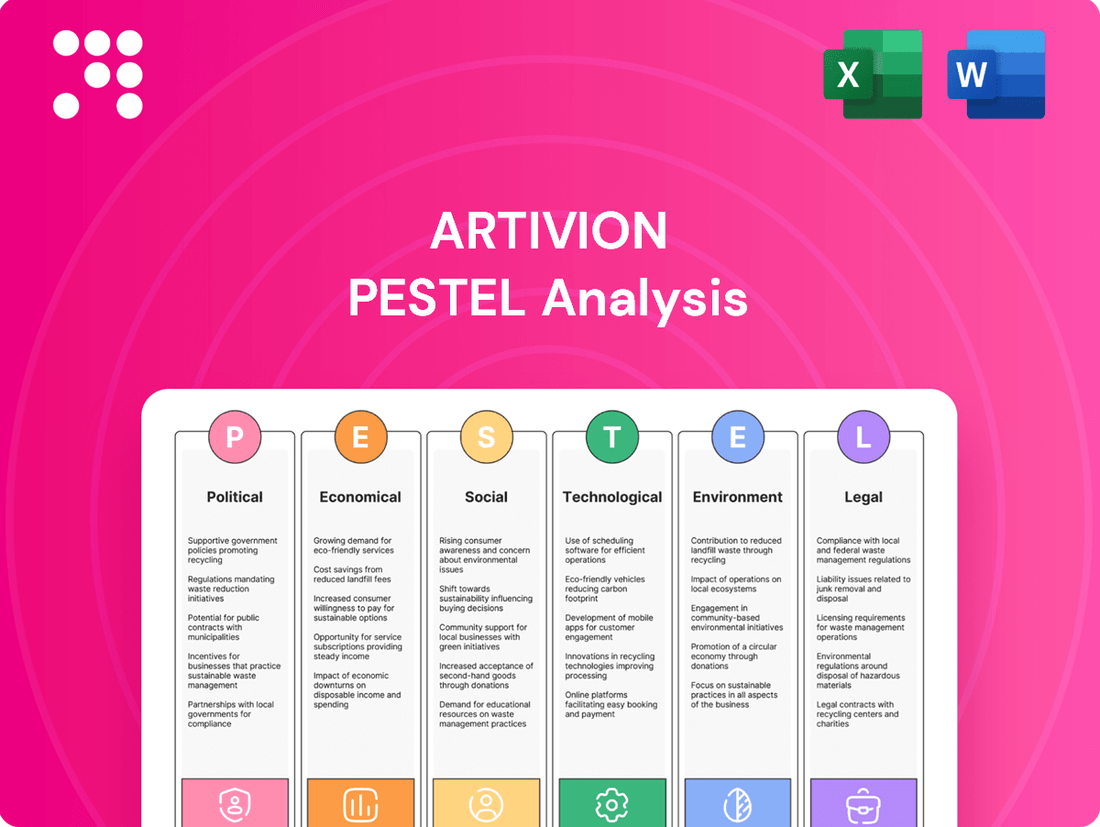

Artivion PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Artivion Bundle

Navigate the complex external landscape impacting Artivion with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are shaping opportunities and challenges for the company. Gain a strategic advantage by leveraging these expert-driven insights to inform your own business planning and investment decisions. Download the full version now for actionable intelligence.

Political factors

Government healthcare policies are a major force shaping Artivion's landscape. For instance, in the US, the Centers for Medicare & Medicaid Services (CMS) sets reimbursement rates, directly impacting how much hospitals and surgeons can pay for Artivion's products. A shift towards value-based care, where providers are reimbursed based on patient outcomes rather than services rendered, could incentivize the adoption of innovative, cost-effective devices like those Artivion offers, potentially boosting their market share.

Regulations around medical devices, such as those enforced by the FDA in the United States or the EMA in Europe, are critical. The FDA's approval process for new cardiovascular devices, for example, can take years and involve extensive clinical trials, influencing Artivion's research and development timelines and market entry strategies. In 2023, the FDA continued to emphasize real-world evidence for post-market surveillance, a trend likely to persist and require robust data collection from companies like Artivion.

