Hostelworld Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hostelworld Bundle

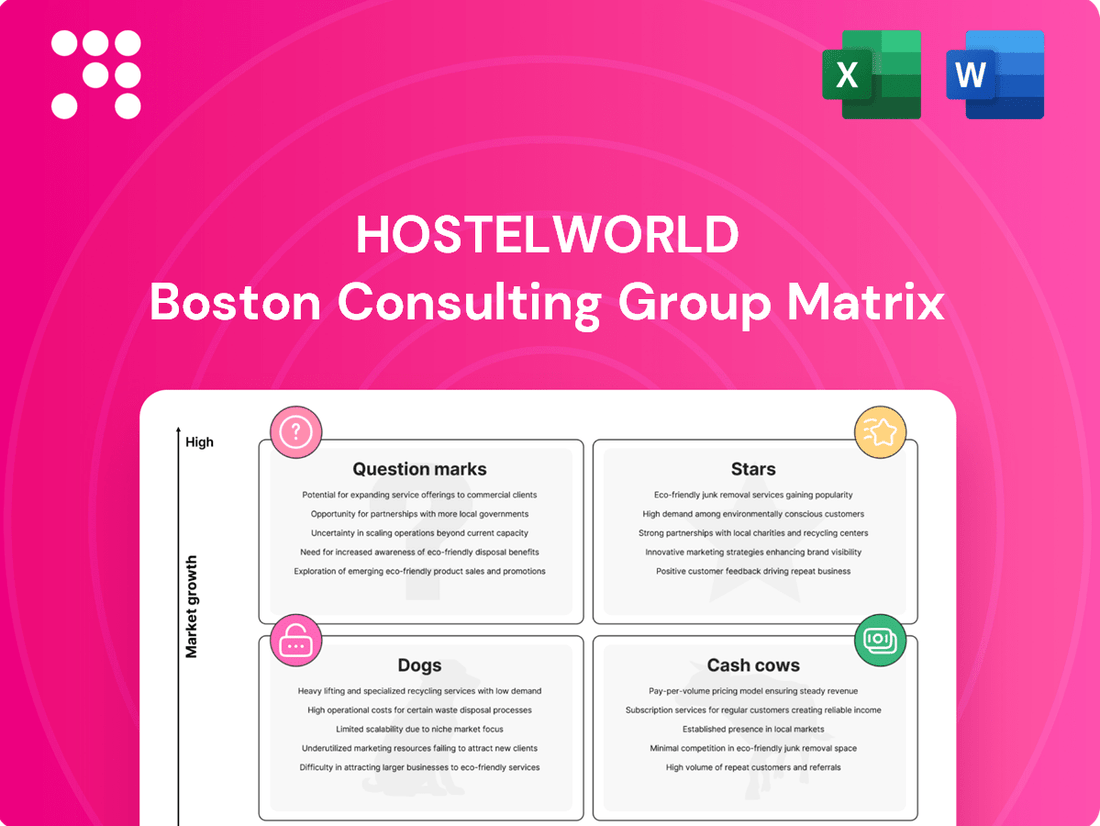

Curious about Hostelworld's strategic positioning? This preview hints at their Stars, Cash Cows, Dogs, and Question Marks, but the full BCG Matrix unlocks the complete picture. Understand where Hostelworld's offerings truly shine and where they might be lagging.

Don't miss out on the crucial insights that drive Hostelworld's success. Purchase the full BCG Matrix to get detailed quadrant placements, data-backed recommendations, and a clear roadmap for their product portfolio and future investments.

This isn't just a theoretical exercise; the complete BCG Matrix provides actionable strategies tailored to Hostelworld's unique market position. Elevate your understanding and planning by securing the full report today.

Stars

Hostelworld's 2022 social network and app-centric strategy has proven to be a significant advantage, boosting customer engagement and lowering acquisition expenses. This focus on community and mobile convenience is clearly resonating with travelers.

By 2024, a remarkable 80% of bookings originated from social members, a substantial jump from 67% in 2023. Furthermore, app bookings saw a healthy 16% year-on-year increase, underscoring the platform's success in capturing a growing segment of the travel market.

