Hazama Ando PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hazama Ando Bundle

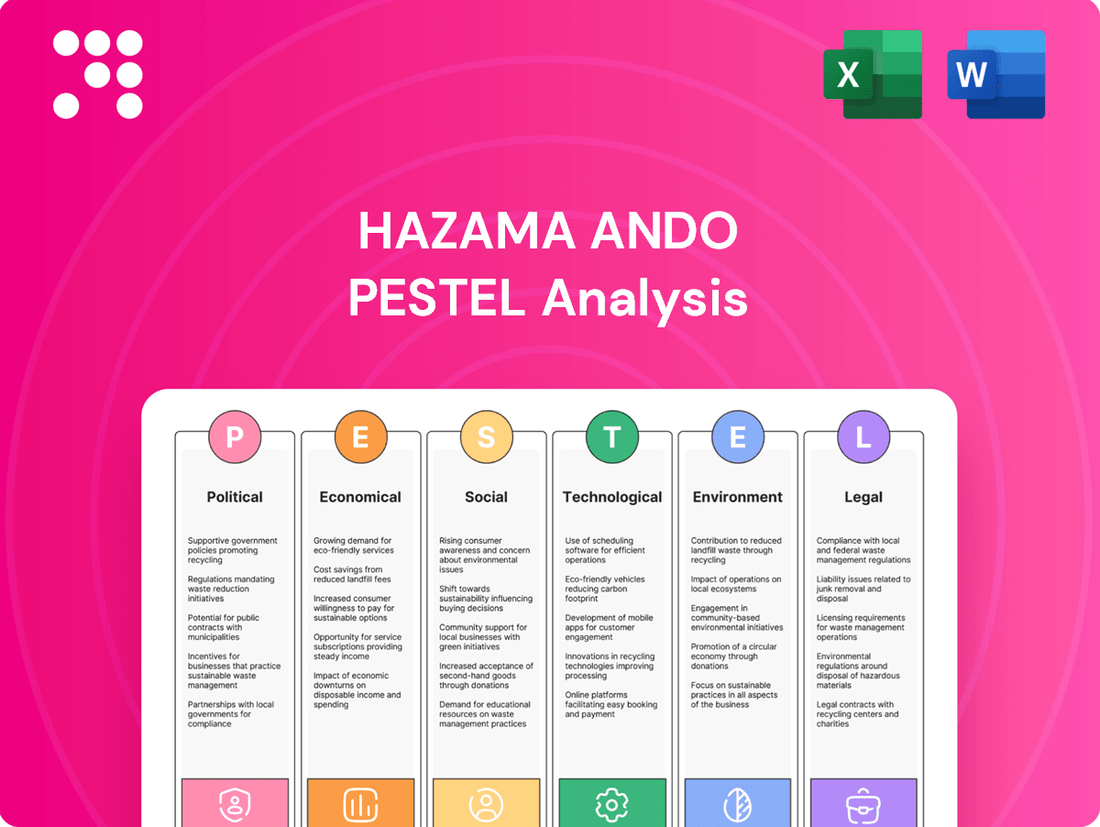

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping Hazama Ando's trajectory. Our meticulously researched PESTLE analysis provides actionable intelligence to navigate these external dynamics and identify strategic opportunities. Gain a competitive edge by understanding the complete landscape. Download the full version now for immediate, in-depth insights.

Political factors

Government investment in infrastructure projects is a major driver for the construction industry. Japan's dedication to improving its transportation systems, urban areas, and disaster preparedness through significant public spending directly benefits companies like Hazama Ando.

The Japanese government's commitment to infrastructure development is evident in its budget allocations. For the 2025/26 fiscal year, planned expenditures are set at JPY115.5 trillion, representing a 2.6% increase from the previous year. This substantial funding will undoubtedly support a wide array of construction projects, creating opportunities for major contractors.

Changes in building standards and regulations, particularly those related to energy efficiency and safety, significantly impact construction practices and material choices for companies like Hazama Ando.

Japan's revised Building Standards Act, effective April 2025, introduces stricter structural review rules and mandates energy efficiency compliance. This means Hazama Ando will need to adapt its designs and construction methods to meet these new requirements, potentially increasing project costs and timelines.

The Japanese government's ongoing commitment to fostering public-private partnerships (PPPs) presents significant avenues for Hazama Ando. For instance, in fiscal year 2023, the Ministry of Land, Infrastructure, Transport and Tourism reported a substantial increase in the number of PPP projects initiated across infrastructure sectors, signaling a robust policy environment. This governmental push encourages collaborations that can streamline the execution of major construction and development projects, particularly in urban renewal and smart city advancements.

