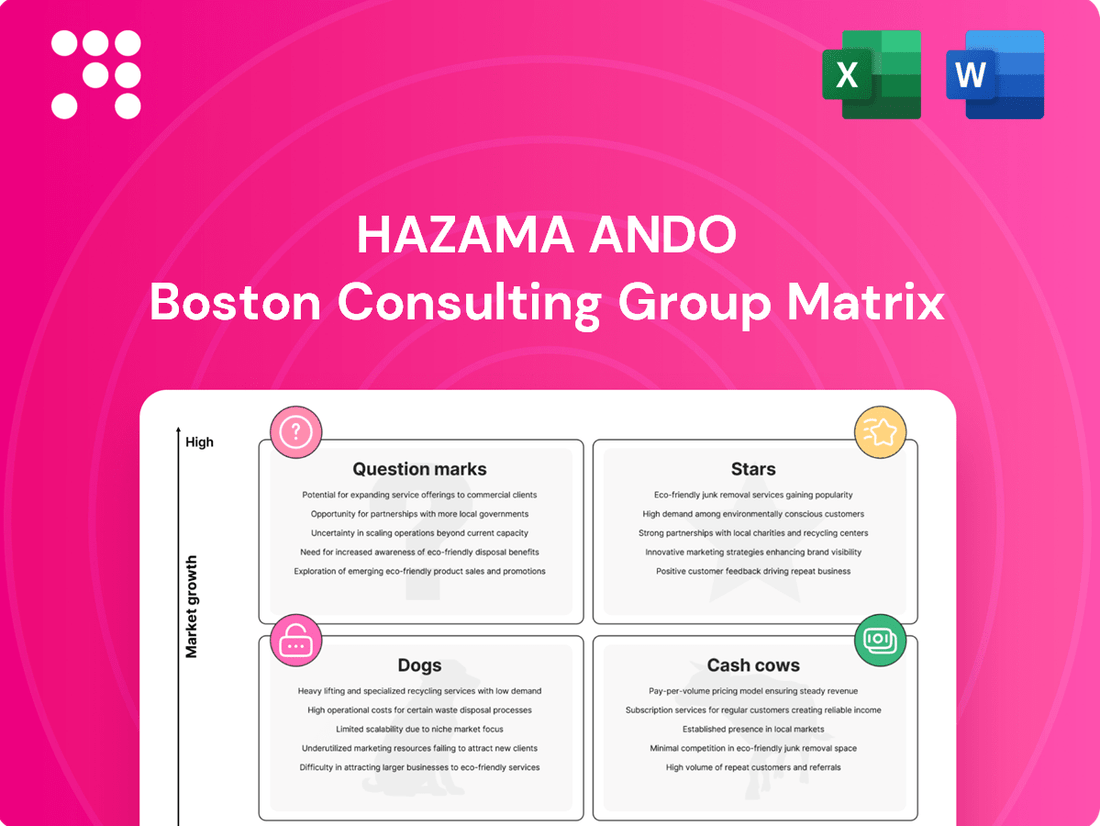

Hazama Ando Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hazama Ando Bundle

Unlock the strategic potential of Hazama Ando with a comprehensive BCG Matrix analysis. Understand where their projects sit as Stars, Cash Cows, Dogs, or Question Marks to make informed investment decisions.

This preview offers a glimpse into Hazama Ando's product portfolio. Purchase the full BCG Matrix report for a detailed breakdown of each quadrant, actionable insights, and a clear roadmap for optimizing their market position and resource allocation.

Stars

Hazama Ando is making significant strides in advanced sustainable infrastructure development, a key area within their BCG matrix. This strategic focus aligns perfectly with the global imperative for decarbonization and eco-friendly construction practices. Their investment in this segment is designed to capitalize on high-growth opportunities, including renewable energy projects and the development of resilient urban environments.

This segment benefits directly from Hazama Ando's deep technical expertise in executing large-scale construction projects. By integrating ESG principles, the company is well-positioned to secure a larger market share as demand for sustainable solutions continues to surge. For instance, in 2024, the global green building market was valued at approximately $1.07 trillion, with projections indicating substantial future growth, underscoring the strategic importance of Hazama Ando's investments.

The Japanese government's substantial investment in semiconductor and AI infrastructure is fueling a robust, high-growth market for specialized manufacturing plant construction. This strategic push, aimed at bolstering domestic technological capabilities, presents a prime opportunity for companies like Hazama Ando. Their expertise in complex, large-scale projects positions them to capture significant market share in this burgeoning sector.

