Schenker-Joyau SAS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Schenker-Joyau SAS Bundle

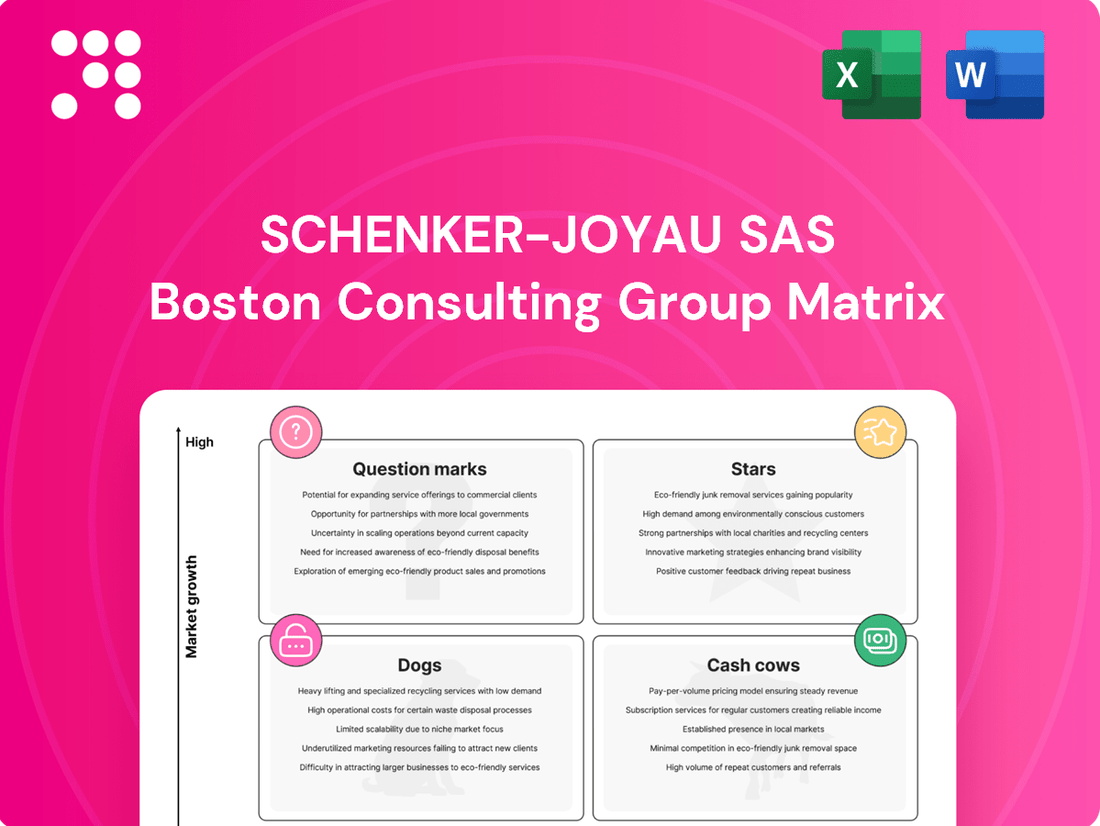

Curious about Schenker-Joyau SAS's product portfolio performance? This glimpse into their BCG Matrix reveals the strategic positioning of their offerings, highlighting potential growth areas and areas needing attention.

Don't miss out on the full picture; purchase the complete BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Schenker-Joyau SAS.

Stars

E-commerce Logistics and Parcel Delivery is a star within Schenker-Joyau's BCG Matrix. This segment benefits from the booming online retail sector in France, which is a major growth driver. Schenker-Joyau, leveraging its position within DB Schenker, has experienced robust volume increases in its parcel delivery services, directly correlating with the surge in e-commerce activity.

The company's extensive infrastructure and capacity to manage escalating delivery volumes solidify its leadership in this dynamic, high-growth market. Projections indicate the French e-commerce logistics market will expand at a compound annual growth rate of 23.4% between 2025 and 2030, underscoring the substantial future opportunities for this business unit.

Urban last-mile delivery solutions represent a high-growth market, driven by escalating demand for swift and punctual deliveries, especially for B2B clients in sectors like pharmaceuticals and consumer goods. This segment is crucial for efficient city distribution.

