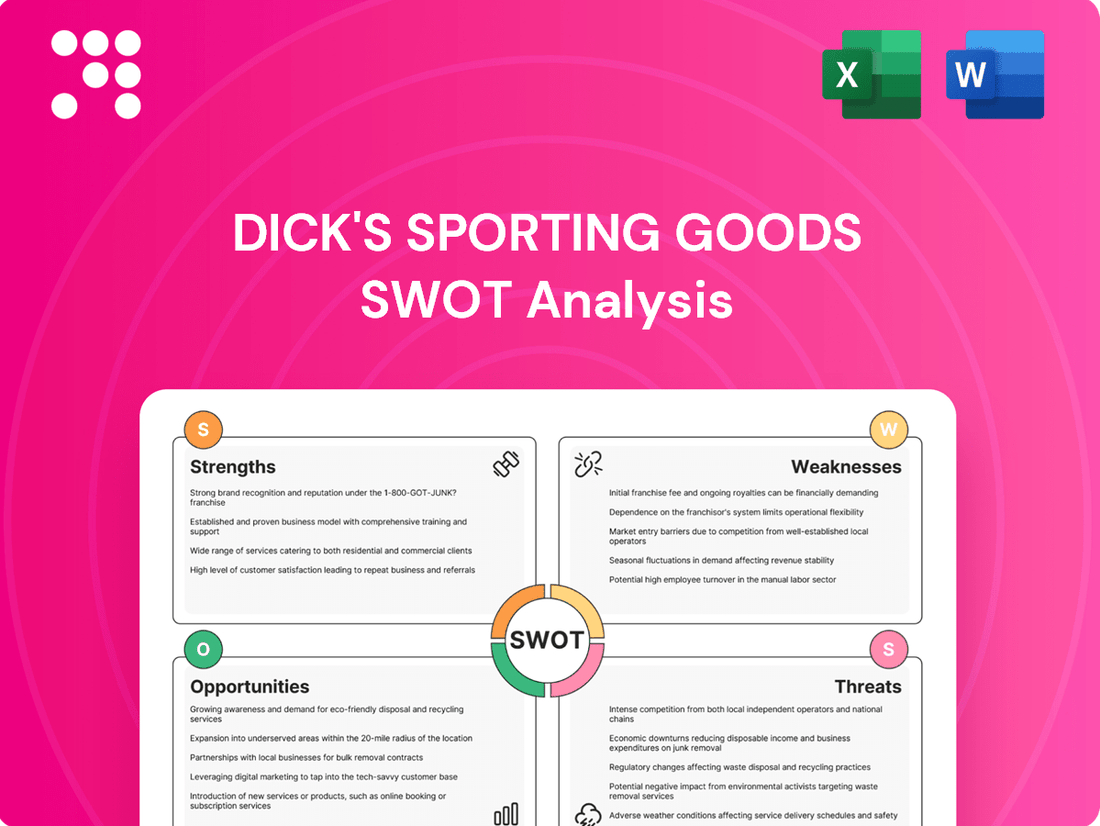

Dick's Sporting Goods SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dick's Sporting Goods Bundle

Dick's Sporting Goods leverages its strong brand recognition and extensive store footprint as key strengths, while facing challenges like intense competition and evolving consumer preferences. Understanding these dynamics is crucial for anyone looking to invest or strategize within the retail sector.

Want the full story behind Dick's Sporting Goods' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Dick's Sporting Goods stands as the premier U.S. sporting goods retailer, consistently growing its market share. In fiscal year 2023, the company reported net sales of $12.44 billion, a testament to its strong market position.

The company's strength lies in its sophisticated omnichannel approach, seamlessly blending its physical store presence with a robust e-commerce operation. This integration, evident in its strong online sales growth, allows Dick's to meet a wide range of customer needs and preferences.

This unified shopping experience, spanning in-store, online, and mobile interactions, is a key driver for both attracting new customers and keeping existing ones engaged. The company's investment in technology and customer experience underpins this leadership.

