Schenker-Joyau SAS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Schenker-Joyau SAS Bundle

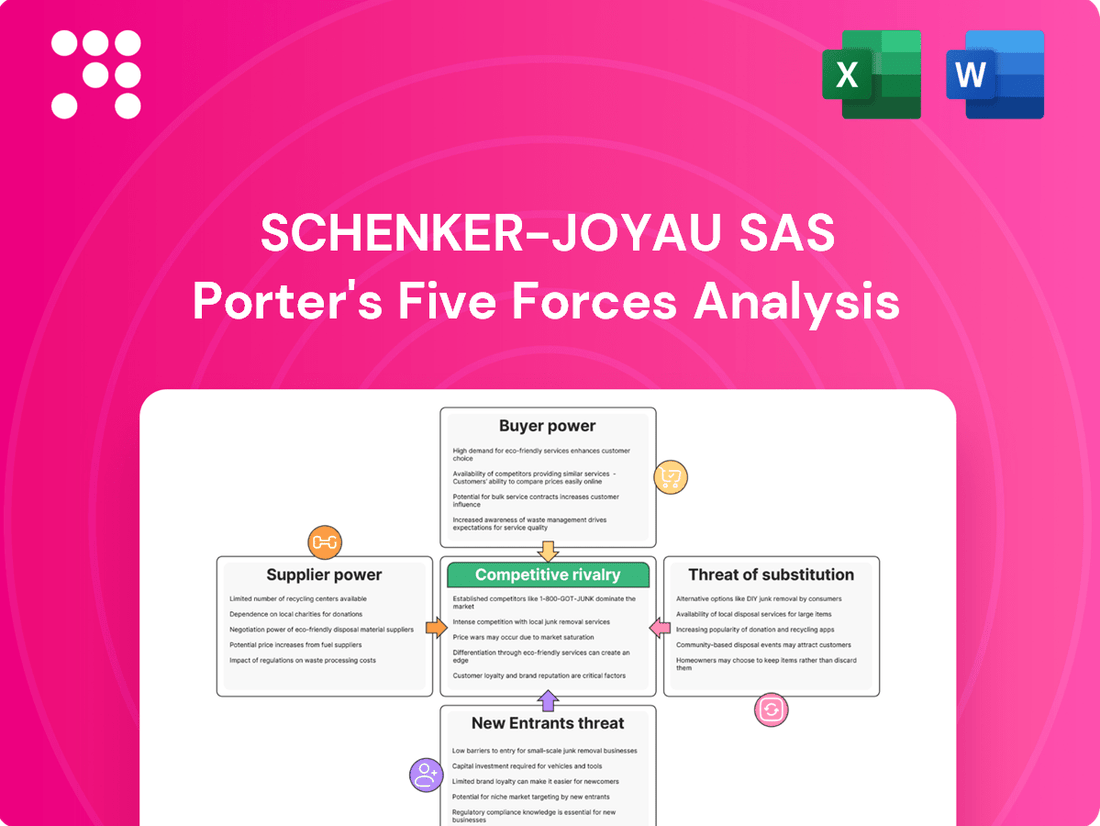

Schenker-Joyau SAS navigates a landscape shaped by intense rivalry and the ever-present threat of substitutes. Understanding the delicate balance of buyer and supplier power is crucial for any stakeholder. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Schenker-Joyau SAS’s competitive dynamics, market pressures, and strategic advantages in detail, revealing the real forces shaping their industry.

Suppliers Bargaining Power

The bargaining power of Schenker-Joyau SAS's suppliers is significantly shaped by industry concentration. For instance, if the market for specialized logistics vehicles or advanced tracking software is dominated by a few key players, these suppliers can exert greater influence over pricing and terms. In 2024, the global logistics technology market saw consolidation, with major IT providers like SAP and Oracle continuing to hold substantial market share, potentially increasing their leverage with logistics firms relying on their systems.

Schenker-Joyau SAS faces significant bargaining power from its suppliers due to high switching costs. For instance, integrating a new fleet maintenance system could cost upwards of €50,000, plus substantial training expenses for mechanics. Similarly, adopting new warehouse management technology might involve initial investments exceeding €100,000 and a learning curve for staff, making a change disruptive and costly.

