Etteplan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Etteplan Bundle

Unlock the critical external factors shaping Etteplan's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that create both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your own strategic planning and investment decisions. Download the full analysis now to gain a significant competitive advantage.

Political factors

Government policies significantly shape the demand for engineering services, with initiatives like R&D subsidies and infrastructure spending directly impacting Etteplan's project pipeline. For instance, the Finnish government's commitment to bolstering its industrial sector through targeted funding, such as the EUR 100 million allocated to sustainable industry investments in 2024, creates a fertile ground for engineering consultancies.

Etteplan's growth is intrinsically linked to governmental support for manufacturing, digitalization, and technological advancement. Countries actively investing in these areas, like Sweden with its focus on green transition technologies, provide a stable and expanding market for Etteplan's expertise.

Changes in international trade agreements, like the potential for new tariffs or trade barriers, could significantly impact Etteplan's global operations and its clients' supply chains. For instance, increased tariffs on components used in product design or manufacturing could raise material costs for Etteplan's clients, potentially altering project scopes and budgets. As of early 2024, ongoing discussions around trade relations between major economic blocs continue to create an evolving landscape for international commerce.

Global geopolitical stability significantly influences international business, directly impacting supply chain reliability. Etteplan, with its global footprint, faces risks from instability in key regions, potentially disrupting client projects and necessitating strategic realignments. For instance, the ongoing conflicts in Eastern Europe and the Middle East in 2024 have already demonstrated the potential for significant disruptions to global trade and manufacturing, areas where Etteplan provides engineering services.

Regulatory Environment for Industry

The regulatory landscape significantly shapes Etteplan's operations. Industrial standards, safety mandates, and compliance obligations directly influence the firm's design and engineering methodologies. For instance, the European Union's Machinery Directive sets stringent safety requirements for equipment, necessitating thorough risk assessments and documentation in Etteplan's project execution.

Increasingly rigorous regulations can elevate project complexity, thereby potentially boosting the demand for Etteplan's specialized compliance engineering services. In 2024, the emphasis on cybersecurity within industrial automation, driven by regulations like the NIS2 Directive, is a prime example of this trend, requiring advanced security-by-design principles.

- Industrial Standards: Adherence to ISO 9001 for quality management and sector-specific standards like those for medical devices (e.g., ISO 13485) is critical.

- Safety Regulations: Compliance with directives such as the Machinery Directive (2006/42/EC) and ATEX directives for explosive atmospheres impacts product design.

- Environmental Compliance: Regulations like RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) affect material selection and product lifecycle management.

Public Procurement Policies

Government procurement policies, particularly in technology, defense, and public infrastructure, represent a substantial revenue stream for engineering service providers like Etteplan. The company's capacity to adapt to and meet the stringent requirements and established frameworks of the public sector is crucial for unlocking these significant market opportunities.

In 2023, the European Union's public procurement market was valued at approximately €2.8 trillion, with a considerable portion allocated to technology and infrastructure services. Etteplan's strategic focus on areas such as smart city development and advanced manufacturing technologies positions it well to capitalize on these government investments. For instance, Finland, Etteplan's home market, has seen increased government spending on digital infrastructure upgrades and sustainable energy projects throughout 2024, directly benefiting engineering firms with relevant expertise.

- Opportunity in Public Spending: Governments globally are channeling significant funds into technology modernization and infrastructure development, creating a robust demand for specialized engineering services.

- Alignment with Public Sector Needs: Etteplan's ability to meet rigorous compliance, security, and sustainability standards required by public tenders is key to securing contracts.

- Growth in Sustainable Infrastructure: With a growing emphasis on green initiatives, public procurement policies are increasingly favoring projects that incorporate sustainable design and energy efficiency, areas where Etteplan has strong capabilities.

- Defense Sector Modernization: Investments in defense technology and upgrades in countries like Sweden and Finland are creating opportunities for engineering firms involved in complex systems integration and advanced material applications.

Government policies, including R&D incentives and infrastructure spending, directly influence Etteplan's project pipeline. For example, Finland's 2024 allocation of EUR 100 million for sustainable industry investments supports engineering consultancies.

International trade agreements and geopolitical stability are crucial for Etteplan's global operations. Disruptions from conflicts in Eastern Europe and the Middle East in 2024 highlight the impact on supply chains and manufacturing.

Regulatory frameworks, such as the EU's Machinery Directive and NIS2 Directive for cybersecurity, shape engineering methodologies and increase demand for compliance services.

