Agree Realty Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agree Realty Bundle

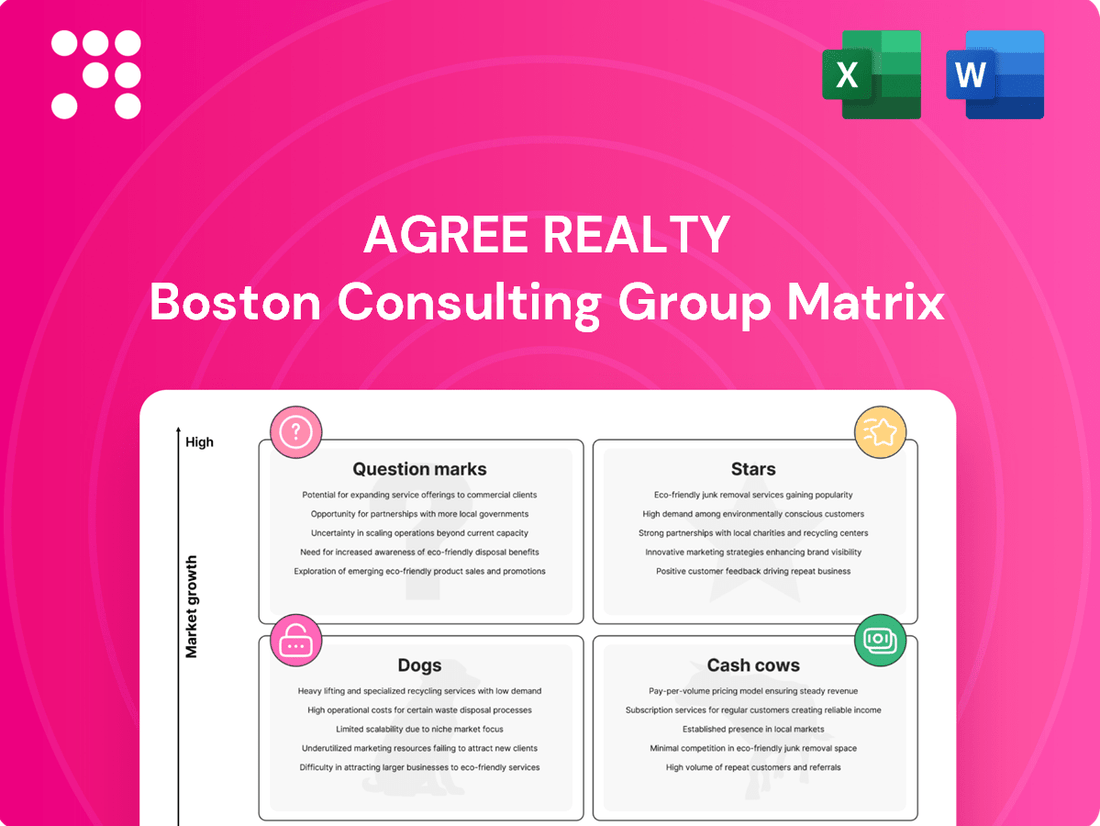

Unlock the strategic positioning of Agree Realty with our comprehensive BCG Matrix analysis. Discover which of their properties are market leaders (Stars), reliable income generators (Cash Cows), underperforming assets (Dogs), or potential growth opportunities (Question Marks).

This preview offers a glimpse into Agree Realty's portfolio dynamics. For a complete, actionable understanding of their market share and growth potential, purchase the full BCG Matrix report today.

Gain the strategic clarity needed to make informed investment decisions. The full report provides detailed quadrant placements and expert commentary, empowering you to navigate Agree Realty's real estate landscape with confidence.

Stars

Agree Realty's significant portfolio allocation to investment-grade retail tenants, which generated 68.3% of annualized base rents as of Q1 2025, positions these properties as strong contenders within the BCG framework. These tenants, often large national and regional brands, provide highly stable and predictable cash flows, indicating a strong market share in a mature yet resilient retail sector.

Agree Realty’s strategic focus on essential and recession-resistant retail tenants, like grocery and home improvement stores, positions them strongly. This segment boasts high market share and consistent growth, ensuring stable demand for their properties even during economic downturns.

By concentrating on retailers such as AutoZone and Dollar General, Agree Realty benefits from their consistent performance. For instance, in the first quarter of 2024, the company reported a 98.7% portfolio occupancy rate, underscoring the resilience of its tenant base.

Agree Realty's robust acquisition and development pipeline fuels its position as a star in the BCG matrix. For 2025, the company has set an aggressive investment guidance of $1.3 billion to $1.5 billion, underscoring a strong commitment to portfolio expansion. This focus on acquiring and developing high-quality net lease properties, supported by initiatives like their Developer Funding Platform, aims to capture significant market share in expanding retail segments.

