Alight Solutions SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alight Solutions Bundle

Alight Solutions leverages its strong market presence and comprehensive benefits administration platform as key strengths, but faces challenges from intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Alight Solutions' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Alight Solutions boasts an extensive portfolio of cloud-based human capital solutions, covering everything from benefits administration and payroll to HR and employee wellbeing. This integrated digital strategy addresses the entire employee journey, offering clients a complete and cohesive package. For instance, in 2023, Alight reported a significant increase in its cloud-based revenue, underscoring the market's strong adoption of these digital HR tools.

Alight Solutions boasts a robust client roster, serving numerous Fortune 500 companies and managing benefits for over 35 million individuals and their dependents. This extensive reach underscores the company's market penetration and the essential nature of its services.

A key strength lies in its high proportion of recurring revenue, a testament to the sticky nature of its client relationships and service offerings. In Q4 2024, recurring revenue constituted an impressive 90.7% of total revenue, climbing even higher to 94.9% in Q1 2025. This predictable revenue stream provides significant financial stability and supports consistent earnings growth.

Alight Solutions has made substantial strides in its technology modernization, culminating in a multi-year initiative that significantly bolsters its AI capabilities. Central to this effort is the Alight LumenAI™ engine, a testament to the company's commitment to leveraging artificial intelligence for enhanced service delivery.

This strategic focus on AI and automation is already yielding tangible benefits. For instance, automated spending account claims and streamlined mobile reimbursement processes are not just improving efficiency and accuracy but also directly contributing to a more positive and seamless employee experience, a critical factor in today's competitive talent landscape.

Strategic Divestiture and Financial Optimization

Alight Solutions' strategic divestiture of its Payroll and Professional Services business, completed in July 2024, significantly streamlines its operational focus. This move is designed to sharpen Alight's concentration on its core employee wellbeing and benefits platform, a key growth area.

The divestiture is projected to yield substantial financial benefits, including an improved profit margin and enhanced cash flow. These improvements are anticipated to fuel more robust and profitable growth throughout 2025, reinforcing Alight's market position.

- Strategic Focus: Divested Payroll and Professional Services in July 2024 to concentrate on core wellbeing and benefits platform.

- Financial Enhancement: Expected to accelerate financial profile, improve profit margins, and boost cash flow.

- Growth Acceleration: Positioned for more profitable growth in 2025 following the strategic simplification.

Commitment to Employee Wellbeing and Industry Recognition

Alight Solutions demonstrates a strong commitment to its employees, earning significant industry recognition. This focus on wellbeing is a key differentiator, attracting clients who prioritize their workforce's holistic health. For instance, Alight was named one of Newsweek's America's Greatest Workplaces for Mental Wellbeing in 2025, and was also recognized as a Fortune 100 Best Companies to Work For® in 2024. These accolades highlight Alight's proactive approach to fostering a supportive work environment.

The company actively promotes mental health initiatives and provides personalized wellbeing solutions. This dedication translates into tangible benefits, such as improved employee morale and retention, which directly impacts client satisfaction and service delivery. Alight's investment in its people underscores its understanding that a healthy workforce is crucial for sustained business success.

- Industry Recognition: Named a Fortune 100 Best Companies to Work For® in 2024 and Newsweek's America's Greatest Workplaces for Mental Wellbeing in 2025.

- Employee Wellbeing Focus: Actively promotes mental health and offers personalized wellbeing solutions.

- Client Attraction: Appeals to clients prioritizing their workforce's holistic health and wellbeing.

Alight's strength lies in its comprehensive suite of cloud-based human capital solutions, covering the entire employee lifecycle from benefits to payroll. This integrated approach, exemplified by significant cloud revenue growth in 2023, demonstrates strong market adoption of its digital HR tools.

The company's substantial client base, serving over 35 million individuals and many Fortune 500 companies, highlights its market penetration and the critical nature of its services. This broad reach is further solidified by a high proportion of recurring revenue, which reached 94.9% in Q1 2025, ensuring financial stability and consistent earnings.

Alight's strategic divestiture of its Payroll and Professional Services business in July 2024 sharpens its focus on its core wellbeing and benefits platform, a key growth area. This move is expected to improve profit margins and cash flow, positioning the company for accelerated, more profitable growth throughout 2025.

Furthermore, Alight's investment in AI, particularly through its Alight LumenAI™ engine, enhances service delivery, as seen in automated claims processing, improving both efficiency and employee experience. The company's commitment to employee wellbeing is also a significant strength, recognized by accolades such as Fortune 100 Best Companies to Work For® in 2024 and Newsweek's America's Greatest Workplaces for Mental Wellbeing in 2025.

