Agree Realty PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agree Realty Bundle

Navigate the dynamic landscape of commercial real estate with our comprehensive PESTLE analysis of Agree Realty. Understand how political shifts, economic fluctuations, and evolving social trends are shaping the company's strategic direction and future growth opportunities. Gain a critical edge by leveraging these expert-level insights to inform your investment decisions and market strategies. Download the full version now for actionable intelligence that empowers you to stay ahead.

Political factors

Government policies are increasingly shaping the commercial real estate landscape. For instance, the 'One Big Beautiful Bill Act,' enacted in July 2025, aims to boost investment through tax reforms, including the reinstatement of 100% bonus depreciation for eligible properties.

This legislation also raises the asset threshold for taxable REIT subsidiaries. Such changes offer significant tax incentives and enhanced flexibility, potentially benefiting Agree Realty's acquisition and development plans by making new projects more financially attractive.

Changes in trade policies, especially tariffs on key construction materials like steel and aluminum, can significantly increase development costs for real estate investment trusts (REITs). For instance, a potential 25% tariff on imported steel, implemented in early 2025, directly impacts the expense of new construction and property renovations. Agree Realty, which actively acquires and develops properties, must factor these rising material costs into its budgeting and project viability assessments.

The regulatory environment for Real Estate Investment Trusts (REITs) remains a key political consideration, with potential shifts in administration influencing the Securities and Exchange Commission (SEC) framework. Discussions are ongoing regarding the extension of the Section 199A business income deduction, a provision vital for REITs, with general expectations leaning towards its continuation.

Regulatory stability and the maintenance of favorable tax treatments are paramount for Agree Realty's financial performance and its attractiveness to investors. For instance, the Tax Cuts and Jobs Act of 2017, which introduced Section 199A, provided a significant tailwind for REITs, and its potential expiration or modification could impact the sector.

State and Local Zoning Regulations

State and local zoning regulations are a key political factor influencing Agree Realty's operations. Recent legislative updates are creating more flexibility in land use, particularly for mixed-use and adaptive reuse projects. For instance, in 2024, several states have seen proposals aimed at streamlining approval processes for such developments, potentially opening new avenues for retail properties to integrate with residential or office spaces.

While Agree Realty's primary focus remains on single-tenant net lease retail properties, these broader shifts in land use laws can indirectly impact its business. Changes in zoning could alter the competitive landscape by making it easier for developers to repurpose land, potentially affecting property values or creating new development opportunities in markets where Agree Realty operates. Monitoring these localized legislative changes is crucial for strategic land acquisition and identifying future growth potential.

The impact of these regulations can be seen in the varying development costs and timelines across different municipalities. For example, a state that has relaxed zoning for commercial development might see a 5% lower average cost for new retail construction compared to a state with more stringent regulations as of early 2025. Agree Realty must stay abreast of these localized nuances to ensure efficient site selection and development.

- Legislative Trends: Many states are actively reviewing and updating zoning laws to encourage economic development and housing solutions.

- Adaptive Reuse: Regulations supporting the conversion of existing structures into retail or mixed-use spaces are becoming more common.

- Market Impact: Flexible zoning can lead to increased competition but also present opportunities for strategic partnerships and diversified property portfolios.

- Due Diligence: Thorough understanding of local zoning ordinances is paramount for Agree Realty's site acquisition and development strategies.

Government Spending and Infrastructure

Government spending on infrastructure, like road improvements and public transit, can boost retail property value by making them more accessible. For instance, in 2024, the U.S. government continued to allocate significant funds towards infrastructure projects, aiming to modernize transportation networks and urban areas. This can lead to increased foot traffic and tenant demand for Agree Realty's properties located in revitalized or well-connected zones.

Pro-growth economic policies and government initiatives aimed at urban revitalization can indirectly support the real estate sector. A strong economy, often fostered by such policies, typically benefits commercial real estate by increasing consumer spending and business expansion. Agree Realty, as a real estate investment trust, can see enhanced tenant stability and potential for rental growth in markets experiencing such positive governmental influence.

- Infrastructure Investment: Continued U.S. federal investment in infrastructure projects throughout 2024 aims to improve connectivity and economic activity.

- Urban Revitalization: Government programs supporting urban renewal can enhance the desirability and economic vitality of areas where Agree Realty holds properties.

- Economic Support: Pro-growth fiscal policies can stimulate consumer spending, a key driver for retail real estate performance.

Government policies significantly influence Agree Realty's operational landscape, with legislative updates in 2024 and 2025 offering both opportunities and challenges. The reinstatement of 100% bonus depreciation for eligible properties under the 'One Big Beautiful Bill Act' in July 2025, for example, provides substantial tax incentives for new investments. Conversely, potential tariffs on construction materials, such as a projected 25% on steel in early 2025, directly increase development costs, requiring careful financial planning for Agree Realty's acquisition and development activities.

