Honda Motor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Honda Motor Bundle

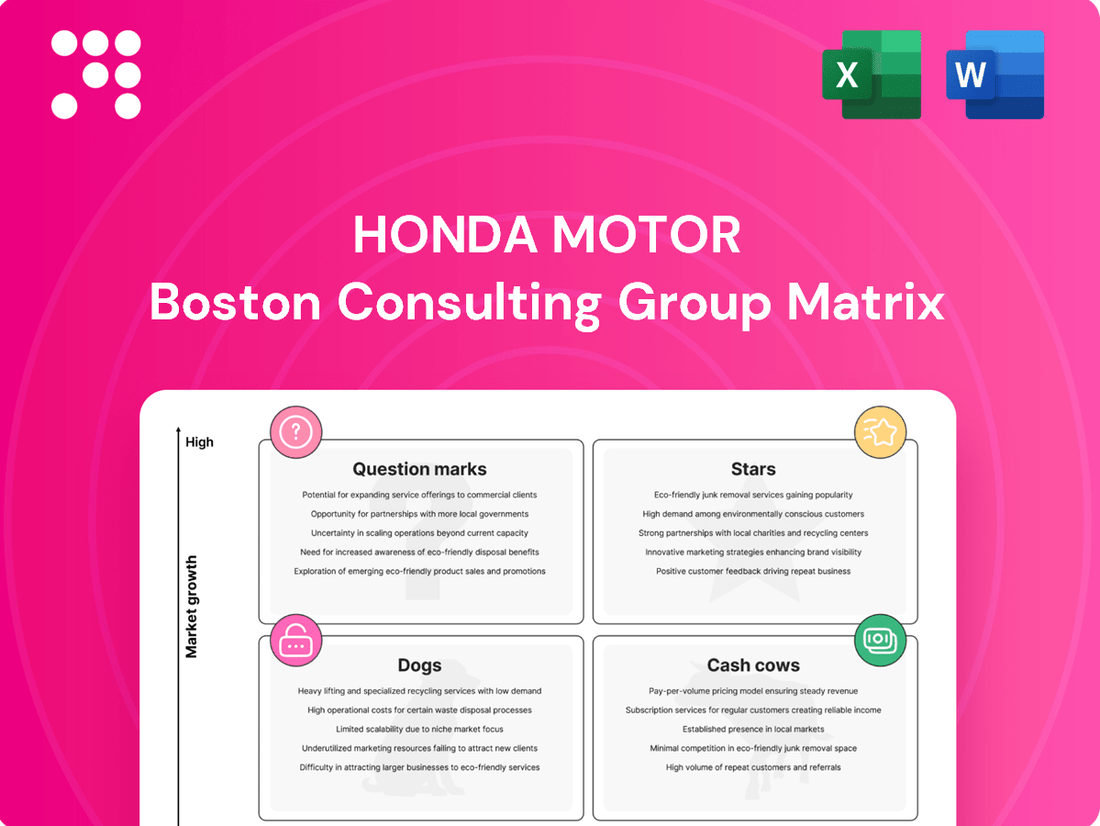

Curious about Honda's product portfolio performance? This preview offers a glimpse into their strategic positioning, but the full BCG Matrix unlocks the complete picture. Discover which of Honda's vehicles are Stars, Cash Cows, Dogs, or Question Marks to make informed decisions.

Don't just wonder about Honda's market share and growth potential; know it. Purchase the full BCG Matrix for detailed quadrant analysis, data-driven insights, and actionable strategies to optimize your investment and product development plans.

Gain a competitive edge by understanding Honda's strategic roadmap. The complete BCG Matrix provides a clear, quadrant-by-quadrant breakdown, empowering you with the knowledge to navigate the automotive landscape with confidence.

Stars

Honda's motorcycle division is a dominant force, projected to hold a 40% global market share by FY2025 with approximately 20.2 million units sold. This segment is a key driver for the company's overall performance.