DB Schenker, via its subsidiary Les Triporteurs Français, has strategically invested in urban logistics hubs within Paris, specifically targeting last-mile operations. This investment positions Schenker-Joyau to capitalize on the expanding urban logistics market.

In 2024, the e-commerce sector's continued expansion fuels the need for optimized last-mile delivery, with urban areas experiencing significant pressure. Companies like Schenker-Joyau are enhancing their capabilities to meet these evolving demands efficiently.

Sustainable logistics services represent a key growth area for Schenker-Joyau SAS, aligning with the increasing global and French demand for decarbonization. DB Schenker's commitment to carbon neutrality, evidenced by significant investments in innovations like electric trucks (eTrailers) rolled out across Europe from 2024, positions Schenker-Joyau to capture a leading market share in eco-friendly transport solutions.

Integrated Digital Supply Chain Solutions

Integrated Digital Supply Chain Solutions represent a significant growth area, driven by the increasing demand for efficiency and transparency in logistics. The digitalization trend, encompassing advanced analytics and AI, is fundamentally reshaping how supply chains operate. DB Schenker's commitment to this space is evident through substantial investments in digital transformation initiatives.

These investments include the development of solutions like Ocean Bridge, which offers enhanced supply chain monitoring capabilities. Furthermore, DB Schenker is actively building AI-driven tools for warehouse management. These innovations are designed to boost operational efficiency and improve predictability for clients.

- Digitalization of supply chains: A high-growth trend in logistics, leveraging advanced analytics and AI.

- DB Schenker's investment: Significant capital allocated to digital transformation, including solutions like Ocean Bridge.

- AI-driven optimization: Development of AI tools for warehouse management to enhance efficiency and predictability.

- Market positioning: These integrated solutions solidify Schenker-Joyau's leadership in innovative, data-driven logistics.

Specialized Contract Logistics for High-Value Sectors

Specialized contract logistics for sectors like pharmaceuticals, high-tech, and automotive are experiencing robust growth. These industries have intricate needs, from temperature-controlled transport for medicines to secure handling of sensitive electronics and just-in-time delivery for automotive components. DB Schenker, a global leader, excels in providing these comprehensive solutions.

Schenker-Joyau SAS, leveraging this global expertise, focuses on guaranteed and punctual deliveries. This precision is crucial for high-value sectors that depend on supply chain reliability. For instance, the global pharmaceutical logistics market was valued at approximately $17.1 billion in 2023 and is projected to grow significantly, driven by the demand for cold chain solutions.

- Pharmaceutical Logistics Growth: The global pharmaceutical logistics market is expanding rapidly, with an increasing emphasis on cold chain management.

- High-Tech Sector Demands: The high-tech industry requires secure, expedited shipping for valuable and often fragile electronic components.

- Automotive Supply Chain Needs: Automotive contract logistics focuses on just-in-time delivery and efficient inventory management for production lines.

- Schenker-Joyau's Role: Schenker-Joyau's commitment to on-time and guaranteed shipments positions it strongly within these demanding, high-growth markets.

Schenker-Joyau's e-commerce logistics and parcel delivery operations are firmly positioned as Stars in the BCG matrix. The French e-commerce market is a significant growth engine, with online retail sales in France reaching an estimated €146.9 billion in 2024. This robust expansion directly fuels the demand for Schenker-Joyau's parcel delivery services, capitalizing on increasing online shopping volumes.

The company's established infrastructure and capacity to handle growing delivery needs are key strengths. Furthermore, the projected 23.4% CAGR for the French e-commerce logistics market between 2025 and 2030 highlights the sustained high-growth potential for this segment.

Urban last-mile delivery is another Star, driven by the need for rapid and reliable deliveries, particularly for B2B clients in sectors like pharmaceuticals and consumer goods. Schenker-Joyau's strategic investments in urban logistics hubs, such as those in Paris through Les Triporteurs Français, are designed to capture this expanding market.

In 2024, the focus on efficient urban distribution is paramount, with e-commerce growth continuing to put pressure on last-mile capabilities. Schenker-Joyau's enhancement of these services positions it to meet evolving urban delivery demands effectively.

