BB Electronics AS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BB Electronics AS Bundle

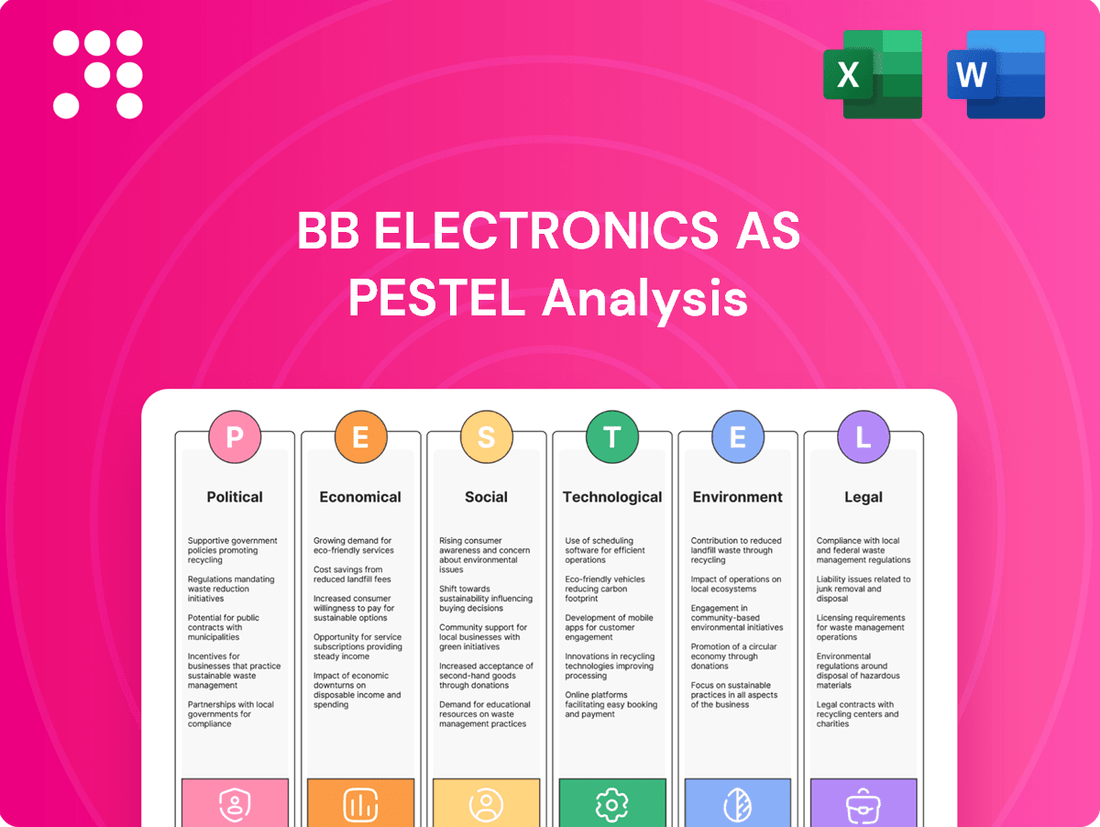

Unlock the critical external factors shaping BB Electronics AS's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, societal shifts, technological advancements, environmental regulations, and legal frameworks are influencing their operations and market position. Equip yourself with actionable intelligence to navigate these forces and identify strategic opportunities. Download the full PESTLE analysis now and gain a decisive competitive advantage.

Political factors

Government policies on trade, tariffs, and subsidies directly influence BB Electronics' operational costs and market reach. For instance, the European Union's Digital Services Act, implemented in 2024, aims to regulate online platforms, which could affect BB Electronics' digital sales channels and marketing strategies.

Shifting geopolitical alliances and trade agreements present both opportunities and hurdles for BB Electronics. The ongoing trade tensions between the US and China, for example, may necessitate diversification of sourcing for components, potentially increasing supply chain complexity and costs for the company.

BB Electronics operates in highly regulated sectors, meaning industry-specific rules significantly shape its business. For instance, its involvement in medical technology requires strict adherence to certifications and safety standards, such as those mandated by the FDA or European MDR, impacting product development timelines and costs.

Similarly, the cleantech and telecommunications industries have their own sets of compliance requirements, including environmental impact assessments and telecommunication equipment certifications like FCC or CE marking. Navigating these complex regulatory landscapes is crucial for market access and maintaining product integrity, directly influencing BB Electronics' operational strategies and investment in quality assurance.

BB Electronics' operations are significantly influenced by the political stability of its key markets and sourcing locations. For instance, geopolitical tensions in East Asia, a primary hub for electronics manufacturing and component sourcing, could lead to supply chain disruptions. As of early 2024, several regions in Asia continue to navigate complex political landscapes, impacting global trade dynamics and manufacturing costs.

Taxation and Investment Incentives

Changes in corporate tax rates directly impact BB Electronics' profitability and cash flow. For instance, a reduction in the Norwegian corporate tax rate from 22% to 21% effective January 1, 2023, offers a slight advantage, potentially freeing up capital for reinvestment.