Political Stability and Policy Continuity

Japan's political landscape has historically been characterized by stability, which is crucial for long-term infrastructure investments like those undertaken by Hazama Ando. This stability translates into a more predictable policy environment, reducing the risk of sudden regulatory shifts that could impact project timelines or profitability. For instance, the government's commitment to infrastructure development, as evidenced by consistent budget allocations for public works, provides a solid foundation for construction firms.

The continuity of policies, particularly those related to urban development and disaster resilience, directly benefits companies like Hazama Ando. These ongoing initiatives ensure a steady pipeline of projects, allowing for strategic planning and efficient resource allocation. In 2024, Japan's focus on rebuilding and modernizing infrastructure, especially in light of climate change adaptation, continues to support the construction sector.

- Consistent Infrastructure Spending: Japan's government has maintained a steady commitment to infrastructure investment, with projected public works spending remaining robust through 2025, supporting companies like Hazama Ando.

- Policy Predictability: A stable political environment minimizes regulatory uncertainty, enabling construction firms to undertake large-scale, multi-year projects with greater confidence in policy continuity.

- Disaster Preparedness Focus: Ongoing government initiatives for seismic retrofitting and disaster-resilient infrastructure development create sustained demand for specialized construction services.

International Relations and Trade Policies

Geopolitical tensions and evolving trade policies significantly impact material costs and the stability of supply chains within the construction sector. For Japanese contractors like Hazama Ando, even with a primary domestic focus, global economic shifts and international sanctions can ripple through, affecting resource expenses and overall project profitability. For instance, in early 2024, disruptions in global shipping, partly due to regional conflicts, led to increased freight costs for imported construction materials, adding pressure to project budgets.

These international dynamics can directly influence the availability and pricing of key construction inputs. For example, fluctuations in the price of steel or cement, often influenced by international demand and trade agreements, can have a substantial effect on Hazama Ando's project costs. The ongoing trade relationship between Japan and its major trading partners, including the United States and China, remains a critical factor in forecasting these material expenses.

- Impact on Material Costs: Trade disputes or tariffs can directly increase the price of imported raw materials and components used in construction projects.

- Supply Chain Disruptions: Geopolitical instability can lead to delays or interruptions in the flow of goods, affecting project timelines and increasing logistical expenses.

- Resource Availability: International sanctions or export restrictions on certain countries can limit access to specific resources or technologies crucial for advanced construction techniques.

- Currency Fluctuations: Global economic uncertainty often leads to currency volatility, which can impact the cost of foreign-sourced materials and equipment for Japanese firms.

Japan's stable political environment provides a predictable framework for long-term infrastructure investments, benefiting companies like Hazama Ando. Government commitment to public-private partnerships (PPPs) and ongoing initiatives for disaster resilience ensure a consistent pipeline of projects, as seen in the continued focus on rebuilding and modernization efforts in 2024.

Changes in building standards, such as the revised Building Standards Act effective April 2025, introduce stricter rules for structural review and energy efficiency, requiring adaptation in construction practices. Geopolitical tensions and evolving trade policies can also impact material costs and supply chain stability for Japanese contractors, even those with a primarily domestic focus.

| Factor | Impact on Hazama Ando | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Infrastructure Spending | Directly benefits construction sector through project opportunities. | Japan's fiscal year 2025/26 budget includes JPY115.5 trillion for public works, a 2.6% increase. |

| Regulatory Changes | Requires adaptation to new building standards, potentially increasing costs. | Revised Building Standards Act (effective April 2025) mandates stricter structural review and energy efficiency. |

| Public-Private Partnerships (PPPs) | Offers avenues for collaboration and streamlined project execution. | Increased number of PPP projects reported by MLIT in fiscal year 2023. |

| Geopolitical/Trade Policies | Can affect material costs and supply chain stability. | Global shipping disruptions in early 2024 led to increased freight costs for imported materials. |

What is included in the product

This PESTLE analysis unpacks the external macro-environmental forces impacting Hazama Ando, examining Political, Economic, Social, Technological, Environmental, and Legal factors to reveal strategic opportunities and potential threats.

A Hazama Ando PESTLE Analysis provides a structured framework to proactively identify and address external factors, acting as a pain point reliever by mitigating unforeseen risks and informing strategic decision-making for sustained business growth.

Economic factors

Japan's Gross Domestic Product (GDP) growth is a key indicator of its overall economic health, and this directly influences the demand for construction services. Strong economic expansion typically translates to increased investment in infrastructure and private sector projects, benefiting companies like Hazama Ando.

