F.I.L.A. - Fabbrica Italiana Lapis ed Affini Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F.I.L.A. - Fabbrica Italiana Lapis ed Affini Bundle

F.I.L.A. - Fabbrica Italiana Lapis ed Affini navigates a landscape shaped by moderate buyer power and a significant threat from substitutes like digital art tools. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping F.I.L.A. - Fabbrica Italiana Lapis ed Affini’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for F.I.L.A. is significantly shaped by the concentration and specialization of its raw material providers. For F.I.L.A.'s premium art brands, such as Canson and Maimeri, which rely on specialized pigments and unique paper types, a limited number of highly capable suppliers can wield considerable influence. This specialization means fewer alternatives, giving these suppliers more leverage in pricing and terms.

In contrast, for F.I.L.A.'s mass-market products, like Giotto crayons, the situation is different. These items often utilize more common materials, meaning there's a wider pool of potential suppliers. This broader availability dilutes the power of any single supplier, as F.I.L.A. can more easily switch between providers for standard components, thereby reducing individual supplier leverage.

For F.I.L.A., the cost and complexity of switching suppliers are crucial. If F.I.L.A. has specialized equipment or production methods that rely on specific materials from a particular supplier, or if vetting new suppliers is a time-consuming and expensive endeavor, then switching costs are elevated. This directly impacts the bargaining power of those suppliers.

High switching costs for F.I.L.A. mean suppliers can potentially demand higher prices or dictate more favorable terms. For instance, if F.I.L.A. sources a unique pigment for its colored pencils that requires specialized grinding equipment, changing to a different pigment supplier would necessitate significant capital investment and retooling, thus strengthening the original supplier's position.

Maintaining consistent quality and safety across F.I.L.A.'s broad product portfolio, from art supplies to stationery, also plays a role. If a supplier consistently meets stringent quality benchmarks, the effort and risk associated with qualifying a new supplier to achieve the same level of reliability can be substantial, thereby enhancing the current supplier's leverage.

The threat of suppliers integrating forward into F.I.L.A.'s finished art materials and stationery market is generally low. This is because producing items like coloring pencils, paints, and modeling clay demands specialized knowledge, manufacturing processes, and established brand loyalty that most raw material providers lack.

For instance, a supplier of wood for pencils or pigments for paints typically doesn't have the intricate machinery for precise coloring, molding, and packaging required for the final consumer product. Furthermore, building consumer trust and recognition in a competitive market like art supplies, where F.I.L.A. has a strong presence, is a significant barrier to entry for raw material providers.

Uniqueness and Importance of Inputs

The bargaining power of suppliers for F.I.L.A. is influenced by the uniqueness and importance of the inputs they provide. While many raw materials used in mass-produced stationery are readily available from multiple sources, specialized components are different. For instance, the pigments used in F.I.L.A.'s artist-quality paints or the specific paper grades for their fine art lines are not as easily substituted.

Suppliers who can provide these unique or high-performance inputs, which are critical to F.I.L.A.'s premium product differentiation and brand image, will naturally wield more influence. This is particularly true if these specialized materials contribute significantly to the final product's perceived quality and performance, as is often the case in art supplies. In 2023, F.I.L.A. reported that its Art and Construction segment, which relies heavily on specialized inputs, represented a substantial portion of its revenue.

- Uniqueness of Pigments: Suppliers of proprietary or high-grade pigments for artist paints can command higher prices due to their specific properties and limited availability.

- Specialty Paper Grades: For F.I.L.A.'s fine art paper brands, suppliers of unique textures or archival-quality paper have significant bargaining power.

- Brand Reputation Linkage: When a supplier's input is directly tied to the quality and reputation of a F.I.L.A. premium brand, their leverage increases.

- R&D Collaboration: Suppliers involved in co-developing unique materials with F.I.L.A. may also possess greater influence.

