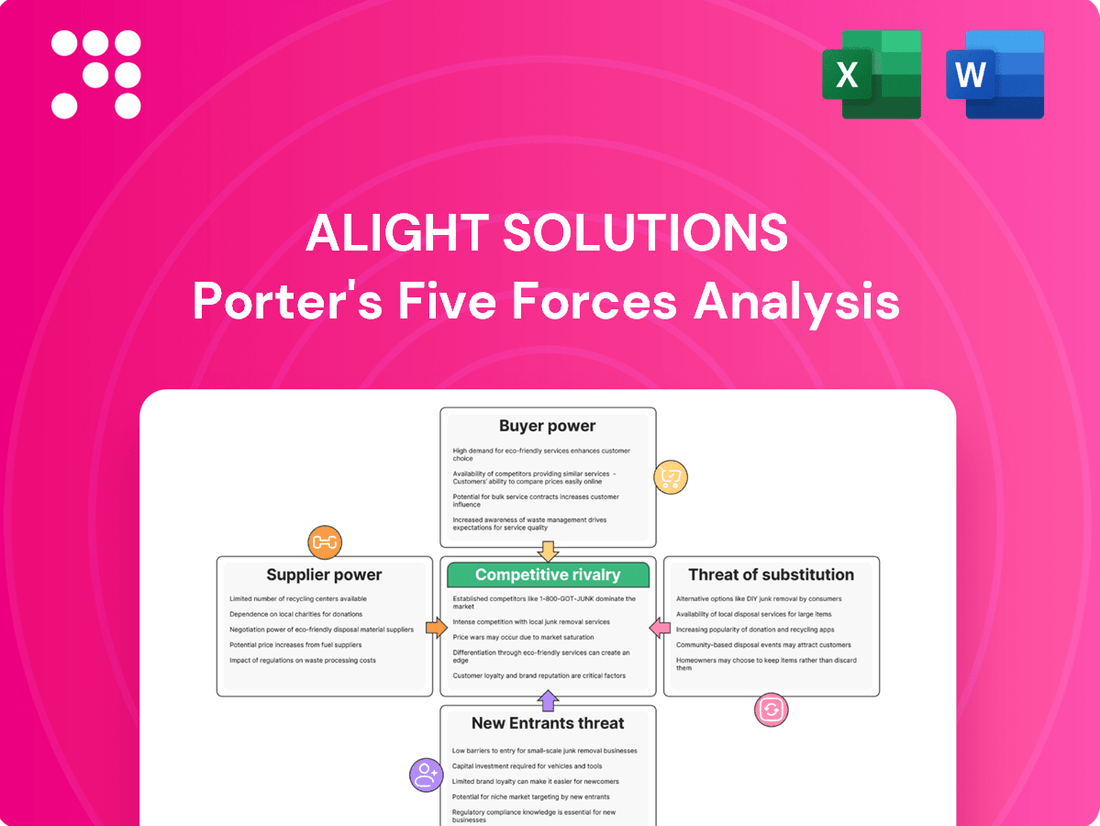

Alight Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alight Solutions Bundle

Alight Solutions navigates a complex landscape shaped by intense rivalry and the growing power of buyers. Understanding these forces is crucial for any stakeholder. The complete report reveals the real forces shaping Alight Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Alight Solutions depends on specialized technology vendors for critical elements like cloud infrastructure and advanced analytics. The bargaining power of these suppliers is often moderate to high, particularly when their technologies are proprietary or offer unique features that are hard to replace, which are vital for Alight's comprehensive service offerings.

The significant switching costs associated with changing major cloud providers or core software vendors represent a key factor in supplier bargaining power. These costs encompass data migration, complex system re-integration, and the necessary retraining of Alight's workforce, making it challenging and expensive to change suppliers.

The availability of highly skilled professionals in human capital management, cloud technology, data science, and AI development forms a crucial supplier group for Alight Solutions. The demand for these specialized skills is exceptionally high within the rapidly expanding HR technology market. For instance, in 2024, the global HR tech market was valued at approximately $35 billion, with a projected compound annual growth rate (CAGR) of over 10% through 2030, indicating intense competition for talent.

