Forbes, Inc. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Forbes, Inc. Bundle

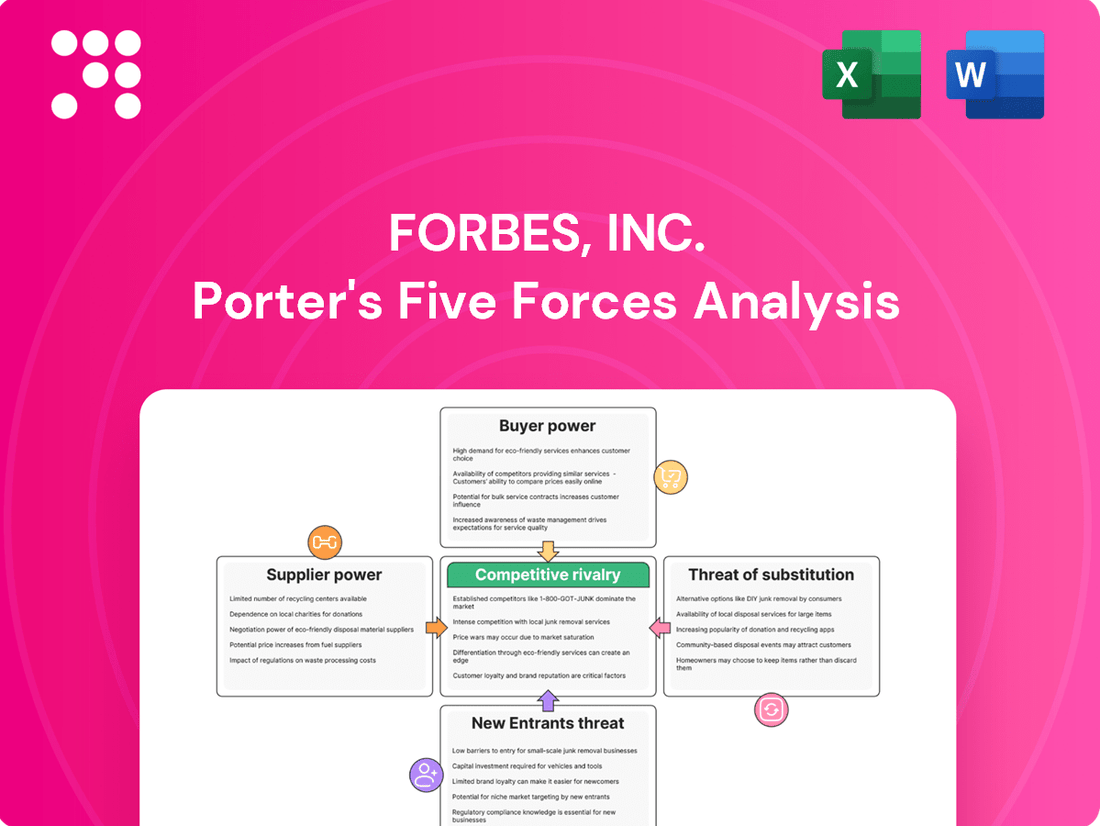

Forbes, Inc. operates in a dynamic media landscape where understanding competitive forces is crucial for success. Our Porter's Five Forces analysis reveals the intense rivalry among existing players, the significant threat of substitute information sources, and the bargaining power of both buyers and suppliers.

The complete report reveals the real forces shaping Forbes, Inc.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Forbes relies on a vast network of journalists and contributors, but the bargaining power of these suppliers can shift. Highly specialized or renowned experts in fields like finance or technology can demand higher compensation or opt for platforms offering better terms, especially as the creator economy provides them with more direct monetization avenues.

Advertising technology providers hold considerable bargaining power over Forbes due to the company's deep reliance on digital advertising for revenue. The concentration of specialized ad tech platforms and proprietary optimization tools can give these suppliers leverage, especially if Forbes finds it difficult to switch providers without significant disruption. For instance, in 2024, the digital advertising market continued to see consolidation, with a few major players dominating programmatic platforms, potentially increasing their influence.

Forbes' print magazine relies on printing and distribution services, which can be seen as commodity providers. While generally having low bargaining power, a few large, specialized players in high-quality printing or niche distribution might exert some leverage. However, the overall trend toward digital media significantly diminishes the collective power of these suppliers for Forbes.