Strong Balance Sheet and Liquidity

Agree Realty's robust financial health, often described as a 'fortress balance sheet,' provides significant strategic advantages. As of the first quarter of 2025, the company maintained over $1.9 billion in total liquidity. This substantial cash reserve, coupled with the absence of significant debt maturities until 2028, positions Agree Realty exceptionally well to pursue growth opportunities without immediate financial strain.

This strong liquidity directly supports Agree Realty's ability to invest aggressively in acquiring new properties and developing its portfolio. Such financial capacity allows the company to act decisively on attractive market opportunities, thereby expanding its footprint and solidifying its market share. The company's financial stability is a key enabler of its long-term growth strategy.

- Total Liquidity: Over $1.9 billion as of Q1 2025.

- Debt Maturity Profile: No material maturities until 2028.

- Strategic Advantage: Enables aggressive investment in new properties and market expansion.

- Financial Flexibility: Supports capitalizing on market opportunities and funding growth initiatives.

Consistent Dividend Growth and AFFO Performance

Agree Realty's commitment to shareholder returns is evident in its consistent dividend growth. The company anticipates its Adjusted Funds From Operations (AFFO) per share to fall between $4.27 and $4.30 for 2025, a figure that supports its ability to continue increasing payouts.

- Consistent Dividend Increases: Agree Realty has a track record of raising its monthly dividends, signaling financial strength and confidence in future earnings.

- Positive AFFO Growth: The projected AFFO per share for 2025, within the $4.27 to $4.30 range, demonstrates the company's operational efficiency and expanding asset base.

- Management Effectiveness: This financial performance underscores the effectiveness of Agree Realty's management team in generating value and supporting sustainable growth.

- Top-Tier REIT Status: The combination of dividend growth and solid AFFO performance solidifies Agree Realty's standing as a leading real estate investment trust.

Agree Realty's portfolio, heavily weighted towards investment-grade tenants (68.3% of annualized base rents in Q1 2025), signifies a strong market position in stable retail segments. Their focus on essential retailers like grocery and home improvement stores, coupled with a high occupancy rate of 98.7% in Q1 2024, demonstrates consistent demand and a resilient tenant base. The company's aggressive 2025 investment guidance of $1.3 billion to $1.5 billion, backed by over $1.9 billion in total liquidity as of Q1 2025 and no debt maturities until 2028, enables continuous growth and market share expansion, solidifying its 'Star' status.

| Metric | Value (Q1 2025 unless noted) | Significance for Star Status |

|---|---|---|

| Investment-Grade Tenant Rent % | 68.3% | Indicates stable, high-quality revenue streams. |

| Portfolio Occupancy Rate | 98.7% (Q1 2024) | Demonstrates strong demand and tenant retention. |

| 2025 Investment Guidance | $1.3B - $1.5B | Signals aggressive growth and expansion strategy. |

| Total Liquidity | Over $1.9B | Provides financial flexibility for acquisitions and development. |

| Debt Maturity Profile | No material maturities until 2028 | Ensures financial stability and capacity for investment. |

What is included in the product

This BCG Matrix overview provides clear descriptions and strategic insights for Agree Realty's Stars, Cash Cows, Question Marks, and Dogs.

The Agree Realty BCG Matrix provides a clear, one-page overview, relieving the pain of complex portfolio analysis.

Cash Cows

Agree Realty's core strength lies in its long-term net lease properties, a defining characteristic of its Cash Cows. This strategy ensures a consistent and reliable stream of income.

In this lease structure, tenants handle property operating expenses, which significantly reduces Agree Realty's costs. This operational efficiency translates to robust profit margins, especially crucial in the stable, mature real estate sector. For instance, as of the first quarter of 2024, Agree Realty reported a portfolio occupancy rate of 99.6%, underscoring the stability of its net lease tenants and their ability to generate predictable rental income.

Agree Realty's expansive portfolio, comprising 2,422 properties strategically located in all 50 states as of March 31, 2025, forms the bedrock of its Cash Cow status. This vast geographic spread and deep penetration across diverse retail sectors naturally creates a robust and stable income stream.

This significant diversification acts as a powerful risk mitigation tool. By not relying on a single tenant or a concentrated geographic area, Agree Realty is shielded from the impact of localized economic slowdowns or tenant-specific financial distress, ensuring predictable cash flow generation.

