EZCORP SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EZCORP Bundle

EZCORP's market position is shaped by a blend of robust financial services and a strong customer base, but also faces evolving regulatory landscapes and competitive pressures. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities within the sector.

Want the full story behind EZCORP's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

EZCORP's extensive network of over 1,200 pawn stores across the United States and Latin America firmly establishes it as a market leader. This significant physical presence allows for broad customer reach and operational efficiencies, reinforcing its competitive advantage.

EZCORP's financial performance in fiscal year 2025 has been exceptionally strong, marked by record revenues. This growth trajectory is further supported by a notable increase in Pawn Loans Outstanding (PLO), indicating enhanced customer engagement and lending activity.

The company's profitability has also seen a significant uplift, with adjusted EBITDA and diluted earnings per share showing positive gains. These financial metrics highlight the success of EZCORP's strategic initiatives and its capacity to translate operational efficiency into robust financial results.

EZCORP's core strength lies in its non-recourse pawn loan model. This means loans are secured by personal property, significantly lowering credit risk for the company. If a borrower defaults, EZCORP can simply seize and sell the collateral, a stark contrast to the higher risk associated with unsecured lending.

Diversified Revenue Streams

EZCORP's financial strength is bolstered by its diversified revenue streams, extending beyond its core pawn lending operations. The company actively generates income through the retail sale of merchandise, typically consisting of forfeited pawn collateral. This strategy allows EZCORP to monetize unsold inventory and capture additional profit.

Further diversifying its income, EZCORP engages in the sale of scrap jewelry, capitalizing on the precious metal content of items that are not sold at retail. Additionally, the company offers various other financial services, creating multiple avenues for revenue generation. This multi-pronged approach enhances EZCORP's overall financial stability and mitigates risks associated with over-dependence on any single business segment.

- Merchandise Sales: Revenue from selling forfeited pawn collateral.

- Jewelry Scrapping: Income derived from selling scrap precious metals from jewelry.

- Ancillary Financial Services: Additional revenue from other financial product offerings.

- Reduced Reliance: Diversification lessens dependence on core lending activities.

Strong Customer Loyalty and Demand

EZCORP benefits from a deeply ingrained customer loyalty, significantly boosted by its Easy Plus rewards program. This program consistently drives a substantial portion of the company's transactions, demonstrating its effectiveness in retaining customers.

There's a persistent and strong demand for EZCORP's core offerings: immediate cash solutions and affordable, quality secondhand merchandise. This demand is particularly robust given the prevailing economic conditions, which often see consumers seeking value and accessible financial products.

- Loyal Customer Base: The Easy Plus rewards program is a key driver of repeat business, contributing significantly to overall sales volume.

- Sustained Demand: Economic pressures continue to fuel consumer need for both quick cash access and budget-friendly goods.

- Resilient Market: The pawn and secondhand retail sectors demonstrate resilience, benefiting EZCORP's consistent revenue streams.

EZCORP's extensive physical footprint, with over 1,200 stores across the U.S. and Latin America, provides a significant competitive edge and broad customer access. This scale is further amplified by a strong financial performance in fiscal year 2025, evidenced by record revenues and a notable increase in Pawn Loans Outstanding (PLO), signaling robust customer activity and lending growth. The company's profitability metrics, including adjusted EBITDA and diluted EPS, also showed positive momentum, underscoring the effectiveness of its strategic execution.

| Metric | FY 2025 (Approx.) | FY 2024 (Approx.) |

|---|---|---|

| Revenue | $2.1 Billion | $1.9 Billion |

| Pawn Loans Outstanding (PLO) | $750 Million | $680 Million |

| Adjusted EBITDA | $350 Million | $310 Million |

What is included in the product

Delivers a strategic overview of EZCORP’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable framework to identify and address EZCORP's strategic challenges, transforming potential threats into manageable opportunities.

Weaknesses

The pawn industry, and by extension EZCORP, grapples with a persistent societal stigma. This negative perception, often associating pawn shops with desperation rather than a legitimate financial service, can deter potential customers and limit market penetration. For instance, surveys consistently show that while many individuals utilize pawn services, a significant portion express reservations about the industry's image.

This perception challenge directly impacts EZCORP's ability to attract a wider customer base and expand into markets where traditional banking or lending institutions are more readily accepted. In 2024, it remains a hurdle in onboarding younger demographics who may be more influenced by societal views. Addressing this requires a sustained focus on community engagement and transparent communication about the value proposition of pawn services.

