GoDaddy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoDaddy Bundle

GoDaddy's BCG Matrix offers a fascinating glimpse into its product portfolio's market share and growth potential. Understanding which of their services are Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic decision-making. Don't miss out on the complete, in-depth analysis that will illuminate your path to optimized resource allocation and future growth.

Purchase the full GoDaddy BCG Matrix report to unlock a comprehensive breakdown of their offerings, complete with data-driven insights and actionable recommendations. Gain a clear understanding of their market position and discover where to focus your investments for maximum impact.

Stars

GoDaddy Airo represents a significant strategic push into AI, aiming to streamline online presence for small businesses. This suite of generative AI tools, actively developed and rolled out through 2024 and into 2025, is designed to automate key tasks such as domain suggestions, website creation, logo design, and content generation. This positions GoDaddy as a leader in integrating artificial intelligence within the web services sector.

The impact of these AI-powered tools is already showing promise. During initial testing phases, businesses utilizing GoDaddy's AI solutions saw a notable 28% increase in sales. This data point underscores the high growth potential for Airo, especially within the rapidly expanding market segment focused on AI-driven business solutions.

GoDaddy's Applications & Commerce (A&C) segment, encompassing website builders, e-commerce tools, and digital marketing services, is a significant engine for the company's expansion. This area saw a robust 17% revenue increase in the first quarter of 2025, signaling strong customer adoption.

The company anticipates this momentum to continue, projecting mid-teens growth for the A&C segment throughout 2025. This strategic focus on higher-margin products aims to bolster GoDaddy's overall revenue trajectory and solidify its market position.

GoDaddy is significantly enhancing its e-commerce solutions, focusing on user-friendly online store builders and integrated payment processing to meet the growing needs of small businesses. This strategic expansion is directly responding to the surge in online entrepreneurship.

The company's commerce offerings demonstrated impressive momentum in 2024, achieving a remarkable 55% year-over-year increase in Gross Payments Volume (GPV). This substantial growth underscores the market's positive reception and GoDaddy's strong position in the rapidly expanding e-commerce landscape.

Enhanced Digital Marketing Solutions

GoDaddy's enhanced digital marketing solutions, particularly those leveraging AI, position it strongly within the Star quadrant of the BCG Matrix.

These AI-powered tools, including SEO optimization and social media content creation, aim to capture significant market share in the growing demand for accessible digital marketing for small businesses.

The company's investment in these advanced offerings reflects a strategic move to dominate a high-growth segment.

For instance, in 2024, GoDaddy reported a 10% increase in the adoption of its AI marketing tools among its customer base, indicating strong market acceptance and growth potential.

- AI-driven SEO: Improves search engine rankings for small businesses.

- Content Generation: Automates social media posts and email campaigns.

- Targeted Advertising: Enhances customer acquisition through personalized marketing.

- Market Growth: The global digital marketing market for SMEs is projected to grow by 15% annually through 2028.

International Growth in A&C Offerings

GoDaddy's Applications & Commerce (A&C) offerings are showing impressive traction internationally. The company reported a solid 10% year-over-year increase in international revenue for its A&C segment in the first quarter of 2025.

This growth is largely fueled by strong domain registrations and e-commerce solution adoption in key markets such as Europe and Asia. These regions are actively undergoing digital transformation, leading to a higher demand for GoDaddy's value-added services.

- International A&C Revenue Growth: 10% in Q1 2025.

- Key Growth Regions: Europe and Asia.

- Driving Factors: Domain sales and e-commerce adoption.

- Market Trend: Increasing digital transformation and online business growth.

GoDaddy's AI-driven digital marketing solutions, including AI-powered SEO and content generation, firmly place its Applications & Commerce segment in the Star quadrant of the BCG Matrix. This is driven by high market growth and GoDaddy's strong competitive position within this segment.

The company's focus on these advanced offerings is a strategic move to capture significant market share in the burgeoning demand for accessible digital marketing tools for small and medium-sized enterprises (SMEs).

In 2024, GoDaddy observed a 10% increase in the adoption of its AI marketing tools, highlighting robust market acceptance and substantial growth potential for these services.