The Japanese construction market is forecast to experience a Compound Annual Growth Rate (CAGR) of 3.30% between 2024 and 2029. This projected growth suggests a favorable and expanding market for Hazama Ando's core business areas, including civil engineering and building construction.

Interest rates are a critical lever for Hazama Ando. Fluctuations directly impact borrowing costs for the company itself and for its clients, which in turn shapes investment decisions for new projects. Higher rates mean more expensive loans, potentially slowing down the pace of construction.

Looking ahead, the economic outlook suggests potential shifts. Analysts are anticipating possible interest rate cuts by the end of 2025. If these cuts materialize, it could significantly boost the construction sector by making capital more accessible and affordable, likely spurring more project starts and overall spending.

Rising material costs, fueled by inflation and ongoing supply chain issues, directly squeeze project profitability for companies like Hazama Ando. This is a significant concern for the construction sector.

The Japanese construction industry, including Hazama Ando, is currently facing substantial inflation and increased resource expenses. Global geopolitical events and the depreciation of the yen have worsened these challenges, making cost control particularly difficult.

For instance, in early 2024, Japan's core inflation rate hovered around 2.5%, a notable increase from previous years, impacting everything from steel to cement prices. This inflationary pressure, coupled with persistent logistical hurdles, means Hazama Ando must navigate higher input costs to maintain its margins.

Labor Costs and Availability

Japan's construction sector faces a critical labor shortage, exacerbated by new overtime regulations implemented in April 2024. This '2024 problem' directly impacts companies like Hazama Ando by escalating labor costs and extending project completion times. For instance, the average monthly wage for construction workers in Japan saw an increase, with some reports indicating a rise of over 5% year-on-year leading into 2024, a trend expected to continue due to these pressures.

The combination of fewer available workers and stricter working hour limits means contractors must offer higher wages and potentially hire more personnel to maintain project schedules. This situation is driving up operational expenses significantly, impacting profitability and the competitiveness of bids. The cost of skilled labor, in particular, has become a major concern, with shortages most acute in specialized trades.

- Labor Shortage Impact: Reduced workforce availability in construction.

- Overtime Limits: New regulations effective April 2024 constrain working hours.

- Cost Escalation: Increased wages and benefits are necessary to attract and retain workers.

- Project Delays: Extended timelines due to labor constraints and working hour restrictions.

Real Estate Market Trends

The real estate market is a significant driver for Hazama Ando, influencing demand across commercial, residential, and public sectors. Urban redevelopment projects, particularly in major hubs like Tokyo and Osaka, are showcasing robust activity. For instance, the ongoing development of new commercial towers and integrated mixed-use complexes in these cities directly translates to increased demand for the building construction services Hazama Ando provides. This trend is expected to continue, supported by Japan's focus on revitalizing urban centers.

Several key trends underscore this dynamic:

- Increased Investment in Urban Redevelopment: Major cities like Tokyo and Osaka are seeing substantial investment in large-scale urban renewal projects, creating a pipeline of construction opportunities.

- Demand for Mixed-Use Developments: The preference for integrated living, working, and leisure spaces is driving the construction of mixed-use complexes, a segment where Hazama Ando can leverage its expertise.

- Government Support for Infrastructure: Public facility development, often linked to urban regeneration, receives government backing, further stimulating construction demand.

- Post-Pandemic Office Space Evolution: While office demand is shifting, the need for modern, flexible, and sustainable office spaces continues to fuel construction and renovation projects.

Japan's economic growth directly impacts construction demand, with a projected CAGR of 3.30% for the sector between 2024 and 2029. Interest rate shifts are critical; potential cuts by late 2025 could boost construction by making capital more accessible. However, rising material costs, with core inflation around 2.5% in early 2024, and a significant labor shortage exacerbated by new overtime regulations from April 2024, are increasing operational expenses and project timelines.

| Economic Factor | 2024/2025 Data/Projection | Impact on Hazama Ando |

|---|---|---|

| GDP Growth (Japan) | Positive, driving infrastructure and private investment | Increased demand for construction services |

| Construction Sector CAGR | 3.30% (2024-2029) | Favorable market expansion |

| Interest Rates | Potential cuts anticipated by end of 2025 | Lower borrowing costs, potentially stimulating project starts |

| Inflation (Core) | Around 2.5% (early 2024) | Increased material and operational costs, squeezing profitability |

| Labor Market | Shortage, impact of April 2024 overtime regulations | Higher labor costs, potential project delays, increased operational expenses |

What You See Is What You Get

Hazama Ando PESTLE Analysis

The preview shown here is the exact Hazama Ando PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of Hazama Ando's operating environment.