Government procurement, particularly in technology and infrastructure, offers significant revenue. In 2023, the EU's public procurement market was valued at approximately €2.8 trillion, with substantial investment in technology and infrastructure services.

| Government Support Area | Example Initiative (2024) | Impact on Etteplan |

| Sustainable Industry | Finland: EUR 100M for sustainable industry | Increased demand for green engineering solutions |

| Digitalization | EU Digital Decade targets | Opportunities in smart city and IoT projects |

| Infrastructure | National infrastructure plans (e.g., Sweden) | Growth in engineering for public works and transport |

What is included in the product

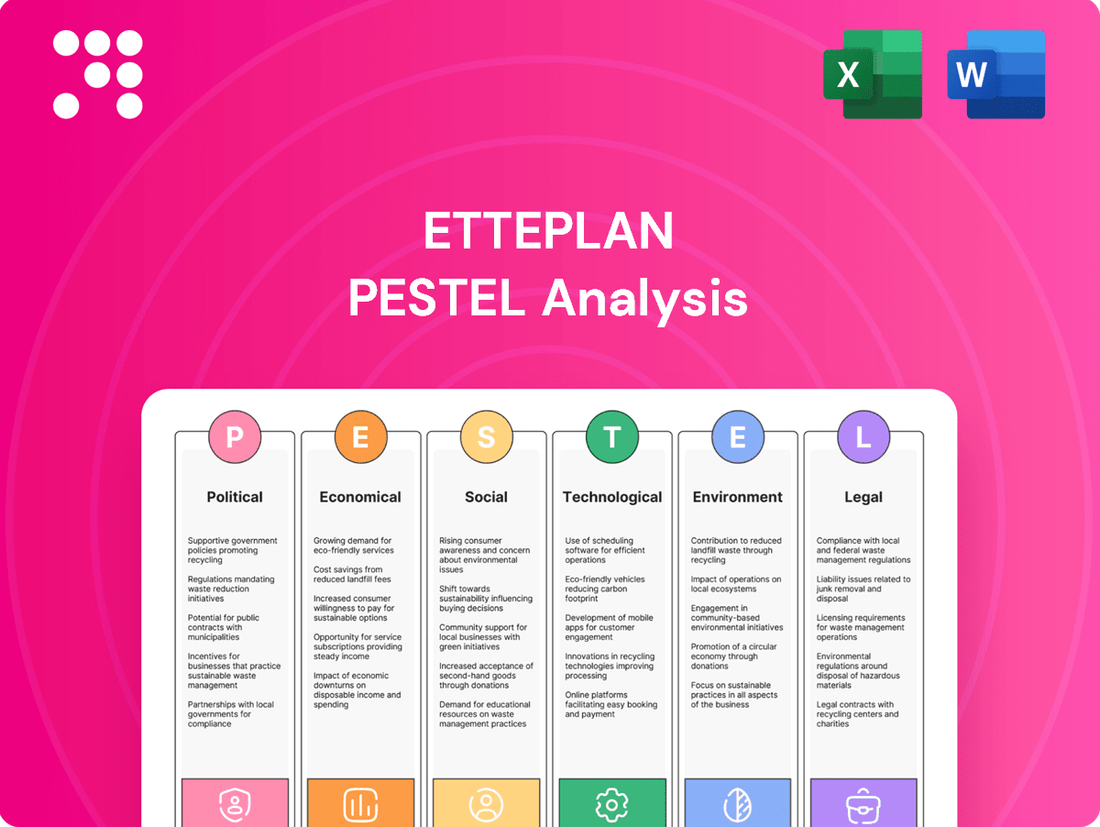

The Etteplan PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, providing a comprehensive understanding of its external operating landscape.

The Etteplan PESTLE Analysis provides a structured framework, alleviating the pain of navigating complex external factors by offering clear insights into political, economic, social, technological, environmental, and legal influences.

Economic factors

Etteplan's performance is intrinsically linked to the global economic climate and the pace of industrial output. A strong global economy, characterized by increased consumer spending and business investment, directly fuels demand for Etteplan's engineering and design services, particularly within the manufacturing and technology sectors. For instance, in 2024, projections from the IMF suggested global growth around 3.2%, a figure that, if realized, would support increased R&D spending by Etteplan's clients.

When industrial production is on an upward trend, businesses are more likely to invest in new product development, process optimization, and technological upgrades, all areas where Etteplan excels. This heightened activity translates into greater project pipelines for the company. As of early 2025, many industrial sectors were showing signs of recovery, with manufacturing output indices in key regions like the Eurozone and North America indicating modest expansion, providing a positive backdrop for Etteplan's service offerings.

High inflation in 2024 and early 2025 directly impacts Etteplan by increasing operational expenses, such as employee compensation and the cost of essential software and tools. For instance, if general inflation hovers around 3-4% in key European markets where Etteplan operates, salary adjustments and license renewals will naturally become more costly, potentially squeezing profit margins.

Concurrently, central banks' responses to inflation, often involving interest rate hikes, present another challenge. Rising interest rates, potentially reaching 4-5% or higher in some regions by mid-2025, can deter clients from initiating or expanding projects that require financing. This could lead to a slowdown in demand for Etteplan's engineering and digital solutions as clients become more cautious with their capital expenditures.

