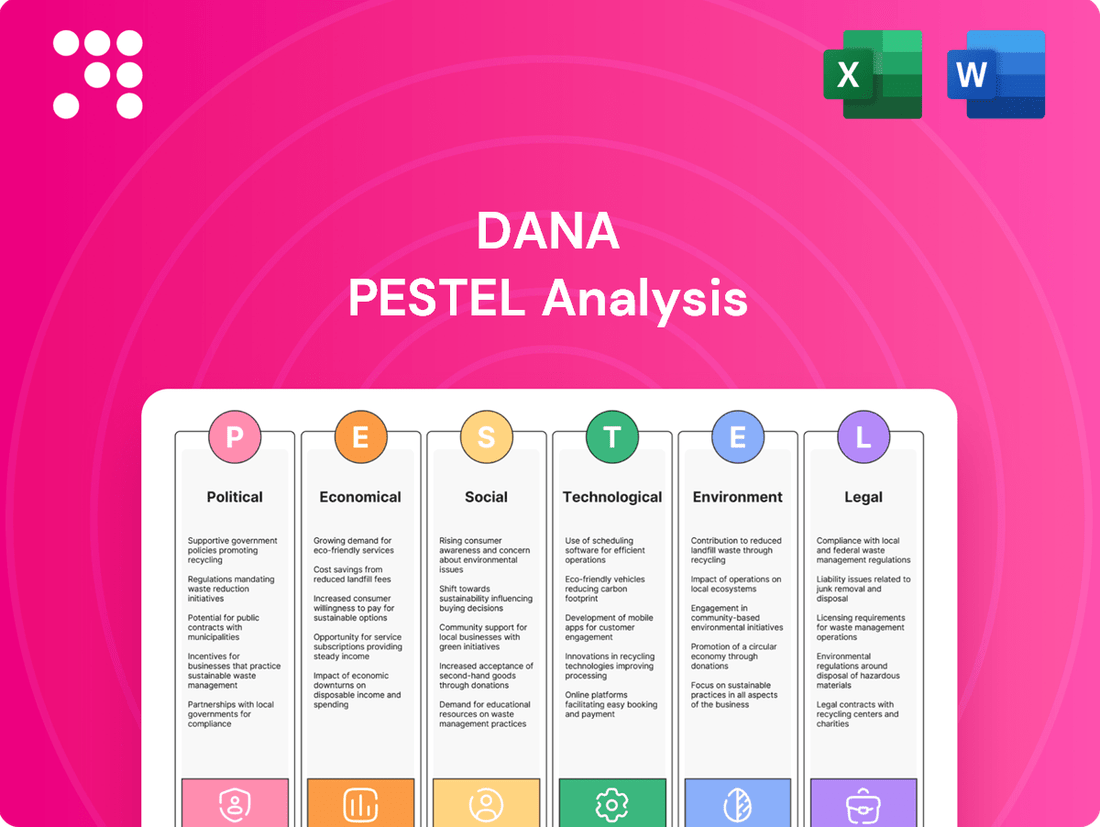

Dana PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dana Bundle

Navigate the complex external environment impacting Dana with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its future. Gain a strategic advantage by identifying opportunities and mitigating risks. Download the full analysis now for actionable insights to inform your decisions.

Political factors

Governments globally are tightening rules on vehicle emissions and fuel economy. For instance, the European Union's CO2 emission standards for new cars and vans aim for an average of 95 g CO2/km by 2020, with further reductions planned. By 2030, the target is a 37.5% reduction from 2021 levels for cars and 50% for vans, pushing companies like Dana to accelerate their investments in electric and hybrid powertrain technologies to meet these mandates and maintain market access.

These stricter regulations directly influence Dana's product portfolio and necessitate significant capital expenditure in research and development for electrification and advanced energy management systems. The push for zero-emission vehicles, such as the proposed 2035 phase-out of new internal combustion engine vehicle sales in California, underscores the urgency for Dana to adapt its offerings across light vehicle, commercial vehicle, and off-highway sectors to remain competitive and compliant.

Fluctuating global trade policies, including tariffs and trade agreements, significantly impact Dana's international supply chains and manufacturing costs. For instance, the imposition of new tariffs on critical components, such as those seen in the US-China trade disputes, could increase production expenses by an estimated 5-15% depending on the specific goods. These shifts necessitate strategic adjustments to Dana's global production and distribution networks to maintain cost efficiency and market access.

Governments worldwide are actively encouraging electric vehicle (EV) adoption and green technology development through significant financial incentives. For instance, in 2024, the United States continued its Inflation Reduction Act (IRA) provisions, offering up to $7,500 in tax credits for qualifying new EVs and $4,000 for used EVs, alongside credits for clean energy manufacturing. Similarly, the European Union's Green Deal initiatives and national programs in countries like Germany and France provide substantial subsidies and tax breaks for EV purchases and charging infrastructure, aiming to meet ambitious emissions reduction targets.

