Dick's Sporting Goods Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dick's Sporting Goods Bundle

Dick's Sporting Goods navigates a competitive landscape shaped by intense rivalry, evolving buyer power, and the constant threat of new entrants. Understanding these dynamics is crucial for any stakeholder looking to grasp the company's strategic positioning.

The complete report reveals the real forces shaping Dick's Sporting Goods’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Dick's Sporting Goods' reliance on a few dominant athletic brands, like Nike, Adidas, and Under Armour, significantly boosts supplier bargaining power. These brands are not just popular; they represent a substantial portion of the market, giving them considerable leverage. For example, Nike's market share in athletic footwear and apparel is immense, and reports indicated it was a major supplier for Dick's in 2023, impacting Dick's purchasing terms and product availability.

Dick's Sporting Goods offers major brands a vital omnichannel distribution network, leveraging its extensive physical store presence alongside a rapidly expanding e-commerce platform. This dual approach makes Dick's an indispensable partner for brands seeking broad market reach and consumer engagement.

The company's strategic investments in innovative store formats, such as House of Sport and Field House, further solidify its position as a preferred retail partner. These concepts provide premium brand experiences, attracting both consumers and brand manufacturers looking for enhanced visibility and sales opportunities.

For the fiscal year 2023, Dick's Sporting Goods reported net sales of $10.01 billion, demonstrating its significant scale and influence within the sporting goods market. This robust financial performance underscores the value Dick's provides to its brand partners as a key distribution channel.

Many of Dick's Sporting Goods' key suppliers are increasingly investing in their own direct-to-consumer (DTC) sales channels. This includes building robust online platforms and opening branded retail stores. For example, Nike's DTC sales reached $23.3 billion in fiscal year 2024, representing a significant portion of their overall revenue.

This growing DTC capability allows suppliers to bypass traditional retailers like Dick's, reducing their reliance on these established channels. Consequently, suppliers gain leverage, as they can directly access their customer base and control the sales experience, potentially increasing their bargaining power when negotiating terms with retailers.

Product Differentiation and Uniqueness

Suppliers offering highly desirable or exclusive product lines, especially in athletic footwear and apparel, wield significant bargaining power. Dick's Sporting Goods relies on these sought-after items to draw in and retain customers. For instance, limited-edition sneaker releases from major brands are a prime example where supplier leverage is high.

To mitigate this supplier influence, Dick's actively develops its own private-label brands. These house brands, such as DSG (Dick's Sporting Goods) and CALIA by Carrie Underwood, not only reduce reliance on external suppliers for key product categories but also offer improved profit margins compared to carrying only third-party brands. In 2023, private label brands represented a growing portion of Dick's sales, contributing to their overall profitability.

- Supplier Dependence: Dick's Sporting Goods' reliance on key brands for popular athletic wear and footwear grants suppliers considerable leverage.

- Product Exclusivity: The demand for exclusive or limited-edition products from major manufacturers strengthens supplier bargaining power.

- Private Label Strategy: Dick's counters supplier power by investing in and expanding its private-label brands, aiming for better margins and reduced dependence.

- Margin Improvement: Private label offerings provide Dick's with greater control over product pricing and a higher profit margin potential compared to exclusively carrying third-party goods.

Switching Costs for Dick's

Switching away from major, established suppliers presents considerable hurdles for Dick's Sporting Goods. These challenges include the potential loss of popular, in-demand inventory that customers expect, which could lead to dissatisfaction and decreased foot traffic or online sales. Furthermore, finding and integrating new product assortments from alternative suppliers requires significant effort and investment.

This reliance on established relationships and the associated costs of disruption directly bolster the bargaining power of Dick's suppliers. For instance, if a key supplier for a popular athletic shoe brand were to change, Dick's would face the immediate task of securing alternative sourcing, potentially at less favorable terms, while also managing customer expectations for those specific products. This difficulty in easily replacing dominant suppliers means they can often dictate terms more effectively.

- High Inventory Dependence: Dick's often relies on a narrow range of suppliers for its most popular and profitable merchandise, making it difficult to switch without impacting sales.

- Customer Loyalty to Brands: Customer loyalty is often tied to specific brands that Dick's sources from these suppliers, not just the retailer itself.