The stability of regulatory environments, particularly concerning medical devices in the US via the FDA and Europe through the CE Mark, directly impacts Artivion's operational efficiency. Unforeseen shifts in approval pathways or post-market surveillance mandates can escalate compliance expenses and hinder timely product introductions. For instance, the FDA's evolving approach to digital health tools, as seen in guidance updates throughout 2024, requires continuous adaptation by medical device manufacturers like Artivion.

Artivion's global operations are significantly shaped by international trade policies. For instance, the United States' trade relations with key manufacturing hubs and markets, such as those in Asia and Europe, directly influence the cost and availability of components for their cardiac and vascular devices. Changes in tariffs or import/export regulations, like those potentially arising from ongoing trade discussions or disputes, can add unexpected costs to Artivion's supply chain. In 2023, global trade growth slowed, with the WTO projecting only a 0.8% increase in merchandise trade volume for 2024, a trend that underscores the sensitivity of companies like Artivion to shifts in these policies.

Political Stability in Operating Regions

Political stability is a cornerstone for Artivion's global operations, particularly concerning its manufacturing and R&D hubs. Regions experiencing political unrest can directly impact supply chains and market access. For instance, Artivion's significant presence in Europe, a region generally characterized by stable political environments, supports its consistent business operations.

However, any disruption, such as unexpected policy changes or social unrest in key markets, could affect Artivion's ability to maintain its production schedules and meet demand. The company's 2023 revenue of $727.2 million highlights the scale of operations that depend on predictable political landscapes.

- Manufacturing Presence: Artivion operates manufacturing facilities in countries like Germany and the United States, which generally boast high political stability.

- Market Access: Stable political environments facilitate smoother market entry and sustained sales growth, crucial for Artivion's international revenue streams.

- Risk Mitigation: Diversifying operations across politically stable regions helps Artivion mitigate the risks associated with localized instability.

Healthcare Funding and Reimbursement

Government decisions on healthcare funding and reimbursement rates for cardiovascular procedures are critical for Artivion. For instance, Medicare reimbursement rates for procedures like TAVR (Transcatheter Aortic Valve Replacement) significantly influence hospital adoption and patient access to Artivion's innovative solutions. Changes in these rates, whether increases or decreases, directly impact the profitability and market penetration of their devices.

Favorable reimbursement policies can accelerate the adoption of Artivion's products, leading to increased demand. Conversely, restrictive policies or cuts in funding can create significant headwinds, limiting patient access and potentially reducing the overall market size for their cardiovascular devices. For example, in 2024, discussions around value-based care models and potential adjustments to inpatient prospective payment systems could reshape the financial landscape for hospitals utilizing Artivion's technologies.

- Medicare Advantage enrollment in 2024 reached over 31 million beneficiaries, highlighting the significant impact of government payer decisions.

- The Centers for Medicare & Medicaid Services (CMS) annually reviews and updates reimbursement rates, directly affecting the financial viability of cardiovascular procedures utilizing advanced medical devices.

- Potential policy shifts towards bundled payments for cardiac procedures could incentivize efficiency and innovation, benefiting companies like Artivion if their devices demonstrably improve outcomes and reduce overall costs.

Government healthcare policies, particularly reimbursement rates set by agencies like CMS, directly influence Artivion's revenue streams. The ongoing shift towards value-based care models in 2024 could favor companies like Artivion if their products demonstrably improve patient outcomes and reduce overall healthcare costs.

Regulatory frameworks, such as those from the FDA and EMA, are paramount for Artivion's product development and market access. Evolving regulations, including increased emphasis on real-world evidence for post-market surveillance, necessitate continuous adaptation and robust data collection strategies from the company.

International trade policies and geopolitical stability impact Artivion's global supply chain and market access. Trade disputes or political instability in key regions could disrupt component sourcing and affect sales, underscoring the importance of diversified operations in stable environments.

| Factor | Impact on Artivion | 2024/2025 Data/Trend |

|---|---|---|

| Healthcare Policy (Reimbursement) | Affects adoption and profitability of devices. | Value-based care models gaining traction; CMS rate reviews ongoing. |

| Medical Device Regulations | Influences R&D timelines and market entry. | Continued focus on real-world evidence; FDA guidance updates for digital health. |

| Trade Policies & Geopolitics | Impacts supply chain costs and market access. | Global trade growth projections remain subdued; geopolitical tensions can affect supply chains. |

What is included in the product

This Artivion PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats within Artivion's operating landscape.

