation styles.

- They appeal to a broader customer base than traditional hostels.

- This diversification expands the competitive landscape for Hostelworld.

Non-Commercial Accommodation

For budget travelers, non-commercial accommodation options represent a significant threat of substitutes to Hostelworld. Alternatives such as staying with friends or family, house-sitting arrangements, or even camping directly fulfill the basic need for shelter without incurring commercial lodging costs.

These non-monetary alternatives can significantly dampen the overall demand for paid accommodation. For instance, a 2024 survey indicated that approximately 15% of budget travelers consider staying with friends or family a primary accommodation choice for domestic trips, bypassing the need for services like Hostelworld.

The appeal of these substitutes lies in their cost-effectiveness and often unique experiences. While not directly participating in the commercial market, their existence siphons off potential customers, impacting the broader hospitality sector.

Key non-commercial substitutes include:

- Staying with friends or family: Often free and provides a social connection.

- House-sitting: Offers free accommodation in exchange for property care.

- Camping: A low-cost option for those who enjoy the outdoors.

- Couchsurfing: While also a platform, it facilitates free stays with locals.

The threat of substitutes for Hostelworld is substantial, encompassing a wide range of accommodation types that cater to budget-conscious travelers. Traditional budget hotels, guesthouses, and even direct bookings with properties bypass the need for an OTA like Hostelworld.

In 2024, the direct booking trend continued to grow, with many hostels and smaller hotels offering incentives to encourage guests to book directly, circumventing commission fees. For instance, loyalty programs and exclusive discounts for direct bookings became more prevalent.

Alternative accommodations, particularly short-term rentals like Airbnb, also pose a significant threat. Airbnb's revenue in 2023 was approximately $10.3 billion, showcasing its massive reach and appeal to travelers seeking varied experiences and price points.

Even non-commercial options, such as staying with friends or family, represent a substitute, particularly for domestic travel, with surveys in 2024 indicating around 15% of budget travelers favoring such arrangements.

| Substitute Category | Examples | 2023/2024 Relevance | Impact on Hostelworld |

|---|---|---|---|

| Budget Hotels | Ibis Budget, Travelodge | Competitive ADR, growing occupancy | Direct competition for price-sensitive travelers |

| Alternative Accommodations | Airbnb, Guesthouses | $10.3B Airbnb Revenue (2023), diverse offerings | Siphons customers seeking privacy/unique stays |

| Direct Bookings | Hotel/Hostel Websites | Increased promotion by properties | Bypasses OTA intermediary |

| Non-Commercial Options | Friends/Family, House-sitting | 15% of budget travelers consider (2024 survey) | Reduces overall paid accommodation demand |

Entrants Threaten

The online travel agency (OTA) sector, including platforms like Hostelworld, presents a formidable challenge for new entrants primarily due to substantial customer acquisition costs. Established players have cultivated strong brand recognition and loyalty over years of operation, requiring significant marketing spend to even begin to compete.

For instance, in 2024, the cost of acquiring a new customer in the digital advertising space continues to be a major hurdle. Companies must invest heavily in search engine marketing, social media campaigns, and affiliate programs to gain visibility and attract bookings.

Hostelworld itself has a mature customer base, meaning new entrants need to offer compelling incentives or unique value propositions to lure travelers away from familiar and trusted platforms. This investment in marketing and customer incentives directly impacts profitability for newcomers, making market penetration a slow and costly process.

Hostelworld thrives on powerful network effects; the more hostels listed and the more travelers using the platform, the more valuable it becomes for everyone. This creates a significant hurdle for newcomers who must simultaneously attract a vast number of hostels and a substantial traveler base to even begin competing. As of 2024, Hostelworld boasts hostel partners in over 180 countries, a testament to its established network.

Hostelworld's established brand, cultivated since its 1999 inception, represents a significant barrier to new entrants. Building a comparable level of trust and recognition among both travelers and hostel owners requires considerable time and financial investment, making it difficult for newcomers to gain immediate traction.

Access to Inventory and Technology

New entrants face significant hurdles in accessing a broad and diverse global inventory of hostels. While property management software is becoming more accessible, the sheer scale and variety of accommodation options that Hostelworld has cultivated over time represent a substantial barrier. This includes not just the physical properties but also the established relationships and contracts with these providers.

Furthermore, building the technological infrastructure to efficiently manage bookings, process payments securely, and deliver robust customer support across a global network is a complex and costly endeavor for newcomers. Hostelworld not only provides a platform for customers but also offers property management software and other essential solutions to accommodation providers, further solidifying its advantage.

- Inventory Acquisition: New entrants need to invest heavily in building relationships and securing contracts with a wide range of hostels worldwide, a process that takes considerable time and resources.

- Technological Investment: Developing and maintaining a sophisticated booking engine, payment gateway, and customer service platform comparable to Hostelworld requires substantial capital and technical expertise.

- Ancillary Services: Offering integrated property management software and support services to hostels, as Hostelworld does, adds another layer of complexity and investment for potential new competitors.

Potential for Niche or AI-Driven Entrants

The threat of new entrants in the budget accommodation sector, particularly those focusing on niche markets or leveraging AI, presents a unique challenge. While new players might emerge with specialized offerings or advanced technology, such as AI-driven personalized recommendations, their ability to match Hostelworld's extensive global network and brand recognition is a significant hurdle.

For instance, AI is increasingly being integrated into customer service, with projections indicating widespread adoption by 2024. This could enable new entrants to offer superior user experiences. However, building the scale necessary to compete with Hostelworld's established presence, which boasts millions of beds across thousands of properties worldwide, remains a formidable barrier.

Key considerations for potential new entrants include:

- Niche Market Focus: Targeting specific traveler segments (e.g., solo female travelers, eco-conscious backpackers) can offer differentiation.

- AI-Powered Operations: Utilizing AI for dynamic pricing, personalized booking experiences, and efficient customer support could attract users.

- Scalability Challenges: Overcoming the immense operational and marketing investment required to achieve Hostelworld's global reach.

- Brand Loyalty and Network Effects: Competing against Hostelworld's established user base and property partnerships.

The threat of new entrants into Hostelworld's market remains moderate, primarily due to significant capital requirements for brand building and customer acquisition. While technology has lowered some barriers, achieving Hostelworld's global reach and established trust demands substantial investment. Newcomers must overcome established network effects and the cost of securing a wide inventory of hostels.

In 2024, the digital advertising landscape continues to see high customer acquisition costs, making it expensive for new platforms to gain visibility against established players like Hostelworld. Building a comparable global network of over 180 countries, as Hostelworld has, requires extensive time and resources for any new entrant.

New entrants also face the challenge of replicating Hostelworld's comprehensive offerings, which include not just booking but also property management software for hostels. This integrated approach creates a stickier ecosystem, making it harder for standalone booking platforms to compete effectively.

| Factor | Impact on New Entrants | Hostelworld's Advantage |

|---|---|---|

| Customer Acquisition Cost | High (2024 digital ad spend) | Established brand loyalty, lower marginal acquisition cost |

| Network Effects | Challenging to replicate | Millions of beds, thousands of properties globally |

| Inventory Access | Requires significant investment/time | Established relationships with hostels worldwide |

| Technological Infrastructure | High upfront and ongoing investment | Mature booking engine, payment systems, and ancillary services |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hostelworld is built upon a foundation of diverse data sources, including Hostelworld's annual reports, investor relations disclosures, and industry-specific market research from firms like Statista and IBISWorld.

We also incorporate data from competitor websites, booking platform trends, and travel industry publications to provide a comprehensive view of the competitive landscape.