Technology Infrastructure Providers

Forbes.com relies heavily on technology infrastructure providers for its web hosting, cloud services, and content management systems. While the market offers numerous options, significant switching costs can arise for established platforms, granting dominant cloud providers and CMS vendors a degree of bargaining power. Forbes’ ongoing investment in digital transformation and artificial intelligence further solidifies its reliance on specific technology suppliers, potentially increasing their leverage.

The bargaining power of technology infrastructure providers for Forbes is influenced by several factors:

- Market Concentration: A few major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud dominate the market, giving them considerable influence.

- Switching Costs: Migrating complex web infrastructure and data management systems can be costly and time-consuming, making it difficult for Forbes to switch providers easily.

- Supplier Specialization: As Forbes integrates advanced technologies like AI, it may become more dependent on specialized providers whose services are not easily replicated.

- Contractual Agreements: Long-term contracts and service level agreements can lock Forbes into specific providers, limiting its flexibility and negotiation power.

Event Management and Venue Suppliers

Forbes' reliance on event management and venue suppliers for its numerous summits and conferences gives these suppliers a degree of bargaining power. For high-profile events, particularly in competitive urban markets, securing prime venues or specialized organizers can be challenging, granting suppliers moderate leverage.

Forbes' strong brand recognition and ability to attract top-tier speakers and attendees can influence the perceived value of these suppliers, potentially mitigating their power. For instance, a venue hosting a Forbes event gains significant prestige, which can be leveraged in future negotiations.

- Supplier Concentration: The number of available high-quality venues and experienced event management firms in key Forbes event locations can influence supplier power. If options are limited, suppliers can command higher prices.

- Switching Costs: The effort and cost involved for Forbes to switch event management partners or venues can impact supplier bargaining power. High switching costs empower existing suppliers.

- Supplier Differentiation: Unique services or established reputations of certain event organizers or venues can give them more leverage over Forbes.

- Importance of Event: The criticality of a specific event to Forbes' overall strategy can affect how much negotiation power suppliers hold; a flagship event might see suppliers with more influence.

Suppliers of specialized talent, like financial journalists or AI experts, can command higher fees as the creator economy offers them more direct monetization options. In 2024, the digital advertising tech market saw continued consolidation, empowering major programmatic platforms and increasing their leverage over media companies like Forbes. While print suppliers generally have low bargaining power, a few high-quality printers or niche distributors might retain some influence, though the overall shift to digital media lessens this impact.

What is included in the product

This analysis unpacks the competitive forces shaping Forbes, Inc.'s media and business intelligence landscape, examining threats from new entrants, the power of buyers and suppliers, and the intensity of rivalry.

Effortlessly identify and quantify competitive threats with a visual representation of each force, simplifying complex market dynamics.

Customers Bargaining Power

Advertisers, including brands and agencies, wield considerable bargaining power over Forbes. This stems from their substantial contribution to Forbes' revenue, generated through both traditional print and increasingly dominant digital advertising, as well as sponsored content initiatives.

The digital advertising landscape is intensely competitive, with platforms like Google and Meta capturing a significant share of ad spend, offering advertisers a vast array of alternatives to Forbes. This abundance of choices directly amplifies advertiser leverage.

Advertisers' focus on return on investment (ROI) further bolsters their negotiating position. They can readily shift budgets to platforms demonstrating more measurable and impactful results, putting pressure on Forbes to deliver demonstrable value for their ad placements.

Subscription holders at Forbes, like those in the broader media landscape, wield considerable bargaining power. This is largely due to the abundance of alternative sources for business and financial news. Many of these alternatives are available for free, directly competing with paid subscription models.

The media industry's shift towards digital content bundling and ad-supported tiers further amplifies customer leverage. These industry-wide trends present subscribers with a wider array of choices and often reduce the financial or practical barriers to switching providers. For instance, in 2024, many major publishers offered introductory digital subscription rates as low as $1 per month, making it easier for consumers to sample multiple services.

Brand partnership clients, such as those engaging Forbes for custom content, possess significant bargaining power. These clients often have defined marketing goals and can readily explore alternative media outlets or marketing agencies, limiting Forbes’ ability to dictate terms unilaterally.

While Forbes' established brand reputation provides some leverage, clients can still negotiate pricing and deliverables based on their budget constraints and desired audience reach. For instance, a major consumer goods company launching a new product might have the scale to demand favorable rates or specific content placements, leveraging their potential spend against Forbes' need for advertising revenue.

