BB Electronics AS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BB Electronics AS Bundle

BB Electronics AS possesses significant strengths in its technological innovation and established market presence, but also faces potential threats from rapid industry shifts and competitive pressures. Understanding these dynamics is crucial for any stakeholder looking to navigate this complex landscape.

Want the full story behind BB Electronics AS's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BB Electronics A/S boasts a comprehensive Electronics Manufacturing Services (EMS) portfolio, encompassing everything from initial design support and Design for Manufacturing (DFM) to intricate system integration and final box building. This end-to-end service offering positions them as a valuable strategic partner, capable of managing the entire electronic product lifecycle for their clients.

Their ability to provide a full spectrum of services, including sourcing, production, and rigorous testing, streamlines the complex process of bringing electronic products to market. This integrated approach not only enhances efficiency but also allows customers to focus on their core competencies, knowing their manufacturing needs are expertly handled.

BB Electronics AS excels in the intricate design, development, manufacturing, and lifecycle management of sophisticated electronic products. This deep specialization allows them to tackle highly technical challenges, positioning them as a key partner for businesses requiring advanced solutions.

Serving demanding sectors like industrial automation, medical devices, cleantech, and telecommunications, BB Electronics AS demonstrates a broad yet focused industry reach. In 2024, the industrial electronics market alone was valued at over $700 billion globally, highlighting the significant opportunity within these complex and high-margin segments.

This strategic focus on complex products and essential industries translates into a higher value proposition per project. For instance, the medical electronics sector, where BB Electronics AS operates, is projected to grow at a compound annual growth rate of over 8% through 2028, indicating strong demand for specialized manufacturing capabilities.

BB Electronics AS excels with its 'best in class' automation, particularly in robot-optimized Design For Automation Assembly (DFAA) solutions. This advanced manufacturing capability allows for highly efficient and precise production processes.

Rooted in a strong LEAN manufacturing philosophy, BB Electronics is adept at agile, high-mix production. This approach enables them to quickly adapt to diverse customer needs and market demands, ensuring flexibility and responsiveness.

These advanced techniques directly translate into significant operational advantages, driving efficiency gains and cost optimization. For instance, in 2024, companies with high levels of automation reported up to 20% lower manufacturing costs compared to those with manual processes.

Leveraging Kitron Group's Global Footprint and Synergies

BB Electronics' acquisition by Kitron Group in 2023 has dramatically amplified its global reach. Operating within Kitron's extensive network, which spans 11 countries, BB Electronics now has a presence in key markets beyond its existing facilities in Denmark, Czech Republic, and China. This integration opens up significant avenues for cross-selling and accessing a wider customer base, thereby accelerating sales growth opportunities.

The synergy created by this integration is a core strength. Kitron Group, a leading electronics manufacturing services (EMS) provider, reported revenues of NOK 7.6 billion (approximately USD 720 million) in 2023. This robust financial backing and established operational framework provide BB Electronics with enhanced capabilities and resources to compete more effectively on a global scale.

- Expanded Market Access: BB Electronics can now leverage Kitron's sales channels in North America, Europe, and Asia, reaching new customer segments.

- Operational Efficiencies: Integration allows for shared best practices and potential consolidation of certain operational functions, leading to cost savings.

- Enhanced Service Offering: Customers can benefit from a more comprehensive suite of EMS solutions, from design to production and logistics, facilitated by the combined entity's capabilities.

Strong Commitment to Sustainability

BB Electronics AS showcases a profound dedication to sustainability, evidenced by its membership in the UN Global Compact. This commitment translates into tangible actions like reducing energy consumption, enhancing waste recycling, and prioritizing sustainable supplier relationships. Their forward-thinking approach includes ambitious goals for green energy adoption, targeting 90% by 2024-2027 and a full 100% by 2028-2030 for Scope 1 and 2 emissions.

This strong environmental focus directly addresses a growing market preference for eco-conscious business partners. For instance, by 2024, a significant portion of their energy needs are expected to be met through sustainable sources, aligning with global trends and customer expectations.

- UN Global Compact Membership

- Ambitious Green Energy Targets: 90% by 2024-2027, 100% by 2028-2030 for Scope 1 & 2 emissions.