This strong demand empowers skilled employees and consulting firms offering such expertise with significant bargaining power. They can negotiate higher compensation packages and more favorable project terms, directly impacting Alight's operational costs and its ability to maintain a rapid pace of innovation. This leverage means Alight must strategically manage its talent acquisition and retention to mitigate the financial and strategic implications of this supplier power.

Data and analytics providers wield significant bargaining power over companies like Alight Solutions. These suppliers offer unique, comprehensive, or real-time data sets and advanced analytics platforms that are crucial for delivering actionable insights and enhancing employee experiences. For instance, the market for specialized HR analytics software and data aggregation services is increasingly consolidated, meaning fewer providers can offer the depth and breadth of information Alight relies on.

The ability of these suppliers to furnish critical information that directly boosts Alight's service value proposition grants them leverage. This leverage can translate into higher costs for data access or analytics tools, or necessitate specific, potentially restrictive, contractual agreements. In 2024, the demand for sophisticated people analytics, particularly around employee well-being and productivity, has surged, further strengthening the hand of data providers who can meet these specialized needs.

Regulatory Compliance and Legal Experts

The bargaining power of suppliers, particularly regulatory compliance and legal experts, is substantial for companies like Alight Solutions. This is due to the intricate and ever-changing web of regulations governing benefits, payroll, and human resources across different countries and regions. Specialized legal and advisory firms that offer current regulatory insights and robust compliance frameworks wield significant influence because their knowledge is essential for Alight's operations.

Alight's imperative to maintain strict adherence to these complex regulations renders these expert suppliers indispensable. For instance, in 2024, the global regulatory landscape continued to see significant updates, including new data privacy laws in several jurisdictions and evolving compliance requirements for employee benefits administration. These changes necessitate constant vigilance and expert interpretation, thereby strengthening the suppliers' position.

- Critical Need for Expertise: Companies like Alight rely heavily on specialized legal and compliance firms to navigate complex HR and benefits regulations, making these suppliers crucial.

- Regulatory Volatility: The dynamic nature of global regulations, with frequent updates in areas like data privacy and employee benefits, amplifies the dependence on expert suppliers.

- High Switching Costs: The cost and effort involved in finding, vetting, and integrating new legal and compliance partners can be substantial, further solidifying the power of existing, trusted suppliers.

Consulting and Implementation Partners

Alight Solutions, while primarily a service provider, may engage consulting and implementation partners for specialized client projects. The bargaining power of these partners hinges on their unique skills, market standing, and the overall demand for their specific expertise. For instance, a partner with deep knowledge in a particular cloud migration technology or a proven track record with a specific industry segment could exert significant influence.

These partners can leverage their specialized capabilities to negotiate higher service fees or more advantageous contract terms. The reliance of Alight on these partners for niche solutions or to scale operations for large implementations directly translates into their bargaining leverage. If a partner holds a critical piece of intellectual property or a proprietary methodology, their power is further amplified.

- Niche Expertise: Partners with highly specialized skills in areas like AI-driven HR analytics or complex benefits administration platforms can command premium rates.

- Reputation and Track Record: Firms with a strong reputation for successful, on-time, and within-budget project delivery have greater negotiating power.

- Client Relationships: Partners who have built strong, direct relationships with Alight's clients can leverage these connections to their advantage.

- Demand for Services: When demand for specific implementation skills outstrips supply, partners offering those services gain increased bargaining power.

The bargaining power of suppliers for Alight Solutions is a significant factor, particularly concerning specialized technology and skilled human capital. Proprietary technologies and high switching costs empower vendors, while the intense demand for HR tech expertise in 2024, a market valued at approximately $35 billion, gives skilled professionals considerable leverage.

Data and analytics providers also hold substantial power, as their unique datasets and advanced platforms are crucial for Alight's service delivery. The increasing consolidation in this market, coupled with a surge in demand for people analytics in 2024, strengthens these suppliers' negotiating positions, potentially leading to higher costs and specific contractual demands.

Furthermore, regulatory compliance and legal experts represent a critical supplier group. The complex and evolving global regulatory landscape, with frequent updates in data privacy and benefits administration in 2024, makes these specialized knowledge providers indispensable, amplifying their bargaining power.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Alight Solutions' position in the HR and benefits administration market.

