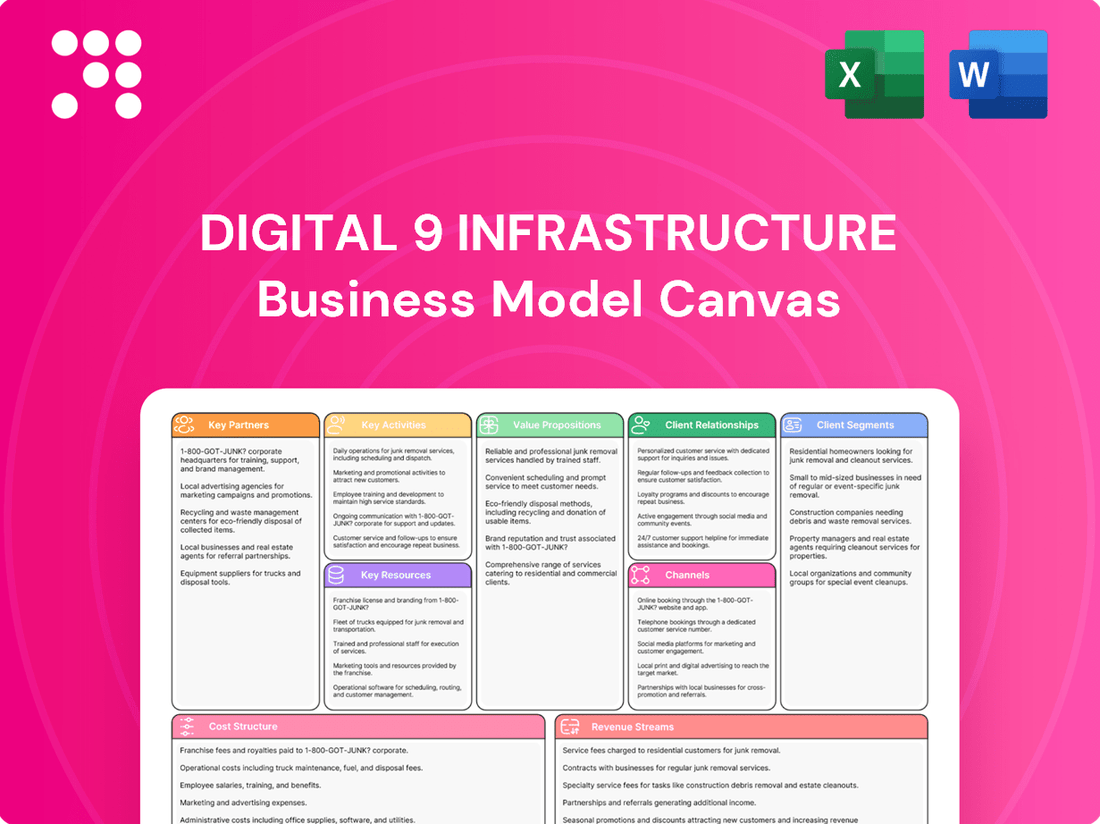

Digital 9 Infrastructure Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital 9 Infrastructure Bundle

Unlock the core strategies of Digital 9 Infrastructure's success with our comprehensive Business Model Canvas. Discover how they leverage key resources and partnerships to deliver unique value propositions. This detailed breakdown is your key to understanding their operational excellence and market positioning.

Partnerships

Digital 9 Infrastructure relies heavily on financial and legal advisors to manage its wind-down. These experts are vital for navigating complex asset disposals and debt restructuring, ensuring compliance with regulations. For instance, in 2024, the company continued its strategic review, which would necessitate significant advisory input to maximize returns from its infrastructure assets.

Engaging specialized financial advisors helps secure the best possible sale prices for infrastructure assets, a critical factor during a liquidation phase. Simultaneously, legal counsel is indispensable for managing contractual obligations and meeting shareholder requirements. This dual expertise minimizes risks and streamlines the entire liquidation process, aiming for an efficient and favorable outcome for all stakeholders.

Digital 9 Infrastructure actively cultivates relationships with a broad spectrum of asset buyers, a crucial partnership for its managed wind-down strategy. This involves identifying and engaging with potential purchasers for its digital infrastructure portfolio, which includes subsea cables and data centers.

Successful divestment hinges on fostering strong connections with a diverse pool of both strategic and financial bidders. For instance, in 2024, the company continued its focus on optimizing its asset base, with a key objective being the efficient sale of non-core or underperforming assets to maximize shareholder value.

InfraRed Capital Partners' appointment in October 2024 as the manager for Digital 9 Infrastructure's wind-down is a pivotal development. By December 2024, they officially became the Alternative Investment Fund Manager (AIFM), signaling a crucial step in the company's strategic shift.

This partnership is the bedrock of the divestment strategy, encompassing the critical tasks of asset valuation, targeted marketing, and meticulous transaction management. InfraRed's extensive global network and deep expertise within the infrastructure sector are instrumental in navigating these complex processes and maximizing value for stakeholders.

Existing Asset Operators/Management Teams

Digital 9 Infrastructure actively maintains strong collaborations with the existing management and operational teams of its portfolio companies, such as Arqiva and Elio Networks. This ongoing partnership is crucial for ensuring the continued smooth operation and value enhancement of these assets. These on-the-ground teams are instrumental in providing the detailed operational and financial data necessary for accurate valuations and the eventual successful disposal of these infrastructure assets.

The expertise of these existing operators is indispensable for Digital 9 Infrastructure's strategy. For instance, in 2023, Arqiva reported significant progress in its fiber network expansion, a key metric that relies on the operational management team’s efficiency. This close working relationship allows for the seamless flow of information, supporting the company’s investment thesis and exit planning.