What is included in the product

Delivers a strategic overview of Alight Solutions’s internal and external business factors, highlighting its strengths in technology and market position, while addressing weaknesses in integration and opportunities in global expansion and threats from competition.

Offers a clear, actionable framework to address Alight Solutions' strategic challenges and capitalize on opportunities.

Weaknesses

Multiple customer reviews highlight significant dissatisfaction with Alight's customer service. Common complaints include long wait times to connect with representatives, frustrating automated systems, lost client documents, and difficulties processing claims and withdrawals. This persistent feedback points to a clear weakness in their client support infrastructure.

This ongoing client dissatisfaction could directly impact Alight's ability to retain existing customers and attract new ones. For instance, a negative customer experience can lead to churn, and word-of-mouth referrals are crucial for growth in the benefits administration sector, a sector where trust and reliability are paramount.

Alight Solutions faced a revenue downturn in late 2024 and early 2025. Specifically, Q4 2024 and the full year 2024 saw revenue declines, a trend that continued into Q1 2025. This contraction was largely attributed to reduced project revenue and less favorable net commercial activity.

While Alight projects a rebound to revenue growth in the latter half of 2025, these recent negative trends highlight ongoing hurdles in achieving consistent top-line expansion. The company's ability to reverse this pattern will be crucial for its financial health.

Some client feedback suggests Alight Solutions can be perceived as bureaucratic, with rigid processes hindering staff from resolving complex issues effectively. This inflexibility, as noted in various reviews, can lead to client frustration and impact the efficiency of service delivery.

Dependence on Technology and Digital Infrastructure

Alight's reliance on advanced technology, including cloud infrastructure and AI, presents a potential vulnerability. Disruptions to this digital backbone or issues with its accessibility could significantly impact service delivery. For instance, if a major cloud provider experiences an outage, Alight's operations could be temporarily halted, affecting millions of users.

Furthermore, not all of Alight's clients or their employees possess the same level of digital literacy or access to reliable internet. Companies with less sophisticated IT systems or workforces unaccustomed to digital platforms may struggle to fully adopt and benefit from Alight's comprehensive solutions. This could lead to underutilization of features and a suboptimal user experience, hindering the perceived value of Alight's offerings.

- Technological Dependency: Alight's operations are intrinsically linked to the stability and performance of its cloud-based technology and AI systems.

- Client Digital Readiness: A significant weakness is the potential for clients and their employees to have varying degrees of digital capability, impacting their ability to fully leverage Alight's platforms.

- User Experience Impact: Organizations with lower digital maturity might encounter challenges navigating Alight's advanced features, potentially diminishing the overall user experience and adoption rates.

Market Share Compared to Larger Competitors

As of the first quarter of 2025, Alight Solutions holds a considerably smaller market share within the professional services industry when contrasted with behemoths like Accenture Plc. This disparity highlights a fiercely competitive environment where established, larger entities command a more substantial presence.

This smaller market share can present hurdles for Alight, potentially restricting its ability to capture significant portions of certain market segments or influence industry standards as readily as its larger rivals. The dominance of key competitors means Alight must navigate a landscape where market penetration and customer acquisition might require more strategic effort.

- Market Share Disparity: Alight's market share in professional services is notably less than industry leaders like Accenture as of Q1 2025.

- Competitive Landscape: Larger competitors maintain a dominant position, posing a significant challenge to Alight's growth.

- Growth Limitations: The competitive advantage of larger players may limit Alight's expansion opportunities in specific service areas.

Alight's customer service has been a consistent pain point, with numerous complaints about long wait times, ineffective automated systems, and issues with document handling and transactions. This ongoing dissatisfaction directly impacts customer retention and the acquisition of new clients, as trust and reliability are critical in the benefits administration sector.

The company experienced a revenue decline in late 2024 and early 2025, primarily due to reduced project revenue and less favorable net commercial activity. While a rebound is projected for the latter half of 2025, these recent trends indicate persistent challenges in achieving steady revenue growth.

Alight's operational efficiency is sometimes hampered by bureaucratic processes, making it difficult for staff to resolve complex client issues promptly. This inflexibility can lead to client frustration and a less than optimal service delivery experience.

As of Q1 2025, Alight Solutions holds a smaller market share in professional services compared to industry leaders like Accenture. This competitive disadvantage can limit Alight's ability to capture market segments and influence industry standards, requiring more strategic efforts for customer acquisition and expansion.