- Reduced Energy Consumption and Waste Recycling Initiatives

- Sustainable Supplier Management Practices

BB Electronics AS benefits from a comprehensive Electronics Manufacturing Services (EMS) portfolio, covering the entire product lifecycle from design to box building. Their expertise in complex product development and manufacturing for demanding sectors like medical devices and telecommunications provides a strong competitive edge. The company's commitment to advanced automation, exemplified by its robot-optimized Design For Automation Assembly (DFAA) solutions, drives significant operational efficiencies and cost savings.

The integration with Kitron Group in 2023 significantly broadens BB Electronics' global market access and operational capabilities. This synergy allows for leveraging Kitron's extensive international network and financial backing, estimated at NOK 7.6 billion (approximately USD 720 million) in 2023 revenues, to enhance growth opportunities. Furthermore, BB Electronics' strong focus on sustainability, including ambitious green energy targets (90% by 2024-2027 for Scope 1 & 2 emissions), aligns with increasing market demand for eco-conscious partners.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Comprehensive EMS Portfolio | End-to-end service offering from design to box building. | Manages entire electronic product lifecycle. |

| Specialization in Complex Products | Deep expertise in high-tech electronics for demanding sectors. | Medical electronics sector projected to grow over 8% annually through 2028. |

| Advanced Automation & LEAN Manufacturing | Robot-optimized DFAA and high-mix production capabilities. | Automated companies reported up to 20% lower manufacturing costs in 2024. |

| Global Reach via Kitron Acquisition | Leverages Kitron's 11-country network and sales channels. | Kitron Group reported NOK 7.6 billion (approx. USD 720 million) in 2023 revenue. |

| Strong Sustainability Commitment | UN Global Compact member with ambitious green energy targets. | Targeting 90% green energy by 2024-2027 for Scope 1 & 2 emissions. |