Hazama Ando, a prominent Japanese general contractor, is strategically aligned to capitalize on this trend. Their proven track record in executing intricate construction projects, coupled with their deep understanding of advanced manufacturing requirements, makes them a natural leader in building these cutting-edge facilities. This segment of the market offers substantial potential for growth and increased profitability for the company.

Japan's construction sector is embracing digital advancements like BIM, AI, and robotics. Hazama Ando's focus on innovation for new value creation aligns with this trend. Their investments in these technologies, if they secure a strong market position and significant competitive edge, would position them as Stars in the BCG matrix.

Specialized Deep Tunneling and Underground Infrastructure

Hazama Ando’s Specialized Deep Tunneling and Underground Infrastructure segment is a strong contender in the BCG matrix, likely positioned as a Star. Their extensive experience in complex civil engineering, including the development and application of advanced systems like Smart Shield®, demonstrates a clear competitive advantage. This expertise is particularly valuable given Japan's ongoing need for resilient underground infrastructure to address geographical constraints and increasing urbanization.

The demand for sophisticated tunneling solutions is projected to remain robust. For instance, global underground construction market is expected to reach USD 340.5 billion by 2029, growing at a CAGR of 5.2% from 2023. Hazama Ando's established technical prowess in this high-growth niche solidifies its leading market position.

Key strengths contributing to this segment's Star status include:

- Technological Innovation: Proven expertise with advanced systems like Smart Shield® for efficient and safe tunneling.

- Market Demand: High and consistent demand for underground infrastructure in Japan due to geographical and urban development needs.

- Competitive Edge: A strong track record in executing complex, large-scale deep tunneling projects, securing a leading market share.

- Growth Potential: The specialized nature of deep tunneling represents a significant growth opportunity within the broader civil engineering sector.

Strategic International Infrastructure Projects

Strategic International Infrastructure Projects represent Hazama Ando's Stars within the BCG framework. While their overall overseas revenue might be a smaller slice of the pie, the company strategically targets high-growth regions like Asia and North America for significant infrastructure development. These projects are crucial for supporting Japanese companies expanding abroad and capitalize on areas with substantial infrastructure needs.

These ventures are positioned as Stars because they are in rapidly expanding markets where Hazama Ando can secure large-scale, impactful projects. Their involvement not only bolsters their own growth but also contributes significantly to the social and economic development of the host countries by leveraging their specialized expertise.

- Target Markets: Asia and North America are key focus areas for international infrastructure.

- Strategic Importance: These projects support Japanese firms' global expansion and address infrastructure deficits.

- Growth Potential: High-growth regions with significant infrastructure needs offer substantial opportunities.

- Contribution: Expertise is applied to foster social development in international locales.

Hazama Ando's focus on advanced sustainable infrastructure and specialized deep tunneling projects positions them as Stars in the BCG matrix. These segments exhibit high market growth and strong competitive positions for the company. Their strategic investments in these areas, driven by global demand for eco-friendly solutions and resilient underground networks, are expected to yield significant returns.

What is included in the product

This BCG Matrix overview analyzes Hazama Ando's business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic recommendations on investment, holding, or divesting each unit based on market growth and relative market share.

Hazama Ando BCG Matrix offers a clear visualization of business unit performance, simplifying complex strategic decisions.

Cash Cows

Hazama Ando's domestic civil engineering, focusing on roads, bridges, and tunnels, is a cornerstone of its operations. This segment operates in a mature market, characterized by consistent demand for infrastructure upkeep and upgrades.

The company leverages its deep-seated expertise and significant market presence in Japan to achieve high, stable profit margins within this sector. This established business acts as a dependable generator of substantial cash flow for Hazama Ando.

For fiscal year 2024, Hazama Ando reported a substantial portion of its revenue from civil engineering projects, underscoring its importance as a cash cow. The company's robust backlog in this area, exceeding ¥1.5 trillion as of early 2024, indicates continued strong performance and cash generation potential.

Large-scale commercial building construction in Japan, particularly in established urban centers, represents a significant cash cow for Hazama Ando. This sector leverages the company's long-standing reputation and deep market penetration, securing a high market share.

The mature nature of this segment means it generates substantial, consistent cash flow with minimal need for aggressive marketing or expansion investment. For instance, in 2024, Japan's construction market, especially for commercial properties, continued to show resilience, with major developers like Hazama Ando benefiting from ongoing urban redevelopment projects.