Furthermore, the availability and structure of Research and Development (R&D) tax credits are crucial. Norway's R&D tax credit scheme, which allows companies to deduct up to 10% of their R&D expenses from their tax liability, can significantly lower the net cost of innovation for BB Electronics. This incentive is particularly important for a company operating in the technology sector, where continuous innovation is key to competitiveness.

Investment incentives in manufacturing, such as accelerated depreciation allowances or grants for establishing new production facilities, can also shape BB Electronics' strategic decisions regarding expansion and capital expenditure. Favorable policies can make investing in new manufacturing capabilities more attractive, potentially leading to increased operational efficiency and market share. Conversely, less supportive tax environments or the phasing out of incentives could discourage such investments.

- Corporate Tax Rate: Norway's corporate tax rate stood at 21% as of 2024, a slight decrease from 22% in previous years, potentially improving BB Electronics' net earnings.

- R&D Tax Credits: The Norwegian R&D tax credit scheme allows for a deduction of up to 10% of qualifying R&D expenses, directly reducing the tax burden on innovation.

- Investment Incentives: Government programs offering grants or tax breaks for establishing advanced manufacturing facilities can lower the barrier to entry for capital-intensive projects.

National Security and Supply Chain Resiliency

Governments worldwide are increasingly prioritizing national security, with a particular focus on the resilience of supply chains for critical electronic components. This trend, amplified by geopolitical tensions observed through 2024 and into 2025, directly impacts companies like BB Electronics. Policies aimed at bolstering domestic or regional manufacturing capabilities for semiconductors and other vital electronic parts are likely to emerge, potentially reshaping the competitive landscape.

These policy shifts could present both opportunities and challenges for BB Electronics. Strengthening local partnerships within key markets might become a strategic imperative to align with national security objectives and secure access to critical resources. Conversely, increased government incentives for localized production could foster new competitors, intensifying competition for BB Electronics in previously stable markets.

For instance, the US CHIPS and Science Act, with significant funding allocated through 2024-2025, aims to onshore semiconductor manufacturing. Similarly, European initiatives are pushing for greater regional autonomy in critical technologies. These developments underscore a growing global effort to de-risk supply chains, a factor BB Electronics must actively monitor and adapt to in its strategic planning.

- Increased Government Scrutiny: Expect heightened governmental oversight on the origin and security of electronic components, impacting sourcing strategies.

- Reshoring Incentives: Policies promoting domestic manufacturing could offer opportunities for BB Electronics to expand local production or face subsidized competition.

- Supply Chain Diversification Mandates: Governments may mandate or strongly encourage diversification away from single-source or geopolitically sensitive regions.

- Potential for Trade Barriers: National security concerns could lead to new tariffs or restrictions on electronic goods, affecting international trade flows.

Government policies directly shape BB Electronics' operational landscape, from trade regulations to R&D incentives. The EU's Digital Services Act, effective 2024, impacts digital sales, while trade tensions necessitate supply chain diversification. Norway's corporate tax rate of 21% in 2024 and its 10% R&D tax credit offer financial advantages for innovation and investment.

| Policy Area | Impact on BB Electronics | Relevant 2024/2025 Data/Trend |

| Trade & Tariffs | Affects costs and market access. | US-China trade tensions continue, prompting sourcing diversification. |

| Digital Regulation | Influences online sales and marketing. | EU Digital Services Act (2024) targets online platforms. |

| Taxation | Impacts profitability and reinvestment. | Norway corporate tax rate: 21% (2024). R&D tax credit: 10% deduction. |

| National Security & Supply Chains | Drives reshoring and component sourcing scrutiny. | US CHIPS Act funding through 2025; European autonomy initiatives. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing BB Electronics AS, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

It offers actionable insights and data-driven perspectives to help BB Electronics AS identify strategic opportunities and mitigate potential risks in its operating landscape.

BB Electronics' AS PESTLE analysis offers a structured framework to identify and address potential external threats and opportunities, thereby alleviating the pain of navigating complex market dynamics and informing strategic decision-making.

Economic factors

Global economic growth is projected to be moderate in 2024 and 2025, with the IMF forecasting 3.2% for both years. However, persistent inflation and geopolitical tensions pose significant recession risks, which could dampen demand for BB Electronics' industrial and telecommunications products.

A slowdown in major economies like the US and China, key markets for electronic components, would directly impact BB Electronics' order volumes. For instance, a contraction in manufacturing output, a sector heavily reliant on advanced electronics, would reduce capital expenditure by potential clients.

Conversely, sustained economic expansion, particularly in emerging markets, could drive increased demand for sophisticated medical and telecommunications equipment. For example, rising disposable incomes in these regions often translate to greater investment in healthcare infrastructure and digital connectivity.

Rising inflation in 2024 and projected into 2025 directly impacts BB Electronics by increasing the cost of essential inputs. For instance, global commodity prices, particularly for semiconductors and rare earth metals vital for electronics manufacturing, saw significant upward pressure throughout 2024, with forecasts suggesting continued volatility. This directly squeezes profit margins if these costs cannot be fully passed on to consumers.