Changes in state and local zoning regulations are also critical, with a trend towards greater flexibility for mixed-use and adaptive reuse projects observed in 2024. While Agree Realty primarily focuses on single-tenant net lease retail, these shifts can indirectly impact property values and create new development opportunities. Staying informed about localized legislative changes is therefore essential for strategic site acquisition and future growth.

Government infrastructure spending, particularly the continued allocation of funds towards transportation networks in 2024, can positively affect Agree Realty's properties by improving accessibility and potentially increasing foot traffic. Furthermore, pro-growth economic policies that foster urban revitalization can indirectly support the real estate sector by stimulating consumer spending and business expansion, benefiting tenant stability and rental growth for Agree Realty.

What is included in the product

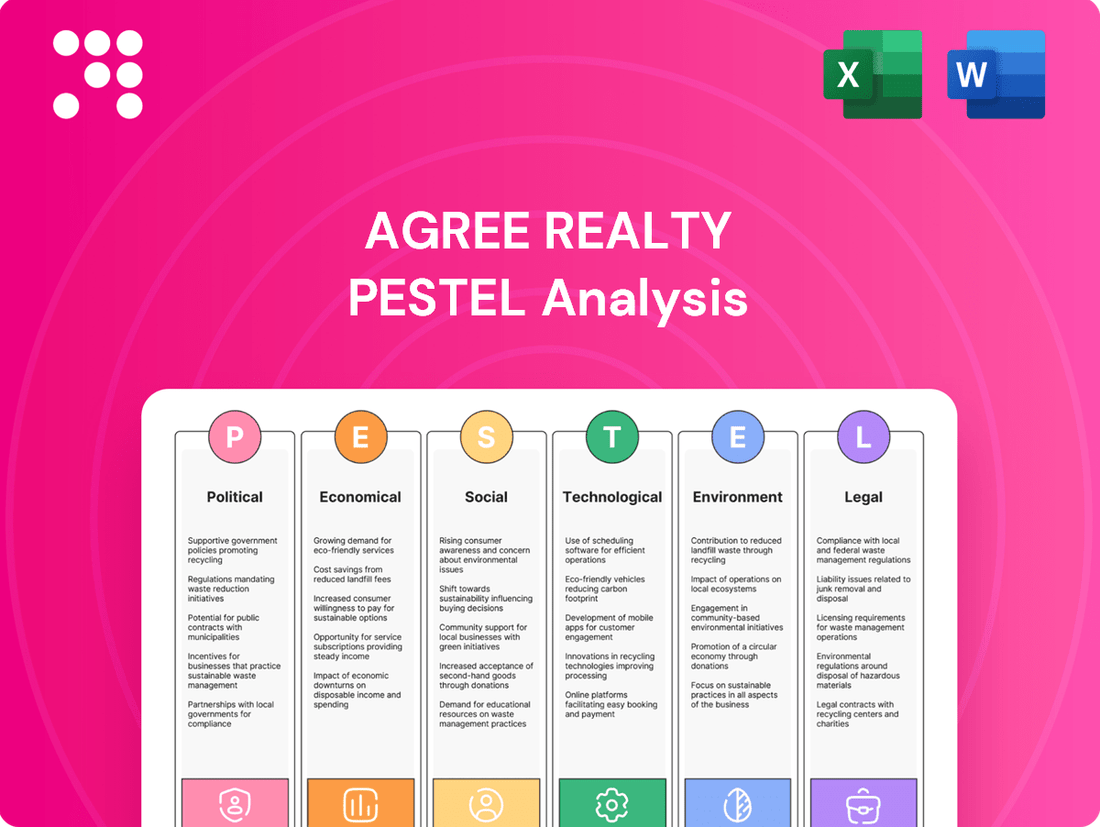

This PESTLE analysis examines the external macro-environmental factors impacting Agree Realty, covering Political, Economic, Social, Technological, Environmental, and Legal influences to identify strategic opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, helping to quickly address potential external challenges impacting Agree Realty's strategy.

Economic factors

Interest rate shifts are a major driver for Real Estate Investment Trusts (REITs) like Agree Realty. Higher rates increase borrowing costs, potentially lowering property values and making debt refinancing more expensive. However, forecasts suggest the 10-year Treasury rate might ease to around 3.5% by late 2025, which would offer more favorable terms for REITs looking to refinance their debt.

Agree Realty's business model, which relies on stable financing for its property acquisitions and the security of long-term leases, is positioned to benefit from more predictable and manageable debt servicing costs. This stability is crucial for maintaining profitability and supporting continued growth initiatives.

