Artivion SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Artivion Bundle

Artivion's market position is strong, with significant opportunities for growth in the regenerative medicine sector. However, understanding its specific vulnerabilities and competitive landscape is crucial for informed decision-making.

Want the full story behind Artivion's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Artivion boasts a comprehensive product portfolio, a significant strength that caters to a wide array of cardiovascular surgical needs. Their offerings include specialized aortic stent grafts, advanced surgical sealants, and the highly regarded On-X mechanical heart valves, demonstrating a deep commitment to cardiac and vascular health innovation.

Furthermore, the company's expertise extends to implantable human tissues, both cardiac and vascular, which are crucial for complex reconstructive procedures. This diversified range allows Artivion to address multiple points within the cardiovascular surgical pathway, solidifying its position in a specialized market.

Artivion boasts a strong product pipeline, underscored by significant clinical and regulatory milestones. The AMDS Hybrid Prosthesis secured FDA Humanitarian Device Exemption (HDE) in late 2024, enabling immediate U.S. commercialization for acute DeBakey Type I dissections, with full PMA approval expected by late 2025.

Further bolstering its pipeline, the NEXUS TRIOMPHE IDE trial has demonstrated promising 30-day data. This trial is on a clear trajectory for FDA approval in the latter half of 2026, indicating continued innovation and market expansion opportunities.

Artivion's financial performance shows a strong upward trend. For the first quarter of 2025, the company reported a 2% increase in GAAP revenue and a 4% rise on a non-GAAP constant currency basis when compared to the same period in 2024. This consistent growth highlights the company's ability to expand its market reach and product sales effectively.

Looking ahead, Artivion has boosted its full-year 2025 revenue forecast. The midpoint of the guidance has been raised to a range of $423 million to $435 million, indicating an anticipated growth of 11% to 14% on a constant currency basis. Furthermore, the company expects its adjusted EBITDA to see a significant increase, projected to grow between 18% and 28% for the entirety of 2025, signaling robust profitability improvements.

Global Market Presence

Artivion boasts a significant global market presence, selling its products in over 100 countries. This extensive international footprint, including robust revenue generation in areas like Latin America and Asia-Pacific, effectively diversifies its income sources and mitigates dependence on any single geographic market. The company's manufacturing facilities strategically located in Kennesaw, Georgia; Austin, Texas; and Hechingen, Germany, are key enablers of this broad international reach.

- Global Reach: Operations in more than 100 countries.

- Revenue Diversification: Strength in Latin America and Asia-Pacific reduces single-market reliance.

- Manufacturing Support: Facilities in the US and Germany underpin international sales.

High-Performing Key Products

Artivion's key product lines demonstrate impressive performance, with stent grafts achieving 14% growth (19% in constant currency) and On-X mechanical heart valves seeing 10% growth (11% in constant currency) in the first quarter of 2025 compared to the prior year. BioGlue also contributed with 7% growth (9% in constant currency) during the same period. This sustained expansion highlights the strong market demand and competitive advantages of these offerings.

The On-X valve stands out due to its superior design, which significantly reduces blood turbulence and lowers the need for anticoagulation therapy. These clinical benefits translate directly into improved patient safety and better long-term outcomes, reinforcing its position as a leading choice in cardiac surgery.

- Stent Grafts: 14% growth (19% constant currency) in Q1 2025 vs. Q1 2024.

- On-X Heart Valves: 10% growth (11% constant currency) in Q1 2025 vs. Q1 2024.

- BioGlue: 7% growth (9% constant currency) in Q1 2025 vs. Q1 2024.

- On-X Valve Advantage: Reduced turbulence and lower anticoagulation requirements.

Artivion's robust product portfolio is a significant strength, covering a wide spectrum of cardiovascular needs from aortic stent grafts to mechanical heart valves and implantable tissues. This comprehensive offering allows the company to address various stages of cardiovascular surgery, solidifying its market position.

The company's financial performance demonstrates consistent growth, with Q1 2025 revenue up 2% GAAP and 4% constant currency year-over-year. Furthermore, Artivion has raised its full-year 2025 revenue forecast, expecting 11% to 14% growth on a constant currency basis, signaling strong market acceptance and sales execution.

Artivion's key products are showing impressive momentum. In Q1 2025, stent grafts grew 14% (19% constant currency), On-X mechanical heart valves increased 10% (11% constant currency), and BioGlue saw 7% growth (9% constant currency). The On-X valve, in particular, offers clinical advantages like reduced turbulence and lower anticoagulation needs, enhancing its market appeal.

The company's strong global presence, operating in over 100 countries with significant revenue from Latin America and Asia-Pacific, diversifies its income streams. This international reach is supported by strategically located manufacturing facilities in the US and Germany, ensuring efficient supply chains for its worldwide sales.

| Product Line | Q1 2025 Growth (GAAP) | Q1 2025 Growth (Constant Currency) |

|---|---|---|

| Stent Grafts | 14% | 19% |

| On-X Mechanical Heart Valves | 10% | 11% |

| BioGlue | 7% | 9% |

What is included in the product

Delivers a strategic overview of Artivion’s internal and external business factors, highlighting its strengths in innovative cardiac solutions and opportunities for market expansion, while also addressing weaknesses in manufacturing capacity and threats from regulatory changes.

Offers a clear, actionable framework to identify and address key challenges and opportunities in the medical device sector.

Weaknesses

Artivion's recent cybersecurity incident in November 2024 exposed significant operational vulnerabilities. The disruption to order and shipping processes, along with temporary impacts on tissue processing, demonstrated a reliance on systems susceptible to external threats.

The incident's financial fallout, including a 23% drop in preservation services revenue in Q1 2025 due to a backlog, underscores the tangible consequences of such breaches. While Artivion downplayed the material impact on full-year 2025 results, the short-term revenue dip highlights a weakness in their ability to maintain seamless operations under cyberattack.

Artivion experienced a net loss of $(0.5) million in Q1 2025, a significant shift from the $7.5 million net income reported in Q1 2024. This GAAP net loss, despite positive non-GAAP figures, highlights potential underlying profitability challenges that warrant investor attention.

Artivion's market share in the cardiovascular devices sector is notably smaller than its major competitors. As of the first quarter of 2025, the company held approximately 0.53% of the market. This positions them behind industry leaders like Medtronic, Boston Scientific, and Abbott Laboratories.

This comparatively modest market share can present challenges in areas such as negotiating pricing power, securing extensive distribution networks, and funding ambitious research and development initiatives. To effectively compete with these larger, more established players, Artivion must continue to invest strategically and clearly define its unique value proposition.

Reliance on Regulatory Approvals

Artivion's growth trajectory is significantly tied to regulatory approvals, particularly for key pipeline products. For instance, the AMDS Hybrid Prosthesis and the NEXUS stent graft system are critical for future revenue streams.

Delays in obtaining these approvals, such as the anticipated late 2025 FDA approval for the AMDS PMA (despite its existing HDE) or the H2 2026 target for NEXUS, could directly affect projected sales and market entry. The intricate and often unpredictable nature of medical device regulatory pathways presents a notable weakness.

- FDA Approval Dependency: Future revenue growth is heavily reliant on the successful and timely FDA approval of products like the AMDS Hybrid Prosthesis and the NEXUS stent graft system.

- Potential for Delays: The AMDS PMA approval is expected in late 2025, and NEXUS in H2 2026, creating vulnerability to unforeseen regulatory setbacks.

- Complex Regulatory Landscape: Navigating the complex and evolving regulatory environment for medical devices introduces inherent risks and potential for extended approval timelines.

Exposure to Foreign Currency Fluctuations

Artivion's extensive global presence, spanning over 100 countries, exposes it to significant risks from foreign currency fluctuations. These shifts can impact the reported value of international sales and expenses, introducing volatility into the company's financial performance. For instance, Artivion anticipates that currency headwinds will reduce its as-reported revenue growth by roughly 2% in 2025.

While some currency revaluations can result in gains, as seen in Q1 2025 non-GAAP net income, the potential for losses creates an unpredictable element for earnings. This makes it challenging to forecast financial results with certainty.

- Global Operations Risk: Operating in over 100 countries exposes Artivion to currency revaluation impacts.

- Earnings Volatility: Foreign currency fluctuations can lead to both gains and losses, affecting earnings predictability.

- 2025 Revenue Impact: Artivion expects currency to negatively impact year-over-year as-reported revenue growth by approximately 2% in 2025.

Artivion's reliance on a few key products, particularly in the cardiovascular segment, creates a concentration risk. The company's growth is heavily dependent on the success and market adoption of products like the On-X valve and the Perimount Magna Ease valve. Any significant issues with these core offerings could disproportionately impact overall financial performance.

The recent cybersecurity incident, while addressed, highlighted potential weaknesses in IT infrastructure resilience. The disruption to order and shipping processes in November 2024, and the subsequent 23% drop in preservation services revenue in Q1 2025, underscore the operational vulnerabilities. This demonstrates a susceptibility to external threats that could hinder business continuity and revenue generation.

Artivion's market share in the cardiovascular devices sector is relatively small, holding approximately 0.53% as of Q1 2025. This positions the company behind larger, more established competitors, potentially limiting its pricing power and ability to secure extensive distribution networks.

Preview the Actual Deliverable

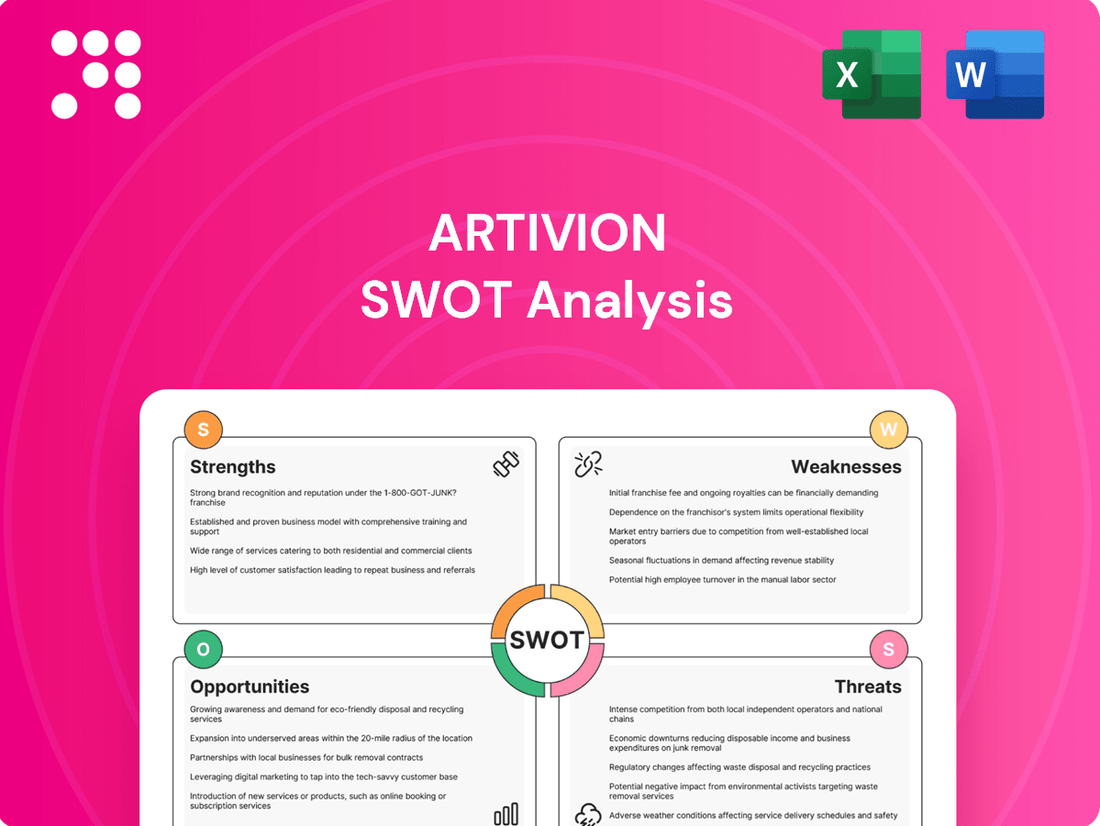

Artivion SWOT Analysis

This is the actual Artivion SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, as well as external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning.

Opportunities

The global medical device market is a significant growth area, projected to hit $586 billion by 2025 and surpass $1 trillion by 2034. This expansion is fueled by an aging global population and the rising incidence of chronic conditions, creating a favorable environment for companies like Artivion.

Artivion's focus on specialized cardiac and vascular devices aligns perfectly with these market trends. The surgical equipment sector, a key segment within the broader medical device industry, is also experiencing robust growth, indicating strong demand for the types of innovative products Artivion provides.

The healthcare industry, particularly in cardiovascular and vascular surgery, is seeing a strong move towards minimally invasive procedures. These techniques often lead to shorter hospital stays and quicker patient recovery, which is a major draw for both patients and healthcare providers. Artivion's product portfolio, including its innovative stent grafts, is well-positioned to capitalize on this significant trend.

For instance, the global minimally invasive surgical instruments market was valued at approximately $30 billion in 2023 and is projected to grow substantially. Artivion's commitment to developing advanced devices that facilitate these less invasive approaches directly supports this market expansion, potentially increasing their market share and the application of their existing products.

The market for treating aortic diseases offers significant growth potential, particularly with Artivion's innovative product pipeline. The AMDS Hybrid Prosthesis, for instance, is poised to tap into an estimated $150 million annual U.S. market once it receives full PMA approval, highlighting a substantial revenue opportunity.

Furthermore, the introduction of devices like NEXUS addresses critical needs in aortic arch repair, a segment with considerable unmet demand. These advancements are key to Artivion capturing new market share and solidifying its position in a growing therapeutic area.

Leveraging Digital Health and AI in MedTech

The medical device sector is rapidly adopting digital health and AI, with remote patient monitoring and AI-driven diagnostics becoming key differentiators. Artivion can capitalize on this by integrating these technologies into its existing portfolio, potentially enhancing product efficacy and expanding service offerings. This strategic move aligns with the industry's trajectory towards more personalized and data-driven patient care.

The global digital health market was valued at approximately $285 billion in 2023 and is projected to grow significantly, with AI in healthcare expected to reach over $188 billion by 2030. Artivion's focus on cardiovascular solutions presents a prime opportunity to leverage AI for improved surgical planning and post-operative patient monitoring.

- Enhanced Diagnostics: AI can analyze imaging data more efficiently, aiding in earlier and more accurate detection of cardiovascular conditions.

- Remote Patient Monitoring: Integrating sensors and data analytics allows for continuous patient oversight, improving outcomes and reducing hospital readmissions.

- Personalized Treatment: AI can help tailor treatment plans based on individual patient data, leading to more effective interventions.

- Product Innovation: Developing smart devices with integrated digital capabilities can create new revenue streams and competitive advantages.

Strategic Acquisitions and Partnerships

Artivion's strategic growth has historically been fueled by acquisitions, with notable examples like the integration of JOTEC. This pattern is expected to continue, with opportunities to further expand its product offerings and market presence through similar strategic moves.

The company's partnership with Endospan for the NEXUS stent graft, which includes an acquisition option post-FDA approval, highlights a key avenue for future expansion. Pursuing similar collaborations and potential acquisitions will be crucial for Artivion to enhance its technological capabilities and broaden its global reach.

- Acquisition of complementary technologies: Artivion could acquire companies with innovative products in adjacent cardiovascular segments, potentially increasing its total addressable market.

- Strategic alliances for market penetration: Partnerships with established players in emerging markets can accelerate Artivion's entry and growth in new regions.

- Integration of acquired R&D capabilities: Successful acquisitions often bring valuable research and development talent, which can be leveraged to accelerate the company's internal innovation pipeline.

Artivion is well-positioned to capitalize on the growing demand for minimally invasive cardiovascular procedures, a trend supported by the global minimally invasive surgical instruments market, valued around $30 billion in 2023. The company's innovative products, such as stent grafts, directly address this shift, promising improved patient outcomes and reduced healthcare costs. Furthermore, Artivion's focus on treating aortic diseases, an area with significant unmet needs, presents a substantial growth avenue, with specific products like the AMDS Hybrid Prosthesis targeting an estimated $150 million annual U.S. market. The integration of digital health and AI technologies into its portfolio offers further opportunities for enhanced diagnostics, remote monitoring, and personalized patient care, aligning with the projected significant growth of the digital health market, which was valued at approximately $285 billion in 2023.

Threats

Artivion operates in a fiercely competitive medical device sector, especially within cardiovascular health. Major players like Medtronic, Abbott, and Boston Scientific, with their vast resources, established distribution channels, and strong brand loyalty, set a high bar.

These industry giants consistently invest heavily in research and development, often leading to rapid product advancements. For instance, in 2023, Medtronic reported over $23 billion in revenue, highlighting its significant market presence and capacity for innovation.

This intense rivalry means Artivion must continuously innovate and clearly differentiate its products to not only retain but also expand its market share against these well-entrenched competitors.

The medical device sector faces a complex and ever-changing web of global regulations, such as the FDA's oversight in the United States and the EU's Medical Device Regulation (MDR). These evolving rules, coupled with heightened scrutiny, can significantly delay product introductions and hinder market entry. For instance, the FDA's premarket approval process can take years, impacting revenue streams.

Cybersecurity risks, starkly illustrated by the November 2024 ransomware attack, represent a significant threat to Artivion. This incident directly impacted operations, data integrity, and the company's reputation, highlighting vulnerabilities that could be exploited further.

Future cyberattacks could escalate disruptions across Artivion's supply chain, manufacturing processes, and customer service channels. The financial implications of remediation efforts, coupled with potential regulatory fines and a damaging loss of customer trust, underscore the severity of this ongoing threat.

Dependence on Healthcare Spending and Reimbursement Policies

Artivion's financial performance is closely linked to healthcare spending and the reimbursement policies that govern medical procedures. These factors are susceptible to changes driven by government decisions, broader economic trends, and evolving insurance practices.

A significant threat arises from potential shifts towards cost containment within healthcare systems. For instance, changes in reimbursement rates for cardiac and vascular surgeries could directly reduce the demand for Artivion's specialized products, impacting its revenue streams and overall profitability. The company's reliance on these procedures means that any adverse policy changes pose a considerable risk.

Economic pressures, particularly those impacting elective procedures, present another challenge. In 2024, for example, economic headwinds have been observed to affect the volume of such procedures, which can translate into slower sales growth for companies like Artivion.

- Healthcare Spending Sensitivity: Artivion's revenue is directly correlated with overall healthcare expenditure, making it vulnerable to economic downturns that reduce discretionary spending on medical treatments.

- Reimbursement Policy Risk: Changes in government or private payer reimbursement rates for cardiac and vascular procedures could negatively affect the economic viability of using Artivion's products.

- Economic Headwinds in 2024: The observed economic pressures on elective procedures in 2024 highlight a tangible threat to Artivion's sales volumes.

- Insurance Trend Impact: Evolving insurance coverage and benefit designs could alter patient access to and affordability of procedures utilizing Artivion's devices.

Product Liability and Litigation Risks

Artivion, like many medical device companies, faces significant product liability and litigation risks. These stem from the inherent nature of implantable devices and tissues, where any adverse patient outcomes or product failures can trigger substantial legal challenges. For instance, in their 2023 SEC filings, Artivion acknowledged these risks, which could lead to considerable financial penalties and reputational harm.

The potential for costly recalls and the diversion of critical resources from core business operations are direct consequences of such litigation. These threats are amplified by the complex regulatory environment and the high stakes involved in patient safety.

- Product Failures: Adverse patient outcomes due to device malfunction or tissue complications.

- Litigation Costs: Significant expenses associated with defending against product liability lawsuits.

- Reputational Damage: Negative publicity impacting brand trust and market perception.

Artivion faces intense competition from established medical device giants like Medtronic and Abbott, which possess greater R&D budgets and market reach. The company's dependence on healthcare spending and reimbursement policies makes it vulnerable to economic downturns and shifts in government or private payer policies, as seen with the impact of economic headwinds on elective procedures in 2024. Additionally, significant product liability risks, acknowledged in Artivion's 2023 SEC filings, and ongoing cybersecurity threats, exemplified by the November 2024 ransomware attack, pose substantial financial and operational challenges.

| Threat Category | Specific Threat | Impact | Example/Data Point |

|---|---|---|---|

| Competition | Rivalry with Major Players | Market share erosion, pricing pressure | Medtronic 2023 Revenue: >$23 billion |

| Regulatory Environment | Evolving Regulations (FDA, EU MDR) | Delayed product launches, market access barriers | FDA premarket approval can take years |

| Cybersecurity | Ransomware Attacks | Operational disruption, data integrity, reputational damage | November 2024 ransomware attack |

| Economic/Reimbursement | Healthcare Spending Fluctuations | Reduced demand for products, slower sales growth | Economic headwinds impacting elective procedures in 2024 |

| Product Liability | Adverse Patient Outcomes/Litigation | Financial penalties, reputational harm, resource diversion | Acknowledged in Artivion's 2023 SEC filings |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including Artivion's official financial filings, comprehensive market research reports, and insights from industry experts to ensure a thorough and reliable assessment.