- Integration Costs: The cost and time involved in vetting, onboarding, and integrating new suppliers, including potential product testing and supply chain adjustments, are substantial.

The bargaining power of suppliers for Dick's Sporting Goods is substantial, primarily due to the company's reliance on a few dominant athletic brands. These brands, such as Nike and Adidas, represent a significant portion of Dick's sales and offer products that are highly sought after by consumers. For example, Nike's substantial market share in athletic footwear and apparel makes it a critical partner, influencing purchasing terms and product availability for Dick's.

Furthermore, many key suppliers are increasingly prioritizing their own direct-to-consumer (DTC) channels, as evidenced by Nike's $23.3 billion in DTC sales in fiscal year 2024. This growing DTC capability reduces their dependence on retailers like Dick's, thereby increasing their leverage. The difficulty Dick's faces in switching suppliers, due to customer loyalty to specific brands and the costs associated with integrating new ones, further amplifies supplier bargaining power.

| Factor | Impact on Dick's Sporting Goods | Supplier Leverage |

| Brand Dominance | High reliance on a few key athletic brands | Strong |

| Product Exclusivity | Demand for limited-edition or exclusive items | High |

| Supplier DTC Growth | Suppliers bypass traditional retail channels | Increasing |

| Switching Costs | Difficulty and cost of replacing key suppliers | Significant |

What is included in the product

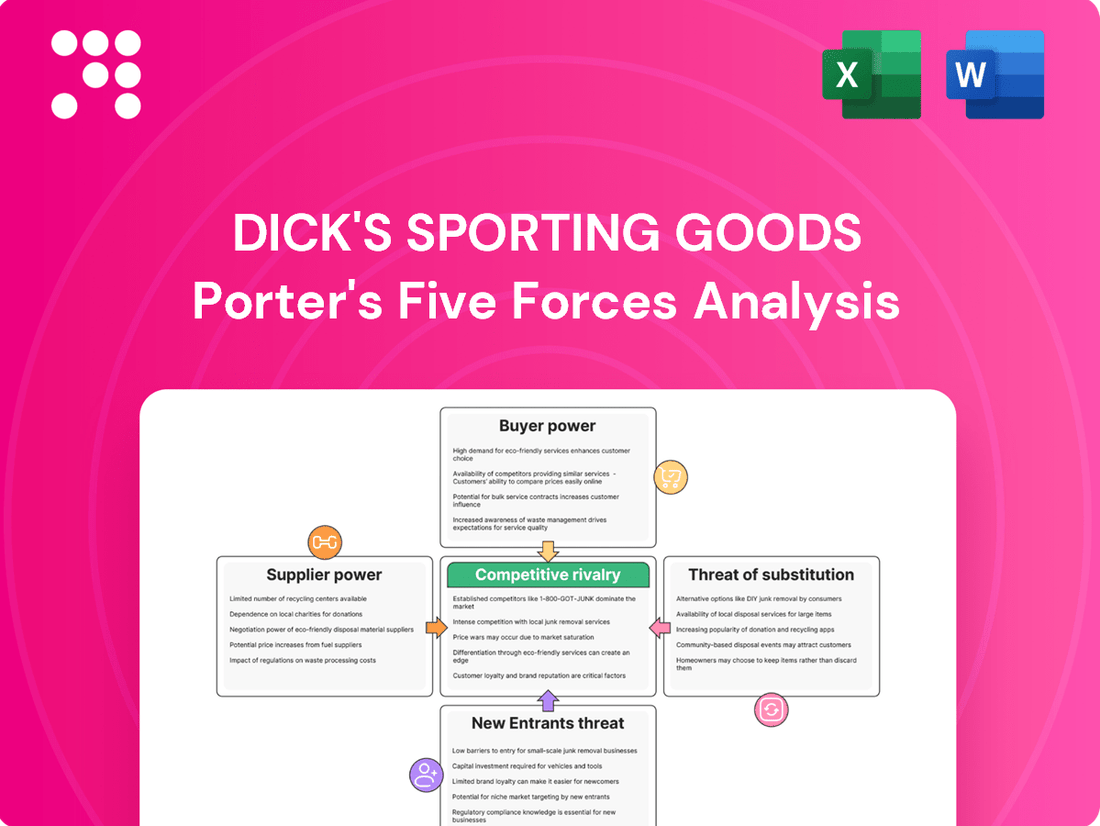

Analyzes the competitive intensity within the sporting goods retail sector, examining buyer power, supplier leverage, new entrant threats, and the availability of substitutes for Dick's Sporting Goods.