Impact of Sustainability Requirements

The increasing demand for sustainable products in the stationery and art supplies sector significantly impacts the bargaining power of suppliers for F.I.L.A. (Fabbrica Italiana Lapis ed Affini). Manufacturers like F.I.L.A. are actively seeking materials that are eco-friendly and ethically sourced to align with consumer preferences and evolving regulations.

Suppliers who can provide certified sustainable or recycled materials gain leverage. For instance, a report from the European Paper Recycling Council indicated that in 2023, paper recycling rates in Europe reached approximately 72%, highlighting the growing availability and importance of recycled fiber. This means suppliers of such materials are in a stronger position to negotiate terms.

- Increased Supplier Leverage: Suppliers offering certified sustainable or recycled inputs can command higher prices and better terms due to F.I.L.A.'s need to meet environmental standards.

- Potential Cost Increases: The premium associated with sustainable materials can lead to higher production costs for F.I.L.A., potentially impacting profit margins or product pricing.

- Reduced Supplier Choice: As F.I.L.A. prioritizes sustainability, its pool of eligible suppliers may shrink, reducing its flexibility in sourcing and potentially increasing reliance on a few key providers.

- Regulatory Compliance Driver: Meeting sustainability requirements, such as those related to responsible forestry or chemical usage, further empowers suppliers who meet these stringent criteria.

The bargaining power of suppliers for F.I.L.A. is moderate, influenced by the availability of raw materials and the cost of switching. While common materials like wood and plastic have many suppliers, specialty items like high-grade pigments and unique paper types are sourced from fewer, more specialized providers, giving them greater leverage. F.I.L.A.'s ability to switch suppliers is impacted by the investment required for retooling and supplier qualification, with higher switching costs empowering suppliers.

| Factor | Impact on F.I.L.A. | Supplier Leverage | 2024 Context |

| Raw Material Availability | High for common materials, low for specialty items | Low for common, High for specialty | Continued global supply chain normalization, but specialty chemical and paper markets remain tight. |

| Switching Costs | Moderate to High for specialized inputs | Moderate to High | Increased focus on supply chain resilience may lead F.I.L.A. to invest more in supplier diversification, potentially lowering future switching costs. |

| Supplier Concentration | Low for bulk materials, high for niche components | Low for bulk, High for niche | Key suppliers for pigments and specialty papers are few, maintaining their pricing power. |

| Importance of Input | Critical for premium brands (e.g., Canson paper, Maimeri pigments) | High | F.I.L.A.'s premium segments are vital for profitability, making reliance on quality specialty inputs significant. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to F.I.L.A. - Fabbrica Italiana Lapis ed Affini's position in the stationery and art supplies market.

Instantly identify and mitigate competitive threats with a clear, actionable F.I.L.A. Porter's Five Forces analysis, simplifying complex market dynamics.

Gain strategic clarity on F.I.L.A.'s competitive landscape, transforming potential market pressures into manageable insights for improved decision-making.

Customers Bargaining Power

F.I.L.A. benefits from a wide array of customers, ranging from individual artists and students to large corporate offices and educational institutions. This broad customer base, encompassing segments identified in their company information [2, 7], naturally disperses purchasing power, making it less likely for any single customer group to wield significant influence over pricing or terms. For instance, in 2023, F.I.L.A.'s sales were diversified across various channels, with no single customer segment representing an overwhelming majority of revenue, thus mitigating concentrated customer leverage.

Customer price sensitivity is a key factor in F.I.L.A.'s bargaining power. For everyday items like pencils and notebooks, consumers and students often look for the best price. However, for premium art supplies from brands like Maimeri or Daler-Rowney, quality and brand reputation often outweigh minor price differences, indicating lower price sensitivity in these segments.

The widespread availability of information through e-commerce and online channels significantly boosts customer bargaining power for companies like F.I.L.A. Customers can effortlessly compare product features, pricing, and reviews across numerous competitors, making price transparency a key factor. For instance, in the stationery and art supplies market, online marketplaces allow consumers to see F.I.L.A.'s offerings alongside similar products from brands like Faber-Castell or Crayola, often with detailed user feedback readily accessible.

