MetroCity Bankshares Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MetroCity Bankshares Bundle

MetroCity Bankshares operates in a market shaped by intense rivalry and the constant threat of new entrants, impacting pricing and profitability. Understanding the bargaining power of both its customers and suppliers is crucial for navigating this landscape.

The full analysis reveals the strength and intensity of each market force affecting MetroCity Bankshares, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

The bargaining power of technology and software providers for MetroCity Bankshares is generally considered moderate to high. This is due to the critical nature of these services, which include core banking systems, essential cybersecurity solutions, and the digital platforms that underpin modern banking operations.

Banks, including MetroCity Bankshares, have a significant dependency on these specialized vendors. The complexity and cost associated with integrating new systems and migrating vast amounts of sensitive data mean that switching providers is a substantial undertaking. This high switching cost grants specialized technology and software vendors considerable leverage.

For instance, the global market for banking software is projected to reach over $50 billion by 2027, indicating a robust and often concentrated vendor landscape. This concentration, coupled with the deep integration required, means MetroCity Bankshares may face limited options and significant costs if it seeks to change its core technology partners, thereby increasing supplier power.

Depositors, acting as the primary suppliers of capital for MetroCity Bankshares, wield significant bargaining power. This is largely due to the minimal costs associated with switching their funds to another financial institution. For instance, in 2024, the average savings account interest rate across major US banks hovered around 0.35%, while high-yield savings accounts offered closer to 4.5% to 5.0%, illustrating the competitive landscape that compels banks to offer attractive rates to retain deposits.

The bargaining power of skilled employees within the banking sector, especially those with expertise in financial technology, risk management, and specialized lending, is currently moderate. This reflects a dynamic labor market where demand for these specialized skills often outstrips supply.

MetroCity Bankshares, like its peers, faces a competitive landscape for seasoned banking professionals. To attract and retain top talent, the bank must offer compelling compensation packages and robust benefits, which directly impacts operational expenses.

For instance, in 2024, the average salary for a senior risk manager in the US banking industry saw an increase, with some roles commanding upwards of $150,000 annually, underscoring the cost associated with securing essential expertise.

Wholesale Funding Providers

Wholesale funding providers, including other banks and capital markets, generally possess moderate bargaining power over MetroCity Bankshares. These institutions are crucial for MetroCity's liquidity and capital needs, especially when deposit growth is insufficient. The cost of this wholesale funding can be volatile, directly impacting the bank's net interest margin and overall profitability. For instance, during periods of tight credit markets, the rates charged by wholesale providers can surge, increasing MetroCity's operational expenses.

- Moderate Bargaining Power: Wholesale funding sources like interbank markets and securitization conduits exert moderate influence due to their essential role in a bank's funding structure.

- Liquidity and Capital Reliance: MetroCity Bankshares depends on these external markets to supplement its deposit base, particularly for meeting regulatory capital requirements and managing short-term liquidity needs.

- Market Condition Sensitivity: The cost and availability of wholesale funds are highly sensitive to broader economic conditions and investor sentiment, directly affecting MetroCity's funding costs.

- Impact on Profitability: Fluctuations in wholesale funding rates can significantly impact MetroCity's profitability by altering its cost of funds and net interest income.

Regulatory and Compliance Service Providers

The bargaining power of regulatory and compliance service providers for MetroCity Bankshares is notably high. This stems from the intensely regulated nature of the banking industry, requiring constant adherence to a complex web of federal and state laws. For instance, in 2024, the banking sector continued to grapple with evolving regulations around data privacy, cybersecurity, and anti-money laundering (AML), demanding specialized legal and auditing expertise.

This reliance on external experts for navigating these intricate requirements grants these service providers significant leverage. Banks, including MetroCity Bankshares, often have limited in-house capabilities for every niche regulatory demand, making them dependent on these specialized firms. This dependency can translate into substantial costs for compliance, audits, and legal counsel, impacting the bank's operational expenses.