The content and structure shown in the preview is the same Hazama Ando PESTLE Analysis document you’ll download after payment, offering detailed insights into Political, Economic, Social, Technological, Legal, and Environmental factors.

Sociological factors

Japan's demographic landscape, marked by an aging population and a declining workforce, poses a substantial hurdle for the construction sector. As of recent data, a considerable 36% of the construction workforce is 55 years or older, highlighting a critical dependency on older workers.

This pronounced demographic trend directly contributes to intensified labor shortages across the industry. Consequently, companies like Hazama Ando must actively develop and implement robust strategies focused on attracting and retaining younger talent to ensure future operational capacity and growth.

Urbanization continues to fuel a robust demand for new infrastructure and extensive redevelopment projects, particularly in Japan's major metropolitan areas. This trend directly benefits companies like Hazama Ando, which specialize in large-scale construction and engineering.

Tokyo and Osaka are at the forefront of these transformations, with significant redevelopment initiatives underway. For instance, Tokyo's Toranomon-Azabudai Project, a massive urban renewal endeavor, aims to create a vibrant new district, showcasing the scale of modernization efforts. These projects not only enhance urban living but also require sophisticated engineering and construction capabilities, aligning with Hazama Ando's core competencies.

Public perception of the construction industry, including companies like Hazama Ando, often paints a picture of low status jobs, demanding physical labor, and a pervasive 'macho culture.' These perceptions act as significant deterrents, particularly for younger generations who may be seeking different work environments and career paths. This image problem directly impacts talent acquisition, a critical factor for any company's future growth and innovation.

To counter this, there's a growing emphasis on improving the industry's overall image. Initiatives focus on highlighting the skilled trades, technological advancements within construction, and the vital role the sector plays in building essential infrastructure. Promoting more diverse and inclusive working environments is also key to attracting a broader range of talent, moving away from traditional stereotypes.

In 2024, reports indicated that the construction sector in Japan, where Hazama Ando operates, faced a significant labor shortage, with demand for skilled workers outstripping supply. For instance, a 2023 survey by the Ministry of Land, Infrastructure, Transport and Tourism revealed a projected deficit of over 1 million construction workers by 2030 if current trends continue. This underscores the urgency for companies like Hazama Ando to actively reshape public perception and create a more appealing workplace.

Work-Life Balance and Labor Practices

New labor laws, such as the overtime caps introduced in April 2024, are significantly impacting the construction industry by prioritizing work-life balance for workers. These regulations, designed to prevent excessive working hours, aim to enhance employee well-being and reduce burnout within the sector.

The implementation of these labor reforms presents a dual-edged sword for companies like Hazama Ando. While fostering a healthier work environment, the mandated overtime limitations can lead to extended project timelines and potentially a reduced capacity for firms to manage the same volume of construction projects as before.

- Overtime Caps: April 2024 saw the introduction of new laws capping overtime hours for construction workers, a move aimed at improving work-life balance.

- Project Timelines: These regulations may contribute to longer construction schedules due to the reduced available working hours per employee.

- Capacity Constraints: Firms might face challenges in undertaking as many projects simultaneously due to these labor practice adjustments.

Community Engagement and Social Responsibility

Hazama Ando's commitment to community engagement and social responsibility is increasingly vital. In 2024, a significant portion of infrastructure projects, particularly those involving large-scale construction, face heightened public scrutiny regarding their local impact. Companies like Hazama Ando are expected to go beyond mere compliance, actively participating in regional revitalization efforts.

This focus translates into tangible actions such as offering site tours to local residents and educational institutions, fostering transparency and understanding of their operations. Furthermore, corporate citizenship activities, including environmental stewardship and support for local charities, are crucial for building and maintaining positive stakeholder relationships. For instance, many construction firms in 2024 are investing in local workforce development programs, aiming to provide skills training and employment opportunities within the communities where they operate.

- Community Connection: In 2024, construction companies are prioritizing outreach to local communities, offering site tours and educational programs to build trust and understanding.

- Regional Revitalization: Hazama Ando's involvement in local development projects, such as infrastructure upgrades or urban renewal initiatives, directly contributes to the economic and social well-being of surrounding areas.

- Stakeholder Relations: Active participation in corporate citizenship, including environmental initiatives and local event sponsorships, strengthens Hazama Ando's reputation and fosters positive relationships with community members and local government.

- Social License to Operate: Demonstrating a strong commitment to social responsibility is becoming a prerequisite for securing and maintaining a social license to operate, particularly for large-scale construction projects in densely populated regions.