Event Attendees

Event attendees hold significant bargaining power when choosing between various industry conferences, workshops, and networking events. Forbes must offer a distinct and compelling value proposition, such as access to high-profile speakers or unique networking opportunities, to attract and retain attendees.

If the perceived value or cost of a Forbes event doesn't align with attendee expectations, they can easily opt for alternative offerings. This dynamic highlights the importance of continuous innovation and delivering superior experiences to maintain attendee loyalty and market share.

- Attendee Choice: The proliferation of industry events means attendees have a wide array of options, directly increasing their leverage.

- Value Proposition: Forbes' ability to attract attendees hinges on providing exclusive content, unparalleled networking, and tangible benefits that competitors cannot easily replicate.

- Price Sensitivity: Attendees are increasingly cost-conscious, making price-value assessments a critical factor in their decision-making process.

- Information Availability: Easy access to information about competing events allows attendees to compare offerings and negotiate better value.

Content Consumers (Non-subscribers)

Content consumers who do not subscribe to services wield immense power. They can effortlessly shift their attention to countless free online sources, from news aggregators to social media feeds. This ease of switching means their loyalty is not guaranteed, forcing content providers to constantly offer compelling value.

The bargaining power of these non-subscribing consumers is exceptionally high because their attention is the primary commodity. They expect content to be not only high-quality and relevant but also readily accessible without cost. For instance, in 2024, the average daily time spent on social media globally was projected to be around 2.5 hours, highlighting the competition for consumer focus.

- High Switching Costs: Consumers face virtually no financial or effort-based barriers to moving between different free content platforms.

- Abundant Alternatives: The internet offers a vast array of free news, entertainment, and information sources, diluting the power of any single provider.

- Price Sensitivity: As they are not paying, consumers are highly sensitive to perceived value and will not tolerate poor quality or relevance.

- Information Overload: The sheer volume of free content available means consumers are selective, further empowering them to choose the best options.

The bargaining power of customers is a key factor in Forbes's competitive landscape. This power is amplified by the sheer volume of alternative information sources available, both free and paid, and the ease with which customers can switch between them. Advertisers, subscribers, and even casual content consumers all leverage this power to negotiate better terms or seek out more compelling value propositions.

In 2024, the digital media environment continued to offer consumers a vast array of choices. For instance, the average consumer had access to hundreds of news websites and thousands of social media accounts, all competing for their attention and loyalty. This abundance directly translates to increased customer leverage.

Forbes must continuously adapt its offerings, from advertising packages to subscription benefits and event experiences, to meet evolving customer expectations and demonstrate clear value. Failure to do so risks losing customers to competitors who can better cater to their demands.

Same Document Delivered

Forbes, Inc. Porter's Five Forces Analysis

This preview showcases the complete Forbes, Inc. Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see here is precisely the same professionally formatted and insightful analysis you will receive immediately after purchase. You can be confident that no placeholders or edited sections are present; what you preview is your final, ready-to-use deliverable.

Rivalry Among Competitors

Forbes faces significant rivalry from established players like Bloomberg, The Wall Street Journal, and the Financial Times. These outlets boast extensive resources and decades of journalistic credibility, making it challenging to capture audience attention and advertising dollars. For instance, in 2023, The Wall Street Journal reported a circulation of over 2.5 million, highlighting the entrenched nature of these competitors.

Digital-first news and content platforms present a significant competitive force for Forbes. Online-only sites, aggregators, and niche platforms like LinkedIn and Substack can rapidly pivot to emerging trends and hone in on specific demographics, directly challenging Forbes for digital attention and advertising revenue.

This intense rivalry means Forbes must continuously innovate its digital offerings to maintain engagement. In 2024, the digital advertising market, a key revenue stream for such platforms, is projected to reach over $600 billion globally, underscoring the high stakes involved in capturing online readership.

Competitive rivalry in the social media and user-generated content space is intense, with platforms like X, TikTok, and LinkedIn vying for user attention and advertising revenue. These platforms are increasingly supplanting traditional media as primary sources for news and business insights, intensifying competition for audience engagement.