These government initiatives directly translate into accelerated market penetration for companies like Dana, which provides electrification and energy-management solutions. The increased consumer demand driven by these incentives creates a fertile ground for Dana's products, potentially boosting sales and market share. For example, a surge in EV sales, potentially exceeding 15 million units globally in 2024, signals a robust market where Dana's components are increasingly vital.

Dana's strategic alignment with these favorable policy environments is crucial for maximizing growth opportunities. By ensuring its product portfolio, such as advanced electric drivetrains and thermal management systems, meets the criteria for these government programs, Dana can effectively capitalize on the expanding green technology market. This proactive approach allows Dana to not only benefit from increased demand but also to solidify its position as a key player in the transition to sustainable mobility.

Geopolitical Stability and Conflicts

Global geopolitical instability remains a significant concern for Dana. For instance, ongoing conflicts in Eastern Europe and the Middle East continue to create supply chain vulnerabilities and price volatility for key commodities essential to automotive manufacturing. These disruptions can directly impact Dana's ability to source components and manage production costs effectively.

Dana's exposure to regions experiencing heightened geopolitical tension necessitates a proactive approach to risk mitigation. The automotive sector, in particular, is sensitive to economic downturns and trade policy shifts that often accompany such instability. For example, the International Monetary Fund (IMF) has repeatedly cited geopolitical fragmentation as a drag on global economic growth projections for 2024 and 2025, directly affecting demand for vehicles and related components.

- Supply Chain Disruptions: Regional conflicts can sever critical transportation routes, impacting Dana's logistics and increasing lead times for parts.

- Raw Material Cost Volatility: Geopolitical events often trigger fluctuations in the prices of metals and energy, directly affecting Dana's input costs.

- Market Demand Uncertainty: Instability in key markets can lead to reduced consumer spending on vehicles, impacting Dana's sales volume.

Industrial Policies and Local Content Requirements

Governments worldwide are increasingly employing industrial policies and local content requirements (LCRs) to stimulate domestic industries and employment. For a company like Dana, this means that decisions about where to build factories and where to buy parts can be significantly impacted. For instance, India's Production Linked Incentive (PLI) scheme for automotive components, launched in 2021, aims to boost domestic manufacturing, potentially influencing Dana's supply chain strategy in the region.

These mandates can necessitate localized production or joint ventures to gain market access or expand operations. In 2024, several emerging economies are strengthening LCRs in sectors like renewable energy and electronics, pushing multinational corporations to increase the proportion of locally sourced goods and services. Dana must navigate these regulations carefully to ensure compliance and operational efficiency.

- Industrial Policy Impact: Government incentives and regulations can steer investment towards specific domestic manufacturing capabilities.

- Local Content Mandates: Requirements for a certain percentage of locally sourced components can alter supply chain decisions.

- Market Access and Expansion: Adherence to LCRs is often a prerequisite for entering or growing market share in certain countries.

- Operational Complexity: Balancing global efficiency with diverse local content rules can increase operational challenges and costs.

Governments globally are implementing stringent environmental regulations, such as the European Union's CO2 emission standards, pushing companies like Dana to invest heavily in electric and hybrid powertrain technologies. These mandates, like California's proposed 2035 phase-out of new internal combustion engine vehicles, directly shape Dana's product development and necessitate adaptation across all its business sectors.

Trade policies, including tariffs and trade agreements, significantly impact Dana's international supply chains and production costs. For example, tariffs on critical components can increase manufacturing expenses, requiring strategic adjustments to global operations to maintain cost-effectiveness and market access.

Governments are actively promoting EV adoption through financial incentives, such as the US Inflation Reduction Act offering tax credits for EV purchases and clean energy manufacturing. These initiatives, coupled with programs like the EU's Green Deal, accelerate market penetration for electrification solutions, boosting demand for Dana's products.

Geopolitical instability creates supply chain vulnerabilities and price volatility for essential automotive manufacturing commodities. Ongoing conflicts can disrupt logistics, increase lead times, and impact raw material costs, directly affecting Dana's operational efficiency and market demand.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Dana, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Dana's PESTLE analysis provides a clear, actionable framework, alleviating the pain of navigating complex external factors by simplifying them into manageable categories for strategic decision-making.

Economic factors

Global economic growth, a key indicator of overall economic health, significantly impacts demand for Dana's products. The International Monetary Fund (IMF) projected global GDP growth to be 3.2% in 2024, a slight slowdown from 3.4% in 2023, but expected to rebound to 3.5% in 2025. This growth rate directly correlates with the production and sales of light vehicles, commercial vehicles, and off-highway equipment, which are Dana's core markets.

Periods of robust economic expansion typically translate into higher consumer and business spending, driving up demand for new vehicles and machinery. For Dana, this means increased orders for their driveline, sealing, and thermal-management technologies. For instance, a 1% increase in global GDP growth can often correlate with a similar or even higher percentage increase in vehicle production volumes, directly benefiting Dana's revenue streams.

