Honda Motor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Honda Motor Bundle

Honda Motor faces moderate bargaining power from buyers, as vehicle choices are plentiful, but brand loyalty and financing options can sway decisions. The threat of new entrants is somewhat mitigated by high capital requirements and established brand recognition, though disruptive technologies could lower barriers. Understanding these dynamics is crucial for strategic positioning.

The complete report reveals the real forces shaping Honda Motor’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

When a few large suppliers control essential parts like specialized semiconductors or advanced battery cells, they gain considerable leverage over Honda. For example, the global semiconductor shortage experienced in 2021 and 2022 significantly disrupted automotive production worldwide, impacting companies like Honda due to their reliance on a limited number of high-tech chip manufacturers.

Honda's deep integration with its suppliers, involving significant upfront investments in specialized tooling and rigorous quality control protocols, creates substantial switching costs. These investments make it both financially burdensome and operationally disruptive for Honda to transition to alternative suppliers, thereby bolstering the bargaining power of its current, established partners.

Honda's bargaining power with suppliers is significantly influenced by supplier product differentiation. When suppliers offer unique or proprietary technologies, such as specialized electric motor components or advanced autonomous driving software, their leverage increases. This is because Honda has fewer viable alternatives for these critical inputs, forcing them to accept less favorable terms.

The automotive industry's rapid shift towards electric vehicles (EVs) and software-defined vehicles amplifies this dynamic. Suppliers specializing in battery technology, advanced semiconductor chips, or sophisticated AI-driven systems for vehicle control are in a strong position. For instance, the demand for high-performance battery cells, a key differentiator in the EV market, has seen intense competition among a limited number of specialized suppliers, giving them considerable pricing power.

Threat of Forward Integration by Suppliers

If a supplier can credibly threaten to move into producing components or even complete vehicles, their bargaining power significantly strengthens. This scenario, while less common in the highly complex automotive sector, can become a real concern for suppliers of highly specialized or proprietary parts.

For instance, a supplier of advanced battery technology for electric vehicles might possess the expertise and intellectual property to consider manufacturing their own battery packs or even integrating into EV production. This potential threat forces automakers like Honda to maintain favorable terms with such suppliers, as losing access to critical, specialized components could halt production. In 2024, the automotive industry continued to see intense competition for advanced materials and technologies, particularly in the EV space, giving key component suppliers considerable leverage.

- Supplier Forward Integration Threat: Suppliers of critical, specialized automotive components could potentially integrate forward into vehicle manufacturing, increasing their bargaining power.

- Complexity Barrier: The intricate nature of vehicle assembly generally limits the feasibility of widespread supplier forward integration in the automotive industry.

- EV Component Leverage: In 2024, suppliers of advanced EV technologies, such as battery systems, held significant leverage due to the high demand and specialized knowledge required.

Impact of Supplier's Products on Honda's Quality/Cost

Suppliers whose components critically influence Honda's vehicle quality and production costs wield significant bargaining power. For instance, a defect in a brake pedal assembly from a supplier could lead to costly recalls and damage brand reputation, giving that supplier leverage.

Honda's experience with recalls, such as those related to Takata airbags or specific engine components, demonstrates the tangible impact supplier-related issues can have. These events highlight how reliance on suppliers for critical parts can shift power dynamics.

- Supplier Dependence: Honda's reliance on specialized suppliers for advanced technologies like battery systems for its electric vehicles (EVs) increases supplier power.

- Recall Costs: In 2023, Honda faced costs related to recalls, some stemming from supplier-related manufacturing defects, illustrating the financial leverage suppliers can indirectly possess.

- Component Criticality: The impact of a single faulty component, like an engine control unit (ECU) from a key supplier, can halt production or lead to widespread quality issues, empowering that supplier.

