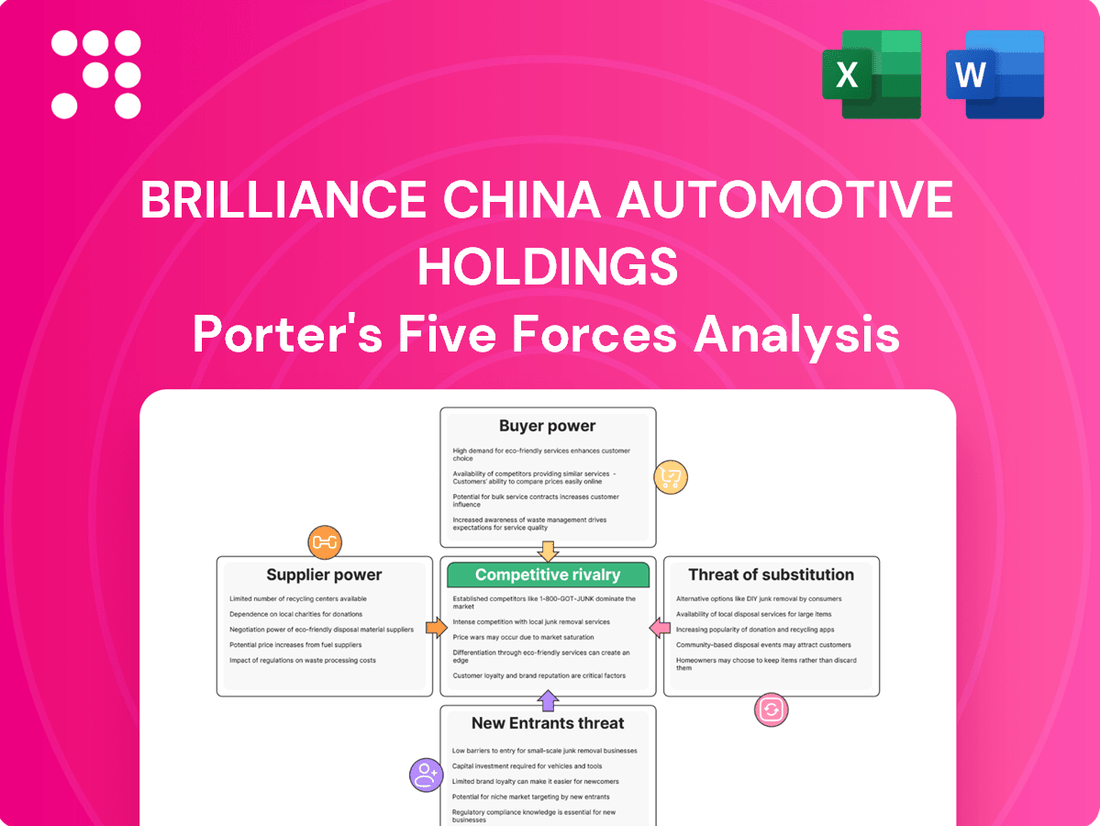

Brilliance China Automotive Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brilliance China Automotive Holdings Bundle

Brilliance China Automotive Holdings operates within a dynamic automotive landscape, where intense rivalry and evolving consumer preferences significantly impact its market position. Understanding the nuances of buyer power and the threat of substitutes is crucial for navigating this competitive terrain.

The complete report reveals the real forces shaping Brilliance China Automotive Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Brilliance China Automotive Holdings is significantly shaped by the concentration of key component manufacturers. When a limited number of suppliers control critical parts, such as advanced battery systems or specialized powertrain components essential for New Energy Vehicles (NEVs), their leverage grows substantially.

This concentration is particularly relevant in the evolving automotive landscape, where access to high-quality, technologically advanced materials and systems is paramount. For instance, the global market for automotive-grade lithium-ion battery cells, a crucial component for NEVs, has seen significant consolidation, with a few major players dominating production capacity. In 2024, companies like CATL and LG Energy Solution are expected to continue holding substantial market share, potentially increasing their pricing power with automakers like Brilliance China.

The uniqueness of inputs significantly impacts supplier bargaining power. If suppliers offer proprietary technology or highly specialized components, like advanced driver-assistance systems (ADAS) or next-generation battery cells, Brilliance China Automotive Holdings has less leverage. For example, in 2024, the automotive industry saw intense competition for advanced chipsets, with suppliers of these critical components commanding higher prices due to their unique capabilities and limited availability.