These embedded costs, whether in specialized IT infrastructure for global network management or bespoke equipment for logistics operations, lock Schenker-Joyau SAS into existing supplier relationships. This reliance means suppliers can often dictate terms, including pricing and service levels, as the logistical and financial hurdles to finding and onboarding a new provider are substantial. For example, a supplier providing critical tracking software might charge a premium, knowing that replacing it would require months of development and integration work, potentially costing millions in lost efficiency.

Suppliers can increase their leverage by threatening to integrate forward, meaning they could start offering logistics services directly. Imagine a large vehicle manufacturer deciding to launch its own freight forwarding arm, directly competing with Schenker-Joyau SAS. This capability makes suppliers more formidable in negotiations.

Importance of Supplier Inputs to Schenker's Operations

The bargaining power of suppliers for Schenker-Joyau SAS is notably influenced by the essential nature of their inputs. Key suppliers like fuel providers, port authorities, and airport cargo handlers are critical for Schenker's integrated logistics and transportation services. Any price hikes or service disruptions from these entities directly affect Schenker-Joyau SAS's operational efficiency and bottom line.

For example, the logistics industry often faces volatility in fuel prices. In 2024, global oil prices experienced fluctuations, impacting transportation costs across the board. Schenker-Joyau SAS, reliant on these fuel suppliers, must absorb or pass on these costs, highlighting the suppliers' leverage.

- Fuel Costs: Fluctuations in global fuel prices directly impact Schenker-Joyau SAS's operational expenses, giving fuel suppliers significant leverage.

- Port and Airport Fees: Charges levied by port operators and airport cargo handlers are essential for freight movement, granting these entities considerable bargaining power.

- Specialized Equipment Providers: Suppliers of specialized vehicles or handling equipment, if few in number, can exert influence through pricing and availability.

- Dependency on Critical Infrastructure: Schenker-Joyau SAS's reliance on a limited number of key infrastructure providers (e.g., specific rail lines or cargo terminals) amplifies supplier power.

Availability of Substitute Inputs

The availability of substitute inputs significantly weakens supplier bargaining power for companies like Schenker-Joyau SAS. For instance, if the logistics industry sees a surge in readily available alternative fuel sources for its fleet, or if more cost-effective and equally efficient transport vehicles enter the market, suppliers of current fuel or vehicles will find it harder to dictate terms. In 2024, the global supply chain disruptions highlighted the critical need for flexibility; companies that could pivot to alternative suppliers or materials faced less pressure.

Consider the impact of open-source logistics software. If Schenker-Joyau SAS can leverage advanced, free or low-cost software solutions instead of relying on proprietary systems from a single vendor, the software supplier's leverage is greatly reduced. This is particularly relevant as digital transformation accelerates, with many companies seeking to avoid vendor lock-in. The ability to switch or adopt alternatives without substantial performance loss or prohibitive costs directly erodes a supplier's ability to command higher prices or impose unfavorable contract terms.

- Substitute Inputs: The presence of readily available alternatives for key resources or services directly counters supplier leverage.

- Fuel Sources: A shift towards diverse and accessible alternative fuels, like electric or hydrogen, diminishes the power of traditional fossil fuel suppliers.

- Vehicle Alternatives: The availability of various transport vehicle types, including those with lower operating costs or different capacities, reduces reliance on specific manufacturers.

- Software Solutions: Open-source or competing logistics software platforms offer alternatives to proprietary systems, lowering switching costs and supplier dependence.

The bargaining power of Schenker-Joyau SAS's suppliers is significantly influenced by the essential nature of their inputs and the availability of substitutes. Critical suppliers like fuel providers and port authorities hold considerable sway, as seen in 2024's fluctuating oil prices which directly impacted transportation costs. However, the growing availability of alternative fuels and logistics software solutions can diminish this power by reducing reliance on single vendors.

High switching costs also bolster supplier leverage. Integrating new fleet management systems or warehouse technology can involve substantial financial outlays and operational disruptions, often exceeding €50,000 or €100,000 respectively. This dependency makes it difficult for Schenker-Joyau SAS to change providers, allowing existing suppliers to dictate terms and pricing more effectively.

| Factor | Impact on Schenker-Joyau SAS | Example (2024 Data) |

|---|---|---|

| Industry Concentration | High concentration among specialized suppliers increases their power. | Major IT providers like SAP and Oracle maintained significant market share in logistics tech. |

| Switching Costs | High costs for new IT or equipment lock Schenker-Joyau SAS in. | Integrating new fleet systems could cost over €50,000; new warehouse tech over €100,000. |

| Essential Inputs | Reliance on critical services like fuel or port access grants suppliers leverage. | Volatility in global oil prices directly affected transportation expenses. |

| Availability of Substitutes | Readily available alternatives weaken supplier power. | Increased interest in electric and hydrogen vehicles offers alternatives to traditional fuel suppliers. |

What is included in the product

This analysis unpacks the competitive forces shaping Schenker-Joyau SAS's industry, detailing threats from new entrants, the power of buyers and suppliers, the intensity of rivalry, and the impact of substitutes.