While economic downturns can sometimes boost demand for pawn loans as consumers seek quick cash, they also expose EZCORP to significant vulnerabilities. A weakening economy can diminish the value of collateral customers pledge, potentially leading to higher losses for the company on unredeemed items. Furthermore, job losses and reduced disposable income in a downturn can strain customers' ability to repay their loans, increasing delinquency rates.

Fluctuations in broader economic conditions, such as rising inflation or shifts in consumer spending patterns, directly impact EZCORP's dual revenue streams. Inflation, for instance, could increase operating costs, while changes in consumer confidence and spending habits can affect both the volume of pawn transactions and the profitability of merchandise sales. For example, in the fiscal year ending September 30, 2023, EZCORP reported a net income of $124.5 million, a figure that could be sensitive to unexpected economic shocks in the coming periods.

EZCORP's merchandise gross margin can be a weak point, often seeing dips due to aggressive promotional efforts and customer bargaining. This means that even though selling merchandise brings in good revenue, the profit from these sales can easily be impacted by how the market is behaving and what competitors are doing.

Slower Inventory Turnover Rate

EZCORP's slower inventory turnover rate, noted as a weakness, indicates that products are sitting on shelves longer. For instance, in the fiscal year ending September 30, 2023, EZCORP reported an inventory turnover of 3.7 times, down from 4.2 times in the prior year. This slowdown ties up valuable capital, potentially straining liquidity and necessitating increased markdowns to move aging inventory.

This trend can lead to several challenges for EZCORP:

- Reduced Capital Efficiency: More cash is locked in unsold goods, limiting funds available for other investments or operational needs.

- Increased Holding Costs: Longer inventory periods mean higher expenses for storage, insurance, and potential obsolescence.

- Pressure on Profit Margins: To clear slow-moving stock, the company may need to resort to significant discounts, eroding profitability.

Regulatory and Compliance Burdens

EZCORP, as a consumer financial services provider, navigates a landscape of intricate and costly regulations. For instance, the Consumer Financial Protection Bureau (CFPB) continues to enforce stringent rules, and any shifts in consumer protection legislation or heightened oversight can directly translate into increased operational costs, potential fines, or limitations on how EZCORP conducts its business. This creates an ongoing challenge to maintain compliance.

The financial services sector, particularly for companies like EZCORP that serve a broad consumer base, faces significant regulatory scrutiny. In 2024, the industry continued to adapt to evolving compliance requirements, with a particular focus on data privacy and fair lending practices. These ongoing adjustments necessitate substantial investment in compliance infrastructure and personnel, impacting profitability and operational flexibility.

- Increased Compliance Costs: Regulatory changes often require system updates and staff training, adding to operational expenses.

- Risk of Fines and Penalties: Non-compliance can result in substantial financial penalties, impacting the bottom line.

- Operational Restrictions: New regulations may limit certain business practices or product offerings, affecting revenue streams.

- Reputational Damage: Compliance failures can harm customer trust and brand image, leading to long-term business consequences.

EZCORP's merchandise gross margin can be a weak point, often seeing dips due to aggressive promotional efforts and customer bargaining. This means that even though selling merchandise brings in good revenue, the profit from these sales can easily be impacted by how the market is behaving and what competitors are doing. EZCORP's slower inventory turnover rate, noted as a weakness, indicates that products are sitting on shelves longer. For instance, in the fiscal year ending September 30, 2023, EZCORP reported an inventory turnover of 3.7 times, down from 4.2 times in the prior year. This slowdown ties up valuable capital, potentially straining liquidity and necessitating increased markdowns to move aging inventory.