Companies are increasingly recognizing R&D as a crucial driver of growth and competitiveness. In 2023, global R&D spending by the top 2,500 companies reached an estimated $1.1 trillion, a significant increase from previous years, indicating a strong demand for innovation across sectors. This trend directly benefits Etteplan, as industries investing heavily in new product development and technological advancements will require specialized design, software engineering, and technical documentation services to bring their innovations to market.

The technology and healthcare sectors, in particular, are leading the charge in R&D investment. For instance, the semiconductor industry saw R&D expenditure rise by approximately 15% in 2023, reflecting the demand for advanced chip designs and software. Similarly, pharmaceutical companies are channeling more resources into drug discovery and development, creating opportunities for Etteplan’s expertise in complex technical documentation and regulatory compliance.

Looking ahead to 2024 and 2025, projections suggest a continued upward trajectory for R&D investments, with an anticipated global growth rate of 6-8% annually. This sustained focus on innovation will likely translate into increased demand for Etteplan's specialized services, particularly in areas like AI integration, advanced manufacturing technologies, and digital transformation initiatives. Companies will need expert support to navigate the complexities of these evolving technological landscapes.

Currency Exchange Rate Fluctuations

Etteplan, operating internationally, is exposed to currency exchange rate fluctuations, primarily impacting its financial results when converting earnings from currencies other than the Euro. For instance, a strengthening Euro against currencies where Etteplan has significant revenue streams could reduce the reported Euro value of those earnings. Conversely, a weaker Euro could boost reported results.

These movements directly affect the value of international contracts and the operational costs incurred in various regions where Etteplan operates. For example, if Etteplan has substantial costs in a country whose currency weakens against the Euro, those costs become cheaper when translated back into Euros, potentially improving profit margins. The opposite is true if the local currency strengthens.

Looking at recent trends, the Euro experienced volatility throughout 2024. For example, the EUR/USD exchange rate saw periods of both appreciation and depreciation. As of late 2024, the Euro has shown some resilience against the US Dollar, but forecasts for 2025 suggest continued uncertainty. Etteplan's financial statements for periods ending in 2024 and projections for 2025 will likely reflect these currency impacts.

- Impact on Revenue: A stronger Euro can decrease the Euro equivalent of revenues earned in USD, GBP, or SEK.

- Impact on Costs: A weaker Euro can increase the Euro cost of operations in countries with strong local currencies.

- Contract Revaluation: Fluctuations can alter the Euro value of fixed-price contracts denominated in foreign currencies.

- Hedging Strategies: Etteplan may employ financial instruments to mitigate the risks associated with significant currency swings.

Availability of Capital and Funding for Clients

The ease with which Etteplan's clients can secure funding directly impacts their willingness to invest in new projects and digital advancements. A robust capital market environment, characterized by accessible credit and investment opportunities, encourages businesses to expand and innovate. For instance, in early 2024, the European Central Bank maintained its key interest rates, contributing to a relatively stable, albeit cautious, lending environment for many European businesses, which would benefit Etteplan's client base.

A favorable funding landscape directly translates into increased demand for Etteplan's services. When clients have access to capital, they are more likely to initiate new product development, upgrade existing processes, and undertake digital transformation projects. This, in turn, drives the need for specialized engineering, design, and technical documentation expertise that Etteplan provides. The global market for engineering and R&D outsourcing was projected to grow by approximately 7-9% in 2024, indicating a positive trend for service providers like Etteplan.

- Increased Investment Appetite: Clients with readily available capital are more inclined to fund R&D, new product launches, and technology upgrades.

- Outsourcing Trends: A supportive funding environment often correlates with higher outsourcing budgets as companies focus on core competencies.

- Digital Transformation Push: Access to capital enables clients to invest in digitalization initiatives, creating opportunities for Etteplan's digital solutions.

- Economic Confidence Indicator: The availability of capital serves as a barometer for client confidence and their long-term strategic planning.

Economic growth directly fuels demand for Etteplan's engineering and design services. In 2024, the IMF projected global growth of around 3.2%, a figure that supports increased R&D spending by Etteplan's clients. When industrial production rises, businesses invest more in new products and process improvements, creating more projects for Etteplan. Early 2025 saw modest manufacturing expansion in key regions, benefiting Etteplan.

Inflation in 2024 and early 2025 increased Etteplan's operational costs, such as salaries and software licenses. For example, inflation around 3-4% in Europe makes compensation and renewals more expensive, potentially affecting profit margins. Higher interest rates, possibly reaching 4-5% in some regions by mid-2025, could also deter clients from financing new projects, leading to slower demand for Etteplan's services.