Preview Before You Purchase

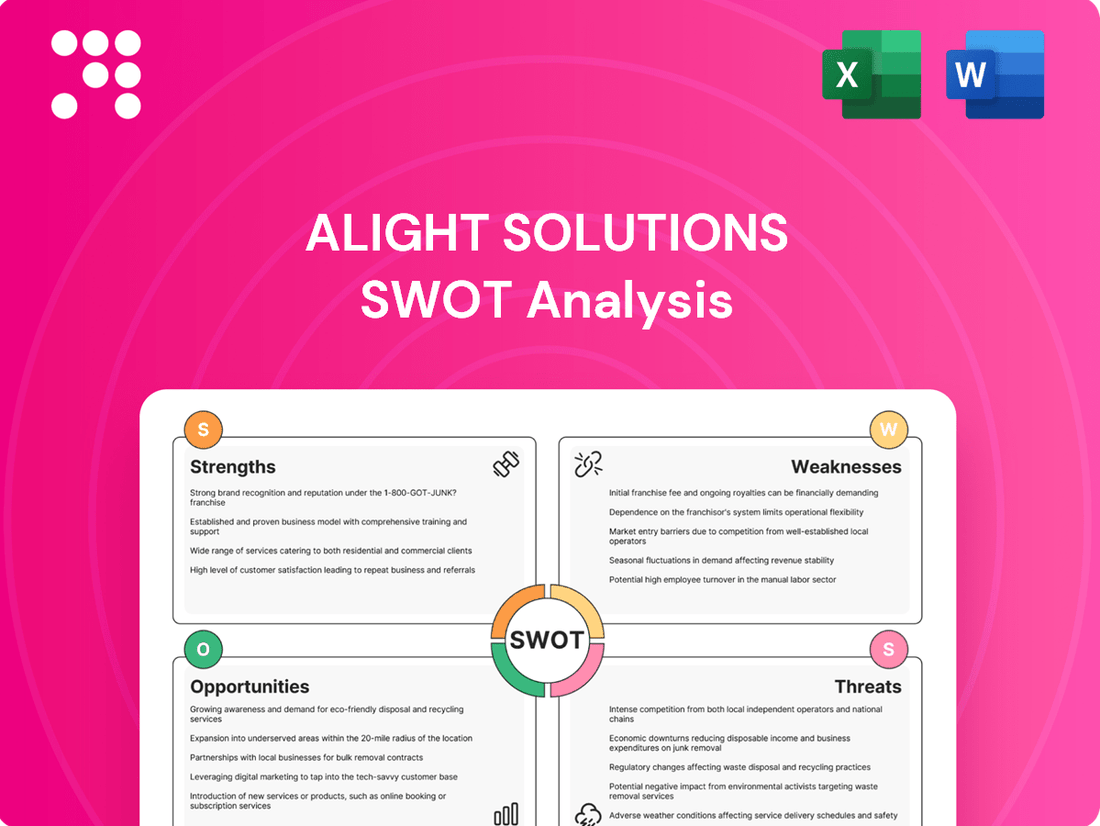

Alight Solutions SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Alight Solutions' Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key factors influencing Alight Solutions' market position and future growth potential.

This preview reflects the real document you'll receive—professional, structured, and ready to use. It highlights Alight Solutions' competitive advantages and areas for improvement, enabling informed decision-making.

Opportunities

Alight has a significant opportunity to expand its integrated digital solutions, particularly by enhancing its Alight Worklife® platform and its Alight LumenAI™ engine. This focus on digital integration is crucial for meeting the growing market demand.

Continued investment in AI-driven insights and automation is key. For example, in Q1 2024, Alight reported a 10% increase in its Worklife platform engagement, highlighting the positive reception of its digital offerings. This growth suggests a strong appetite for seamless, personalized employee benefits experiences.

By further developing AI capabilities, Alight can attract new clients and strengthen ties with existing ones. The company's commitment to innovation in this area is evident, with a projected 15% increase in AI-related feature development for 2024, aimed at delivering more sophisticated and user-friendly solutions.

Employers are significantly increasing their investment in financial wellbeing programs, with almost 60% planning enhancements in 2025, moving beyond just retirement savings. This presents a substantial opportunity for Alight Solutions to broaden its service portfolio by offering integrated solutions covering budgeting, debt management, and broader financial literacy.

By developing and marketing these holistic financial wellbeing tools, Alight can tap into this growing employer demand, thereby expanding its market presence and customer base. This strategic focus aligns with the evolving needs of the workforce, making Alight a more comprehensive partner for businesses seeking to support their employees' overall financial health.