Japan's aging demographic, with 36% of construction workers over 55, creates significant labor shortages, compelling companies like Hazama Ando to focus on attracting younger talent. The industry's perception as low-status and physically demanding deters new entrants, necessitating image improvement initiatives highlighting skilled trades and technology.

New labor laws in 2024, including overtime caps, aim to improve work-life balance but may lengthen project timelines and constrain firm capacity. Furthermore, heightened public scrutiny in 2024 demands greater community engagement and social responsibility from construction firms, with many investing in local workforce development.

| Sociological Factor | Impact on Hazama Ando | Supporting Data/Trends (2024/2025) |

|---|---|---|

| Demographics (Aging Population) | Critical labor shortages, need for talent acquisition strategies | 36% of construction workforce aged 55+; projected deficit of over 1 million workers by 2030 (Ministry of Land, Infrastructure, Transport and Tourism) |

| Public Perception of Industry | Deters younger talent, requires image enhancement | Perceived as low-status, physically demanding; initiatives focus on skilled trades and technology |

| Labor Laws & Work-Life Balance | Potential for longer project timelines, reduced capacity | Overtime caps introduced April 2024; focus on employee well-being |

| Community Engagement & Social Responsibility | Essential for social license to operate, stakeholder relations | Increased public scrutiny; focus on local revitalization, transparency, and corporate citizenship |

Technological factors

Building Information Modeling (BIM) adoption is significantly reshaping how construction projects are designed, managed, and executed within Japan. This digital transformation is crucial for companies like Hazama Ando, as it streamlines workflows and improves collaboration.

The Japanese Ministry of Land, Infrastructure, Transport and Tourism has set a target for BIM implementation by 2025, signaling its critical role for all stakeholders. This push aims to boost overall industry productivity and deliver greater project value.

Hazama Ando is increasingly seeing the impact of automation and robotics on construction efficiency. This technology offers a promising solution to the persistent labor shortages in the sector, potentially boosting productivity. For instance, projects in 2024 are leveraging robotic bricklayers and autonomous excavators, aiming to reduce project timelines by up to 20% in controlled environments.

The development and adoption of advanced, eco-friendly materials are increasingly vital for construction firms like Hazama Ando. Innovations such as CO2-absorbing concrete, which can capture atmospheric carbon dioxide during its curing process, are gaining traction. For instance, by 2024, several pilot projects in Japan are showcasing the potential of such materials to significantly reduce the carbon footprint of buildings.

Sustainable construction methods, including the reuse and recycling of structural materials, are also becoming critical drivers. This aligns directly with Japan's ambitious carbon neutrality goals, aiming for net-zero greenhouse gas emissions by 2050. Companies are investing in technologies that facilitate the deconstruction and repurposing of building components, contributing to a circular economy within the construction sector.

The push for green building certifications, such as LEED or Japan's CASBEE, further incentivizes the use of these advanced materials and methods. As of early 2025, the demand for certified green buildings continues to rise, creating a market advantage for contractors who can demonstrate expertise in sustainable construction practices and material sourcing.

Digital Project Management and AI Integration

Hazama Ando is increasingly leveraging digital project management tools, including artificial intelligence (AI) and data analytics. These technologies are crucial for enhancing site inspections and overall project oversight, offering real-time insights that were previously unattainable. For instance, the adoption of AI in construction project management is projected to save the industry billions annually by improving efficiency and reducing errors.

The integration of these advanced digital solutions directly translates into tangible benefits for Hazama Ando. By minimizing waste, reducing operational costs, and streamlining collaboration among diverse project teams, these tools optimize resource allocation and improve project delivery timelines. The global construction project management software market was valued at approximately $2.5 billion in 2023 and is expected to grow significantly, indicating a strong industry trend towards digital transformation.

Specific technological advancements are reshaping how construction projects are managed and executed:

- AI-powered analytics: These tools analyze vast datasets from site activities to predict potential delays or cost overruns, allowing for proactive mitigation strategies.

- Drone technology: Drones equipped with advanced sensors provide high-resolution aerial imagery for progress monitoring, safety inspections, and site surveying, improving accuracy and speed.

- Digital twins: Creating virtual replicas of physical assets allows for detailed simulation and analysis, optimizing design, construction, and maintenance phases.

- Data-driven decision-making: Real-time data from IoT devices and sensors on equipment and materials enables more informed and agile decision-making throughout the project lifecycle.

Smart City Technologies

Investment in smart city technologies, particularly those leveraging the Internet of Things (IoT) and Artificial Intelligence (AI), is a significant driver in shaping modern urban development and infrastructure. These advancements are fundamentally altering how cities operate, from traffic flow to resource management. For instance, the global smart city market was valued at approximately $510 billion in 2023 and is projected to reach over $1.7 trillion by 2030, showcasing substantial growth and opportunity.