Low Switching Costs for Customers

For many of F.I.L.A.'s art materials and stationery products, the cost for a customer to switch brands is quite low. This means if prices rise or quality dips, consumers can readily explore other options without significant hassle or expense.

This low switching barrier directly enhances the bargaining power of customers. They have the leverage to demand better prices or higher quality because alternatives are readily available and easy to adopt.

- Low Switching Costs: Customers can easily move between brands of art supplies and stationery.

- Price Sensitivity: If F.I.L.A. increases prices, customers are likely to seek out cheaper alternatives.

- Brand Loyalty Factors: While some brand loyalty exists, it's often not strong enough to overcome significant price differences or perceived quality issues.

- Market Dynamics: In 2024, the art supplies market saw continued competition, with online retailers offering a wide array of brands, further empowering consumers with choice and price comparison tools.

Demand for Sustainable and Customized Products

Customers are increasingly vocal about their desire for sustainable and eco-friendly art supplies and stationery. This growing preference significantly shifts bargaining power towards consumers who prioritize these attributes, compelling manufacturers like F.I.L.A. to allocate resources towards environmentally conscious materials and production methods. For instance, a 2024 Nielsen report indicated that 73% of global consumers would change their consumption habits to reduce their environmental impact, directly influencing purchasing decisions for products like those offered by F.I.L.A.

The demand for customization also amplifies customer leverage. In segments ranging from bespoke gift sets to personalized stationery, consumers are willing to pay a premium for unique features. This allows them to negotiate for specific product designs, materials, or even packaging. For example, the custom stationery market alone was projected to reach over $2 billion globally by 2025, highlighting the significant customer influence driven by personalization trends.

- Growing Consumer Demand for Sustainability: A significant majority of consumers, often exceeding 70% in recent surveys, are actively seeking out eco-friendly products, pressuring companies to adopt greener practices.

- Impact of Customization on Leverage: The ability for customers to request personalized products, particularly in premium or niche markets, grants them greater power to dictate product specifications and features.

- Market Trends Supporting Customer Power: The expansion of markets focused on ethical sourcing and bespoke goods, such as the custom stationery sector, demonstrates a clear shift in influence towards the end consumer.

F.I.L.A.'s customer base is broad, reducing the power of any single buyer. While price sensitivity is high for basic items, premium art supplies see less price elasticity due to brand and quality focus. The ease of online price comparison and low switching costs for many products empower customers, especially as demand for sustainable and customized goods grows, as evidenced by a 2024 report showing 73% of consumers would alter habits for environmental reasons.

| Factor | Impact on F.I.L.A. | Supporting Data (2024/Recent) |

|---|---|---|

| Customer Base Diversity | Lowers individual customer bargaining power. | F.I.L.A.'s sales are spread across artists, students, and institutions, with no single segment dominating revenue. |

| Price Sensitivity | Varies by product segment. High for stationery, lower for premium art brands. | Consumers often prioritize value for everyday items, but quality and brand reputation influence choices for art materials. |

| Information Availability & Switching Costs | Increases customer leverage due to transparency and ease of switching. | Online marketplaces allow easy comparison of F.I.L.A. products against competitors like Faber-Castell or Crayola. |

| Demand for Sustainability & Customization | Shifts power to consumers prioritizing these attributes. | 73% of global consumers would change habits for environmental impact; custom stationery market projected over $2 billion by 2025. |