Instantly identify and address competitive threats with a dynamic, interactive visualization of all five forces.

Customers Bargaining Power

The bargaining power of Schenker-Joyau SAS's customers is significantly shaped by client concentration and the volume of business each customer represents. Major clients, such as large multinational corporations or prominent e-commerce platforms, often contribute a substantial portion of the company's overall revenue.

This concentration grants these key customers considerable leverage. They can more effectively negotiate for better pricing, more favorable contract terms, and enhanced service level agreements, directly impacting Schenker-Joyau SAS's profitability and operational flexibility.

Customers face considerable switching costs when considering a change from Schenker-Joyau SAS to another logistics provider. These costs often involve the time and resources needed to integrate new IT systems, potential disruptions to ongoing supply chains, and the administrative burden of renegotiating service agreements and contracts.

While these switching costs can act as a deterrent, thus limiting customer bargaining power, the logistics landscape is evolving. The growing digitalization of services and the increasing number of competing logistics firms entering the market may gradually reduce these barriers. For instance, in 2024, the global logistics market saw a significant increase in technology adoption, with companies investing heavily in digital platforms that aim to streamline onboarding processes for new clients.

The availability of numerous alternative logistics providers in the French market significantly boosts customer bargaining power. Major global competitors such as DHL, Kuehne + Nagel, and Geodis, alongside many smaller regional firms, offer customers a wide selection of services and pricing structures.

This abundance of choice empowers customers to readily compare offerings and switch providers if they find better value or service elsewhere. For instance, in 2024, the French logistics market continued to see robust competition, with many providers vying for market share by offering competitive rates and specialized services, directly impacting the leverage Schenker-Joyau SAS has with its clients.

Customer Threat of Backward Integration

Customers, particularly large retailers and manufacturers, can exert significant leverage if they possess the capability and inclination to bring logistics operations in-house. This threat of backward integration is more pronounced for clients with high-volume, consistent freight movements, where the potential cost efficiencies of self-operation might offset the inherent complexities. For example, in 2024, major e-commerce players continued to invest heavily in their own fulfillment and last-mile delivery networks, demonstrating this trend.

This looming possibility of customers managing their own logistics directly enhances their bargaining power when negotiating with external providers like Schenker-Joyau SAS. They can credibly threaten to reduce or eliminate their reliance on third-party services if terms are not favorable.

- Customer Control: Large customers can develop their own logistics capabilities, especially for predictable, high-volume shipments.

- Cost Savings Incentive: The potential for cost reduction through in-house management drives this integration.

- Increased Negotiation Power: This threat directly strengthens customers' ability to negotiate better rates and terms with logistics providers.

- Industry Trend: Major retailers and e-commerce giants are increasingly investing in their own logistics infrastructure to gain greater control and efficiency.

Customer Price Sensitivity and Service Differentiation

Customers in the logistics sector often display significant price sensitivity, particularly when procuring standard shipping and warehousing solutions. This pressure compels companies like Schenker-Joyau SAS to maintain competitive pricing structures to attract and retain business. For instance, the global freight forwarding market, valued at approximately $270 billion in 2023, sees intense competition on price for less differentiated services.

However, this price sensitivity can be mitigated when logistics providers offer specialized or value-added services. Customers are frequently willing to pay a premium for offerings such as expedited delivery with guaranteed arrival times, intricate supply chain optimization, or environmentally conscious logistics solutions. This willingness to pay more for differentiation reduces the exclusive focus on cost, thereby lessening the bargaining power of these customers.

- Price Sensitivity: High for standardized logistics services, driving competitive pricing.

- Value-Added Services: Customers may pay more for specialized offerings like guaranteed delivery or sustainable solutions.

- Differentiation Impact: Premium services can reduce a customer's sole focus on price, diminishing their bargaining power.

- Market Context: The global freight forwarding market's 2023 valuation of around $270 billion highlights the competitive pricing environment for basic services.