Agree Realty’s focus on maintaining a high occupancy rate, which stood at an impressive 99.2% in the first quarter of 2025, is a key indicator of its strength. This near-perfect leasing level underscores robust tenant demand for its retail properties and highlights the company's effective property management strategies.

A portfolio that is almost entirely leased means Agree Realty is maximizing its revenue generation from its existing real estate assets. This efficiency significantly reduces the financial burden of vacant properties, directly contributing to stable and predictable income streams.

Ground Lease Portfolio

Agree Realty's ground lease portfolio is a key component of its strategy, demonstrating a commitment to stable, predictable income. This segment, which accounted for 11% of annualized base rents in the first quarter of 2025, offers a compelling blend of low risk and high margins.

Ground leases function as a foundational element, akin to a bond, within Agree Realty's broader asset base. They provide a secure, long-term revenue stream with significantly reduced landlord responsibilities compared to traditional net lease properties.

- Growing Ground Lease Contribution: Constituting 11% of annualized base rents as of Q1 2025.

- Low-Risk, High-Margin Profile: Characterized by stable, long-term income generation.

- Minimal Landlord Responsibility: Enhances operational efficiency and profitability.

- 'Bond-Like' Stability: Provides a predictable and secure income foundation for the portfolio.

Established Industry Relationships

Agree Realty's established industry relationships are a cornerstone of its Cash Cow status. These long-standing partnerships with leading omni-channel retailers provide a predictable and consistent revenue stream. For instance, in 2024, Agree Realty continued to benefit from its strong ties with major tenants, many of whom operate in resilient, albeit lower-growth, retail sectors. This stability is a key characteristic of a Cash Cow, allowing the company to generate significant cash flow with minimal reinvestment.

These deep-rooted relationships are not just about current income; they also pave the way for future opportunities. The trust and proven track record built over years facilitate easier negotiation for lease renewals and potential expansion projects within these established tenant relationships. This strategic advantage ensures continued occupancy and rental income, reinforcing Agree Realty's position in its core markets.

- Strong Tenant Diversification: Agree Realty's portfolio in 2024 featured a diverse mix of high-quality tenants, reducing reliance on any single entity.

- Long-Term Lease Agreements: Many of these established relationships are underpinned by long-term leases, often with built-in rent escalations, further securing predictable cash flows.

- Proven Market Resilience: The company's focus on essential retail and service-oriented businesses has historically demonstrated resilience, even during economic fluctuations.

- Operational Efficiency: The familiarity and ease of working with established partners contribute to operational efficiencies, minimizing management costs and maximizing profitability from these assets.

Agree Realty's extensive portfolio of 2,422 properties across all 50 states as of March 31, 2025, forms the bedrock of its Cash Cow status. This wide geographic spread and deep penetration across diverse retail sectors naturally creates a robust and stable income stream.

The company's commitment to maintaining a high occupancy rate, which stood at an impressive 99.2% in the first quarter of 2025, is a key indicator of its strength. This near-perfect leasing level underscores robust tenant demand and highlights effective property management, directly contributing to stable and predictable income streams.

Agree Realty's ground lease portfolio, accounting for 11% of annualized base rents in the first quarter of 2025, offers a compelling blend of low risk and high margins, providing 'bond-like' stability.

The company's established industry relationships with leading omni-channel retailers in 2024 provide a predictable and consistent revenue stream, often underpinned by long-term leases with built-in rent escalations.

| Metric | Q1 2025 Value | Significance for Cash Cows |

|---|---|---|

| Portfolio Occupancy Rate | 99.2% | Maximizes revenue from existing assets, ensures predictable income. |

| Ground Lease Contribution to Annualized Base Rents | 11% | Provides low-risk, stable, and high-margin income. |

| Property Count | 2,422 | Geographic diversification reduces risk and enhances income stability. |

| Tenant Diversification (2024 data) | High | Reduces reliance on any single tenant, ensuring consistent cash flow. |

Preview = Final Product

Agree Realty BCG Matrix

The Agree Realty BCG Matrix document you are currently previewing is the identical, fully-unlocked version you will receive immediately after purchase. This means you'll get the complete strategic analysis, free from any watermarks or placeholder content, ready for immediate application in your business planning.

Rest assured, the Agree Realty BCG Matrix report displayed here is the exact file you will download upon completing your purchase. It's a professionally crafted, analysis-ready document, providing comprehensive insights into Agree Realty's portfolio without any hidden surprises or need for further editing.

Dogs

Underperforming non-core assets in Agree Realty's portfolio are properties not deemed essential, lacking recession resistance, or not leased to creditworthy tenants. These assets may be candidates for disposition.