Same Document Delivered

F.I.L.A. - Fabbrica Italiana Lapis ed Affini Porter's Five Forces Analysis

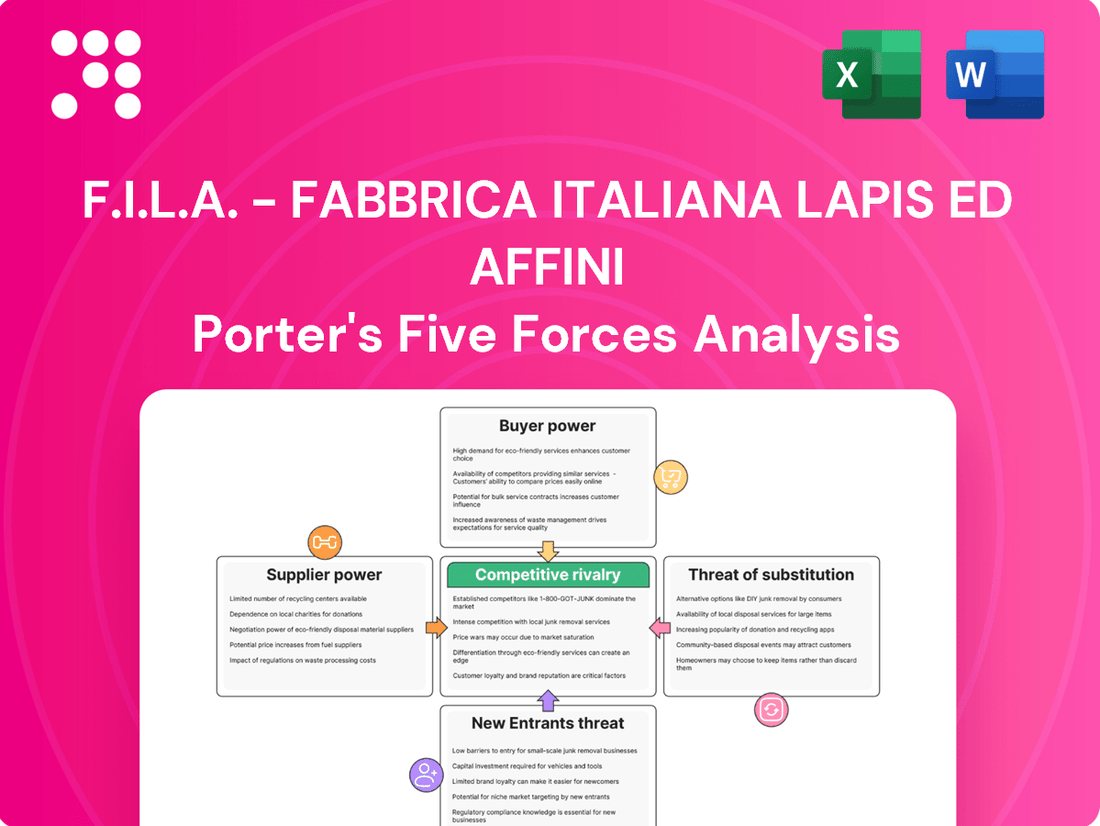

This preview showcases the complete F.I.L.A. - Fabbrica Italiana Lapis ed Affini Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate utility. You can confidently acquire this comprehensive analysis, knowing it's ready for your strategic planning without any hidden elements or placeholders.

Rivalry Among Competitors

The art materials and stationery sector is a crowded landscape, brimming with both global giants and nimble local contenders. This intense competition is a defining characteristic for companies like F.I.L.A.

F.I.L.A. faces off against established international powerhouses such as Newell Brands, known for its Sharpie and Rubbermaid lines, and Faber-Castell, a historic name in pencils and art supplies. Brands like Colart, which owns Winsor & Newton, and Société BIC, the parent company of Crayola, also represent significant competitive forces. The sheer number of these players, alongside many smaller, specialized brands operating in specific product niches and regional markets, significantly amplifies the rivalry within the industry.

The stationery and art supplies markets are demonstrating robust growth, with projected compound annual growth rates (CAGRs) between 3.8% and 8% extending through 2034 and 2035. This expansion, while generally positive, intensifies the competitive landscape as it attracts new entrants and spurs existing players to innovate.