Artivion's PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, simplifying complex external factors.

Economic factors

The global economic outlook significantly impacts healthcare expenditure, directly influencing the market for Artivion's cardiovascular devices. In 2024, the International Monetary Fund projected global growth at 3.2%, a stable rate that supports continued investment in healthcare infrastructure and advanced medical technologies. This economic stability translates to increased disposable income for individuals and greater budget allocations for healthcare systems, fostering demand for Artivion's innovative solutions.

Global healthcare spending is projected to reach $11.6 trillion by 2025, with a significant portion allocated to cardiovascular care. This rise is driven by an aging population and the increasing incidence of conditions like atherosclerosis and heart failure, directly impacting demand for Artivion's specialized surgical solutions.

However, Artivion must navigate increasing pressure from governments and insurers to control costs. For instance, in 2024, many national health systems are implementing stricter reimbursement policies for medical devices, forcing manufacturers to demonstrate clear value and cost-effectiveness for their cardiovascular repair products.

Inflationary pressures in 2024 and early 2025 are a significant concern for Artivion. For instance, rising costs for medical-grade plastics and metals, key components in their surgical devices, directly impact Artivion's cost of goods sold. This can squeeze profit margins if these increased expenses cannot be fully passed on to customers.

Furthermore, the prevailing interest rate environment in 2024, with central banks like the Federal Reserve maintaining higher rates to combat inflation, influences Artivion's borrowing costs. Any new capital expenditures, such as expanding manufacturing capacity or investing in new product development, will likely come with higher debt servicing expenses, potentially impacting the feasibility and return on investment for such projects.

Currency Exchange Rate Fluctuations

As a global entity, Artivion's financial performance is inherently influenced by the ebb and flow of currency exchange rates. Fluctuations can significantly impact both the revenue generated from international sales and the cost of goods or services procured from overseas markets.

For instance, a strengthening US dollar can present a dual challenge: it may render Artivion's products more costly for international customers, potentially dampening demand, while simultaneously diminishing the reported value of overseas earnings when repatriated into USD. This dynamic necessitates careful financial planning and hedging strategies.

- Impact on Revenue: A stronger USD can decrease the dollar value of sales made in weaker currencies.

- Impact on Costs: Conversely, a weaker USD can increase the cost of imported materials or components.

- Strategic Hedging: Artivion likely employs financial instruments to mitigate the risks associated with currency volatility.

Reimbursement Policies and Pricing Pressure

Evolving reimbursement policies from government bodies like Medicare and private insurers are a significant factor influencing Artivion's pricing strategy. These policies, which dictate how much healthcare providers are paid for using medical devices, are increasingly scrutinized for cost-effectiveness. This directly translates to pricing pressure on companies like Artivion, as payers seek to control overall healthcare expenditures.

The persistent drive to reduce healthcare costs across the board intensifies this pressure. For instance, in the United States, the Centers for Medicare & Medicaid Services (CMS) continually reviews payment rates and coverage decisions for medical technologies. This environment necessitates that Artivion not only price its products competitively but also clearly demonstrate the value proposition of its devices to both payers and providers, ensuring they justify the cost through improved patient outcomes or operational efficiencies.

- Reimbursement Landscape: Changes in Medicare reimbursement rates for cardiovascular procedures directly impact the revenue potential for Artivion's products.

- Value-Based Care: The shift towards value-based care models encourages payers to favor devices that demonstrate long-term cost savings and improved patient outcomes.

- Competitive Pricing: Artivion must balance its pricing to remain competitive against alternative treatments and devices while ensuring profitability.

- Market Access: Favorable reimbursement decisions are critical for broad market access and adoption of Artivion's innovative medical devices.

Economic conditions directly influence healthcare spending and Artivion's market. Global economic growth projections for 2024, such as the IMF's 3.2% forecast, indicate a stable environment supporting healthcare investments. However, inflationary pressures in 2024 and early 2025, affecting raw material costs for medical devices, alongside higher interest rates impacting borrowing costs, present significant challenges for Artivion's profitability and expansion plans.

| Economic Factor | 2024/2025 Projection/Trend | Impact on Artivion |

|---|---|---|

| Global GDP Growth | Projected at 3.2% for 2024 (IMF) | Supports stable healthcare expenditure and demand. |

| Inflation | Persistent concern, increasing raw material costs. | Squeezes profit margins if costs cannot be passed on. |

| Interest Rates | Higher rates maintained by central banks. | Increases borrowing costs for capital expenditures. |

| Currency Exchange Rates | Volatile, impacting international revenue and costs. | Requires hedging strategies to mitigate financial risk. |

Same Document Delivered

Artivion PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Artivion PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing valuable strategic insights.