- High Demand for Specialized Expertise: The complexity of banking regulations necessitates highly skilled legal, auditing, and compliance professionals, limiting the pool of qualified providers.

- Significant Switching Costs: Changing compliance service providers can involve substantial time, effort, and potential disruption to ongoing regulatory processes.

- Impact on Financial Performance: In 2024, increased regulatory scrutiny led to higher compliance costs for many financial institutions, directly affecting profitability.

The bargaining power of depositors as suppliers of capital for MetroCity Bankshares is significant. This is primarily due to the low costs associated with moving funds to alternative financial institutions. In 2024, the average interest rate for traditional savings accounts remained low, around 0.35%, while high-yield options offered competitive rates between 4.5% and 5.0%, highlighting the need for banks to offer attractive terms to retain customer deposits.

Technology and software providers hold moderate to high bargaining power over MetroCity Bankshares. Core banking systems, cybersecurity, and digital platforms are critical, and the expense and complexity of switching vendors create high switching costs. The global banking software market, projected to exceed $50 billion by 2027, often features concentrated vendors, limiting options and increasing their leverage.

Skilled employees, particularly in areas like fintech, risk management, and specialized lending, possess moderate bargaining power. Demand for these professionals often outstrips supply, forcing banks like MetroCity to offer competitive compensation. For instance, in 2024, senior risk manager salaries in US banking could exceed $150,000 annually, reflecting the cost of acquiring essential expertise.

Wholesale funding providers, such as other banks and capital markets, generally have moderate bargaining power. They are vital for MetroCity’s liquidity and capital needs, especially when deposit growth is insufficient. The cost of this funding can fluctuate based on market conditions, directly impacting the bank's net interest margin.

Regulatory and compliance service providers exert high bargaining power due to the banking industry's stringent regulatory environment. Navigating complex laws requires specialized legal and auditing expertise, often limited in-house, making banks reliant on these external firms. Increased regulatory scrutiny in 2024, particularly around data privacy and AML, drove up compliance costs for financial institutions.