Companies are actively developing new products and refining existing ones to capture a larger share of this expanding market. F.I.L.A. is strategically positioned to navigate this environment by emphasizing its unique product offerings and reinforcing its leadership status through continuous innovation and a focus on quality.

F.I.L.A. benefits from a robust collection of globally recognized brands, including Giotto, Lyra, Daler-Rowney, Maimeri, and Canson, each carrying significant heritage and a history of innovation. This established brand equity acts as a powerful differentiator in the market.

However, the competitive landscape is characterized by the presence of other established players who also command strong brand recognition and cultivate deep customer loyalty. This means F.I.L.A. faces significant rivalry as companies vie for consumer attention and market share, with brands like Stabilo and Faber-Castell also holding considerable sway.

Product Differentiation and Market Segmentation

F.I.L.A. actively differentiates its offerings by catering to a broad spectrum of consumers, from professional artists to students and everyday users, with distinct product lines. This strategy is crucial in a market where competition hinges significantly on innovation, quality, and unique features, particularly within the high-end art supplies and premium stationery sectors.

The intense rivalry is fueled by continuous efforts from competitors to launch novel designs and enhanced functionalities, aiming to capture evolving consumer demands and preferences. For instance, in 2024, the global art supplies market was valued at approximately $13.5 billion, with a projected compound annual growth rate of 4.2% through 2030, underscoring the importance of differentiation.

- Product Innovation: Companies like F.I.L.A. invest heavily in R&D to introduce new colors, materials, and ergonomic designs.

- Market Segmentation: Targeting specific user groups, such as fine artists, educators, or children, allows for tailored product development and marketing.

- Quality and Performance: Superior materials and manufacturing processes are key differentiators, especially for professional-grade art supplies.

- Brand Reputation: Established brands with a history of quality and innovation command premium pricing and customer loyalty.

Sustainability and Digital Integration as Competitive Factors

Sustainability and digital integration are increasingly shaping the competitive landscape for companies like F.I.L.A. Businesses demonstrating genuine commitment to eco-friendly practices and products can attract environmentally conscious consumers, a growing market segment. For instance, F.I.L.A.'s focus on sustainable materials and production methods directly addresses this trend, potentially differentiating them from competitors who lag in these areas.

Leveraging digital platforms for sales, marketing, and customer engagement provides another significant competitive advantage. F.I.L.A.'s online presence allows for direct consumer interaction, brand building, and wider market reach. This digital integration is not just about e-commerce; it extends to building communities around their brands, fostering loyalty and gathering valuable market insights.

The competitive intensity within the stationery and art supplies sector is amplified by these factors. Companies that effectively weave sustainability into their core operations and embrace digital transformation are better positioned to thrive.

- Sustainability drives consumer preference: Reports indicate that a significant percentage of consumers, particularly younger demographics, are willing to pay more for sustainable products.

- Digital channels expand reach: Online sales channels are crucial for accessing a broader customer base and competing with agile, digitally native brands.

- Brand reputation is enhanced: Demonstrating a commitment to environmental responsibility and digital innovation positively impacts brand perception and loyalty.

- Innovation in materials and processes: Companies investing in eco-friendly materials and digital solutions for product development and customer service gain a distinct edge.

The competitive rivalry within the art materials and stationery sector is exceptionally high, with F.I.L.A. facing numerous global and specialized competitors. This intense competition is driven by market growth, which attracts new players and encourages existing ones to innovate aggressively. Companies like Newell Brands, Faber-Castell, Colart, and Société BIC are major rivals, alongside many smaller, niche brands.

Differentiation through product innovation, quality, brand reputation, and market segmentation is crucial for F.I.L.A. to maintain its position. The global art supplies market was valued at approximately $13.5 billion in 2024, with a projected CAGR of 4.2% through 2030, highlighting the stakes involved in capturing market share.