Sociological factors

The global population is getting older, and with age often comes a higher risk of heart and blood vessel problems. This trend is particularly relevant for companies like Artivion, which specialize in products for cardiac and vascular surgery. As more people enter older age brackets, the demand for these life-saving procedures is naturally expected to increase.

In 2024, it's estimated that over 1.2 billion people worldwide are aged 60 and over, a number projected to reach nearly 1.4 billion by 2025. This demographic shift directly translates into a substantial and expanding market for Artivion's offerings, as the need for advanced cardiovascular solutions grows in tandem with the aging demographic.

Increased public focus on cardiovascular health, coupled with a rise in lifestyle diseases like obesity and diabetes, directly fuels demand for sophisticated medical solutions. This growing awareness means more people are seeking advanced interventions for heart conditions.

The prevalence of these conditions is significant; for instance, in 2023, the CDC reported that over 37 million Americans had diabetes, and obesity rates continue to climb globally. This trend underscores the critical need for companies like Artivion, which provide specialized devices and tissue grafts essential for treating these expanding health challenges.

Patients are increasingly taking a more active role in their healthcare journey, seeking out information and expressing preferences for treatment options. This shift means companies like Artivion must consider how their products align with patient desires for less invasive procedures and better overall quality of life. For instance, a 2024 survey indicated that over 60% of patients would prefer a minimally invasive surgical option if available and equally effective.

This growing patient empowerment directly impacts product innovation and marketing strategies. Artivion's focus on cardiac and vascular solutions means understanding patient-reported outcomes and satisfaction metrics is paramount. By adapting offerings to meet these evolving demands, Artivion can enhance patient satisfaction and potentially see improved market adoption rates for its advanced medical devices.

Healthcare Access and Equity

Societal conversations about making healthcare more accessible and fair directly influence where and how advanced medical devices like those Artivion produces are used. As of 2024, there's a growing global emphasis on reducing disparities in healthcare outcomes, which could reshape market demand for specialized cardiovascular treatments.

Initiatives aimed at broadening access to cardiovascular care, especially in areas that have historically been underserved, represent significant growth potential for Artivion. For instance, the World Health Organization's efforts to strengthen primary healthcare systems in low- and middle-income countries by 2030 are expected to increase the need for essential medical technologies.

- Increased Demand: As healthcare systems focus on equity, demand for Artivion's minimally invasive solutions is likely to rise in previously neglected markets.

- Policy Influence: Government policies promoting universal healthcare coverage and access to specialized treatments will directly benefit companies like Artivion.

- Market Expansion: Expansion into emerging economies, driven by the need for improved cardiovascular care, offers new revenue streams.

Ethical Considerations in Medical Innovation

Societal attitudes towards medical innovations, especially those involving human tissues like Artivion's aortic grafts, significantly shape market adoption and regulatory pathways. Public trust is paramount, and ethical concerns regarding sourcing, consent, and patient outcomes can lead to increased scrutiny. For instance, in 2024, a significant portion of the public expressed concerns about the use of donor tissues in medical procedures, highlighting the need for transparent communication and robust ethical frameworks.

Artivion's commitment to ethical practices is crucial for navigating the complex landscape of medical device innovation. The company must demonstrate responsible stewardship of human tissues and advanced surgical techniques to foster public confidence and ensure regulatory compliance. By prioritizing patient safety and ethical sourcing, Artivion can mitigate potential backlash and build a strong reputation, which is essential for long-term success in the medical field.

Key ethical considerations for Artivion include:

- Transparency in tissue sourcing and donor consent processes.

- Ensuring equitable access to innovative treatments.

- Addressing potential biases in clinical trial data.

- Responsible marketing of new medical technologies.

The global population is aging, with over 1.2 billion people aged 60+ in 2024, a figure projected to hit nearly 1.4 billion by 2025. This demographic trend directly boosts demand for Artivion's cardiac and vascular solutions. Furthermore, increasing awareness of cardiovascular health and lifestyle diseases like diabetes, which affects over 37 million Americans as of 2023, fuels the need for advanced medical interventions.