Preview Before You Purchase

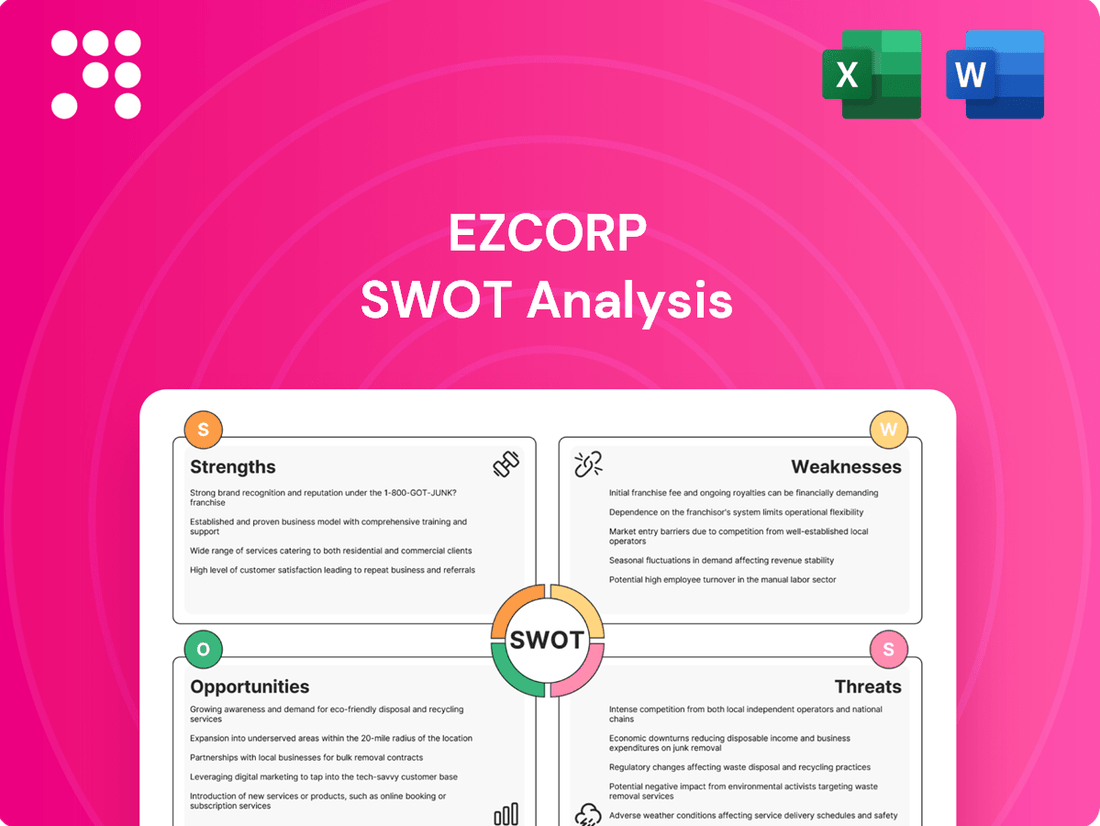

EZCORP SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It provides a comprehensive overview of EZCORP's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic planning.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain a deeper understanding of EZCORP's competitive landscape and internal capabilities.

Opportunities

EZCORP has a substantial opportunity for growth by opening new stores, especially in Latin America, a region showing strong performance. The company reported a 14% increase in revenue from its Latin American segment in the first quarter of fiscal year 2024, highlighting the potential for de novo expansion.

Strategic acquisitions also offer a clear path to expanding EZCORP's footprint and customer base. For instance, the acquisition of 20 stores in Mexico during fiscal year 2023 has already contributed to a 5% increase in the company's overall store count, demonstrating the effectiveness of this strategy in broadening market access.

EZCORP can capitalize on the shift to online pawn transactions, with digital platforms and mobile apps becoming increasingly popular. This trend, amplified by the adoption of technologies like AI, presents a significant opportunity for EZCORP to modernize its service offerings and enhance customer convenience. For instance, a growing number of consumers prefer digital interactions, and by embracing these channels, EZCORP can expand its customer base beyond its physical store footprint.

By investing in robust digital infrastructure, EZCORP can streamline internal processes, leading to improved operational efficiency and cost savings. The company can leverage data analytics and AI-powered tools to personalize customer experiences, optimize inventory management, and even improve fraud detection. This digital transformation is crucial for staying competitive in a rapidly evolving market where customer expectations for seamless online services are continually rising.

The pawn industry is seeing a significant shift towards high-value and luxury items, a trend EZCORP can leverage. By expanding its luxury pawn services, EZCORP can tap into a more affluent customer base, potentially securing higher-margin transactions. This strategic move could bolster overall profitability and broaden the company's market appeal.

Capitalizing on Demand for Short-Term Liquidity

Ongoing economic pressures, such as persistent inflation and constrained credit markets, are fueling a growing need for accessible, short-term credit solutions. This environment directly benefits companies like EZCORP, which specialize in providing these services.

EZCORP is strategically positioned to meet this demand, particularly among individuals and segments of the population underserved by traditional banking institutions. The company's ability to offer quick cash access without stringent credit checks presents a substantial market opportunity.

- Increased Demand: Economic headwinds in 2024 and projected into 2025 are likely to sustain or increase demand for short-term lending.

- Underserved Market: EZCORP's model caters to a demographic often excluded from conventional financial services, expanding its potential customer base.

- Regulatory Landscape: While regulations exist, the fundamental need for liquidity in challenging economic times creates a persistent demand for EZCORP's offerings.