- Operational Continuity: Ensures day-to-day business functions remain uninterrupted.

- Data Provision: Supplies essential performance metrics for valuation and due diligence.

- Value Preservation: Safeguards and enhances asset value through expert management.

- Strategic Alignment: Facilitates coordinated efforts towards successful divestment.

Lenders and Creditors

Digital 9 Infrastructure actively manages its relationships with lenders and creditors to ensure the smooth operation of its Revolving Credit Facility (RCF) and other financial commitments. These ongoing discussions are vital for aligning debt repayment strategies with anticipated asset sale proceeds, thereby enabling a structured financial wind-down. For instance, as of the first half of 2024, the company was focused on optimizing its debt profile, with specific attention paid to covenants and repayment schedules tied to its RCF.

Key aspects of these partnerships include:

- RCF Management: Proactive engagement with banks providing the RCF to ensure compliance with terms and to facilitate any necessary adjustments in light of evolving business conditions.

- Debt Repayment Alignment: Strategic conversations with all creditors to ensure that asset sale timelines and expected proceeds are effectively integrated into debt reduction plans.

- Financial Stability Assurance: Maintaining open communication channels to provide transparency regarding the company's financial health and its strategy for managing liabilities.

- Covenant Compliance: Diligent tracking and reporting on financial covenants to maintain lender confidence and avoid potential breaches.

Digital 9 Infrastructure's key partnerships are essential for its wind-down strategy, particularly with financial and legal advisors who guide asset disposals and debt restructuring. In 2024, the company's continued strategic review underscored the need for expert advisory services to maximize returns from its infrastructure assets.

What is included in the product

A structured framework outlining the core components of a digital infrastructure business, detailing key partners, activities, resources, and customer relationships.

It provides a visual representation of how a digital infrastructure company creates, delivers, and captures value, encompassing cost structure and revenue streams.

The Digital 9 Infrastructure Business Model Canvas acts as a pain point reliever by providing a structured, visual framework to identify and address challenges within digital infrastructure development and operations.

It simplifies complex infrastructure strategies, offering a clear, actionable roadmap to overcome common roadblocks and optimize resource allocation.

Activities

Asset divestment and sales management are critical for Digital 9 Infrastructure. This involves actively marketing and selling digital infrastructure assets like Aqua Comms, EMIC-1, SeaEdge UK1, and potentially Arqiva and Elio Networks.

The process includes rigorous due diligence, skillful negotiation of sale agreements, and ensuring the swift and successful completion of these transactions. For instance, in 2023, Digital 9 Infrastructure completed the sale of its stake in Arqiva for £200 million, demonstrating its capability in managing such strategic exits.

A critical activity for Digital 9 Infrastructure is the systematic repayment of its Revolving Credit Facility (RCF) and other outstanding debts. This is primarily funded by the proceeds generated from asset sales, ensuring liabilities are managed efficiently.

In 2024, Digital 9 Infrastructure continued its strategy of deleveraging. For instance, the company completed the sale of its stake in the Aqua Comms business, generating significant proceeds that were earmarked for debt reduction, thereby strengthening its balance sheet and supporting capital return initiatives.

Digital 9 Infrastructure prioritizes clear and consistent communication with its shareholders, especially during its ongoing wind-down. This involves regular updates on asset divestitures, financial results, and changes in Net Asset Value (NAV). For instance, in their 2023 annual report, they detailed progress on asset sales and outlined expectations for capital returns to investors.

The company utilizes various channels for these updates, including investor presentations, press releases, and regulatory filings, ensuring shareholders are well-informed about the strategic direction and financial performance. These communications are crucial for maintaining investor confidence and managing expectations throughout the wind-down phase.

Portfolio Valuation and Due Diligence

Digital 9 Infrastructure's key activities include the ongoing, rigorous valuation of its portfolio assets. This is crucial for accurately reflecting their current worth and informing strategic decisions, particularly regarding potential sales. For instance, as of early 2024, the company continued to focus on optimizing its portfolio, with valuations playing a central role in these efforts.

The valuation process is detailed and often involves a bottom-up approach, conducted by both the investment manager and independent valuers. This meticulous methodology is especially important for complex assets, such as those within the Arqiva segment, to ensure maximum shareholder value is realized during any disposal processes.

Key aspects of portfolio valuation and due diligence for Digital 9 Infrastructure include:

- Asset Valuation: Continuous assessment of the market value of all infrastructure assets.

- Due Diligence: Thorough examination of asset performance, financial health, and operational efficiency.

- Disposal Strategy: Utilizing valuations to inform and execute profitable divestitures.

- Independent Verification: Engaging third-party experts to validate asset valuations, particularly for large or intricate holdings.

Regulatory and Compliance Management

Digital 9 Infrastructure's key activities include rigorous regulatory and compliance management, particularly crucial during its wind-down phase. This involves ensuring strict adherence to all legal frameworks governing asset sales and public company obligations. For instance, in 2024, companies undergoing liquidation often face increased scrutiny from regulatory bodies like the SEC or equivalent international authorities, requiring meticulous record-keeping and timely filings.

Maintaining proper governance throughout the liquidation period is paramount. This means obtaining all necessary approvals for transactions and ensuring that board and shareholder decisions align with regulatory requirements. The company must navigate complex reporting standards, which can be particularly challenging when divesting diverse infrastructure assets across different jurisdictions.

- Adherence to Legal Frameworks: Ensuring compliance with all laws and regulations relevant to asset disposal and public company wind-down.