Companies are increasingly prioritizing R&D, with global spending by major firms reaching an estimated $1.1 trillion in 2023. This trend benefits Etteplan, as industries investing in innovation require specialized design and technical services. Technology and healthcare sectors, in particular, are leading R&D investments, with the semiconductor industry's R&D expenditure rising by approximately 15% in 2023.

Etteplan's international operations expose it to currency fluctuations. For instance, a stronger Euro can reduce the reported value of earnings from other currencies. Conversely, a weaker Euro can increase operational costs in countries with stronger local currencies. The Euro experienced volatility in 2024, with continued uncertainty forecast for 2025, impacting Etteplan's financial results.

Same Document Delivered

Etteplan PESTLE Analysis

The Etteplan PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, offering a comprehensive overview of Etteplan's operating environment.

Sociological factors

The availability of skilled engineers and software developers in key regions like Finland and Sweden directly influences Etteplan's project execution. For instance, a report from Statistics Finland in late 2023 indicated a persistent shortage of IT specialists, a trend likely to continue into 2024 and 2025, potentially increasing recruitment costs and impacting delivery timelines for Etteplan.

A highly competitive labor market, as seen in the tech sector globally, can drive up salary expectations for specialized roles. This necessitates robust talent development and retention programs for Etteplan to maintain its project delivery capabilities and manage operational expenses effectively through 2025.

Workforce demographics are shifting, with many developed nations experiencing an aging population. This trend, coupled with a growing desire for work-life balance, is fueling a significant increase in remote and hybrid work arrangements. For Etteplan, this means adapting recruitment to attract younger talent and retaining experienced professionals by offering flexible working options, which can boost satisfaction and broaden the candidate pool.

Clients increasingly expect industrial products to be as user-friendly as consumer electronics. This means Etteplan needs to provide engineering and documentation services that focus on intuitive interfaces and a smooth user journey. For instance, a 2024 report indicated that 75% of B2B buyers consider user experience a key factor when selecting industrial equipment, directly impacting the demand for user-centric design.

Meeting this demand requires Etteplan to adapt its service portfolio. The company must ensure its documentation is not only accurate but also easily accessible and understandable for end-users, a trend highlighted by a recent survey showing that 60% of industrial users prefer digital, interactive manuals over traditional paper ones. This shift necessitates investment in digital documentation platforms and user experience design expertise.

Societal Focus on Sustainability and ESG

Growing public awareness about environmental, social, and governance (ESG) issues is significantly shaping product design and manufacturing. Consumers and investors alike are increasingly demanding that companies prioritize sustainability, pushing for greener materials and ethical production processes.

Etteplan is well-positioned to assist clients in achieving their sustainability objectives. Through specialized services like eco-design, comprehensive lifecycle assessments, and meticulous documentation of environmental performance, Etteplan helps businesses navigate the complexities of sustainable development and demonstrate their commitment to ESG principles. For instance, a 2024 report indicated that 70% of consumers are more likely to purchase from brands with strong sustainability practices.

- Growing Consumer Demand: 65% of global consumers state they are willing to pay more for sustainable products, a trend expected to continue through 2025.

- Investor Scrutiny: ESG investments globally are projected to reach $50 trillion by 2025, highlighting the financial imperative for companies to adopt sustainable practices.

- Regulatory Tailwinds: Evolving environmental regulations, such as extended producer responsibility schemes, necessitate robust product lifecycle management, a core Etteplan offering.

- Brand Reputation: Companies with strong ESG performance often experience enhanced brand loyalty and a better ability to attract and retain talent.

Education System and STEM Emphasis

The quality and focus of education systems, especially in STEM, directly impact Etteplan's future talent pool. A robust pipeline of skilled engineers and digital professionals is essential for the company's innovation and growth. For instance, Finland, a key market for Etteplan, saw approximately 20% of university degrees awarded in 2023 being in technology and natural sciences, indicating a strong foundational supply.

A significant emphasis on practical engineering and digital competencies within educational curricula ensures that graduates are well-prepared for the demands of the tech industry. This focus cultivates professionals adept at driving advancements in areas like software development and industrial digitalization, which are core to Etteplan's service offerings.

- Finland's universities awarded over 18,000 degrees in technology and natural sciences in 2023.

- The European Union is aiming to increase the number of ICT specialists to 9 million by 2030, highlighting a growing demand for digital skills.

- Etteplan actively collaborates with educational institutions to shape curriculum and offer internships, ensuring alignment with industry needs.

Societal attitudes towards technology and automation influence the adoption rate of new engineering solutions. As automation becomes more accepted, demand for Etteplan's expertise in areas like robotics and smart manufacturing is likely to increase. For example, a 2024 survey found that 70% of industrial workers in Europe are open to working alongside automated systems, signaling a positive societal shift.