Visualize competitive intensity across all five forces—instantly revealing where Dick's Sporting Goods faces the greatest strategic pressure.

Customers Bargaining Power

Customers in the sporting goods sector, particularly with the current cautious spending, are very sensitive to price and often compare options from different stores. A significant portion of shoppers, often over 70% in recent surveys, actively compare prices before making a purchase. This behavior grants consumers considerable leverage.

Dick's Sporting Goods customers face a highly competitive retail landscape, significantly increasing their bargaining power. They can easily find similar products at other large sporting goods chains like Academy Sports + Outdoors, or even at mass merchants such as Walmart and Target. The rise of specialized athletic apparel and footwear retailers, like Lululemon and Foot Locker, further fragments the market, offering niche options that can draw customers away.

The proliferation of online retailers presents an even greater challenge to Dick's. Consumers can readily compare prices and product selections across numerous e-commerce platforms, from Amazon to direct-to-consumer brands. This ease of comparison and accessibility means customers can almost always find a better deal or a more specific product elsewhere, forcing Dick's to remain competitive on price and product offering.

The explosive growth of e-commerce, particularly in the sporting goods sector, significantly amplifies customer bargaining power. Consumers now enjoy unparalleled convenience, the ability to easily compare prices across numerous retailers, and access to a vast array of products, all from their own homes. This shift means customers are less reliant on any single brick-and-mortar store.

Dick's Sporting Goods recognizes this trend and has made substantial investments in its online platform to cater to this evolving consumer behavior. For instance, in fiscal year 2023, Dick's reported that their e-commerce sales represented a significant portion of their overall revenue, demonstrating their commitment to meeting online demand. However, this very ease of online access inherently empowers consumers, making them more likely to seek out the best deals and switch between brands or retailers with minimal friction.

Influence of Athleisure and Fashion Trends

The rise of athleisure has significantly amplified customer bargaining power at Dick's Sporting Goods. Consumers now expect activewear to be both functional and fashionable, making them more discerning and trend-conscious. This shift means they can easily switch brands or retailers based on the latest styles and influencer recommendations, forcing Dick's to constantly adapt its inventory.

This trend is evident in the market's response to popular athleisure brands. For instance, Lululemon saw its revenue increase by approximately 19% year-over-year in the first quarter of 2024, reaching $1.01 billion, showcasing the strong consumer demand for stylish activewear. Dick's must align its offerings with these high-demand fashion trends to retain customers.

The influence of social media and celebrity endorsements further empowers customers. They are often aware of new product launches and style trends before they hit mainstream advertising. This makes them less reliant on traditional retail channels and more inclined to seek out specific, trending items, thereby increasing their leverage in purchasing decisions.

- Athleisure's Fashion Integration: Consumers increasingly view athletic wear as everyday fashion, demanding stylish designs.

- Trend-Driven Purchases: Purchasing decisions are heavily influenced by rapidly evolving fashion trends and social media influencers.

- Brand Switching: Customers are more willing to switch between brands and retailers to access the latest styles and popular items.

- Impact on Inventory: Retailers like Dick's Sporting Goods face pressure to maintain a dynamic inventory that reflects current fashion demands.

Customer Loyalty Programs and In-store Experiences

Dick's Sporting Goods actively cultivates customer loyalty through its rewards program and by enhancing in-store experiences, notably with its House of Sport concept stores. These efforts aim to create a stickier customer base.

Despite these initiatives, the bargaining power of customers remains significant. The retail environment for sporting goods is highly competitive, with numerous alternatives available to consumers.

- Customer Retention Efforts: Dick's loyalty program offers rewards and exclusive access, encouraging repeat business.

- In-Store Experience: House of Sport locations provide curated brand experiences and specialized services, differentiating Dick's from online competitors and other brick-and-mortar stores.