Conversely, economic contractions or recessions present significant headwinds. During downturns, reduced consumer confidence and business investment lead to decreased vehicle sales and production. This directly impacts Dana's order books and profitability, as seen in historical periods of global recession where vehicle production plummeted, forcing manufacturers to scale back operations and, consequently, their component orders from suppliers like Dana.

Changes in interest rates directly influence Dana's investment capacity and customer purchasing behavior. For instance, if the Federal Reserve keeps its benchmark interest rate elevated in 2024-2025, borrowing costs for Dana's capital expenditures, like upgrading manufacturing facilities or developing new powertrain technologies, will increase. Similarly, higher rates can make vehicle financing more expensive for consumers, potentially dampening demand for new trucks and other vehicles Dana supplies.

Persistently high inflation, a concern throughout 2023 and projected to remain a factor in 2024-2025, poses a dual threat to Dana. It can diminish consumer discretionary spending, impacting vehicle sales, while simultaneously driving up Dana's input costs for materials such as steel and aluminum, as well as labor expenses. For example, if the Consumer Price Index (CPI) remains above the Federal Reserve's 2% target, Dana will face pressure to pass these increased costs onto its customers or absorb them, impacting profit margins.

Dana's reliance on key commodities like steel and aluminum directly ties its production costs to global market fluctuations. For instance, the average price of hot-rolled coil steel, a crucial component, saw significant volatility in 2024, impacting manufacturers across various sectors. This sensitivity means that even minor price swings in these raw materials can ripple through Dana's operations, affecting everything from manufacturing expenses to the final price of their advanced driveline and e-propulsion systems.

Managing these commodity price risks is paramount for Dana's profitability. As of early 2025, copper prices have shown an upward trend, driven by increased demand from the electronics and renewable energy sectors. Dana's strategy to mitigate such volatility involves robust hedging programs and a proactive approach to diversifying its supplier base, ensuring a more stable and predictable cost structure for its engineered solutions.

Supply Chain Resilience and Logistics Costs

The cost and reliability of global supply chains are paramount economic factors for Dana. Shipping and transportation expenses, along with effective inventory management, directly impact operational efficiency and profitability. For instance, the Drewry World Container Index reported an average cost of $1,780 per 40ft container on major East-West trade routes in early 2024, a figure that can fluctuate significantly due to various economic pressures.

Disruptions, whether from geopolitical tensions or environmental events, can severely inflate logistics costs and cause production delays. This was evident in 2023 when ongoing port congestion and labor issues contributed to higher freight rates for many industries. Dana needs to proactively manage these risks to maintain its competitive edge.

- Supply Chain Costs: Global shipping rates, while down from pandemic peaks, remain a significant operational expense.

- Reliability Concerns: Geopolitical instability and climate-related events continue to pose threats to timely delivery.

- Inventory Management: Efficiently managing inventory levels is crucial to mitigate the impact of potential supply chain disruptions.

- Diversification Strategy: Dana's investment in diversified supply chains is essential for ensuring consistent product availability and controlling operational expenses.

Currency Exchange Rates

Currency exchange rates significantly impact Dana's global financial results. For example, a stronger U.S. dollar in 2024 could make Dana's exports pricier for international buyers, potentially dampening sales volume. Conversely, when Dana repatriates profits earned in foreign currencies, a stronger dollar reduces the U.S. dollar value of those earnings.

Dana actively manages these currency fluctuations. By employing hedging strategies, such as forward contracts, the company aims to lock in exchange rates for future transactions. This proactive approach helps to stabilize profitability and ensures Dana can maintain competitive pricing across its diverse international markets, even amidst volatile currency movements.

- Impact of USD Strength: In early 2024, the U.S. dollar experienced a notable strengthening against several major currencies, which could increase the cost of Dana's products in those regions.

- Repatriation Value: The value of foreign earnings brought back to the U.S. is directly affected by the exchange rate at the time of repatriation; a stronger dollar means fewer dollars received for the same amount of foreign currency.

- Hedging Importance: Dana's use of financial instruments to hedge currency risk is crucial for mitigating unexpected losses and maintaining predictable financial performance in its international operations.

- Competitive Pricing: Effective currency management allows Dana to offer consistent and competitive pricing globally, preventing sharp price increases that could alienate customers in markets with weakening local currencies.

Global economic growth is a primary driver for Dana, influencing demand across its key markets like light vehicles and commercial vehicles. The IMF projected global GDP growth at 3.2% for 2024, expected to rise to 3.5% in 2025, indicating a generally positive, albeit moderate, environment for vehicle production and sales.

Interest rates directly impact Dana's operational costs and customer affordability. For instance, sustained higher interest rates in 2024-2025 increase borrowing costs for Dana's capital investments and can make vehicle financing more expensive for consumers, potentially slowing sales.