Furthermore, sustainability and digital integration are increasingly becoming key battlegrounds. Companies that prioritize eco-friendly practices and leverage digital platforms for sales and engagement gain a significant competitive edge. This focus on responsible operations and digital presence is vital for attracting environmentally conscious consumers and expanding market reach.

| Key Competitors | Key Brands | Market Focus |

| Newell Brands | Sharpie, Rubbermaid | Broad consumer and office products |

| Faber-Castell | Faber-Castell pencils, art supplies | Premium art supplies, writing instruments |

| Colart | Winsor & Newton, Liquitex | Professional artist materials |

| Société BIC | Crayola | Children's art supplies, writing instruments |

| Stabilo International | Stabilo pens, markers | Writing instruments, art supplies |

SSubstitutes Threaten

The proliferation of digital art tools and software presents a substantial threat of substitution for traditional art supplies offered by companies like F.I.L.A. Artists can now achieve a wide range of creative outcomes using devices such as iPads with Apple Pencil or Wacom tablets, coupled with software like Adobe Photoshop or Procreate. This digital shift can diminish the demand for physical mediums such as oil paints, acrylics, canvases, and graphite pencils, as these tools offer convenience, reduced ongoing material costs, and enhanced editing capabilities.

The increasing consumer focus on environmental responsibility is a significant threat of substitution for F.I.L.A. Products. For instance, the global market for sustainable stationery and art supplies is projected to grow substantially, with some estimates suggesting a compound annual growth rate of over 8% through 2027, indicating a clear shift in consumer preference away from traditional, less eco-friendly options.

This trend means consumers might choose reusable notebooks over traditional paper pads or opt for pens made from recycled plastics or biodegradable materials. Even within the physical product category, the move towards sustainability presents a direct substitution challenge for F.I.L.A. if its product lines are not perceived as sufficiently eco-conscious.

The rise of multi-functional and hybrid products presents a significant threat of substitutes for traditional stationery. For instance, the market has seen the integration of technology with classic stationery items, leading to innovations like smart notebooks and stylus-enabled writing instruments. While F.I.L.A. may engage with these trends, the broader availability of digital devices that consolidate note-taking, drawing, and organizational capabilities can directly replace the need for numerous individual physical stationery products, thereby diminishing demand for F.I.L.A.'s diverse physical offerings.

DIY and Crafting with Everyday Materials

The burgeoning DIY and crafting movement poses a threat of substitution for F.I.L.A. by encouraging the use of readily available household items and repurposed materials in creative projects. This trend can divert consumer spending away from specialized art supplies. For instance, a 2024 survey indicated that over 60% of crafters reported using found objects or repurposed materials in at least one project in the past year.

This preference for accessible materials can diminish the demand for traditional art supplies like paints, brushes, and specialty papers offered by F.I.L.A. The perceived cost savings and environmental consciousness associated with upcycling further bolster this substitution effect. Many consumers now view crafting as an opportunity to reduce waste, making non-purchased materials an attractive alternative.

The accessibility of online tutorials and inspiration, often showcasing DIY solutions using everyday items, amplifies this threat. Platforms dedicated to upcycling and crafting with recycled materials saw a 25% increase in user engagement in 2024. This widespread dissemination of ideas makes it easier for consumers to bypass traditional art supply channels.

- Increased DIY Project Popularity: A significant portion of consumers are engaging in DIY activities, often prioritizing cost-effective and readily available materials.

- Use of Repurposed Materials: Consumers are increasingly opting for household items and recycled goods, directly substituting for conventional art supplies.

- Reduced Demand for Specialized Products: This trend can lead to a decline in sales for traditional art materials that F.I.L.A. offers.

- Environmental and Cost Motivations: The appeal of sustainability and budget-friendliness drives consumers towards alternative crafting resources.

General Purpose vs. Specialized Products

For many everyday writing and drawing tasks, general-purpose pens and pencils serve as readily available substitutes for F.I.L.A.'s more specialized art supplies. This means consumers can easily opt for cheaper, widely distributed alternatives if their needs are basic or if cost is a significant factor.