The bargaining power of Schenker-Joyau SAS's customers is substantial, driven by client concentration and the potential for backward integration. Major clients, representing a significant revenue share, can negotiate favorable terms due to their volume and the threat of handling logistics in-house. This is evident as e-commerce giants continued investing in their own logistics in 2024.

The availability of numerous alternative logistics providers in the French market, including global players like DHL and Kuehne + Nagel, further empowers customers. They can easily compare services and pricing, switching providers if better value is found. In 2024, the competitive landscape intensified with providers offering specialized services and attractive rates.

While customers are price-sensitive for standard services, this power is tempered by Schenker-Joyau SAS's ability to offer specialized, value-added solutions like guaranteed delivery or sustainable logistics. This differentiation allows for premium pricing, reducing the customers' sole focus on cost and thus their leverage.

| Factor | Impact on Bargaining Power | 2024 Context/Data |

|---|---|---|

| Client Concentration | High for major clients | Large multinational corporations and e-commerce platforms significantly influence terms. |

| Switching Costs | Moderate, decreasing with digitalization | Digital platforms in 2024 are streamlining onboarding, potentially lowering barriers. |

| Availability of Alternatives | High | Numerous competitors like DHL, Kuehne + Nagel, Geodis offer choices. |

| Threat of Backward Integration | Significant for high-volume clients | E-commerce players increased investment in own logistics networks in 2024. |

| Price Sensitivity | High for standard services | Global freight forwarding market (approx. $270 billion in 2023) shows intense price competition. |

| Value-Added Services | Mitigates price sensitivity | Customers willing to pay premiums for guaranteed delivery, optimization, or sustainability. |

Same Document Delivered

Schenker-Joyau SAS Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Schenker-Joyau SAS, reflecting the exact document you will receive immediately after purchase. You are viewing the complete, professionally formatted report, ensuring no surprises or missing sections. This detailed analysis will equip you with critical insights into the competitive landscape of Schenker-Joyau SAS.

Rivalry Among Competitors

The French logistics sector is a battleground with many strong contenders. Global giants like DHL, Kuehne + Nagel, DSV, Geodis, and FedEx are all actively competing for business. This crowded field means intense price wars and a constant drive for innovation to win and keep customers.

In 2023, the global logistics market was valued at over $10.6 trillion, with Europe being a significant contributor. Companies like DSV, for instance, reported revenues exceeding €27 billion in 2023, showcasing the substantial scale of operations for key players in the French market.

The French logistics market is on a steady growth trajectory. Projections for 2024 and beyond highlight expansion, particularly within the e-commerce and contract logistics sectors, which are key drivers for companies like Schenker-Joyau SAS.

This growth, while positive, doesn't necessarily soften competitive intensity. In fact, it often fuels it as all participants vie for a larger slice of the expanding pie. Companies are aggressively seeking to win new contracts and retain existing ones, intensifying the rivalry.

Schenker-Joyau SAS differentiates itself by offering integrated transport solutions, leveraging its extensive global network and emphasizing guaranteed delivery times. While many logistics services can become similar, leading to price wars, innovation in sustainable logistics and AI-powered route optimization helps the company stand out. For instance, in 2024, the global logistics market saw continued investment in technology, with companies reporting increased efficiency from AI adoption, a trend Schenker-Joyau SAS is actively participating in.

Exit Barriers for Competitors

High exit barriers significantly influence competitive rivalry within the logistics sector, as exemplified by companies like Schenker-Joyau SAS. The substantial investments in physical assets, such as extensive warehouse networks and large vehicle fleets, make it financially challenging for firms to simply cease operations. For instance, in 2024, the average cost of a new heavy-duty truck can range from $120,000 to $200,000, and a modern logistics warehouse represents a multi-million dollar investment.

These considerable fixed costs mean that even underperforming logistics companies often remain operational rather than incurring massive write-offs. This persistence, even in less profitable periods, can intensify competition as these firms continue to vie for market share. The reluctance to exit due to sunk costs means that the market might remain crowded with more players than economic conditions would ideally support, leading to sustained price pressures and a more aggressive competitive landscape.

Furthermore, long-term contracts with clients, common in the logistics industry, also act as an exit barrier. Dissolving these agreements can lead to penalties and reputational damage, further entrenching companies in the market. This situation can lead to situations where:

- Companies with significant capital tied up in specialized infrastructure, like cold chain logistics facilities, face substantial losses if they attempt to exit.