Concurrently, central banks' responses to inflation, typically through interest rate hikes, affect BB Electronics' financial strategy. As of late 2024, many major economies have maintained or slightly adjusted benchmark interest rates upwards to combat persistent inflation. This makes borrowing more expensive, impacting BB Electronics' ability to finance new projects, acquisitions, or even manage working capital efficiently, potentially delaying expansion plans.

Currency exchange rate volatility significantly impacts BB Electronics, an international EMS provider. Fluctuations in exchange rates directly affect the revenue generated from exports and the cost of essential imported components, creating uncertainty in their financial planning.

For instance, if the Norwegian Krone (NOK) strengthens against major trading currencies like the US Dollar or Euro, BB Electronics' exported goods become more expensive for international buyers, potentially reducing demand. Conversely, a weaker NOK could boost export sales but increase the cost of imported raw materials and components, squeezing profit margins.

This volatility poses a challenge for accurate financial forecasting and maintaining competitive pricing in the global marketplace. In 2024, major currency pairs like EUR/NOK and USD/NOK have experienced notable swings, with the NOK showing periods of both appreciation and depreciation against its peers, highlighting the ongoing risk for companies like BB Electronics.

Supply Chain Costs and Component Availability

The electronics sector, including companies like BB Electronics AS, is particularly vulnerable to shifts in supply chain costs and the availability of essential components. These disruptions directly impact production timelines and can significantly inflate operational expenses. For instance, the global semiconductor shortage, which persisted into 2023 and continued to affect various electronic component markets through early 2024, led to price increases of up to 20-30% for certain critical parts, forcing manufacturers to absorb or pass on these costs.

Effective management of supplier relationships and the proactive diversification of sourcing channels are paramount for BB Electronics to navigate these economic headwinds. A strategy that includes building strong partnerships with multiple component suppliers can provide a buffer against single-source dependency and sudden price hikes. By mid-2024, many electronics firms were actively exploring nearshoring options to reduce lead times and mitigate geopolitical risks, a trend that could influence BB Electronics' sourcing decisions.

Key economic factors impacting BB Electronics AS regarding supply chain costs and component availability include:

- Increased Component Prices: Volatility in raw material costs and manufacturing capacity has led to price surges for components like microcontrollers and memory chips, with some experiencing year-over-year increases exceeding 15% in late 2023 and early 2024.

- Logistics and Shipping Costs: Elevated global shipping rates and port congestion, although showing signs of easing from peak 2022 levels, continued to add to the overall cost of bringing components to manufacturing facilities through the first half of 2024.

- Supplier Reliability: Ensuring consistent and reliable delivery from a diverse supplier base is critical; reliance on a limited number of suppliers, especially in regions facing political instability or natural disasters, poses a significant risk to production continuity.

- Inventory Management: Balancing the need to hold sufficient component inventory to avoid production stoppages against the costs of carrying excess stock is a constant economic challenge, particularly with lead times that can stretch to over 52 weeks for some specialized parts.

Customer Industry Investment Trends

BB Electronics' demand is closely tied to investment trends in key sectors. For instance, the industrial sector saw global capital expenditure grow by an estimated 5% in 2024, signaling robust demand for automation and manufacturing components.

The medical technology industry, a significant market for BB Electronics, experienced a projected 7% increase in R&D investment in 2025, driven by advancements in diagnostics and personalized medicine. Cleantech, including renewable energy infrastructure, is also a growth area, with global investment expected to reach over $2 trillion by 2030, according to various industry reports from late 2024.

Telecommunications, particularly the ongoing 5G rollout and infrastructure upgrades, continues to be a strong driver of demand. Investment in global telecom infrastructure is anticipated to remain high through 2025, with significant capital being allocated to network expansion and modernization.

- Industrial Sector: Global capital expenditure growth of approximately 5% in 2024.

- Medical Technology: Projected 7% increase in R&D investment for 2025.

- Cleantech: Global investment trajectory aiming for over $2 trillion by 2030.

- Telecommunications: Continued high investment in 5G and infrastructure upgrades through 2025.

Global economic growth is projected to remain moderate in 2024 and 2025, with potential headwinds from inflation and geopolitical risks. A slowdown in key markets like the US and China could impact BB Electronics' order volumes, especially in manufacturing. Conversely, emerging market expansion offers opportunities for increased demand in medical and telecommunications sectors.

Persistent inflation in 2024 and 2025 directly increases BB Electronics' input costs, particularly for semiconductors and rare earth metals, potentially squeezing profit margins. Rising interest rates, maintained by central banks to combat inflation, make financing more expensive, impacting expansion and working capital management.

Currency exchange rate volatility, seen in pairs like EUR/NOK and USD/NOK throughout 2024, creates uncertainty for BB Electronics by affecting export revenue and the cost of imported components. This necessitates careful financial planning and competitive pricing strategies.