F.I.L.A. itself acknowledges this dynamic, noting in its 2023 annual report that the stationery market is highly competitive, with a significant portion driven by price sensitivity for essential items. For instance, the global market for writing instruments, excluding luxury segments, is vast, with numerous manufacturers offering low-cost options.

The threat of substitutes is particularly strong when considering the vast array of private-label and unbranded stationery products available in mass-market retailers and online marketplaces. These often compete directly on price, making it easier for consumers to switch away from F.I.L.A.'s offerings for non-premium applications.

- Broad Accessibility: Basic pens and pencils are found everywhere, from supermarkets to convenience stores, offering immediate alternatives.

- Price Sensitivity: For routine use, consumers often prioritize cost-effectiveness over brand prestige or specialized features.

- Market Saturation: The sheer volume of low-cost writing and drawing tools available limits the pricing power for general-purpose items.

The threat of substitutes for F.I.L.A. is multifaceted, encompassing digital alternatives, eco-friendly options, and the DIY movement. Digital art tools offer convenience and reduced material costs, while a growing consumer preference for sustainability pushes demand towards recycled or reusable products. Furthermore, the rise of DIY crafting, often utilizing readily available or repurposed materials, directly competes with specialized art supplies.

For basic writing and drawing needs, generic and private-label pens and pencils present a significant substitution threat due to their widespread availability and lower price points. This is particularly true in a market where price sensitivity for everyday items is high, as noted by F.I.L.A.'s own reports on market competitiveness.

| Substitution Threat Category | Key Substitutes | Impact on F.I.L.A. | Supporting Data/Trend (2024/2023) |

|---|---|---|---|

| Digital Art Tools | Tablets (iPad, Wacom), Styluses, Art Software (Photoshop, Procreate) | Reduced demand for physical art mediums | Continued growth in digital art adoption |

| Sustainable Alternatives | Recycled paper notebooks, biodegradable pens, eco-friendly craft materials | Shift in consumer preference away from traditional supplies | Projected 8%+ CAGR for sustainable stationery market (through 2027) |

| DIY & Repurposed Materials | Household items, recycled goods, found objects for crafting | Decreased sales of specialized art supplies | Over 60% of crafters used found/repurposed materials in 2024 projects |

| Basic Writing Instruments | Generic pens, unbranded pencils, mass-market stationery | Price competition, reduced demand for premium offerings | High price sensitivity for essential stationery items (F.I.L.A. 2023 report) |

Entrants Threaten

The art materials and stationery sector demands substantial upfront capital. Newcomers face the hurdle of investing heavily in production facilities, advanced machinery, and maintaining a robust inventory to meet market demand. This high barrier to entry significantly deters potential new competitors.

Global players like F.I.L.A. have established extensive operational networks, boasting 23 production facilities and 32 subsidiaries worldwide. To even begin to challenge such an established presence, new entrants would require immense financial backing to replicate or overcome F.I.L.A.'s scale and reach in production and distribution channels.

F.I.L.A. benefits from strong brand heritage and a diverse portfolio of iconic brands like Giotto, Lyra, Daler-Rowney, Maimeri, and Canson. These brands have cultivated substantial customer loyalty over many years, making it difficult for newcomers to replicate this established trust and recognition.

New entrants face a considerable hurdle in building comparable brand awareness and loyalty. This often necessitates significant investment in marketing and a considerable amount of time to gain traction in a market where F.I.L.A.'s brands already hold a strong position.

New companies face a significant hurdle in accessing the extensive distribution networks that F.I.L.A. has cultivated. Establishing a presence in specialty stores, supermarkets, and a strong online sales infrastructure requires substantial investment and time.

F.I.L.A.'s established global footprint, spanning five continents and over 20 countries, presents a formidable barrier. Replicating this market penetration and brand recognition is exceptionally challenging for emerging competitors seeking to compete on a similar scale.