What is included in the product

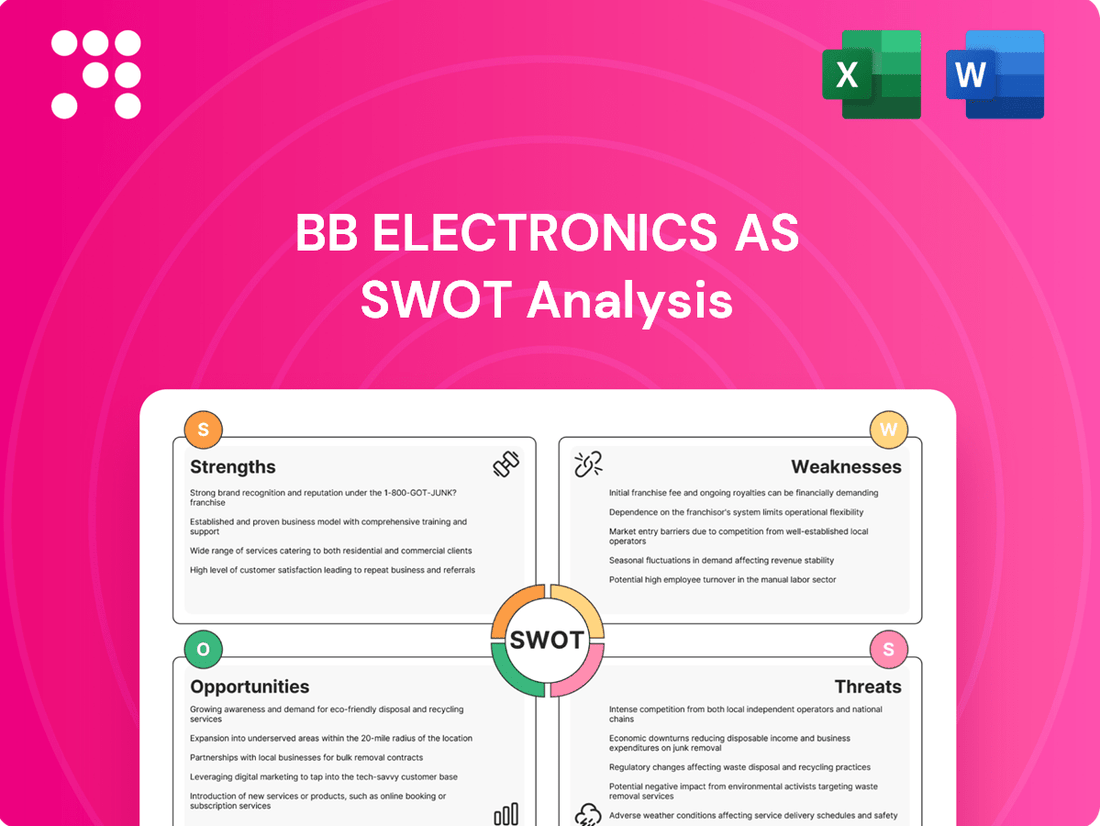

Delivers a strategic overview of BB Electronics AS’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address BB Electronics AS's strategic challenges, turning potential weaknesses into opportunities.

Weaknesses

Despite the harmonization efforts following its 2022 acquisition by Kitron Group, BB Electronics AS faces lingering integration challenges. Fully merging BB Electronics' operational systems and organizational culture into Kitron's broader framework is a complex process that could cause temporary disruptions. This integration demands substantial resources for alignment, potentially impacting internal efficiencies during the transition phase.

As BB Electronics A/S becomes integrated into the Kitron Group, there's a significant risk that its unique brand identity, cultivated since its founding in 1975, could be overshadowed. This potential dilution might impact its established market recognition and customer loyalty.

Maintaining BB Electronics' distinct value proposition will require deliberate strategic initiatives. For instance, Kitron's 2023 annual report highlighted a focus on brand integration across its acquired entities, suggesting a potential challenge in preserving individual brand equity while achieving group synergies.

BB Electronics AS, as a subsidiary of Kitron Group, experiences a significant weakness in its dependency on the parent company's strategic direction. This means BB Electronics' independent decision-making power is curtailed, potentially slowing its response to niche market opportunities or specific customer needs that might not align with Kitron's broader objectives.

This strategic alignment requirement can limit BB Electronics' agility. For instance, if Kitron prioritizes investments in other divisions, BB Electronics might miss out on crucial R&D funding or market expansion opportunities. In 2024, Kitron Group reported a revenue of NOK 7,914 million, highlighting the scale of decisions that influence its subsidiaries.

Intense Competition in a Fragmented EMS Market

The electronics manufacturing services (EMS) sector is notoriously fragmented, with a vast number of companies competing for business. Even with the backing of Kitron, BB Electronics AS operates in this intensely competitive environment, facing relentless pressure on pricing. This necessitates continuous efforts to differentiate its offerings and secure valuable contracts in a crowded market.

In 2024, the global EMS market was valued at approximately $700 billion, with numerous smaller players contributing to its fragmentation. BB Electronics AS, despite its integration into Kitron, still contends with this dynamic. The need to maintain competitive pricing while investing in advanced manufacturing capabilities is a constant challenge.

- Market Fragmentation: The EMS industry comprises many small and medium-sized enterprises alongside larger players, leading to intense competition.

- Pricing Pressure: High competition directly translates into downward pressure on pricing, impacting profit margins for all participants.

- Differentiation Imperative: To gain an edge, BB Electronics AS must continually innovate and offer specialized services or superior quality to stand out.

High Capital Investment for Technology Upgrades

BB Electronics AS faces a significant hurdle in maintaining its technological edge, requiring substantial capital outlays for automation and advanced production. For instance, in 2024, the global electronics manufacturing sector saw capital expenditures on advanced machinery and automation solutions increase by an estimated 8-10% year-over-year, a trend expected to continue into 2025. This continuous need for investment, even with group support, can strain finances as technology evolves rapidly.

The commitment to remaining 'best in class' necessitates ongoing substantial investment in:

- Cutting-edge machinery: Acquiring and maintaining state-of-the-art manufacturing equipment.

- Advanced software: Implementing and upgrading sophisticated production and control systems.

- Research and Development: Funding innovation to stay ahead in a competitive landscape.