Inflation remains a significant consideration for Real Estate Investment Trusts (REITs), as it can drive up operating costs and potentially lead to increased interest rates. Agree Realty's strategy of focusing on net-leased properties with long-term lease agreements is designed to mitigate these impacts.

These leases often include rent escalation clauses, typically linked to the Consumer Price Index (CPI) or fixed annual increases of 2-4%. For instance, in 2024, Agree Realty reported that a substantial portion of its portfolio has rent increases structured to keep pace with or exceed inflation, offering a degree of protection for its cash flows.

Agree Realty benefits from sustained economic expansion, which typically boosts demand for retail space and rental income. For instance, the US economy experienced a robust GDP growth of 2.5% in 2023, indicating a healthy environment for retail real estate.

Despite a cost-of-living crisis making consumers more budget-conscious, Agree Realty's focus on essential retail like grocery and home improvement stores offers significant resilience. This strategic positioning helps mitigate the impact of economic downturns on their tenant base and property performance.

Continued economic stability is crucial for Agree Realty's diverse tenant roster, which includes major retailers. The expectation for continued, albeit potentially slower, economic growth in 2024, with forecasts around 1.5-2.0% for the US, supports the operational stability and payment capacity of these tenants.

Cost of Capital and Debt Markets

REITs are anticipated to see enhanced access to capital markets in 2025, including unsecured debt, positioning them favorably for acquisitions. Agree Realty's conservative leverage and established access to public markets provide a distinct advantage in securing advantageous financing terms.

This financial flexibility allows Agree Realty to effectively pursue investment opportunities as transaction volumes are expected to rise. For instance, by maintaining a low debt-to-equity ratio, Agree Realty can more readily secure new debt or equity financing at competitive rates compared to highly leveraged peers.

- Improved Capital Access: REITs, including Agree Realty, are expected to benefit from easier access to capital in 2025, particularly for unsecured debt.

- Competitive Advantage: Agree Realty's low-leverage balance sheet and public market access enable it to secure more favorable financing terms than many competitors.

- Acquisition Opportunities: This strong financial footing allows Agree Realty to capitalize on increased investment and acquisition activity as market conditions evolve.

Property Valuations and Transaction Activity

The commercial real estate sector is anticipating a surge in deal-making throughout 2025. This uptick is largely attributed to a reduction in the gap between what buyers are willing to pay and what sellers expect, alongside strengthening underlying market conditions.

While capitalization rates (cap rates) are likely to stay higher than recent historical lows, certain segments, particularly those favored by robust demand such as Agree Realty's focus areas, might witness cap rates stabilizing or even declining slightly. For instance, reports from major commercial real estate firms in late 2024 indicated a growing investor appetite for well-located, necessity-based retail properties, suggesting potential for cap rate compression in these specific niches.

This evolving market landscape creates favorable conditions for companies like Agree Realty to pursue growth. Strategic acquisitions in these high-demand sectors can lead to accretive results, meaning the acquired properties are expected to generate income that enhances the overall profitability of the company.

- Increased Transaction Activity: Projections for 2025 indicate a busier commercial real estate market.

- Narrowing Bid-Ask Spread: A key driver for increased transactions is the closing gap between buyer and seller price expectations.

- Cap Rate Stabilization: While generally elevated, cap rates in strong sectors like Agree Realty's could stabilize or fall.

- Accretive Growth Opportunities: The market presents chances for strategic acquisitions that boost Agree Realty's earnings.

Economic growth is a foundational element for Agree Realty's success, directly impacting tenant demand and rental income. The US economy's projected growth of around 1.5-2.0% for 2024, following a strong 2.5% in 2023, signifies a stable environment for its retail tenants. This continued expansion supports tenant stability and their ability to meet lease obligations, which is critical for Agree Realty's consistent revenue streams.

Inflationary pressures, while a concern, are somewhat mitigated by Agree Realty's lease structures. Many leases include annual rent escalations, often tied to CPI or fixed at 2-4%, ensuring that rental income can keep pace with rising costs. This feature is particularly important as inflation, though showing signs of moderation, remains a factor in the economic landscape through 2025.

Interest rate movements significantly influence Agree Realty's cost of capital and property valuations. Forecasts for the 10-year Treasury rate to potentially ease to around 3.5% by late 2025 would reduce borrowing costs and improve refinancing opportunities. This easing of financial conditions is beneficial for REITs seeking to manage debt and fund future acquisitions.

The capital markets are expected to become more accessible in 2025, with improved opportunities for unsecured debt. Agree Realty's prudent financial management, including a low debt-to-equity ratio, positions it to capitalize on this trend, securing favorable financing for strategic growth initiatives and acquisitions in an anticipated active commercial real estate market.