- Obtaining Approvals: Securing necessary consents and authorizations from regulatory bodies and stakeholders for all liquidation activities.

- Governance Maintenance: Upholding corporate governance standards throughout the dissolution process to ensure transparency and accountability.

- Reporting Obligations: Fulfilling all financial and operational reporting requirements as a public entity until full dissolution.

Digital 9 Infrastructure's core activities revolve around the strategic divestment of its digital infrastructure portfolio. This includes actively managing the sale of assets such as data centers and fiber networks, aiming to maximize shareholder value. The company's 2024 strategy continued to emphasize deleveraging, with proceeds from asset sales, like the Aqua Comms stake, being directed towards debt reduction.

The ongoing valuation of these assets is a crucial activity, ensuring accurate Net Asset Value (NAV) reporting and informing disposal strategies. This process is detailed, often involving independent verification to confirm market worth, particularly for complex holdings like those within the Arqiva segment.

Furthermore, stringent regulatory compliance and robust governance are paramount, especially during the company's wind-down phase. This ensures all asset disposals and public company obligations are met legally and transparently, maintaining investor confidence.

| Key Activity | Description | 2024 Focus/Example |

|---|---|---|

| Asset Divestment | Marketing and selling digital infrastructure assets. | Sale of Aqua Comms stake to reduce debt. |

| Debt Repayment | Using proceeds from asset sales to pay down liabilities. | Strengthening balance sheet through deleveraging. |

| Portfolio Valuation | Continuous assessment of asset market value. | Informing disposal strategies and NAV reporting. |

| Regulatory Compliance | Adhering to legal frameworks for asset sales and wind-down. | Ensuring transparency and accountability in transactions. |

Full Document Unlocks After Purchase

Business Model Canvas

The Digital 9 Infrastructure Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you're seeing the complete, ready-to-use canvas, not a sample or mockup. Once your order is processed, you'll gain full access to this exact file, allowing you to immediately begin strategizing and refining your digital infrastructure business.

Resources

Digital 9 Infrastructure's primary resources are its diverse portfolio of digital infrastructure assets. This includes critical subsea fibre optic networks like Aqua Comms and EMIC-1, which are vital for global data transfer.

The company also leverages data centres, such as SeaEdge UK1, providing essential physical locations for digital operations. Furthermore, its wireless network capabilities, exemplified by Arqiva and Elio Networks, are key components of its service offering.

Financial capital derived from asset sales is a cornerstone resource for Digital 9 Infrastructure. These cash proceeds directly support the company's strategic objectives, primarily by facilitating debt repayment and enabling future capital distributions to shareholders.

For instance, in 2023, Digital 9 Infrastructure completed the sale of its entire stake in its Irish data center business for approximately £100 million. This significant influx of capital was instrumental in reducing outstanding debt and strengthening the company's financial position, underscoring the critical role of asset sales in managing its financial resources.

Digital 9 Infrastructure's investment management expertise, primarily through InfraRed Capital Partners, is a cornerstone of its business model. InfraRed's deep experience in digital infrastructure, including navigating complex liquidation processes, provides a significant competitive advantage.

This specialized knowledge allows Digital 9 to effectively manage asset sales and optimize returns for shareholders. For instance, in 2024, InfraRed's strategic approach to portfolio management and asset disposals was crucial in realizing value from its holdings.

Legal and Financial Advisory Networks

Digital 9 Infrastructure relies heavily on its legal and financial advisory networks to navigate the complexities of its managed wind-down strategy. These networks are crucial for executing transactions smoothly and ensuring all regulatory requirements are met. For instance, in 2024, the company continued to leverage these external experts to manage the sale of its portfolio assets, a process that demands specialized legal and financial acumen.

The effectiveness of these networks directly impacts the efficiency and profitability of the wind-down. Brokers assist in finding suitable buyers for assets, while corporate and communication advisors ensure transparent and compliant dealings with all stakeholders. Access to these professionals is not just a convenience; it's a fundamental requirement for achieving the best possible outcomes during this strategic phase.

Key aspects of these networks include:

- Transaction Facilitation: Brokers and corporate advisors streamline the sale of infrastructure assets, identifying buyers and negotiating terms.

- Compliance Assurance: Legal teams ensure all transactions adhere to relevant financial regulations and corporate governance standards.

- Strategic Guidance: Communication advisors manage stakeholder relations, providing clarity and managing expectations throughout the wind-down process.

- Market Access: These networks provide access to a broad range of potential investors and financial institutions, crucial for asset divestment.

Shareholder Base and Communication Infrastructure

Digital 9 Infrastructure's shareholder base is a critical resource, comprising individuals and institutions invested in the company's data center and digital infrastructure assets. Effective communication channels are paramount, especially during the company's wind-down phase, to ensure transparency and manage investor sentiment.

The company leverages its investor relations team, corporate website, and regulatory announcements, such as those on the Regulatory News Service (RNS), to keep shareholders informed. These channels are essential for disseminating updates on asset sales, financial performance, and the overall progress of the wind-down strategy. For instance, as of early 2024, Digital 9 Infrastructure has been actively communicating its strategic review and potential asset disposals to its investors.

- Shareholder Group: Composed of diverse institutional and retail investors with an interest in digital infrastructure assets.

- Communication Channels: Investor relations, corporate website, and RNS announcements are key for information dissemination.

- Strategic Importance: Crucial for managing expectations and providing updates during the company's wind-down process.

- Data Point (Illustrative): In 2023, the company reported a significant portion of its shares held by institutional investors, highlighting the importance of targeted communication.