The Asian market, encompassing nations like India, Indonesia, Thailand, and Vietnam, represents a massive 85% of Honda's motorcycle sales. This strong presence in a high-growth region firmly places the Asian motorcycle business as a Star in Honda's BCG Matrix.

The Honda CR-V has demonstrated exceptional market traction, achieving its best-ever sales performance in 2024. This success underscores its position as a strong performer within Honda's product lineup, likely classifying it as a Star or Cash Cow depending on its investment needs and market growth rate.

Complementing the CR-V, the Honda HR-V also saw substantial sales growth, with May 2024 figures showing significant year-over-year increases. This upward trend suggests the HR-V is gaining market share and contributing positively to Honda's overall automotive revenue, further solidifying its strong standing.

The robust sales of both the CR-V and HR-V, especially their increasingly popular hybrid versions, are pivotal to Honda's growth strategy in the competitive automotive sector. Their strong market demand and revenue generation point towards them being key assets, likely categorized as Stars in the BCG matrix due to their high growth and market share.

The Honda Civic is a strong contender in the automotive market, consistently performing well. In 2024, it secured the top spot in its segment, demonstrating its enduring appeal and market dominance.

Sales figures for May 2024 showed a significant uptick for the Civic, further solidifying its leading position. It maintained a notable lead over key competitors such as the Toyota Corolla, highlighting its competitive edge.

This sustained high performance underscores the Civic's substantial market share within a highly competitive and dynamic automotive landscape. Its consistent sales success is a testament to its product strength and brand loyalty.

Electrified Models (Hybrids)

Honda's hybrid vehicles are a clear star in their lineup, showing robust growth and strong consumer interest. These electrified models are not just a niche offering; they are becoming mainstream.

The demand is evident in recent sales figures. For instance, hybrid versions made up more than half of all CR-V and Accord sales in May 2024. This trend is reflected in broader company performance, with electrified models contributing over 25% of Honda's total sales throughout 2024.

Looking ahead, Honda is doubling down on its hybrid strategy. The company has ambitious plans to introduce 13 new next-generation hybrid electric vehicles (HEVs) globally between 2027 and 2031. This strategic push aims to achieve a significant milestone of 2.2 million HEV sales annually by 2030.

- Hybrid sales dominance: Over 50% of CR-V and Accord sales in May 2024 were hybrid variants.

- Electrified share: Electrified models constituted more than a quarter of Honda's total sales in 2024.

- Future HEV expansion: Honda plans to launch 13 new next-generation HEV models globally from 2027-2031.

- Ambitious HEV target: The company aims to sell 2.2 million HEVs annually by 2030.

HondaJet (Very Light Jet Segment)

The HondaJet is a shining example of a star in the very light jet segment. It commands a significant portion of this niche market, holding approximately 40% share as of late 2024.

While the very light jet market itself is smaller compared to larger aircraft categories, HondaJet's dominance within it is undeniable. This strong market position, combined with strategic growth initiatives, solidifies its star status.

Honda is actively working to boost annual sales and is set to introduce new models, such as the HondaJet Echelon. These efforts are aimed at further expanding its presence in what is a specialized but growing aviation sector.

- Market Share: HondaJet holds around 40% of the very light jet market.

- Growth Potential: Plans are in place to increase annual sales and introduce new models like the HondaJet Echelon.

- Segment Strength: Dominant player in a growing, albeit specialized, very light jet segment.

Honda's motorcycle division, particularly its strong presence in Asia, is a clear Star, projected to achieve a 40% global market share by FY2025 with around 20.2 million units sold, with 85% of these sales originating from Asian markets. The Honda Civic also stands out as a Star, consistently securing the top spot in its automotive segment in 2024 and maintaining a significant lead over competitors like the Toyota Corolla. Furthermore, Honda's hybrid vehicles are performing exceptionally well, with hybrid variants making up over half of CR-V and Accord sales in May 2024 and contributing over 25% to total company sales in 2024, indicating strong market growth and share.