Agree Realty has demonstrated a proactive approach to managing its portfolio through strategic sales. For instance, in the second quarter of 2024, the company completed dispositions totaling $36.9 million. This activity underscores a clear strategy to divest assets that are underperforming or no longer align with the company's core strategic focus.

Properties with short remaining lease terms, particularly those lacking clear renewal options or strong re-leasing potential, would fall into the Dogs category within the Agree Realty BCG Matrix. These assets require careful attention to prevent them from becoming financial burdens.

While Agree Realty generally focuses on properties with extended lease agreements, a minor portion of its annualized base rents, such as the 0.9% maturing in 2025, necessitates proactive management. This ensures these expiring leases do not negatively impact cash flow.

Geographically concentrated or niche market properties within Agree Realty's portfolio could be those situated in declining retail areas or highly specialized sectors that diverge from their primary focus on essential retail. While Agree Realty boasts a diversified portfolio, specific underperforming assets in markets lacking resilience might fit this description.

Legacy Assets with Lower Cap Rates

Legacy Assets with Lower Cap Rates represent older properties in Agree Realty's portfolio, acquired when capitalization rates were generally lower. These assets might not provide the same level of yield as more recent acquisitions, particularly given the current interest rate landscape. Agree Realty's strategic emphasis on acquiring new properties at higher cap rates signals a potential move to rebalance its portfolio away from these lower-yielding legacy holdings.

The impact of these legacy assets can be observed in the overall portfolio yield. For instance, while Agree Realty's 2024 acquisition strategy targets higher cap rates, the existing portfolio's weighted average cap rate is influenced by these older, lower-yielding properties. This dynamic highlights the ongoing management of asset age and acquisition timing to optimize portfolio returns.

- Portfolio Yield Influence: Legacy assets acquired at lower cap rates can dilute the overall portfolio's average yield.

- Strategic Rebalancing: Agree Realty's focus on new acquisitions at higher cap rates indicates a strategy to improve portfolio income.

- Market Dynamics: Changing interest rate environments can further accentuate the lower relative returns of legacy assets.

Tenant-Specific Challenges

Even with a diversified portfolio, Agree Realty can face challenges if specific tenants experience financial difficulties. For instance, if a major tenant like Big Lots were to face bankruptcy, the properties leased to them could become problematic, impacting cash flow and requiring active management to find new tenants.

These tenant-specific issues can temporarily tie up capital that could otherwise be invested in growth opportunities. Agree Realty's ability to quickly re-lease vacant spaces is crucial in mitigating these risks, as demonstrated by their efforts to backfill spaces vacated by struggling retailers.

- Tenant Financial Distress: Properties linked to tenants facing bankruptcy or significant financial strain can become underperforming assets.

- Capital Tie-up: Vacancies caused by tenant issues can immobilize capital, delaying new investments.

- Re-leasing Agility: Agree Realty's success in finding new tenants quickly is key to minimizing the impact of tenant-specific challenges.

- Example: The situation with Big Lots highlights the potential for specific tenant struggles to affect property performance.

In Agree Realty's portfolio, "Dogs" represent properties that are underperforming and offer limited growth potential. These are often older assets with shorter lease terms or tenants facing financial uncertainty, such as those with limited renewal options. The company's strategy involves actively managing these assets, potentially through disposition, to optimize the overall portfolio's performance and cash flow.

Agree Realty's proactive approach to portfolio management includes divesting assets that no longer align with its strategic goals. For example, the company completed $36.9 million in dispositions during Q2 2024, signaling a clear intent to shed underperforming properties. This focus ensures that capital is directed towards more promising opportunities, enhancing the portfolio's overall yield and resilience.

While Agree Realty's portfolio is largely composed of long-term leases with creditworthy tenants, a small percentage of annualized base rents, like the 0.9% maturing in 2025, requires careful attention. These short-term leases, especially those without strong renewal prospects, can be categorized as "Dogs" if they don't offer clear paths to continued income or re-leasing.

Legacy assets acquired at lower capitalization rates can also be considered "Dogs" if they no longer meet current yield expectations, particularly in a rising interest rate environment. Agree Realty's strategy of acquiring new properties at higher cap rates suggests a move to rebalance the portfolio away from these lower-yielding, older holdings.

Question Marks

Agree Realty's new development projects, including those within its Developer Funding Platform (DFP), represent significant investments in future growth. As of the first quarter of 2024, the company reported approximately $1.2 billion in total development commitments, underscoring a robust pipeline of new retail locations. These initiatives are strategically targeting expanding markets, aiming to capture increasing market share and generate future profitability as they stabilize.