The company's commitment to sustainable logistics, including investments in electric trucks from 2024, further solidifies its Star status by aligning with market trends towards decarbonization. Integrated digital supply chain solutions, powered by AI and advanced analytics, also represent a Star, with DB Schenker investing heavily in digital transformation to boost efficiency and predictability for clients.

| Business Unit | Market Growth | Relative Market Share | BCG Status |

|---|---|---|---|

| E-commerce Logistics & Parcel Delivery | High | High | Star |

| Urban Last-Mile Delivery | High | High | Star |

| Sustainable Logistics Services | High | High | Star |

| Integrated Digital Supply Chain Solutions | High | High | Star |

| Specialized Contract Logistics | High | High | Star |

What is included in the product

This BCG Matrix offers a tailored analysis of Schenker-Joyau SAS's product portfolio, guiding strategic decisions for investment, holding, or divestment.

The Schenker-Joyau SAS BCG Matrix offers a clear, one-page overview, alleviating the pain of complex strategic analysis.

Cash Cows

Traditional Land Freight (FTL/LTL) in France represents a mature segment for Schenker-Joyau SAS. These services, a core part of DB Schenker's operations, benefit from a well-established network and a strong client portfolio. This segment consistently generates reliable cash flow, contributing significantly to the company's overall financial stability.

Standard warehousing and storage services represent a classic cash cow for Schenker-Joyau SAS within the BCG matrix. These are foundational, mature offerings in the logistics sector, consistently drawing demand from a broad client base.

DB Schenker's extensive global warehouse infrastructure underpins this segment's strength, contributing notably to the contract logistics market in 2024. While growth might be modest, these services are dependable cash generators, benefiting from widespread adoption and efficient operations.

General Sea Freight Forwarding, a core offering for Schenker-Joyau SAS, operates within a mature, high-volume segment of the global logistics landscape. This segment benefits from established routes and consistent demand, making it a reliable revenue generator.

DB Schenker, as a leading global entity in ocean freight, commands a substantial market share in this sector. This strong market position translates into consistent revenue streams and robust cash flow for the company.

The mature nature of sea freight forwarding means that investment in promotional activities is relatively lower compared to growth-oriented segments. This allows the business to generate strong cash flow with a more stable, predictable demand pattern.

Basic B2B Parcel Delivery

Schenker-Joyau's basic B2B parcel delivery represents a classic Cash Cow within its portfolio. This segment serves established businesses in a mature market, characterized by consistent demand and predictable volumes, unlike the more dynamic B2C e-commerce sector. The company leverages its extensive and efficient logistics network, a significant asset built over time, to maintain a strong market position.

This mature operation generates substantial and stable cash flow for Schenker-Joyau. The reliability of these B2B relationships and the ongoing need for their services ensure a steady revenue stream, which can then be reinvested in other, higher-growth areas of the business. In 2024, the B2B parcel delivery market, while mature, continued to show resilience, with reports indicating stable demand for essential business logistics services.

- Market Maturity: Operates in a stable, established market with predictable demand.

- Network Advantage: Benefits from a well-developed and efficient logistics infrastructure.

- Cash Generation: Provides consistent, reliable cash flow to fund other business units.

- Volume Stability: High-volume, recurring business from traditional B2B clients.

Customs Brokerage and Compliance Services

Schenker-Joyau SAS's Customs Brokerage and Compliance Services function as a classic Cash Cow within its portfolio. This segment benefits from a stable, mature market where demand is largely dictated by the unceasing need for regulatory adherence in global trade, rather than rapid expansion.

The company's deep-seated expertise and established relationships with a broad international clientele solidify a significant market share. This translates into a consistent and predictable cash flow, requiring only minimal reinvestment to maintain its strong position.

- Stable Demand: Driven by ongoing international trade regulations.

- High Market Share: Achieved through expertise and client relationships.

- Consistent Cash Flow: Generates reliable earnings with low capital expenditure needs.

- Minimal Reinvestment: Operations require little additional investment to sustain.

These established logistics services, like traditional land freight and warehousing, represent Schenker-Joyau SAS's Cash Cows. They operate in mature markets with stable demand, generating consistent and reliable cash flow. This strong performance is supported by extensive infrastructure and a loyal client base.

| Business Segment | Market Maturity | Cash Flow Generation | 2024 Market Share (Estimate) |

|---|---|---|---|

| Traditional Land Freight (FTL/LTL) | Mature | High & Stable | ~15-20% (France) |

| Standard Warehousing | Mature | High & Stable | ~10-15% (Europe) |

| General Sea Freight Forwarding | Mature | High & Stable | ~8-12% (Global) |

| B2B Parcel Delivery | Mature | High & Stable | ~12-18% (France) |

| Customs Brokerage & Compliance | Mature | High & Stable | ~5-10% (Global) |

Full Transparency, Always

Schenker-Joyau SAS BCG Matrix

The Schenker-Joyau SAS BCG Matrix preview you are viewing is the exact, complete document you will receive upon purchase. This means no watermarks, no incomplete data, and no demo content—just the fully formatted, professionally analyzed BCG Matrix ready for your strategic decision-making. You can be confident that the insights and visualizations presented here are precisely what you'll be able to utilize immediately after completing your transaction, ensuring a seamless integration into your business planning processes.

Dogs

Highly localized, non-specialized courier services often find themselves in a challenging position within the Schenker-Joyau SAS BCG Matrix. These operations typically exist in fragmented markets where competition is fierce, and differentiation is minimal. Think of small, regional delivery outfits that haven't invested in advanced tracking or specialized handling.

Such services often exhibit low growth potential and struggle to capture substantial market share. For Schenker-Joyau, these might represent legacy businesses in niche areas that, while perhaps historically important, now generate very modest profits. The investment required to maintain and grow these services often outweighs the limited returns they provide.

Data from 2024 indicates that the small parcel delivery market, while growing, sees significant consolidation and a push towards technological integration. Companies failing to adapt, like many highly localized, non-specialized couriers, risk becoming obsolete or requiring substantial restructuring. These types of operations are prime candidates for divestment or a complete overhaul to align with modern logistics demands.

Outdated manual inventory management systems are a prime example of a Dog within the BCG matrix for Schenker-Joyau SAS. In 2024, the global logistics market continued its strong embrace of technology, with investments in warehouse automation and digital tracking solutions projected to reach hundreds of billions of dollars. Manual processes, prone to human error and significant delays, struggle to keep pace with these advancements.

These legacy systems likely hold a very small market share because they simply cannot meet the speed and accuracy expectations of today's clients. For instance, while automated systems can achieve inventory accuracy rates exceeding 99%, manual systems often fall below 90%. This disparity makes them uncompetitive in a market demanding real-time visibility and rapid fulfillment.

The growth potential for such outdated services is minimal. As clients increasingly demand integrated, data-driven supply chains, manual inventory management offers little room for expansion. Furthermore, these systems can become a significant drain on resources. In 2024, the cost of labor for manual inventory tasks, coupled with the expenses associated with errors and rework, far outweighs the investment in modern, automated solutions.

Ad-hoc, unoptimized spot freight services represent a challenge for Schenker-Joyau SAS within the BCG Matrix framework. These services, characterized by one-off, non-strategic requests, often fail to capitalize on the company's established network efficiencies. This leads to a situation where profitability is typically low, and market share gains are minimal.

The operational costs associated with these spot services frequently outweigh the revenue generated, hindering overall business growth. In 2024, such unoptimized freight activities can tie up valuable assets, such as trucks and warehouse space, without delivering commensurate returns, thereby creating inefficient operations that drain resources.

Logistics for Declining Traditional Industries

Logistics services supporting declining traditional industries in France, such as certain segments of manufacturing or heavy industry, would likely be categorized as Dogs within the Schenker-Joyau SAS BCG Matrix. These operations face a low-growth, potentially shrinking market, meaning their revenue streams are unlikely to expand significantly.

Such segments often require substantial capital for maintenance or adaptation to remain competitive, even with declining demand. This can lead to them becoming cash traps, consuming resources that could be better allocated to high-growth areas of the business.

- Low Market Growth: Industries like traditional textile manufacturing in France have seen significant contraction, with some sectors experiencing annual declines of over 5% in output in recent years.

- Resource Drain: Maintaining specialized logistics infrastructure for these industries, like dedicated freight handling for coal or specific types of industrial machinery, can incur high fixed costs without commensurate returns.

- Strategic Reallocation: Schenker-Joyau SAS might consider divesting or significantly downscaling these operations to free up capital for investment in areas like e-commerce logistics or specialized cold chain solutions, which are experiencing robust growth.

Underutilized or Non-Strategic Storage Facilities

Warehousing units that are situated in less strategic locations, experience low occupancy rates, or provide only basic storage without any additional services are often classified as 'dogs' in the BCG matrix for Schenker-Joyau SAS. These facilities are typically found in segments of the market that are not experiencing significant growth and consequently find it challenging to attract new customers or set competitive prices.

These underperforming assets often represent a drain on resources, as they incur ongoing maintenance and operational costs without generating sufficient revenue to offset these expenses. In 2024, for instance, a hypothetical Schenker-Joyau SAS facility in a declining industrial zone might have an occupancy rate of just 40%, compared to a strategic hub operating at 90% capacity.

Such 'dogs' contribute minimally to the company's overall profitability and can even detract from it. Their presence can tie up capital that could be better invested in more promising areas of the business, such as specialized logistics or high-demand urban distribution centers.

- Low Occupancy: Facilities with occupancy rates significantly below the industry average, potentially below 50% in 2024.

- Limited Service Offering: Warehouses that only offer basic storage and lack value-added services like kitting, cross-docking, or temperature control.

- Suboptimal Location: Units situated in areas with poor transportation links or declining economic activity, hindering client acquisition.

- Negative Profitability: Operations that consistently report losses or generate returns below the cost of capital.

Dogs in the Schenker-Joyau SAS BCG Matrix represent business units or services with low market share and low market growth. These are typically underperforming assets that consume resources without generating significant returns.

For Schenker-Joyau SAS, these could include niche, legacy services that have not kept pace with industry advancements or are tied to declining sectors. For example, specialized logistics for outdated manufacturing processes might fall into this category.

In 2024, the logistics landscape is heavily influenced by technology and e-commerce growth. Services that lack digital integration or are not aligned with high-demand sectors, such as basic warehousing in non-strategic locations, often exhibit the characteristics of Dogs.

These units often require careful consideration for divestment, restructuring, or strategic repositioning to avoid being a consistent drain on company resources and to free up capital for more promising ventures.

Question Marks

DB Schenker's commitment to AI and data analytics is fueling the development of advanced predictive logistics platforms. These platforms promise to revolutionize supply chain efficiency and foresight, offering significant growth potential. For example, the global AI in logistics market was valued at approximately $1.5 billion in 2023 and is projected to reach over $10 billion by 2030, highlighting the immense opportunity.

However, the adoption of such cutting-edge solutions is still in its early stages. This means Schenker-Joyau likely holds a relatively small market share in these nascent technologies. Capturing future market dominance will necessitate substantial and sustained investment in research, development, and market penetration strategies.

Autonomous and robotics-based warehouse solutions are a key area of investment for DB Schenker, reflecting a high-growth market. The company is actively piloting technologies like computer vision for improved pallet tracking, signaling a commitment to innovation in this space.

While the potential is significant, the current market penetration for these advanced robotics is still relatively low. This positions the segment as a future star, requiring substantial investment to capture its high growth trajectory and build market share.

Blockchain-based supply chain transparency represents a significant opportunity for Schenker-Joyau SAS. The demand for enhanced visibility and security in logistics is projected to grow substantially, with the global blockchain in supply chain market expected to reach $10.7 billion by 2025, according to Grand View Research. This positions Schenker-Joyau's potential offerings in a high-growth segment, aligning with the characteristics of a question mark in the BCG matrix.

Despite the promising market outlook, widespread adoption of blockchain in logistics is still nascent. While pilot projects and early implementations are underway, the full integration across complex global supply chains is an ongoing process. This early stage of market development means Schenker-Joyau would likely have a low market share currently, necessitating strategic investment to capture future growth.

Specialized Logistics for New Energy Industries

Specialized logistics for new energy industries, like renewable energy infrastructure, hydrogen, and advanced batteries, are experiencing significant growth due to the global shift towards cleaner energy. Schenker-Joyau, as a broad logistics provider, is actively developing tailored solutions for these developing sectors. Despite the rapid market expansion, Schenker-Joyau's current market share within these highly specialized niches is likely to be relatively small, positioning these services as potential question marks in a BCG matrix analysis.