What is included in the product

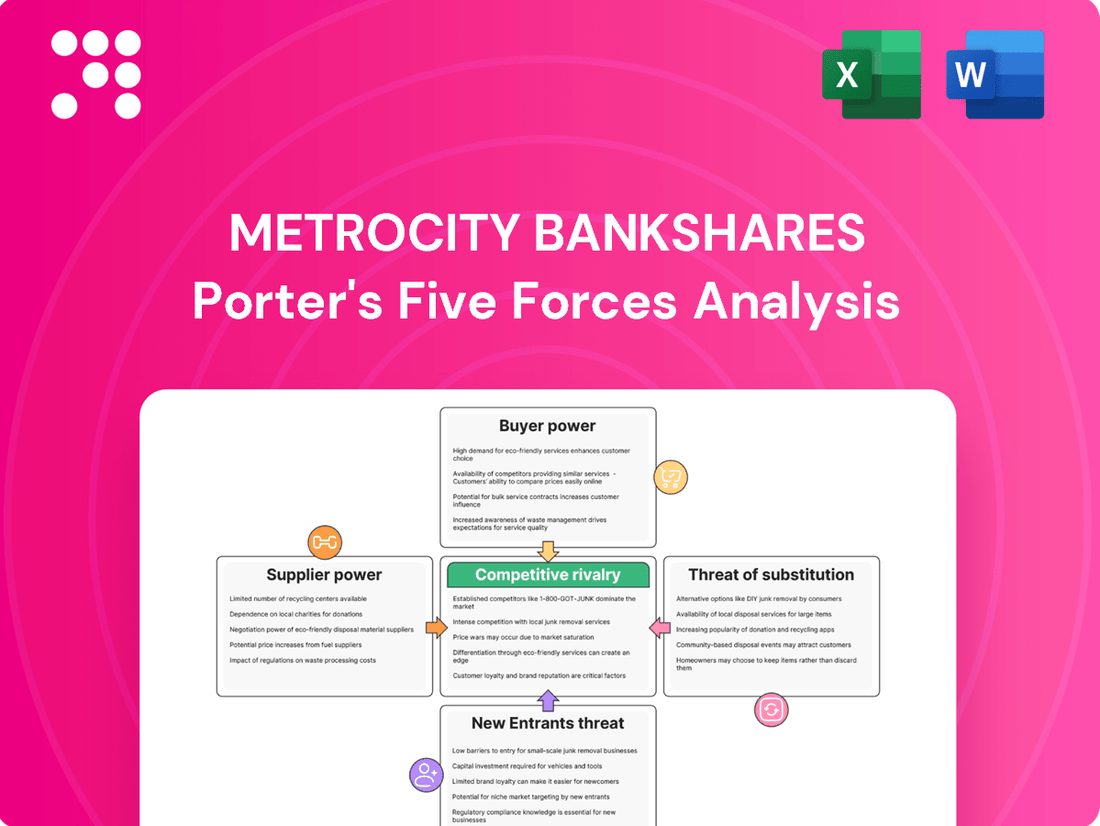

This Porter's Five Forces analysis for MetroCity Bankshares dissects industry rivalry, buyer and supplier power, the threat of new entrants and substitutes, offering strategic insights into competitive pressures.

Instantly visualize competitive pressures with a dynamic, interactive dashboard, allowing MetroCity Bankshares to proactively address market challenges.

Customers Bargaining Power

Individual and small to medium-sized business customers at MetroCity Bankshares typically wield considerable bargaining power. This stems from the sheer abundance of financial service providers available, ranging from major national institutions and community banks to credit unions and rapidly evolving fintech platforms.

The ease with which customers can switch their banking relationships, particularly for fundamental services like checking accounts and basic loans, further amplifies their leverage. For instance, in 2024, the average customer retention rate for basic deposit accounts across the banking industry hovered around 90%, indicating that a significant portion of customers are open to moving if more attractive terms are offered elsewhere.

This competitive landscape means that MetroCity Bankshares must remain vigilant in offering competitive interest rates, user-friendly digital tools, and responsive customer service to retain its client base. Failure to do so can result in a noticeable outflow of deposits and loan origination opportunities to rivals.

Customers are becoming more aware of pricing, especially for everyday banking services like checking and savings accounts, which are often seen as similar across different banks. This heightened price sensitivity means MetroCity Bankshares must remain competitive on rates and fees to retain its customer base.

The internet has made it incredibly easy for consumers to shop around. For instance, in 2024, comparison websites readily display interest rates on savings accounts, with some offering yields significantly higher than the national average, putting pressure on banks like MetroCity Bankshares to match competitive offerings or risk losing deposits.

This easy access to information empowers customers, giving them more leverage. They can quickly identify and switch to institutions offering better terms on loans, mortgages, or even lower ATM fees, directly impacting MetroCity Bankshares' ability to dictate pricing and terms.

MetroCity Bankshares' concentration on the Korean-American community and other ethnic groups can potentially temper customer bargaining power. This is especially true if the bank offers highly specialized services that are not widely available elsewhere, making these customers more reliant on MetroCity. For instance, in 2024, many community banks reported strong customer loyalty in their niche markets, often translating to less price sensitivity.

Access to Diverse Financial Products

Customers today have an unprecedented ability to compare and switch between financial institutions due to the wide availability of diverse products. This includes everything from user-friendly mobile banking apps to specialized loan products and investment platforms. For instance, in 2024, the digital-only banking sector saw continued growth, with many challenger banks offering highly competitive rates and seamless digital experiences, directly increasing customer options.

MetroCity Bankshares faces pressure from this broad access. If their product suite, encompassing digital services, mobile functionality, and various lending options, doesn't match or exceed what competitors offer, customers will readily move their business. This necessitates constant innovation and a proactive approach to expanding their financial product and service portfolio to maintain customer engagement and minimize churn.