Alight Solutions' Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces, perfect for quick decision-making and immediate understanding of strategic pressure.

Customers Bargaining Power

Alight Solutions' large enterprise client base significantly influences its bargaining power. Serving many of the world's largest organizations means these clients are concentrated and highly influential. For instance, in 2023, Alight reported that its top 10 clients represented a substantial portion of its revenue, underscoring their collective leverage.

These major clients wield considerable purchasing power due to the sheer volume of services they procure. This allows them to negotiate favorable terms, pricing, and service level agreements, often demanding customized solutions and competitive rates that Alight must consider.

While customers can choose from various providers, the cost and effort involved in switching Alight Solutions' human capital technology and services are significant. This includes the complex process of migrating HR, payroll, and benefits data, reconfiguring integrated systems, and retraining personnel, all of which demand substantial time and resources, potentially causing operational disruption.

These high switching costs effectively limit the immediate bargaining power of Alight's existing customer base. Once a client is deeply integrated with Alight's platform, the financial and operational hurdles to move to a competitor become a strong deterrent, anchoring them to the current provider and reducing their leverage.

The availability of competitors significantly amplifies the bargaining power of Alight Solutions' customers. With major players like ADP, Workday, SAP, and Oracle, alongside numerous specialized consulting firms, clients have a wealth of alternatives to consider. This robust competitive environment empowers customers to meticulously compare services, features, and pricing structures.

This comparison capability directly translates into stronger customer leverage during negotiations for new contracts and renewals. For instance, in the HR technology and services sector, clients often leverage competitive bids to secure more favorable terms. Alight, therefore, faces constant pressure to differentiate itself and consistently deliver exceptional value to maintain its client base.

Price Sensitivity and ROI Demands

Customers, especially large corporations with extensive employee bases, are keenly focused on the financial impact of HR and benefits solutions. They meticulously evaluate pricing structures, seeking concrete evidence of improved efficiency, cost reductions, and enhanced employee well-being. This scrutiny often translates into rigorous price negotiations, directly impacting Alight's profitability.

For instance, in 2024, the HR technology market experienced significant competition, with clients frequently leveraging competitive bids to secure favorable pricing. Companies are increasingly sophisticated in their ROI calculations, demanding clear metrics that link Alight's services to tangible business outcomes.

- Price Sensitivity: Large enterprise clients often have budgets that are highly sensitive to the per-employee cost of HR solutions.

- ROI Demands: Buyers expect demonstrable returns on investment, looking for cost savings, productivity gains, or improved employee retention.

- Negotiation Leverage: The availability of alternative providers gives customers significant leverage to negotiate pricing and contract terms.

- Total Cost of Ownership: Customers consider not just upfront costs but also implementation, ongoing maintenance, and potential disruption costs.

In-house Capabilities and Customization Needs

Some very large enterprises might have strong internal HR and IT teams that can handle specific human capital functions, potentially reducing their reliance on external providers like Alight. This capability allows them to perform certain tasks in-house, influencing their negotiation leverage.

Customers often assess if their unique requirements can be fulfilled internally or by piecing together solutions from various specialized vendors, a process that can shift bargaining power towards them. For instance, a company with a highly specialized payroll need might explore niche providers if Alight's offering isn't perfectly tailored.

The increasing demand for highly customized solutions also empowers customers. Alight must demonstrate flexibility and adaptability to meet these specific needs, as a failure to do so could lead customers to seek alternatives or develop their own solutions.

- In-house HR/IT: Large enterprises may have the capacity to manage certain HR functions internally, impacting their need for comprehensive outsourcing.

- Specialized Vendor Alternatives: Customers can opt for a mix of specialized vendors if Alight's integrated solutions don't precisely match their niche requirements.

- Customization Demand: The drive for tailored solutions grants customers greater bargaining power, compelling Alight to offer adaptable service models.