Dick's Sporting Goods is actively developing and rolling out unique experiential store formats such as 'House of Sport' and '50K DICK'S' (also referred to as 'Field House'). These locations offer engaging features like climbing walls and batting cages, significantly boosting customer interaction and driving robust omnichannel sales.

These innovative store concepts also serve as attractive venues for premier brands looking to present their products in dynamic, immersive settings. This strategy not only enhances brand visibility but also strengthens Dick's position as a key retail partner.

Furthermore, the company's portfolio is diversified through specialty retail banners like Golf Galaxy and Public Lands. This approach allows Dick's to effectively target and serve distinct sporting communities, broadening its market reach and catering to specialized consumer needs.

Dick's Sporting Goods leverages robust partnerships with leading athletic wear companies like Nike, adidas, On, and HOKA. These collaborations provide a unique product selection that appeals strongly to customers, setting DICK'S apart from competitors.

The company's strategic expansion of its private label offerings, including popular brands such as CALIA, DSG, and VRST, has been a significant success. These in-house brands now contribute substantially to overall revenue and boast higher gross margins, directly boosting the company's profitability.

Robust Financial Health and Capital Allocation

Dick's Sporting Goods exhibits robust financial health, a key strength. For the first quarter of fiscal 2025, the company reported net sales of $2.60 billion, an increase of 5.6% compared to the first quarter of fiscal 2024. Comparable store sales also saw a healthy rise of 3.1%, underscoring strong customer demand.

The company's financial discipline is evident in its expanding gross margin, which reached 27.4% in Q1 2025, up from 26.3% in the prior year's first quarter. This improvement reflects effective cost management and pricing strategies.

Dick's Sporting Goods employs a strategic approach to capital allocation. Investments are channeled into critical areas like new store openings, technological advancements, and supply chain enhancements. Simultaneously, the company prioritizes returning value to shareholders through consistent dividend payments and active share repurchase programs.

- Strong Sales Growth: Net sales of $2.60 billion in Q1 2025, a 5.6% increase year-over-year.

- Comparable Store Sales Increase: 3.1% growth in Q1 2025, indicating positive store performance.

- Margin Expansion: Gross margin improved to 27.4% in Q1 2025 from 26.3% in Q1 2024.

- Disciplined Capital Allocation: Strategic investments in growth initiatives alongside shareholder returns via dividends and buybacks.

Customer Loyalty and Data-Driven Engagement

Dick's Sporting Goods cultivates strong customer loyalty through its ScoreCard program, a significant driver of sales and brand devotion. This program, coupled with advanced data analytics and AI, allows for a deep understanding of customer preferences, leading to personalized marketing and product suggestions that enhance the overall shopping journey.

The company actively uses data to refine its strategies, with a notable focus on digital engagement. Platforms like GameChanger are crucial for this, connecting with youth sports participants and introducing them to the Dick's brand, thereby building a pipeline of future valuable customers. This integrated approach ensures a sticky customer base.

- ScoreCard Loyalty Program: Drives a substantial portion of sales and fosters repeat business.

- Data Analytics & AI: Enables personalized marketing and product recommendations.

- Digital Engagement: Platforms like GameChanger connect with youth sports, creating early brand affinity.

Dick's Sporting Goods demonstrates significant market leadership, evidenced by its $12.44 billion in net sales for fiscal year 2023. Its strength is amplified by a successful omnichannel strategy, blending physical stores with a growing e-commerce presence, which contributed to a 5.6% year-over-year net sales increase to $2.60 billion in Q1 2025.

The company's innovative store formats, like 'House of Sport', and its diversified specialty banners, such as Golf Galaxy and Public Lands, enhance customer engagement and broaden market appeal. Furthermore, strong partnerships with premier brands and the strategic expansion of high-margin private labels like CALIA and DSG bolster its competitive edge and profitability.