- Increased Competition: The proliferation of fintech companies and digital-first banks in 2024 intensified competition by offering specialized, often lower-cost, financial solutions.

- Customer Expectations: A 2024 survey indicated that over 70% of banking customers prioritize digital convenience and a wide range of integrated services when choosing a primary financial institution.

- Switching Costs: While traditional switching costs exist, the ease of opening new accounts online and transferring funds has significantly lowered the barrier for customers to explore alternative banking providers.

- Product Differentiation: Banks that fail to offer a compelling and comprehensive product suite, including robust digital tools and personalized financial advice, risk alienating customers who can easily find better alternatives elsewhere.

Relationship-Based Banking

For many small businesses and some individuals, the strength of their relationship with MetroCity Bankshares, encompassing personalized attention and customized financial products, is a crucial consideration. This relationship-building fosters loyalty, but it also means customers can leverage their needs to demand superior service and prompt responses, readily switching to competitors if these expectations aren't met.

The bargaining power of customers in relationship-based banking is evident when considering the churn rates and customer acquisition costs within the financial sector. For instance, in 2024, the average cost to acquire a new retail banking customer in the US was estimated to be around $200 to $500, highlighting the expense incurred when customers switch due to unmet relationship needs.

- Customer Retention: Strong relationships can significantly boost customer retention, a key metric for banks.

- Service Expectations: Customers expect tailored advice and proactive support, not just transactional services.

- Switching Costs: While switching banks can involve some hassle, the availability of digital tools and competitive offers lowers these costs for customers.

- Competitive Landscape: MetroCity Bankshares operates in a market where numerous banks and credit unions vie for customer loyalty through relationship management.

Customers at MetroCity Bankshares possess significant bargaining power due to the vast array of financial service providers available, from large banks to fintech startups. The ease with which customers can switch accounts, especially for basic services, further amplifies their leverage. For instance, in 2024, comparison websites made it simple for consumers to find higher interest rates, pressuring banks like MetroCity to offer competitive terms or risk losing deposits.

| Factor | Impact on MetroCity Bankshares | 2024 Data/Trend |

|---|---|---|

| Availability of Alternatives | High bargaining power for customers | Proliferation of fintech and digital banks |

| Switching Costs | Low switching costs empower customers | Digital account opening lowered barriers |

| Price Sensitivity | Customers demand competitive rates/fees | Comparison sites highlight rate differences |

| Information Availability | Customers easily compare offerings | Online tools readily available for research |

Full Version Awaits

MetroCity Bankshares Porter's Five Forces Analysis

This preview shows the exact MetroCity Bankshares Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the intensity of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products within the banking industry. You'll gain a comprehensive understanding of the strategic landscape affecting MetroCity Bankshares, enabling informed decision-making and competitive strategy development. The document is fully formatted and ready for your immediate use, offering no surprises or placeholders.

Rivalry Among Competitors

MetroCity Bankshares operates in a highly competitive landscape, particularly challenged by large national banks. These behemoths, like JPMorgan Chase and Bank of America, leverage their immense capital, nationwide branch presence, and cutting-edge technology to offer a comprehensive suite of financial products and services. For instance, in 2024, the top five U.S. banks held over $10 trillion in assets, dwarfing regional institutions.

The sheer scale of national banks allows them to achieve significant economies of scale, enabling more aggressive pricing on loans and deposits. Their substantial marketing budgets also translate into greater brand recognition and customer acquisition capabilities, making it harder for regional banks like MetroCity to capture market share. This competitive pressure often forces smaller banks to focus on niche markets or specialized services to differentiate themselves.

MetroCity Bankshares faces direct rivalry from other regional and community banks in its operating territories. These competitors often vie for the same customers by emphasizing tailored service, deep understanding of local economic conditions, and strong community ties. For instance, in 2024, many community banks across the US reported robust growth in their loan portfolios, often fueled by these very relationships, putting pressure on larger institutions like MetroCity to maintain market share in deposit gathering and lending.