BB Electronics AS's integration into Kitron Group presents a weakness due to potential brand identity dilution, risking the erosion of its established market recognition and customer loyalty. This challenge is compounded by the need for deliberate strategic initiatives to preserve its unique value proposition amidst group-wide brand harmonization efforts, as indicated by Kitron's 2023 focus on brand integration.

The company's dependency on Kitron's strategic direction limits its independent decision-making agility, potentially hindering its ability to capitalize on niche market opportunities or respond swiftly to specific customer needs that may not align with the parent company's broader objectives. This can impact crucial R&D funding or market expansion opportunities, especially considering Kitron Group's 2024 revenue of NOK 7,914 million, which underscores the scale of decisions influencing subsidiaries.

Operating within the highly fragmented EMS sector, BB Electronics AS faces persistent pricing pressure from numerous competitors, necessitating continuous differentiation efforts to secure contracts. The global EMS market, valued at around $700 billion in 2024, exemplifies this intense competition, forcing BB Electronics to balance competitive pricing with investments in advanced manufacturing capabilities.

Maintaining a technological edge requires substantial capital for automation and advanced production, with the global electronics manufacturing sector seeing an estimated 8-10% year-over-year increase in capital expenditures on advanced machinery and automation in 2024. This continuous investment need, even with group support, can strain finances as technology evolves rapidly.

Full Version Awaits

BB Electronics AS SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual BB Electronics AS SWOT analysis, providing a clear snapshot of its strategic position. Purchase unlocks the complete, in-depth report.

Opportunities

The acquisition by Kitron Group in 2023, which saw Kitron acquire BB Electronics for approximately SEK 1.3 billion (around EUR 120 million), significantly broadens BB Electronics' market reach. This integration grants access to Kitron's established customer base and its operational footprint across 11 countries, opening new avenues for growth.

This expanded presence creates substantial opportunities for cross-selling BB Electronics' specialized Electronic Manufacturing Services (EMS) to Kitron's existing clients. Furthermore, BB Electronics can leverage Kitron's global network to introduce its own unique service offerings to a much wider and diverse customer base, potentially boosting revenue streams and market share.

BB Electronics' focus on medical electronics and cleantech aligns perfectly with rapidly expanding markets. The global medical electronics market is anticipated to reach approximately $100 billion by 2026, fueled by an aging population and advancements in healthcare technology. This specialization allows BB Electronics to tap into a sector with consistent demand for sophisticated electronic components and manufacturing services.

Original Equipment Manufacturers (OEMs) are increasingly choosing to outsource their production to specialized Electronic Manufacturing Services (EMS) providers, a trend that directly benefits companies like BB Electronics. This shift is largely fueled by OEMs' pursuit of greater manufacturing efficiency and cost savings, allowing them to concentrate on their core research and development and market strategies.

This sustained demand for outsourcing is a significant opportunity, as evidenced by the global EMS market, which was valued at approximately $686.4 billion in 2023 and is projected to reach $989.4 billion by 2028, growing at a compound annual growth rate (CAGR) of 7.6%. Companies like Kitron, a competitor to BB Electronics, have also seen growth driven by this trend, reporting a 12% revenue increase in 2023 compared to 2022.

Leveraging Parent Company's Strategic Collaborations

Being a part of the Kitron Group provides BB Electronics with significant opportunities to tap into strategic collaborations initiated at the parent company level. For instance, Kitron's involvement with Easy Aerial Inc. in developing autonomous UAV solutions or its work with BRC Solar GmbH on solar energy products opens new avenues for BB Electronics.

BB Electronics can capitalize on these parent-driven initiatives by applying its robust manufacturing expertise. This allows for the expansion of its product offerings into high-growth sectors like advanced drone technology and renewable energy. In 2024, Kitron reported a substantial increase in its order backlog, reaching NOK 9.5 billion by the end of Q3, indicating a strong demand for its manufacturing services across various advanced technology segments, which BB Electronics can directly benefit from.

- Access to Parent-Initiated Partnerships: Kitron's established relationships with companies like Easy Aerial Inc. and BRC Solar GmbH offer BB Electronics direct entry into new technology markets.

- Portfolio Expansion: Leveraging manufacturing capabilities for parent company collaborations allows BB Electronics to diversify into emerging areas such as autonomous systems and solar energy.