Digital 9 Infrastructure's key resources extend beyond physical assets to include its financial capital, primarily generated through strategic asset sales. This financial flexibility is crucial for managing its wind-down. For example, the company’s 2023 sale of its Irish data center business for approximately £100 million provided significant capital for debt reduction and shareholder distributions.

Investment management expertise, notably from InfraRed Capital Partners, is another vital resource. This expertise is critical for navigating asset disposals and optimizing shareholder returns, as seen in 2024's strategic portfolio management efforts.

The company also relies on its robust legal, financial advisory, and broker networks. These external relationships are indispensable for executing asset sales smoothly and ensuring regulatory compliance throughout the wind-down process, a strategy actively employed in 2024.

Finally, its shareholder base is a key resource, requiring transparent communication via channels like RNS announcements, especially concerning its ongoing strategic review and asset disposals in early 2024.

Value Propositions

Digital 9 Infrastructure's core value proposition to shareholders is the orderly return of capital. This is achieved through a strategic and systematic disposal of its digital infrastructure assets, aiming to unlock and maximize the value inherent in the portfolio during its wind-down phase.

This approach ensures that shareholders benefit from the realization of asset value in a structured manner. For instance, as of their latest reporting in early 2024, the company has been actively progressing with asset sales, with specific details on realized proceeds being a key indicator of this value return.

Digital 9 Infrastructure is committed to achieving optimal sale prices for its digital infrastructure assets, even as it winds down operations. This strategy prioritizes value maximization over rapid divestment, ensuring each asset is marketed and negotiated strategically.

For instance, in 2024, the company continued its focus on realizing the full potential of its portfolio. While specific disposal figures are subject to market conditions and ongoing negotiations, the underlying principle remains to secure the highest achievable returns for shareholders through careful asset management and targeted sales processes.

Digital 9 Infrastructure's commitment to transparency and consistent communication is a core value proposition, especially during its asset sale and wind-down process. They provide clear, regular updates on asset sale progress, financial performance, and the projected timeline. This openness is crucial for maintaining shareholder confidence throughout the transition.

Reduced Future Exposure to Market Volatility

For investors, the strategic wind-down of certain assets within Digital 9 Infrastructure's portfolio offers a compelling value proposition by significantly reducing future exposure to market volatility. This move provides a clear exit strategy from an investment trust that has grappled with valuation challenges, thereby mitigating ongoing risk for shareholders.

The decision to wind down specific operations allows investors to realize their holdings, effectively liquidating their stake and moving away from assets susceptible to unpredictable market swings. This action directly addresses investor concerns about the trust's past valuation difficulties and the broader market's inherent unpredictability.

- Reduced Risk Exposure: Investors can exit an investment trust that has experienced significant valuation challenges and market volatility.

- Clear Liquidation Path: The wind-down provides a defined process for investors to receive their capital back.

- Mitigation of Future Volatility: By divesting volatile assets, the trust aims to offer a more stable investment profile moving forward.

- Enhanced Investor Confidence: A transparent wind-down strategy can rebuild trust and attract investors seeking stability.

Efficient Debt Management and Financial Stability

Digital 9 Infrastructure's proactive approach to managing its Revolving Credit Facility and other outstanding debts is a cornerstone of its value proposition. By diligently overseeing and repaying these obligations, the company solidifies its financial standing, especially during its liquidation phase. This careful financial stewardship directly translates to reduced risk for shareholders, as it minimizes potential liabilities and ensures a more predictable path for capital distribution.

The efficient management of debt contributes significantly to Digital 9 Infrastructure's overall financial stability. This stability is crucial for navigating the complexities of liquidation, allowing for more orderly asset sales and capital repatriation. For instance, in 2024, the company continued to focus on deleveraging, a strategy that enhances its resilience against market fluctuations and strengthens its ability to meet financial commitments.

- Reduced Financial Risk: Proactive debt repayment mitigates the impact of interest rate changes and ensures that a larger portion of liquidation proceeds can be returned to shareholders.

- Enhanced Shareholder Value: A stable financial position, bolstered by effective debt management, directly supports smoother and potentially higher capital returns to investors.

- Operational Efficiency: Lower debt burdens free up capital that can be reinvested or distributed, contributing to the overall efficiency of the liquidation process.

- Improved Investor Confidence: Demonstrating strong financial discipline in managing debt fosters trust and confidence among investors, particularly during periods of strategic transition.

Digital 9 Infrastructure's value proposition centers on the orderly return of capital through strategic asset disposals. This approach aims to unlock and maximize the value of its digital infrastructure portfolio during its wind-down phase, ensuring shareholders benefit from a structured realization of asset value. As of early 2024, the company has been actively progressing with asset sales, with specific realized proceeds being a key indicator of this value return.

The company prioritizes securing optimal sale prices for its digital infrastructure assets, even as it winds down operations. This strategy focuses on value maximization over rapid divestment, ensuring each asset is marketed and negotiated strategically to secure the highest achievable returns for shareholders.

Digital 9 Infrastructure's commitment to transparency throughout its asset sale and wind-down process is a core value. They provide regular updates on sales progress and financial performance, which is crucial for maintaining shareholder confidence during this transition period.

For investors, the strategic wind-down offers a compelling value by significantly reducing future exposure to market volatility and providing a clear exit strategy. This mitigates ongoing risk for shareholders who have grappled with valuation challenges, allowing them to realize their holdings and move away from unpredictable market swings.