Hazama Ando's strategic involvement in projects that incorporate smart traffic management systems and energy-efficient housing directly aligns with Japan's national objectives for creating interconnected and resilient urban environments. These initiatives are crucial for improving quality of life and sustainability. Japan's government has been actively promoting smart city development, with significant national funding allocated to pilot projects and research in areas like 5G deployment and data-driven urban planning, aiming to boost technological integration across its cities.

The company's participation in such projects positions it to capitalize on the increasing demand for integrated urban solutions.

- Smart City Market Growth: The global smart city market is expected to surge from around $510 billion in 2023 to over $1.7 trillion by 2030.

- IoT and AI Integration: These technologies are central to enhancing urban efficiency, safety, and sustainability.

- Japanese Government Support: National initiatives and funding are actively encouraging smart city development in Japan.

- Hazama Ando's Role: The company is actively engaged in projects that integrate smart traffic management and energy-efficient housing solutions.

Technological advancements are rapidly transforming the construction industry, impacting efficiency and sustainability. Hazama Ando is adapting by integrating Building Information Modeling (BIM), which is becoming standard practice with a government target for widespread adoption by 2025. Automation and robotics are also being deployed to combat labor shortages, with projects in 2024 utilizing robotic systems to potentially reduce timelines by up to 20%. Furthermore, the company is exploring advanced, eco-friendly materials like CO2-absorbing concrete, showcased in pilot projects by 2024, to meet Japan's 2050 carbon neutrality goals.

| Key Technology | Impact on Construction | Adoption Status/Outlook | Example Data/Trend |

| BIM | Improved design, management, collaboration | Targeted for widespread adoption by 2025 | Government mandate by Ministry of Land, Infrastructure, Transport and Tourism |

| Automation & Robotics | Increased efficiency, addresses labor shortages | Increasing use in 2024 projects | Potential for up to 20% timeline reduction in controlled environments |

| Advanced Materials | Enhanced sustainability, reduced carbon footprint | Gaining traction, pilot projects by 2024 | CO2-absorbing concrete |

| AI & Data Analytics | Enhanced site inspections, project oversight, predictive analysis | Growing integration | Global construction PM software market ~$2.5 billion in 2023, with significant growth |

Legal factors

Hazama Ando must meticulously adhere to Japan's Building Standards Act, particularly with significant revisions scheduled for April 2025. These updates introduce more rigorous requirements for energy efficiency, structural integrity reviews, and fire safety protocols, impacting all construction projects.

Compliance with these evolving standards, such as the enhanced seismic resistance and energy-saving performance mandates, is critical for maintaining operational licenses and avoiding penalties. For instance, the 2025 revisions are expected to increase construction costs by an estimated 2-5% due to new material and design specifications, a factor Hazama Ando must integrate into its project planning and budgeting.

The enforcement of new labor laws, such as the overtime hour cap for construction workers implemented in April 2024, significantly influences project timelines and how companies manage their staff. This regulation, part of broader efforts to improve worker welfare, necessitates careful planning to maintain productivity without violating legal stipulations.

Failure to comply with these labor regulations, including adherence to overtime limits and fair wage practices, can result in substantial legal penalties and reputational damage for construction firms. Adapting operational strategies to align with these legal requirements is crucial for ensuring smooth project execution and avoiding costly disruptions.

Hazama Ando, like all construction firms in Japan, must strictly adhere to environmental regulations. This includes compliance with the Noise Regulation Act, the Air Pollution Control Act, and the Waste Management and Public Cleansing Act, all of which impact project execution and site management. For instance, specific noise level limits are enforced during construction hours, and stringent rules govern the disposal and recycling of construction waste, with penalties for non-compliance.

Furthermore, Japan's ambitious goal of achieving carbon neutrality by 2050 directly influences the construction sector. New building projects are increasingly mandated to meet higher eco-energy performance standards, requiring the integration of energy-efficient designs and materials. This push towards sustainability presents both challenges and opportunities for companies like Hazama Ando, necessitating investment in green technologies and practices to meet evolving regulatory requirements and market expectations.

Contract Law and Project Liability

Contract law is fundamental to Hazama Ando's operations, dictating the terms of agreements with clients and subcontractors. These legal frameworks, particularly concerning project liability, directly influence risk allocation and dispute resolution processes. For instance, in 2024, the construction industry continued to grapple with the aftermath of supply chain disruptions, leading to increased material costs and potential for delays, which can trigger contractual disputes.