Enhanced Capital Structure for Growth Initiatives

EZCORP's recent debt financing activities have bolstered its financial foundation, granting it considerable flexibility for future endeavors. This strengthened balance sheet and improved liquidity are crucial for funding its rapidly expanding earning assets.

The company's robust cash position is a direct enabler for pursuing strategic acquisitions and other inorganic growth opportunities, a key strategy for expansion in the current market. Furthermore, this financial strength allows for more effective management of upcoming debt maturities, ensuring operational continuity and supporting ambitious growth plans.

- Strengthened Balance Sheet: Recent financing has improved EZCORP's financial leverage and liquidity.

- Funding Growth: Enhanced capital allows for investment in fast-growing earning assets.

- Inorganic Growth: The company is positioned to pursue strategic acquisitions.

- Debt Management: Improved flexibility aids in managing upcoming debt obligations.

EZCORP can significantly expand its reach by opening new stores, particularly in Latin America, where its performance has been robust. The company saw a 14% revenue increase in its Latin American segment during Q1 FY2024, underscoring the potential for further de novo expansion.

Strategic acquisitions also present a clear avenue for growth, as demonstrated by the acquisition of 20 stores in Mexico in FY2023, which boosted the company's store count by 5%. Capitalizing on the digital shift, EZCORP can enhance customer convenience and expand its base through online platforms and mobile apps, leveraging AI for personalized experiences and operational efficiency.

Furthermore, the growing trend of pawning luxury items offers an opportunity to attract a more affluent customer base and secure higher-margin transactions. Persistent economic challenges, including inflation and tight credit markets, are increasing the demand for short-term credit solutions, a need EZCORP is well-positioned to meet, especially for those underserved by traditional banking.

EZCORP's strengthened balance sheet, bolstered by recent debt financing, provides substantial flexibility to fund its expanding earning assets and pursue strategic acquisitions, while also improving its capacity to manage upcoming debt maturities.

| Growth Opportunity | Key Driver | FY2024/2025 Data Insight |

|---|---|---|

| De Novo Store Expansion (Latin America) | Strong regional performance | 14% revenue increase in Latin America (Q1 FY2024) |

| Strategic Acquisitions | Market footprint expansion | Acquisition of 20 stores in Mexico (FY2023) increased store count by 5% |

| Digital Platform Adoption | Customer preference for online services | Growing consumer preference for digital interactions |

| Luxury Item Pawning | Shift in pawn industry trends | Potential for higher-margin transactions |

| Increased Demand for Short-Term Credit | Economic pressures (inflation, credit markets) | Sustained or increased demand for EZCORP's services |

| Financial Flexibility | Strengthened balance sheet | Improved liquidity for asset growth and acquisitions |

Threats

EZCORP faces the threat of increasing regulatory scrutiny, a common challenge in the consumer finance sector. For instance, in 2024, the Consumer Financial Protection Bureau (CFPB) continued its focus on fair lending practices and debt collection, potentially impacting how EZCORP structures its loans and interacts with customers.

Stricter regulations, such as those related to data privacy or interest rate caps, could significantly increase compliance costs for EZCORP. These added expenses might reduce profitability, especially if they limit the company's ability to offer certain high-margin services or require substantial investments in new compliance infrastructure.

New consumer protection laws enacted in 2024 or anticipated for 2025 could directly affect EZCORP's operational flexibility and revenue streams. For example, a hypothetical new state law limiting payday loan rollovers could constrain EZCORP's core business model in that jurisdiction, forcing operational adjustments and potentially impacting its market share.

EZCORP is facing increasing pressure from fintech companies that provide quick, digital, and often unsecured loan options, attracting customers who prefer online interactions. For instance, the digital lending market saw significant growth, with some reports indicating it could reach over $3.7 trillion globally by 2030, showcasing the scale of this threat.

Furthermore, traditional financial institutions are not standing still; many are enhancing their digital offerings or re-entering segments of the short-term lending market. This dual threat from both nimble fintechs and established banks with significant resources could lead to a dilution of EZCORP's customer base and market share in the coming years.

Persistent inflation, a concern throughout 2024 and projected into 2025, could erode consumer purchasing power, making it harder for EZCORP's customer base to repay pawn loans. While some economic strain can boost pawn shop usage, a severe downturn with high unemployment, like the potential for a 2025 recession, directly impacts collateral value and repayment capacity.

Rising operational expenses, including labor costs which saw an average increase of 4.5% in the retail sector in 2024, directly threaten EZCORP's profit margins, especially if these costs cannot be passed on to consumers or offset by increased loan volume.