Preview the Actual Deliverable

Agree Realty PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Agree Realty provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You can trust that the detailed insights into Agree Realty's market landscape, competitive environment, and potential growth opportunities are presented in a clear and actionable format.

The content and structure shown in the preview is the same document you’ll download after payment. This includes a thorough examination of regulatory changes, economic trends, consumer behavior shifts, technological advancements, legal frameworks, and sustainability initiatives relevant to Agree Realty's real estate investment trust business.

Sociological factors

Consumers are increasingly focused on value and managing their budgets, a trend amplified by persistent inflation. This has naturally led to a greater emphasis on essential goods and services over discretionary spending.

Agree Realty's property portfolio is strategically aligned with these evolving habits. With a significant concentration in sectors like grocery stores, home improvement outlets, auto parts retailers, and discount stores, the company is well-positioned to capture demand in categories often deemed recession-resistant.

For instance, grocery spending remained robust through 2023, with the U.S. grocery market valued at over $800 billion. Similarly, home improvement sales, while moderating from pandemic highs, are expected to see continued demand driven by essential repairs and value-focused upgrades, with the U.S. home improvement market projected to reach over $500 billion by 2025.

Consumers increasingly favor retailers offering essential goods and engaging in-person experiences, a trend that complements online shopping. This preference for tangible interactions and necessity-driven purchases is a significant sociological shift.

Agree Realty's portfolio, heavily weighted towards tenants in essential retail sectors like grocery stores and pharmacies, directly benefits from this consumer behavior. For instance, grocery-anchored centers, a core component of Agree Realty's strategy, consistently demonstrate resilience, with U.S. grocery sales reaching an estimated $900 billion in 2024, underscoring the enduring demand for these essential services.

This strategic alignment with fundamental consumer needs helps ensure long-term lease stability for Agree Realty, as these businesses are less vulnerable to the disruptions posed by e-commerce, providing a solid foundation for predictable revenue streams.

Demographic shifts are increasingly highlighting consumer preferences for self-sufficiency and a strong inclination towards local products. This trend directly impacts retail location strategies, favoring centers that serve community needs. For instance, a 2024 survey indicated that over 60% of consumers actively seek to support local businesses.

Agree Realty's portfolio, with its national and regional tenant mix across various retail sectors, is well-positioned to capitalize on this. By maintaining a presence in diverse geographic areas, the company can adapt its tenant mix to align with localized consumer demand for community-focused retail. This adaptability is crucial as consumers increasingly prioritize supporting their local economies, driving foot traffic to strategically located centers.

Impact of Omnichannel Shopping

The increasing prevalence of omnichannel shopping significantly influences consumer behavior, demanding a fluid connection between digital and physical retail spaces. For Agree Realty, this means its retail tenants must effectively integrate online and in-store operations to meet evolving customer expectations. This trend underscores the enduring importance of strategically positioned brick-and-mortar locations as integral components of a comprehensive retail strategy.

The success of Agree Realty's tenant portfolio is directly tied to their adaptability in this hybrid shopping environment. For instance, by mid-2024, a significant portion of retail sales are projected to incorporate some form of online-to-offline interaction, highlighting the necessity for tenants to offer 'phygital' experiences. This integration is crucial for maintaining customer engagement and driving sales within physical stores.

- Consumer Expectation Shift: Shoppers increasingly anticipate a unified experience, moving seamlessly between online browsing and in-store purchasing.

- Tenant Adaptability: Agree Realty's tenants must invest in technology and operational changes to support omnichannel strategies, such as buy online, pick up in-store (BOPIS).

- Physical Store Relevance: Well-located physical stores remain vital, serving as fulfillment centers, brand experience hubs, and crucial touchpoints in the omnichannel journey.

- Data-Driven Insights: Understanding consumer data across channels allows tenants to personalize offerings, further solidifying the value of physical presence.

Social Responsibility and Consumer Values

Consumers are increasingly prioritizing brands and retailers that show a commitment to social and environmental responsibility. This shift makes corporate values a significant factor in building customer loyalty and trust, influencing purchasing decisions. For Agree Realty, this means considering the broader societal impact of its properties, not just for end consumers but also for its retail tenants.

This growing consumer consciousness encourages Agree Realty to think about the social aspects of its real estate portfolio. Factors like community engagement, accessibility for diverse populations, and the sustainability of its properties become important differentiators. By aligning with these evolving expectations, Agree Realty can attract and retain high-quality tenants who, in turn, cater to socially conscious consumers.

- Consumer Preference for ESG: A significant majority of consumers, often cited as over 70% in various surveys from 2023 and early 2024, indicate a preference for brands that demonstrate strong Environmental, Social, and Governance (ESG) practices.