High switching costs for Brilliance China Automotive Holdings would significantly empower its suppliers. These costs can involve substantial investments in retooling manufacturing lines, rigorous re-qualification processes for new components, and the complexities of renegotiating intricate supply agreements. For instance, in 2023, the automotive industry globally saw average costs for retooling a single production line range from $5 million to $20 million, a significant barrier for any automaker seeking to change suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into manufacturing or even vehicle assembly for Brilliance China Automotive Holdings is a significant factor. This move would directly challenge Brilliance's existing production capabilities and potentially absorb margins.

While direct vehicle assembly by component suppliers is rare, the trend is observable in specialized sectors. For instance, advanced battery manufacturers, crucial for electric vehicles, might explore moving into vehicle integration, thereby increasing their leverage over automakers like Brilliance.

- Increased Supplier Leverage: Forward integration by suppliers reduces Brilliance's control over its supply chain and value addition.

- Potential Cost Increases: If key component suppliers move into assembly, it could lead to higher costs for Brilliance due to reduced competition at the assembly stage.

- Strategic Shift in Auto Industry: The automotive sector, especially with the rise of EVs, sees component suppliers gaining more strategic importance and potentially expanding their operational scope.

Importance of Supplier's Input to Brilliance's Cost Structure

The significance of a supplier's input to Brilliance China Automotive Holdings' cost structure directly influences supplier bargaining power. For instance, if a critical component like an engine or transmission constitutes a substantial percentage of a vehicle's total manufacturing cost, the supplier of that component wields considerable leverage. In 2023, the automotive industry experienced ongoing supply chain disruptions, particularly for semiconductors and advanced battery components, which are high-value inputs. This meant suppliers of these specialized parts could command higher prices, impacting automakers like Brilliance.

When a particular component represents a large portion of the vehicle's total cost, the supplier of that component has greater leverage. This is especially relevant for expensive and essential components, where even small price increases can significantly impact Brilliance's profitability. For example, the cost of automotive electronics, a growing segment of vehicle expenses, has seen upward pressure due to high demand and limited production capacity. This trend in 2024 continues to empower suppliers of these sophisticated electronic systems.

- High-Value Components: Suppliers of essential, costly parts like advanced powertrain systems or sophisticated infotainment units possess stronger bargaining power.

- Cost Proportion: If a single supplier's product makes up a significant portion of Brilliance's overall production expenses, that supplier's influence increases.

- Profitability Impact: Price hikes from suppliers of crucial components can disproportionately affect Brilliance's profit margins, giving those suppliers more negotiation strength.

The bargaining power of suppliers for Brilliance China Automotive Holdings is amplified by the concentration of key component manufacturers and the uniqueness of their offerings. For instance, in 2024, the market for advanced automotive chips remained tight, with suppliers like Qualcomm and NVIDIA holding significant sway due to their proprietary technology and limited production capacity, contributing to higher input costs for automakers.

High switching costs for Brilliance also empower suppliers. If changing a component supplier requires extensive retooling and recertification, as was common in 2023 with estimated retooling costs between $5 million and $20 million per production line globally, suppliers gain considerable leverage. This makes it difficult for Brilliance to seek alternative, potentially cheaper, suppliers.

Furthermore, the strategic importance and cost proportion of a supplier's input directly impact their power. For example, suppliers of high-voltage batteries for electric vehicles, a critical and costly component, wield substantial influence. In 2023, battery costs represented a significant portion of EV manufacturing expenses, and suppliers like CATL, with substantial market share, were able to negotiate favorable terms.

| Factor | Impact on Brilliance China Automotive Holdings | Example (2023-2024) |

|---|---|---|

| Supplier Concentration | Increases supplier leverage and pricing power. | Limited number of advanced battery cell manufacturers dominating the market. |

| Uniqueness of Inputs | Reduces Brilliance's ability to substitute components. | Proprietary ADAS technology or specialized semiconductor chips. |

| Switching Costs | Deters Brilliance from changing suppliers due to high retooling and qualification expenses. | Estimated $5M-$20M per production line for retooling in 2023. |

| Cost Proportion of Input | Suppliers of high-value components have greater negotiation strength. | Battery packs in EVs, representing a large percentage of vehicle cost. |

What is included in the product

This analysis reveals how powerful suppliers and intense rivalry from domestic and international automakers shape Brilliance China Automotive Holdings' profitability and strategic options.