The proliferation of individual content creators and influencers further fuels this rivalry, directly challenging established media outlets for advertising dollars. For instance, in 2024, influencer marketing spend globally is projected to reach over $20 billion, demonstrating the significant shift in advertising budgets towards these user-generated content ecosystems.

Emerging AI-Powered Content Solutions

The competitive rivalry in content creation is intensifying with the rise of AI-powered solutions. These tools can rapidly produce articles, summaries, and analyses, significantly increasing the volume of content available. In 2024, the AI content generation market is projected to reach $1.5 billion, highlighting its rapid growth and the increasing number of players entering this space.

Forbes is actively integrating AI into its operations, but it faces competition from numerous startups and established tech companies also leveraging these advanced technologies. This creates a dynamic landscape where speed and efficiency in content production become critical differentiators.

- AI's Impact on Content Volume: AI tools can generate content at a scale and speed previously unimaginable, flooding the market with new material.

- Market Growth: The AI content generation market is experiencing exponential growth, with new solutions emerging constantly.

- Competitive Landscape: Established media companies and agile startups are all vying for attention by adopting and refining AI content strategies.

Diversification of Revenue Streams

The intense competition among media companies, including Forbes, to diversify revenue streams beyond traditional advertising fuels significant rivalry. This diversification push into areas like subscription services, live events, and strategic brand partnerships intensifies competition as established players and new entrants vie for consumer attention and advertiser dollars.

Forbes, like its peers, must constantly innovate its product offerings to stay relevant and profitable. The shift from print advertising to digital subscriptions and branded content requires continuous adaptation. In 2023, the digital advertising market saw continued growth, but subscription revenue became increasingly crucial for media outlets seeking stable income.

- Subscription Growth: Many media companies reported strong subscriber growth in 2023, with digital subscriptions becoming a primary revenue driver.

- Event Revenue: Forbes' own events, such as the Forbes Under 30 Summit, represent a significant and growing revenue stream, demonstrating the value of in-person engagement.

- Brand Partnerships: The demand for integrated brand partnerships and sponsored content remains high, with companies investing in content that resonates with targeted audiences.

- Digital Transformation: The ongoing digital transformation necessitates investment in new technologies and platforms to deliver diverse content formats effectively.

Forbes faces intense competition from legacy media like Bloomberg and The Wall Street Journal, which possess significant resources and established credibility. Digital-first platforms and aggregators also challenge Forbes by rapidly adapting to trends and targeting specific demographics. In 2023, The Wall Street Journal's circulation exceeded 2.5 million, illustrating the entrenched nature of these rivals.

The rise of social media and user-generated content, including platforms like X and TikTok, further intensifies rivalry by drawing audience attention and advertising revenue away from traditional media. Individual content creators and influencers are also capturing significant advertising spend; global influencer marketing was projected to reach over $20 billion in 2024.

AI-powered content generation is rapidly increasing the volume of available material, with the AI content market expected to hit $1.5 billion in 2024. This necessitates continuous innovation in content quality and delivery for outlets like Forbes to maintain engagement and market share.

| Competitor Type | Key Strengths | 2024 Market Projection/Data |

|---|---|---|

| Legacy Media (e.g., WSJ, Bloomberg) | Established credibility, extensive resources | WSJ Circulation: >2.5 million (2023) |

| Digital-First Platforms & Aggregators | Agility, niche targeting | Digital Ad Market: >$600 billion (Global, 2024) |

| Social Media & Influencers | Audience engagement, user-generated content | Influencer Marketing Spend: >$20 billion (Global, 2024) |

| AI Content Generation | Speed, scalability | AI Content Generation Market: $1.5 billion (2024) |

SSubstitutes Threaten

The proliferation of free online news and information sources presents a significant threat of substitutes for Forbes' content. Consumers can readily access a vast array of business and financial news through websites, aggregators, and social media, diminishing the perceived value of paid or ad-supported premium content. This readily available free information directly competes with Forbes' offerings, potentially reducing user willingness to subscribe or engage with their platform.

Social media platforms and independent content creators are increasingly becoming substitutes for traditional financial news and analysis. In 2024, platforms like TikTok and YouTube saw significant growth in financial content consumption, with many users, particularly younger demographics, preferring the often more accessible and relatable insights offered by influencers over established financial media outlets. This shift means that established financial institutions face competition not just from other traditional players, but from a vast and growing ecosystem of individual creators who can disseminate information rapidly and often with a personal touch.