The management of construction delays, often exacerbated by fluctuating economic conditions and unexpected cost escalations, presents significant legal challenges. Hazama Ando must meticulously manage its contracts to mitigate liabilities arising from such issues. A proactive approach to contractual clauses, including force majeure and delay penalties, is crucial for navigating these complexities and protecting the company's financial interests.

Key legal considerations for Hazama Ando include:

- Contractual Clarity: Ensuring all agreements clearly define scope, timelines, payment terms, and liability limits to prevent future disputes.

- Subcontractor Management: Vetting subcontractors and establishing robust contracts that align with primary project obligations and liability.

- Dispute Resolution: Implementing efficient mechanisms for resolving contractual disagreements, such as mediation or arbitration, to minimize project impact.

- Regulatory Compliance: Adhering to all relevant building codes, safety regulations, and employment laws to avoid legal penalties and project stoppages.

Corporate Governance Regulations

Hazama Ando's commitment to robust corporate governance is crucial for maintaining investor confidence and operational integrity. Adherence to these standards ensures transparency, fairness, and accountability in its management practices. For example, in fiscal year 2024, the company reported on its ongoing efforts to enhance stakeholder engagement and manage its portfolio of strategic shareholdings, a key aspect of good governance.

The company's governance framework includes:

- Regular reporting to the Board of Directors: This ensures oversight and timely decision-making on critical governance matters.

- Stakeholder dialogue: Active engagement with various stakeholders, including investors and employees, is a cornerstone of responsible corporate behavior.

- Progress in reducing strategic shareholdings: This demonstrates a strategic focus on optimizing capital allocation and improving financial flexibility.

Hazama Ando must navigate Japan's evolving legal landscape, including significant updates to the Building Standards Act effective April 2025. These revisions will impose stricter energy efficiency and structural integrity requirements, potentially increasing construction costs by an estimated 2-5% for new projects.

Compliance with labor laws, such as the April 2024 overtime hour cap for construction workers, directly impacts project scheduling and workforce management, necessitating careful operational adjustments to avoid penalties and maintain productivity.

Environmental regulations, including noise and waste management acts, are critical for site operations, with specific limits and disposal rules enforced. Furthermore, Japan's 2050 carbon neutrality goal drives higher eco-energy performance standards for new construction, requiring investment in green technologies.

Contract law governs relationships with clients and subcontractors, with liability and dispute resolution being key considerations, especially amidst 2024's supply chain disruptions and material cost fluctuations.

| Legal Area | Key Regulations/Considerations | Impact on Hazama Ando | Estimated Cost/Timeline Impact (2024-2025) |

|---|---|---|---|

| Building Standards Act | April 2025 Revisions: Energy efficiency, structural integrity, fire safety | Increased compliance costs, potential design modifications | 2-5% increase in construction costs |

| Labor Law | April 2024 Overtime Hour Cap | Project timeline adjustments, workforce management changes | Potential for extended project durations if not managed efficiently |

| Environmental Law | Noise Regulation Act, Waste Management Act | Site operation constraints, waste disposal protocols | Operational costs for compliance and waste management |

| Contract Law | Liability, dispute resolution, supply chain impacts | Risk management, potential for contractual disputes | Increased legal fees for dispute resolution if issues arise |

Environmental factors

Japan's susceptibility to natural disasters, including earthquakes and typhoons, makes climate change and disaster resilience a paramount concern. Hazama Ando's commitment to developing earthquake-resistant structures and advanced disaster prevention technologies is therefore crucial. For instance, in 2024, the company continued to leverage its expertise in seismic isolation and damping systems, vital for safeguarding infrastructure against Japan's frequent seismic activity.

The company's focus on resilient construction directly addresses national safety and ensures business continuity for its clients. This includes ongoing projects aimed at reinforcing existing infrastructure and building new facilities designed to withstand extreme weather events and seismic shocks, a critical factor given the increasing frequency of such occurrences.

Japan's ambitious goal of achieving carbon neutrality by 2050 places considerable pressure on the construction sector to slash CO2 emissions. This necessitates a shift towards eco-friendly materials, manufacturing processes with lower carbon footprints, and the widespread adoption of Zero Energy Houses (ZEH) and Zero Energy Buildings (ZEB).

In 2023, the Japanese government continued to push for these initiatives, with a particular focus on promoting ZEH adoption. While specific figures for Hazama Ando's direct emissions reduction in 2024 are not yet publicly available, the broader industry trend indicates a significant investment in sustainable construction practices. For instance, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) has been actively supporting the development of ZEB technologies, aiming for all new public buildings to be ZEB-ready by 2030.