- The need to fulfill existing contractual obligations discourages premature market withdrawal, even for less profitable ventures.

- The high cost of decommissioning or selling specialized assets, such as advanced tracking systems or custom-built vehicles, deters exit.

Switching Costs for Customers

Schenker-Joyau SAS strives to build high switching costs by offering integrated logistics and supply chain solutions. However, if customers perceive these costs as low, it intensifies competitive rivalry. For instance, in the freight forwarding sector, a company might switch providers for a mere 5% price difference if the integration effort is minimal.

When customers can easily switch, competitors offering superior pricing or enhanced services can attract Schenker-Joyau SAS's client base. This pressure compels Schenker-Joyau SAS to continuously innovate and focus on delivering exceptional value to retain customers. In 2024, the global logistics market saw intense competition, with companies like DHL and Kuehne+Nagel vying for market share, often by offering flexible service packages that lower perceived switching barriers.

- Low perceived switching costs empower customers to explore alternative providers more readily.

- Competitors can leverage lower switching costs to gain market share by offering competitive pricing or superior service features.

- Schenker-Joyau SAS must therefore maintain a strong value proposition to counteract the ease with which customers might switch.

- The ability for customers to switch easily necessitates ongoing innovation and a focus on customer retention strategies.

The competitive rivalry within the French logistics sector is fierce, characterized by a crowded market with major global players like DHL, Kuehne + Nagel, DSV, Geodis, and FedEx. This intense competition drives price wars and necessitates continuous innovation to secure and retain clients, a dynamic that Schenker-Joyau SAS navigates daily.

High exit barriers, such as substantial investments in physical assets like fleets and warehouses, keep even underperforming companies in the market, thus sustaining competitive pressure. For instance, in 2024, a new heavy-duty truck can cost between $120,000 and $200,000, and modern logistics facilities represent multi-million dollar investments.

Low perceived switching costs for customers further intensify this rivalry. If clients can easily switch providers for minor price differences, Schenker-Joyau SAS must consistently offer superior value and innovative solutions to maintain its customer base, a challenge underscored by the market's 2024 trend of flexible service packages from competitors.

| Key Competitor | 2023 Revenue (Approx.) | Key Differentiator Example |

|---|---|---|

| DHL | €25 Billion+ | Extensive global express network |

| Kuehne + Nagel | CHF 28 Billion+ | Strong in sea and air freight forwarding |

| DSV | €27 Billion+ | Integrated logistics solutions, acquisitions |

| Geodis | €14 Billion+ | Focus on contract logistics and distribution |

| FedEx | $90 Billion+ | Global e-commerce delivery capabilities |

SSubstitutes Threaten

The threat of substitutes for Schenker-Joyau SAS is significantly influenced by customers choosing to handle their logistics internally. Large corporations, in particular, might develop their own in-house logistics capabilities, investing in fleets, warehousing, and advanced supply chain software if they perceive it as a more cost-effective or strategically advantageous approach. This direct control can be appealing, especially for businesses with complex or highly specialized logistical needs.

For certain segments, particularly very small or local parcel deliveries, direct transport modes like ride-sharing services or local couriers using passenger cars present a viable substitute. These alternatives can effectively serve the lighter end of Schenker-Joyau SAS's parcel delivery business. For instance, in 2024, the growth of on-demand delivery platforms, often utilizing personal vehicles, has intensified competition in urban last-mile logistics.

Advancements in digital solutions and 3D printing present a growing threat to traditional logistics services like Schenker-Joyau SAS. The ability to transmit digital designs instantly and manufacture goods locally via 3D printing bypasses the need for physical transportation for a segment of products. For example, by 2024, the global 3D printing market was projected to reach over $20 billion, indicating a significant and expanding capacity for on-demand local production.

Shift to Alternative Supply Chain Models

A significant threat to Schenker-Joyau SAS comes from the evolving landscape of supply chain models. As businesses increasingly explore localized or nearshored operations, the need for extensive global logistics networks may diminish. This shift could reduce the demand for traditional freight forwarding and warehousing services that form the core of Schenker-Joyau's offerings.

For instance, the rise of direct-to-consumer (DTC) strategies allows many companies to bypass intermediaries, including large logistics providers. In 2024, many e-commerce businesses are investing in their own fulfillment centers and last-mile delivery capabilities, directly impacting the market share available for third-party logistics (3PL) providers like Schenker-Joyau.