Inflationary pressures, a persistent concern through 2023 and into 2024-2025, can erode consumer spending power and simultaneously increase Dana's raw material and labor costs, squeezing profit margins if these costs cannot be passed on.

Commodity prices, particularly for steel and aluminum, significantly affect Dana's production expenses. Copper prices, for example, trended upward in early 2025 due to demand from electronics and renewables, highlighting the need for Dana's hedging and supply chain diversification strategies.

Supply chain costs and reliability remain critical. While global shipping rates have eased from pandemic highs, they still represent a substantial operational expense, and geopolitical or climate events can reintroduce significant disruptions and cost increases, as seen with port congestion in prior years.

Currency exchange rates impact Dana's international revenue and profitability. A strengthening U.S. dollar in 2024, for example, could make Dana's exports more expensive abroad and reduce the dollar value of repatriated foreign earnings, underscoring the importance of Dana's currency hedging strategies.

| Economic Factor | 2024 Projection/Trend | 2025 Projection/Trend | Impact on Dana | Key Data Point |

|---|---|---|---|---|

| Global GDP Growth | 3.2% | 3.5% | Drives demand for vehicles and equipment. | IMF projection |

| Interest Rates | Elevated/Stable | Potentially stable or gradually decreasing | Affects capital expenditure costs and vehicle financing. | Federal Reserve policy |

| Inflation (CPI) | Above 2% target | Moderating but potentially still elevated | Increases input costs and impacts consumer spending. | Bureau of Labor Statistics |

| Commodity Prices (Steel, Copper) | Volatile, upward trend for copper | Continued volatility expected | Directly impacts manufacturing costs. | Market price indices |

| Global Shipping Costs | $1,780/40ft container (early 2024) | Fluctuating based on demand and capacity | Affects logistics expenses and supply chain efficiency. | Drewry World Container Index |

| USD Exchange Rate | Strengthening trend | Subject to global economic shifts | Impacts export competitiveness and repatriated earnings. | Major currency pairs |

Preview Before You Purchase

Dana PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Dana PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this detailed PESTLE analysis for Dana, providing actionable insights for strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. Equip yourself with this thorough PESTLE analysis to understand the external forces shaping Dana's business environment.

Sociological factors

Societal trends show a clear and increasing preference for sustainable transportation. Consumers and businesses alike are actively seeking out electric and hybrid vehicles, driven by environmental consciousness and a desire for reduced operating costs. This growing demand directly impacts automotive manufacturers like Dana, necessitating a strategic pivot towards advanced electrification technologies.

By 2024, the global electric vehicle market was projected to reach over $800 billion, with significant growth anticipated through 2025. Dana's investments in electrification, including its e-propulsion systems and thermal management solutions, are directly aligned with this powerful market shift. Meeting this evolving consumer demand is not just about compliance; it's crucial for Dana's future market share and relevance in the automotive industry.

The automotive and manufacturing sectors are grappling with attracting and keeping skilled workers, particularly in areas like electrification and advanced manufacturing. Dana must anticipate potential shortages of engineers, technicians, and tradespeople needed for developing, building, and maintaining its cutting-edge products.

In 2024, the U.S. manufacturing sector alone faced an estimated 2.1 million unfilled jobs, highlighting a significant skills gap. Dana's strategy must include robust investments in training and talent development to cultivate the necessary expertise for future growth.

Societal shifts are profoundly reshaping how people move. Ride-sharing services like Uber and Lyft saw significant growth, with Uber reporting over 1.8 billion rides globally in Q1 2024. This trend, alongside the emergence of vehicle subscription models, challenges the traditional idea of individual car ownership.

The increasing adoption of these new mobility solutions could decrease demand for new personal vehicles. However, this evolution also presents a distinct opportunity for Dana. As shared and potentially autonomous vehicle fleets expand, there will be a growing need for specialized components to support these commercial platforms.

Dana needs to proactively adjust its strategies to capitalize on these evolving mobility patterns. By focusing on supplying parts for shared autonomous fleets, Dana can tap into a burgeoning market segment, mitigating potential declines in traditional vehicle sales. For example, the global autonomous vehicle market is projected to reach over $2 trillion by 2030, indicating substantial future component demand.

Public Perception of Environmental Responsibility

Public and investor scrutiny of corporate environmental responsibility is on the rise, significantly impacting brand image and consumer purchasing decisions. Dana's dedication to sustainability, encompassing its carbon footprint reduction initiatives, ethical sourcing practices, and the creation of environmentally friendly products, is crucial for cultivating a favorable public perception and drawing in eco-conscious consumers and employees.

Transparency in these sustainability efforts is becoming a key differentiator. For instance, in 2024, a significant majority of consumers globally indicated they would pay more for products from sustainable brands, with reports suggesting this figure could reach over 70% by 2025. Dana's proactive communication about its progress in areas like waste reduction and renewable energy adoption directly addresses this growing demand for accountability.