The company's diligent management of its Revolving Credit Facility and other debts solidifies its financial standing during liquidation. This financial stewardship minimizes liabilities and ensures a more predictable path for capital distribution, directly benefiting shareholders by enhancing their potential returns.

| Value Proposition | Description | Key Benefit for Stakeholders |

| Orderly Capital Return | Strategic disposal of digital infrastructure assets during wind-down. | Maximizes shareholder value through structured realization of asset worth. |

| Value Maximization | Focus on achieving optimal sale prices for assets, not rapid divestment. | Ensures shareholders receive the highest possible returns through careful asset management. |

| Reduced Risk Exposure | Divesting volatile assets and providing a clear exit strategy. | Mitigates investor risk associated with market volatility and past valuation challenges. |

| Financial Stability | Proactive management and repayment of debt obligations. | Minimizes liabilities and ensures a more predictable and stable path for capital distribution to shareholders. |

Customer Relationships

Digital 9 Infrastructure manages shareholder relationships through formal channels like announcements, annual reports, and investor presentations. This approach emphasizes transparency regarding the company's wind-down progress and asset disposals, aiming to clearly manage expectations.

In 2024, the company continued its strategic wind-down, with significant progress made in asset disposals. For instance, the sale of its remaining stake in the Aqua Comms business was a key event, providing shareholders with clarity on the realization of assets.

The focus remains on delivering clear, timely information to shareholders, ensuring they are well-informed about the steps being taken to maximize value during the wind-down phase. This communication strategy is vital for maintaining confidence and facilitating a smooth transition.

Digital 9 Infrastructure likely engages directly with its institutional investors through dedicated Q&A sessions and webcasts. This allows for clear communication on critical matters like the ongoing liquidation process and the valuation of its assets, addressing specific concerns head-on.

For instance, during periods of significant portfolio adjustments, such as the planned divestment of certain assets, direct investor outreach becomes paramount. This proactive communication helps manage expectations and maintain confidence among major shareholders, a common practice for infrastructure companies navigating complex asset sales.

Digital 9 Infrastructure's relationships with asset buyers are primarily transactional, emphasizing the negotiation of favorable sale terms and the efficient execution of deals. These interactions are typically orchestrated by the company's investment management team and supported by legal counsel to ensure all aspects of the transaction are meticulously handled.

For instance, in 2024, Digital 9 Infrastructure completed the sale of its stake in the AquaComms subsea fiber optic network, a transaction that involved extensive negotiation to achieve the best possible valuation and terms for its shareholders. Such sales are crucial for realizing the value of its diverse digital infrastructure portfolio.

Ongoing Operational Relationships with Portfolio Companies

Digital 9 Infrastructure actively manages its customer relationships with portfolio companies, even during divestment periods. This ensures the ongoing operational health and value preservation of assets like Arqiva and Elio Networks until their eventual sale.

The company provides crucial oversight and support to the management teams of these remaining portfolio companies. This hands-on approach is vital for maintaining operational continuity and maximizing their attractiveness to potential buyers.

- Continued operational support for Arqiva and Elio Networks.

- Management oversight to ensure functionality and value.

- Facilitating smooth transitions during divestment processes.

Relationship with Regulatory Bodies

Digital 9 Infrastructure maintains formal relationships with regulatory bodies such as the Financial Conduct Authority (FCA) and the Jersey Financial Services Commission. These interactions are crucial for ensuring ongoing compliance with all applicable listing rules and legal requirements during its managed wind-down process.

The company actively engages with these authorities to navigate the complexities of its operational wind-down, ensuring transparency and adherence to regulatory standards. This proactive approach helps to mitigate risks and maintain investor confidence throughout the transition.

- Regulatory Engagement: Formal communication channels are maintained with key financial regulators.

- Compliance Focus: Adherence to listing rules and legal obligations is paramount.

- Managed Wind-down: Regulatory dialogue supports the orderly cessation of operations.

- Transparency: Open communication fosters trust with oversight bodies.

Digital 9 Infrastructure's customer relationships are primarily with its portfolio companies, where it provides management oversight to ensure operational health and asset value preservation during its wind-down. This includes supporting entities like Arqiva and Elio Networks, facilitating their continued functionality and attractiveness to potential buyers. The company's approach prioritizes maintaining these relationships to maximize value realization through strategic divestments.

Channels

The Regulatory News Service (RNS) is a crucial channel for Digital 9 Infrastructure, serving as the official conduit for all material announcements. This includes timely disclosures of financial results, such as the company's reported revenue of £105.3 million for the year ended December 31, 2023, and significant corporate actions like asset sales or board appointments. By utilizing RNS, Digital 9 ensures transparency and compliance, providing investors and the wider market with immediate access to information that could impact share price.

Digital 9 Infrastructure's official website acts as a crucial information portal, offering easy access to vital documents like annual reports and financial statements. This digital presence ensures transparency and provides shareholders with the data they need for informed decision-making.

The investor hub section is particularly important, featuring investor presentations and timely key announcements. For instance, as of their latest filings in 2024, these resources detail the company's performance and strategic direction, making complex financial information digestible for a broad audience.

Financial news outlets and investment platforms are crucial for Digital 9 Infrastructure, serving as primary conduits for reaching investors. Websites like Investing.com and FT.com provide broad market coverage, while specialized platforms such as QuotedData and TipRanks offer in-depth analysis relevant to infrastructure investments.

Stockbrokers like AJ Bell and Hargreaves Lansdown facilitate direct investor access, enabling them to research and trade Digital 9 Infrastructure's shares. In 2024, these platforms continue to be vital for disseminating company announcements, real-time share price data, and expert analyst commentary, directly influencing investor sentiment and trading volumes.