| Product Segment | BCG Category | Key Performance Indicators (2024/FY2025 Data) | Strategic Importance |

| Motorcycles (Asia Focus) | Star | 40% global market share (FY2025 projection), 20.2 million units sold (FY2025 projection), 85% sales from Asia. | Dominant market position in high-growth region. |

| Civic | Star | Top segment performer, significant lead over competitors (e.g., Toyota Corolla), strong sales uptick in May 2024. | Consistent market leadership and brand loyalty. |

| Hybrid Vehicles (CR-V, Accord, etc.) | Star | Over 50% of CR-V/Accord sales in May 2024 were hybrid, over 25% of total 2024 sales were electrified models. | Pivotal to growth strategy, strong consumer demand, planned expansion with 13 new HEVs by 2031. |

What is included in the product

This BCG Matrix overview analyzes Honda's product portfolio, identifying which units to invest in, hold, or divest.

The Honda Motor BCG Matrix provides a clear, one-page overview, relieving the pain of scattered business unit performance data.

Cash Cows

Honda's established internal combustion engine (ICE) automobile models, such as the Civic and CR-V, act as significant cash cows. These vehicles benefit from decades of brand loyalty and a robust, mature market presence, ensuring steady revenue streams without requiring substantial investment in growth initiatives. For instance, in the first half of fiscal year 2024, Honda reported global automobile sales of approximately 1.9 million units, with these core models contributing significantly to that volume.

Honda's global motorcycle business, encompassing all markets, functions as a robust cash cow. This segment consistently generates substantial profits, underpinning the company's financial stability and enabling investments in emerging technologies and other business units.

With a commanding global market share estimated at approximately 40%, Honda's motorcycle division demonstrates remarkable sales volume and brand loyalty across diverse geographical regions. This consistent performance solidifies its role as a primary revenue driver for the entire corporation.

Honda's power equipment division, encompassing items like lawnmowers, generators, and marine engines, functions within a mature market characterized by consistent demand. Despite a minor revenue dip and a loss in fiscal year 2025, this segment typically generates positive cash flow, a testament to its strong brand recognition and customer loyalty across residential, landscaping, and construction industries.

Financial Services

Honda’s Financial Services segment functions as a Cash Cow within its BCG Matrix. This division offers crucial financing and leasing options, directly supporting the sale of Honda’s vehicles.

This business unit consistently generates substantial revenue and healthy profit margins by enabling customers to purchase or lease Honda products. It serves as a reliable, stable source of cash flow, operating within a mature market that complements Honda’s core automotive offerings.

- Revenue Generation: Honda Financial Services contributes significantly to overall profitability by facilitating vehicle sales.

- Stable Cash Flow: The segment provides a predictable and consistent stream of income, crucial for reinvestment and operational stability.

- Market Support: It acts as a vital support mechanism for Honda's primary product lines, enhancing customer accessibility.

Aftermarket Parts and Services

Honda's aftermarket parts and services represent a significant Cash Cow within its business portfolio. The vast global installed base of Honda vehicles, motorcycles, and power equipment, numbering in the tens of millions, ensures a consistent demand for maintenance and replacement parts. This mature segment generates a stable, high-margin revenue stream, crucial for funding growth in other areas of the company.

The aftermarket segment benefits from Honda's strong brand loyalty and the perceived reliability of its products, encouraging customers to stick with genuine Honda parts and authorized service centers. This loyalty translates into predictable sales volumes and pricing power.

- Extensive Installed Base: Millions of Honda vehicles, motorcycles, and power equipment worldwide require ongoing maintenance.

- High-Margin Revenue: The aftermarket segment provides a steady and profitable income stream for Honda.

- Brand Loyalty: Customers often prefer genuine Honda parts and services for their existing products.

- Global Reach: Honda's aftermarket operations span across numerous international markets.

Honda's established automobile models, like the Civic and CR-V, are prime examples of cash cows. These vehicles benefit from decades of brand loyalty and a strong presence in mature markets, consistently generating revenue without needing massive new investments. In the first half of fiscal year 2024, Honda sold about 1.9 million automobiles globally, with these core models being major contributors to that figure.