- Reduced Demand for Global Reach: Shorter, localized supply chains lessen the reliance on complex international shipping routes.

- Rise of Direct-to-Consumer (DTC): Companies building their own fulfillment and delivery networks bypass traditional logistics services.

- Nearshoring and Reshoring Trends: These strategies inherently shorten supply chains, decreasing the volume of international freight.

- Increased Competition from Niche Providers: Specialized local logistics firms may emerge to serve these shorter, more focused supply chains.

Customer Self-Collection or Peer-to-Peer Logistics

Customer self-collection, often seen with locker systems or retail pickup points for e-commerce, presents a viable substitute for traditional parcel delivery, particularly in the consumer segment. This trend, sometimes called click-and-collect, allows customers to retrieve their goods at their convenience, bypassing standard home or business delivery. For instance, in 2024, the global smart locker market was valued at over $1.5 billion, indicating significant adoption of these self-service collection points.

Emerging peer-to-peer logistics platforms also offer an alternative, leveraging individuals for last-mile deliveries. While these primarily affect smaller parcel volumes and not heavy B2B freight, they can fragment the market and divert business from traditional carriers like Schenker-Joyau SAS. These platforms often compete on price and speed for urban deliveries, impacting the overall last-mile landscape.

- Self-collection bypasses traditional delivery networks, offering convenience to consumers.

- The global smart locker market's valuation in 2024 exceeded $1.5 billion.

- Peer-to-peer logistics platforms introduce competition for last-mile parcel services.

- These substitutes primarily impact the consumer-facing parcel delivery segment.

The threat of substitutes for Schenker-Joyau SAS is multifaceted, encompassing in-house logistics capabilities, direct transport modes, and digital alternatives. Large corporations increasingly opt for self-managed logistics, driven by cost-efficiency and strategic control, particularly for specialized needs. In 2024, the burgeoning growth of on-demand delivery platforms utilizing personal vehicles intensified competition in urban last-mile deliveries, directly impacting parcel services.

Furthermore, advancements in 3D printing and localized manufacturing are diminishing the need for traditional transportation for certain goods. The global 3D printing market, projected to exceed $20 billion in 2024, highlights a significant shift towards on-demand production, bypassing conventional supply chains. This trend, coupled with the rise of direct-to-consumer (DTC) models where companies manage their own fulfillment, directly erodes the market for third-party logistics providers like Schenker-Joyau.

Customer self-collection through locker systems and retail pickup points is another significant substitute, particularly for e-commerce parcel delivery. The global smart locker market's valuation surpassing $1.5 billion in 2024 underscores the widespread adoption of these convenient alternatives. Emerging peer-to-peer logistics platforms also fragment the market, offering price-competitive last-mile delivery for smaller parcels, thereby diverting business from established carriers.

| Substitute Type | Impact on Schenker-Joyau | Key Drivers/Examples (2024 Data) | Market Size/Growth Indicator |

|---|---|---|---|

| In-house Logistics | Reduced demand for outsourced services, especially from large corporations. | Cost savings, strategic control, specialized needs. | N/A (Internal decision) |

| Direct Transport/Ride-Sharing | Competition in last-mile parcel delivery. | On-demand delivery platforms, urban logistics focus. | Growth in gig economy delivery services. |

| 3D Printing/Local Manufacturing | Reduced need for physical goods transportation. | Digital design transmission, on-demand production. | Global 3D printing market > $20 billion (projected 2024). |

| Direct-to-Consumer (DTC) | Loss of B2B logistics volume. | Companies managing own fulfillment and delivery. | Increased investment in e-commerce fulfillment centers. |

| Self-Collection/Lockers | Shift in parcel delivery preferences. | Convenience, click-and-collect models. | Global smart locker market > $1.5 billion (2024). |

| Peer-to-Peer Logistics | Market fragmentation, competition for last-mile. | Leveraging individuals for delivery, price competition. | Rise of niche delivery platforms. |

Entrants Threaten

The logistics sector, particularly for integrated transport and warehousing services, demands significant upfront capital. Companies like Schenker-Joyau SAS need to invest heavily in physical assets such as extensive warehouse networks, diverse vehicle fleets, and sophisticated IT infrastructure for tracking and management. For instance, major logistics players often operate fleets numbering in the thousands of vehicles and manage millions of square feet of warehouse space, representing billions in asset value.