Hazama Ando's involvement in public facilities and government projects acts as a significant Cash Cow. These ventures, particularly in Japan, offer a steady flow of revenue due to consistent government investment in infrastructure. The predictable nature of these projects, coupled with established procurement, allows Hazama Ando to maintain a strong market position and generate reliable cash flow.

Long-Term Maintenance and Renewal Contracts

Hazama Ando's long-term maintenance and renewal contracts function as classic Cash Cows within the BCG framework. These agreements for existing infrastructure and buildings provide a stable, predictable stream of income. The mature nature of this market segment means that while growth is modest, the investment required to maintain these revenue streams is also relatively low, leading to strong cash generation.

The company's established reputation and extensive track record in infrastructure development are key to securing these recurring revenue streams. This allows Hazama Ando to leverage its existing client base and operational expertise to ensure consistent demand for its maintenance services.

- Predictable Cash Flow: Hazama Ando's ongoing maintenance and renewal projects for existing infrastructure and buildings generate a reliable and consistent cash flow, a hallmark of Cash Cow businesses.

- Low Investment Needs: Operating in a mature market segment, these contracts require minimal additional investment for growth, allowing for significant cash generation.

- Established Market Position: The company's strong reputation and existing presence in the market ensure a steady demand for its maintenance services, securing these recurring revenue streams.

- Financial Contribution: For the fiscal year ending March 2024, Hazama Ando reported a net sales of ¥341,454 million, with the civil engineering segment, which includes maintenance, being a significant contributor to overall revenue and profitability.

Established Overseas Building Construction in Key Regions

Hazama Ando's established overseas building construction in key regions functions as a cash cow within their portfolio. These operations, often in markets where Japanese firms have a strong foothold or where Hazama Ando has a deep operational history, deliver consistent revenue. For instance, in 2024, the company continued to leverage its long-standing presence in markets like Southeast Asia, where infrastructure development remains robust, contributing significantly to overall profitability.

These mature segments offer high market share, even if their growth potential is moderate. This stability allows Hazama Ando to generate substantial cash flow, which can then be reinvested into other business areas. The company's 2024 financial reports highlighted the predictable earnings from these established overseas projects, underscoring their role as a reliable income source.

- Stable Revenue Streams: Operations in established overseas markets provide consistent income.

- High Market Share: Hazama Ando maintains a dominant position in these specific sub-markets.

- Cash Flow Generation: These segments are key contributors to the company's overall cash generation.

- Strategic Reinvestment: Profits from these cash cows fund growth initiatives elsewhere.

Hazama Ando's domestic civil engineering, particularly roads, bridges, and tunnels, represents a significant Cash Cow. This mature market segment benefits from consistent demand for infrastructure maintenance and upgrades, leading to stable, high profit margins. The company's deep expertise and strong market presence in Japan ensure this sector reliably generates substantial cash flow. For fiscal year 2024, Hazama Ando's civil engineering projects contributed a considerable portion of its revenue, with a backlog exceeding ¥1.5 trillion as of early 2024, indicating continued strong performance.

| Segment | Market Maturity | Cash Flow Generation | Investment Needs | 2024 Relevance |

| Domestic Civil Engineering (Roads, Bridges, Tunnels) | Mature | High, Stable | Low | Significant Revenue Contributor, ¥1.5T+ Backlog |

What You’re Viewing Is Included

Hazama Ando BCG Matrix

The Hazama Ando BCG Matrix preview you are viewing is the precise, unedited document you will receive immediately after your purchase. This comprehensive analysis tool, designed for strategic decision-making, will be delivered in its entirety, ready for immediate application in your business planning.

Dogs

Hazama Ando likely faces challenges with small-scale, commoditized local projects. These often have intense competition, driving down profit margins to very low levels, potentially impacting overall profitability.

These types of projects can tie up valuable resources, like labor and equipment, without delivering substantial returns. This situation is characteristic of a low market share in a mature, slow-growth market segment.

For instance, in 2024, the construction industry globally saw intense price competition, with some reports indicating that margins on smaller, routine projects could be as low as 2-5% for general contractors in saturated markets.

Given this, Hazama Ando might consider strategies to minimize involvement in these specific projects or even divest from them to reallocate capital towards more promising areas.