Honda's global motorcycle business is another significant cash cow, consistently producing substantial profits. This segment provides the financial stability needed to invest in new technologies and other business areas. With an estimated 40% global market share, Honda's motorcycles demonstrate impressive sales volumes and brand loyalty across many regions, solidifying their role as a key revenue generator.

The power equipment division, including items like lawnmowers and generators, operates in a stable, mature market. While it saw a slight revenue dip and a loss in fiscal year 2025, this segment typically generates positive cash flow due to strong brand recognition and customer loyalty in residential and professional sectors.

Honda's Financial Services segment acts as a crucial cash cow by offering financing and leasing for Honda products, directly supporting vehicle sales. This unit consistently delivers strong revenue and profit margins by making it easier for customers to purchase Honda vehicles, providing a reliable cash flow in a mature market that complements the company's main automotive business.

The aftermarket parts and services segment is a vital cash cow for Honda. With tens of millions of Honda vehicles, motorcycles, and power equipment in use worldwide, there's a constant demand for maintenance and replacement parts. This mature segment yields stable, high-margin revenue, essential for funding growth in other company ventures.

| Business Segment | BCG Category | Key Characteristics | Fiscal Year 2024 (H1) Data/Context |

|---|---|---|---|

| Automobile (Core Models) | Cash Cow | High brand loyalty, mature market, steady revenue. | ~1.9 million global units sold. |

| Motorcycles (Global) | Cash Cow | Dominant market share (~40%), consistent profitability, strong brand loyalty. | Significant profit contributor. |

| Power Equipment | Cash Cow | Mature market, consistent demand, brand recognition. | Typically positive cash flow despite minor FY25 dip. |

| Financial Services | Cash Cow | Supports vehicle sales, stable high margins, mature market. | Reliable revenue and profit stream. |

| Aftermarket Parts & Services | Cash Cow | Large installed base, consistent demand, high margins. | Tens of millions of products requiring ongoing service. |

Delivered as Shown

Honda Motor BCG Matrix

The Honda Motor BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be ready for your direct use without any further modifications or hidden content. You can confidently use this preview as an exact representation of the high-quality, actionable BCG Matrix report that will be yours to download and implement for Honda's strategic planning.

Dogs

The Honda Accord and Passport are currently positioned as Dogs in Honda's BCG Matrix. Both models have seen substantial sales drops, with the Accord experiencing a 17% year-over-year decline and a 31% decrease in May 2024 compared to May 2023.

Similarly, the Passport faced a significant 28.7% sales reduction in May 2024. These figures indicate that both vehicles are operating within market segments that are either experiencing low growth or are in decline for Honda, coupled with a relatively low market share compared to their potential.

The Honda Ridgeline, a mid-size pickup truck, is currently positioned as a dog in Honda's product portfolio. Launched in 2016, its sales trajectory has been on a significant decline. In May 2024, month-to-date sales plummeted by 65.3%, and year-to-date sales saw a 25.5% decrease. This sharp drop in demand, coupled with its relatively low market share in a competitive segment, solidifies its status as a dog, indicating a product with low growth and low relative market share.

Older, less fuel-efficient internal combustion engine (ICE) models at Honda are increasingly falling into the 'dog' category of the BCG Matrix. As the automotive industry rapidly pivots towards electrification and navigates tighter emissions regulations, these vehicles are becoming less attractive to consumers. For instance, in 2024, the global market share for pure electric vehicles (EVs) is projected to exceed 15%, a significant jump from just a few years prior, putting pressure on traditional ICE offerings.

Automobile Sales in China

Honda's automobile sales in China experienced a notable downturn in the fiscal third quarter ending December 31, 2024. This decline contributed to a significant overall decrease in Honda's automobile unit sales across Asia.

The Chinese market proved challenging for Honda, as it did for other established automakers like Nissan. Both companies faced increasing pressure from domestic Chinese brands and electric vehicle manufacturers such as Tesla, resulting in a loss of market share.

- Honda's Asian sales, heavily impacted by China, saw a significant decrease in Q3 FY2024.