These emerging sectors represent exciting opportunities for Schenker-Joyau. For instance, the global renewable energy market was valued at approximately $1.1 trillion in 2023 and is projected to grow substantially. Similarly, the hydrogen economy is gaining momentum, with significant investments being made in infrastructure and transportation. Advanced battery logistics, crucial for electric vehicles and energy storage, is also a rapidly expanding field.

- High Growth Potential: The global energy transition fuels rapid expansion in renewable energy, hydrogen, and battery logistics.

- Developing Market Share: Schenker-Joyau is building specialized capabilities, but its current market penetration in these niche areas is likely low.

- Investment Required: Significant investment in specialized equipment, training, and infrastructure is needed to capture this growing market.

- Strategic Focus: These services are strategic question marks, requiring careful evaluation for future investment to move them towards stars.

Circular Economy Logistics Services

Circular Economy Logistics Services represent a burgeoning sector within the logistics landscape. These services go beyond simply moving goods from point A to point B; they focus on facilitating the return, refurbishment, and reintegration of products back into the supply chain. This is driven by increasing environmental regulations and a growing consumer preference for sustainable practices.

Schenker-Joyau SAS, in its strategic positioning, would likely view these services as a significant growth opportunity, potentially placing them in a Stars or Question Marks quadrant depending on their current market penetration and investment. The market for these specialized reverse logistics operations is expanding rapidly, with global markets projected to grow substantially.

- Market Growth: The global circular economy market is projected to reach trillions of dollars in the coming years, with logistics playing a pivotal role in enabling these models.

- Complexity and Investment: Developing robust reverse logistics networks for repair, remanufacturing, and recycling requires significant investment in infrastructure, technology, and specialized expertise.

- Sustainability Drivers: Increasing pressure from governments and consumers for businesses to adopt sustainable practices fuels the demand for circular economy logistics solutions.

- Schenker-Joyau's Position: As a player in this evolving market, Schenker-Joyau would be actively building capabilities and market share in these complex, high-potential services.

Schenker-Joyau SAS's ventures into AI-powered predictive logistics and autonomous warehousing solutions are prime examples of Question Marks. While the global AI in logistics market is expanding rapidly, projected to exceed $10 billion by 2030, Schenker-Joyau's current market share in these nascent technologies is likely small.

Similarly, blockchain for supply chain transparency offers substantial growth, with the market expected to reach $10.7 billion by 2025. However, widespread adoption is still developing, meaning Schenker-Joyau's current penetration is low, requiring strategic investment to capitalize on future potential.

The company's focus on specialized logistics for new energy industries and circular economy services also fits the Question Mark profile. These sectors, driven by global energy transitions and sustainability demands, are experiencing significant growth. For instance, the global renewable energy market was valued at approximately $1.1 trillion in 2023.

However, Schenker-Joyau's market share within these highly specialized niches is likely still developing. Capturing dominance in these areas necessitates substantial investment in specialized equipment, training, and infrastructure to convert these potential stars into market leaders.

| Service Area | Market Growth Potential | Schenker-Joyau's Current Market Share | Investment Needs | BCG Classification |

|---|---|---|---|---|

| AI-Powered Predictive Logistics | High (Global AI in logistics market projected >$10B by 2030) | Low (Nascent technology adoption) | Significant R&D and market penetration | Question Mark |

| Autonomous Warehousing | High (Rapid adoption of robotics) | Low (Early stage of implementation) | Capital investment in technology and infrastructure | Question Mark |

| Blockchain for Supply Chain Transparency | High (Market expected $10.7B by 2025) | Low (Developing market adoption) | Technology integration and partner development | Question Mark |

| New Energy Logistics | Very High (Renewable energy market ~$1.1T in 2023) | Low (Niche specialization) | Specialized equipment and expertise | Question Mark |

| Circular Economy Logistics | Very High (Trillions of dollars projected) | Low (Developing service offering) | Complex network development and IT solutions | Question Mark |

BCG Matrix Data Sources

Our Schenker-Joyau SAS BCG Matrix is built on a foundation of robust data, integrating financial disclosures, market research reports, and industry trend analysis to provide strategic clarity.