BB Electronics' demand is closely linked to investment trends in key sectors like industrial automation, medical technology, cleantech, and telecommunications. For example, global capital expenditure in the industrial sector grew by an estimated 5% in 2024, while medical technology R&D is projected for a 7% increase in 2025. Telecommunications infrastructure investment, particularly for 5G, is expected to remain robust through 2025.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on BB Electronics |

|---|---|---|---|

| Global GDP Growth | 3.2% (IMF) | 3.2% (IMF) | Moderate demand, risk of recession impacting orders. |

| Inflation | Persistent, leading to higher input costs. | Continued concern, impacting margins. | Increased costs for components, potential margin squeeze. |

| Interest Rates | Maintained or slightly increased in major economies. | Likely to remain elevated. | Higher borrowing costs, impacting financing and expansion. |

| Key Market Growth (Industrial Capex) | ~5% growth | Continued investment | Increased demand for industrial automation components. |

| Key Market Growth (Medical R&D) | Significant investment | Projected 7% increase | Strong demand for medical technology components. |

Preview the Actual Deliverable

BB Electronics AS PESTLE Analysis

The preview you see here is the exact BB Electronics AS PESTLE analysis document you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file, providing a comprehensive PESTLE analysis of BB Electronics, ready for immediate download.

No placeholders, no teasers—this is the real, ready-to-use BB Electronics AS PESTLE analysis document you’ll get upon purchase, ensuring you have the complete picture.

Sociological factors

Societal shifts are heavily influencing what consumers want from electronics. There's a clear upward trend in demand for devices that are not just smart, but also connected and tailored to individual needs, impacting everything from home automation to wearable tech. This growing preference for personalized, interconnected gadgets is directly shaping the product portfolios BB Electronics is being asked to produce.

Meeting this evolving consumer appetite requires BB Electronics to excel in several key areas. The company must possess strong capabilities in miniaturization, allowing for sleeker and more portable devices. Integrating Internet of Things (IoT) functionalities is also paramount, enabling seamless connectivity between products and platforms. Furthermore, advancements in sensor technologies are crucial for creating more responsive and intelligent electronic products, pushing the boundaries of their manufacturing and design processes.

For instance, the global smart home market was valued at over $80 billion in 2023 and is projected to grow significantly, with many analysts expecting it to surpass $150 billion by 2027, demonstrating a clear consumer push towards connected living. Similarly, the wearable technology market, encompassing smartwatches and fitness trackers, saw sales of over 100 million units in the first half of 2024 alone, underscoring the widespread adoption of personalized, connected devices.

BB Electronics relies heavily on a skilled workforce, especially engineers and technicians. In 2024, Norway faced a shortage of skilled labor in technical fields, with reports indicating a growing gap between industry needs and graduates. This scarcity directly impacts BB Electronics' capacity for innovation and efficient production.

Demographic trends, such as an aging workforce and lower birth rates, are exacerbating talent availability. Educational institutions' output in relevant technical disciplines needs to align with industry demands to mitigate these skill gaps. For instance, while Norway aims to boost its digital skills, the pace of technological advancement often outstrips educational system adjustments, presenting ongoing challenges for companies like BB Electronics in 2025.

Societal expectations for ethical sourcing and labor practices are increasingly influencing consumer and investor decisions. BB Electronics must demonstrate robust adherence to fair labor standards and supply chain transparency to maintain its corporate reputation and market standing.

A 2024 survey indicated that 72% of consumers consider a company's ethical labor practices when making purchasing decisions. This trend is amplified by investor focus on Environmental, Social, and Governance (ESG) criteria, with a significant portion of institutional capital now allocated to companies with strong ethical frameworks, impacting BB Electronics' access to capital and valuation.

Aging Populations and Healthcare Needs

Demographic shifts, particularly the aging populations in key markets like Europe and North America, are significantly boosting demand for sophisticated medical electronics. For instance, in 2024, the global medical device market was projected to reach over $600 billion, with a substantial portion driven by an aging demographic requiring continuous monitoring and advanced treatment solutions.

This trend presents a clear growth avenue for BB Electronics, necessitating a focus on specialized medical electronics manufacturing. The company must leverage its expertise in areas like wearable health trackers, diagnostic equipment components, and implantable device electronics, all of which are seeing increased investment and development.

- Increased Demand: The World Health Organization (WHO) estimates that by 2030, one in six people globally will be 65 years or older, driving demand for eldercare technologies.

- Market Opportunity: The global market for medical electronics is expected to grow at a compound annual growth rate (CAGR) of around 7-8% through 2025, fueled by these demographic changes.

- Regulatory Focus: BB Electronics must navigate stringent regulatory environments, such as FDA approvals in the US and CE marking in Europe, which are critical for medical device components.

Corporate Social Responsibility (CSR) Demands

Customers, investors, and employees are increasingly scrutinizing companies like BB Electronics for their commitment to corporate social responsibility (CSR). This heightened awareness translates into tangible expectations regarding environmental sustainability, active community involvement, and robust ethical governance practices. For instance, a 2024 survey by Edelman revealed that 59% of consumers globally consider CSR when making purchasing decisions, directly impacting brand loyalty and market share.