MetroCity Bankshares' focus on the Korean-American community and other ethnic groups, while a strategic advantage, also attracts competition from larger institutions. These larger banks may offer similar specialized services or have dedicated branches, increasing rivalry within this niche. For instance, in 2024, several major national banks expanded their community outreach programs, specifically targeting underserved ethnic demographics, directly challenging MetroCity's specialized customer base.

Industry Consolidation and M&A Activity

The banking sector, including the period leading up to July 2025, has seen significant consolidation. This trend means larger banks are emerging, which can intensify competition for institutions like MetroCity Bankshares. These larger entities often possess greater resources and broader market reach.

This ongoing consolidation can reduce the number of smaller, independent banks, thereby concentrating market power among fewer, larger players. For MetroCity Bankshares, this translates into facing more formidable rivals who may offer a wider array of services or more competitive pricing.

For instance, in 2024, the U.S. banking industry witnessed several notable M&A deals, indicating continued investor interest in scale and efficiency. Such transactions can reshape competitive landscapes, potentially increasing the bargaining power of acquiring banks with suppliers and customers alike.

- Increased Competition: Consolidation leads to fewer, larger competitors with greater market share and resources.

- Reduced Independence: The number of community banks may shrink, limiting options for customers and increasing pressure on smaller players.

- Enhanced Rival Power: Merged entities often gain economies of scale, allowing them to invest more in technology and customer acquisition.

- Strategic Challenges: MetroCity Bankshares must adapt its strategies to compete effectively against these expanded, well-resourced rivals.

Digital Banking and Fintech Competition

The competitive landscape for MetroCity Bankshares is increasingly shaped by digital banking and fintech innovation. The emergence of agile fintechs and digital-only banks, often unburdened by extensive physical infrastructure, significantly lowers entry barriers for specific financial services, intensifying rivalry. These new players are setting higher customer expectations for seamless, rapid, and convenient digital experiences.

To counter this, MetroCity Bankshares needs substantial investment in its own digital infrastructure and capabilities. This is crucial to keep pace with tech-savvy competitors who can attract and retain customers, even without a traditional branch network. For instance, in 2024, digital-only banks continued to gain market share, with some reporting double-digit percentage growth in customer acquisition year-over-year.

- Fintech Disruption: Fintechs are unbundling traditional banking services, offering specialized, user-friendly digital solutions that challenge incumbent banks.

- Customer Expectations: Consumers, accustomed to seamless digital interactions from other industries, now demand similar speed and ease from their banking providers.

- Investment Imperative: MetroCity Bankshares must allocate capital towards enhancing its mobile app, online platforms, and back-end digital processes to compete effectively.

- Branch Footprint vs. Digital Reach: While traditional banks have physical branches, fintechs leverage digital reach to acquire customers rapidly and at a lower cost per acquisition.

MetroCity Bankshares faces intense rivalry from a spectrum of competitors, ranging from massive national banks to nimble fintechs. Large national players, boasting trillions in assets as of 2024, leverage scale and extensive branch networks to offer competitive pricing and broad services. Regional and community banks, meanwhile, compete by emphasizing local ties and personalized service, with many reporting strong loan growth in 2024 due to these relationships.

The banking sector's ongoing consolidation further amplifies competitive pressures, creating larger, more resource-rich rivals. For instance, 2024 saw several significant M&A deals, consolidating market power. This trend necessitates that MetroCity Bankshares continually invest in its digital capabilities to meet evolving customer expectations and counter the disruptive force of agile fintech companies that are rapidly acquiring market share through user-friendly digital solutions.

SSubstitutes Threaten

The threat of substitutes for traditional banking services offered by MetroCity Bankshares is significant, primarily driven by fintech and digital payment platforms. These innovators provide alternatives for core banking functions, impacting customer loyalty and transaction volumes.