The increasing emphasis on user experience across all product categories means clients expect intuitive and accessible designs. This societal expectation directly impacts Etteplan's need to integrate user-centric design principles into its engineering and documentation services, as evidenced by a 2024 report showing 75% of B2B buyers prioritize user experience.

The growing public demand for sustainable products and ethical business practices is a significant societal factor. Etteplan's ability to offer eco-design and lifecycle assessment services aligns with this trend, with 65% of global consumers willing to pay more for sustainable goods, a figure expected to hold through 2025.

| Societal Trend | Impact on Etteplan | Supporting Data (2023-2025 Projections) |

|---|---|---|

| Acceptance of Automation | Increased demand for automation and robotics engineering services. | 70% of European industrial workers are open to working with automated systems (2024 survey). |

| User Experience Focus | Need for user-centric design in engineering and documentation. | 75% of B2B buyers consider user experience a key factor in equipment selection (2024 report). |

| Sustainability Demand | Growth in demand for eco-design and lifecycle assessment services. | 65% of global consumers willing to pay more for sustainable products (expected through 2025). |

Technological factors

The rapid evolution of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping the engineering landscape, presenting significant opportunities for companies like Etteplan. These technologies are increasingly being integrated into the core of engineering processes, from initial design conceptualization to ongoing operational management.

By harnessing AI and ML, Etteplan can unlock new levels of efficiency and precision in its service offerings. For instance, AI-powered design tools can accelerate product development cycles, while ML algorithms can optimize manufacturing processes, leading to reduced waste and improved output quality. This technological advancement directly translates into more innovative and value-driven solutions for Etteplan’s clientele.

The practical applications are already demonstrating tangible benefits. In 2024, reports indicated that companies adopting AI in their engineering workflows saw an average improvement of 15% in design iteration speed and a 10% reduction in operational costs through predictive maintenance. Etteplan's ability to leverage these advancements positions it to deliver superior outcomes and maintain a competitive edge in the market.

The increasing adoption of Industrial Internet of Things (IIoT) and digitalization across manufacturing is a significant tailwind for Etteplan. Companies are investing heavily in smart technologies to enhance efficiency and product innovation. For instance, the global IIoT market was valued at approximately $214 billion in 2023 and is projected to reach over $1 trillion by 2030, indicating substantial growth opportunities for Etteplan's software and engineering services.

As industrial systems increasingly rely on interconnectedness, cybersecurity for embedded solutions and data management has become paramount. The growing sophistication of cyber threats, including ransomware and data breaches, directly impacts operational integrity and client intellectual property. For instance, the global cybersecurity market was valued at approximately $217.9 billion in 2023 and is projected to reach $371.8 billion by 2028, highlighting the escalating investment in this area.

Etteplan must therefore embed advanced security measures within its software and engineering processes. This includes implementing robust data encryption, secure coding practices, and regular vulnerability assessments to safeguard client assets. Failure to do so could lead to significant financial and reputational damage, as seen in the average cost of a data breach, which reached $4.45 million globally in 2023 according to IBM's report.

Emergence of Digital Twin and Simulation Technologies

The growing adoption of digital twin and simulation technologies offers significant advantages for product development and lifecycle management. Etteplan is well-positioned to capitalize on this trend by utilizing its design and software capabilities to build and maintain these virtual representations.

This approach allows for the optimization of product performance and a reduction in the need for costly physical prototypes. For instance, the global digital twin market was valued at approximately $6.2 billion in 2023 and is projected to reach $65.8 billion by 2030, demonstrating a compound annual growth rate of over 40%.

- Enhanced Product Optimization: Digital twins enable real-time monitoring and analysis, leading to continuous improvement in product functionality and efficiency.

- Reduced Development Costs: Simulations minimize the requirement for physical testing, saving substantial resources in the product development cycle.

- Accelerated Time-to-Market: Virtual testing and validation speed up the overall product development process.

- Lifecycle Management: Digital twins provide valuable insights for predictive maintenance and performance tracking throughout a product's lifespan.

Automation and Robotics in Manufacturing

The manufacturing sector's increasing embrace of automation and robotics is a significant technological driver. This trend directly fuels demand for sophisticated engineering services, particularly in areas like system integration, advanced control software development, and precise robotic programming. Etteplan is well-positioned to capitalize on this by offering its expertise to clients looking to implement and fine-tune automated production lines.

The global industrial robotics market is projected to grow substantially. For instance, it was valued at approximately USD 50 billion in 2023 and is expected to reach over USD 100 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 10-12%. This expansion highlights a clear opportunity for engineering firms like Etteplan.

- Increased demand for automation: Manufacturers are investing heavily in robotics to boost efficiency, quality, and safety.

- Etteplan's role: The company can provide crucial services in designing, implementing, and maintaining these automated systems.

- Growth projections: The industrial automation market is experiencing robust growth, indicating sustained demand for related engineering expertise.