These CSR demands significantly influence brand perception, making it a critical factor in attracting and retaining top talent. Furthermore, the investment community is placing greater emphasis on Environmental, Social, and Governance (ESG) factors. In 2025, sustainable investment funds are projected to exceed $50 trillion in assets under management, indicating a strong financial incentive for companies to prioritize CSR initiatives.

- Customer Expectations: A significant majority of consumers now factor a company's social and environmental impact into their buying choices.

- Investor Scrutiny: ESG performance is becoming a key metric for investment decisions, driving capital towards responsible businesses.

- Talent Acquisition: Companies with strong CSR reputations are more attractive to potential employees, particularly younger generations.

- Brand Reputation: Demonstrating commitment to CSR enhances a company's public image and builds trust.

Societal expectations for ethical sourcing and labor practices are increasingly influencing consumer and investor decisions. BB Electronics must demonstrate robust adherence to fair labor standards and supply chain transparency to maintain its corporate reputation and market standing.

A 2024 survey indicated that 72% of consumers consider a company's ethical labor practices when making purchasing decisions. This trend is amplified by investor focus on Environmental, Social, and Governance (ESG) criteria, with a significant portion of institutional capital now allocated to companies with strong ethical frameworks, impacting BB Electronics' access to capital and valuation.

Customers, investors, and employees are increasingly scrutinizing companies like BB Electronics for their commitment to corporate social responsibility (CSR). This heightened awareness translates into tangible expectations regarding environmental sustainability, active community involvement, and robust ethical governance practices. For instance, a 2024 survey by Edelman revealed that 59% of consumers globally consider CSR when making purchasing decisions, directly impacting brand loyalty and market share.

These CSR demands significantly influence brand perception, making it a critical factor in attracting and retaining top talent. Furthermore, the investment community is placing greater emphasis on Environmental, Social, and Governance (ESG) factors. In 2025, sustainable investment funds are projected to exceed $50 trillion in assets under management, indicating a strong financial incentive for companies to prioritize CSR initiatives.

| Societal Factor | Impact on BB Electronics | Supporting Data (2024/2025) |

|---|---|---|

| Ethical Sourcing & Labor | Reputation, Market Standing, Investor Confidence | 72% of consumers consider ethical labor practices (2024 Survey) |

| Corporate Social Responsibility (CSR) | Brand Loyalty, Talent Acquisition, Investment Attraction | 59% of consumers consider CSR in purchasing (2024 Edelman Survey) |

| ESG Investment Focus | Access to Capital, Company Valuation | Sustainable investment funds projected to exceed $50 trillion (2025) |

Technological factors

The manufacturing sector is seeing a significant surge in automation and AI adoption. For instance, by 2024, the global industrial robotics market was projected to reach $70 billion, with AI integration expected to further accelerate this growth. BB Electronics can leverage these advancements to boost production efficiency and lower operational expenses.

Implementing advanced automation and AI in manufacturing lines offers BB Electronics the chance to refine its production processes and tackle more intricate manufacturing challenges. This technological leap, however, necessitates substantial capital outlay, a factor that requires careful financial planning.

The relentless advancement in electronic components, including next-generation semiconductors and sophisticated sensor arrays, demands that BB Electronics AS proactively integrates these innovations. For instance, the global semiconductor market is projected to reach $700 billion by 2025, highlighting the rapid pace of development.

BB Electronics' ability to incorporate these emerging technologies, such as advanced power electronics enabling greater energy efficiency, directly impacts its capacity to deliver state-of-the-art solutions. This technological adoption is crucial for maintaining a competitive edge and meeting evolving customer demands in 2024 and beyond.

As BB Electronics expands its range of connected and IoT-enabled products, the importance of strong cybersecurity and data protection cannot be overstated. Protecting customer data and intellectual property is crucial, especially with the increasing sophistication of cyber threats. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the significant financial risks involved.

BB Electronics must implement advanced security protocols to safeguard both its devices and the sensitive manufacturing data it handles. This includes end-to-end encryption, regular security audits, and secure software development practices. A data breach could not only lead to financial losses but also severely damage the company's reputation and customer trust.

Rapid Innovation Cycles in Customer Industries

The rapid innovation cycles across key customer industries like industrial, medical, cleantech, and telecommunications present a significant technological factor. These sectors demand swift product development and frequent updates, requiring EMS providers like BB Electronics to maintain highly agile manufacturing processes and invest consistently in research and development. This adaptability is crucial for supporting the quick prototyping and scaled production of next-generation products.

For BB Electronics, this translates into a need for flexible production lines and advanced manufacturing technologies. For instance, the medical device sector, a key market for many EMS providers, saw global revenues reach approximately $520 billion in 2024, with a projected compound annual growth rate (CAGR) of 6.5% through 2030, driven by technological advancements and an aging population. Similarly, the cleantech industry is experiencing exponential growth, with investments in renewable energy technologies projected to exceed $2 trillion globally by 2030, necessitating rapid scaling of production for new energy solutions.