Hostelworld saw remarkable booking growth in Asia and Central America during 2024, a key indicator of its strong position in these expanding travel regions. This regional success directly contributed to the company's overall 6% rise in net bookings for the year, reaching a total of 6.9 million.

The 'Staircase to Sustainability' certification program highlights Hostelworld's commitment to eco-friendly practices. With over 2,100 hostels already certified and an additional 500 in progress, this initiative demonstrates significant leadership in the hostel industry's sustainability efforts.

This focus on sustainability directly addresses the increasing demand from travelers who prioritize environmentally conscious choices. Hostelworld is effectively capturing a growing market segment by aligning its operations with these eco-conscious trends.

Elevate Monetization Tool

Elevate, Hostelworld's new marketplace monetization tool, is demonstrating positive early traction. This initiative is designed to boost revenue from its established market presence, positioning it as a strong performer within the company's core offerings. The tool's effectiveness is evident in the increase in base commissions.

Specifically, Hostelworld reported that base commissions climbed to 15.8% in the first half of 2025. This represents a notable increase from the 15.2% recorded in the same period of 2024. This upward trend highlights Elevate's success in enhancing monetization.

- Monetization Tool: Elevate

- Impact: Increased base commissions

- H1 2025 Commission: 15.8%

- H1 2024 Commission: 15.2%

Global Trip Plan Marketplace

Hostelworld's innovative global trip plan marketplace, integrated into its social network, is proving to be a significant driver of bookings. This pre-booking feature capitalizes on the increasing desire for experience-focused travel and pre-trip social connections.

The impact is evident in the booking data: in the first half of 2025, 85% of bookings originated from social members, a notable increase from 80% in the first half of 2024. This growth highlights the marketplace's effectiveness in engaging users and facilitating trip planning directly within the platform.

- Feature: Global trip plan marketplace within Hostelworld's social network.

- Objective: Facilitate pre-booking and leverage social connections for travel planning.

- H1 2025 Data: 85% of bookings from social members.

- H1 2024 Data: 80% of bookings from social members.

Hostelworld's social network and app integration are strong Stars in the BCG matrix, driving significant user engagement and booking growth. The platform's focus on community and mobile convenience has clearly resonated, leading to impressive performance metrics.

By H1 2025, 85% of bookings came from social members, up from 80% in H1 2024, showcasing the power of its integrated trip plan marketplace. This trend, coupled with a 16% year-on-year app booking increase in 2024, solidifies its position as a market leader.

The success of Stars is further evidenced by the strong performance in emerging markets like Asia and Central America in 2024, contributing to a 6% net booking rise. These regions represent high growth potential, reinforcing the Star status of Hostelworld's core social and app offerings.

| Metric | H1 2024 | H1 2025 | Growth/Change |

|---|---|---|---|

| Bookings from Social Members | 80% | 85% | +5 pp |

| App Booking Growth (YoY) | - | 16% | N/A |

| Net Bookings Growth (2024) | - | 6% | N/A |

What is included in the product

This BCG Matrix overview analyzes Hostelworld's offerings, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide strategic decisions.

It provides clear strategic insights for each category, highlighting which business units warrant investment, maintenance, or divestment.

A clear BCG matrix visualizes Hostelworld's portfolio, easing the pain of strategic resource allocation.

Cash Cows

Hostelworld's core booking platform is a classic cash cow. It dominates the global hostel booking market, consistently bringing in significant revenue, with €92.0 million in net revenue reported for FY 2024. This mature product, despite flat revenue growth in the first half of 2025, remains a reliable generator of substantial cash, underpinning the company's financial stability.

Hostelworld's strategic focus on social marketing has significantly lowered its direct marketing expenses. This shift saw direct marketing as a percentage of revenue decrease from 50% in 2023 to 46% in 2024.

This operational efficiency directly contributed to a 7% boost in the company's net margin. Leveraging its strong brand recognition, Hostelworld achieves cost-effective customer acquisition, which underpins its robust profit margins and consistent cash flow generation.

Hostelworld's financial performance in 2024 showcases a robust business model, evidenced by its return to a net cash position of €2.0 million. This achievement is particularly noteworthy as the company also managed to repay all its bank debt two years ahead of schedule.

The ability to generate substantial free cash flow, with €14.4 million in adjusted free cash flow recorded for 2024, firmly places Hostelworld in the Cash Cows quadrant of the BCG Matrix. This indicates a mature, highly profitable business that consistently generates more cash than it needs for reinvestment.

Established Global Market Coverage

Hostelworld's established global market coverage is a significant strength, positioning it firmly within the Cash Cows quadrant of the BCG Matrix. In 2024, the company achieved an impressive 77% market coverage, a notable increase of 3 percentage points from 2023. This expansion demonstrates a robust and sustained presence in a vast number of countries worldwide.

This extensive network is built upon partnerships with hostels in over 180 countries. Such broad geographical reach translates directly into a consistent and reliable stream of commission-based revenue, a hallmark of a Cash Cow. The sheer volume of bookings facilitated across this global infrastructure provides a stable financial foundation for Hostelworld.

- Global Reach: Hostelworld operates in over 180 countries, ensuring a wide customer base.

- Market Share Growth: Market coverage increased to 77% in 2024, up from 74% in 2023.

- Revenue Stability: Consistent commission revenue is generated from a large volume of bookings.

- Established Network: A well-developed network of hostel partners supports ongoing operations.

Reinstatement of Progressive Dividend Policy

Hostelworld's decision to reinstate a progressive dividend policy, targeting 20% to 40% of adjusted profit after tax, signals a strong belief in its ongoing cash-generating capabilities. This policy, with an interim payment anticipated in the second half of 2025, underscores a commitment to rewarding shareholders from a business unit that is both stable and consistently profitable.

This strategic move is indicative of Hostelworld's mature business segment, often categorized as a Cash Cow within the BCG Matrix framework. Such segments typically exhibit low growth but high market share, generating more cash than they require for reinvestment. The reinstatement of dividends directly leverages this surplus cash.

- Cash Generation: The policy suggests Hostelworld expects to consistently generate substantial profits from its core operations, allowing for shareholder returns.

- Shareholder Value: By returning capital through dividends, Hostelworld aims to enhance shareholder value, a common strategy for mature, cash-rich businesses.

- Financial Stability: The ability to reinstate and maintain a progressive dividend policy points to robust financial health and predictable earnings.

Hostelworld's core booking platform exemplifies a Cash Cow. Its extensive global reach, operating in over 180 countries with 77% market coverage in 2024, ensures a consistent revenue stream from commissions.

This mature business generates significant cash, evidenced by €92.0 million in net revenue for FY 2024 and €14.4 million in adjusted free cash flow. The company's return to a net cash position of €2.0 million and early debt repayment highlight its strong cash-generating ability.

The reinstatement of a progressive dividend policy, targeting 20-40% of adjusted profit after tax, further solidifies its Cash Cow status by returning surplus capital to shareholders.

| Metric | 2023 | 2024 |

|---|---|---|

| Net Revenue | €88.5 million | €92.0 million |

| Adjusted Free Cash Flow | €12.1 million | €14.4 million |

| Market Coverage | 74% | 77% |

| Net Cash Position | -€0.5 million | €2.0 million |

What You’re Viewing Is Included

Hostelworld BCG Matrix

The Hostelworld BCG Matrix you're previewing is the complete, unwatermarked document you will receive immediately after your purchase. This comprehensive analysis is ready for immediate use, offering strategic insights without any demo content or limitations, ensuring you get the full value of expert market analysis.

Dogs

Hostelworld's investment in Goki Pty Limited, a startup specializing in hostel locks, has been written down to zero as of December 31, 2024, following an impairment of €1.2 million. This significant write-down signals that Goki is likely a 'Dog' in the BCG matrix, characterized by low market share and poor growth prospects within the hostel industry. The decision to impair the investment suggests that further capital injection is unlikely to yield positive returns, making divestiture a probable next step.

Hostelworld observed a notable slowdown in bookings for more expensive European locations during 2024. This trend contributed to an 8% drop in the average net booking value compared to the previous year.

This segment within Hostelworld's portfolio appears to be in a mature or declining phase, characterized by low growth and potentially shrinking market share. The company needs to strategize carefully for these higher-cost European destinations.

While app bookings are showing strong growth, traditional web channels, especially paid ones, faced significant cost inflation in the first half of 2025. This pushed direct marketing expenses up to 51% of revenue, a notable increase from 45% in the first half of 2024.

This trend indicates that older web booking methods, particularly those heavily dependent on paid advertising, might be becoming less efficient and could be classified as a 'dog' within the BCG Matrix if cost-saving optimizations aren't implemented.

Lagging Domestic Travel in India

Hostelworld's 2024 Country Report for India revealed a concerning trend of lagging domestic travel bookings. While the first quarter showed promise, the subsequent quarters experienced a noticeable decline, specifically impacting the domestic traveler segment. This slowdown suggests a potential shift in booking patterns or a reduced interest from Indian nationals using the platform.

This segment, characterized by its recent performance, could be categorized as a 'Dog' within the Hostelworld BCG Matrix. This classification stems from the observed low growth and potentially low market share within the domestic Indian market. If these trends persist without strategic intervention, this area might become a drain on resources.

- Declining Domestic Bookings: Hostelworld's 2024 data indicates a drop in domestic bookings in India during Q2, Q3, and Q4, following a strong Q1.

- Potential 'Dog' Status: The combination of weak performance in the latter half of 2024 and a potentially shrinking market share positions this segment as a 'Dog'.

- Strategic Consideration Needed: Without targeted strategies to revitalize domestic bookings, this segment risks becoming a low-return area for Hostelworld in India.

Legacy Platform Areas

Hostelworld's legacy platform areas, while not explicitly detailed in the BCG matrix, represent components that are likely candidates for the 'dog' quadrant. These are typically older, less profitable, and may have declining market share or growth potential. The company's multi-year core services upgrade program, slated for completion in H1 2025, directly addresses the need to modernize these less efficient parts of the platform.

These legacy systems, if left unaddressed, can become a drain on resources. They often require significant maintenance and may hinder the implementation of new, innovative features. For instance, in 2023, Hostelworld reported that its platform modernization efforts were crucial for improving operational efficiency and customer experience, indirectly highlighting the cost and risk associated with aging infrastructure.

The potential 'dog' status of these legacy areas is underscored by their low growth prospects compared to newer, more agile technologies. Without investment and modernization, their contribution to overall revenue and market position is likely to diminish. Hostelworld's strategic focus on upgrading its core services indicates a proactive approach to managing these potential 'dogs' by either improving them or preparing for their eventual replacement.

- Low Growth Potential: Legacy systems often operate in mature or declining market segments.

- High Maintenance Costs: Older technology typically incurs higher operational and support expenses.

- Hindrance to Innovation: Inefficient legacy platforms can slow down the adoption of new technologies and features.

- Strategic Obsolescence: Failing to modernize can lead to a competitive disadvantage as the market evolves.

Segments identified as 'Dogs' in Hostelworld's portfolio, such as the written-down investment in Goki Pty Limited, represent areas with low market share and minimal growth potential. The slowdown in bookings for more expensive European locations during 2024, leading to an 8% drop in average net booking value, also points to a mature or declining market segment. Similarly, traditional web channels facing cost inflation and declining domestic bookings in India during 2024 suggest segments that are becoming less efficient and may require strategic divestment or revitalization.

| BCG Category | Hostelworld Segment Example | Key Characteristics | 2024/2025 Data Points |

|---|---|---|---|

| Dogs | Goki Pty Limited Investment | Low market share, poor growth prospects | Written down to zero as of Dec 31, 2024, with a €1.2 million impairment. |

| Dogs | Expensive European Locations | Mature or declining phase, low growth | Bookings slowed in 2024, resulting in an 8% drop in average net booking value. |

| Dogs | Traditional Web Channels (Paid) | Low growth, high cost | Direct marketing expenses rose to 51% of revenue in H1 2025 from 45% in H1 2024 due to cost inflation. |

| Dogs | Domestic Indian Travel Bookings | Low growth, potentially shrinking market share | Lagging domestic bookings in India during Q2-Q4 2024 after a strong Q1. |

Question Marks

Hostelworld's strategic vision involves venturing into adjacent budget accommodation segments like budget hotels and guesthouses. This move targets a high-growth sector, presenting a significant opportunity for expansion.