- Increasing Consumer Demand: Surveys in early 2025 show that over 65% of consumers actively seek out brands with strong environmental commitments.

- Investor Scrutiny: Environmental, Social, and Governance (ESG) investment funds saw substantial inflows in 2024, with many focusing on companies demonstrating tangible sustainability progress.

- Talent Attraction: A 2025 study revealed that over 50% of job seekers consider a company's environmental stance a critical factor in their employment decisions.

- Brand Reputation: Companies with perceived strong environmental practices often report higher customer loyalty and a more resilient brand image, even during economic downturns.

Aging Population and Demographic Shifts

Demographic shifts, particularly the aging global population, are significantly reshaping vehicle design and consumer preferences across both light and commercial sectors. As of 2024, many developed nations are experiencing a higher proportion of older adults, leading to increased demand for vehicles with enhanced accessibility features, such as lower floor heights and wider door openings. Dana must proactively integrate these evolving needs into its product development pipeline to cater to this growing market segment.

The purchasing habits of an aging demographic are also changing, with a greater emphasis on advanced safety technologies like automatic emergency braking and blind-spot monitoring. Furthermore, usage patterns may shift towards less demanding driving conditions, influencing the types of powertrain and suspension systems that are most desirable. Dana's long-term product innovation and market strategies need to reflect these evolving consumer priorities, ensuring relevance and competitiveness.

- Aging Population Impact: By 2050, the number of people aged 65 and over is projected to reach 1.6 billion globally, a substantial increase from approximately 761 million in 2021.

- Vehicle Accessibility Demand: Features like step-in height, seat adjustability, and ease of entry/exit are becoming critical purchasing factors for older drivers.

- Safety Feature Prioritization: Advanced driver-assistance systems (ADAS) are increasingly sought after by all age groups, but particularly by older drivers concerned with maintaining independence and safety.

- Market Strategy Adaptation: Dana's strategic planning must account for this demographic trend to ensure future product offerings align with market demand and evolving mobility needs.

Societal values are increasingly prioritizing sustainability and ethical business practices. This trend means consumers and investors alike are scrutinizing companies like Dana's environmental footprint and social responsibility initiatives. Dana's commitment to reducing emissions and ensuring ethical supply chains directly addresses these evolving societal expectations, bolstering its brand reputation and market appeal.

The shift towards electric and autonomous vehicles is not just a technological change; it's a societal one, impacting how people view transportation and ownership. As ride-sharing and subscription models gain traction, demand for traditional personal vehicle components might shift. Dana's strategic focus on supplying components for commercial and shared mobility platforms, including autonomous fleets, positions it to capitalize on these evolving consumer behaviors.

The global automotive market is undergoing a significant transformation, with electrification at its forefront. By 2024, the electric vehicle market was valued at over $800 billion, with projections indicating continued strong growth through 2025. Dana's investments in e-propulsion and thermal management solutions align directly with this societal and market demand, ensuring its relevance in the future automotive landscape.

Technological factors

Rapid advancements in battery technology, electric motors, and charging infrastructure are fundamentally reshaping the automotive and off-highway sectors. For Dana, a key player in electrification solutions, this necessitates ongoing innovation and significant R&D investment. Dana's focus on cutting-edge e-drive systems and thermal management solutions is crucial for meeting the escalating performance and efficiency demands of these evolving markets, positioning it for future growth.

The evolution of autonomous driving systems is fundamentally reshaping vehicle design, requiring new approaches to driveline integration and component functionality. As vehicles gain more self-driving capabilities, there's a growing demand for enhanced precision in control, built-in redundancy for safety, and optimized efficiency in how power is delivered.

Dana must proactively ensure its product portfolio aligns with and actively supports the performance demands of these sophisticated autonomous platforms. For instance, the increasing reliance on sensor fusion and advanced algorithms in Level 4 and Level 5 autonomy necessitates driveline components that can precisely interpret and react to complex environmental data, a trend expected to accelerate through 2025.

The manufacturing sector is rapidly embracing Industry 4.0, integrating smart factories, AI, IoT, and advanced robotics to transform production. This digital shift allows for enhanced operational efficiency, cost reduction, and superior product quality, directly impacting competitiveness.

Dana can capitalize on these advancements to streamline its manufacturing processes. For instance, the global market for industrial IoT is projected to reach $110.5 billion by 2028, indicating significant opportunities for efficiency gains through connected systems.

By adopting digitalization, Dana can achieve faster time-to-market for its products. Companies that have implemented Industry 4.0 solutions have reported up to a 20% increase in productivity and a 15% reduction in operational costs, demonstrating the tangible benefits of this technological evolution.

New Materials Science for Lightweighting and Durability

Innovations in materials science are revolutionizing vehicle component design. Advanced high-strength steels, sophisticated aluminum alloys, and cutting-edge composites are making vehicles lighter and significantly more durable. For instance, the automotive industry's adoption of aluminum alloys in body-in-white construction saw a notable increase, with some manufacturers reporting up to a 30% weight reduction in certain chassis components by early 2024 compared to traditional steel structures.