The integration of advanced technologies like AI, IIoT, and digital twins presents a significant growth avenue for Etteplan. These innovations are driving efficiency and new product development across industries. For example, AI in engineering design can reduce iteration times by up to 15%, as seen in 2024 industry reports.

The increasing reliance on interconnected systems also elevates the importance of cybersecurity. With the global cybersecurity market projected to reach $371.8 billion by 2028, Etteplan's expertise in securing embedded solutions is crucial. The average cost of a data breach in 2023 was $4.45 million, underscoring the financial imperative for robust security.

Furthermore, the digital twin market's rapid expansion, forecasted to reach $65.8 billion by 2030, offers substantial opportunities for Etteplan to provide virtual product development and lifecycle management services.

Automation and robotics are also key technological drivers, with the industrial robotics market expected to exceed $100 billion by 2030. Etteplan's role in system integration and advanced control software is vital for manufacturers adopting these technologies.

| Technology Area | 2023 Market Value (Approx.) | Projected Growth Driver | Etteplan Opportunity |

|---|---|---|---|

| AI in Engineering | N/A (integrated) | 15% faster design iterations (2024) | Enhanced design and optimization services |

| IIoT | $214 billion | Growth to >$1 trillion by 2030 | Smart factory solutions, data analytics |

| Cybersecurity | $217.9 billion | Projected to reach $371.8 billion by 2028 | Secure embedded systems and data management |

| Digital Twins | $6.2 billion | Projected to reach $65.8 billion by 2030 | Virtual prototyping and lifecycle management |

| Industrial Robotics | ~$50 billion | Growth to >$100 billion by 2030 | Automation system integration and programming |

Legal factors

Etteplan's reliance on client designs, software, and proprietary information makes strong intellectual property rights (IPR) protection absolutely vital. This ensures that the innovations Etteplan develops or handles for its clients are shielded from unauthorized use or copying, which is a core part of their service offering. In 2024, the global IP market continued to grow, with patent filings in technology sectors relevant to Etteplan's engineering services showing steady increases, underscoring the importance of robust legal frameworks.

Strict data privacy regulations, like the GDPR in Europe and its equivalents worldwide, significantly shape how Etteplan manages sensitive client data, proprietary project information, and employee personal details. Failure to adhere to these stringent rules can lead to substantial financial penalties and damage to client relationships, making compliance a critical operational imperative.

Etteplan's operations are significantly shaped by industry-specific regulations and standards. For instance, in the automotive sector, compliance with ISO 26262 for functional safety is paramount, while aerospace demands adherence to standards like AS9100. The medical device industry, a key area for Etteplan, is governed by stringent regulations such as the EU Medical Device Regulation (MDR) and FDA guidelines in the US, requiring meticulous documentation and validation processes.

Staying abreast of these evolving legal landscapes is not merely a matter of compliance but a strategic imperative. For example, changes in data privacy laws, like GDPR, impact how Etteplan handles client information and intellectual property. The company's ability to navigate and integrate these complex regulatory requirements ensures the delivery of legally sound and market-ready engineering solutions, directly influencing project feasibility and client trust.

Labor Laws and Employment Regulations

Etteplan must navigate a complex web of labor laws across its operating regions, impacting everything from standard working hours and mandated employee benefits to the rights and processes surrounding unionization. For instance, in Finland, a key market, the Working Hours Act sets limits on daily and weekly work, while collective bargaining agreements often dictate additional benefits and working conditions.

Staying compliant with these diverse employment regulations is not just a legal necessity but a core component of effective workforce management and crucial for minimizing potential legal liabilities stemming from employment practices. Failure to adhere to these laws can result in significant fines and reputational damage.

Key areas of focus for Etteplan's legal compliance include:

- Working Hours: Adherence to statutory limits on daily and weekly work, overtime regulations, and rest periods as defined by local legislation.

- Employee Benefits: Ensuring provision of legally mandated benefits such as paid leave, sick pay, and pension contributions, which vary significantly by country.

- Unionization and Collective Bargaining: Understanding and respecting employee rights to organize and engage in collective bargaining, and complying with the terms of any applicable collective agreements.

- Termination and Redundancy: Following strict procedures and providing required notice periods and severance pay during employee dismissals or layoffs.

Contract Law and Liability in Services

Contract law is paramount for Etteplan, dictating the terms of service delivery and client relationships. These agreements outline scope, deliverables, payment, and intellectual property rights, directly impacting Etteplan's operational framework and revenue streams. In 2024, the global services market, including engineering and IT, continued to see robust growth, underscoring the importance of well-defined contracts to capture this value.

Professional liability, often addressed through specific clauses in service contracts and professional indemnity insurance, is a key legal consideration for Etteplan. This covers potential errors or omissions in engineering designs or software code that could lead to client losses. For instance, in the construction sector, a single design flaw can result in significant financial repercussions, making robust liability management essential.