Services such as peer-to-peer lending platforms and mobile payment solutions directly compete with bank loans and traditional payment processing. For instance, the global digital payments market was valued at over $2 trillion in 2023 and is projected to grow substantially, indicating a strong shift towards these alternatives.

Digital wallets and apps often boast user-friendly interfaces and lower transaction costs, appealing to a broad customer segment, especially younger demographics. This convenience factor can draw customers away from established banks, potentially reducing MetroCity Bankshares' market share in key service areas.

The rise of non-bank lenders presents a substantial threat to MetroCity Bankshares. Businesses and individuals now have readily available credit from online platforms, private equity, and specialized finance companies. These alternatives frequently provide more adaptable terms and quicker approvals, directly competing with MetroCity's traditional loan offerings.

For instance, the non-bank lending sector experienced significant growth, with some online lenders reporting loan origination volumes in the tens of billions of dollars annually by 2024. This expansion means more potential customers are bypassing traditional banks like MetroCity for their financing needs, especially for segments like small business loans or consumer credit where speed and flexibility are paramount.

Customers seeking higher yields for their savings have numerous alternatives to traditional bank deposit accounts offered by MetroCity Bankshares. Investment firms, mutual funds, and brokerage accounts present themselves as viable substitutes, often touting the potential for greater returns. This can divert significant capital away from bank deposits, directly impacting MetroCity's funding base and stability.

For instance, the U.S. Treasury yield on a 1-year note reached approximately 5.25% in early 2024, a notable increase from previous years. This competitive yield environment makes it more attractive for individuals to move funds from low-yield bank savings accounts into instruments like Treasury bills or money market funds, which are managed by these substitute financial institutions.

Cryptocurrencies and Blockchain Technology

Cryptocurrencies and blockchain technology, while still emerging in mainstream banking, present a significant long-term threat of substitutes for traditional financial institutions like MetroCity Bankshares. These decentralized systems could fundamentally alter how payments and remittances are handled, offering speed and cost efficiencies that traditional methods struggle to match. For instance, the global remittance market, a key revenue area for many banks, is a prime target for blockchain-based solutions that bypass intermediaries.

The potential for blockchain to disrupt lending is also substantial. Decentralized finance (DeFi) platforms, built on blockchain, are already offering alternative lending and borrowing mechanisms, often with lower fees and greater accessibility. By 2024, the total value locked in DeFi protocols continued to grow, indicating increasing adoption and a tangible challenge to conventional banking models. This shift could siphon off significant transaction volumes and interest income from established players.

- Decentralized Payments: Blockchain offers alternatives to traditional wire transfers and credit card processing, potentially reducing fees and transaction times.

- Remittance Disruption: Cryptocurrencies can facilitate cross-border payments more efficiently, impacting a core banking service.

- DeFi Lending: Decentralized finance platforms provide alternative avenues for borrowing and lending, bypassing traditional banks.

- Evolving Landscape: While still nascent, the rapid development and increasing adoption of these technologies pose a growing, long-term threat to established banking revenue streams.

Internal Financing and Self-Funding

For larger corporations, the threat of substitutes to traditional bank financing is significant. Companies can tap into retained earnings, which for many large firms represent substantial pools of capital. For instance, in 2024, the S&P 500 companies collectively held trillions of dollars in cash and equivalents, providing a robust internal funding source.

Furthermore, direct access to capital markets through issuing bonds or equity offers an alternative to bank loans. In 2024, corporate bond issuance remained strong, with companies raising hundreds of billions of dollars to fund operations and investments, bypassing commercial banks like MetroCity Bankshares. This reduces the dependency on bank credit, thereby limiting lending opportunities for financial institutions.

- Retained Earnings: Large corporations often possess substantial cash reserves, diminishing the need for external bank financing.