- Both Honda and Nissan are losing ground in China's competitive automotive landscape.

- Key competitors like domestic brands and Tesla are gaining market share at the expense of traditional players.

Certain Regional Automobile Markets with Declining Sales

Beyond the significant market of China, Honda Motor is facing sales headwinds in other key regions. These declining sales figures in specific markets suggest a challenging environment characterized by low market share and limited growth potential for Honda's automotive products in those areas.

For instance, India's domestic automotive market has shown a downturn for Honda. In June 2025, the company's domestic sales experienced a year-on-year decrease of 3.9%. This follows a more substantial decline of 15.6% observed in January 2025 when compared to the same month in 2024.

- India's domestic sales decline: 3.9% year-on-year drop in June 2025.

- India's January sales comparison: 15.6% decline in January 2025 versus January 2024.

- Market implication: These figures point to low market share and low growth in these specific geographic segments for Honda.

The Honda Accord and Passport are prime examples of Honda's 'Dogs' in the BCG Matrix, showing significant sales declines. The Accord saw a 17% year-over-year drop and a 31% decrease in May 2024 compared to the previous year, while the Passport experienced a 28.7% sales reduction in the same month. These figures highlight low market share and limited growth potential for these models.

The Honda Ridgeline also falls into the 'Dog' category, with a 65.3% month-to-date sales plunge in May 2024 and a 25.5% year-to-date decrease. This sharp decline in demand, coupled with its low market share in a competitive segment, reinforces its position as a low-growth, low-share product.

Older internal combustion engine (ICE) models are increasingly becoming 'Dogs' as the industry shifts to EVs. By 2024, EVs are projected to capture over 15% of the global market share, intensifying pressure on traditional ICE vehicles.

Honda's sales in China and India also reflect 'Dog' characteristics. China's market saw a downturn in Q3 FY2024, with Honda losing share to domestic brands and EV makers like Tesla. India's domestic sales declined by 3.9% in June 2025 year-on-year, and by 15.6% in January 2025 compared to January 2024, indicating low growth and market share in these regions.

| Product | BCG Category | May 2024 Sales Change (YoY) | YTD Sales Change (YoY) | Market Context |

|---|---|---|---|---|

| Honda Accord | Dog | -17% | N/A | Declining segment, low relative share |

| Honda Passport | Dog | -28.7% | N/A | Declining segment, low relative share |

| Honda Ridgeline | Dog | -65.3% (MTD) | -25.5% | Low growth, low relative share in pickup segment |

| Older ICE Models | Dog | Declining | Declining | Industry shift to EVs, regulatory pressure |

| Honda (China) | Dog | Downturn in Q3 FY2024 | N/A | Intense competition from domestic & EV brands |

| Honda (India) | Dog | -3.9% (June 2025) | N/A | Low growth, low market share |

Question Marks

Honda's investment in hydrogen fuel cell electric vehicles (FCEVs) positions them as a potential star in the BCG matrix, albeit currently in a nascent stage. The company is set to launch the 2025 CR-V e:FCEV and plans to produce next-generation fuel cell systems starting in fiscal year 2027/2028, signaling a strong commitment to this high-growth potential market.

Despite the environmental advantages and Honda's strategic push, FCEVs currently represent a very small fraction of the overall automotive market. This low market share, coupled with the substantial infrastructure and technology investments needed for widespread adoption, suggests FCEVs might be considered question marks or even dogs in the current BCG framework, depending on the specific market segment and Honda's progress in overcoming adoption hurdles.

Honda's eVTOL aircraft project fits squarely into the question mark category of the BCG matrix. This signifies a high-growth potential market in urban air mobility, an area where Honda is making significant strides with FAA approval for flight testing of its prototype.

While the eVTOL market is poised for rapid expansion, Honda currently holds a negligible market share. The substantial research and development costs associated with bringing this innovative technology to commercial viability mean it requires considerable investment to capture a meaningful position.