Suppliers of critical, high-tech components for Honda's evolving product line, especially in the electric vehicle (EV) sector, possess significant bargaining power. This is amplified by the specialized nature of these parts and the high switching costs associated with changing suppliers, as seen with advanced battery cells and sophisticated semiconductor chips. In 2024, the automotive industry continued to see this trend, with key component providers dictating terms due to high demand and limited alternatives.

| Supplier Factor | Impact on Honda | 2024 Relevance |

|---|---|---|

| Concentration of Suppliers | Few suppliers for specialized parts (e.g., advanced semiconductors) increase their leverage. | Continued reliance on a limited number of chip manufacturers for advanced vehicle systems. |

| Switching Costs | High investment in tooling and integration makes changing suppliers difficult and expensive. | Honda's established relationships with battery suppliers for EVs involve significant upfront customization. |

| Product Differentiation | Unique technologies (e.g., proprietary EV powertrain components) give suppliers pricing power. | Suppliers of AI and autonomous driving software possess strong leverage due to the complexity and novelty of their offerings. |

What is included in the product

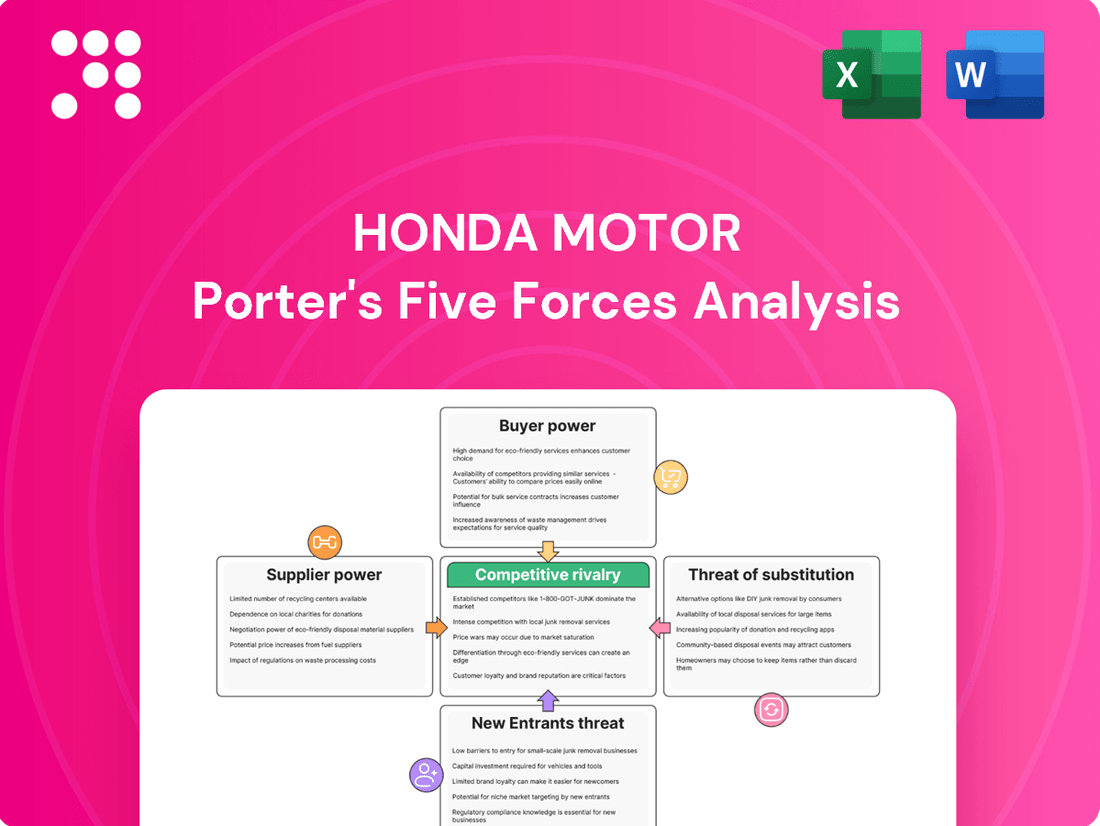

This Porter's Five Forces analysis for Honda Motor examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes within the automotive and powersports industries.

Instantly identify and mitigate competitive threats by visualizing the intensity of rivalry, bargaining power of suppliers and buyers, threat of new entrants, and substitute products impacting Honda Motor.