Etteplan must navigate various legal jurisdictions, each with its own nuances in contract enforcement and liability standards. Compliance with data protection regulations, such as GDPR, also adds a layer of legal complexity when handling client information within software solutions. The increasing interconnectedness of global projects means a thorough understanding of international contract law is vital.

- Service Contract Clarity: Ensuring all contracts clearly define project scope, deliverables, timelines, and payment terms is crucial to prevent disputes.

- Professional Indemnity Insurance: Maintaining adequate insurance coverage protects Etteplan against claims arising from professional negligence in its engineering and software services.

- Jurisdictional Compliance: Adhering to the specific legal requirements of each country where Etteplan operates is vital for smooth business operations.

- Data Protection Adherence: Strict compliance with data privacy laws like GDPR is necessary when managing sensitive client data in software projects.

Etteplan's operations are heavily influenced by intellectual property rights (IPR) laws, necessitating robust protection for client designs and its own innovations. In 2024, global patent filings in technology sectors relevant to engineering services saw continued growth, highlighting the critical need for strong legal frameworks to safeguard intellectual assets and maintain competitive advantage.

Data privacy regulations, such as GDPR, are central to Etteplan's handling of sensitive client and project information. Non-compliance carries significant financial penalties and reputational risks, making adherence a key operational focus. Etteplan's commitment to data protection is further reinforced by ongoing global efforts to strengthen privacy laws, impacting how client data is managed across its international operations.

Industry-specific regulations, like ISO 26262 for automotive functional safety and AS9100 for aerospace, are integral to Etteplan's service delivery. The medical device sector, a significant area for Etteplan, is governed by stringent rules like the EU MDR and FDA guidelines, demanding meticulous documentation and validation to ensure product safety and market access.

Contract law governs Etteplan's client relationships and service agreements, defining deliverables, payment, and IP ownership. The global services market, including engineering, experienced strong growth in 2024, emphasizing the importance of clear contractual terms for value capture and dispute avoidance. Professional liability, managed through contracts and insurance, is also crucial, particularly in sectors where design errors can have severe financial consequences.

Environmental factors

Governments worldwide are increasingly implementing regulations to foster a circular economy, focusing on extended producer responsibility and enhanced product recyclability. These mandates directly impact how products are conceived and manufactured, pushing for greater sustainability throughout their lifespan.

Etteplan's expertise in product engineering and lifecycle management is crucial here. They assist clients in developing designs that prioritize ease of disassembly, component reuse, and efficient recycling processes, thereby ensuring compliance with evolving environmental legislation and market expectations.

For instance, the European Union's Ecodesign for Sustainable Products Regulation, expected to be fully implemented by 2025, will set stringent requirements for product durability, repairability, and recyclability across numerous sectors, impacting millions of products sold within the bloc.

Consumers and industries are increasingly prioritizing products with a reduced environmental footprint, fueling a significant demand for sustainable design. This trend is not just a niche concern; reports in early 2024 indicated that over 70% of consumers consider sustainability when making purchasing decisions.

Etteplan is well-positioned to capitalize on this by offering specialized expertise in eco-design principles, advising on the selection of environmentally sound materials, and optimizing products for greater energy efficiency. Their capabilities directly address the growing need for solutions that minimize ecological impact throughout a product's lifecycle.

Clients are increasingly demanding that their entire supply chains be sustainable, scrutinizing the environmental footprint of every component and manufacturing step. This pressure is a significant driver for change in how businesses operate and source materials.

Etteplan is well-positioned to help companies meet these evolving demands. By optimizing product designs, Etteplan can facilitate more sustainable sourcing of materials and implement manufacturing processes that minimize waste, directly addressing client sustainability requirements.

For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), which came into full effect in 2024, mandates detailed reporting on supply chain impacts, pushing companies to actively manage environmental factors. Companies are seeing supply chain sustainability as a competitive advantage, with a 2024 Deloitte survey indicating that 73% of executives believe sustainability initiatives improve their company's financial performance.

Energy Efficiency Standards and Green Technologies

Stricter energy efficiency standards, like those being implemented across the EU and North America for industrial machinery and consumer electronics, present a significant avenue for Etteplan. These evolving regulations necessitate the development of more energy-conscious designs, directly aligning with Etteplan's expertise in engineering and technology solutions. For instance, the EU's Ecodesign directive continues to set ambitious targets for energy-related products, pushing manufacturers to innovate.

By focusing on energy efficiency, Etteplan can offer clients tangible benefits, including lower operational expenditures and a reduced carbon footprint. This proactive approach not only helps clients meet increasingly stringent environmental regulations but also enhances their brand reputation in a market that values sustainability. The global push towards net-zero emissions is a key driver here, with many countries setting aggressive timelines.