Patients are becoming more proactive in their healthcare, with over 60% preferring minimally invasive options in 2024, influencing Artivion's product development and marketing. Societal pressure for healthcare equity is also driving demand for specialized treatments in underserved regions, aligning with global health initiatives aimed at improving access by 2030.

Public trust in medical innovations, particularly those involving human tissues, is critical. Artivion must maintain transparency in tissue sourcing and ethical practices to ensure market acceptance and regulatory compliance, especially given public concerns about tissue use voiced in 2024.

| Sociological Factor | Trend/Impact | Relevance to Artivion | Data Point (2024/2025) |

| Aging Population | Increasing demand for cardiovascular care | Directly drives market for Artivion's products | 1.2 billion+ people aged 60+ globally (2024), projected 1.4 billion by 2025 |

| Health Awareness & Lifestyle Diseases | Rise in conditions requiring intervention | Increases need for specialized medical devices | 37 million+ Americans with diabetes (2023) |

| Patient Empowerment | Preference for minimally invasive procedures | Influences product innovation and patient satisfaction | 60%+ patient preference for minimally invasive options (2024 survey) |

| Healthcare Equity Focus | Expansion into underserved markets | Creates new growth opportunities | WHO aims to strengthen primary healthcare systems by 2030 |

| Public Trust & Ethics | Scrutiny of tissue-based products | Requires transparency in sourcing and ethical conduct | Public concerns regarding tissue use noted in 2024 |

Technological factors

Continuous innovation in materials science, imaging, and surgical techniques is a significant technological driver for medical device companies like Artivion. These advancements enable the creation of more effective and less invasive cardiovascular repair solutions. For instance, the development of advanced biomaterials and robotic-assisted surgery platforms are transforming patient outcomes and treatment accessibility.

Artivion's strategic advantage hinges on its capacity to integrate these cutting-edge technological advancements into its product portfolio. By offering state-of-the-art devices for aortic, cardiac, and vascular repair, the company can meet evolving clinical needs. The global medical device market, projected to reach over $600 billion by 2025, underscores the immense opportunity for companies that can leverage technological progress.

Advancements in biomaterials and tissue engineering are significantly impacting the medical device sector, particularly for companies like Artivion that specialize in implantable human tissues. Innovations in biocompatibility and durability mean that Artivion's products, such as aortic grafts, can offer better patient outcomes and longer lifespans. For example, the development of bioresorbable scaffolds and advanced polymer coatings is enhancing integration with the body, potentially reducing rejection rates and improving healing processes.

Investing in and leveraging these technological leaps is paramount for Artivion to maintain its competitive edge. The company's commitment to research and development in these areas directly translates to improved product performance and the potential to explore new applications for its existing technologies. This focus ensures Artivion remains at the forefront of cardiovascular and regenerative medicine solutions.

The increasing adoption of digital health tools and AI in cardiovascular care is a significant technological trend. For instance, AI-powered diagnostic tools are becoming more prevalent, with the global AI in healthcare market projected to reach $188 billion by 2030, growing at a CAGR of 37.4% from 2023.

Artivion can leverage these advancements by integrating AI into its surgical planning software for better patient selection and procedural customization. Furthermore, wearable devices and remote patient monitoring platforms, which saw a surge in demand during the pandemic, offer opportunities to enhance post-operative care and track patient recovery more effectively.

The use of data analytics is also crucial for identifying trends and improving the efficacy of medical devices. Artivion's focus on innovative solutions means it can benefit from real-world data generated by its products to drive further product development and clinical insights, potentially leading to improved patient outcomes and operational efficiencies.

Minimally Invasive Surgical Techniques

The increasing adoption of minimally invasive surgical techniques in cardiovascular care is a significant technological driver for companies like Artivion. This trend necessitates continuous innovation in specialized medical devices that facilitate these less invasive procedures. For instance, by 2024, the global minimally invasive surgical instruments market was projected to reach over $35 billion, highlighting the substantial demand for such technologies.

Artivion's strategic focus must remain on developing and refining its product portfolio to align with these evolving surgical methods. These techniques are associated with improved patient outcomes, including quicker recovery times and shorter hospitalizations, which are increasingly valued by healthcare systems and patients alike.