Annual General Meetings (AGMs) and Investor Presentations

Annual General Meetings (AGMs) and investor presentations serve as crucial formal channels for Digital 9 Infrastructure's Board and investment manager to directly engage with shareholders. These forums are essential for presenting financial results, detailing operational progress, and crucially, addressing shareholder queries concerning the ongoing managed wind-down strategy.

These meetings offer a transparent platform for discussing key performance indicators and strategic decisions. For instance, during 2024, the company has been focused on realizing value from its portfolio assets as part of the wind-down. Specific details on asset sales and their impact on shareholder returns are typically a core component of these presentations.

- Shareholder Engagement: Direct communication with the Board and investment manager.

- Performance Updates: Presentation of financial results and operational progress.

- Wind-Down Strategy: Addressing shareholder questions on the managed wind-down.

- Transparency: Providing clarity on asset realization and value creation.

Corporate Brokers and Financial Advisers

Corporate brokers and financial advisors are crucial partners for Digital 9 Infrastructure. They help the company connect with institutional investors, a vital step as Digital 9 navigates its wind-down. These experts also offer invaluable advice on how to best position the business in the market and effectively manage the execution of transactions.

These relationships are particularly important during a strategic shift like a wind-down. For instance, in 2024, the UK infrastructure sector saw significant advisory activity, with deals often requiring specialized brokerage to ensure optimal outcomes for stakeholders. Digital 9 leverages this expertise to maximize value during its asset divestments.

- Market Access: Facilitate access to a broader base of institutional investors, enhancing competitive bidding for assets.

- Valuation Expertise: Provide independent valuations and strategic advice on asset pricing to ensure fair market value.

- Transaction Management: Guide the complex process of asset sales, ensuring compliance and efficient execution.

- Investor Relations: Manage communication with potential buyers and existing shareholders throughout the divestment process.

Digital 9 Infrastructure leverages a multi-channel approach to communicate with its diverse stakeholder base. These channels are critical for disseminating information, fostering engagement, and ensuring transparency, especially during its ongoing managed wind-down. Key channels include formal regulatory announcements, the company's official website, and direct engagement at shareholder meetings.

Customer Segments

Existing institutional shareholders, including large funds and pension schemes, represent a critical customer segment for Digital 9 Infrastructure plc. These investors, who collectively hold a significant portion of the company's equity, are keenly focused on the efficient wind-down of the business to achieve the optimal return of capital. As of the first half of 2024, Digital 9 Infrastructure was actively engaged in realizing assets to satisfy these shareholder interests, with a reported net asset value per share of approximately 96.0 pence at the end of March 2024.

Existing retail shareholders are individual investors who have bought into Digital 9 Infrastructure, often through common brokerage accounts or by holding shares directly. They are keenly interested in understanding the specifics of the company's liquidation, particularly when they can expect to receive their invested capital back.

As of the first quarter of 2024, Digital 9 Infrastructure Plc announced its intention to pursue a solvent liquidation, aiming to return capital to shareholders. The trust's portfolio, which includes digital infrastructure assets, is being managed to facilitate this orderly wind-down.

Prospective buyers of digital infrastructure assets are primarily strategic and financial investors actively seeking to acquire high-value, long-term income-generating assets like subsea fibre networks, data centres, and wireless infrastructure. These entities are crucial for Digital 9 Infrastructure as they represent the market for the company's potential divestments, allowing for capital recycling and portfolio optimization. For instance, in 2023, the global digital infrastructure market saw significant M&A activity, with data centres alone attracting over $50 billion in investment, highlighting strong investor appetite.

These investors often include large pension funds, sovereign wealth funds, private equity firms specializing in infrastructure, and strategic corporate buyers looking to expand their digital footprint or integrate new capabilities. Their interest is driven by the stable, predictable cash flows and the essential nature of digital infrastructure in the modern economy. In 2024, the demand for data centre capacity is projected to grow by 20-30% year-over-year, further increasing the attractiveness of these assets to buyers.

Creditors and Lenders

Creditors and lenders, such as financial institutions that have provided Digital 9 Infrastructure with a Revolving Credit Facility or other debt, are a key customer segment. They require consistent and transparent updates regarding the company's financial health, particularly concerning its ability to meet repayment schedules and the progress of any planned asset sales. For instance, as of their latest reports in early 2024, lenders closely monitor Digital 9's debt-to-equity ratios and cash flow generation to ensure covenant compliance.

These stakeholders are primarily interested in the security of their investment and the predictable return of capital. Their engagement is driven by the need to assess risk and ensure the ongoing viability of Digital 9's operations to safeguard their loan portfolios. Key metrics they scrutinize include:

- Interest Coverage Ratio: To assess the company's ability to service its debt obligations.

- Loan-to-Value Ratios: Particularly relevant for asset-backed lending, ensuring collateral value remains sufficient.

- EBITDA growth: A strong indicator of operational profitability and debt repayment capacity.

Regulatory Authorities

Regulatory authorities are crucial for Digital 9 Infrastructure, acting as overseers ensuring compliance with laws governing investment trusts and public company dissolutions. These bodies, such as the Financial Conduct Authority (FCA) in the UK, scrutinize operations to maintain market integrity and investor protection. For instance, in 2024, the FCA continued its focus on digital markets and sustainable finance, impacting how infrastructure companies report and operate.

Their role extends to approving significant corporate actions, including potential dissolutions or major structural changes, ensuring transparency and fairness. This oversight is vital for building trust among investors and stakeholders. The regulatory landscape is dynamic, with bodies like the Securities and Exchange Commission (SEC) in the US also influencing global standards for digital infrastructure investments.

Key areas of oversight include:

- Compliance with listing rules and financial reporting standards.

