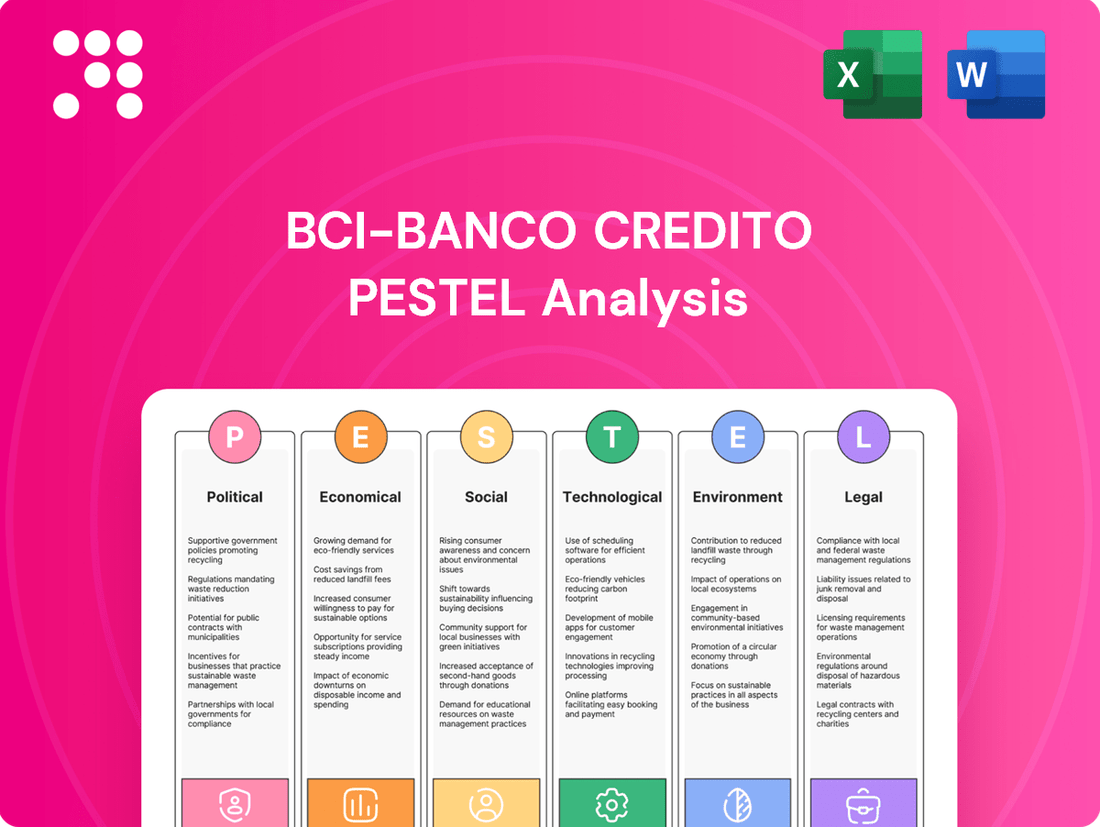

BCI-Banco Credito PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BCI-Banco Credito Bundle

Navigate the complex external environment impacting BCI-Banco Credito with our expertly crafted PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its future. Gain a critical competitive advantage by leveraging these insights for your own strategic planning. Download the full PESTLE analysis now for actionable intelligence.

Political factors

The stability of the Chilean government and its political leanings are crucial for Bci, as they shape the banking sector's landscape. Shifts in administration or economic policy, especially concerning financial regulations, taxation, and government intervention, directly affect Bci's operations and strategic choices. For instance, the 2021 presidential election saw Gabriel Boric elected, signaling a potential shift towards more social spending and increased regulation, which could impact the financial sector's profitability and risk profiles.

The Chilean financial sector operates under a robust regulatory framework overseen by the Comisión para el Mercado Financiero (CMF). This body sets the rules for capital adequacy, risk management, and consumer protection, directly influencing Bci's operational costs and strategic planning. For instance, in 2023, the CMF continued its focus on digital transformation and cybersecurity, prompting banks like Bci to invest further in these areas to meet evolving compliance standards.