The bargaining power of Alight Solutions' customers is substantial, driven by their significant purchasing volume and the competitive landscape of HR technology and services. While high switching costs can anchor clients, their ability to leverage alternative providers and demand demonstrable ROI keeps their influence strong. In 2024, the market saw continued price sensitivity and a focus on value, with clients actively comparing offerings.

| Factor | Impact on Alight | Customer Leverage |

|---|---|---|

| Client Concentration | High revenue dependence on top clients | Top clients have significant negotiation power |

| Switching Costs | High integration complexity | Limits immediate leverage, but long-term retention is key |

| Competitive Intensity | Numerous alternative providers (ADP, Workday, etc.) | Customers can easily compare and negotiate better terms |

| Price Sensitivity & ROI | Clients scrutinize costs and demand clear value | Drives aggressive pricing negotiations and performance metrics |

Same Document Delivered

Alight Solutions Porter's Five Forces Analysis

This preview showcases the complete Alight Solutions Porter's Five Forces analysis, detailing the competitive landscape and strategic implications for the company. You are looking at the actual document; once purchased, you will receive this exact, professionally formatted analysis immediately, ready for your strategic decision-making.

Rivalry Among Competitors

The human capital technology and services sector is a crowded arena, with giants like Workday, ADP, Oracle, and SAP vying for dominance. These established global competitors offer a wide array of overlapping services, including benefits administration, payroll, and comprehensive HR solutions, intensifying the competition for Alight Solutions.

Major consulting firms such as Accenture and Deloitte also play a significant role, further fragmenting the market and increasing competitive pressures. This broad spectrum of players means Alight Solutions faces constant pressure to innovate and differentiate its offerings to maintain and grow its market share.

Competitive rivalry in the HR technology, payroll, and benefits administration sectors remains intense, yet the market itself is expanding. This growth is fueled by digital transformation, the rise of remote work, and the strategic integration of artificial intelligence and automation. For instance, the global HR tech market was valued at approximately $24.4 billion in 2023 and is projected to reach $39.4 billion by 2028, showcasing a compound annual growth rate of around 10.1%.

This expanding market landscape presents a dual dynamic: it offers opportunities for established players like Alight Solutions to grow their customer base and service offerings. However, it also intensifies the competition as companies strive to differentiate themselves through innovation, particularly in leveraging AI to enhance efficiency and user experience in areas like personalized benefits recommendations and automated HR processes.

Alight Solutions differentiates itself with its integrated Alight Worklife® platform, a cloud-based solution combining HR, benefits, payroll, and wellbeing services. This approach aims to provide a seamless experience for employers and employees alike.

Competitors are also investing heavily in comprehensive platforms, specialized functionalities, and superior customer service to stand out. For instance, many HR tech providers are enhancing their AI capabilities and data analytics to offer more personalized employee experiences, a trend that intensified in 2024 as companies sought to improve retention and engagement.

The intense rivalry pushes companies like Alight to continuously innovate their technology and service delivery. This focus on technological advancement and service excellence is crucial for capturing market share and maintaining a competitive edge in the evolving HR solutions landscape.

High Fixed Costs and Customer Retention

The human resources and benefits administration industry, where Alight Solutions operates, is characterized by substantial upfront investments. These include significant capital outlays for developing sophisticated technology platforms, building robust infrastructure, and establishing extensive sales and marketing networks. For instance, companies in this space often invest millions in cloud computing, data security, and specialized HR software.

These high fixed costs create a powerful incentive for companies to aggressively pursue market share. By scaling operations and onboarding more clients, firms can spread these initial investments over a larger revenue base, leading to greater economies of scale and improved profitability. This competitive dynamic often results in intense price competition, especially for larger enterprise contracts.

Furthermore, customer retention is paramount due to the considerable switching costs involved. Migrating complex HR and benefits data, retraining employees on new systems, and ensuring seamless integration with existing payroll and financial systems are time-consuming and expensive processes for clients. This reality fosters a strong emphasis on long-term contracts and customer loyalty, as demonstrated by industry players focusing on client satisfaction and service continuity to minimize churn.

- High upfront investments in technology and infrastructure are a hallmark of the HR and benefits administration sector.

- Economies of scale are crucial for profitability due to significant fixed costs, driving aggressive competition for market share.

- Client retention is a strategic imperative, underscored by the high costs and complexities associated with switching HR and benefits providers.