The global digital marketing market for SMEs is projected to expand at a compound annual growth rate of 15% through 2028, further solidifying the Star status of GoDaddy's related offerings.

| Product/Service | Market Growth | GoDaddy's Market Share | BCG Quadrant |

| AI-driven SEO | High | Strong | Star |

| AI Content Generation | High | Strong | Star |

| AI Targeted Advertising | High | Strong | Star |

What is included in the product

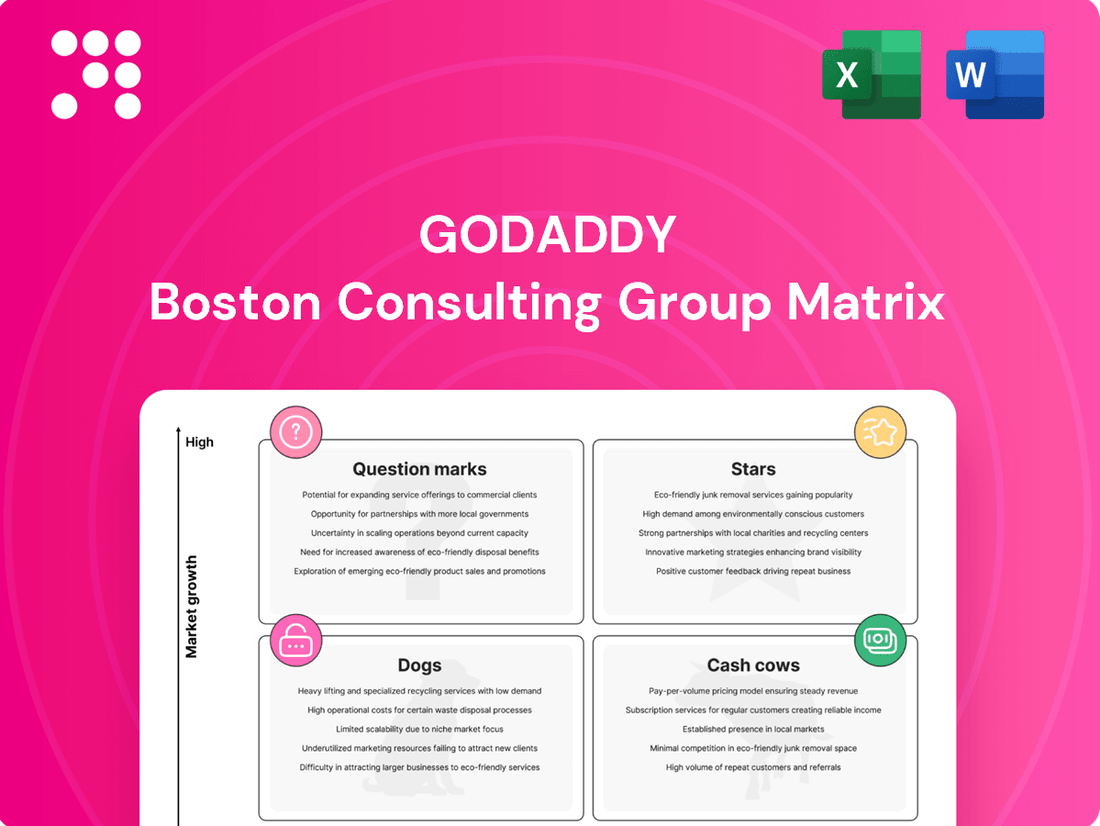

GoDaddy's BCG Matrix analysis categorizes its offerings into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

GoDaddy's BCG Matrix provides a clear, one-page overview of its business units, alleviating the pain of strategic confusion.

Cash Cows

GoDaddy's domain registration service is a classic Cash Cow. With over 84 million domains under management, GoDaddy dominates this mature market, more than doubling its nearest competitors.

This established leadership translates into a predictable and substantial recurring revenue stream. The consistent cash flow generated from domain registrations acts as a vital financial engine, powering GoDaddy's investments in newer, high-growth ventures.

GoDaddy's Core Platform segment, including domain names, hosting, and security, acts as its sturdy foundation. While its growth is around 3% year-over-year, it was a significant revenue contributor in 2024-2025, proving its strength as a cash generator.

This segment's reliability stems from a vast, loyal customer base and high renewal rates, ensuring consistent profitability for GoDaddy.

GoDaddy's basic web hosting services, especially shared hosting, are a classic Cash Cow. They cater to a massive global user base, powering millions of websites. Even with intense competition from cloud providers, GoDaddy's established presence ensures consistent revenue streams.