- Competitive Landscape: The presence of big-box retailers, specialty stores, and robust online marketplaces means customers can readily switch if prices or offerings are more attractive elsewhere.

Customers wield substantial bargaining power in the sporting goods market due to widespread price comparison and readily available alternatives. This leverage is amplified by the convenience of online shopping, where consumers can effortlessly compare prices and product assortments across numerous platforms, including direct-to-consumer brands.

The athleisure trend further empowers consumers, who now prioritize style alongside performance, leading to brand switching based on fashion trends and social media influence. Dick's Sporting Goods, while investing in loyalty programs and enhanced in-store experiences like its House of Sport concept, still faces significant customer bargaining power.

| Factor | Impact on Dick's Sporting Goods | Supporting Data (2023/2024) |

|---|---|---|

| Price Sensitivity | High | Over 70% of consumers compare prices before purchasing. |

| Availability of Alternatives | High | Competition from Academy Sports, Walmart, Target, Lululemon, Foot Locker, and numerous online retailers. |

| Online Shopping Convenience | High | E-commerce sales represent a significant portion of Dick's revenue, indicating customer preference for online accessibility. |

| Athleisure Trend Influence | High | Lululemon's Q1 2024 revenue growth of 19% to $1.01 billion highlights strong consumer demand for fashionable activewear. |

Same Document Delivered

Dick's Sporting Goods Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Dick's Sporting Goods, detailing threats from new entrants, buyer power, supplier power, the threat of substitutes, and the intensity of rivalry within the sporting goods industry. The document you see here is precisely what you will receive immediately after purchase, offering a fully formatted and ready-to-use strategic assessment. You can be confident that no placeholders or mockups are used; this is the actual, professionally written analysis you'll be able to download and utilize without delay.

Rivalry Among Competitors

The sporting goods retail sector is incredibly fragmented, featuring a mix of large big-box stores, smaller specialty shops, mass merchandisers, and a significant online presence. This wide array of competitors, from dedicated sporting goods retailers to general merchandise sellers and direct-to-consumer brands, fuels intense rivalry. For instance, in 2024, Dick's Sporting Goods competes not only with established players like Academy Sports + Outdoors but also with online giants such as Amazon and direct sales from brands like Nike and Adidas, all vying for market share.

While Dick's Sporting Goods holds a substantial market share and has been expanding its reach, challenger brands are demonstrating more rapid growth. This suggests a competitive landscape where emerging players are effectively capturing market segments, intensifying rivalry.

For instance, in 2023, Dick's reported net sales of $10.03 billion, a slight increase from the previous year. However, the overall sporting goods market is seeing innovation from smaller, digitally native brands that are agile in responding to niche consumer demands.

This dynamic environment means Dick's must continuously innovate and adapt its strategies to maintain its leadership position against these faster-growing challengers who are actively competing for customer loyalty and market share.

The competitive rivalry within the sporting goods sector is intensifying as major players, including Dick's Sporting Goods, pour resources into enhancing their omnichannel presence and digital offerings. This strategic push is evident in investments in advanced e-commerce platforms and innovative in-store concepts, such as Dick's House of Sport.

This arms race for customer attention forces competitors to continuously differentiate themselves through superior shopping experiences, both online and offline. For instance, in fiscal year 2023, Dick's Sporting Goods reported a 3% increase in net sales, reaching $12.32 billion, reflecting the ongoing efforts to capture market share through these strategic investments.

Pricing Pressure and Promotional Activities

The sporting goods retail landscape is intensely competitive, often forcing companies like Dick's Sporting Goods into aggressive pricing strategies and frequent promotional events. This rivalry directly impacts profitability as retailers strive to attract and retain customers in a crowded market. In 2024, we observed this trend with major players rolling out significant seasonal sales and loyalty program incentives.

Retailers commonly employ tactics such as offering discounts, buy-one-get-one deals, and price matching guarantees. These actions, while necessary to stay competitive, can erode profit margins across the industry. For instance, Dick's Sporting Goods' promotional calendar in 2024 included several major sales events designed to drive traffic and clear inventory, a common practice among its peers.

- Intense Competition: The sporting goods sector sees numerous players vying for market share, leading to constant pressure on pricing.