These high capital requirements act as a formidable barrier for potential new entrants. New companies would struggle to match the scale of investment already made by established firms. This financial hurdle makes it difficult for newcomers to compete effectively from the outset.

Furthermore, established companies, including Schenker-Joyau SAS, leverage substantial economies of scale. This allows them to spread their fixed costs over a larger volume of goods and services, leading to lower per-unit costs. Consequently, they can offer more competitive pricing and absorb market fluctuations or unexpected expenses more readily than smaller, less capitalized new entrants.

New entrants into the logistics sector, particularly within France and the broader European Union, encounter significant regulatory obstacles. Obtaining the necessary licenses and permits for operations, especially those involving international freight, hazardous materials transport, and customs brokerage, requires navigating a complex web of legal frameworks. For instance, the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation imposes stringent requirements on the handling and transport of chemicals, adding another layer of compliance for logistics providers.

Established logistics providers like Schenker-Joyau SAS benefit from deeply entrenched access to crucial distribution channels and extensive global networks. These networks, built over years, include vital ports, airports, and rail hubs, which are difficult for newcomers to replicate. For instance, in 2024, major logistics players continued to consolidate their control over key infrastructure, making it challenging for new entrants to secure comparable operational advantages.

Brand Loyalty and Reputation

Brand loyalty and a strong reputation are significant barriers for new entrants in the logistics sector. Schenker-Joyau SAS, leveraging the global brand recognition of DB Schenker, has cultivated trust over years of consistent, reliable service. This established reputation for speed and security is not easily replicated.

New companies entering the market face the considerable challenge of building this same level of trust and customer loyalty. They would require substantial investment in marketing and years of dedicated, high-quality service delivery to even begin to compete with the established reputation of a company like Schenker-Joyau SAS.

- Established Brand Equity: Schenker-Joyau SAS benefits from DB Schenker's global brand, which signifies reliability and extensive network capabilities.

- Customer Trust: Years of consistent performance in speed and security have fostered deep customer loyalty, making switching to a new, unproven provider less attractive.

- High Entry Costs for Reputation Building: New entrants must invest heavily in marketing and operational excellence to overcome the established reputation advantage.

- Customer Retention: Existing clients are less likely to switch due to the perceived risks associated with unproven service quality, thereby limiting new entrants' market penetration.

Technological Sophistication and Digitalization

The escalating technological demands in logistics, encompassing AI, automation, real-time tracking, and advanced data analytics, present a significant hurdle for new entrants. These sophisticated systems require substantial upfront investment and specialized knowledge, making it difficult for newcomers to match the capabilities of established players like Schenker-Joyau SAS.

For instance, the global logistics technology market was valued at approximately $30 billion in 2023 and is projected to grow significantly, indicating the scale of investment needed. New entrants must not only acquire but also integrate these complex technologies to offer competitive services, a process that is both capital-intensive and time-consuming.

- High Capital Investment: Acquiring state-of-the-art logistics technology, including AI-powered route optimization software and automated warehousing systems, demands considerable financial resources, often running into millions of dollars.

- Specialized Expertise: Operating and maintaining advanced logistics platforms requires a workforce skilled in data science, AI, and automation engineering, talent that is scarce and expensive to recruit.

- Integration Challenges: Seamlessly integrating new technologies with existing supply chain infrastructure can be complex and costly, posing a further barrier to entry for companies lacking established operational frameworks.

The threat of new entrants for Schenker-Joyau SAS is moderate, primarily due to substantial capital requirements and established economies of scale. While the logistics sector offers attractive growth, the sheer investment needed for infrastructure, technology, and global networks deters many potential newcomers. Existing players benefit from significant cost advantages, making it difficult for new firms to compete on price from the outset.

Regulatory hurdles and the need for specialized licenses further complicate market entry, especially for international operations. Building a comparable network of distribution channels and securing access to key transport hubs requires years of development and strong relationships, which are difficult for new entrants to quickly establish.

Furthermore, the established brand equity and customer trust enjoyed by companies like Schenker-Joyau SAS, backed by DB Schenker's global reputation, represent a significant intangible barrier. New entrants must invest heavily in marketing and demonstrate consistent, high-quality service over extended periods to build credibility and attract customers away from proven providers.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Schenker-Joyau SAS leverages data from official company filings, industry-specific market research reports, and economic indicators to provide a comprehensive view of the competitive landscape.