Strategic Divestitures and Focus

Alight Solutions' strategic divestiture of its Payroll & Professional Services business in July 2024 signals a significant move to sharpen its competitive edge. This action, which generated approximately $1.1 billion in cash, allows Alight to concentrate its resources and strategic efforts on its high-growth cloud-based human capital technology and services, particularly in employee wellbeing and benefits administration.

By shedding non-core assets, Alight aims to become a more agile and focused player in the HR technology market. This strategic pruning is designed to enhance its ability to innovate and lead in its chosen segments, thereby intensifying rivalry with competitors who offer broader, more integrated solutions.

- Divestiture of Payroll & Professional Services: Completed in July 2024, generating significant cash.

- Focus on Core Strengths: Concentrating on cloud-based HR technology and employee wellbeing services.

- Enhanced Competitiveness: Streamlining operations to better compete in specialized HR tech markets.

- Market Leadership Ambition: Aiming to be a dominant force in specific, high-growth HR service areas.

The competitive landscape for Alight Solutions is defined by intense rivalry from established HR technology giants like Workday, ADP, Oracle, and SAP, as well as major consulting firms such as Accenture and Deloitte. These players offer a wide range of overlapping services, forcing Alight to continuously innovate and differentiate its offerings.

The market's expansion, projected to grow from an estimated $24.4 billion in 2023 to $39.4 billion by 2028, fuels this competition. Companies are heavily investing in AI and data analytics to enhance user experience and personalize services, a trend that accelerated in 2024 as businesses prioritized employee engagement and retention.

Alight's strategic divestiture of its Payroll & Professional Services business in July 2024, generating approximately $1.1 billion, signals a sharpened focus on its core cloud-based HR technology and employee wellbeing services to gain a competitive edge.

High upfront investments in technology and infrastructure, coupled with significant customer switching costs, create a dynamic where economies of scale are critical, driving aggressive competition for market share and emphasizing client retention strategies.

SSubstitutes Threaten

Large enterprises often possess the internal capacity to manage HR and benefits administration, acting as a direct substitute for external providers like Alight Solutions. Companies with substantial financial resources and in-house talent may opt for self-management, particularly for highly specialized or sensitive employee data and processes.

In 2024, it’s estimated that over 60% of Fortune 500 companies maintain dedicated internal HR departments capable of handling core benefits administration, showcasing the significant threat of in-house capabilities as a substitute.

This internal approach allows for greater control and customization, potentially reducing perceived costs and ensuring alignment with unique organizational cultures and strategic objectives, thereby posing a competitive challenge to outsourced solutions.

The threat of niche point solutions is a significant concern for Alight Solutions. Companies may choose to use specialized, standalone software or services for specific HR functions instead of an integrated platform. For example, they might opt for separate payroll software, dedicated benefits enrollment tools, or specialized wellness platforms.

While these niche providers can offer highly specialized functionality, they often lack the seamless integration and comprehensive insights that Alight's holistic offering provides. This fragmented approach can lead to data silos and inefficiencies, potentially hindering a unified view of the workforce. In 2024, the HR tech market continued to see growth in specialized solutions, with companies like Workday and ADP also offering modular components that could be adopted independently.

Broader enterprise resource planning (ERP) systems from major players like SAP and Oracle offer integrated human capital management (HCM) capabilities. While not as specialized as dedicated HR solutions, these modules can handle fundamental HR tasks, presenting a viable substitute for organizations seeking a unified software ecosystem.

For instance, a company might opt for SAP S/4HANA, which includes robust HR functionalities, rather than implementing a separate, best-of-breed HR technology stack. This consolidation can reduce integration complexity and potentially lower overall software costs, making these broader ERP systems a significant competitive threat to specialized HR tech providers.

Manual Processes and Traditional Consulting

For smaller organizations or those with less complex needs, manual processes and traditional HR consulting can act as substitutes. For instance, many smaller businesses might still rely on spreadsheets for benefits administration, a practice that was common before integrated HR tech solutions became widespread. While these methods can be cheaper upfront, they often fall short in efficiency and scalability compared to advanced platforms.

These manual or less technologically integrated approaches offer limited capabilities in areas like real-time data analysis and automated compliance, which are critical for larger enterprises. The lack of sophisticated reporting and predictive analytics in these substitutes means businesses miss out on crucial insights for strategic decision-making. For example, a business relying solely on manual tracking might struggle to identify trends in employee benefits utilization, unlike a company using a platform like Alight’s.