Dana can leverage these material advancements to enhance its driveline and thermal management systems. By incorporating lighter, stronger materials, Dana can improve vehicle fuel efficiency and extend the lifespan of its products. This strategic adoption directly addresses the automotive sector's increasing demand for lighter, more robust, and performance-oriented designs, a trend that accelerated through 2024 and is projected to continue into 2025.

- Lightweighting Benefits: Reduced vehicle weight leads to improved fuel economy, with a 10% weight reduction potentially improving fuel efficiency by 5-7%.

- Durability Enhancements: Advanced materials offer superior resistance to wear and corrosion, extending component service life.

- Performance Gains: Lighter and stronger components contribute to better vehicle handling and overall performance.

- Market Demand Alignment: Meeting industry requirements for sustainable and high-performing automotive solutions.

Data Analytics and Connectivity

The increasing connectivity of vehicles is a significant technological driver for Dana. This connectivity generates massive amounts of data, which is crucial for predictive maintenance, optimizing vehicle performance, and creating innovative service models. For instance, by 2024, the automotive industry is expected to generate over 100 zettabytes of data annually, a figure that will continue to grow exponentially.

Dana can harness this data from its products operating in the field. Analyzing this information allows for continuous improvement in product design and reliability. Furthermore, it opens doors to developing new value-added services for customers, potentially creating new revenue streams and fostering stronger, more enduring customer relationships. Companies like Dana are exploring how telematics data can inform everything from warranty claims to proactive service scheduling.

- Data Generation: Connected vehicles are producing unprecedented volumes of data, with projections indicating a significant increase in data generated per vehicle year-over-year.

- Predictive Maintenance: Real-time data allows for early detection of potential component failures, reducing downtime and maintenance costs for fleet operators.

- Service Innovation: Insights from field data can lead to the development of new digital services, such as performance monitoring and optimization tools for commercial vehicle fleets.

- Customer Relationships: Leveraging data analytics strengthens customer engagement by offering tailored solutions and improving product support.

The automotive industry's rapid embrace of electrification and autonomous driving systems presents significant technological challenges and opportunities for Dana. Innovations in battery technology, e-drive systems, and thermal management are critical for Dana to maintain its competitive edge. The increasing sophistication of autonomous vehicle platforms also demands highly precise and reliable driveline components, a trend that is accelerating through 2025.

Legal factors

Global vehicle safety standards, such as those set by the National Highway Traffic Safety Administration (NHTSA) in the US and the UNECE in Europe, dictate rigorous requirements for crashworthiness, braking, and component durability. Dana's product development must align with these evolving legal frameworks, impacting everything from axle strength to the reliability of its sealing technologies. For instance, the increasing stringency of frontal and side-impact crash tests necessitates advanced materials and design considerations for Dana's driveline components.

Compliance isn't just a hurdle; it's a prerequisite for market access. Failure to meet these safety mandates, like those concerning electronic stability control (ESC) system integration or advanced driver-assistance systems (ADAS) sensor compatibility, can lead to significant fines and prevent Dana from selling its products in key markets. The automotive industry's commitment to reducing road fatalities, aiming for zero-emission and safer vehicles by 2030 and beyond, means these regulations will only become more demanding.

Dana's ongoing investment in research and development to meet these safety regulations is crucial for maintaining its market position and brand trust. Adherence to standards like Euro NCAP's five-star safety ratings, which increasingly incorporate active safety features, directly influences the engineering of Dana's powertrain and chassis solutions. This continuous adaptation ensures Dana's products contribute to overall vehicle safety, mitigating product liability and supporting long-term business sustainability.

Dana's competitive edge hinges on its advanced, proprietary technologies in driveline, electrification, and thermal management. These innovations are the bedrock of its market position.

Strong intellectual property laws and diligent patent protection are vital. They safeguard Dana's significant investments in research and development, preventing rivals from exploiting its patented innovations without permission.

In 2024, Dana continued to actively manage its patent portfolio, a key component of its strategy to maintain technological leadership. The company's commitment to innovation is reflected in its ongoing patent filings, ensuring its technological advancements remain protected in a competitive landscape.

Dana's global footprint necessitates navigating a complex web of labor laws, from minimum wage requirements and working hour limits to workplace safety standards and collective bargaining rights in each operating region. For instance, in 2024, countries like Germany continued to enforce stringent worker protections, impacting hiring flexibility and labor costs. Conversely, some emerging markets might offer more relaxed regulations, presenting different operational considerations.

Failure to comply with these diverse legal frameworks can lead to significant financial penalties, reputational damage, and operational disruptions. In 2025, we anticipate increased scrutiny on supply chain labor practices globally, potentially impacting companies like Dana with extensive international manufacturing. Adherence to regulations such as the EU's General Data Protection Regulation (GDPR) also extends to employee data management, adding another layer of legal complexity.