- Tenant Attraction: Retailers themselves are increasingly evaluating landlords based on their ESG credentials, recognizing that properties in socially responsible developments can enhance their own brand image and appeal to their customer base.

- Community Impact Focus: Agree Realty’s focus on necessity-based retail, often serving local communities, presents opportunities to highlight positive social impacts, such as job creation and convenient access to essential goods and services.

Sociological factors significantly shape consumer behavior, influencing spending habits and retail preferences. Trends like value consciousness, a focus on essential goods, and a growing appreciation for local products are paramount. Agree Realty's portfolio, with its emphasis on grocery, home improvement, and discount retailers, aligns well with these shifts, as evidenced by the U.S. grocery market's over $800 billion valuation in 2023 and projected growth. This strategic positioning ensures resilience and stable demand for its properties.

The increasing demand for omnichannel shopping experiences means consumers expect seamless integration between online and physical retail. Agree Realty's tenants must adapt to this, offering 'phygital' solutions, as a substantial portion of retail sales by mid-2024 are expected to involve online-to-offline interactions. This adaptability is key for tenants to maintain customer engagement and leverage physical stores as fulfillment hubs and brand experience centers.

Consumers are also increasingly prioritizing brands and retailers with strong social and environmental commitments, with over 70% of consumers in 2023-2024 surveys favoring businesses with robust ESG practices. This trend influences tenant selection and landlord appeal, making Agree Realty's focus on community-serving, necessity-based retail a potential advantage in attracting both tenants and end consumers.

| Sociological Factor | Impact on Consumer Behavior | Agree Realty Portfolio Alignment | Supporting Data (2023-2025 Estimates) |

|---|---|---|---|

| Value Consciousness & Essential Spending | Prioritization of necessities over discretionary items due to inflation. | Concentration in grocery, home improvement, auto parts, and discount stores. | U.S. Grocery Market: >$800 billion (2023), projected to exceed $900 billion (2024). U.S. Home Improvement Market: Projected >$500 billion by 2025. |

| Omnichannel Shopping | Demand for seamless online-to-offline retail experiences. | Tenants must integrate digital and physical operations; physical stores act as fulfillment/experience centers. | Significant portion of retail sales by mid-2024 expected to involve online-to-offline interactions. |

| Localism & Self-Sufficiency | Preference for supporting local businesses and products. | National and regional tenant mix allows adaptation to localized consumer demand for community-focused retail. | Over 60% of consumers actively seek to support local businesses (2024 survey). |

| Social & Environmental Responsibility (ESG) | Preference for brands with strong ESG commitments influencing loyalty and purchasing. | Focus on community-serving retail enhances positive social impact and tenant appeal. | >70% of consumers prefer brands with strong ESG practices (2023-2024 surveys). |

Technological factors

The real estate sector is rapidly embracing digitalization, with technologies like the Internet of Things (IoT) and sophisticated property management software transforming operations. Agree Realty can harness these PropTech advancements to boost efficiency and cut expenses across its vast retail property holdings. For instance, predictive maintenance enabled by IoT sensors can preemptively address issues, minimizing downtime and repair costs, ultimately optimizing asset performance and rental income.

Artificial intelligence (AI) and advanced data analytics are transforming real estate operations, offering unprecedented insights into property valuation, marketing, and performance optimization. Agree Realty can leverage these technologies to predict market shifts, identify high-potential acquisition targets, and refine tenant strategies. For instance, AI can analyze vast datasets to forecast rental income or vacancy rates with greater accuracy, supporting more robust financial planning.

Virtual and augmented reality are revolutionizing how people interact with properties, offering virtual tours and immersive visualizations that were once impossible. While this trend is already strong in residential markets, Agree Realty can leverage these technologies to elevate the customer experience for its tenants and to present its own properties more effectively to potential lessees.

By offering virtual walkthroughs and augmented reality overlays, Agree Realty can significantly boost engagement and help prospective tenants make quicker, more informed decisions about leasing spaces. This technological adoption is particularly relevant as the global AR/VR market was projected to reach over $100 billion by 2025, indicating a significant shift in consumer expectations for digital interaction.

Automation in Retail and Supply Chains

Automation is rapidly transforming retail and supply chains. Technologies like robotics and artificial intelligence are streamlining everything from inventory management to order fulfillment. For Agree Realty's retail tenants, this translates to more efficient operations within their leased properties. This enhanced efficiency can bolster their financial performance, directly impacting lease stability and their ability to meet rental obligations.

The drive for more resilient supply chains is also a significant factor. This trend increases the demand for strategically located retail distribution centers and properties that can support advanced logistics. Agree Realty is well-positioned to benefit as its portfolio often includes properties suitable for these evolving supply chain needs.

- Retail automation adoption is projected to reach $15.9 billion globally by 2027, up from $5.7 billion in 2020.