Financially, Dick's Sporting Goods shows robust health with a Q1 2025 gross margin of 27.4%, up from 26.3% in the prior year, reflecting effective cost management. The company also maintains disciplined capital allocation, investing in growth while returning value to shareholders.

Customer loyalty is a key strength, driven by the ScoreCard program and sophisticated data analytics, which enable personalized marketing and deeper customer engagement. Platforms like GameChanger actively build brand affinity with younger demographics, securing future customer relationships.

| Metric | Q1 2025 | Q1 2024 | YoY Change |

|---|---|---|---|

| Net Sales | $2.60 billion | $2.46 billion | +5.6% |

| Comparable Store Sales | +3.1% | N/A | N/A |

| Gross Margin | 27.4% | 26.3% | +1.1 pp |

What is included in the product

Maps out Dick's Sporting Goods’s market strengths, operational gaps, and risks by examining its brand reputation and private label success against challenges like online competition and inventory management.

Offers a clear, actionable roadmap for addressing Dick's Sporting Goods' competitive challenges and market shifts.

Weaknesses

Dick's Sporting Goods' reliance on national brands, while a strength, also creates a vulnerability. If major suppliers like Nike or Adidas shift their strategies or face inventory issues, it can directly impact Dick's product availability and sales. For instance, a significant portion of Dick's revenue is tied to these key partners, making them susceptible to the brands' own direct-to-consumer (DTC) expansion efforts.

Dick's Sporting Goods anticipates an increase in its selling, general, and administrative (SG&A) expenses. This is a direct result of planned strategic investments aimed at bolstering its digital presence, improving in-store experiences, and expanding marketing efforts.

While these investments are vital for DKS's future growth and competitiveness, they are expected to cause SG&A expenses to deleverage in the short term. This means that as a percentage of sales, these costs might rise, potentially impacting immediate profitability if not carefully managed.

For instance, the company's Q1 2024 earnings report indicated that SG&A expenses as a percentage of net sales increased to 25.5% compared to 24.9% in the prior year's first quarter, reflecting these ongoing investments.

Dick's Sporting Goods faces inventory management risks due to rising inventory levels. For instance, as of the first quarter of 2024, total inventory was reported at $3.1 billion, a notable increase from the previous year. This buildup could become problematic if consumer demand falters or if fashion trends shift unexpectedly, leading to a need for significant markdowns.

Higher inventory levels also translate to increased carrying costs, including storage, insurance, and potential obsolescence. If the company is forced to liquidate excess stock, it could negatively impact gross margins, as seen in past quarters where promotional activity was necessary to manage inventory effectively.

Vulnerability to Macroeconomic Conditions

Dick's Sporting Goods, like many retailers, faces significant headwinds from broader economic shifts. As a seller of non-essential items, consumer spending on sporting goods can be particularly vulnerable when inflation bites or interest rates climb, as seen in the persistent inflation figures throughout 2024, which have pressured household budgets.

The specter of a potential recession also looms, which could further curtail discretionary spending. For instance, if consumer confidence dips significantly in late 2024 or early 2025, shoppers might postpone purchases of higher-ticket sporting equipment or new athletic wear. This sensitivity means that even with a strong brand, Dick's sales and profit margins are directly tied to the overall health of the economy.

- Inflationary Pressures: Persistent inflation in 2024 has reduced consumers' purchasing power, impacting discretionary spending on items like sporting goods.

- Rising Interest Rates: Higher interest rates can increase borrowing costs for consumers and businesses, potentially slowing economic activity and consumer demand.

- Recession Fears: Concerns about a potential economic downturn in late 2024 or 2025 can lead to cautious consumer behavior and reduced spending on non-essential goods.

Competition from Diverse Retail Channels

Dick's Sporting Goods operates in a fiercely competitive landscape. This includes online giants like Amazon, which offer vast selections and often lower prices, as well as mass retailers such as Walmart and Target that carry a broad range of sporting goods alongside their other merchandise.