Evolving labor legislation, such as potential increases in minimum wages or new mandates for employee benefits, can directly influence Dana's operational expenditures and strategic planning. For example, a proposed increase in the national living wage in the UK for 2025 could add millions to Dana's payroll costs in that region, requiring careful financial forecasting and potential adjustments to business models.

Anti-trust and Competition Laws

Dana, as a major force in the automotive and off-highway component sectors, must rigorously adhere to anti-trust and competition legislation across all its operational territories. These regulations are designed to curb monopolistic behaviors, price manipulation, and other practices that stifle fair market competition. For instance, the European Union's robust competition framework, enforced by the European Commission, actively scrutinizes mergers and acquisitions to prevent undue market concentration. In 2023, the EU imposed significant fines on companies for anti-competitive practices, underscoring the financial risks of non-compliance.

Failure to comply can result in severe penalties, including substantial financial penalties, damage to Dana's brand image, and limitations on strategic business moves such as mergers, acquisitions, and market expansion plans. The U.S. Department of Justice and the Federal Trade Commission, for example, maintain strict oversight on market competition, with significant fines levied for violations. Dana's commitment to ethical business practices and thorough legal counsel is paramount to navigating these complex regulatory landscapes and safeguarding its market position.

- Regulatory Scrutiny: Dana operates under stringent anti-trust laws in key markets like the United States and the European Union, which monitor market share and potential monopolistic practices.

- Financial Penalties: Non-compliance can lead to fines that can amount to billions of dollars, as seen in various high-profile cases impacting the automotive supply chain in recent years.

- Strategic Limitations: Violations can restrict Dana's ability to pursue mergers, acquisitions, or partnerships that could otherwise enhance its competitive edge.

- Reputational Impact: Allegations or findings of anti-competitive behavior can severely damage Dana's reputation with customers, suppliers, and investors.

Product Liability Laws and Recalls

Dana faces significant product liability risks. If its automotive and industrial components are found to be defective and cause harm or damage, the company can be held responsible. This exposure is amplified by strict product liability laws prevalent in key markets, demanding robust quality control and thorough testing throughout Dana's extensive manufacturing operations.

The specter of product recalls looms large, a direct consequence of potential safety or performance failures. Such recalls carry substantial financial burdens, including repair or replacement costs, and can severely damage Dana's hard-earned reputation. For instance, in 2024, the automotive industry saw numerous recalls impacting various component suppliers, with some facing multi-million dollar liabilities and significant operational disruptions.

- Product Liability Exposure: Dana's reliance on complex manufacturing processes exposes it to potential defects in its components, leading to liability claims.

- Regulatory Compliance: Stringent product liability laws necessitate continuous investment in quality assurance, testing protocols, and supply chain traceability to mitigate risks.

- Recall Impact: Product recalls, driven by safety or performance concerns, can result in substantial financial penalties and long-term reputational damage for Dana.

- Industry Precedent: The automotive sector experienced an estimated 30-40 million vehicles recalled in North America during 2024, highlighting the pervasive nature of these risks for component manufacturers.

Dana's legal landscape is heavily shaped by intellectual property rights, particularly patents protecting its innovative driveline, electrification, and thermal management technologies. The company actively manages its patent portfolio, as evidenced by its continued patent filings throughout 2024, to safeguard its competitive edge and prevent unauthorized use of its advancements. This diligent protection is crucial for maintaining its market leadership and recouping its substantial R&D investments.

Environmental factors

Global initiatives like the Paris Agreement, aiming to limit warming to 1.5°C, directly impact Dana by pushing for cleaner automotive and industrial technologies. Many nations, including the United States and members of the European Union, have set ambitious targets for vehicle emissions reductions and are phasing out internal combustion engines, with some aiming for 100% zero-emission vehicle sales by 2035. This necessitates Dana's accelerated development of electric and hybrid powertrain components.

Dana must align its product roadmap with these evolving environmental regulations and market demands. For instance, the company's investment in electrified solutions, such as e-axles and thermal management systems, directly addresses the need for reduced vehicle emissions. Furthermore, Dana's commitment to reducing its own operational footprint, aiming for a 25% reduction in Scope 1 and 2 greenhouse gas emissions by 2030 compared to a 2020 baseline, is critical for maintaining regulatory compliance and corporate reputation.

Dana's operations are significantly shaped by evolving waste management and recycling regulations. For instance, the European Union's End-of-Life Vehicles (ELV) Directive, which mandates higher recycling rates and limits hazardous substances, directly influences how Dana designs and sources materials for its automotive components. In 2023, the EU reported that approximately 95% of vehicle weight was recovered or reused, with recycling rates often exceeding 85%, a benchmark Dana must consider.