- AI in supply chain management is expected to generate $30.4 billion in economic impact by 2026.

- Companies investing in automation report an average of 10-15% improvement in operational efficiency.

Smart Building Technologies and IoT

Smart building technologies, including the Internet of Things (IoT), are increasingly vital for commercial real estate, focusing on energy optimization and tenant satisfaction. Agree Realty can leverage these advancements to boost operational efficiency and attract modern tenants, potentially leading to higher rental rates. For instance, IoT sensors can monitor and adjust HVAC systems in real-time, reducing energy consumption by an estimated 15-30% in commercial buildings.

Implementing these smart solutions offers Agree Realty a competitive edge by appealing to a growing segment of businesses prioritizing sustainability and advanced amenities. Enhanced security features, such as smart access control and integrated surveillance, also become a significant draw for tenants. The global smart building market was valued at approximately $80 billion in 2023 and is projected to grow substantially, indicating strong demand for these integrated solutions.

Key benefits for Agree Realty include:

- Enhanced Energy Efficiency: IoT-driven systems can significantly cut utility costs, improving net operating income.

- Improved Tenant Experience: Amenities like smart climate control and seamless building access increase tenant retention.

- Data-Driven Operations: Real-time data from IoT devices allows for predictive maintenance and optimized resource allocation.

- Attracting Premium Tenants: Properties equipped with cutting-edge technology can command higher rents and attract high-quality lessees.

The integration of Artificial Intelligence (AI) and data analytics is reshaping property management and investment strategies. Agree Realty can leverage AI for predictive maintenance, tenant behavior analysis, and optimized leasing, enhancing operational efficiency and profitability. For instance, AI-powered tools can forecast market trends with greater accuracy, informing strategic acquisitions and portfolio adjustments. The global AI in real estate market is expected to reach $10.9 billion by 2027, highlighting its growing importance.

Virtual and Augmented Reality (VR/AR) are transforming property showcasing and tenant engagement. Agree Realty can utilize VR/AR for immersive virtual tours, allowing prospective tenants to experience properties remotely. This technology is crucial as the global AR/VR market is projected to exceed $100 billion by 2025, signaling a shift in customer expectations for digital property interaction.

Automation and smart building technologies, including IoT, are critical for operational efficiency and tenant satisfaction. Agree Realty can implement these to reduce energy consumption, improve building management, and offer enhanced amenities. Smart building technologies are projected to be a significant market, with global spending expected to reach $150 billion by 2025. For example, IoT-enabled HVAC systems can cut energy usage by 15-30%, directly boosting net operating income.

| Technology | Impact on Agree Realty | Market Projection/Data |

| AI & Data Analytics | Optimized operations, predictive insights, enhanced tenant strategies | Global AI in Real Estate Market: $10.9 billion by 2027 |

| VR/AR | Immersive property tours, improved tenant engagement | Global AR/VR Market: >$100 billion by 2025 |

| Automation & IoT (Smart Buildings) | Energy efficiency, reduced operational costs, improved tenant experience | Smart Building Market: ~$150 billion by 2025; IoT HVAC savings: 15-30% |

Legal factors

Recent legislative changes, like the proposed 'One Big Beautiful Bill Act' (though its final form and passage are subject to ongoing legislative processes and may differ), aim to be favorable for real estate businesses and Real Estate Investment Trusts (REITs). These potential reforms could solidify tax advantages, impacting entities like Agree Realty.

Key provisions under consideration include the permanent reinstatement of 100% bonus depreciation for qualified property, offering immediate tax benefits on capital investments. Additionally, there's a proposal to increase the taxable REIT subsidiary (TRS) asset threshold from 20% to 25%, granting REITs like Agree Realty more flexibility in their operational structures and asset management.

The Corporate Transparency Act (CTA) is designed to shed light on who truly owns and controls companies, requiring the disclosure of beneficial ownership information. However, its implementation has hit a snag, with a federal court ruling in March 2024 finding the CTA unconstitutional as applied to a specific group of plaintiffs, leading to a pause in enforcement for certain entities. This legal challenge creates uncertainty about the CTA's future scope and enforceability.

For Agree Realty, a real estate investment trust (REIT) already subject to stringent public reporting requirements by the SEC, the direct impact of the CTA might be less about increasing its own transparency, as that is already high. However, the broader regulatory environment it operates within is shifting. Agree Realty must remain vigilant regarding potential changes to the CTA's enforcement or scope, which could influence how its partners or tenants structure their own entities and report their ownership, impacting operational clarity.

New environmental, social, and governance (ESG) disclosure requirements are on the horizon, with bodies like the U.S. Securities and Exchange Commission (SEC) expected to implement new rules by 2025. These regulations will likely mandate detailed climate-related disclosures for companies, impacting how Agree Realty reports on its operations.