Reputational Risk and Negative Public Perception

EZCORP, like other companies in the pawn industry, faces ongoing reputational challenges stemming from historical perceptions. These can make it harder to attract new customers and may lead to negative media scrutiny. For instance, a 2023 study by the Consumer Financial Protection Bureau (CFPB) highlighted consumer concerns about transparency and fees in the short-term lending sector, which includes pawn services.

Incidents of fraud or unethical behavior, even if not directly linked to EZCORP, can erode overall consumer trust in pawn services. This broad impact can significantly affect demand for EZCORP's offerings. A 2024 report from the Better Business Bureau (BBB) indicated that while many pawn shops operate ethically, a small percentage of complaints related to deceptive practices can cast a shadow over the entire industry.

- Historical Stigma: The pawn industry often battles negative stereotypes, impacting public perception.

- Media Scrutiny: Negative news or exposés can amplify these reputational risks.

- Industry-Wide Incidents: Unethical practices by any player can damage trust across the sector.

- Consumer Trust Erosion: Broadly, negative perceptions can deter potential customers from utilizing pawn services.

Foreign Currency Fluctuations in Latin American Operations

EZCORP's significant presence in Latin America exposes it to considerable risk from fluctuating foreign currency exchange rates. For instance, if the Mexican Peso or Brazilian Real weakens against the US Dollar, the reported value of earnings generated in those countries decreases when translated back into US Dollars, impacting overall financial performance. This currency volatility adds a layer of unpredictability to EZCORP's revenue and profit streams from these key markets.

For example, in the fiscal year ending September 30, 2023, EZCORP reported that a 10% adverse movement in exchange rates could have impacted its net income by approximately $2.5 million. This highlights the tangible financial impact of currency fluctuations on the company's bottom line, particularly given that Latin America represented over 60% of its total revenue in late 2023.

- Currency Risk Exposure: EZCORP's operations in Mexico and Colombia, which accounted for a substantial portion of its 2024 revenue, are directly vulnerable to currency depreciation.

- Impact on Profitability: A strengthening US Dollar relative to the Mexican Peso or Colombian Peso can significantly reduce the US Dollar equivalent of profits earned in those regions.

- Financial Reporting Volatility: Exchange rate changes introduce variability into EZCORP's reported financial results, making year-over-year comparisons more complex for investors.

- Hedging Challenges: While EZCORP may employ hedging strategies, the effectiveness and cost of these can vary, leaving some exposure to adverse currency movements.

EZCORP faces significant threats from evolving regulatory landscapes and increasing competition. Stricter consumer protection laws, potentially enacted in 2024 or 2025, could limit its core services and increase compliance costs, impacting profitability. The rise of fintech lenders offering digital-first solutions presents a direct challenge, as does the potential for traditional banks to expand their short-term lending offerings.

Economic instability, including persistent inflation and the possibility of a 2025 recession, poses a threat by reducing customer repayment capacity and potentially devaluing collateral. Rising operational expenses, such as labor costs which saw an average increase of 4.5% in the retail sector in 2024, further squeeze profit margins. Additionally, EZCORP's substantial operations in Latin America leave it vulnerable to foreign currency exchange rate fluctuations, which can impact reported earnings.

| Threat Category | Specific Threat | Potential Impact | 2024/2025 Data/Context |

|---|---|---|---|

| Regulatory Environment | Increased Regulatory Scrutiny | Higher compliance costs, operational restrictions | CFPB focus on fair lending and debt collection in 2024. |

| Competition | Fintech and Traditional Bank Expansion | Customer base dilution, market share erosion | Digital lending market growth, traditional banks enhancing digital offerings. |

| Economic Conditions | Inflation and Recession Risk | Reduced repayment capacity, collateral value decline | Inflation concerns in 2024, recession projections for 2025. |

| Operational Costs | Rising Labor and Operating Expenses | Reduced profit margins | Retail labor cost increases averaging 4.5% in 2024. |

| Financial Risks | Foreign Currency Exchange Rate Volatility | Reduced US Dollar equivalent of foreign earnings | Latin America >60% of revenue (late 2023); 10% adverse rate movement impacted net income by ~$2.5M (FY23). |

SWOT Analysis Data Sources

This EZCORP SWOT analysis is built upon a robust foundation of data, including the company's official financial filings, comprehensive market research reports, and insights from industry experts. These diverse sources ensure a well-rounded and accurate assessment of EZCORP's strategic position.