- Capital Markets: Direct access to bond and equity markets provides an alternative funding avenue, reducing reliance on traditional bank loans.

- Reduced Lending Opportunities: The availability of these substitutes directly impacts the potential for banks like MetroCity Bankshares to secure new lending business.

The threat of substitutes for MetroCity Bankshares' services is multifaceted, encompassing fintech innovations, alternative lenders, and direct capital market access. These substitutes offer convenience, potentially lower costs, and greater flexibility, diverting customers and revenue streams from traditional banking.

Fintech platforms, particularly in digital payments, represent a growing substitute. The global digital payments market was valued at over $2 trillion in 2023, with continued strong growth projected, indicating a significant shift away from traditional payment methods.

Non-bank lenders and direct access to capital markets are also key substitutes, especially for corporate financing. In 2024, large corporations continued to leverage substantial retained earnings and robust corporate bond issuance, raising hundreds of billions, which reduces their reliance on bank loans.

| Threat Category | Example Substitute | Impact on MetroCity Bankshares | Key Data Point (2023-2024) |

| Digital Payments | Mobile payment solutions, digital wallets | Reduced transaction fees, customer attrition | Global digital payments market > $2 trillion (2023) |

| Alternative Lending | Online lenders, private equity | Loss of loan origination revenue | Non-bank lending sector loan origination in tens of billions annually (2024) |

| Savings & Investment | Money market funds, Treasury bills | Reduced deposit base, lower net interest margin | U.S. 1-year Treasury yield ~5.25% (early 2024) |

| Corporate Financing | Retained earnings, bond issuance | Decreased corporate lending opportunities | S&P 500 companies held trillions in cash (2024); strong corporate bond issuance |

Entrants Threaten

The threat of new entrants in the banking sector, including for MetroCity Bankshares, is considerably diminished by the high capital requirements. Establishing a new bank necessitates substantial funding to comply with stringent regulatory capital adequacy ratios, such as the Common Equity Tier 1 (CET1) ratio, which for larger banks can be upwards of 4.5% plus buffers.

These initial capital outlays, coupled with the need to cover operational expenses, technology investments, and branch networks, present a formidable barrier. For instance, in 2024, the average startup cost for a new community bank can easily run into tens of millions of dollars, making it an unappealing proposition for most aspiring competitors looking to challenge established players like MetroCity Bankshares.

New entrants seeking to compete with MetroCity Bankshares encounter formidable regulatory barriers. Obtaining a banking charter, a foundational step, involves extensive applications and rigorous vetting by federal and state authorities. For instance, in 2024, the average time to secure a new national bank charter approval was reported to be over 12 months, with significant capital requirements.

Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations presents another substantial challenge. These rules demand sophisticated systems and ongoing monitoring, adding considerable operational costs and complexity for any new financial institution. Failure to comply can result in severe penalties, further increasing the risk for potential entrants.

Furthermore, adherence to consumer protection laws, such as those enforced by the Consumer Financial Protection Bureau (CFPB), requires robust internal processes and dedicated compliance teams. The sheer volume of regulations, coupled with the expertise and financial resources needed to navigate them, acts as a powerful deterrent, thereby protecting established players like MetroCity Bankshares from immediate, disruptive new competition.

Building customer trust and a strong brand reputation is a significant barrier for new entrants in banking. It takes years, even decades, to cultivate the confidence needed to attract deposits and loans. For instance, in 2024, established banks like MetroCity Bankshares benefit from decades of consistent service, making it hard for newcomers to gain traction. Consumers are inherently cautious with their finances, preferring the perceived security of familiar institutions.

Economies of Scale and Experience Curve

Existing financial institutions like MetroCity Bankshares significantly benefit from economies of scale. This means their larger operational footprint allows for lower per-unit costs in areas like technology infrastructure, customer service centers, and marketing campaigns. For instance, in 2024, major banks continued to invest billions in digital transformation, a cost that would be prohibitive for a new entrant without a similar scale to amortize those expenses.