The company's ability to provide cutting-edge solutions for minimally invasive cardiovascular interventions will be crucial for maintaining its competitive edge. This includes advancements in areas such as:

- Transcatheter aortic valve replacement (TAVR) devices: Supporting less invasive valve replacement procedures.

- Minimally invasive cardiac surgery (MICS) instruments: Enabling smaller incisions and reduced trauma.

- Advanced graft technologies: Facilitating complex reconstructions with minimal disruption.

Research and Development Investment

Artivion's commitment to research and development is critical for staying ahead in the fast-evolving medical device sector. This sustained investment fuels the creation of innovative solutions that meet changing healthcare needs and market opportunities.

The medical technology landscape demands constant innovation. Artivion's R&D spending directly impacts its ability to develop next-generation products, ensuring it remains competitive and addresses emerging clinical challenges.

For instance, Artivion reported $71.6 million in R&D expenses for the fiscal year ending December 31, 2023, representing a significant portion of its strategy to drive future growth and technological advancement.

- Innovation Pipeline: R&D investment directly supports the development of new and improved medical devices, such as advanced cardiac and vascular solutions.

- Competitive Advantage: Continuous innovation allows Artivion to differentiate its offerings and maintain a strong market position against competitors.

- Addressing Clinical Needs: Funds allocated to R&D enable the company to respond to unmet clinical needs and develop technologies that enhance patient outcomes.

Technological advancements in materials science and imaging are crucial for Artivion, driving the development of more effective cardiovascular repair solutions. The global medical device market's projected growth to over $600 billion by 2025 highlights the opportunities for tech-savvy companies.

Artivion's strategic edge lies in integrating innovations like AI in healthcare, a market expected to reach $188 billion by 2030, and minimally invasive surgical instruments, a market projected over $35 billion by 2024. These trends necessitate continuous R&D investment, with Artivion spending $71.6 million in 2023 to maintain its competitive edge and address evolving clinical needs.

Legal factors

Artivion navigates a complex web of global medical device regulations, necessitating adherence to standards like FDA approvals in the United States and CE Marking in Europe for market access. Failure to comply with these increasingly stringent and evolving rules, which cover everything from product design to manufacturing and sales, can severely hinder market entry and compromise patient safety.

Intellectual property, particularly patents, is crucial for Artivion's medical device innovations. The company actively seeks patent protection for its proprietary technologies, like its Thoraflex™ hybrid graft, to maintain a competitive edge. For instance, in late 2023, Artivion was involved in ongoing patent litigation concerning its BioGlue® surgical sealant, highlighting the significant legal risks associated with IP protection in its sector.

Artivion, like all medical device manufacturers, operates under strict product liability laws. If its heart valve or other implantable devices are found to be defective and cause patient harm, the company could face significant lawsuits. For instance, in 2023, the medical device industry saw continued scrutiny over product safety, with regulatory bodies like the FDA issuing recalls for various devices, underscoring the importance of robust quality management.

To navigate these legal waters, Artivion must prioritize adherence to stringent safety standards, such as those set by the FDA and international regulatory bodies. Thorough pre-market testing and ongoing post-market surveillance are essential. A strong quality control system, which was likely a key focus for Artivion in 2024, helps minimize the risk of defects and builds crucial patient and physician trust, directly impacting market acceptance and long-term viability.

Data Privacy and Security Laws

Artivion, operating in the healthcare sector, must navigate a complex web of data privacy and security laws. Compliance with regulations like the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe is paramount. These laws mandate stringent measures for protecting sensitive patient information and ensuring data integrity.

Failure to adhere to these legal frameworks can result in substantial financial penalties and severe reputational damage. For instance, HIPAA violations can lead to fines ranging from $100 to $50,000 per violation, with annual maximums reaching $1.5 million. GDPR penalties are even more significant, with fines up to €20 million or 4% of annual global turnover, whichever is higher. This underscores the critical need for robust data protection strategies within Artivion's operations.

- HIPAA Fines: Up to $1.5 million annually for repeated violations.

- GDPR Fines: Up to €20 million or 4% of global annual turnover.

- Data Breach Impact: Significant financial and reputational costs.

- Legal Imperative: Safeguarding patient information is a core requirement.