The rapidly expanding podcast market presents a significant threat of substitution for traditional business and finance content. Listeners can access a vast array of free podcasts offering in-depth analysis, interviews, and commentary on financial markets and business trends, often consumed during commutes or other multitasking activities.

In 2024, the global podcasting market is projected to reach over $30 billion, with millions of hours of new content uploaded weekly. This accessibility and volume of free, high-quality audio content directly competes with written articles, online videos, and even live seminars as a primary source of information for many in our target audience.

Direct Company Communications and Industry Reports

For business professionals, direct company communications like press releases and investor relations reports offer primary data that can substitute for Forbes' analysis. These internal documents often provide granular financial details and strategic outlooks directly from the source.

Industry association publications and specialized market research reports also act as potent substitutes. For instance, a report from Gartner in 2024 on cloud computing adoption might offer more in-depth, niche data than a broader Forbes article, directly impacting strategic decisions.

- Company Investor Relations: Direct access to financial statements and management commentary.

- Industry Market Research: Deep dives into sector-specific trends and forecasts.

- Trade Publications: Specialized news and analysis for niche industries.

- Analyst Reports: In-depth valuations and outlooks from financial institutions.

AI-Generated and Curated Content

The rise of AI-generated and curated content presents a significant threat of substitutes for traditional journalism. As AI models become more adept at producing news summaries, market analyses, and even personalized content feeds, they offer a compelling alternative to human-created journalism, potentially at a lower cost and with greater speed.

This trend is already impacting the media landscape. For instance, in 2024, reports indicated that AI tools were being used by various news organizations to automate the generation of financial reports and sports recaps, demonstrating a tangible shift towards AI-driven content creation. This efficiency gain can translate into cost savings for publishers.

- Cost Efficiency: AI can produce content at a fraction of the cost of employing human journalists, especially for routine or data-heavy reporting.

- Speed and Volume: AI can generate and disseminate information much faster than humans, allowing for real-time updates and a higher volume of published material.

- Personalization: AI excels at tailoring content to individual user preferences, offering a highly personalized experience that can be difficult for traditional outlets to match.

- Scalability: AI-generated content can be scaled rapidly to meet demand, a significant advantage in fast-moving news cycles.

The increasing availability of specialized financial data platforms and direct company communications serves as a significant substitute for Forbes’ content. Professionals can access granular, real-time financial statements and investor relations reports directly from companies, bypassing third-party analysis. Furthermore, niche industry publications and detailed analyst reports offer depth that broad-based media may not replicate.

In 2024, the digital media landscape continues to be reshaped by user-generated content and alternative information sources. Platforms like TikTok and YouTube are increasingly becoming go-to sources for financial insights, especially among younger demographics, often providing more accessible and relatable content than traditional publications. This trend highlights a shift in how financial information is consumed, with influencers and creators directly competing for audience attention.

The proliferation of podcasts, with the global market projected to exceed $30 billion in 2024, offers a powerful substitute. These audio platforms provide in-depth analysis and interviews, consumed conveniently during multitasking, directly challenging written and video content. AI-generated content also presents a growing threat, offering cost-efficient, rapid, and personalized news summaries and market analyses, with many news organizations already integrating AI for report generation.

| Substitute Source | Key Characteristics | Impact on Forbes |

|---|---|---|

| Social Media & Influencers | Accessible, relatable, often free | Diverts audience, particularly younger demographics |

| Podcasts | Convenient, in-depth analysis, often free | Competes for attention during multitasking, offers alternative consumption |

| Direct Company Communications | Primary data, granular financial details | Reduces reliance on secondary analysis for core data |

| AI-Generated Content | Cost-efficient, rapid, personalized, high volume | Threatens traditional content creation models, potential for lower-cost alternatives |

Entrants Threaten

The cost and technical knowledge needed to start an online publication or content platform have dropped considerably. Tools like accessible web hosting, content management systems (CMS), and social media platforms mean anyone can launch a digital presence. This dramatically lowers the initial investment required, allowing individuals or small groups to easily enter the market.

The burgeoning creator economy presents a significant threat of new entrants, particularly within media and content-driven industries. Platforms like Substack and Patreon have lowered the barrier to entry, allowing individuals to directly monetize their expertise and build audiences without relying on established distribution channels.