- Promotional Reliance: Companies frequently use discounts and special offers to differentiate themselves and attract consumers.

- Margin Impact: Aggressive pricing and promotions can compress profit margins for all participants in the industry.

Product Differentiation and Private Label Growth

Companies are increasingly focusing on differentiating their products, with a significant trend towards expanding private label brands to secure a stronger market position. This strategy allows businesses to control the entire product lifecycle and offer unique items that aren't available elsewhere.

Dick's Sporting Goods is actively pursuing this by emphasizing its vertical brands, such as Calia and DSG. These in-house brands are crucial for the company because they typically yield higher profit margins compared to third-party merchandise. Furthermore, they provide distinctive products that can attract and retain customers, setting Dick's apart from competitors.

- Product Differentiation Focus: Retailers are investing in unique product offerings to stand out.

- Private Label Expansion: Growth in proprietary brands is a key competitive tactic.

- Higher Margins: Private labels often contribute more to profitability.

- Brand Loyalty: Unique offerings can foster stronger customer relationships.

Competitive rivalry in the sporting goods market is fierce, driven by a fragmented industry with numerous players including large retailers, specialty stores, mass merchandisers, and online giants. Dick's Sporting Goods faces strong competition from established names like Academy Sports + Outdoors, as well as e-commerce behemoths such as Amazon, and direct-to-consumer brands like Nike and Adidas. While Dick's reported net sales of $12.32 billion in fiscal year 2023, indicating a solid market presence, challenger brands are often showing faster growth, highlighting the need for continuous innovation.

| Competitor Type | Examples | 2023 Net Sales (Dick's) |

|---|---|---|

| Large Retailers | Academy Sports + Outdoors | $12.32 billion |

| Online Giants | Amazon | N/A (Diverse Revenue Streams) |

| Direct-to-Consumer Brands | Nike, Adidas | N/A (Brand-Specific Revenue) |

SSubstitutes Threaten

While sporting goods are essential for participating in sports, the threat of substitutes isn't about finding alternative products for a tennis racket, but rather alternatives to physical activity itself. Think about things like virtual fitness apps, at-home workout equipment, or even just the increasing trend of people being less active overall. These can all divert consumer spending and attention away from traditional sports and the gear associated with them.

For example, the global virtual fitness market was valued at approximately $15 billion in 2023 and is projected to grow significantly. This indicates a substantial shift towards at-home and digital fitness solutions, which can reduce the need for specialized sporting goods and gym memberships.

However, the sporting goods industry is actively working to counter this by focusing on strategies to convert inactive individuals into active participants. This involves making sports more accessible and appealing to a broader audience, thereby expanding the market for sporting goods rather than letting substitutes erode it.

Consumers have a vast array of choices for their leisure time that don't involve sporting goods. Think about streaming services, travel, or even learning a new craft. These alternatives are all vying for the same discretionary income that people have available for entertainment and recreation.

This competition for consumer dollars means that money spent on Netflix or a weekend getaway is money that isn't being spent on new running shoes or a tennis racket. For instance, in 2024, global spending on digital media and entertainment was projected to exceed $2.5 trillion, highlighting the significant portion of consumer budgets allocated to these non-sporting activities.

The growing popularity of the second-hand market and rental services presents a significant threat to Dick's Sporting Goods. Platforms like Sideline Swap and Geartrade allow consumers to buy and sell used sporting equipment, offering a more affordable alternative to new purchases. For instance, a used high-quality bicycle or ski set can be acquired for a fraction of the original price, directly impacting sales of new, higher-margin items.

Rental services for specialized or infrequently used gear, such as kayaks, camping equipment, or even high-end golf clubs, also siphon demand away from outright ownership. This is particularly true for consumers who participate in these activities only occasionally or are trying them out for the first time. By offering access without the commitment of purchase, these services reduce the need for Dick's Sporting Goods to sell new equipment to a segment of the market.

General Apparel and Footwear

The threat of substitutes for Dick's Sporting Goods, particularly in athletic apparel and footwear, is significant. General fashion apparel and casual footwear can easily step in, especially as athleisure continues to blur the lines between active and everyday wear. Consumers often seek comfort and style, and these broader categories can provide that without the premium often associated with specialized athletic brands. For instance, in 2024, the global casual wear market is projected to reach substantial figures, indicating a large pool of consumers who might not exclusively seek out sporting goods retailers for their apparel needs.

- Athleisure Trend: The increasing popularity of athleisure wear means consumers are more likely to purchase comfortable, stylish apparel from non-specialty retailers for everyday use.

- Price Sensitivity: Consumers may opt for more affordable fashion brands that offer similar comfort and aesthetic appeal to athletic wear, especially during economic downturns.

- Brand Proliferation: The market is flooded with brands offering comfortable and stylish clothing and footwear, many of which are not directly sportswear-focused but can serve as substitutes.

- Online Retailers: General online fashion retailers offer a vast selection of apparel and footwear that can compete directly with Dick's offerings, often at competitive price points.

Low Switching Costs to Substitutes

The threat of substitutes for Dick's Sporting Goods is significant due to the low switching costs consumers face when opting for alternative products or activities. This means customers can readily shift their spending away from specialized sporting goods. For instance, a consumer might choose a less equipment-dependent hobby or opt for versatile, general-purpose apparel rather than investing in specific athletic wear.

This ease of substitution is particularly evident when considering the broad range of leisure activities available. Consumers can easily pivot to options that require minimal specialized gear, such as hiking, running without specialized shoes, or engaging in bodyweight exercises. This flexibility in consumer choice directly impacts demand for Dick's core offerings.

- Low Switching Costs: Consumers can easily switch to alternative products or activities with minimal effort or expense.

- Versatile Apparel: General-purpose clothing and athleisure wear often serve as substitutes for specialized sports apparel, offering broader utility.

- Non-Equipment Intensive Activities: Many popular recreational activities require little to no specialized equipment, presenting a direct substitute for sporting goods purchases.

- Price Sensitivity: The availability of lower-priced substitutes, such as discount retailers or private label brands, further intensifies this threat.

The threat of substitutes for Dick's Sporting Goods is multifaceted, encompassing alternatives to physical activity itself, the rise of the second-hand and rental markets, and the increasing appeal of general athleisure wear. Consumers can easily opt for digital fitness solutions, which saw the global virtual fitness market valued at around $15 billion in 2023, or engage in hobbies that require less specialized equipment. The accessibility of used gear through platforms like Sideline Swap and the availability of rental services for niche sports equipment further dilute the demand for new purchases. Additionally, the blurring lines between athletic and casual wear mean consumers might source apparel from broader fashion retailers, impacting sales of specialized sporting goods.

| Substitute Category | Example | Impact on Dick's Sporting Goods | Market Size/Trend (2024 Data) |

|---|---|---|---|

| Alternative Leisure Activities | Virtual fitness apps, streaming services, travel | Diverts discretionary spending away from sporting goods. | Global digital media and entertainment spending projected over $2.5 trillion. |

| Second-hand Market | Used sporting equipment (e.g., bikes, skis) | Offers lower-priced alternatives, impacting sales of new, higher-margin items. | Growing platforms like Sideline Swap and Geartrade facilitate this market. |

| Rental Services | Kayaks, camping gear, golf clubs | Reduces the need for consumers to purchase infrequently used equipment. | Caters to occasional users and those trying new activities. |

| General Athleisure/Fashion | Comfortable, stylish apparel from non-specialty retailers | Competes for apparel spending, especially as athleisure blurs lines between active and casual wear. | Global casual wear market projected for substantial growth. |

Entrants Threaten

The significant capital needed to establish a physical retail presence is a major hurdle for potential new entrants in the sporting goods market. Building a chain similar to Dick's Sporting Goods involves extensive costs for prime real estate, vast inventory, sophisticated supply chain networks, and advanced technology systems. For instance, Dick's operates over 700 stores across the United States, each representing a substantial upfront investment in property, fixtures, and initial stock. This high barrier means that only well-funded entities can realistically consider competing in this segment, effectively limiting the threat of new, smaller players entering the brick-and-mortar space.

Dick's Sporting Goods, like many established retailers, benefits significantly from decades of building brand loyalty and deep customer relationships. This makes it difficult for newcomers to gain traction. For instance, Dick's reported net sales of $10.5 billion for fiscal year 2023, a testament to its strong market presence and customer trust.