The threat from these substitutes is mitigated by the increasing complexity of regulatory environments and the growing demand for data-driven HR insights. Companies that adopt sophisticated HR solutions often see significant improvements in operational efficiency and compliance, making the cost-benefit analysis favor advanced platforms. For example, Alight’s integrated solutions aim to streamline processes, which can lead to cost savings through reduced errors and improved employee engagement, a benefit often absent in manual systems.

Key limitations of manual processes and traditional consulting as substitutes include:

- Lack of Scalability: Manual systems become unmanageable as an organization grows.

- Limited Data Analytics: Inability to provide deep insights into workforce trends.

- Higher Risk of Errors: Manual data entry is prone to mistakes, impacting compliance.

- Inefficiency: Time-consuming processes that divert resources from strategic HR functions.

Emerging AI-driven Automation Tools

The increasing sophistication of AI and automation presents a significant threat of substitutes for Alight Solutions. New, highly specialized tools are emerging that can automate specific HR functions, potentially replacing parts of Alight's comprehensive service offerings. For instance, AI-powered platforms focusing solely on automated candidate sourcing or real-time employee performance monitoring could emerge as direct or indirect competitors.

These specialized AI tools might offer a more focused or cost-effective solution for certain tasks, drawing clients away from integrated platforms like Alight's. By mid-2024, the HR tech market saw a surge in AI-driven solutions, with venture capital funding pouring into startups specializing in niche HR automation. For example, companies developing AI for automated payroll processing or benefits administration are gaining traction, directly challenging established players.

- Specialized AI Tools: Emerging AI platforms can automate distinct HR processes, acting as substitutes for specific Alight services.

- Cost-Effectiveness: Niche AI solutions may offer lower costs for targeted automation compared to comprehensive platforms.

- Market Growth: The HR tech sector experienced significant investment in AI startups throughout 2024, indicating a growing competitive landscape.

The threat of substitutes for Alight Solutions is multifaceted, encompassing in-house capabilities, niche HR technologies, broader ERP systems, and even manual processes. Large enterprises often possess the internal capacity to manage HR and benefits administration, acting as a direct substitute. In 2024, over 60% of Fortune 500 companies maintained dedicated internal HR departments capable of handling core benefits administration, showcasing the significant threat of in-house capabilities.

Niche point solutions also pose a threat, as companies may opt for specialized software for specific HR functions instead of an integrated platform. For instance, companies might choose separate payroll software or dedicated benefits enrollment tools. By mid-2024, the HR tech market saw a surge in AI-driven solutions, with venture capital funding pouring into startups specializing in niche HR automation, directly challenging established players.

Broader enterprise resource planning (ERP) systems from major players like SAP and Oracle offer integrated human capital management (HCM) capabilities that can handle fundamental HR tasks. For example, a company might opt for SAP S/4HANA, which includes robust HR functionalities, rather than implementing a separate, best-of-breed HR technology stack.

Manual processes and traditional HR consulting serve as substitutes for smaller organizations or those with less complex needs. However, these methods often fall short in efficiency and scalability compared to advanced platforms, lacking sophisticated reporting and predictive analytics crucial for strategic decision-making.

Entrants Threaten

Entering the cloud-based human capital technology and services market, where Alight Solutions operates, demands significant upfront capital. Developing sophisticated, scalable platforms equipped with advanced features like artificial intelligence and data analytics requires a substantial financial commitment. For instance, companies like Workday, a major competitor, reported over $7.2 billion in revenue in fiscal year 2024, underscoring the scale of investment needed to compete at this level.

New entrants must also overcome the challenge of building technology infrastructures that can match the security, reliability, and integration capabilities of established players. The complexity of integrating with various HR systems and ensuring data privacy, a critical concern in the sector, adds another layer of difficulty and cost. This high barrier to entry, driven by both capital and technological expertise, naturally limits the number of new competitors that can realistically challenge incumbents.