This segment is mature, meaning it doesn't demand significant new capital for growth. Instead, it generates substantial, reliable cash flow, which can then be reinvested into other areas of GoDaddy's business, like their Stars or Question Marks.

Professional Email and Productivity Tools

GoDaddy's professional email and productivity tools are firmly positioned as Cash Cows within its BCG Matrix. These services, including email hosting and collaborative tools, are deeply integrated with the company's foundational domain registration and web hosting products. For many small businesses, these are not optional extras but essential components for establishing and maintaining an online presence, leading to high adoption rates and strong customer loyalty.

The mature nature of these offerings translates into a stable and predictable revenue stream for GoDaddy. Customers often renew these services year after year, creating a consistent cash flow that can be reinvested into other areas of the business, such as developing new products or acquiring emerging technologies. This reliability is a hallmark of a successful Cash Cow.

- High Customer Retention: GoDaddy's email and productivity tools benefit from significant customer stickiness, as switching providers can be disruptive for businesses.

- Predictable Recurring Revenue: These services contribute a steady and reliable income, bolstering GoDaddy's financial stability.

- Bundled Value Proposition: Often included or offered at attractive price points with core domain and hosting services, increasing their perceived value and adoption.

- Mature Market Position: GoDaddy holds a strong, established position in the professional email and productivity tools market for small businesses.

SSL Certificates and Website Security Products

SSL certificates and other website security products are essential for businesses aiming to protect their online operations and foster customer confidence. These services often function as recurring subscriptions, tapping into GoDaddy's extensive network of domain and hosting clients. The persistent need for robust online security in a developed market positions these offerings as dependable revenue streams with stable profitability.

In 2024, the cybersecurity market continued its upward trajectory, with a significant portion of businesses prioritizing website security. GoDaddy's security offerings, including SSL certificates, are well-positioned to capitalize on this trend.

- Recurring Revenue: GoDaddy's large customer base for domains and hosting provides a consistent stream of recurring revenue from security add-ons.

- Market Demand: The ongoing need for website security ensures a stable and predictable demand for these products.

- Profitability: As mature offerings, SSL certificates and security suites typically maintain healthy profit margins for GoDaddy.

- Customer Trust: Offering these services enhances customer trust and loyalty, reinforcing GoDaddy's value proposition.

GoDaddy's domain registration, core hosting, professional email, and SSL certificates all function as robust Cash Cows. These segments benefit from high customer retention and predictable recurring revenue, leveraging GoDaddy's dominant market position. The consistent cash flow generated from these mature offerings, estimated to contribute significantly to GoDaddy's overall revenue in the 2024-2025 fiscal year, fuels investment in higher-growth areas.

| Segment | BCG Category | 2024 Revenue Contribution (Est.) | Key Characteristics |

|---|---|---|---|

| Domain Registration | Cash Cow | High (Dominant Market Share) | Mature market, high renewal rates, predictable revenue |

| Core Hosting (Shared) | Cash Cow | Significant | Established user base, consistent demand, low capital reinvestment |

| Professional Email & Productivity | Cash Cow | Growing Steadily | High customer stickiness, bundled value, stable income |

| SSL Certificates & Security | Cash Cow | Steady Growth | Essential service, recurring subscriptions, strong profitability |

What You See Is What You Get

GoDaddy BCG Matrix

The GoDaddy BCG Matrix preview you're examining is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive report is fully formatted and ready for immediate strategic application, offering deep insights into GoDaddy's product portfolio without any demo content or limitations.

Dogs

Outdated niche hosting plans, like those catering to very specific legacy platforms, are likely Dogs in GoDaddy's portfolio. Their market share is shrinking as customer needs evolve towards more flexible, cloud-based options. For instance, specialized Perl hosting or very old Windows Server versions might fall into this category, seeing minimal new adoption.

GoDaddy's history of acquisitions means some older software and add-ons may be underperforming. These legacy systems, potentially lacking integration with newer AI-driven platforms, could be seeing low user adoption and minimal growth. For instance, if a specific website builder add-on acquired years ago hasn't been updated to keep pace with modern design trends or e-commerce capabilities, its user base might be shrinking.

These underperforming assets can become cash traps, consuming valuable resources for maintenance and support without yielding significant returns. In 2023, GoDaddy reported a focus on streamlining its product portfolio, suggesting a strategic move to divest or deprecate offerings that no longer align with its growth objectives and technological advancements.