Furthermore, the rise of direct-to-consumer (DTC) brands, including major players like Nike and Under Armour, presents a significant challenge. These brands control their own distribution and marketing, allowing them to build strong customer loyalty and often offer competitive pricing. This multi-faceted competition pressures Dick's on pricing, product innovation, and the ability to hold onto its market share. For instance, in the first quarter of 2024, Dick's reported a 5.1% decrease in same-store sales, partly attributed to a challenging retail environment and increased promotional activity from competitors.

- Intense Competition: Faces rivals from online-only retailers, mass merchandisers, and direct-to-consumer brands.

- Pricing Pressure: Competitors' pricing strategies can force Dick's to lower its margins.

- Market Share Erosion: Diverse retail channels can siphon customers away, impacting market share.

- Innovation Demands: The need to constantly innovate to keep pace with agile DTC brands and large retailers.

Dick's Sporting Goods' significant reliance on national brands like Nike and Adidas makes it vulnerable to supply chain disruptions or shifts in brand strategies, such as increased direct-to-consumer sales by these partners. The company also faces rising selling, general, and administrative (SG&A) expenses, projected to deleverage in the short term due to strategic investments in digital and in-store enhancements, as evidenced by a rise in SG&A as a percentage of net sales to 25.5% in Q1 2024. Furthermore, an increase in inventory levels to $3.1 billion in Q1 2024 poses risks of markdowns and increased carrying costs if consumer demand softens or trends change unexpectedly.

Full Version Awaits

Dick's Sporting Goods SWOT Analysis

The preview you see is the actual Dick's Sporting Goods SWOT analysis document you'll receive upon purchase. This ensures you know exactly what you're getting—a professional, comprehensive report. No hidden surprises, just the complete analysis ready for your review.

Opportunities

Dick's Sporting Goods has a prime opportunity to further expand its successful experiential store concepts, like House of Sport and Field House. These formats are proving to be a significant draw for customers, offering more than just a place to buy gear. They create engaging environments that foster brand loyalty and differentiate Dick's from competitors.

The company's strategic expansion plans highlight this opportunity. With approximately 16 new House of Sport and 18 Field House locations slated for 2025, and a goal of 75-100 House of Sport stores by 2027, Dick's is clearly investing in this growth area. This focused approach on experiential retail is designed to capture market share and build a more robust customer connection.

Dick's Sporting Goods is strategically capitalizing on the booming e-commerce landscape by heavily investing in its online infrastructure. This includes enhancing the speed and convenience of its digital platforms and refining its mobile app, aiming to provide a seamless shopping journey for customers. For instance, the company reported a significant increase in its e-commerce sales, with online channels contributing a substantial portion of its overall revenue in recent quarters, reflecting the growing consumer preference for digital shopping.

There's a clear avenue for Dick's to further solidify its position in the online retail space, potentially taking market share from competitors who are exclusively online. The company is exploring advanced technologies such as RFID for better inventory management and even the concept of digital twins for its supply chain. These innovations promise to streamline operations, reduce costs, and ultimately elevate the customer experience by ensuring product availability and faster delivery times.

Footwear is a major growth driver for Dick's Sporting Goods, now accounting for a substantial part of their revenue. The company is doubling down on this segment with enhanced marketing efforts and strategic brand collaborations for significant product releases throughout 2024 and 2025.

Dick's is also poised to expand its apparel offerings, especially in fast-growing categories. By capitalizing on established brand partnerships and its own private label success, the company aims to capture more market share in apparel.

Vertical Brand Expansion and Product Diversification

Dick's Sporting Goods has a significant opportunity in expanding its private label (vertical) brands. These brands, such as DSG and CALIA, are already proving popular and profitable, giving the company greater control over product design, sourcing, and ultimately, profit margins. This vertical integration allows Dick's to offer unique products that differentiate it from competitors.

For instance, in fiscal year 2023, private label sales represented a notable portion of Dick's overall revenue, contributing to stronger gross margins compared to national brands. By investing further in these exclusive lines, Dick's can cater to niche markets and build stronger brand loyalty, potentially capturing a larger share of customer spending on athletic apparel and equipment.