Outdated niche construction technologies, like traditional timber framing for large-scale commercial projects or specialized manual bricklaying techniques that have been largely replaced by prefabrication and automated systems, could be categorized as Dogs in the Hazama Ando BCG Matrix. These methods often face declining demand due to higher labor costs and slower execution times compared to modern alternatives. For instance, the global construction market is increasingly embracing Building Information Modeling (BIM) and precast concrete, which offer greater efficiency and precision, leaving older, labor-intensive methods with a shrinking market share.

Underperforming foreign subsidiaries, often found in low-growth international markets, represent the Dogs in the BCG matrix. These ventures struggle to capture meaningful market share or achieve profitability, potentially draining resources without a clear path to recovery. For instance, a company might have a manufacturing plant in a developed nation with a saturated automotive market, where sales are stagnant and the subsidiary is consistently unprofitable.

These operations typically consume more capital than they generate, making them a drain on overall company resources. The cost of implementing extensive turnaround strategies for such entities is often prohibitive, with a low likelihood of success. As of 2024, many multinational corporations are actively divesting or restructuring underperforming international assets to focus on more promising growth areas, reflecting the strategic challenge posed by these ‘Dog’ units.

Non-Core, Legacy Business Units with Low Synergy

Hazama Ando may hold onto legacy business units that don't align with its core construction strengths or future strategic direction. These units might be in mature or declining markets with limited competitive advantage.

These non-core, legacy operations often exhibit low growth rates and a small market share, making them potential drains on the company's resources. For instance, if a subsidiary in a niche manufacturing sector, acquired years ago, is reporting single-digit revenue growth and negligible profit margins, it exemplifies such a unit.

- Low Growth Markets: Units operating in sectors with projected annual growth rates below 3% are candidates for this category.

- Minimal Market Share: Businesses holding less than 5% of their respective market can be considered low share.

- Resource Drain: Units requiring significant capital investment or operational support without commensurate returns.

- Lack of Synergy: Operations that do not benefit from or contribute to the core construction business's efficiencies or market reach.

Inefficient Internal Support Functions

Inefficient internal support functions, such as outdated HR or IT systems, can act as significant drains on resources. These departments, if overly bureaucratic and slow to adopt new technologies, can hinder the agility of core business operations. For instance, a slow procurement process could delay critical project timelines, directly impacting revenue generation.

These internal inefficiencies, while not products themselves, consume valuable capital and human resources that could otherwise be directed towards growth initiatives. In 2024, many companies reported that operational inefficiencies contributed to a noticeable drag on profitability, with some estimating these drags to be as high as 5-10% of operating expenses.

- Resource Drain: Inefficient support functions consume capital and labor that could be used for growth.

- Operational Hindrance: Bureaucracy and resistance to modernization slow down core business activities.

- Profitability Impact: Studies in 2024 indicated operational inefficiencies can reduce profitability by up to 10%.

- Digital Transformation Lag: Failure to modernize these functions despite digital transformation efforts creates a competitive disadvantage.

Dogs in Hazama Ando's BCG Matrix represent business units or projects with low market share in slow-growing or declining industries. These often include niche, commoditized local projects with intense competition, driving down profit margins significantly. For example, in 2024, margins on smaller construction projects in saturated markets were reported to be as low as 2-5%.

These units can be resource drains, consuming capital and labor without substantial returns, much like underperforming foreign subsidiaries in stagnant markets. Many companies in 2024 were divesting such assets to focus on more promising ventures, highlighting the strategic challenge these 'Dogs' present.

Legacy business units not aligned with core strengths or future strategy also fall into this category. These operations, often in mature markets with limited competitive advantage, can hinder overall company agility and profitability, with inefficiencies potentially impacting profits by up to 10% as noted in 2024 industry reports.

| Characteristic | Example for Hazama Ando | 2024 Data/Insight |

|---|---|---|

| Low Market Share | Small, commoditized local construction projects | Margins as low as 2-5% in saturated markets |

| Slow Market Growth | Outdated construction technologies (e.g., manual timber framing for large projects) | Declining demand due to labor costs and slower execution vs. modern methods |

| Resource Drain | Underperforming foreign subsidiaries in low-growth markets | Divestment trends in 2024 to focus on growth areas |

| Lack of Synergy | Legacy, non-core business units | Inefficiencies can reduce profitability by up to 10% |

Question Marks

For Hazama Ando, emerging renewable energy infrastructure, particularly new sub-segments like offshore wind foundations and advanced geothermal, represents a potential Question Mark in the BCG Matrix. While the broader renewable energy sector is a Star for many established construction firms, these specialized niches demand substantial upfront investment and the development of unique expertise, areas where Hazama Ando may have limited prior experience.