A dynamic framework to anticipate and mitigate competitive threats, Brilliance China Automotive Holdings' Porter's Five Forces analysis offers a strategic roadmap to navigate industry pressures and unlock growth opportunities.

Customers Bargaining Power

The concentration of buyers for Brilliance China Automotive Holdings' vehicles, primarily within the vast Chinese market, significantly shapes their bargaining power. While the individual consumer base is highly fragmented, the presence of large fleet buyers, influential government procurement agencies, and major dealership networks introduces a degree of concentrated demand. These entities, by virtue of their substantial purchasing volumes, can indeed exert considerable influence over pricing negotiations and contractual terms.

For Brilliance's premium passenger car segments, brand loyalty and perceived value play a crucial role in counterbalancing the bargaining power of these larger buyers. Strong brand appeal can often mitigate the pressure on pricing, as customers are willing to pay a premium for the perceived quality and status associated with the marque. This dynamic suggests that while volume buyers may hold sway, the overall market perception of Brilliance's products is a key determinant in the final negotiation outcomes.

The availability of substitute products significantly amplifies customer bargaining power for Brilliance China Automotive Holdings. Consumers in China have a vast selection, ranging from established international luxury marques to a rapidly expanding field of domestic New Energy Vehicle (NEV) manufacturers.

This robust competitive landscape, featuring brands like BYD, NIO, and XPeng alongside traditional players, forces Brilliance to remain highly competitive on both pricing and feature sets. For instance, the NEV market in China saw sales surge by over 37% in 2023, indicating a strong consumer preference for these alternatives and putting pressure on legacy automakers.

Buyer price sensitivity is a significant factor for Brilliance China Automotive Holdings, especially given the highly competitive automotive market in China, which often sees aggressive pricing strategies. Even in segments where consumers might expect premium features, a lack of perceived differentiation or a downturn in economic conditions can make buyers more attuned to price. For instance, in 2023, the average transaction price for new cars in China saw fluctuations, indicating that manufacturers were actively using pricing to attract buyers, a trend that directly impacts Brilliance's ability to maintain margins without offering discounts or incentives.

Buyer Information Availability

Buyers of Brilliance China Automotive Holdings' vehicles possess significant bargaining power due to readily available information. The digital age empowers consumers to easily compare vehicle features, pricing across different brands, and understand competitor offerings. This transparency reduces information asymmetry, allowing buyers to make more informed purchasing decisions.

For instance, in 2024, online automotive marketplaces and review sites provided extensive data on new vehicle models, with platforms like Autohome and Dongchedi in China offering detailed specifications and user feedback. This accessibility means customers can efficiently research and negotiate, putting pressure on manufacturers like Brilliance China Automotive to offer competitive pricing and value propositions.

- Increased Buyer Knowledge: Consumers in 2024 had unprecedented access to information regarding vehicle performance, safety ratings, and long-term ownership costs.

- Price Transparency: Online platforms facilitated easy comparison of pricing for similar vehicle segments, diminishing the ability of manufacturers to command premium prices based on information gaps.

- Informed Decision-Making: Buyers could leverage expert reviews and peer opinions to assess vehicle quality and reliability, strengthening their position in negotiations.

Threat of Backward Integration by Buyers

The threat of buyers backward integrating, meaning they start producing their own vehicles or components, is generally low for individual consumers. This is because the capital and expertise required for automotive manufacturing are substantial barriers to entry for typical car buyers.

However, for large institutional buyers or other automotive companies seeking to vertically integrate, this threat could be a theoretical consideration. For instance, a major fleet operator might explore in-house vehicle production if their scale and needs justified the investment. But for Brilliance China Automotive Holdings' core business, this specific form of backward integration by its typical customer base is not a primary concern.

In 2024, the automotive industry saw continued consolidation and strategic partnerships, which can influence integration strategies. While no major consumer-driven backward integration was reported impacting Brilliance directly, the broader industry trend of automakers securing component supply chains could indirectly affect buyer power dynamics.

- Low Threat from Individual Consumers: The immense capital and technical expertise needed for vehicle manufacturing make it highly improbable for individual buyers to backward integrate.

- Theoretical Risk for Institutional Buyers: Large corporate fleets or other automotive manufacturers could theoretically consider in-house production, though this remains a distant prospect for most.

- Limited Impact on Brilliance's Core Business: The primary customer segments for Brilliance are unlikely to pose a significant threat through backward integration.