- Agile Manufacturing: BB Electronics must continually enhance its ability to reconfigure production lines quickly to accommodate diverse product specifications and smaller batch sizes common in fast-evolving markets.

- R&D Investment: Sustained investment in R&D is vital for staying ahead of technological curves, enabling the development of expertise in emerging areas like advanced sensor technology or miniaturization for medical devices.

- Supply Chain Resilience: Building a robust and responsive supply chain is paramount to ensure the timely availability of components needed for rapid product introductions and to mitigate risks associated with component obsolescence.

- Digitalization and Automation: Embracing Industry 4.0 principles, including AI-driven quality control and robotic automation, will be essential for improving efficiency and reducing lead times in production.

Adoption of Industry 4.0 and Smart Factory Concepts

BB Electronics' embrace of Industry 4.0 and smart factory concepts is a pivotal technological factor. This shift involves integrating interconnected systems, leveraging real-time data analytics, and employing predictive maintenance strategies. While this presents a significant opportunity to boost efficiency, it also necessitates substantial investment in technological upgrades to remain competitive.

Implementing these advanced manufacturing principles can lead to substantial operational improvements for BB Electronics. Optimizing production processes, minimizing costly downtime, and providing enhanced transparency to clients are key benefits. For instance, a study by McKinsey in late 2023 indicated that factories adopting Industry 4.0 technologies saw an average improvement of 20% in operational efficiency and a 15% reduction in maintenance costs.

- Interconnected Systems: Facilitating seamless communication between machinery, software, and personnel for enhanced workflow.

- Real-time Data Analysis: Enabling immediate insights into production performance for agile decision-making.

- Predictive Maintenance: Utilizing data to forecast equipment failures, thereby reducing unplanned downtime and repair expenses.

- Client Transparency: Offering clients greater visibility into production status and quality control measures.

Technological advancements are rapidly reshaping the electronics manufacturing landscape, demanding constant adaptation from companies like BB Electronics AS. The increasing integration of AI and automation, with the global industrial robotics market projected to hit $70 billion by 2024, offers significant opportunities for efficiency gains. Furthermore, the relentless pace of innovation in electronic components, evidenced by the semiconductor market's projected $700 billion valuation by 2025, necessitates proactive adoption to maintain competitiveness.

BB Electronics must navigate these technological shifts by embracing Industry 4.0 principles, such as interconnected systems and real-time data analytics, to optimize production. This strategic adoption, while requiring capital investment, is crucial for improving operational efficiency, as demonstrated by a McKinsey study showing a 20% average improvement in factories adopting these technologies. Staying abreast of rapid innovation cycles in key customer sectors, like the medical device industry's substantial growth, is also vital for BB Electronics to provide state-of-the-art solutions and meet evolving market demands.

| Technology Trend | Projected Market Size/Growth (2024/2025) | Impact on BB Electronics |

|---|---|---|

| Industrial Automation & AI | Global Industrial Robotics Market: $70 Billion (2024) | Boost production efficiency, lower operational expenses, tackle complex manufacturing challenges. |

| Advanced Electronic Components | Global Semiconductor Market: $700 Billion (2025) | Integrate next-generation semiconductors and sensors for state-of-the-art solutions. |

| Cybersecurity Threats | Global Cost of Cybercrime: $10.5 Trillion Annually (by 2025) | Implement advanced security protocols to protect data and reputation. |

| Industry 4.0/Smart Factories | 20% Average Operational Efficiency Improvement (McKinsey Study) | Enhance efficiency, reduce downtime, and increase client transparency through interconnected systems. |

Legal factors

BB Electronics AS operates within a landscape of rigorous product liability and safety standards, especially critical for its medical and industrial electronic components. Failure in these sectors can lead to severe consequences, making adherence paramount. For instance, in 2024, the global medical device market faced increased scrutiny regarding cybersecurity vulnerabilities, with regulatory bodies like the FDA issuing updated guidance on post-market surveillance to mitigate risks.

Maintaining compliance is not just a legal necessity but a strategic imperative to prevent expensive lawsuits, product recalls, and irreparable damage to BB Electronics' reputation. The company's commitment to robust quality control and rigorous testing protocols, including adherence to standards such as ISO 13485 for medical devices, directly impacts its financial health and market standing. In 2023, the cost of product recalls in the electronics industry averaged millions of dollars per incident, underscoring the financial impact of non-compliance.

Protecting intellectual property (IP) is paramount for BB Electronics, encompassing both customer designs and their own advanced manufacturing processes. This legal imperative is underscored by the increasing value placed on proprietary technology in the electronics sector, where innovation cycles are rapid.

Robust legal frameworks, including well-drafted contracts and stringent non-disclosure agreements (NDAs), are essential to prevent IP leakage. In 2024, the global cybersecurity market, which directly supports IP protection through secure data management, was projected to reach over $270 billion, highlighting the significant investment in safeguarding sensitive information.

Internal security measures and employee training are also critical legal components to prevent infringement and safeguard proprietary design and production data. Failure to adequately protect IP can lead to costly litigation and loss of competitive advantage, a risk that BB Electronics actively mitigates through comprehensive legal and operational strategies.