The construction sector is increasingly prioritizing renewable energy and eco-friendly materials. This shift is evident in the growing adoption of recycled steel, bamboo, and eco-concrete in projects, aiming to meet green building standards and minimize environmental footprints. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to reach over $450 billion by 2028, indicating a strong market pull for sustainable solutions.

Resource Scarcity and Waste Management

Hazama Ando, like many in the construction sector, faces increasing pressure from resource scarcity. The company is actively investigating ways to incorporate recycled materials into its projects. For instance, in 2023, the global construction industry consumed an estimated 40 billion tonnes of raw materials, highlighting the urgency for more sustainable sourcing.

Improving waste management is also a critical environmental focus. Hazama Ando is implementing strategies to reduce construction and demolition waste, aiming for greater material reuse and recycling. The European Union's Circular Economy Action Plan, for example, sets ambitious targets for waste reduction, with construction and demolition waste accounting for a significant portion of the total.

- Material Reuse: Exploring the use of recycled aggregates and reclaimed materials in new builds.

- Waste Reduction Targets: Setting internal goals for minimizing landfill waste from project sites.

- Efficient Construction: Adopting prefabrication and modular construction techniques to reduce on-site waste.

- Circular Economy Principles: Aligning practices with broader initiatives promoting a closed-loop system for construction materials.

Water and Air Quality Regulations

Hazama Ando, like many in the construction sector, faces stringent environmental regulations. These rules, covering everything from water discharge to airborne particulate matter, necessitate significant investment in advanced mitigation technologies and meticulous operational planning. Failure to comply can result in substantial fines and damage to the company's reputation.

For instance, in 2024, Japan's Ministry of the Environment continued to enforce strict limits on construction site runoff, impacting material sourcing and site management practices. Similarly, air quality standards, particularly concerning dust and emissions from heavy machinery, require ongoing monitoring and the adoption of cleaner technologies. Noise pollution regulations also play a crucial role, dictating working hours and the use of sound-dampening equipment.

- Water Quality: Strict regulations on wastewater discharge from construction sites aim to prevent contamination of rivers and groundwater.

- Air Quality: Limits on dust, particulate matter, and emissions from construction equipment are enforced to protect public health.

- Noise Levels: Regulations govern the permissible noise levels and working hours for construction activities to minimize disturbance.

- Compliance Costs: Adherence to these regulations often involves increased operational costs for Hazama Ando due to specialized equipment and management practices.

Japan's vulnerability to natural disasters like earthquakes and typhoons underscores the importance of climate change adaptation and disaster resilience for Hazama Ando. The company's expertise in seismic isolation and damping systems, vital for safeguarding infrastructure, was further demonstrated in 2024. This focus on resilient construction directly addresses national safety concerns and ensures business continuity for clients facing increasing extreme weather events.

The push for carbon neutrality by 2050 is driving the construction sector, including Hazama Ando, towards eco-friendly practices and reduced CO2 emissions. This involves embracing sustainable materials and technologies like Zero Energy Houses (ZEH). The Ministry of Land, Infrastructure, Transport and Tourism's support for ZEB technologies, aiming for all new public buildings to be ZEB-ready by 2030, signals a strong market trend towards sustainability.

Hazama Ando, like others in the industry, faces environmental regulations concerning water discharge, air quality, and noise pollution. Compliance requires investment in mitigation technologies, impacting operational planning and costs. For instance, strict limits on construction site runoff and emissions from machinery, enforced by Japan's Ministry of the Environment in 2024, necessitate ongoing monitoring and adoption of cleaner practices.

| Environmental Factor | Impact on Hazama Ando | 2024/2025 Data/Trend |

|---|---|---|

| Natural Disasters & Climate Change | Need for resilient infrastructure, disaster prevention technologies | Continued focus on seismic isolation and damping systems; increasing frequency of extreme weather events. |

| Carbon Neutrality Goals | Shift to eco-friendly materials, low-carbon processes, ZEH/ZEB adoption | Industry-wide investment in sustainable construction; MLIT target for ZEB-ready public buildings by 2030. |

| Resource Scarcity & Waste Management | Increased use of recycled materials, focus on waste reduction | Global construction industry consumed ~40 billion tonnes of raw materials in 2023; growing market for recycled aggregates and reclaimed materials. |

| Environmental Regulations | Compliance costs, need for advanced mitigation technologies | Strict enforcement of water discharge, air quality, and noise pollution standards by the Ministry of the Environment. |

PESTLE Analysis Data Sources

Our Hazama Ando PESTLE analysis is meticulously constructed using a blend of official government publications, reputable industry associations, and leading economic forecasting agencies. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscapes affecting Hazama Ando.