Honda is introducing its 'Honda 0 Series' of next-generation battery-electric vehicles (BEVs) globally in 2026. This new lineup will integrate advanced software-defined vehicle (SDV) technology and artificial intelligence, aiming to redefine the electric mobility experience. While the overall EV market is experiencing robust growth, Honda's current market share in BEVs is relatively low, positioning the 0 Series as a significant investment to capture a stronger foothold.

Advanced Driver-Assistance Systems (ADAS) and ASIMO OS

Honda is investing heavily in proprietary next-generation Advanced Driver-Assistance Systems (ADAS) and the ASIMO Operating System (OS) for its future vehicle lineup. These advancements are targeted at achieving Level 3 automated driving capabilities and delivering ultra-personalized driver experiences.

This strategic focus places Honda in a high-growth segment of automotive technology, with the global ADAS market projected to reach approximately $100 billion by 2027, according to some industry estimates. However, the market adoption of these sophisticated software solutions, and Honda's current share within this specific niche, remains relatively low. Significant ongoing investment is therefore crucial for development and seamless integration.

- High Growth Potential: ADAS and autonomous driving software represent a rapidly expanding sector within the automotive industry.

- Investment Requirement: Developing and integrating proprietary OS and advanced ADAS requires substantial R&D expenditure.

- Market Adoption Lag: While the technology is promising, widespread market acceptance and Honda's current market penetration in these advanced software areas are still developing.

- Strategic Importance: These technologies are key to Honda's future competitiveness and differentiation in the evolving automotive landscape.

Robotics (beyond ASIMO) and Lunar Technology

Honda’s ventures into advanced robotics, such as the Avatar Robot, and its exploration of lunar technology for surface development are prime examples of its commitment to high-growth, future-oriented sectors. These initiatives, while showcasing Honda’s innovative spirit and long-term vision, are currently in their nascent stages.

The market share for these specific robotic and lunar technologies is negligible, reflecting their early-stage development. Significant, sustained investment is necessary for these projects, with returns not expected in the immediate future, positioning them as potential question marks within Honda’s portfolio.

- Robotics Development: Continued investment in advanced robotics like the Avatar Robot aims to tap into future markets for remote operation and assistance.

- Lunar Technology Exploration: Honda’s interest in lunar surface development signifies a bold step into emerging space economy opportunities.

- Market Position: Current market share in these specialized fields is extremely low, indicating a long road to commercial viability.

- Investment Horizon: These are long-term projects requiring substantial capital with uncertain, distant payoff timelines.

Honda's investments in areas like hydrogen fuel cell vehicles (FCEVs), electric vertical take-off and landing (eVTOL) aircraft, and advanced driver-assistance systems (ADAS) can be categorized as question marks in the BCG matrix. These ventures operate in high-growth potential markets but currently hold a small market share, necessitating significant ongoing investment to capture future market leadership.

The company's strategic focus on next-generation battery-electric vehicles (BEVs), such as the 'Honda 0 Series' launching in 2026, also fits this category. Despite the overall EV market's expansion, Honda's current BEV market share requires substantial capital to establish a more dominant position.

Similarly, Honda's commitment to advanced robotics and lunar technology exploration represents long-term bets in nascent, high-growth sectors. These projects demand considerable investment with uncertain, distant returns, aligning them with the question mark quadrant.

Honda's strategic allocation of resources towards these developing technologies underscores its ambition to shape future mobility and technological landscapes, even as they require substantial capital infusion to mature into market leaders.

| Initiative | Market Growth Potential | Current Market Share | Investment Need | BCG Category |

| FCEVs | High | Negligible | Substantial | Question Mark |

| eVTOL Aircraft | Very High | Negligible | Significant R&D | Question Mark |

| Next-Gen BEVs (Honda 0 Series) | High | Low | High | Question Mark |

| Advanced ADAS/Autonomous Driving | High | Developing | Ongoing R&D | Question Mark |

| Robotics/Lunar Tech | Emerging/High | Extremely Low | Long-term Capital | Question Mark |

BCG Matrix Data Sources

Our Honda Motor BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on vehicle sales and market share, and expert commentary on future trends.