As BB Electronics AS develops increasingly connected products, compliance with data privacy regulations like GDPR and CCPA becomes critical. These laws govern how user data is collected, processed, and stored throughout a product's lifecycle, impacting everything from initial design to eventual disposal. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of global annual turnover or €20 million, whichever is higher.

International Trade Laws and Customs Compliance

BB Electronics, as an Electronics Manufacturing Services (EMS) provider, operates within a landscape shaped by intricate international trade laws. Navigating customs duties and export controls is paramount for their global supply chain. Failure to comply can lead to significant disruptions, including costly penalties and delays in the movement of essential components and finished products. For instance, in 2024, the World Trade Organization (WTO) reported that trade facilitation measures, including streamlined customs procedures, could boost global trade by up to 13% by 2030, highlighting the financial impact of efficient customs compliance.

Ensuring adherence to these regulations is not merely a procedural requirement but a strategic imperative for BB Electronics. This includes understanding and implementing measures related to tariffs, import quotas, and product origin rules. The company must maintain robust internal processes to track changes in trade policies across the various countries where it sources materials or sells its manufactured goods.

Key aspects of compliance for BB Electronics include:

- Understanding and adhering to specific import/export licensing requirements for electronic components and finished goods.

- Accurate declaration of goods to customs authorities to ensure correct duty payments and avoid sanctions.

- Staying updated on evolving trade agreements and sanctions that could impact supply chain operations.

- Implementing robust due diligence to ensure compliance with anti-bribery and corruption laws in international trade.

Employment and Labor Laws

BB Electronics must navigate a complex web of employment and labor laws across its global operations. This includes adhering to varying regulations on minimum wage, overtime, and employee benefits in regions like the European Union, where directives often set baseline standards, and in countries with distinct national labor codes. For instance, in 2024, the average minimum wage in EU member states saw an increase, impacting labor costs for companies with a significant workforce there.

Compliance extends to workplace safety standards, which are rigorously enforced in many of BB Electronics' key markets. Failure to meet these requirements, such as those mandated by OSHA in the United States or similar bodies in Asia, can result in substantial fines and operational disruptions. The International Labour Organization (ILO) continues to promote safe working environments globally, influencing national legislation and corporate responsibility.

Furthermore, BB Electronics needs to manage relationships with labor unions and comply with collective bargaining agreements where they exist. The prevalence and influence of unions can significantly affect wage negotiations, working conditions, and the company's flexibility in workforce management. In 2025, labor union membership rates in some developed economies are projected to remain stable, indicating continued relevance in industrial relations.

- Global Compliance Burden: BB Electronics faces the challenge of aligning its HR practices with diverse national and international employment regulations, impacting operational consistency and cost management.

- Workplace Safety Mandates: Adherence to stringent health and safety laws, such as those enforced by the EU's Agency for Safety and Health at Work, is critical to avoid penalties and maintain employee well-being.

- Union Relations and Bargaining: Managing collective bargaining agreements and employee representation is a key legal consideration, influencing labor costs and operational flexibility.

BB Electronics AS must navigate a complex web of international trade laws, including customs duties and export controls, which are critical for its global supply chain. Non-compliance can lead to significant disruptions, penalties, and delays. For instance, in 2024, the World Trade Organization estimated that improved trade facilitation could boost global trade by up to 13% by 2030, underscoring the financial benefits of efficient customs adherence.

Accurate declaration of goods and understanding import/export licensing requirements are paramount to avoid sanctions and ensure correct duty payments. Staying updated on evolving trade agreements and sanctions is essential for maintaining operational continuity. In 2025, global trade policies continue to evolve, requiring constant vigilance from companies like BB Electronics.

The company must also implement robust due diligence to comply with anti-bribery and corruption laws in international trade. This proactive approach helps mitigate risks associated with cross-border transactions and ensures ethical business practices. The legal framework surrounding international commerce is constantly adapting to new global challenges.

Environmental factors

BB Electronics AS must navigate stringent regulations such as RoHS and REACH, which govern the use of hazardous substances in electronic components. These directives, like the EU's REACH regulation, which saw over 23,000 substances registered by early 2024, directly impact material sourcing and product design, requiring careful selection of compliant materials to ensure market access in key regions.

Failure to comply with these environmental regulations can lead to significant penalties and loss of market access, making adherence a critical operational imperative for BB Electronics. For instance, non-compliance with REACH can result in hefty fines, potentially impacting profitability and supply chain stability, underscoring the need for robust internal compliance frameworks.

Growing environmental concerns are pushing manufacturers like BB Electronics to adopt stricter energy efficiency standards. This trend is directly influenced by increasing regulatory pressures and a broader societal push for sustainability.

BB Electronics is actively investing in advanced energy-saving technologies, such as smart grid integration and more efficient machinery, to cut down on its carbon emissions. For instance, the manufacturing sector in the EU saw a 1.5% reduction in energy consumption per unit of output in 2023, a trend BB Electronics aims to mirror and exceed.