Agree Realty's strategy generally favors established tenants with proven track records, making early-stage acquisitions in emerging retail concepts a rarer occurrence. These types of investments, while potentially offering high growth, carry greater risk due to unproven long-term market share and require substantial marketing and management to foster buyer adoption and market penetration.

Agree Realty's portfolio may include properties within retail sub-sectors undergoing rapid evolution, such as experiential retail or those heavily integrated with e-commerce fulfillment. These investments represent a commitment to high-growth areas, though their long-term stability is still being shaped by evolving consumer behaviors and technological advancements. For instance, the rise of omnichannel retail strategies has fundamentally altered how consumers interact with physical stores, creating both opportunities and uncertainties for property owners in these dynamic segments.

Opportunistic Lender-Owned Asset Acquisitions

Agree Realty's strategic focus on acquiring lender-owned assets in stressed markets highlights a key opportunistic approach. This strategy allows them to capitalize on situations where distressed properties may offer attractive risk-adjusted returns, aligning with their ability to act with speed and decisiveness.

These acquisitions, while potentially high-reward, often involve properties that may initially exhibit lower market share. Agree Realty's objective is to transform these into high-growth 'Stars' within their portfolio through targeted strategic investments and operational improvements. For instance, during 2024, Agree Realty continued to refine its portfolio, divesting non-core assets and reinvesting in high-quality, necessity-based retail properties, which often include opportunities arising from market dislocations.

- Opportunistic Acquisitions: Agree Realty can leverage its financial strength and agility to acquire lender-owned assets, often at favorable valuations.

- Risk-Adjusted Returns: These distressed assets, when strategically managed, can yield superior returns compared to traditional acquisitions.

- Portfolio Enhancement: The strategy aims to identify and reposition underperforming assets into strong performers, boosting overall portfolio quality.

- Market Agility: Agree Realty's capacity to move quickly in stressed markets is a critical enabler of this opportunistic acquisition strategy.

Expansion into New Geographic Regions with High Growth

Expansion into new geographic regions with high growth potential, even within existing operational states, would position Agree Realty’s new ventures as question marks in the BCG matrix. While the company has a nationwide presence, targeting specific, rapidly expanding sub-markets or exploring international opportunities represents a move into areas where Agree Realty currently holds a low market share, despite the overall market's strong growth trajectory.

For instance, if Agree Realty were to focus on expanding its retail footprint in Sun Belt states experiencing significant population influx, such as Texas or Florida, in 2024, these new locations would represent question marks. These markets offer substantial growth opportunities, but Agree Realty’s brand recognition and existing property portfolio in those specific burgeoning sub-markets might be nascent, leading to an initial low market share despite high market growth.

- Targeting high-growth sub-markets within existing states.

- Exploring international markets with strong economic expansion.

- Initial low market share in these new, growing territories.

- Significant investment required to build market presence and capture share.

Agree Realty's expansion into new, high-growth geographic areas or retail sub-sectors positions these ventures as question marks. These initiatives, while tapping into rapidly expanding markets, often begin with a relatively low market share for Agree Realty. Significant investment is typically needed to establish a strong foothold and gain market traction in these nascent territories.

For example, Agree Realty's continued focus on necessity-based retail in Sun Belt states during 2024, such as Texas and Florida, where population growth is robust, exemplifies this strategy. While the overall market is growing, Agree Realty's presence in specific, rapidly developing sub-markets within these states might be limited, thus representing an initial low market share.

These question mark investments require careful evaluation due to their inherent uncertainty and the need for substantial capital to cultivate them into potential stars. The success of these ventures hinges on Agree Realty's ability to execute its strategy effectively and adapt to evolving consumer preferences in these dynamic markets.

Agree Realty's commitment to new development, including its Developer Funding Platform, highlights its pursuit of future growth. As of Q1 2024, the company had approximately $1.2 billion in total development commitments, signaling a pipeline of new retail locations in markets with high growth potential but where Agree Realty's current market share may be low.

| BCG Category | Market Growth | Relative Market Share | Agree Realty Example (2024 Focus) | Strategic Consideration |

|---|---|---|---|---|

| Question Marks | High | Low | New retail developments in rapidly expanding Sun Belt sub-markets (e.g., Texas, Florida) | Requires significant investment to build market presence and achieve scale. High potential for future growth if successful. |

| Question Marks | High | Low | Entry into emerging, high-growth retail sub-sectors (e.g., experiential retail) | Long-term viability uncertain due to evolving consumer behavior; needs strategic repositioning and tenant mix optimization. |

BCG Matrix Data Sources

Our Agree Realty BCG Matrix leverages comprehensive data from SEC filings, property transaction records, and real estate market analytics to accurately assess portfolio performance and growth potential.