- Adherence to regulations concerning mergers, acquisitions, and potential de-listings.

- Ensuring fair treatment of all shareholders during any dissolution or restructuring processes.

Digital 9 Infrastructure Plc's primary customer segments are its existing shareholders, both institutional and retail, who are focused on the efficient return of capital through the company's planned solvent liquidation. Prospective buyers of its digital infrastructure assets, such as data centres and subsea fibre networks, are also a key segment, driven by the strong demand in the digital infrastructure market. Creditors and lenders are another vital group, requiring assurance of debt repayment and covenant compliance.

| Customer Segment | Primary Interest | Key Data/Focus (as of early-mid 2024) |

|---|---|---|

| Institutional Shareholders | Optimal return of capital via asset wind-down | Significant equity holders; focus on net asset value per share (approx. 96.0 pence end March 2024) |

| Retail Shareholders | Return of invested capital | Individual investors seeking clarity on liquidation timelines |

| Prospective Asset Buyers | Acquisition of digital infrastructure assets | Strategic/financial investors; strong M&A in digital infra ($50B+ for data centres in 2023); 20-30% YoY data centre capacity growth projected for 2024 |

| Creditors & Lenders | Debt repayment and covenant compliance | Monitoring debt-to-equity, cash flow, interest coverage, LTV, EBITDA growth |

Cost Structure

Digital 9 Infrastructure incurs significant costs when divesting assets. These include substantial fees for financial advisors, legal counsel, and technical experts, often running into millions of pounds for large transactions. For instance, in 2023, the sale of certain data center assets involved advisory fees that represented a notable percentage of the deal value.

Beyond advisory fees, due diligence processes for asset sales demand considerable resources, covering site inspections, environmental surveys, and financial audits. There's also the potential for break fees or penalties if existing contracts tied to the divested assets cannot be smoothly transferred or are terminated early, adding another layer of financial risk to divestment activities.

Debt servicing and repayment costs are a significant component of Digital 9 Infrastructure's expenses. These include interest payments on their revolving credit facility and other outstanding loans. For instance, in their 2023 results, Digital 9 reported finance costs of £28.7 million, largely driven by interest on their borrowings.

Additional costs arise from any debt refinancing activities or early repayment fees. These expenses are incurred to manage their capital structure effectively and ensure long-term financial stability. Until their debt is fully repaid, these servicing costs will continue to impact their profitability and cash flow.

Management and administrative fees are a key cost for Digital 9 Infrastructure. These fees are primarily paid to InfraRed Capital Partners, the investment manager, for their oversight of the company's operations and, importantly, its ongoing wind-down process. These expenses are essential for ensuring the orderly realization of assets and the efficient return of capital to shareholders.

In 2024, these management and administrative costs represent a significant portion of the company's expenditures as it navigates the final stages of its investment lifecycle. For example, in the first half of 2024, the company reported £3.7 million in management fees and £0.7 million in administrative expenses, reflecting the ongoing costs associated with professional services and operational overhead during this wind-down period.

Professional Services (Legal, Audit, Valuation)

Digital 9 Infrastructure incurs ongoing expenses for essential professional services. These include legal counsel for contract management and regulatory compliance, annual audits to ensure financial transparency, and independent asset valuations to maintain accurate reporting, especially during a wind-down phase.

These costs are critical for maintaining good governance and providing reliable financial statements. For instance, in 2024, companies in the infrastructure sector often allocate between 0.5% to 2% of their revenue to legal and audit services, depending on the complexity of their operations and regulatory environment.

- Legal Services: Costs associated with contract review, regulatory filings, and potential litigation.

- Audit Fees: Expenses for independent financial statement audits, crucial for investor confidence.

- Valuation Services: Fees for external experts to assess the fair value of infrastructure assets.

- Other Professional Fees: Including consulting, tax advisory, and compliance support.

Shareholder Communication and Reporting Expenses

Digital 9 Infrastructure incurs costs related to keeping shareholders informed. These include expenses for regulatory announcements, ensuring compliance with disclosure requirements. In 2024, companies in the infrastructure sector often allocate significant budgets to investor relations activities, reflecting the importance of transparent communication.

Preparing and distributing comprehensive annual reports is a key expense. This involves gathering financial data, drafting narratives, and printing or digitally distributing these documents to a wide shareholder base. For instance, a typical FTSE 250 company might spend upwards of £100,000 on its annual report production and distribution.

Hosting investor presentations, both physical and virtual, also contributes to these costs. These events allow management to discuss performance and strategy directly with investors. Additionally, maintaining an up-to-date and informative investor relations section on the company website is crucial for accessibility and engagement.

- Regulatory Announcements: Costs for legal and compliance teams to prepare and disseminate mandatory disclosures.

- Annual Reports: Expenses for content creation, design, printing, and distribution of financial and operational summaries.

- Investor Presentations: Costs associated with venue hire, technology, and speaker preparation for earnings calls and investor days.

- Website Maintenance: Ongoing expenses for updating and hosting the investor relations portal.

Digital 9 Infrastructure's cost structure is heavily influenced by its investment manager, InfraRed Capital Partners. Management fees, paid for operational oversight and the ongoing wind-down process, are a significant expense. In the first half of 2024, these fees amounted to £3.7 million, alongside £0.7 million in administrative expenses, reflecting the costs of professional services during this lifecycle stage.

Costs associated with asset divestments are substantial, encompassing fees for financial advisors, legal counsel, and technical experts. These transaction-related expenses can represent a notable percentage of deal values. Furthermore, due diligence processes, including site inspections and financial audits, require considerable resources, adding to the overall cost of sales.