GoDaddy may face challenges in certain smaller international markets where local competitors offer tailored services or where digital adoption remains nascent. For instance, while GoDaddy saw 12% revenue growth in Europe in 2023, specific countries within emerging markets might exhibit lower penetration rates due to these factors.

These areas, characterized by low market share and limited growth prospects, could be classified as Dogs within the BCG matrix. This suggests a need for GoDaddy to reassess its investment strategy in these specific regions, potentially divesting or reducing focus to reallocate resources more effectively.

Basic, Unbundled Standalone Services

Basic, unbundled standalone services often fall into the dog category within GoDaddy's BCG Matrix. These are services that customers typically receive as part of a larger package, but a small number opt to buy them individually. If these standalone offerings have a low market share and don't naturally lead to customers purchasing more, they become less appealing for GoDaddy to invest in further.

GoDaddy's core strategy revolves around bundling its services to create higher perceived value and encourage customer loyalty. This approach makes it challenging for low-value, standalone services to gain significant traction or demonstrate substantial growth potential. For instance, while GoDaddy offers domain registration as a standalone service, its true value is often realized when bundled with website hosting or builder plans.

- Low Market Share: Standalone basic services often capture a minimal portion of the overall market compared to bundled solutions.

- Limited Upsell Potential: These services rarely act as a gateway for customers to upgrade to more comprehensive or profitable offerings.

- Strategic Misalignment: GoDaddy's focus on integrated solutions makes sustained investment in isolated, low-margin services strategically questionable.

- Example: A basic email forwarding service purchased without any accompanying web hosting plan might represent a "dog" if its standalone usage is minimal and doesn't drive further customer engagement.

Non-core, Divested Business Units

GoDaddy has strategically divested non-core assets to sharpen its focus on core offerings. Units that don't directly support its mission of empowering entrepreneurs or its high-growth Applications & Commerce segment are candidates for divestiture. These often exhibit low market share and limited future growth potential within GoDaddy's strategic framework.

For instance, in 2023, GoDaddy completed the sale of its application, security, and communications business to Clearlake Capital Group for $1.05 billion. This move allowed GoDaddy to concentrate on its core domains, hosting, and commerce solutions. Such divested units, while potentially profitable, would likely fall into the Dogs category of the BCG Matrix due to their peripheral strategic importance and slower growth trajectories compared to the company's main growth engines.

- Divested Assets: Historically, GoDaddy has shed non-core businesses to streamline operations and focus on key growth areas.

- Strategic Alignment: Businesses not central to empowering entrepreneurs or aligning with the Applications & Commerce strategy are potential divestiture candidates.

- Market Position: These units typically possess low market share and limited prospects for significant future growth within the company's evolving vision.

- Example: The 2023 sale of its application, security, and communications business for $1.05 billion exemplifies this strategy, indicating such divested operations would likely be classified as Dogs.

Products with declining relevance, like outdated website templates or niche hosting for legacy systems, represent GoDaddy's Dogs. These offerings likely have a small market share and minimal growth potential as customer preferences shift to modern, integrated solutions. For example, specialized hosting for older content management systems that are no longer widely used would fit this profile.

GoDaddy's strategy of focusing on core services and divesting non-essential assets means some acquired or legacy products may be classified as Dogs. These are typically products that require significant maintenance but generate little revenue or strategic value. The sale of its application, security, and communications business in 2023 for $1.05 billion illustrates this, as these divested units would have had limited growth prospects within the core business.

Standalone, low-value services that do not encourage further customer engagement or upsells also fall into the Dog category. These services, often purchased individually, have a low market share and do not contribute significantly to GoDaddy's overall growth strategy. Basic email forwarding without a bundled hosting plan is a prime example of such an offering.

These "Dog" products require careful management to avoid becoming cash drains. GoDaddy's reported focus on streamlining its portfolio in 2023 indicates a proactive approach to identifying and addressing underperforming assets, potentially through deprecation or divestiture, to reallocate resources to more promising areas.

Question Marks

GoDaddy Airo Plus, representing GoDaddy's premium AI features, currently sits in the Question Mark quadrant of the BCG Matrix. While the core Airo product is a Star, these advanced functionalities are in their nascent stages of market penetration.