Agree Realty will need to establish strong systems for gathering and reporting environmental data across its diverse property portfolio to meet these upcoming mandates. This includes tracking energy consumption, water usage, and waste management at each location.

Adhering to these evolving ESG standards is vital for Agree Realty to remain attractive to investors. In 2024, a significant majority of institutional investors indicated that ESG factors are increasingly influencing their investment decisions, with a growing demand for transparent and standardized ESG reporting.

Zoning and Land Use Laws

Changes in zoning and land use regulations at the state and local levels directly affect commercial real estate development, including how properties can be used. For instance, many municipalities are now exploring more adaptable zoning ordinances to encourage mixed-use developments and the repurposing of existing structures, a trend that could reshape retail environments. Agree Realty needs to closely monitor these evolving legislative landscapes to uncover potential new investment avenues or to understand how current holdings might be impacted.

These shifts in zoning can create both challenges and opportunities. For example, some regions are streamlining approval processes for certain types of commercial development, potentially speeding up project timelines. Conversely, stricter regulations on building height, density, or parking requirements in other areas could increase development costs or limit expansion possibilities for retail properties. Staying informed is key to strategic asset management and growth.

For Agree Realty, understanding these legal frameworks is crucial. Consider the recent trend in some suburban areas to allow for more flexible zoning, permitting smaller-scale retail alongside residential or office spaces. This could open doors for Agree Realty to invest in or develop properties that cater to evolving consumer preferences for convenience and localized shopping experiences. The National Association of REALTORS® reported in late 2024 that over 60% of surveyed municipalities were considering or had implemented zoning reforms to encourage diverse land use.

- Zoning Reform Impact: Municipalities increasingly adopt flexible zoning, impacting commercial property use.

- Mixed-Use Growth: Adaptive reuse and mixed-use projects are gaining traction, influencing retail site selection.

- Opportunity Identification: Agree Realty must track regional legislative changes to spot new development potential.

- Risk Mitigation: Understanding zoning is vital for assessing risks and impacts on existing Agree Realty assets.

Lease Agreement Regulations and Tenant Protections

The legal landscape for commercial leases is dynamic, impacting Agree Realty's core business. Tenant protections and landlord responsibilities are subject to ongoing legislative changes. For instance, in 2024, several states are reviewing or have enacted new regulations concerning lease renewal options and early termination clauses, which could affect the terms of Agree Realty's long-term net leases.

Adaptability to evolving landlord-tenant laws is critical for Agree Realty. Changes in commercial leasing regulations, such as those related to property tax pass-throughs or common area maintenance (CAM) charges, could directly influence the profitability and stability of its portfolio. Staying abreast of these legal shifts ensures the integrity of its lease agreements.

- Evolving Lease Regulations: Legal frameworks governing commercial leases are constantly updated, affecting tenant rights and landlord obligations.

- Net Lease Impact: Agree Realty's reliance on net leases means changes in laws regarding expense allocation could directly impact its net operating income.

- Tenant Protection Focus: Increased tenant protections in lease agreements require careful review and potential adjustments to standard lease terms.

- Regulatory Compliance: Adherence to new or revised leasing laws is paramount to avoid legal challenges and maintain operational efficiency.

The legal environment for real estate investment trusts (REITs) like Agree Realty is shaped by evolving tax laws and corporate transparency mandates. Proposed legislation in 2024 could enhance tax advantages for REITs, such as potentially making bonus depreciation permanent, which would directly benefit Agree Realty's capital investments. However, legal challenges to regulations like the Corporate Transparency Act introduce uncertainty regarding beneficial ownership disclosures, although Agree Realty's existing public reporting may limit direct impact.

Environmental factors

Environmental, Social, and Governance (ESG) factors are significantly influencing commercial real estate, with new regulations anticipated by 2025. Agree Realty must embed ESG principles into its asset management and investment approaches, focusing on metrics like energy usage, carbon footprints, and climate vulnerability. For instance, the U.S. Green Building Council reported that green buildings can reduce energy costs by up to 30%.

The increasing demand for environmentally conscious real estate is a significant factor, with green building certifications like LEED (Leadership in Energy and Environmental Design) gaining substantial traction. Agree Realty can boost its portfolio's appeal and intrinsic worth by focusing on energy-efficient technologies and sustainable construction methods in both current assets and future projects.

Properties that achieve green certifications often see higher rental income and increased asset valuations, reflecting a strong alignment with prevailing market preferences and investor sentiment. For instance, studies in 2024 indicated that LEED-certified buildings can achieve a 3-5% higher rental premium compared to conventional structures.