Anti-Trust and Competition Laws

Artivion must strictly adhere to anti-trust and competition laws to ensure fair market operations. These regulations are designed to prevent monopolies and promote a level playing field for all businesses. For instance, in 2024, the U.S. Federal Trade Commission (FTC) continued its focus on challenging mergers that could harm competition, a trend expected to persist.

Any significant mergers, acquisitions, or attempts to gain substantial market dominance by Artivion could attract close examination from regulatory bodies like the FTC or the European Commission. Navigating these legal frameworks is crucial to avoid hefty fines and maintain the company's ability to compete effectively. In 2023, the FTC filed numerous lawsuits to block mergers across various industries, signaling an aggressive stance on antitrust enforcement that will likely continue into 2024 and 2025.

- Regulatory Scrutiny: Artivion's strategic moves, particularly acquisitions, are subject to review by competition authorities globally.

- Compliance Costs: Ensuring compliance with evolving antitrust legislation incurs legal fees and requires dedicated internal resources.

- Market Share Limits: Laws may restrict Artivion's ability to acquire competitors or engage in practices that unduly limit competition, impacting growth strategies.

- Global Enforcement Trends: Increased antitrust enforcement worldwide, as seen in 2024 with significant merger challenges, necessitates proactive legal counsel for Artivion.

Artivion's operations are heavily influenced by global medical device regulations, requiring adherence to standards like FDA approvals and CE Marking for market access. Non-compliance with these evolving rules can significantly impede market entry and compromise patient safety, a critical consideration for 2024 and beyond.

Intellectual property, especially patents, is vital for Artivion's innovation, as seen with its Thoraflex™ graft. The company's involvement in patent litigation, such as the 2023 BioGlue® case, highlights the substantial legal risks in protecting proprietary technologies.

Product liability laws pose a significant risk for Artivion. Defective devices causing patient harm could lead to major lawsuits, a concern amplified by increased regulatory scrutiny on product safety, as evidenced by FDA recalls in 2023.

Data privacy laws like HIPAA and GDPR are paramount for Artivion, demanding robust protection of patient information. HIPAA violations can incur fines up to $1.5 million annually, while GDPR penalties can reach €20 million or 4% of global turnover, emphasizing the critical need for data security.

Antitrust and competition laws require Artivion to ensure fair market operations, avoiding practices that could lead to regulatory scrutiny. The FTC's aggressive stance on challenging mergers in 2024, a trend likely continuing into 2025, necessitates careful navigation of these legal frameworks.

Environmental factors

Artivion, like all medical device manufacturers, faces stringent regulations concerning the waste generated from producing and utilizing its products, particularly implantable human tissues. These rules are designed to protect public health and the environment. Failure to comply can result in significant penalties.

In 2024, the global healthcare waste management market was valued at approximately $30 billion, with a projected compound annual growth rate of around 4.5% through 2030, reflecting the increasing focus on proper disposal. Artivion must invest in robust waste management systems and processes to adhere to these evolving environmental standards, ensuring responsible disposal practices and mitigating risks of fines or operational disruptions.

Artivion's supply chain, encompassing everything from sourcing raw materials to delivering finished medical devices, inherently carries an environmental impact. This footprint includes emissions from manufacturing processes and the transportation of goods across global networks.

Increasingly, stakeholders are scrutinizing and demanding transparency regarding the environmental performance of Artivion's suppliers and logistics partners. For instance, the company's reliance on air and sea freight for international distribution contributes to carbon emissions, a key area for sustainability focus.

In 2023, the global logistics industry was responsible for approximately 10% of total greenhouse gas emissions, highlighting the significant environmental considerations for companies like Artivion. Proactive management of these factors, including optimizing shipping routes and exploring lower-emission transport options, is crucial for Artivion's long-term environmental stewardship.

Artivion, like other medical device manufacturers, faces increasing scrutiny regarding its environmental footprint. There's a significant push for companies to adopt sustainable manufacturing practices, focusing on reducing energy consumption, water usage, and the generation of hazardous waste. For example, the medical device industry, in general, is exploring ways to cut down on its substantial waste streams, with some estimates suggesting a significant portion of medical waste is non-infectious and could be recycled or repurposed.