New entrants would face a considerable hurdle in replicating Dick's established brand equity and securing access to sought-after product lines from major sports apparel and equipment manufacturers. These long-standing supplier relationships are crucial for offering competitive and desirable merchandise, a key factor in customer retention.

Dick's Sporting Goods leverages significant economies of scale in purchasing, marketing, and logistics, stemming from its substantial size and widespread distribution network. For instance, in 2023, the company reported net sales of $10.5 billion, a testament to its operational capacity. New entrants would struggle to match these efficiencies, facing higher per-unit costs for inventory and marketing, thus hindering their ability to compete on price.

Market Saturation and Intense Competition

The sporting goods retail landscape is already quite crowded, with many established players and some segments nearing maturity. This market saturation means new companies entering the space face an uphill battle to gain a meaningful foothold. They often need to employ aggressive pricing or innovative marketing to stand out.

For instance, in 2024, the sporting goods sector continues to grapple with the dominance of large online retailers and big-box stores, making it difficult for smaller, niche brands to compete on scale and price. This intensity means significant investment in brand building and customer acquisition is typically required for any new entrant to make an impact.

- Market Saturation: The sporting goods market is characterized by a high number of existing retailers, both online and brick-and-mortar.

- Intense Competition: Established brands and retailers have significant market share, brand loyalty, and economies of scale.

- Barriers to Entry: New entrants must overcome substantial marketing costs, supply chain establishment, and brand recognition challenges.

- 2024 Outlook: Continued growth of e-commerce and direct-to-consumer (DTC) models presents both opportunities and challenges for new entrants seeking market penetration.

Digital Disruption and Niche Market Entry

While traditional brick-and-mortar retail presents significant barriers to entry, the digital landscape offers a different story. Online-only businesses and specialized e-commerce players can carve out niches with considerably lower initial investment. For instance, the rise of direct-to-consumer (DTC) brands in athletic apparel and niche sports equipment demonstrates this trend, often bypassing the extensive overhead associated with physical stores.

These digital challengers have capitalized on decreasing barriers in specific market segments. They leverage agile business models and targeted marketing to attract customers. However, achieving the scale and brand recognition of an established player like Dick's Sporting Goods remains a substantial hurdle. While they can disrupt specific product categories, replicating Dick's broad inventory, national store footprint, and established customer loyalty is a complex undertaking.

Consider the growth of specialized online retailers in areas like cycling or running gear. These businesses might offer a curated selection and expert advice, appealing to a dedicated customer base. While they might not compete across Dick's entire product range, their ability to gain traction in these segments highlights the evolving nature of market entry. For example, in 2024, online sales of sporting goods continued to grow, with some niche categories showing particularly strong performance, indicating the ongoing threat from digitally native entrants.

- Digital-first entrants can penetrate niche sporting goods markets with lower capital requirements than traditional retailers.

- Specialized online retailers have benefited from declining barriers to entry in specific product categories, like cycling or running equipment.

- Direct-to-consumer (DTC) brands have successfully bypassed traditional retail channels, building direct relationships with customers.

- Despite success in niches, **scaling to the size and scope of Dick's Sporting Goods** remains a significant challenge for new entrants.

The threat of new entrants for Dick's Sporting Goods is moderate, largely due to high capital requirements and established brand loyalty. While digital channels lower some barriers, replicating Dick's scale, supplier relationships, and store footprint remains a significant challenge for newcomers. The sporting goods market in 2024 continues to see growth in e-commerce, but established players like Dick's maintain a strong competitive advantage.

| Factor | Impact on Dick's Sporting Goods | New Entrant Challenge |

|---|---|---|

| Capital Investment | High (Store build-out, inventory) | Significant barrier for physical retail |

| Brand Loyalty | Strong, built over decades | Difficult for newcomers to replicate |

| Supplier Relationships | Established, access to key brands | Challenging for new entrants to secure |

| Economies of Scale | Significant cost advantages | New entrants face higher per-unit costs |

| Digital Channels | Growing, but physical presence is key | Lower entry barriers for online-only |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dick's Sporting Goods is built on a foundation of public financial disclosures, including annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and Statista.