Alight Solutions can significantly boost its business by broadening its partner network. A prime example is their collaboration with Lyra Health, which aims to deliver comprehensive mental health solutions for the workforce. This type of integration is key to expanding service offerings.

By fostering an ecosystem of solutions through strategic alliances, Alight can offer a more extensive range of employee benefits and more robust administrative support. This approach not only enhances the employee experience but also presents opportunities for employers to realize greater cost savings, a critical factor in the current economic climate.

Capitalizing on Post-Divestiture Focus and Improved Financial Profile

Alight Solutions' divestiture of its Payroll and Professional Services business in late 2023 has sharpened its strategic direction, allowing it to concentrate entirely on its core wellbeing and benefits offerings. This simplification is expected to yield a stronger financial profile, with projected improvements in profit margins and cash flow anticipated for 2025. This enhanced financial flexibility creates a significant opportunity to strategically reinvest in key growth initiatives, bolster technological capabilities, and more effectively pursue synergistic acquisitions.

The company's refined focus is poised to unlock several key opportunities:

- Enhanced Investment Capacity: With a more streamlined business, Alight can allocate greater resources to innovation and product development within its wellbeing and benefits segments.

- Improved Profitability: The divestiture is anticipated to lead to higher overall profit margins, as the company sheds lower-margin service lines. For instance, the company has previously highlighted the potential for margin expansion following such strategic moves.

- Strategic Acquisition Potential: A stronger balance sheet and clearer strategic focus make Alight a more attractive partner for targeted acquisitions that complement its core business, potentially accelerating market penetration and service expansion.

- Accelerated Growth Trajectory: By concentrating on its core strengths, Alight can pursue a more aggressive and focused growth strategy, aiming to capture greater market share in the burgeoning wellbeing and benefits sector.

Addressing Evolving Employer Needs for Employee Experience

The market's persistent demand for enhanced employee experiences, talent optimization, and improved business results presents a significant opportunity for Alight Solutions. By leveraging its cloud-based platform, Alight can further solidify its position by showcasing how its personalized benefits management and data-driven insights deliver tangible return on investment and boost employee engagement for clients.

This focus allows Alight to capitalize on the growing trend of employers prioritizing holistic employee well-being and productivity. For instance, in 2024, a significant percentage of companies reported increasing their investment in employee experience initiatives, recognizing its direct link to retention and performance.

- Market Demand: Employers are actively seeking solutions to improve employee experience and talent management.

- Alight's Advantage: Its cloud platform and personalized benefits approach directly meet these evolving needs.

- Differentiation: Demonstrating clear ROI and enhanced employee engagement will be key to capturing market share.

- Data-Driven Insights: Alight's ability to provide actionable data further strengthens its value proposition to clients.

Alight Solutions has a significant opportunity to expand its integrated digital solutions, particularly by enhancing its Alight Worklife® platform and its Alight LumenAI™ engine, as the market shows a strong appetite for seamless, personalized employee benefits experiences. Continued investment in AI-driven insights and automation is key, with Q1 2024 seeing a 10% increase in Worklife platform engagement, signaling positive reception.

The company can capitalize on the growing employer investment in financial wellbeing programs, with nearly 60% planning enhancements in 2025, moving beyond retirement savings. By developing holistic financial wellbeing tools, Alight can tap into this demand, expanding its market presence and customer base by offering integrated solutions for budgeting and debt management.

Broadening its partner network, exemplified by the collaboration with Lyra Health for mental health solutions, allows Alight to offer a more extensive range of employee benefits and robust administrative support, enhancing the employee experience and providing cost savings for employers.

Following the divestiture of its Payroll and Professional Services business in late 2023, Alight can concentrate on its core wellbeing and benefits offerings, leading to projected improvements in profit margins and cash flow for 2025. This refined focus enables greater investment in innovation, potential for strategic acquisitions, and an accelerated growth trajectory in the burgeoning wellbeing and benefits sector.

Threats

The human capital management (HCM) and benefits administration sector is a fiercely contested arena, witnessing constant innovation from both seasoned providers and emerging companies. This intense competition presents a significant challenge for Alight Solutions, potentially impacting its pricing strategies and ability to capture new clients.

Key competitors such as Accenture Plc, Automatic Data Processing Inc. (ADP), and Workday Inc. are actively vying for market share. For instance, Workday's strong cloud-based HCM platform and continuous feature development pose a direct threat, as seen in their reported revenue growth in recent fiscal periods, which can pressure Alight's market positioning and client retention efforts.