- Synergistic Growth: By supporting Kitron's strategic ventures, BB Electronics can achieve synergistic growth, enhancing its market position and technological capabilities.

Further Advancements in Automation and Industry 4.0

BB Electronics' established expertise in automation, including its Design For Automation Assembly (DFAA) capabilities, positions it well to capitalize on the evolving landscape of Industry 4.0. This existing strength is a significant asset as the company looks to integrate more advanced smart manufacturing technologies.

Continued strategic investment in automation and Industry 4.0 principles is expected to yield substantial benefits. For instance, by 2025, the global manufacturing automation market is projected to reach approximately $315 billion, indicating a robust growth trajectory that BB Electronics can tap into.

- Enhanced Efficiency: Further automation can streamline production processes, potentially reducing operational costs by up to 20% in certain areas, as seen in industry benchmarks.

- Reduced Lead Times: Implementing advanced automation can shorten product development and manufacturing cycles, allowing for quicker responses to market demands.

- Technological Leadership: Proactive adoption of Industry 4.0 technologies, such as AI-driven quality control and predictive maintenance, can solidify BB Electronics' competitive edge.

- Increased Agility: Smart manufacturing environments offer greater flexibility to adapt production lines for new products or customized orders, a key differentiator in today's market.

The acquisition by Kitron Group significantly expands BB Electronics' market reach and customer base, creating opportunities for cross-selling and introducing its specialized EMS to a wider audience. This integration, following the SEK 1.3 billion acquisition in 2023, positions BB Electronics to leverage Kitron's global network for growth.

BB Electronics' specialization in medical electronics and cleantech aligns with high-growth sectors; the medical electronics market is projected to reach around $100 billion by 2026. This focus allows the company to capitalize on consistent demand for sophisticated electronic manufacturing services.

The increasing trend of OEMs outsourcing production presents a substantial opportunity for BB Electronics, as the global EMS market was valued at approximately $686.4 billion in 2023. This outsourcing trend is driven by the pursuit of manufacturing efficiency and cost savings by OEMs.

Being part of the Kitron Group offers access to strategic collaborations, such as those in autonomous UAV solutions and solar energy products. BB Electronics can leverage its manufacturing expertise to expand into these high-growth sectors, benefiting from Kitron's strong order backlog of NOK 9.5 billion as of Q3 2024.

Threats

Global supply chain disruptions pose a significant threat to BB Electronics AS. The electronics manufacturing sector, in general, is highly susceptible to issues like component shortages and fluctuating raw material prices. For instance, the semiconductor shortage that began in late 2020 and continued through 2023 significantly impacted production across the industry, with some reports indicating lead times for certain chips extending by over a year.

These disruptions can directly affect BB Electronics' production timelines and inflate operational expenses. Logistical hurdles, such as port congestion and increased shipping costs, further exacerbate these problems. In 2024, global shipping costs, while having stabilized from pandemic peaks, remain elevated compared to pre-2020 levels, impacting the landed cost of components and finished goods.

The consequence for BB Electronics is a direct threat to its ability to meet customer demand and maintain profitability. Delayed product deliveries can damage customer relationships and lead to lost sales, while higher costs squeeze profit margins. For example, a report by McKinsey in early 2024 highlighted that companies with less resilient supply chains experienced revenue losses up to 7% higher than their more agile counterparts during periods of disruption.

BB Electronics AS faces significant threats from intense price pressure within the fragmented Electronic Manufacturing Services (EMS) market. Numerous domestic and international competitors frequently engage in aggressive pricing strategies, forcing BB Electronics to constantly re-evaluate its cost structure to remain competitive.

This relentless price competition directly contributes to margin erosion. For instance, in 2024, the average EMS industry operating margin hovered around 3-5%, a tight range that leaves little room for error. This squeeze makes it difficult for BB Electronics to allocate sufficient capital for crucial technological advancements and R&D, potentially impacting long-term growth and competitiveness.

The electronics sector is notorious for its swift technological shifts, meaning product lifecycles are shrinking. This rapid pace poses a significant threat of obsolescence for BB Electronics. For instance, in 2024, the average smartphone replacement cycle in developed markets was around 2.5 years, highlighting how quickly consumer electronics can become outdated.