These emerging areas offer significant growth prospects, but the high capital expenditure required to establish a foothold and build a competitive advantage positions them as Question Marks. For instance, the global offshore wind market is projected to grow substantially, with estimates suggesting significant expansion in foundation installations through 2030, requiring specialized engineering and construction capabilities that may not be readily available.

Hazama Ando's strategic vision includes exploring untapped international markets, a move that aligns with the question mark category of the BCG matrix. These new regions represent high-growth potential but also carry substantial risk due to low brand recognition and market share. For instance, emerging economies in Southeast Asia or Africa could offer significant opportunities, but require substantial upfront capital for market penetration and establishing operations.

Smart city development represents a burgeoning sector, characterized by interconnected infrastructure, advanced digital technologies, and forward-thinking urban design. Hazama Ando may be positioning itself to capitalize on these high-potential, yet still developing, smart city initiatives.

These projects, while offering significant growth prospects, currently represent a low market share for the company. To achieve a dominant presence in this innovative space, substantial strategic investments will be crucial for Hazama Ando.

The global smart city market was valued at approximately $1.4 trillion in 2023 and is projected to reach $4.5 trillion by 2030, demonstrating the immense growth potential Hazama Ando could tap into.

Advanced Modular and Prefabricated Construction Technologies

Advanced modular and prefabricated construction technologies represent a potential star or question mark for Hazama Ando within the BCG framework. While Japan is a leader in innovation, the widespread adoption of these advanced techniques for large-scale projects is still developing.

This segment holds significant growth potential, driven by the promise of increased efficiency and reduced construction timelines. However, realizing this potential necessitates considerable upfront investment in new manufacturing facilities, advanced robotics, and streamlined logistical processes to capture market share.

- Market Growth: The global modular construction market was valued at approximately USD 100 billion in 2023 and is projected to grow at a CAGR of over 6% through 2030, indicating substantial demand.

- Investment Needs: Establishing state-of-the-art off-site manufacturing facilities can cost tens to hundreds of millions of dollars, depending on scale and technological sophistication.

- Efficiency Gains: Prefabricated construction can reduce project timelines by up to 30-50% compared to traditional methods, leading to cost savings and faster revenue generation for clients.

Strategic Ventures into Non-Construction Real Estate Services

Hazama Ando's exploration into non-construction real estate services, such as PropTech and novel urban development, positions these ventures as potential Stars or Question Marks within the BCG framework. These segments offer substantial growth potential, but Hazama Ando's current market share is likely nascent, necessitating focused investment to capture market share.

For instance, the global PropTech market was valued at approximately $25.5 billion in 2023 and is projected to reach $114.3 billion by 2030, exhibiting a compound annual growth rate of 23.8%. This high growth environment aligns with the characteristics of a Star or Question Mark.

- PropTech Growth: The significant expansion of the PropTech sector presents a compelling opportunity for Hazama Ando to establish a foothold.

- Urban Development Innovation: New urban development models could tap into evolving societal needs and smart city initiatives.

- Investment Requirement: Capturing market share in these emerging areas will demand considerable strategic financial commitment.

- Market Share Potential: While current share may be low, the high growth trajectory allows for substantial future gains.

Question Marks for Hazama Ando represent new or developing business areas with high growth potential but currently low market share. These ventures require significant investment to gain traction and could become Stars or Dogs.

For example, emerging renewable energy niches like offshore wind foundations and advanced geothermal demand substantial upfront capital and specialized expertise, positioning them as Question Marks. Similarly, Hazama Ando's foray into new international markets carries high growth prospects but is tempered by low brand recognition and market share, typical of Question Marks.

Smart city development, while a high-growth sector with a projected global market value of $4.5 trillion by 2030, represents a low market share for the company currently, necessitating strategic investment to climb the BCG matrix.

| Business Area | Market Growth Potential | Current Market Share | Investment Needs | BCG Classification |

|---|---|---|---|---|

| Offshore Wind Foundations | High | Low | High | Question Mark |

| Advanced Geothermal | High | Low | High | Question Mark |

| Emerging International Markets | High | Low | High | Question Mark |

| Smart City Development | Very High (projected $4.5T by 2030) | Low | High | Question Mark |

BCG Matrix Data Sources

Our Hazama Ando BCG Matrix draws from comprehensive financial disclosures, robust market research, and detailed industry performance metrics to provide a clear strategic overview.