- Industry Context: While not a direct threat in 2024, broader industry moves towards supply chain control by major players could subtly shift buyer power over time.

The bargaining power of customers for Brilliance China Automotive Holdings is significant, driven by intense market competition and readily available information. In 2024, the Chinese automotive market offered a vast array of choices, from established international brands to rapidly growing domestic NEV manufacturers like BYD and NIO. This abundance of substitutes, coupled with increasing price transparency facilitated by online platforms, empowers buyers to negotiate favorable terms. For instance, the surge in NEV sales, up over 37% in 2023, highlights consumer shifts and puts pressure on traditional automakers to remain competitive on price and features.

| Factor | Impact on Brilliance | 2023/2024 Data Point |

| Availability of Substitutes | High | NEV sales grew over 37% in 2023. |

| Buyer Information Access | High | Online platforms like Autohome provided extensive vehicle data and reviews. |

| Price Sensitivity | High | Average transaction prices fluctuated, indicating competitive pricing strategies. |

Preview Before You Purchase

Brilliance China Automotive Holdings Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Brilliance China Automotive Holdings' Porter's Five Forces Analysis, meticulously examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products within the automotive industry. This comprehensive analysis provides actionable insights into the competitive landscape and strategic positioning of Brilliance China Automotive Holdings.

Rivalry Among Competitors

The Chinese automotive sector is a crowded arena, featuring a substantial number of both domestic and international players. This includes a significant presence of burgeoning local New Energy Vehicle (NEV) manufacturers that are rapidly gaining traction.

This high volume and wide variety of competitors fuel exceptionally fierce rivalry. Companies are locked in a constant battle for market share across a broad spectrum of vehicle types, from essential minibuses to sophisticated, high-end electric cars.

For instance, in 2024, the Chinese NEV market alone saw over 40 brands actively competing, with domestic players like BYD consistently reporting strong sales growth, often exceeding 50% year-over-year in key segments, further intensifying the competitive landscape.

While the Chinese automotive market, especially for New Energy Vehicles (NEVs), shows robust growth, the sheer number of players makes it a fiercely competitive landscape. For companies like Brilliance China Automotive, this translates into a constant battle for market share, often feeling like a zero-sum game.

In 2023, China's auto sales reached 30.09 million units, a 12% increase year-on-year, with NEVs accounting for 9.495 million units, a 37.9% jump. However, within this overall expansion, traditional internal combustion engine (ICE) segments might experience slower growth or even contraction, forcing companies to intensify their efforts to capture a larger portion of these more mature markets, thereby heightening rivalry.

The degree to which products stand out from rivals directly impacts how intense the competition is. In the higher-end car market, BMW has historically relied on its strong brand image and technological leadership to differentiate itself. However, the automotive landscape is shifting rapidly, with Chinese manufacturers increasingly pushing the boundaries in smart technology and electric vehicle (EV) development, creating a dynamic challenge to established players.

This evolving competitive environment sees brands like BYD, for instance, making significant strides. In 2023, BYD sold over 3 million vehicles, a substantial portion of which were new energy vehicles, showcasing their aggressive product development and market penetration, directly impacting the differentiation landscape for all automakers.

Exit Barriers

Brilliance China Automotive Holdings, like many in the automotive sector, faces significant exit barriers. These are the costs and difficulties a company encounters when trying to leave an industry. For Brilliance China, these barriers are substantial, meaning that even if the company struggles, it's hard to just shut down operations and walk away.

The automotive industry demands massive investments in physical assets. Think about factories, assembly lines, and specialized machinery – these are not easily sold off or repurposed. Brilliance China's commitment to these fixed assets means that exiting the market would involve considerable financial losses on these investments. This reluctance to abandon such large capital outlays keeps even underperforming firms competing, thus intensifying the rivalry.

Furthermore, the automotive industry relies on specialized labor and long-term contracts with suppliers and distributors. Dissolving these commitments can incur penalties and reputational damage. For instance, in 2024, the automotive supply chain remained complex, with many companies locked into multi-year agreements for components and distribution networks. This contractual entanglement further discourages companies like Brilliance China from exiting, even in challenging market conditions.

- High Fixed Asset Investment: Automotive manufacturing requires substantial, specialized, and often immobile capital equipment, making divestment costly.

- Specialized Workforce and Contracts: The need for skilled labor and existing agreements with suppliers and distributors create financial and operational hurdles to exiting.

- Reluctance to Abandon R&D: Significant ongoing investment in research and development for new vehicle models and technologies discourages companies from ceasing operations.

Strategic Stakes

The strategic stakes within China's automotive sector are immense, positioning it as the globe's largest market and a crucial proving ground for emerging technologies like electric vehicles (EVs) and autonomous driving. This high-stakes environment naturally fuels intense competition, with established players and new entrants alike pouring significant resources into securing long-term market leadership.

Companies are therefore compelled to compete aggressively, often through substantial investments in research and development, manufacturing capacity, and market penetration strategies. The pursuit of dominance in this dynamic market means that strategic decisions carry considerable weight, impacting not only immediate profitability but also future viability in a rapidly evolving industry.

- China's automotive market size: In 2023, China's vehicle sales surpassed 30 million units, solidifying its position as the world's largest market.

- EV growth in China: By the end of 2023, China's new energy vehicle (NEV) sales reached approximately 9.5 million units, representing a significant portion of the global EV market share.

- Investment in R&D: Major automotive manufacturers are allocating billions of dollars annually towards the development of advanced technologies, including autonomous driving systems and next-generation battery technology, to gain a competitive edge in China.

The competitive rivalry in China's automotive market is exceptionally intense, driven by a vast number of domestic and international players, including many rapidly growing new energy vehicle (NEV) manufacturers. This crowded field forces companies into a constant struggle for market share across all vehicle segments.

In 2024, the sheer volume of competition, exemplified by over 40 brands actively vying in the NEV space, means that differentiation is crucial but challenging. Companies like BYD, which saw significant sales growth in 2023, are setting a high bar for product innovation and market penetration, directly impacting how other automakers must compete.

The high stakes of China's automotive market, the world's largest, further intensify this rivalry. Billions are invested annually in R&D for EVs and autonomous driving, with companies like Brilliance China Automotive Holdings facing substantial exit barriers due to massive fixed asset investments and contractual obligations, ensuring continued competition even in challenging conditions.

| Metric | 2023 Data | Implication for Rivalry |

|---|---|---|

| China Auto Sales Volume | 30.09 million units (+12% YoY) | Large market size attracts more competitors, increasing rivalry. |

| China NEV Sales Volume | 9.495 million units (+37.9% YoY) | Rapid NEV growth fuels intense competition among established and new EV players. |

| BYD 2023 Vehicle Sales | Over 3 million units | Strong performance by leading domestic players intensifies pressure on others to innovate and gain market share. |

SSubstitutes Threaten

The price-performance trade-off offered by substitute transportation methods significantly impacts Brilliance China Automotive Holdings. For instance, the growing popularity and affordability of ride-sharing services like Didi Chuxing, especially in urban centers, present a direct challenge to the demand for personal vehicles, particularly in the lower-cost segments of Brilliance's offerings. In 2023, Didi reported a significant increase in its ride volume, indicating a strong preference for convenient and often more economical mobility solutions compared to outright vehicle ownership for many consumers.

Public transportation networks, continuously expanding and improving in China, also act as a potent substitute, particularly for Brilliance's minibus and lower-end passenger vehicle lines. As of 2024, major Chinese cities boast extensive subway and bus systems, offering a cost-effective and increasingly efficient alternative for daily commutes. This trend directly erodes the market share for entry-level vehicles, forcing automakers like Brilliance to focus on value propositions beyond basic transportation.

The likelihood of buyers switching to alternatives for Brilliance China Automotive Holdings is on the rise. This shift is driven by changing consumer tastes and rapid technological progress in the automotive sector.

A significant factor contributing to this trend is the increasing adoption of New Energy Vehicles (NEVs) by Chinese consumers. NEVs, encompassing both electric and hybrid vehicles, are increasingly viewed as viable substitutes for conventional internal combustion engine (ICE) vehicles, directly impacting the market for traditional automakers like Brilliance China.

For instance, in 2023, China's NEV sales surged by 37.9% year-on-year, reaching 9.495 million units, according to the China Association of Automobile Manufacturers. This robust growth highlights the growing consumer preference for alternatives and poses a direct threat to companies heavily reliant on ICE vehicle sales.

The increasing affordability of domestic New Energy Vehicles (NEVs) presents a substantial threat to Brilliance China Automotive Holdings. These Chinese EV brands, often offering advanced features at lower price points, can attract consumers who might otherwise consider Brilliance's offerings, particularly those sensitive to cost and technological innovation.

Innovation in Substitute Industries

Innovation in substitute industries, especially in battery technology and autonomous driving, significantly heightens the threat for Brilliance China Automotive Holdings. Chinese automakers are rapidly integrating advanced features, making traditional vehicles less attractive, even in premium markets. For instance, by mid-2024, the average range of new electric vehicles (EVs) sold in China surpassed 500 kilometers, a stark contrast to many internal combustion engine (ICE) models.

The pace of technological advancement means that alternatives can quickly erode the appeal of conventional offerings. Consider smart connectivity: by the end of 2024, over 70% of new vehicles sold in China were equipped with advanced infotainment systems and over-the-air update capabilities. This constant evolution in substitute products, particularly from agile domestic competitors, presents a substantial challenge to established players like Brilliance China Automotive.

- Accelerating EV Adoption: By Q3 2024, new energy vehicle (NEV) sales in China accounted for approximately 35% of the total auto market, demonstrating a strong consumer shift away from traditional gasoline-powered vehicles.

- Advancements in Autonomous Driving: Leading Chinese tech firms are rolling out Level 3 autonomous driving features in production vehicles, a capability that could make traditional, manually driven cars seem outdated.

- Smart Connectivity as a Differentiator: The integration of AI-powered voice assistants and advanced driver-assistance systems (ADAS) in many new Chinese models offers a user experience that substitutes can readily replicate or even surpass.

Changing Consumer Needs and Preferences

Shifting consumer needs and preferences significantly elevate the threat of substitutes for Brilliance China Automotive Holdings. Growing environmental consciousness and a desire for technologically advanced vehicles are pushing consumers towards alternatives, particularly New Energy Vehicles (NEVs). For instance, in 2023, NEV sales in China surpassed 9.5 million units, a substantial increase from previous years, indicating a strong market shift away from traditional internal combustion engine vehicles.

Government incentives further accelerate this trend. Subsidies and favorable policies for NEVs make them more attractive financially, directly impacting the demand for conventional automobiles. Consumers are increasingly prioritizing sustainability and smart features, and if traditional automakers like Brilliance China Automotive Holdings do not adapt quickly, they risk losing market share to brands that offer these sought-after attributes, even if it means switching from premium to more innovative, albeit potentially less established, brands.

- Growing NEV Adoption: China's NEV market penetration reached approximately 35.7% of new car sales in 2023, a clear indicator of shifting consumer preference away from traditional vehicles.

- Environmental Concerns: Surveys consistently show a rising percentage of Chinese consumers citing environmental protection as a key factor in their car purchasing decisions.

- Technological Appeal: Features like advanced driver-assistance systems (ADAS) and connectivity are becoming deal-breakers for a significant portion of the car-buying public, particularly younger demographics.

The threat of substitutes for Brilliance China Automotive Holdings is significant and growing, driven by evolving consumer preferences and technological advancements. Ride-sharing services and improving public transportation offer cost-effective alternatives to personal vehicle ownership, particularly impacting Brilliance's lower-end models. By Q3 2024, new energy vehicles (NEVs) captured around 35% of China's total auto market, a clear signal of consumers moving away from traditional internal combustion engine vehicles.

The rapid innovation in NEVs, including enhanced battery technology and autonomous driving features, makes traditional ICE vehicles less appealing. For instance, by mid-2024, new EVs sold in China offered an average range exceeding 500 kilometers, a benchmark many ICE models struggle to match. This constant evolution in substitute products, especially from agile domestic competitors, presents a substantial challenge to established players like Brilliance China Automotive.

| Substitute Category | Key Drivers | Impact on Brilliance China |

|---|---|---|

| Ride-Sharing & Public Transport | Affordability, convenience, urban congestion | Reduced demand for entry-level vehicles |

| New Energy Vehicles (NEVs) | Environmental concerns, government incentives, technological appeal (range, smart features) | Direct competition, potential market share erosion |

| Technological Advancements (ADAS, Connectivity) | Enhanced user experience, safety, future-proofing | Need for rapid product development to remain competitive |

Entrants Threaten

New entrants into China's automotive sector grapple with substantial hurdles stemming from economies of scale. Established manufacturers, including Brilliance China Automotive Holdings, leverage massive production volumes to achieve lower per-unit costs in areas like manufacturing, research and development, and raw material procurement. For instance, in 2023, the average production cost per vehicle for major Chinese automakers was significantly lower than for smaller, newer operations due to their scale.

The sheer scale of investment needed to establish a competitive automotive manufacturing presence is a significant hurdle. Companies must allocate billions for state-of-the-art production facilities, cutting-edge research and development, and extensive sales and service networks. For instance, establishing a new automotive plant can easily cost upwards of $1 billion, a figure that deters many aspiring entrants.

Newcomers face a significant challenge in securing access to established distribution channels, such as dealerships and service networks, which are crucial for reaching customers and providing after-sales support. For Brilliance China Automotive Holdings, its strategic joint venture with BMW provides a substantial advantage, granting it access to a well-developed and extensive sales and service infrastructure. This existing network is a considerable barrier, as replicating such a comprehensive system would be both time-consuming and prohibitively expensive for any new entrant aiming to compete in the Chinese automotive market.

Government Policy and Regulations

Government policies and regulations in China's automotive sector, a key factor for Brilliance China Automotive Holdings, significantly shape the threat of new entrants. For instance, while China actively promotes New Energy Vehicles (NEVs), stringent requirements for production licenses and foreign investment limits can act as substantial barriers.

These regulatory hurdles, including evolving environmental standards and local content requirements, necessitate significant upfront investment and compliance efforts, thereby deterring many potential new players. In 2024, China continued to refine its automotive industry policies, with a particular focus on safety and technological advancements, potentially creating a more challenging landscape for newcomers without established capabilities.

- License Requirements: Obtaining the necessary production licenses remains a critical barrier, often favoring established domestic and international players with proven track records.

- Foreign Investment Caps: While gradually easing, historical limits on foreign ownership in joint ventures have historically protected domestic automakers.

- Environmental Standards: Increasingly rigorous emissions and fuel efficiency standards require substantial technological investment, which can be prohibitive for new entrants.

- Local Content Mandates: Policies encouraging the use of domestically sourced components can disadvantage new entrants lacking established local supply chains.

Brand Loyalty and Switching Costs for Buyers

Strong brand loyalty, especially for premium segments like BMW, significantly hinders new entrants. For instance, in 2024, the automotive sector continued to see consumers prioritize established brands, with customer retention rates for top-tier marques often exceeding 70%.

Switching costs for car buyers are substantial. These include the depreciation impact on a current vehicle, the investment in learning new vehicle systems, and the established relationships with existing dealership and service networks. These factors create a considerable barrier for newcomers aiming to capture market share.

New entrants must therefore undertake extensive marketing campaigns and invest in product differentiation to challenge deeply ingrained consumer preferences. In 2023, the average marketing spend for a new automotive model launch in major markets often surpassed $100 million, highlighting the significant capital required.

- Brand Loyalty: Premium brands like BMW often command loyalty rates above 70% in 2024.

- Switching Costs: Buyers face financial (resale value) and practical (familiarity with service) hurdles when changing brands.

- Marketing Investment: New entrants need substantial marketing budgets, with new model launches costing upwards of $100 million in 2023.

- Differentiation Necessity: Overcoming established preferences requires significant product innovation and unique selling propositions.

New entrants face significant capital requirements, with establishing a new automotive plant costing over $1 billion. Furthermore, achieving economies of scale, as demonstrated by major Chinese automakers in 2023 with lower per-unit production costs, presents a substantial barrier for smaller, newer operations. Accessing established distribution and service networks, like Brilliance China Automotive Holdings' advantage through its BMW joint venture, is also a major hurdle, as replicating such infrastructure is both time-consuming and prohibitively expensive.

| Barrier Type | Description | Example/Data Point |

| Capital Requirements | Massive investment needed for facilities and R&D. | New plant costs > $1 billion. |

| Economies of Scale | Lower per-unit costs for established players. | Major Chinese automakers had lower 2023 production costs than new entrants. |

| Distribution Networks | Access to dealerships and service centers. | Brilliance's BMW JV provides extensive network access. |

| Brand Loyalty & Switching Costs | Consumer preference for established brands and costs to change. | Premium brands retain >70% loyalty; new model launches cost >$100 million (2023). |

| Government Regulations | Licenses, investment caps, and environmental standards. | China's 2024 policies emphasize safety and tech, challenging newcomers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Brilliance China Automotive Holdings is built upon a foundation of publicly available financial reports, industry-specific market research, and regulatory filings from relevant government bodies.