- Enhanced Margin Control: Private label brands typically offer higher gross margins than national brands, allowing Dick's to improve profitability on these exclusive products.

- Product Differentiation: Expanding unique, in-house brands creates a competitive advantage by offering items not available at other retailers.

- Customer Loyalty: Exclusive product lines can foster stronger customer relationships and encourage repeat purchases as consumers seek out these specific offerings.

- Supply Chain Efficiency: Greater control over the development and production of private label goods can lead to more efficient inventory management and faster response to market trends.

Sustainability Initiatives and Community Engagement

Dick's Sporting Goods is actively pursuing sustainability, aiming to eliminate single-use plastic bags by 2025 and setting goals for greenhouse gas emission reductions. This commitment resonates with a growing segment of consumers who prioritize eco-friendly practices. For instance, in 2023, a significant portion of consumers indicated they would pay more for sustainable products, a trend Dick's can capitalize on.

By bolstering these environmental initiatives and continuing community outreach, such as the Sports Matter program which has provided over $20 million in grants to youth sports teams, Dick's can enhance its brand reputation. This focus on corporate social responsibility not only attracts environmentally aware customers but also strengthens ties within local communities, fostering loyalty and potentially increasing market share.

- Environmental Goals: Target of eliminating single-use plastic bags by 2025, alongside established targets for greenhouse gas emission reduction.

- Consumer Appeal: Growing consumer preference for sustainable brands, with a notable percentage willing to pay a premium for eco-friendly products.

- Community Impact: Programs like Sports Matter demonstrate commitment to community well-being, fostering brand loyalty and positive public perception.

Dick's Sporting Goods can leverage its growing private label brands, like DSG and CALIA, to enhance profitability and product differentiation. These exclusive lines offer higher gross margins and foster customer loyalty by providing unique offerings not found elsewhere. By expanding these vertical brands, Dick's can capture more market share in key apparel and equipment categories.

The company has a significant opportunity to capitalize on the increasing consumer demand for sustainability. By continuing to implement eco-friendly initiatives, such as eliminating single-use plastic bags by 2025 and reducing greenhouse gas emissions, Dick's can attract environmentally conscious shoppers. This focus on corporate social responsibility, coupled with community programs like Sports Matter, strengthens brand reputation and fosters customer loyalty.

| Metric | 2023 (approx.) | 2024/2025 Outlook |

|---|---|---|

| Private Label Contribution to Sales | Notable portion, driving stronger gross margins | Continued growth expected, increasing market share |

| Sustainability Initiatives | Progress towards eliminating single-use plastic bags by 2025 | Continued focus on emission reduction targets and eco-friendly practices |

| Community Investment (Sports Matter) | Over $20 million in grants to youth sports | Ongoing commitment to community well-being and brand building |

Threats

The sporting goods landscape is intensely competitive. Dick's faces significant pressure from online retailers, mass merchandisers, and a surge in direct-to-consumer (DTC) brands from major athletic companies. This trend, evident throughout 2024, means Dick's might see its access to popular brands constrained or face greater pricing challenges, potentially eroding its market share and profitability.

Economic uncertainty, marked by persistent inflation and elevated interest rates, presents a considerable threat to discretionary spending. As consumers navigate these macroeconomic headwinds, their willingness to purchase non-essential items like sporting goods may diminish. This cautious consumer sentiment, expected to continue into 2025, could directly impact Dick's Sporting Goods' sales volumes and overall financial health.

Dick's Sporting Goods, despite efforts to bolster supply chain resilience, still faces significant threats from geopolitical instability and evolving trade policies. Tariffs, for instance, could directly impact the cost of imported goods, squeezing margins or forcing price increases that deter consumers. In 2023, global supply chain disruptions continued to be a concern, with events like the Red Sea shipping crisis impacting transit times and costs for many retailers.