Climate resilience is becoming a critical factor for real estate. Agree Realty needs to integrate assessments of climate risks, like increased flooding or extreme heat, into how it chooses and develops properties. This proactive approach ensures its portfolio can handle environmental challenges.

By focusing on resilient building designs, such as elevated foundations or advanced cooling systems, Agree Realty can better protect its assets. For instance, in 2024, property damage from severe weather events in the US alone exceeded $50 billion, highlighting the financial impact of climate change.

Collaborating with communities on climate adaptation strategies, such as improving local infrastructure or water management, further safeguards Agree Realty's investments. This not only reduces potential financial losses but also enhances the long-term value and stability of its real estate holdings.

Energy Efficiency and Carbon Emissions Reduction

The real estate industry is a major source of global carbon emissions, prompting a push for more sustainable properties. Agree Realty is positioned to address this by upgrading its existing portfolio with energy-efficient technologies and integrating renewable energy sources to lower its environmental impact. For instance, as of early 2024, the commercial real estate sector in the US is increasingly investing in green building certifications, with over 30% of new construction aiming for LEED certification, reflecting a growing market demand for sustainability.

Stricter regulations, such as evolving Energy Performance Certificate (EPC) standards, are set to mandate higher energy efficiency for both new developments and existing properties. This regulatory pressure, expected to intensify through 2025, will likely drive further investment in sustainable retrofitting and operational improvements within the sector. For example, the European Union's "Energy Performance of Buildings Directive" aims to significantly reduce emissions from buildings by 2030, impacting property owners and investors across member states.

- Energy Efficiency Investments: Agree Realty can capitalize on the growing demand for sustainable real estate by investing in retrofitting its properties with advanced energy-efficient systems, such as LED lighting, high-performance insulation, and smart building management systems.

- Renewable Energy Integration: Exploring the adoption of on-site renewable energy generation, like solar panels, can further reduce Agree Realty's carbon footprint and potentially lower operating costs.

- Regulatory Compliance: Proactive adaptation to evolving EPC regulations will ensure long-term compliance and enhance the marketability and value of Agree Realty's assets.

- ESG Reporting: Demonstrating commitment to energy efficiency and carbon reduction aligns with increasing Environmental, Social, and Governance (ESG) investor expectations, potentially attracting a broader investor base.

Sustainable Materials and Waste Management

The real estate sector, including companies like Agree Realty, faces increasing pressure to adopt sustainable construction materials and implement efficient waste management. This trend is driven by both regulatory bodies and investor preferences for environmentally responsible operations. For instance, by 2024, the global green building materials market was projected to reach over $400 billion, highlighting a significant shift towards eco-friendly options.

Agree Realty can bolster its environmental credentials by prioritizing the use of recycled content, low-VOC (volatile organic compound) materials, and sustainably sourced timber in its development projects. Furthermore, robust waste management strategies, including comprehensive recycling programs and waste-to-energy initiatives at its properties, can substantially reduce its carbon footprint. Such practices are not only beneficial for the environment but also align with the growing demand from investors for Environmental, Social, and Governance (ESG) performance.

- Sustainable Materials: Increased adoption of recycled steel, reclaimed wood, and low-emission paints in new constructions and renovations.

- Waste Reduction: Implementation of on-site composting and advanced recycling systems for construction debris and operational waste.

- Carbon Footprint: Aiming to reduce embodied carbon in materials and operational emissions through efficient resource management.

- Investor Demand: Meeting ESG criteria, which are becoming increasingly critical for attracting capital and maintaining property valuations.

Environmental regulations are tightening, pushing companies like Agree Realty to prioritize energy efficiency and carbon reduction. By 2025, new standards will likely mandate higher performance from buildings, making sustainable practices essential for compliance and asset value. For example, the U.S. Green Building Council notes that green buildings can cut energy costs by up to 30%.

The market is increasingly favoring green certifications, with LEED-certified buildings often commanding higher rental premiums. Agree Realty can enhance its portfolio by adopting energy-efficient technologies and sustainable construction, aligning with investor preferences for ESG performance. Studies in 2024 showed these buildings can achieve 3-5% higher rental premiums.

Climate resilience is a growing concern, with severe weather events causing significant property damage, exceeding $50 billion in the US in 2024 alone. Agree Realty must assess and mitigate climate risks, such as flooding, by integrating resilient designs into its properties to protect its investments and ensure long-term stability.

Sustainable materials are also gaining traction, with the global green building materials market projected to exceed $400 billion by 2024. Agree Realty can improve its environmental footprint by using recycled content and low-VOC materials, meeting both regulatory demands and investor expectations for responsible operations.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Agree Realty is built upon comprehensive data from reputable sources including government economic reports, real estate market trend analyses, and industry-specific publications. This ensures a thorough understanding of the political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategic decisions.