Customers Bargaining Power

Customer price sensitivity is a significant factor for Honda. In 2024, with ongoing inflation and elevated interest rates impacting consumer spending power, buyers are keenly focused on vehicle affordability. This heightened price consciousness directly influences Honda's pricing strategies, pushing the company to remain competitive to attract and retain customers.

This sensitivity means that even small price increases can lead to a noticeable shift in demand. For instance, if competitors offer comparable models at lower price points, Honda risks losing market share. This dynamic pressures Honda to carefully manage its production costs and explore efficiencies to maintain attractive pricing without unduly sacrificing profitability.

The automotive market is flooded with options, meaning customers have a vast selection of vehicles to choose from. This includes traditional gasoline-powered cars, fuel-efficient hybrids, and increasingly popular electric vehicles (EVs). For instance, in 2024, the global automotive market offered over 300 distinct car models from various manufacturers, providing ample alternatives to Honda's offerings.

This abundance of choices significantly enhances customer bargaining power. If a customer isn't satisfied with Honda's pricing, features, or service, they can readily switch to a competitor. This ease of switching means customers can demand better terms, pushing down prices and impacting Honda's profitability.

For many car buyers, the financial and logistical hurdles of switching brands are minimal, particularly with the increasing prevalence of online car sales and digital purchasing tools. This low barrier to entry allows consumers to easily explore and move between different automotive manufacturers, enhancing their bargaining power.

In 2024, the automotive industry continues to see a trend where digital platforms simplify the comparison and acquisition of vehicles. For instance, online car marketplaces reported significant growth, with many consumers completing a substantial portion of their purchase journey online, reducing the perceived commitment to a single brand.

Customer Information Availability

Customers today have an unprecedented amount of information at their fingertips. Online resources provide detailed vehicle specifications, transparent pricing, owner reviews, and direct comparisons between models, significantly leveling the playing field when negotiating with dealerships.

This readily available data empowers consumers to understand market values and the true cost of vehicles, giving them stronger leverage in price discussions. For instance, platforms like Kelley Blue Book and Edmunds offer extensive data that buyers utilize to secure better deals.

- Informed Decisions: Consumers can research safety ratings, fuel efficiency, and reliability data for models like the Honda CR-V or Civic, comparing them against competitors.

- Price Transparency: Websites often display invoice pricing and average transaction prices, reducing the information asymmetry that previously favored dealerships.

- Negotiation Power: Armed with this knowledge, customers can confidently negotiate pricing, potentially leading to lower profit margins for automakers like Honda if they cannot offer competitive value.

Influence of Customer Segments and Channels

Honda's customer bargaining power differs significantly between individual car buyers and large fleet purchasers. Fleet buyers, like rental car companies or government agencies, can negotiate substantial discounts due to the sheer volume of vehicles they acquire. For example, in 2024, large fleet sales often represent a considerable portion of a manufacturer's total sales, giving these buyers considerable leverage.

The chosen sales channel also impacts customer power. While traditional dealerships offer a more personal interaction, the rise of online sales platforms and direct-to-consumer models can empower buyers by increasing price transparency and potentially offering more competitive pricing. This shift in channels can put pressure on traditional margins.

- Segmented Power: Individual buyers have less power than fleet customers due to lower purchase volumes.

- Channel Influence: Online sales channels can increase customer bargaining power through price transparency.

- Volume Discounts: Fleet purchasers, buying in bulk, typically secure better pricing from manufacturers like Honda.

- Market Dynamics: In 2024, the automotive market saw continued negotiation flexibility for high-volume buyers.

Customer bargaining power remains a significant force for Honda, amplified by market saturation and informed consumers. In 2024, the availability of over 300 car models globally means buyers can easily find alternatives, pushing Honda to maintain competitive pricing. This ease of switching, particularly with streamlined online purchasing, allows customers to demand better terms, impacting Honda's profitability.

The sheer volume of choices available in 2024, from traditional gasoline cars to a growing EV market, empowers consumers. For instance, online platforms provide exhaustive data on pricing, features, and reliability, enabling customers to negotiate effectively. This transparency reduces information asymmetry, giving buyers leverage and potentially squeezing manufacturer margins if value propositions aren't compelling.

Fleet buyers, in particular, wield considerable influence due to their bulk purchases. In 2024, large fleet deals often constitute a substantial portion of total vehicle sales, allowing these entities to negotiate significant discounts. While individual buyers have less leverage, the overall trend points to increased customer power across the automotive sector.

Preview Before You Purchase

Honda Motor Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Honda Motor's competitive landscape through Porter's Five Forces, analyzing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the automotive industry. The comprehensive insights provided are crucial for understanding Honda's strategic positioning and future challenges.

Rivalry Among Competitors

The automotive sector is a crowded arena, with giants like Toyota, Hyundai, and Ford, alongside a growing number of electric vehicle startups, all vying for customer attention. This makes competitive rivalry particularly fierce for companies like Honda.

While the global automotive market is projected to see a modest 2.7% growth in 2025, this relatively slow expansion means companies must fight harder to capture and retain their share of the market, further intensifying the competitive landscape.

Honda faces intense competition, holding a substantial but not controlling global market share. In the crucial U.S. market, Honda's share was around 8.5% in 2023, illustrating the need for constant strategic maneuvering against formidable competitors.

This competitive landscape means Honda must continually innovate and offer compelling value to retain and expand its customer base. The rivalry is characterized by aggressive pricing, extensive marketing campaigns, and a race to develop cutting-edge technology and fuel-efficient vehicles.

Honda, like other major automakers, operates in a capital-intensive industry. The significant investments required for manufacturing facilities, research and development, and establishing robust distribution networks mean that fixed costs are exceptionally high. For instance, building a new automotive plant can cost billions of dollars, a substantial barrier to entry and a powerful deterrent to exiting the market.

These substantial fixed costs translate directly into high exit barriers. Companies that have invested heavily in these assets find it very difficult and costly to divest or shut down operations. This reality compels manufacturers to remain in the market and compete aggressively, even when facing periods of reduced demand or profitability, as the cost of leaving is often prohibitive.

In 2024, the automotive sector continues to grapple with these dynamics. The ongoing transition to electric vehicles (EVs) necessitates further massive capital outlays for new battery production facilities and retooling existing plants. This increased investment further solidifies the high fixed cost structure, intensifying competitive pressures as incumbents strive to recoup their investments and maintain market share.

Product Differentiation and Innovation Race

The automotive industry is locked in an intense product differentiation and innovation race, compelling manufacturers like Honda to continuously introduce new models, advanced technologies, and unique features. This competition is driven by the need to capture consumer attention and market share in a crowded landscape. Automakers are heavily investing in areas like electric vehicles (EVs), autonomous driving capabilities, and the development of software-defined vehicles to stay ahead.

Honda's strategy directly reflects this competitive pressure. The company is actively expanding its electrified offerings, notably with models like the Honda Prologue, which launched in early 2024. Furthermore, Honda has announced its upcoming Honda 0 Series of EVs, set for a 2026 global rollout, signaling a significant commitment to future mobility trends. This push for innovation is crucial for Honda to maintain its competitive edge against rivals who are also rapidly advancing their technological portfolios.

- EV Investment: Global automakers are projected to invest over $1.2 trillion in electric vehicles and batteries through 2030, highlighting the scale of the innovation race.

- Honda's EV Push: Honda aims for its global sales to be 100% electric vehicles by 2040.

- Software-Defined Vehicles: The market for software-defined vehicles is expected to grow substantially, with estimates suggesting it could reach $200 billion by 2030, indicating a key area of differentiation.

Strategic Alliances and Mergers

Strategic alliances and potential mergers significantly influence Honda's competitive environment. For instance, reports in late 2024 indicated discussions between Honda, Nissan, and Mitsubishi regarding potential collaborations. Such moves could lead to consolidated market power and a more intense competitive landscape for other automotive manufacturers.

These potential consolidations can alter market share dynamics and necessitate strategic realignments from competitors. The automotive sector is already characterized by intense rivalry, and significant mergers or alliances would amplify this pressure, potentially leading to shifts in pricing strategies and product development focus.

- Strategic Alliances: Honda has previously engaged in alliances, such as its partnership with Sony for electric vehicle development, aiming to leverage complementary strengths.

- Merger Rumors: Late 2024 saw speculation about potential mergers or closer ties between major Japanese automakers like Honda, Nissan, and Mitsubishi.

- Market Impact: Any significant consolidation would likely intensify competition, potentially impacting pricing, innovation cycles, and market access for all players in the global automotive market.

The automotive industry is intensely competitive, with Honda facing a crowded field of established giants and emerging EV players. This rivalry is fueled by a constant need for innovation, aggressive pricing, and extensive marketing efforts to capture market share in a sector experiencing moderate growth. Honda's position, holding a significant but not dominant global share, underscores the necessity for continuous strategic adaptation to maintain its competitive edge.

The race for technological leadership, particularly in electric vehicles and autonomous driving, is a defining characteristic of this competition. Automakers are investing heavily in R&D and new manufacturing capabilities, creating high fixed costs that deter market exit and intensify pressure on existing players. This dynamic forces companies like Honda to innovate relentlessly to attract and retain customers.

Strategic alliances and potential consolidations further shape the competitive landscape. As of late 2024, discussions among major Japanese automakers hint at future collaborations that could significantly alter market dynamics and intensify rivalry for all participants. Honda's own partnerships, like the one with Sony for EV development, illustrate the industry's trend towards leveraging complementary strengths to navigate this competitive environment.

| Competitor | Approx. Global Market Share (2023) | Key Competitive Actions |

|---|---|---|

| Toyota | ~11.5% | Hybrid leadership, diverse product range, strong brand loyalty |

| Volkswagen Group | ~10.0% | Aggressive EV rollout, premium brand portfolio, European market dominance |

| Hyundai Motor Group | ~8.8% | Rapid EV development, value-for-money offerings, design innovation |

| General Motors | ~7.5% | Focus on EVs (Ultium platform), truck and SUV strength, North American presence |

| Stellantis | ~7.0% | Brand diversification, electrification strategy across multiple marques |

SSubstitutes Threaten

The growing accessibility and ease of use of public transit and ride-sharing platforms, especially in cities, offer a compelling alternative to owning a car. This is particularly true for younger demographics embracing mobility-as-a-service concepts, directly impacting demand for traditional personal vehicles.

In 2024, ride-sharing services like Uber and Lyft continued to expand their offerings, integrating public transit options in many cities. For instance, Uber partnered with transit agencies in cities like Denver and Los Angeles to provide integrated journey planning and booking, making public transport a more seamless choice. This trend directly challenges Honda's core market by presenting a convenient, often more cost-effective, mobility solution that reduces the perceived need for personal car ownership.

The rise of micromobility solutions like e-scooters and electric bicycles presents a growing threat to traditional automobile sales, particularly for short urban trips. These alternatives are increasingly affordable and convenient, directly competing with Honda's core product offerings for city dwellers.

With the global micromobility market projected to reach over $200 billion by 2030, the appeal of these substitutes is undeniable. Honda's own strategic moves into electric motorcycles and potential micromobility products signal an awareness of this competitive pressure and an effort to adapt.

The significant increase in telecommuting and remote work arrangements directly impacts Honda by reducing the necessity for daily commutes. This shift means fewer miles driven annually, potentially lowering the overall demand for new vehicles as existing ones are used less frequently.

In 2023, surveys indicated that around 30% of the global workforce worked remotely at least part-time, a substantial increase from pre-pandemic levels. This sustained trend means a larger pool of consumers may delay vehicle purchases or opt for less frequent replacements, directly affecting Honda's sales volume.

Walking and Cycling Infrastructure Development

As urban areas increasingly prioritize and invest in walking and cycling infrastructure, these become more viable and appealing options for short-distance travel, directly challenging the dominance of automobiles.

For instance, cities like Copenhagen, Denmark, have long championed cycling, with over 62% of residents commuting by bike in 2023. This trend is expanding globally, with significant infrastructure investments reported in major cities throughout 2024.

This shift presents a growing threat of substitutes for Honda, particularly impacting its sales of smaller, urban-focused vehicles and motorcycles. The convenience and cost-effectiveness of active transportation for shorter trips are undeniable.

Key factors contributing to this threat include:

- Increased Government Funding: Many nations are allocating substantial budgets to active transportation projects in 2024, aiming to reduce congestion and emissions. For example, the United States' Bipartisan Infrastructure Law includes significant funding for pedestrian and bicycle safety initiatives.

- Growing Environmental Awareness: Consumers are increasingly seeking sustainable transportation alternatives, making walking and cycling more attractive.

- Health and Wellness Benefits: The personal health advantages associated with walking and cycling further bolster their appeal as viable substitutes for motorized transport.

Advancements in Connectivity and Autonomous Technology

Advancements in connectivity and autonomous driving technologies present a subtle but significant threat to traditional vehicle ownership models. While not direct substitutes for the physical car itself, these innovations could fundamentally change how consumers interact with transportation. For instance, the rise of sophisticated ride-sharing platforms and the potential for fully autonomous fleets could make personal car ownership less appealing or even unnecessary for many.

This shift could lead to a greater adoption of vehicle-as-a-service (VaaS) models, where consumers pay for access to transportation rather than owning a vehicle outright. In 2024, the global mobility-as-a-service market was valued at over $70 billion and is projected to grow significantly in the coming years, indicating a growing consumer preference for flexible transportation solutions. This trend directly impacts automakers like Honda by potentially reducing the demand for new vehicle sales.

- Shifting Consumer Behavior: Increased reliance on mobility services could decrease the perceived need for individual car ownership.

- Growth of VaaS: The expanding vehicle-as-a-service market offers alternatives to traditional purchasing.

- Impact on Sales: A move towards service models may reduce the volume of new car sales for manufacturers.

The threat of substitutes for Honda is substantial, driven by evolving mobility trends and consumer preferences. Ride-sharing, micromobility, and increased remote work all reduce the necessity of personal vehicle ownership, directly impacting Honda's core business.

Active transportation like walking and cycling, supported by growing urban infrastructure investment, offers cost-effective and environmentally friendly alternatives for shorter trips. This trend is particularly potent in urban centers, directly challenging Honda's market share for city-oriented vehicles.

The expanding mobility-as-a-service (MaaS) and vehicle-as-a-service (VaaS) markets, valued at over $70 billion globally in 2024, further present a significant substitute threat by offering transportation access without ownership, potentially decreasing new vehicle sales volume.

| Substitute Type | Key Drivers | Impact on Honda | 2024 Data/Projections |

| Ride-Sharing & MaaS | Convenience, Cost-Effectiveness, Urbanization | Reduced personal vehicle demand | Global MaaS market > $70 billion |

| Micromobility (E-scooters, E-bikes) | Affordability, Short-distance convenience, Environmental concerns | Competition for urban commuters | Global micromobility market projected > $200 billion by 2030 |

| Active Transportation (Walking, Cycling) | Health benefits, Environmental awareness, Infrastructure investment | Decreased reliance on motorized transport for short trips | Cities like Copenhagen see >62% cycling commutes; significant infrastructure funding in 2024 |

| Remote Work | Flexibility, Reduced commuting needs | Lower annual mileage, delayed vehicle purchases | ~30% global workforce remote part-time (2023) |

Entrants Threaten

The automotive industry demands immense upfront capital. Building factories, developing new vehicle technologies, establishing global supply chains, and creating robust distribution networks can easily run into billions of dollars. For instance, establishing a new automotive manufacturing plant can cost upwards of $1 billion, making it a formidable hurdle for potential new entrants.

Honda's established brand loyalty and extensive distribution network present a significant barrier to new entrants. In 2024, Honda continued to leverage its reputation for reliability and quality, cultivated over decades, which fosters deep customer trust and repeat purchases. Newcomers face the daunting task of replicating this brand equity and the widespread accessibility of Honda's dealerships, which are crucial for sales, service, and customer support.

The automotive sector faces significant regulatory barriers, including demanding safety, emissions, and environmental standards. These regulations translate into substantial compliance costs and complex technical requirements, making it exceptionally difficult for new companies to enter the market and compete with established players like Honda.

Access to Raw Materials and Supply Chains

Newcomers face substantial hurdles in securing consistent access to vital raw materials, such as the rare earth minerals essential for electric vehicle batteries, and in building robust global supply chains. Honda, for instance, has strategically invested in securing long-term supply agreements for critical materials, a feat difficult for nascent competitors to replicate. In 2024, the automotive industry continued to grapple with supply chain volatility, with disruptions impacting production schedules across the board, underscoring the advantage of established players with pre-existing supplier relationships.

The threat of new entrants is amplified by the difficulty in establishing efficient and resilient global supply chains. New companies must navigate complex logistics, secure manufacturing capacity, and build relationships with numerous suppliers, all while facing established competitors who benefit from economies of scale and proven operational expertise. For example, as of early 2024, many EV startups were still working to solidify their battery supply chains, impacting their production ramp-up timelines.

- Securing critical raw materials like lithium and cobalt for EV batteries presents a significant barrier for new automotive manufacturers.

- Establishing resilient and cost-effective global supply chains requires substantial capital investment and extensive negotiation power.

- Honda's proactive approach to supply chain management, including direct sourcing initiatives, mitigates this threat for the company but highlights the challenge for new entrants.

- Supply chain disruptions in 2024, particularly for semiconductors and battery components, demonstrated the ongoing vulnerability for less established players.

Technological Expertise and R&D Investment

The significant capital outlay required for research and development, particularly in areas like electric vehicle (EV) technology and autonomous driving systems, presents a substantial hurdle for potential new entrants. Companies like Honda are investing billions annually to stay competitive. For instance, Honda announced plans to invest approximately ¥5 trillion (around $35 billion USD) in electrification and software development through fiscal year 2030.

This intense focus on innovation means that newcomers must possess not only substantial financial resources but also a deep pool of specialized engineering talent. The pace of technological advancement in the automotive sector, driven by the transition to EVs and the development of advanced driver-assistance systems (ADAS), necessitates constant adaptation and substantial ongoing R&D expenditure. By mid-2024, global automotive R&D spending was projected to exceed $200 billion annually, a figure largely dominated by established players.

- High R&D Costs: Developing advanced automotive technologies like EVs and autonomous driving demands significant financial investment.

- Technological Expertise: New entrants need to acquire or develop specialized engineering and software development capabilities.

- Capital Intensity: The automotive industry is inherently capital-intensive, with substantial upfront investment required for manufacturing and technology development.

- Rapid Innovation Cycles: The fast-evolving technological landscape necessitates continuous R&D to remain competitive.

The threat of new entrants into the automotive market, particularly for Honda, remains moderate due to substantial barriers. The immense capital required for manufacturing, R&D, and establishing global supply chains deters many potential competitors. For example, building a new EV battery plant can cost billions, a significant hurdle. Furthermore, established brand loyalty, extensive distribution networks, and stringent regulatory compliance add further layers of difficulty for newcomers.

| Barrier Type | Description | Impact on New Entrants | Honda's Position |

| Capital Requirements | High costs for factories, R&D, and supply chains. | Significant deterrent. | Established infrastructure and access to capital. |

| Brand Loyalty & Distribution | Decades of cultivated trust and widespread dealerships. | Difficult to replicate customer relationships and sales/service access. | Strong brand equity and extensive global network. |

| Regulatory Hurdles | Strict safety, emissions, and environmental standards. | High compliance costs and technical complexity. | Existing expertise and systems for compliance. |

| Supply Chain Access | Securing raw materials and building resilient logistics. | Challenging due to volatility and established relationships. | Strategic investments and long-term supplier agreements. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Honda Motor leverages data from Honda's annual reports, investor presentations, and official company press releases. We also incorporate industry-specific market research reports from firms like IHS Markit and JD Power, alongside automotive trade publications.