However, Hostelworld's current penetration in these broader budget categories is likely minimal. This positions these new ventures as question marks within the BCG matrix, necessitating substantial investment to capture market share and establish a strong foothold.

Hostelworld is strategically exploring selective acquisition opportunities to bolster its market presence. These targets are often in emerging or complementary sectors where Hostelworld's current footprint is minimal, positioning them as question marks within the BCG framework. This approach allows for focused investment in high-potential areas.

Hostelworld's offering of property management software and related solutions to accommodation providers represents a strategic move to diversify its revenue beyond booking commissions. This segment taps into a growing need for streamlined operations within the hospitality sector.

While this diversification is promising, the property management software market is highly competitive, featuring established giants and specialized providers. Hostelworld's current market share in this crowded space is likely modest, placing this offering potentially in the question mark category of the BCG matrix, requiring significant investment to gain traction against dominant players.

New Product Features and Innovation beyond core booking

Hostelworld is actively exploring new product features and innovations that extend beyond its core booking functionality. These initiatives are strategically positioned to tap into the evolving travel technology landscape, aiming for high growth potential.

These nascent offerings, while promising, represent a significant investment for Hostelworld. They are expected to have a low initial market share as they are developed and introduced, aligning with the characteristics of a question mark in the BCG matrix.

Hostelworld plans to roll out these new features in late 2025 and early 2026, reflecting a commitment to technological advancement and a forward-looking growth strategy. For instance, the company has been investing in AI-powered personalization tools to enhance user experience.

- Focus on AI-driven personalization: Enhancing user experience through tailored recommendations and content.

- Development of integrated travel planning tools: Moving beyond just booking to offer a more comprehensive trip planning solution.

- Exploration of loyalty programs and community features: Building stronger customer relationships and engagement.

- Investment in sustainable travel options: Catering to a growing market segment interested in eco-friendly travel.

Catering to Digital Nomads and Multigenerational Travel

The travel landscape in 2025 is being reshaped by two significant forces: the burgeoning digital nomad movement and the increasing prevalence of multigenerational trips. These trends represent substantial growth opportunities for the hospitality sector, particularly for hostels that can adapt their offerings.

Hostelworld, while a dominant player in the broader hostel market, may currently hold a relatively low market share in services specifically tailored to these burgeoning segments. This suggests a strategic need for investment to develop and promote features that directly appeal to remote workers seeking flexible accommodations and to families traveling across multiple age groups.

- Digital Nomad Growth: Projections indicate that by 2025, the number of individuals identifying as digital nomads could reach over 35 million globally, a significant increase from previous years, highlighting a demand for reliable Wi-Fi, co-working spaces, and longer-stay options.

- Multigenerational Travel Surge: Data from 2024 showed a 20% year-over-year increase in multigenerational family bookings, with many citing shared experiences and cost-effectiveness as key drivers.

- Hostelworld's Opportunity: To capture these high-growth segments, Hostelworld could focus on enhancing its platform to feature more "work-friendly" hostels and family-oriented accommodations, potentially increasing its market share in these specialized niches.

Question marks in Hostelworld's BCG matrix represent new ventures or offerings with low market share but operating in high-growth potential areas. These require significant investment to determine if they can become stars or will eventually be divested.

Hostelworld's expansion into budget hotels and guesthouses, alongside its property management software and new feature development, all fall into this category. The company is strategically investing in these areas, aiming to capture market share and establish a stronger presence.

By late 2025 and early 2026, Hostelworld plans to introduce AI-driven personalization and integrated travel planning tools. These initiatives, while promising for future growth, are currently in their nascent stages, fitting the profile of question marks needing further development and market validation.

BCG Matrix Data Sources

Our Hostelworld BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.