Furthermore, the experience curve plays a crucial role. MetroCity Bankshares has developed refined processes and risk management strategies over years of operation. This accumulated knowledge, often referred to as the experience curve, leads to greater efficiency and lower error rates. New entrants would need considerable time and resources to build a comparable level of operational sophistication, making it difficult to match the cost-effectiveness of established players.

- Economies of Scale: MetroCity Bankshares leverages its size to reduce per-unit costs in technology and operations, a barrier for new, smaller competitors.

- Experience Curve: Years of operational refinement provide MetroCity Bankshares with efficiency advantages that new entrants would struggle to quickly replicate.

- Capital Requirements: The substantial capital needed to establish a bank, coupled with the scale advantages, significantly raises the barrier to entry.

Access to Funding and Distribution Networks

New entrants into the banking sector grapple with the significant challenge of securing consistent and affordable funding, primarily through attracting and retaining deposits. Establishing a reliable deposit base, crucial for lending operations, requires substantial marketing investment and building customer trust, which incumbent institutions like MetroCity Bankshares already possess. For instance, in 2024, the average cost of deposits for established banks remained relatively stable, while new entrants often had to offer higher rates to attract initial funding.

Furthermore, the development of effective distribution networks presents a substantial barrier. Traditional banks leverage extensive branch networks and ATM accessibility, which are costly to replicate. Even digital-only banks, while avoiding physical infrastructure costs, must invest heavily in sophisticated digital platforms and aggressive marketing campaigns to acquire a critical mass of customers. This need for significant upfront investment in both funding acquisition and customer reach makes it difficult for new players to compete effectively with established entities.

- Funding Acquisition: New banks must compete for deposits, often at higher initial rates, to build their capital base.

- Distribution Channels: Replicating the physical or robust digital presence of established banks demands significant capital expenditure.

- Customer Trust: Building a loyal customer base takes time and considerable marketing investment, a hurdle for new entrants.

The threat of new entrants for MetroCity Bankshares is low due to substantial capital requirements and stringent regulatory hurdles. Establishing a new bank in 2024 still demanded tens of millions in startup costs, including compliance with capital adequacy ratios like CET1, which can exceed 4.5% plus buffers for larger institutions. Securing a banking charter alone can take over a year, with extensive vetting and ongoing compliance costs for AML and KYC regulations adding further complexity and expense, acting as significant deterrents.

Established players like MetroCity Bankshares benefit from deeply ingrained customer trust and brand loyalty, built over decades of consistent service. Newcomers struggle to replicate this, as consumers are risk-averse with their finances. Furthermore, the significant investments required for distribution networks, whether physical branches or advanced digital platforms, coupled with the need to attract deposits, often at higher initial rates, create formidable barriers for any aspiring competitor seeking to challenge established market positions.

| Barrier Type | Description | Impact on New Entrants (2024) | MetroCity Bankshares Advantage |

|---|---|---|---|

| Capital Requirements | Substantial initial funding needed for operations and regulatory compliance. | Tens of millions in startup costs; high capital adequacy ratios. | Established financial strength to absorb these costs. |

| Regulatory Hurdles | Complex chartering process, ongoing AML/KYC compliance. | Over 12 months for charter approval; significant compliance overhead. | Existing infrastructure and expertise to manage compliance efficiently. |

| Customer Trust & Brand | Building a loyal customer base takes time and marketing investment. | Difficulty attracting deposits without a proven track record. | Decades of service foster strong customer loyalty and perceived security. |

| Economies of Scale | Lower per-unit costs due to larger operational footprint. | Prohibitive costs for new entrants to match technology and marketing spend. | Ability to amortize massive technology and marketing investments. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for MetroCity Bankshares is built upon a foundation of verified data, including SEC filings, annual reports, and industry-specific market research from sources like IBISWorld and S&P Capital IQ. This ensures a comprehensive understanding of the competitive landscape.