These investments not only help BB Electronics meet its corporate sustainability targets but also offer a tangible benefit by lowering operational expenses. Energy costs represent a significant portion of manufacturing overhead, and efficiency improvements can lead to substantial cost savings, enhancing overall profitability.

BB Electronics faces increasing regulatory pressure concerning Waste Electrical and Electronic Equipment (WEEE). For instance, the European Union's WEEE Directive mandates member states to collect and recycle specific amounts of e-waste, with targets often increasing year-on-year. In 2024, for example, the EU aimed for a collection rate of 65% of all placed on the market WEEE, or 85% of WEEE generated.

These laws directly impact BB Electronics by necessitating proactive end-of-life product management. This translates to designing products with recyclability in mind, potentially incorporating modular components and avoiding hazardous materials. Furthermore, compliance may require BB Electronics to participate in producer responsibility schemes or invest in recycling infrastructure, adding to its operational costs and strategic planning.

Customer Demand for Sustainable Products and Practices

Customer demand for sustainable products is significantly shaping BB Electronics' market. A notable portion of their clientele, especially within the cleantech and medical industries, actively seeks out environmentally conscious goods and production methods. This trend translates into a strong preference for sustainable materials, energy-saving designs, and clear environmental disclosures from suppliers.

This heightened customer expectation directly influences BB Electronics' strategic decisions, pushing them to integrate sustainability into their competitive approach. For instance, a 2024 report indicated that 65% of B2B buyers in the technology sector consider a supplier's environmental, social, and governance (ESG) performance a key factor in their purchasing decisions. This emphasizes the need for BB Electronics to demonstrate robust sustainability credentials to maintain and grow market share.

The company's response to this demand is evident in their product development and operational adjustments. Key areas of focus include:

- Adoption of recycled and bio-based materials in product components.

- Investment in energy-efficient manufacturing processes to reduce carbon footprint.

- Enhanced transparency in environmental impact reporting, including life cycle assessments of their products.

Climate Change Policies and Carbon Footprint Reduction

Global and national climate change policies, such as the European Union's Fit for 55 package aiming for a 55% net greenhouse gas emission reduction by 2030, directly influence BB Electronics' operational costs and long-term strategy. These regulations, including potential carbon taxes or stricter emissions standards, necessitate proactive adaptation.

BB Electronics is increasingly incentivized to meticulously measure and actively reduce its carbon footprint throughout its entire value chain. This includes scrutinizing raw material sourcing, manufacturing processes, and logistics to demonstrate genuine environmental stewardship and meet evolving stakeholder expectations.

- EU Emissions Trading System (ETS): As of early 2024, the price of EU carbon allowances has fluctuated around €60-€70 per tonne of CO2 equivalent, impacting energy-intensive industries.

- Corporate Sustainability Reporting Directive (CSRD): This EU directive, fully applicable from 2024 for many companies, mandates detailed reporting on environmental impact, pushing for greater transparency in carbon footprint data.

- National Targets: Countries like Norway have set ambitious carbon reduction targets, potentially influencing energy costs and manufacturing location decisions for companies operating within their borders.

Environmental factors significantly shape BB Electronics AS's operations, driven by stringent regulations and growing customer demand for sustainability. Compliance with directives like REACH and RoHS, which govern hazardous substances, is paramount for market access, with the EU's REACH regulation seeing over 23,000 substances registered by early 2024. Furthermore, the increasing focus on energy efficiency and waste management, exemplified by the EU's WEEE Directive aiming for high collection rates in 2024, compels BB Electronics to invest in greener technologies and product lifecycle management. These environmental considerations are not just compliance issues but also strategic opportunities, as a significant portion of B2B buyers, around 65% in the tech sector by 2024, prioritize suppliers with strong ESG performance.

| Environmental Factor | Impact on BB Electronics AS | Key Data/Regulation |

|---|---|---|

| Hazardous Substance Regulations | Requires careful material sourcing and product design for market access. | REACH (EU): Over 23,000 substances registered by early 2024. RoHS compliance mandatory. |

| Energy Efficiency & Carbon Footprint | Drives investment in efficient machinery and processes to reduce operational costs and emissions. | EU Fit for 55 package targets 55% GHG reduction by 2030. EU ETS prices around €60-€70/tonne CO2e (early 2024). |

| Waste Electrical and Electronic Equipment (WEEE) | Necessitates proactive end-of-life product management and potential investment in recycling. | EU WEEE Directive: 2024 targets for collection rates of placed on market or generated WEEE. |

| Customer Demand for Sustainability | Influences product development and supplier selection, with 65% of B2B tech buyers considering ESG performance (2024). | Preference for recycled materials, energy-saving designs, and transparent environmental reporting. |

PESTLE Analysis Data Sources

Our BB Electronics AS PESTLE Analysis is built on a robust foundation of data from official government agencies, reputable market research firms, and international economic institutions. We incorporate insights from industry-specific reports, technological trend analyses, and legal databases to ensure comprehensive and accurate assessments.