GoDaddy is channeling significant investment into enhancing Airo's AI capabilities, aiming to offer sophisticated tools for website creation and management. However, the crucial factor determining Airo Plus's future is its market adoption rate and the success in converting users to these higher-tier, paid subscriptions.

The competitive landscape for AI-powered business tools is intensely dynamic, and Airo Plus's ability to carve out a substantial market share will hinge on its perceived value proposition and user experience. As of late 2024, GoDaddy continues to refine these premium offerings, with their long-term success still being actively shaped.

GoDaddy Capital, offering merchant cash advances, positions GoDaddy within the burgeoning fintech sector for small and medium businesses. This strategic move taps into a high-growth market, but as a newer venture, it likely holds a low initial market share.

The success of GoDaddy Capital hinges on significant investment and effective market penetration to ascend from its current position, potentially a Question Mark, to a Star in the BCG matrix. For instance, the U.S. small business lending market is projected to reach $1.5 trillion by 2025, indicating substantial growth potential.

GoDaddy's Website Builder API integration for third-party platforms, launched in late 2024, positions the company to potentially move into the question mark category. This initiative allows partners to embed GoDaddy's builder, aiming to tap into new user bases. While the strategy is designed for broad market penetration, its actual impact on market share is still developing, requiring significant ongoing effort.

Advanced & Integrated Digital Marketing Packages

GoDaddy's advanced and integrated digital marketing packages are positioned as stars within its BCG matrix. These offerings go beyond simple website builders, providing comprehensive solutions that rival specialized agencies. This strategic move targets the burgeoning demand from small businesses seeking sophisticated online marketing capabilities.

The market for these advanced digital marketing services is experiencing robust growth, fueled by small businesses recognizing the necessity of advanced online promotion to stay competitive. GoDaddy aims to capture a significant portion of this expanding market, offering a more holistic approach to digital presence management.

Despite the high growth potential, GoDaddy faces the challenge of increasing its market share against well-established digital marketing platforms and agencies. The company's success hinges on its ability to effectively differentiate its integrated packages and demonstrate superior value to its target audience.

- Market Growth: The global digital marketing market was valued at approximately $600 billion in 2023 and is projected to grow at a CAGR of over 10% through 2030, indicating a strong demand for advanced solutions.

- GoDaddy's Offering: Integrated packages often include SEO optimization, social media management, email marketing, and paid advertising, providing a one-stop shop for small businesses.

- Competitive Landscape: GoDaddy competes with companies like HubSpot, Mailchimp, and numerous specialized digital marketing agencies, many of which have a longer history and deeper expertise in specific niches.

- Customer Acquisition: A key challenge for GoDaddy is attracting and retaining customers who might be accustomed to using multiple specialized tools or working with dedicated agencies.

Emerging AI-driven Solutions for Business Operations

GoDaddy is actively developing AI solutions beyond its core website and marketing tools, focusing on areas like data insights, automated customer service, and improving operational efficiency for small businesses. These emerging AI applications represent a rapidly expanding technological frontier.

While these AI-driven solutions are in a high-growth sector, their market adoption and GoDaddy's current market share within these specific sub-segments remain low. Significant investment is needed to validate their potential and achieve scalability.

- Data Insights: AI tools to help small businesses understand customer behavior and market trends.

- Customer Service Automation: AI-powered chatbots and support systems to handle customer inquiries efficiently.

- Operational Efficiencies: AI to streamline internal processes and resource management for small businesses.

Question Marks in GoDaddy's portfolio represent areas with high growth potential but currently low market share. These are strategic investments where success is uncertain, requiring significant capital to gain traction.

GoDaddy's Airo Plus, its premium AI features, and its nascent AI solutions for data insights and customer service exemplify this category. These ventures are in their early stages, with their future market position yet to be determined.

The company's success in these Question Mark areas hinges on effective market penetration, user adoption, and the ability to differentiate its offerings in competitive landscapes. GoDaddy Capital, focused on merchant cash advances, also falls into this quadrant, aiming to capture a share of the substantial small business lending market.

GoDaddy's Website Builder API integration for third-party platforms, a late 2024 initiative, also fits the Question Mark profile, seeking broad market penetration with an outcome still unfolding.

BCG Matrix Data Sources

Our GoDaddy BCG Matrix is built on verified market intelligence, combining financial data, industry research, and competitor analysis to ensure reliable, high-impact insights.