By embracing eco-friendly production methods, Artivion has a clear opportunity to bolster its brand image among environmentally conscious stakeholders and potentially achieve operational cost reductions. A 2024 report indicated that companies prioritizing sustainability saw, on average, a 3% improvement in operational efficiency, directly linked to resource conservation efforts.

Climate Change and Resource Availability

Climate change poses indirect risks to Artivion, potentially disrupting its supply chain through extreme weather. For instance, the increasing frequency of severe storms in regions where key raw materials are sourced could lead to shortages and price volatility. Ensuring operational resilience against these climate-related risks is a critical long-term environmental consideration for the company.

Artivion's reliance on specific materials means that changes in resource availability due to climate impacts, such as prolonged droughts affecting agricultural inputs or water scarcity impacting manufacturing processes, could affect production costs and capacity. The company's sustainability reports for 2023 and projections for 2024 indicate an ongoing assessment of these vulnerabilities.

Key environmental considerations for Artivion include:

- Supply Chain Vulnerability: Assessing and mitigating the impact of extreme weather events on the availability and cost of raw materials.

- Resource Scarcity: Monitoring and adapting to potential changes in the availability of water and other essential resources impacting manufacturing.

- Operational Resilience: Investing in infrastructure and processes that can withstand climate-related disruptions.

- Regulatory Adaptation: Staying ahead of evolving environmental regulations related to climate change and resource management.

Environmental, Social, and Governance (ESG) Reporting

Artivion, like many companies in the medical technology sector, is experiencing increased scrutiny regarding its Environmental, Social, and Governance (ESG) performance. Investors and stakeholders are increasingly prioritizing companies with strong sustainability practices, which can translate into pressure for more transparent reporting on Artivion's environmental initiatives, such as waste reduction and energy consumption in its manufacturing processes.

A robust ESG strategy can be a significant differentiator. For instance, a 2024 report by Morningstar indicated that sustainable funds, a category often driven by strong ESG principles, continued to attract substantial inflows, demonstrating investor appetite for companies demonstrating responsible operations. Artivion's commitment to ESG can therefore enhance its corporate reputation and attract a wider pool of capital from responsible investors.

Key areas of focus for Artivion's ESG reporting may include:

- Environmental Impact: Tracking and reporting on carbon emissions, water usage, and waste management across its global operations.

- Social Responsibility: Detailing efforts in employee well-being, diversity and inclusion, and ethical supply chain management.

- Governance Practices: Ensuring transparent board oversight, executive compensation alignment, and robust risk management frameworks.

Artivion must navigate evolving environmental regulations, particularly concerning medical waste disposal, a market valued at approximately $30 billion in 2024 and growing. The company's global supply chain, from sourcing to delivery, contributes to its carbon footprint, with the logistics sector alone accounting for about 10% of global greenhouse gas emissions in 2023. Prioritizing sustainable manufacturing and resource conservation, as seen in a 2024 report showing a 3% efficiency gain for sustainability-focused companies, can enhance Artivion's brand and operational efficiency.

Climate change introduces risks like supply chain disruptions from extreme weather and resource scarcity, impacting raw material availability and manufacturing costs. Artivion's 2023 and 2024 sustainability assessments reflect an ongoing evaluation of these vulnerabilities, emphasizing the need for operational resilience and adaptation to changing resource availability.

Investor focus on ESG performance is driving demand for transparency in environmental initiatives like waste reduction and energy use. Companies demonstrating strong sustainability practices, as evidenced by the continued inflows into sustainable funds in 2024, can attract more capital and improve their corporate reputation.

| Environmental Factor | 2023/2024 Data Point | Implication for Artivion |

|---|---|---|

| Medical Waste Management Market Value | ~$30 billion (2024) | Need for robust compliance and investment in disposal systems. |

| Logistics Sector Greenhouse Gas Emissions | ~10% of global total (2023) | Focus on optimizing shipping and reducing transport emissions. |

| Sustainability-Driven Efficiency Gains | ~3% average improvement | Opportunity to reduce operational costs through eco-friendly practices. |

| Sustainable Fund Inflows | Continued strong trend (2024) | Enhanced corporate reputation and access to capital for strong ESG performers. |

PESTLE Analysis Data Sources

Our Artivion PESTLE Analysis is informed by a comprehensive blend of data, including reports from leading market research firms, government regulatory updates, and economic indicators from international bodies. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.