Unforeseen global events, such as natural disasters or further pandemics, pose a persistent risk to inventory availability and delivery schedules. These disruptions can lead to stockouts of popular items, frustrating customers and potentially driving them to competitors. For example, a severe weather event impacting a key manufacturing region in Asia could halt production of essential sporting equipment, directly affecting Dick's sales.

Changing Consumer Preferences and Retail Trends

Dick's Sporting Goods faces a significant threat from evolving consumer preferences and retail trends. For instance, a notable shift in 2024 has been the increasing demand for athleisure wear and specialized fitness equipment, potentially diverting sales from traditional team sports gear. Failure to quickly pivot inventory and marketing to align with these evolving tastes, such as a surge in demand for pickleball equipment or a continued move to online-only purchasing, could erode Dick's market share.

The rapid pace of change in consumer behavior presents a constant challenge. For example, if consumers increasingly prefer direct-to-consumer (DTC) sales from brands or embrace new resale platforms for sporting goods, Dick's traditional retail model could be negatively impacted. Staying ahead of these shifts is crucial; a 2024 report indicated that online sales in the sporting goods sector grew by 12%, highlighting the importance of a robust digital strategy.

- Shifting Demand: Consumer interest can rapidly move towards niche sports or wellness activities, requiring agile inventory management.

- Channel Preference: A strong move towards e-commerce or mobile shopping necessitates continuous investment in digital platforms.

- Product Innovation: Keeping pace with new materials, technologies, and product categories in sports apparel and equipment is vital for relevance.

Operational Costs Associated with Large Store Formats

While Dick's Sporting Goods' innovative experiential store formats, such as House of Sport, are a key strength, they also represent a significant threat due to their associated operational costs. These larger, more engaging spaces require substantial capital investment upfront and, consequently, incur higher ongoing expenses for staffing, maintenance, and inventory compared to traditional retail footprints.

The financial viability of these premium stores hinges on consistently high customer traffic and robust sales volumes to offset the increased operational burden. For instance, while specific data for House of Sport's operational cost per square foot isn't publicly disclosed, general retail trends indicate that enhanced experiential elements can increase operating expenses by 15-25% over standard stores. This creates a financial risk if customer engagement doesn't translate into the expected sales performance, potentially impacting profitability.

- Higher Capital Expenditure: Building and equipping large, experiential stores like House of Sport demands significant upfront investment.

- Increased Operating Expenses: These formats typically have higher costs for staffing, utilities, and specialized upkeep.

- Sales Volume Dependency: Profitability is directly tied to achieving and sustaining high sales per square foot to justify the investment.

Dick's faces intense competition from online retailers, mass merchandisers, and direct-to-consumer (DTC) brands, potentially limiting brand access and increasing pricing pressure. Economic headwinds like inflation and high interest rates could dampen consumer spending on discretionary items. Evolving consumer preferences towards athleisure and specialized gear, alongside a growing preference for online channels, demand constant adaptation in product assortment and digital strategy.

| Threat Category | Specific Threat | Potential Impact | 2024/2025 Data/Trend |

|---|---|---|---|

| Competition | Online Retailers & DTC Brands | Market share erosion, margin pressure | Online sales in sporting goods grew 12% in 2024; major brands increasingly prioritizing DTC. |

| Economic Factors | Inflation & Interest Rates | Reduced discretionary spending, lower sales volume | Consumer confidence remained subdued through early 2025 due to persistent inflation concerns. |

| Consumer Trends | Shifting Preferences (Athleisure, Niche Sports) | Inventory obsolescence, missed sales opportunities | Increased demand for pickleball equipment and specialized fitness gear noted in 2024. |

| Supply Chain | Geopolitical Instability, Trade Policies | Increased costs, disrupted inventory | Red Sea shipping crisis in late 2023/early 2024 highlighted ongoing supply chain vulnerabilities. |

SWOT Analysis Data Sources

This analysis is built upon a foundation of credible data, including Dick's Sporting Goods' financial statements, comprehensive market research, and expert industry analyses to provide a well-rounded and accurate SWOT assessment.