The human capital domain, particularly benefits administration and payroll, faces a complex and ever-shifting regulatory environment. New companies must contend with intricate compliance requirements, varying legal frameworks across different geographies, and stringent data privacy regulations like GDPR and CCPA. For instance, in 2024, businesses operating globally must remain vigilant about updates to tax laws and employment regulations that can impact payroll processing and benefits eligibility, demanding significant legal and domain expertise, thereby creating a substantial barrier to entry for newcomers.

Alight Solutions' strong brand reputation and established client trust present a significant barrier to new entrants. Securing contracts with major global organizations, like the Fortune 500 companies Alight serves, requires years of demonstrated reliability and a deep understanding of complex HR and financial operations. New players often find it challenging to build this level of credibility and overcome the inherent caution of large enterprises when outsourcing critical functions.

Economies of Scale and Scope

Established players like Alight Solutions leverage significant economies of scale in technology development and service delivery, enabling them to offer competitive pricing and a broad suite of solutions. For instance, Alight's substantial investment in its cloud-native platform, Workday, allows for efficient processing of payroll and benefits for millions of employees, a feat difficult for newcomers to replicate without massive upfront capital. This scale advantage makes it challenging for new entrants to match Alight's cost-effectiveness and comprehensive service offerings from the outset.

New entrants often struggle to achieve the same operational efficiencies and breadth of services without incurring substantial initial losses. For example, a startup entering the HR technology space would need to invest heavily in platform development, security, and compliance, all while lacking the established client base and brand recognition that Alight possesses. This disparity in scale creates a significant barrier, as new companies find it difficult to compete on price or the depth of their product portfolio against incumbents who have already amortized these costs over a larger customer base.

- Economies of Scale: Alight's large operational footprint reduces per-unit costs in service delivery and technology infrastructure.

- Technology Investment: Significant capital deployment in proprietary or licensed platforms like Workday creates a high barrier to entry.

- Client Support Infrastructure: Established customer service and support networks are costly to build and maintain for new entrants.

- Pricing Power: Scale allows Alight to offer competitive pricing, squeezing margins for smaller, less efficient competitors.

Talent Acquisition and Retention

New entrants face significant hurdles in acquiring and retaining the specialized talent needed for integrated human capital solutions. This includes not only HR professionals but also critical roles like software engineers, data scientists, and cybersecurity experts. Building a competitive team requires substantial investment and time, which can be a deterrent for newcomers.

Established players in the market, like Alight Solutions, often benefit from existing, robust talent pools and well-developed recruitment pipelines. For instance, in 2024, the demand for skilled HR tech professionals remained exceptionally high, with reports indicating a 15% year-over-year increase in job postings for roles requiring expertise in HR analytics and cloud-based HR platforms. This existing advantage makes it considerably more challenging for new entrants to quickly assemble the caliber of team necessary to compete effectively.

- Talent Gap: A significant shortage of qualified HR tech specialists existed in 2024, impacting both new and established firms.

- Recruitment Costs: The average cost to hire a specialized HR technology professional in 2024 was estimated to be between $15,000 and $25,000, a substantial barrier for startups.

- Retention Challenges: High demand meant an average employee turnover rate of 20% for tech-focused HR roles in 2024, increasing the ongoing cost of talent for any company, especially new entrants.

The threat of new entrants in the cloud-based human capital solutions market is moderate. High capital requirements for technology development and infrastructure, coupled with complex regulatory compliance, create substantial barriers. For example, Workday's 2024 revenue of over $7.2 billion highlights the significant investment needed to compete.

Building secure, reliable, and integrated technology platforms that meet stringent data privacy standards is a major hurdle. The cost and expertise required to navigate evolving regulations, such as GDPR and CCPA, further deter new players. This complexity necessitates significant legal and domain knowledge, acting as a strong deterrent.

Established brand reputation and client trust, built over years of reliable service, are difficult for newcomers to replicate. Large enterprises are cautious about outsourcing critical functions, making it challenging for new entrants to gain credibility. Alight's existing relationships with Fortune 500 companies exemplify this advantage.

Porter's Five Forces Analysis Data Sources

Our Alight Solutions Porter's Five Forces analysis leverages a comprehensive blend of data, including Alight's own financial reports, industry-specific market research from firms like Gartner and Forrester, and publicly available competitor financial statements. This allows for a robust assessment of industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes.