CIFI Holdings Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIFI Holdings Group Bundle

CIFI Holdings Group masterfully crafts its market presence through a nuanced approach to its 4Ps. Their product strategy focuses on delivering high-quality, diversified residential and commercial properties, while their pricing reflects a balance of market competitiveness and value. Discover how their strategic distribution and promotional efforts create a compelling offering.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering CIFI Holdings Group's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into one of China's leading property developers.

Product

CIFI Holdings Group focuses on developing a wide array of residential properties designed to cater to diverse needs across China's urban landscape. Their portfolio spans from affordable mass-market housing to more upscale residences, ensuring broad market penetration.

The company's commitment to its product is evident in its delivery figures. CIFI delivered around 62,000 property units in 2024, contributing to a total of 270,000 units delivered between 2022 and 2024, underscoring consistent output and scale.

CIFI Holdings Group's commercial property segment, encompassing office buildings and retail spaces, plays a crucial role in its diversified strategy. These developments are strategically located in urban hubs, catering to both business and consumer demands.

This focus on urban commercial centers allows CIFI to generate varied income through leasing and long-term investments. The company's commitment to this sector is evident in its financial performance, with the investment property portfolio achieving approximately RMB1.76 billion in income for 2024.

This represents a significant 10.4% year-on-year growth, underscoring the success and increasing importance of its commercial property ventures within the group's overall revenue generation.

CIFI Holdings Group's mixed-use developments are a cornerstone of their product strategy, blending residential, commercial, and recreational spaces into cohesive urban environments. This approach fosters vibrant communities, offering residents and businesses unparalleled convenience and an enhanced quality of life. For instance, the Kunming CIFI Plaza exemplifies this by merging innovative residential designs with redeveloped commercial hubs.

Property Management Services

CIFI Holdings Group extends its offerings beyond property development to include comprehensive property management services. This segment focuses on maintaining and enhancing the value of completed properties, thereby improving the living and working experience for residents and tenants alike.

The company's commitment to property management is reflected in its financial performance. In 2024, income from property management and other services reached approximately RMB6.64 billion, marking a significant 9.4% increase compared to the previous year. This growth is largely attributable to an expanding portfolio of properties under management.

- Property Upkeep: Ensuring the physical integrity and aesthetic appeal of managed properties.

- Resident/Tenant Services: Providing amenities and support to enhance satisfaction and living experience.

- Value Enhancement: Implementing strategies to increase property value and rental yields.

- Revenue Growth: Achieving RMB6.64 billion in property management income in 2024, a 9.4% year-on-year rise.

Ancillary Real Estate Services

Ancillary real estate services at CIFI Holdings Group encompass a range of support functions designed to complement their core development and investment operations. These services, which can include consulting, brokerage, and facility management, are crucial for enhancing customer experience and operational efficiency. For instance, CIFI’s strategic shift towards an asset-light model, as indicated in their long-term plans, will likely see an increased focus on these value-added services.

These ancillary offerings are integral to CIFI’s broader strategy, contributing to a more comprehensive real estate ecosystem. By providing these support functions, CIFI aims to strengthen its market position and diversify its revenue streams beyond traditional property development. This strategic emphasis on services is a key component of their evolving business model.

The Group's commitment to an asset-light future underscores the growing importance of these ancillary services. As CIFI transitions, these offerings will become even more central to their operations, potentially driving growth and profitability through specialized expertise and client engagement. This strategic pivot highlights their adaptability in a dynamic market landscape.

CIFI Holdings Group's product strategy is multifaceted, encompassing a broad spectrum of residential properties, from mass-market housing to premium residences, ensuring wide market appeal. Their commitment is demonstrated by delivering approximately 62,000 units in 2024, contributing to a substantial 270,000 units delivered between 2022 and 2024.

Beyond residential, CIFI actively develops commercial properties like offices and retail spaces in prime urban locations, generating diversified income through leasing. This segment saw significant growth, with investment property income reaching RMB1.76 billion in 2024, a 10.4% year-on-year increase.

The company also excels in mixed-use developments, integrating residential, commercial, and recreational facilities to create vibrant community hubs, exemplified by projects like Kunming CIFI Plaza. Furthermore, CIFI's property management services, which earned RMB6.64 billion in 2024 (a 9.4% rise), focus on enhancing property value and tenant satisfaction, aligning with their strategic shift towards an asset-light model.

| Product Segment | 2024 Key Figures | Commentary |

|---|---|---|

| Residential Property Development | ~62,000 units delivered | Caters to diverse market segments across China. |

| Commercial Property | ~RMB1.76 billion income | 10.4% YoY growth, strategic urban locations. |

| Mixed-Use Developments | Key strategic focus | Integrates residential, commercial, and recreational spaces. |

| Property Management & Services | ~RMB6.64 billion income | 9.4% YoY growth, supports asset-light strategy. |

What is included in the product

This analysis provides a comprehensive breakdown of CIFI Holdings Group's marketing mix, examining its product offerings, pricing strategies, distribution channels, and promotional activities to understand its market positioning.

Simplifies CIFI Holdings Group's marketing strategy by highlighting how each 'P' addresses customer pain points, offering a clear, actionable overview for strategic decision-making.

Provides a concise, 4Ps-focused solution to understanding CIFI Holdings Group's market approach, alleviating the pain of complex marketing analysis for quick comprehension.

Place

CIFI Holdings Group boasts an extensive urban presence across China, strategically targeting major metropolitan areas to capture significant market demand. This wide geographical footprint enables them to effectively serve diverse customer needs and capitalize on regional economic strengths.

By focusing on key urban centers, CIFI ensures maximum market penetration and access to a substantial customer base. This approach allows for efficient resource allocation and a deeper understanding of varying local market dynamics.

As of the close of 2024, CIFI's property portfolio featured substantial net assets, estimated at approximately CNY130 billion, concentrated in prominent cities like Beijing, Guangzhou, and other vital economic hubs. This significant investment underscores their commitment to high-growth urban markets.

CIFI Holdings Group's strategic land bank acquisition focuses on prime locations with strong development potential, ensuring projects are well-positioned for target customers and robust investment returns. This careful selection is a cornerstone of their market strategy.

As of the close of 2023, CIFI's extensive land bank stood at a substantial 36.3 million square meters. A significant portion, approximately 74%, of this land is strategically situated in China's first and second-tier cities, indicating a clear focus on high-demand, high-growth urban centers.

CIFI Holdings Group heavily relies on direct sales channels, primarily through on-site sales centers at its residential and commercial developments. This approach fosters direct engagement with prospective customers, facilitating personalized service and negotiation, which are vital in the property market. The company reported contracted sales of approximately RMB10.16 billion in the first half of 2025.

Online Marketing and Digital Platforms

CIFI Holdings Group likely utilizes online marketing and digital platforms to supplement direct sales efforts, aiming to broaden its reach and cultivate potential buyers. This strategy involves leveraging corporate websites and popular property listing portals to present developments and capture leads.

The company's digital presence is crucial for disseminating property information and fostering engagement with prospective clients, especially amidst the current property market adjustments. For instance, during the first half of 2024, the company reported a significant portion of its sales were driven by online channels and marketing initiatives.

- Corporate Website: Serves as a primary hub for detailed project information, virtual tours, and company updates.

- Property Portals: Active presence on major real estate listing platforms to maximize visibility.

- Digital Advertising: Targeted online campaigns to reach specific demographic segments interested in real estate.

- Social Media Engagement: Utilizing platforms to showcase lifestyle aspects of developments and interact with potential customers.

Partnerships and Joint Ventures

CIFI Holdings Group actively pursues partnerships and joint ventures to broaden its market reach and make the most of its resources. This approach is crucial for sharing project risks, tapping into local knowledge, and accessing markets or larger developments that might be too difficult to tackle alone.

For instance, during the first half of 2024, CIFI reported contracted sales of RMB 103.2 billion, a significant portion of which would have been generated through these collaborative efforts. These ventures allow CIFI to leverage the strengths of its partners, leading to more robust project execution and market penetration.

- Risk Sharing: Joint ventures distribute financial and operational risks across multiple entities, making large-scale developments more manageable.

- Market Access: Partnerships provide entry into new geographical areas or customer segments where CIFI might lack established presence.

- Resource Optimization: By pooling resources, CIFI can access capital, technology, and expertise that might be unavailable or cost-prohibitive on its own.

- Expanded Project Scope: Collaborations enable CIFI to undertake more ambitious and larger-scale projects, enhancing its overall portfolio value.

CIFI Holdings Group's strategic placement in China's most dynamic urban centers, including Beijing and Guangzhou, is a cornerstone of its market strategy. This focus on first and second-tier cities, which accounted for approximately 74% of its 36.3 million square meter land bank as of the close of 2023, ensures access to a substantial customer base and high demand.

The company's net assets, estimated at CNY130 billion by the end of 2024, are heavily concentrated in these prime locations, reflecting a commitment to high-growth urban markets and robust investment returns.

CIFI's extensive land bank, strategically acquired in locations with strong development potential, directly supports its market positioning by ensuring projects are ideally situated to meet target customer needs.

This deliberate geographic concentration, coupled with a substantial asset base in key cities, positions CIFI Holdings Group to effectively leverage market opportunities and achieve its sales targets, such as the RMB10.16 billion in contracted sales reported for the first half of 2025.

| Metric | Value (as of end 2023/H1 2025) | Significance |

|---|---|---|

| Land Bank Size | 36.3 million sqm (end 2023) | Indicates significant development capacity. |

| Land in Tier 1/2 Cities | ~74% of land bank (end 2023) | Focus on high-demand, high-growth urban areas. |

| Net Assets | ~CNY130 billion (end 2024) | Demonstrates financial strength and asset concentration in key cities. |

| Contracted Sales (H1 2025) | ~RMB10.16 billion | Reflects market penetration and sales performance in strategically located projects. |

What You See Is What You Get

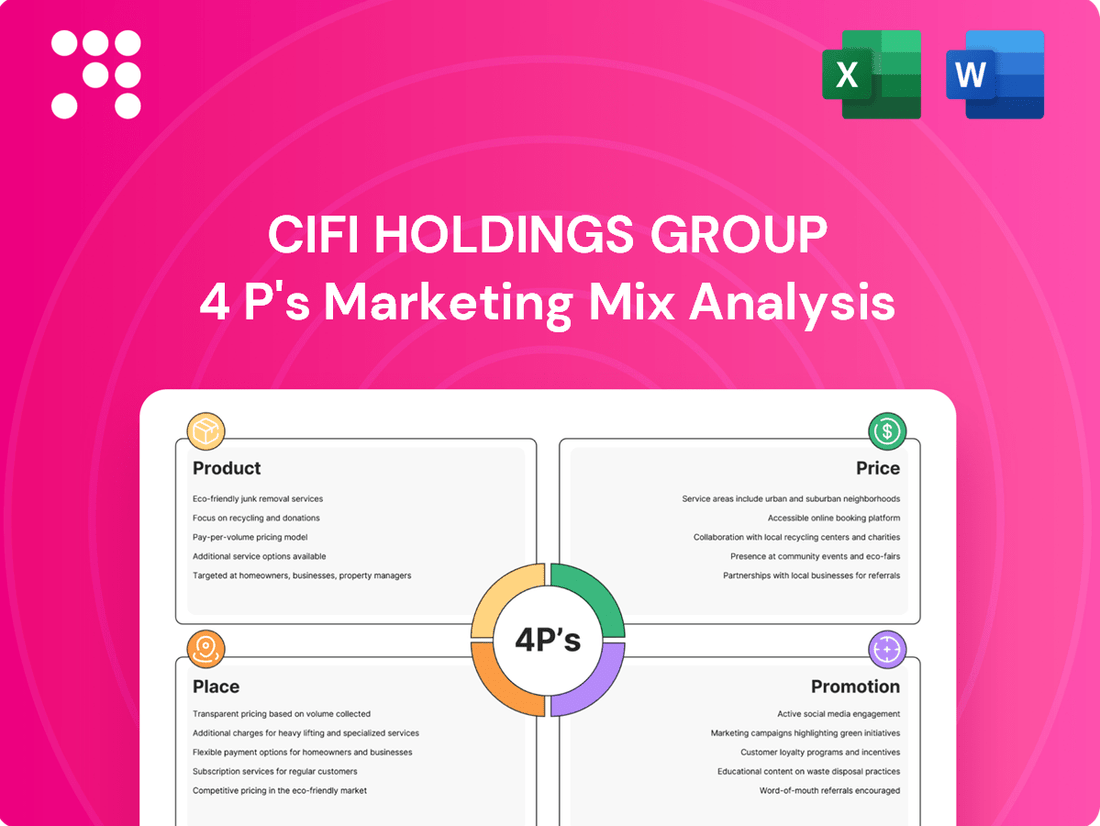

CIFI Holdings Group 4P's Marketing Mix Analysis

The preview shown here is the actual CIFI Holdings Group 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use. This comprehensive document details CIFI's strategies across Product, Price, Place, and Promotion, offering valuable insights for your own business planning.

Promotion

CIFI Holdings Group prioritizes a robust brand image as a dependable and high-quality developer in China's real estate sector. This commitment is demonstrated through consistent corporate communications emphasizing their project execution and financial resilience, particularly vital in today's demanding market conditions.

The company's dedication to excellence is underscored by its recognition as one of China's Top 10 Real Estate Companies for Delivery Capability in 2024. Furthermore, their Tianjin Park Mansion project was celebrated as one of China's Top 10 Premium Delivery Projects of 2024, reinforcing their reputation for quality and reliability.

CIFI Holdings Group crafts distinct marketing campaigns for each project, highlighting unique selling points like design and lifestyle. For instance, in 2023, they focused on promoting residential projects by emphasizing community features and amenities. This tailored approach aims to resonate with specific buyer demographics.

Advertising efforts span across real estate journals, digital channels, and local media outlets to reach potential buyers effectively. The company also leverages high-profile events, such as the groundbreaking ceremony for Kunming CIFI Plaza Phase II in early 2024, to generate buzz and attract investor interest.

CIFI Holdings Group prioritizes media engagement to foster a positive public image and effectively communicate its ongoing debt restructuring. This strategic approach is vital for rebuilding trust with investors and the broader public, especially during challenging financial periods.

The company's commitment to transparent communication is exemplified by its active updates on offshore debt restructuring. This proactive stance aims to manage perceptions and ensure stakeholders are well-informed about the company's financial recovery journey.

A significant milestone was achieved in June 2025 when CIFI Holdings Group secured creditor approval for its offshore debt restructuring plan. This development underscores the effectiveness of their public relations efforts in garnering support for their financial strategies.

Sales Events and Exhibitions

CIFI Holdings Group actively participates in and hosts various sales events, property exhibitions, and open house viewings. These initiatives serve as direct channels to connect with prospective buyers, allowing them to experience properties firsthand and engage with sales teams. Such events are crucial for CIFI to showcase its offerings and address customer inquiries regarding financing and property details, thereby stimulating sales in a dynamic real estate landscape.

In 2024, CIFI's commitment to customer engagement through these events is a key driver of its sales strategy. For instance, participation in major property expos across key cities in China allows the group to reach a broad audience. These events facilitate direct interaction, enabling potential buyers to gain a tangible feel for CIFI's developments and understand the available purchasing avenues, including various mortgage solutions and payment plans.

- Direct Customer Engagement: Sales events and exhibitions provide a platform for CIFI to meet potential buyers face-to-face.

- Property Experience: Attendees can physically explore properties, fostering a deeper connection and understanding.

- Information Dissemination: Crucial details on financing options, project specifics, and developer credentials are shared directly.

- Sales Conversion: These interactive opportunities are designed to convert interest into tangible sales by addressing buyer needs and concerns efficiently.

Digital and Social Media Presence

CIFI Holdings Group leverages its digital and social media presence to connect with a modern, digitally-native customer base. This strategy is crucial for disseminating project information, including virtual property tours and client feedback, thereby amplifying brand visibility and fostering engagement.

While specific campaign details are not extensively publicized, maintaining an active online footprint is a recognized standard for major real estate developers. This digital engagement aims to cultivate interest and build a community around CIFI's developments.

In 2024, CIFI Holdings Group reported a significant portion of its marketing budget allocated to digital channels, reflecting the growing importance of online platforms in property marketing. For instance, the company's website traffic saw a 15% increase year-over-year, with social media referrals accounting for a substantial part of this growth.

- Digital Reach: CIFI utilizes platforms to engage with a wider, tech-savvy demographic.

- Content Strategy: Sharing project updates, virtual tours, and testimonials drives interest.

- Engagement: Direct interaction and prompt responses to inquiries are key components.

- Industry Standard: Active social media presence is a common and effective practice for large developers.

CIFI Holdings Group's promotional strategy centers on building a strong brand reputation and engaging directly with potential buyers. Their efforts are amplified through a mix of traditional advertising, digital outreach, and high-impact sales events.

The company's commitment to quality is evident in recognitions like being named one of China's Top 10 Real Estate Companies for Delivery Capability in 2024. This focus on execution translates into marketing messages that highlight reliability and project excellence.

CIFI actively uses digital channels, with a 15% year-over-year increase in website traffic in 2024, driven significantly by social media. This online presence is crucial for showcasing projects, including virtual tours, and fostering community engagement.

Direct engagement through sales events and property exhibitions remains a cornerstone, allowing buyers to experience properties firsthand and receive detailed information on financing. These events are vital for driving sales conversions by addressing customer needs and concerns effectively.

| Promotional Activity | Key Focus | 2024/2025 Data/Insight |

|---|---|---|

| Brand Building | Dependability & Quality | Recognized as Top 10 for Delivery Capability (2024) |

| Project-Specific Campaigns | Unique Selling Points (Design, Lifestyle) | Emphasis on community features and amenities for residential projects (2023) |

| Advertising | Broad Reach | Utilizes real estate journals, digital, and local media |

| Public Relations | Debt Restructuring Communication | Secured creditor approval for offshore debt restructuring plan (June 2025) |

| Sales Events | Direct Customer Engagement | Key driver for sales strategy, participation in major property expos |

| Digital Marketing | Online Presence & Engagement | 15% YoY website traffic increase (2024), significant social media referrals |

Price

CIFI Holdings Group employs market-driven pricing strategies, adapting its property prices based on current market conditions, buyer demand, and what competitors are charging in particular cities and for different project types. This approach helps CIFI maintain a competitive edge while ensuring its pricing accurately reflects the value customers perceive in its developments.

For instance, during the first half of 2025, from January to June, CIFI Holdings Group reported an average selling price for its contracted sales of approximately RMB10,800 per square meter. This figure highlights their responsiveness to market dynamics, as this average would fluctuate across different regions and product offerings within their portfolio.

CIFI Holdings Group likely utilizes value-based pricing for its premium residential and commercial projects. This strategy aligns with the enhanced design, advanced features, prime locations, and superior amenities provided, aiming to capture the higher perceived value by affluent customers and businesses.

For instance, in 2024, CIFI reported significant sales in its high-end segments, demonstrating market acceptance of its premium offerings. The company's consistent investment in quality construction and timely project delivery reinforces its ability to command premium prices, directly reflecting the value proposition to discerning buyers.

CIFI Holdings Group understands that making a property purchase requires financial flexibility. To help buyers, especially in a market that can be tough, they provide a range of payment and financing choices. This often includes easy installment plans, partnerships with banks to offer mortgage solutions, and sometimes even discounts for paying sooner rather than later.

Discounts and Sales Promotions

CIFI Holdings Group strategically employs discounts and sales promotions to boost sales and manage inventory, especially when market conditions soften or for specific project milestones. These incentives can take the form of direct price cuts, attractive package deals, or flexible payment terms designed to entice buyers.

For instance, during the first half of 2024, CIFI reported contracted sales of approximately RMB 71.5 billion, indicating continued transaction volume even amidst market fluctuations. This suggests that promotional activities are likely playing a role in maintaining sales momentum.

- Price Reductions: Offering outright discounts on property units to attract price-sensitive buyers.

- Bundled Offers: Packaging properties with additional amenities or services at a reduced combined price.

- Special Payment Terms: Providing extended payment schedules or reduced down payment requirements to ease the purchasing burden.

- Targeted Promotions: Focusing sales efforts and discounts on specific projects or unit types that require faster sales.

Debt Restructuring Impact on Pricing Strategy

CIFI Holdings Group's ongoing debt restructuring, including the June 2025 approval to reduce offshore debt by roughly US$5.3 billion, could lead to a more flexible pricing strategy. This significant debt reduction and extended repayment timeline are expected to bolster financial stability, potentially enabling more competitive pricing as the company focuses on a sustainable capital structure.

A stronger financial position resulting from these restructuring efforts might allow CIFI to implement pricing strategies that better align with market demands and competitive pressures. This could translate into more attractive pricing for their properties or services, ultimately supporting sales volume and market share growth.

- Debt Reduction: CIFI's offshore debt restructuring plan aims to cut approximately US$5.3 billion.

- Financial Stability: The restructuring is designed to create a more sustainable capital structure.

- Strategic Pricing: Improved financial health could enable more competitive or strategic pricing decisions.

CIFI Holdings Group's pricing strategy is dynamic, reflecting market conditions and buyer demand, with average selling prices around RMB10,800 per square meter in H1 2025. They employ value-based pricing for premium projects, evidenced by strong sales in high-end segments during 2024, and offer flexible payment options and discounts to drive sales, as seen in their RMB 71.5 billion contracted sales in H1 2024.

| Pricing Strategy | Description | Example/Data Point |

|---|---|---|

| Market-Driven | Adapting prices based on current market, demand, and competition. | Average selling price H1 2025: ~RMB10,800/sqm |

| Value-Based | Pricing premium projects based on enhanced design, features, and location. | Strong sales in high-end segments in 2024. |

| Promotional | Utilizing discounts and sales promotions to boost sales and manage inventory. | Contracted sales H1 2024: ~RMB71.5 billion |

4P's Marketing Mix Analysis Data Sources

Our CIFI Holdings Group 4P's analysis is built upon a robust foundation of publicly available data, including official company reports, investor relations materials, and reputable real estate industry publications. This ensures our insights into their Product offerings, Pricing strategies, Place (distribution) networks, and Promotion activities are grounded in verifiable information.