To combat this, BB Electronics faces the ongoing necessity of substantial investment in research and development, as well as upgrading manufacturing equipment. Failing to stay current with technological advancements could quickly render their product lines uncompetitive. The global semiconductor industry alone saw R&D spending reach an estimated $100 billion in 2024, a figure that underscores the competitive pressure to innovate.

Economic Downturns and Industry-Specific Fluctuations

Economic downturns, whether broad or sector-specific, pose a significant threat to BB Electronics AS. A general economic slowdown in 2024, as predicted by many institutions, could dampen consumer and business spending on electronics. Furthermore, downturns within the industrial, medical, cleantech, or telecommunications sectors, which are key markets for BB Electronics, would directly shrink demand for their electronic products and EMS services.

These fluctuations can lead to a cascade of negative effects. Decreased order volumes mean BB Electronics might face underutilized manufacturing capacity, driving up per-unit costs. This directly impacts revenue and profitability, as seen in the broader EMS industry where companies often report reduced margins during economic contractions. For instance, global manufacturing output saw a notable dip in late 2023 and early 2024, a trend that could continue to affect order pipelines.

- Reduced Demand: Economic slowdowns in 2024 could decrease consumer and business spending on electronics across BB Electronics' served sectors.

- Sector-Specific Risks: Downturns in industrial, medical, cleantech, or telecommunications markets directly impact BB Electronics' core client base.

- Capacity Underutilization: Lower order volumes lead to idle manufacturing capacity, increasing operational costs per unit.

- Profitability Squeeze: Reduced demand and higher costs during economic contractions negatively affect BB Electronics' revenue and profit margins.

Cybersecurity Risks and Data Security Breaches

BB Electronics, as a designer and manufacturer of intricate electronic products, manages substantial intellectual property and client data. The escalating complexity of cyber threats presents a serious danger of data breaches, IP theft, or operational interruptions. This could significantly harm its reputation, lead to financial losses, and diminish customer confidence.

The financial impact of such breaches can be substantial. For instance, the average cost of a data breach in the manufacturing sector reached $4.73 million in 2023, according to IBM's Cost of a Data Breach Report. For BB Electronics, a breach could mean not only direct financial costs but also lost business due to damaged trust.

- Intellectual Property Theft: Competitors could gain access to proprietary designs and manufacturing processes, undermining BB Electronics' competitive edge.

- Operational Disruption: Ransomware attacks or system failures could halt production lines, leading to significant revenue loss and missed delivery deadlines.

- Reputational Damage: A major data breach can erode customer trust, making it harder to secure new contracts and retain existing clients.

- Regulatory Fines: Non-compliance with data protection regulations, such as GDPR, following a breach can result in hefty penalties, potentially millions of Euros.

Intensifying global competition poses a significant threat to BB Electronics AS. The electronics manufacturing services (EMS) market is highly fragmented, with numerous players vying for market share. This competition can lead to aggressive pricing strategies, impacting BB Electronics' profit margins. For example, in 2024, the average operating margin for EMS providers was reported to be between 3% and 5%, indicating a highly competitive environment.

Rapid technological advancements in the electronics sector also present a threat of obsolescence. Product lifecycles are shortening, requiring continuous investment in research and development and manufacturing upgrades. In 2024, the global semiconductor industry’s R&D spending was estimated to be around $100 billion, reflecting the high cost of staying competitive.

Economic downturns can significantly reduce demand for electronics. Downturns in key sectors like industrial, medical, or telecommunications, which are crucial markets for BB Electronics, directly impact order volumes and profitability. Global manufacturing output saw a dip in late 2023 and early 2024, illustrating the vulnerability to economic shifts.

Cybersecurity threats are a growing concern, with the potential for data breaches, intellectual property theft, and operational disruptions. The average cost of a data breach in the manufacturing sector was approximately $4.73 million in 2023, highlighting the substantial financial and reputational risks.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, incorporating BB Electronics AS's official financial statements, comprehensive market research reports, and insights from industry experts to provide a thorough and accurate SWOT assessment.