Here are some key aspects:

- Increased Demand for Energy-Efficient Design: Growing regulatory pressure, such as the EU's updated Ecodesign requirements for motors and industrial equipment, fuels demand for Etteplan's services in creating more efficient products.

- Integration of Green Technologies: The adoption of renewable energy sources and smart grid technologies by industries creates opportunities for Etteplan to incorporate these into client solutions, improving overall system efficiency.

- Cost Savings for Clients: By designing for lower energy consumption, Etteplan directly contributes to reduced operating costs for its clients, a critical factor in business decision-making, especially with fluctuating energy prices. In 2024, industrial energy costs in many regions saw significant volatility, making efficiency a paramount concern.

- Contribution to Climate Goals: Etteplan's focus on energy efficiency supports both national and international climate objectives, such as the Paris Agreement, by enabling clients to lower their greenhouse gas emissions.

Climate Change Adaptation and Resilience

Industries are increasingly recognizing the necessity of adapting to climate change impacts. Extreme weather events, like the record-breaking heatwaves experienced in parts of Europe in 2023, can significantly disrupt supply chains and operational continuity. This creates a demand for innovative engineering solutions.

Etteplan is well-positioned to address these challenges by developing more resilient infrastructure and products. For instance, designing buildings and industrial facilities to withstand increased flood risks or higher temperatures presents new engineering opportunities. The global market for climate adaptation solutions is projected to grow substantially, with some estimates suggesting it could reach hundreds of billions of dollars annually by the late 2020s.

- Increased demand for climate-resilient design: Engineering firms like Etteplan can capitalize on the need for infrastructure that can withstand extreme weather.

- Supply chain vulnerability: Companies must invest in solutions to mitigate disruptions caused by climate-related events, impacting logistics and manufacturing.

- Product innovation: Developing products that perform reliably under changing environmental conditions, such as extreme heat or altered precipitation patterns, is a key growth area.

- Regulatory drivers: Evolving environmental regulations and carbon pricing mechanisms will further incentivize adaptation investments.

Environmental regulations are a major force shaping product development and manufacturing. Governments are pushing for circular economies, extended producer responsibility, and improved recyclability, directly influencing how products are designed and produced. For example, the EU's Ecodesign for Sustainable Products Regulation, set for full implementation by 2025, will impose strict criteria on durability, repairability, and recyclability across many product categories.

Consumer and industry demand for sustainability is also a significant driver. By early 2024, over 70% of consumers reported considering sustainability in their purchasing decisions. This trend, coupled with supply chain scrutiny, as highlighted by the EU's 2024 Corporate Sustainability Reporting Directive (CSRD), means companies must actively manage their environmental impact. A 2024 Deloitte survey found that 73% of executives believe sustainability initiatives boost financial performance.

Energy efficiency standards are tightening globally, impacting everything from industrial machinery to consumer electronics. Etteplan's expertise in engineering solutions that reduce energy consumption offers clients lower operational costs and a smaller carbon footprint, aligning with national and international climate goals like the Paris Agreement. The volatility in industrial energy prices seen in 2024 further emphasizes the financial benefits of efficiency.

Climate change impacts are also driving demand for resilient design. Extreme weather events, such as the record heatwaves in Europe in 2023, disrupt supply chains and operations. Engineering firms are increasingly needed to develop infrastructure and products that can withstand these changing conditions. The market for climate adaptation solutions is expected to grow substantially, potentially reaching hundreds of billions of dollars annually by the late 2020s.

| Environmental Factor | Impact on Business | Etteplan's Role/Opportunity | Supporting Data (2024/2025) |

|---|---|---|---|

| Circular Economy Mandates | Increased compliance costs, product redesign needs | Designing for disassembly, reuse, and recycling; lifecycle management | EU Ecodesign Regulation (full implementation by 2025) |

| Consumer Sustainability Preferences | Demand for eco-friendly products, brand reputation impact | Eco-design expertise, sustainable material selection, energy optimization | 70%+ consumers consider sustainability (early 2024) |

| Supply Chain Sustainability Pressure | Need for transparent and ethical sourcing, risk management | Optimizing designs for sustainable sourcing, waste reduction in manufacturing | EU CSRD effective 2024; 73% executives see financial benefits (Deloitte 2024) |

| Energy Efficiency Standards | Need for more efficient product designs, potential for reduced operational costs | Engineering for lower energy consumption, integration of smart technologies | EU Ecodesign directive for motors; industrial energy cost volatility (2024) |

| Climate Change Adaptation | Supply chain disruptions, need for resilient infrastructure | Developing resilient infrastructure and products, designing for extreme weather | Global climate adaptation solutions market projected to reach hundreds of billions annually by late 2020s |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on comprehensive data from reputable sources including government publications, international organizations, and leading market research firms. This ensures that each aspect of the macro-environment, from political stability to technological advancements, is thoroughly analyzed.