Persistent negative customer reviews concerning service quality, administrative errors, and communication breakdowns present a substantial threat to Alight's reputation and ability to retain clients. For instance, a significant portion of customer complaints in late 2024 and early 2025 have centered on delays in benefit processing and inaccuracies in employee data management, directly impacting client satisfaction.

Failure to effectively address these ongoing issues could lead to increased client churn, making it considerably harder to attract new business. This erosion of trust directly impacts Alight's revenue streams and overall market standing, potentially hindering growth prospects in a competitive benefits administration landscape.

Economic instability, marked by rising inflation and potential recessionary fears in late 2024 and early 2025, can directly impact Alight's clients. Increased layoffs and widespread employee burnout are forcing organizations to scrutinize their expenditures, leading to tighter budgetary constraints. This financial pressure often translates to reduced spending on non-essential services, including HR and benefits outsourcing.

Consequently, Alight may face a scenario where client organizations actively seek more cost-effective solutions or even scale back their reliance on comprehensive service providers. For instance, if a significant portion of Alight's client base operates in sectors heavily impacted by economic slowdowns, such as retail or hospitality, the demand for their services could see a noticeable dip. This could directly affect Alight's revenue streams and hinder its projected growth for the 2024-2025 period.

Data Security and Privacy Concerns

As a provider of cloud-based human capital technology, Alight Solutions handles a vast amount of sensitive employee data, making it a prime target for cyber threats. The increasing sophistication of cyberattacks poses a significant risk of data breaches and privacy violations. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, a figure that underscores the potential financial and reputational damage Alight could face.

A major security incident could have severe repercussions for Alight. Beyond the direct financial costs of remediation and potential regulatory fines, a breach could erode client trust, leading to customer churn and a loss of future business. The company's reputation as a secure custodian of employee information is paramount to its value proposition.

- Reputational Damage: A data breach can severely tarnish Alight's image, making it difficult to attract and retain clients.

- Legal and Regulatory Penalties: Violations of data privacy laws, such as GDPR or CCPA, can result in substantial fines.

- Loss of Client Trust: Clients entrust Alight with their most sensitive employee data, and a breach would shatter that trust.

Rapid Technological Advancements and Disruption

The relentless march of technology, especially in areas like artificial intelligence and cloud infrastructure, poses a significant challenge for Alight Solutions. While the company is actively investing in AI, the speed of innovation means there's a constant risk of falling behind. Competitors introducing disruptive technologies could quickly make Alight's offerings less relevant or competitive.

This necessitates ongoing, substantial investment in research and development to ensure Alight's solutions remain cutting-edge. For instance, the global AI market was valued at approximately $136.6 billion in 2022 and is projected to reach over $1.8 trillion by 2030, highlighting the immense growth and competitive pressure in this space. Failure to adapt could see Alight's market share erode.

- Technological Obsolescence: Competitors leveraging newer AI models or more efficient cloud architectures could offer superior performance or cost savings, making Alight's current platforms less attractive.

- Disruptive Innovation: A competitor might introduce a novel approach to benefits administration or HR technology that fundamentally changes customer expectations, requiring Alight to rapidly re-engineer its services.

- R&D Investment Strain: The need for continuous innovation places a significant financial burden on R&D, potentially diverting resources from other critical business areas if not managed effectively.

- Talent Acquisition: Keeping pace also requires attracting and retaining top tech talent, a competitive and costly endeavor in the current market.

Alight faces significant threats from intense competition, with major players like Workday and ADP continuously innovating their HCM platforms. Persistent customer complaints regarding service quality and administrative errors, particularly concerning benefit processing delays and data inaccuracies noted in late 2024 and early 2025, directly jeopardize client retention and Alight's market standing.

Economic downturns, including inflation and recession fears prevalent in late 2024 and early 2025, pressure clients to cut costs, potentially reducing demand for Alight's services. Furthermore, the ever-present and growing threat of sophisticated cyberattacks poses a severe risk of data breaches, with the global average cost of a breach reaching $4.45 million in 2024, which could lead to substantial financial penalties and irreparable reputational damage.

The rapid pace of technological advancement, especially in AI, creates a risk of obsolescence if Alight fails to invest sufficiently in R&D, potentially losing ground to competitors offering more cutting-edge solutions. Keeping pace also requires significant investment in attracting and retaining skilled tech talent, adding to operational costs.

SWOT Analysis Data Sources

This Alight Solutions SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of the company's internal capabilities and external market positioning.