Debt servicing remains a major cost component, with interest payments on its revolving credit facility and other loans being a primary driver. In 2023, finance costs reached £28.7 million, underscoring the impact of borrowings on profitability. Refinancing activities or early repayment fees can also incur additional expenses.

Ongoing professional services, including legal counsel for compliance, annual audits, and asset valuations, are critical for maintaining governance and accurate financial reporting. These costs are essential, particularly during a wind-down, to ensure transparency and investor confidence.

| Cost Category | Description | H1 2024 (Estimate) | 2023 Actual |

|---|---|---|---|

| Management & Admin Fees | Fees paid to investment manager for oversight and wind-down. | £4.4 million | £8.2 million (approx.) |

| Divestment Costs | Advisory, legal, and due diligence fees for asset sales. | Variable, significant per transaction | Significant portion of deal value |

| Finance Costs | Interest on borrowings and debt servicing. | £14.35 million (H1 est.) | £28.7 million |

| Professional Services | Legal, audit, valuation, and other expert fees. | £1.0 million - £2.0 million (est.) | £2.0 million - £4.0 million (est.) |

Revenue Streams

Proceeds from asset disposals represent Digital 9 Infrastructure's primary revenue source as it navigates a managed wind-down. This strategy involves selling off its digital infrastructure holdings, including key entities like Verne Global, EMIC-1, Aqua Comms, and SeaEdge UK1.

The cash generated from these sales is strategically allocated. A significant portion is directed towards repaying outstanding debt, thereby strengthening the company's financial position. The remaining capital is then returned to shareholders, fulfilling the company's commitment to its investors during this transition phase.

Digital 9 Infrastructure may continue to generate residual operational income from its existing assets until they are divested. This could include ongoing lease payments from data center facilities or revenue from capacity sales on its fiber optic networks. For example, in 2024, Digital 9 Infrastructure's portfolio continued to provide stable income streams, contributing to the offset of operational expenditures.

Digital 9 Infrastructure, as part of its business model, can generate interest income from significant cash balances. These balances might arise from asset sales that occur before debt obligations are fully settled or before capital is returned to shareholders. This stream acts as a supplementary revenue source, particularly noted during periods of strategic transition or wind-down.

Recovery of Working Capital from Disposed Entities

When Digital 9 Infrastructure sells off parts of its portfolio, it can get back money tied up in the day-to-day operations of those businesses. This recovered working capital directly boosts the cash available.

This influx of cash is crucial for paying down debt, which strengthens the company's financial position. It also provides funds that can be returned to shareholders, perhaps through dividends or buybacks.

For instance, in the first half of 2024, Digital 9 Infrastructure reported significant progress in its portfolio optimization, which included such working capital recoveries contributing to its financial flexibility.

- Working Capital Recovery: Funds freed up from sold entities.

- Debt Reduction: Improves the company's balance sheet.

- Shareholder Returns: Potential for increased dividends or buybacks.

Potential Earn-Outs or Deferred Payments

Digital 9 Infrastructure might structure asset sale agreements to include earn-out clauses. These provisions tie additional payments to the future performance of the divested asset or the achievement of specific operational milestones. For example, if a data center is sold, the buyer might agree to pay an extra amount if it reaches a certain occupancy rate within two years.

These earn-outs act as a contingent revenue stream, materializing only if predetermined targets are met post-transaction. This approach aligns seller incentives with the buyer’s success, potentially unlocking greater value for Digital 9 Infrastructure beyond the initial sale price. Such arrangements are common in infrastructure deals where future cash flows are a key valuation driver.

For instance, in 2024, infrastructure M&A activity saw a notable portion of deals incorporating deferred consideration or earn-out structures, particularly in sectors with predictable, long-term revenue generation. These mechanisms allow for risk sharing and can bridge valuation gaps between buyers and sellers.

- Earn-Out Provisions: Contingent payments based on the future performance of divested assets.

- Milestone-Based Payments: Additional revenue tied to achieving specific operational or financial targets post-sale.

- Risk Sharing: Aligns seller and buyer interests, ensuring value realization is linked to successful integration and operation.

- Deferred Consideration: A portion of the sale price paid over time, often linked to performance metrics.

Digital 9 Infrastructure's revenue streams are primarily driven by its strategic asset disposals as it undergoes a managed wind-down. This involves selling off its digital infrastructure assets, such as Verne Global and Aqua Comms. The proceeds from these sales are then used to repay debt and return capital to shareholders.

While the company focuses on divestments, it may still generate residual operational income from its existing assets until they are sold. This could include lease payments from data centers or revenue from its fiber optic networks. For example, in the first half of 2024, Digital 9 Infrastructure continued to optimize its portfolio, generating income from its operational assets.

Additionally, Digital 9 Infrastructure can earn interest income on significant cash balances held from asset sales before debt repayment or shareholder distributions. Earn-out provisions in sale agreements, tied to the future performance of divested assets, also represent a potential, albeit contingent, revenue stream.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Asset Disposals | Proceeds from selling digital infrastructure holdings. | Primary revenue source for wind-down. |

| Residual Operational Income | Income from existing assets until divestment (e.g., leases, capacity sales). | Contributes to offsetting operational costs. |

| Interest Income | Earnings on cash balances held from asset sales. | Supplementary income during transition. |

| Earn-Out Provisions | Contingent payments based on future performance of divested assets. | Potential for additional value realization post-sale. |

Business Model Canvas Data Sources

The Digital 9 Infrastructure Business Model Canvas is built using a blend of operational metrics, subscriber data, and network performance reports. These sources provide a comprehensive view of our service delivery and customer engagement.