Economies of Scale and Cost Advantages

Established companies in the stationery and art supplies sector, like F.I.L.A., leverage significant economies of scale. This translates into lower per-unit production costs due to bulk purchasing of raw materials and optimized manufacturing processes. For instance, in 2023, F.I.L.A. reported a consolidated net revenue of €1.1 billion, indicating a substantial operational footprint that underpins these cost advantages.

New entrants would struggle to match these efficiencies. Starting at a much smaller scale, they would likely incur higher costs for procurement and manufacturing, creating a price disadvantage. This cost gap makes it difficult for newcomers to compete effectively with the pricing strategies of established players who benefit from years of scaled operations.

- Economies of Scale: F.I.L.A.'s large production volumes reduce per-unit costs in manufacturing and distribution.

- Cost Advantages: Bulk purchasing of raw materials like wood, graphite, and pigments provides significant savings.

- Barriers to Entry: New entrants face higher initial operating costs, making price competition challenging.

- 2023 Revenue: F.I.L.A.'s €1.1 billion revenue highlights its established market presence and scale.

Regulatory Compliance and Sustainability Standards

The threat of new entrants into the stationery and art supplies industry, particularly for a company like F.I.L.A. - Fabbrica Italiana Lapis ed Affini, is significantly influenced by regulatory compliance and sustainability standards. New companies must navigate a landscape increasingly shaped by rules governing product safety, such as those mandated by the European Chemicals Agency (ECHA) for substances like lead in pencils, and quality certifications like ISO 9001.

The growing emphasis on environmental and social governance (ESG) presents a substantial barrier. For example, new entrants must immediately invest in and adhere to evolving standards for sustainable material sourcing, such as FSC certification for wood-based products, and eco-friendly production processes. Failure to meet these requirements can lead to reputational damage and market exclusion, as seen with increasing consumer demand for recycled content and reduced carbon footprints in manufacturing.

- Product Safety Regulations: Compliance with directives like the EU's Toy Safety Directive and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) is mandatory, adding upfront costs for testing and certification.

- Environmental Standards: New entrants must meet stringent environmental regulations concerning waste management, emissions, and the use of hazardous substances, which can be capital-intensive.

- Sustainability Reporting: Increasingly, businesses are expected to provide transparent sustainability reports, requiring new players to establish robust data collection and reporting frameworks from inception.

- Supply Chain Scrutiny: Ensuring ethical and sustainable sourcing throughout the supply chain, including labor practices and raw material origins, adds complexity and requires diligent oversight, a challenge for startups lacking established relationships.

The significant capital investment required for manufacturing facilities and distribution networks acts as a substantial deterrent for new entrants. F.I.L.A.'s established global presence, with 23 production sites and 32 subsidiaries, underscores the immense scale needed to compete effectively. Furthermore, the brand loyalty cultivated by F.I.L.A.'s well-known brands like Giotto and Canson creates a high hurdle for newcomers aiming to build comparable recognition and trust, necessitating considerable marketing investment.

| Barrier Type | Description | Impact on New Entrants | F.I.L.A. Advantage |

|---|---|---|---|

| Capital Requirements | High upfront costs for production, machinery, and inventory. | Significant financial hurdle. | Established infrastructure and scale. |

| Brand Loyalty & Recognition | Customer preference for established, trusted brands. | Difficulty in attracting customers. | Portfolio of iconic brands (Giotto, Canson). |

| Distribution Networks | Access to retail channels (specialty, mass market, online). | Challenges in reaching target customers. | Extensive global distribution channels. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | Higher initial operating costs and price disadvantage. | €1.1 billion revenue in 2023 indicates significant scale. |

Porter's Five Forces Analysis Data Sources

Our F.I.L.A. Porter's Five Forces analysis is built upon a foundation of comprehensive data, including F.I.L.A.'s annual financial reports, industry-specific market research from firms like Statista and IBISWorld, and broader economic data from sources such as Bloomberg.