Compliance with these environmental laws fosters resource efficiency, which can translate into cost savings for Dana. By implementing robust recycling programs for manufacturing waste and end-of-life vehicle parts, the company can recover valuable materials, reducing the need for virgin resources. This aligns with circular economy principles, aiming to keep materials in use for as long as possible.

The increasing scarcity of critical resources, like rare earth minerals vital for electrification, presents significant supply chain risks. For instance, global demand for lithium, a key component in EV batteries, is projected to grow by over 40% annually through 2030, intensifying competition and price volatility.

Water scarcity is another pressing issue, particularly impacting manufacturing sectors. By 2030, it's estimated that 40% of the world's population will face water stress, directly affecting industries reliant on water for production, potentially increasing operational costs for companies like Dana.

Dana must prioritize sustainable sourcing and explore alternative materials to mitigate these risks. Investing in circular economy models and optimizing water usage in its 2024 operations, for example, can reduce environmental impact and build resilience against resource price shocks.

Climate Change Impacts on Operations

Climate change presents significant physical risks to Dana's operations. Increased frequency and intensity of extreme weather events, like hurricanes and floods, can directly impact manufacturing plants and logistics, leading to costly downtime. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, a record-breaking year, underscoring the growing threat.

To counter these disruptions, Dana must prioritize climate resilience. This involves conducting thorough risk assessments for all facilities, particularly those located in coastal or flood-prone regions. Diversifying supply chains is also crucial; relying on single-source suppliers in vulnerable areas increases operational fragility. By 2025, many companies are expected to have integrated climate risk into their enterprise-wide risk management frameworks, with a focus on building more robust and adaptable operational infrastructures.

- Physical Risks: Increased extreme weather events can halt production and disrupt supply chains.

- Resilience Strategies: Implementing risk assessments for vulnerable facilities is key.

- Supply Chain Diversification: Reducing reliance on single-source suppliers mitigates disruption.

- Operational Continuity: Proactive measures ensure business operations can continue despite climate impacts.

Circular Economy Principles

The global push towards a circular economy significantly impacts manufacturing, urging companies like Dana to prioritize product longevity, repair, reuse, and recycling. This means designing components for easier disassembly and material recovery, a key challenge in minimizing waste and maximizing resource efficiency.

Dana's commitment to circularity is reflected in its sustainability goals. For instance, by 2025, the company aims to reduce manufacturing waste by 15% compared to 2023 levels, with a specific focus on increasing the recyclability of end-of-life components. This strategic shift not only addresses environmental concerns but also opens avenues for innovative business models and strengthens Dana's sustainability profile.

- Product Design: Focus on modularity and ease of repair to extend product lifecycles.

- Material Sourcing: Increased use of recycled and sustainably sourced materials in component manufacturing.

- End-of-Life Management: Developing robust systems for component collection, refurbishment, and recycling.

- New Business Models: Exploring service-based offerings like remanufacturing and product-as-a-service.

Dana's environmental strategy must address the increasing global pressure for sustainability and resource efficiency. Regulations pushing for reduced emissions, like the EU's 2035 target for zero-emission vehicle sales, directly influence Dana's product development towards electrified components. Furthermore, the company's commitment to reducing its own greenhouse gas emissions, targeting a 25% decrease by 2030 from a 2020 baseline, demonstrates proactive compliance and a focus on operational sustainability.

The company faces challenges related to resource scarcity, particularly for materials like lithium essential for EV batteries, with demand projected to grow over 40% annually through 2030. Water scarcity also poses a risk, as an estimated 40% of the global population may face water stress by 2030, potentially increasing operational costs for Dana.

Dana is also impacted by climate change through physical risks like extreme weather events. The record 28 billion-dollar weather and climate disasters in the U.S. in 2023 highlight the growing threat to manufacturing and supply chains, necessitating robust resilience strategies and supply chain diversification by 2025.

The shift towards a circular economy requires Dana to design products for longevity, repair, and recycling, aiming to reduce manufacturing waste by 15% by 2025. This involves embracing innovative business models and increasing the use of recycled materials, aligning with sustainability goals and enhancing resource efficiency.

| Environmental Factor | Impact on Dana | Key Data/Target |

|---|---|---|

| Emissions Regulations | Demand for electrified powertrain components | EU: 100% zero-emission vehicle sales by 2035 |

| Greenhouse Gas Reduction | Need for operational efficiency | Dana target: 25% reduction by 2030 (vs. 2020) |

| Resource Scarcity | Supply chain risk for critical minerals | Lithium demand: >40% annual growth through 2030 |

| Water Stress | Potential increase in operational costs | Global: 40% population facing water stress by 2030 |

| Extreme Weather Events | Disruption to production and logistics | US: 28 billion-dollar disasters in 2023 |

| Circular Economy | Focus on product lifecycle and waste reduction | Dana target: 15% manufacturing waste reduction by 2025 |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using a blend of official government publications, reputable financial news outlets, and leading market research firms. This ensures that every aspect, from political stability to technological advancements, is grounded in verifiable and current information.