In 2024, the creator economy continues its rapid expansion, with estimates suggesting the market could reach over $200 billion globally. This growth is fueled by creators leveraging these platforms to bypass traditional gatekeepers, directly engaging with and monetizing niche audiences, thereby introducing formidable competition to incumbents.

Generative AI technologies are significantly lowering the barrier to entry for content creation. For example, by mid-2024, AI tools can produce articles and summaries at speeds previously unimaginable, potentially flooding markets with new information sources. This ease of content generation means that new competitors can emerge rapidly, challenging established players with lower operational costs.

Niche Content Focus

New entrants can effectively penetrate the media landscape by zeroing in on niche content areas, such as specialized investment strategies or emerging lifestyle trends. This focused approach allows them to cultivate a highly engaged audience that might be underserved by larger, more generalized platforms. For instance, a new digital publication dedicated solely to sustainable investing could attract significant attention, bypassing direct competition with broad financial news outlets.

This strategy enables new players to build a loyal following and establish credibility within a specific domain. By offering deep dives into topics that larger competitors only touch upon, these niche entrants can carve out a defensible market position. The key is to provide unique value and expertise that resonates with a particular segment of the audience, making them less susceptible to the scale advantages of established media giants.

Consider the growth of platforms like Substack, where writers focus on specific newsletters covering everything from AI ethics to artisanal coffee. Many of these newsletters have quickly amassed tens of thousands of subscribers, demonstrating the power of niche focus. In 2024, the creator economy continued to boom, with many individuals leveraging platforms to build direct relationships with audiences around specialized interests, bypassing traditional media gatekeepers.

- Niche Audience Building: Focusing on specific interests like fintech innovation or personal finance for Gen Z allows new entrants to attract dedicated readerships.

- Reduced Initial Competition: By avoiding broad categories, new media companies can bypass direct clashes with established giants like Forbes or Bloomberg.

- Content Specialization: Offering in-depth analysis and unique perspectives on a narrow topic builds authority and reader loyalty.

- Creator Economy Leverage: Platforms enabling direct audience engagement empower niche content creators to gain traction rapidly.

Access to Advertising and Distribution Platforms

New entrants into the media landscape, like Forbes, Inc., face a significantly altered competitive environment due to the accessibility of digital advertising and distribution platforms. Services such as Google Ads and Meta's advertising network offer immediate reach, bypassing the need for substantial investment in traditional broadcast or print infrastructure. In 2024, digital advertising spending globally was projected to reach over $600 billion, demonstrating the vastness of these available channels.

These digital avenues democratize audience access and revenue generation. For instance, a new digital publication can leverage social media algorithms and search engine optimization to gain visibility, a stark contrast to the capital-intensive barriers of establishing a physical presence in the past. While this lowers the entry threshold, the sheer volume of content means that capturing audience attention requires sophisticated content strategies and significant engagement efforts.

- Digital advertising platforms offer immediate access to global audiences.

- Social media provides cost-effective distribution channels for new content creators.

- The low barrier to entry in digital media intensifies competition for user attention.

- In 2024, digital ad spend exceeded $600 billion globally, highlighting platform scale.

The threat of new entrants in media is amplified by the creator economy and generative AI. Platforms like Substack and AI content generators drastically lower the cost and technical skill needed to produce and distribute content. This allows individuals and small teams to quickly establish a presence, often by targeting niche audiences underserved by larger publications.

In 2024, the global creator economy was estimated to be worth over $200 billion, showcasing the significant potential for new players. Generative AI tools, by mid-2024, can produce articles and summaries at unprecedented speeds, further reducing operational costs for emerging media outlets. This ease of entry intensifies competition for audience attention.

| Factor | Impact on New Entrants | 2024 Data/Trend |

| Creator Economy Platforms | Lowers barrier to entry, enables direct audience monetization. | Market size exceeding $200 billion globally. |

| Generative AI | Reduces content creation costs and time. | AI can produce articles rapidly, flooding markets. |

| Digital Advertising Reach | Provides immediate access to audiences without infrastructure investment. | Global digital ad spend projected over $600 billion. |

| Niche Audience Focus | Allows new entrants to build loyal followings and bypass direct competition. | Growth of specialized newsletters on platforms like Substack. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Forbes, Inc. is built upon a foundation of publicly available financial reports, industry-specific market research from firms like Statista and IBISWorld, and regulatory filings to capture the competitive landscape.