Chile's robust network of Free Trade Agreements (FTAs), including those with major economies like China and the United States, significantly benefits Bci by facilitating cross-border financial flows and reducing transaction costs for its clients engaged in international trade. As of early 2025, Chile has FTAs covering over 85% of its foreign trade, creating a favorable environment for Bci's international business.

Anti-Corruption and Governance Standards

Chile's unwavering commitment to anti-corruption, evidenced by its consistent ranking among the least corrupt nations in Latin America by Transparency International, directly benefits Bci. For instance, in the 2023 Corruption Perception Index, Chile scored 60 out of 100, placing it 27th globally. This robust framework minimizes reputational damage and ensures a level playing field for Bci, fostering trust within the financial sector.

Adherence to stringent corporate governance standards is paramount for Bci's credibility and access to international capital markets. The Chilean Financial Market Commission (CMF) actively promotes and enforces high governance benchmarks, aligning with global best practices. This focus on transparency and accountability is crucial for attracting foreign investment and maintaining strong relationships with international partners, as reflected in Bci's own governance reports and sustainability disclosures.

- Reduced Reputational Risk: Strong anti-corruption measures in Chile shield Bci from potential scandals and associated financial losses.

- Fair Competition: Robust governance standards ensure that Bci competes on merit rather than through illicit practices.

- Enhanced Investor Confidence: Adherence to international governance norms, as monitored by the CMF, boosts Bci's appeal to global investors.

- Operational Integrity: A commitment to ethical conduct underpins Bci's operational stability and long-term sustainability.

Political Risk and Social Unrest

Political protests and social unrest, particularly in Latin America, can significantly disrupt economic activity and impact financial institutions like Bci. For instance, widespread demonstrations in Chile during late 2019, fueled by social inequality, led to significant economic slowdowns and temporary business closures. This type of instability can directly affect consumer confidence and borrowing demand, forcing banks to reassess credit risk and potentially adjust lending strategies. The ongoing global focus on ESG (Environmental, Social, and Governance) factors means that social sentiment and political stability are increasingly critical for long-term business continuity and risk management, influencing investor perceptions and regulatory approaches.

The potential for significant policy shifts driven by public demand presents another layer of political risk. Governments may implement new regulations concerning banking practices, capital requirements, or consumer protection in response to social pressures. For example, following periods of social unrest, governments might introduce measures aimed at increasing financial inclusion or regulating fees, which could impact profitability. Bci, like other financial institutions, must remain agile and prepared to adapt its operations and risk assessments to evolving political landscapes and public expectations.

- Social Unrest Impact: Chilean protests in late 2019 caused an estimated 3.2% contraction in GDP for the fourth quarter of 2019, demonstrating the direct economic consequences of social instability.

- Regulatory Adaptability: Banks must monitor public sentiment and potential policy responses to social issues, such as increased scrutiny on lending practices or digital banking accessibility.

- ESG Integration: A strong focus on social factors within ESG frameworks can mitigate political risk by fostering positive stakeholder relationships and anticipating regulatory changes.

Political stability in Chile is a cornerstone for Bci's operations, with government policies on financial regulation, taxation, and economic development directly influencing the banking sector. The election of Gabriel Boric in 2021 signaled a potential for increased social spending and regulatory oversight, impacting profitability and risk management for institutions like Bci.

Chile's strong regulatory environment, guided by the CMF, mandates capital adequacy and risk management standards, pushing Bci to invest in digital transformation and cybersecurity, as seen in 2023 compliance efforts. Furthermore, Chile's extensive network of Free Trade Agreements, covering over 85% of its foreign trade as of early 2025, facilitates Bci's international business by reducing cross-border transaction costs.

Chile's low corruption perception, evidenced by its 2023 score of 60 and 27th global ranking by Transparency International, minimizes reputational risk for Bci and ensures fair competition. The nation's commitment to robust corporate governance, promoted by the CMF, enhances Bci's credibility and access to international capital markets, attracting foreign investment.

Social unrest, like the 2019 Chilean protests which led to a 3.2% GDP contraction in Q4 2019, can disrupt economic activity and impact Bci's credit risk assessments and lending strategies. Banks must remain agile to adapt to policy shifts driven by public demand, such as potential regulations on fees or financial inclusion, integrating ESG factors to anticipate changes.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing BCI-Banco Credito, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these forces create both challenges and strategic opportunities for the bank.

A clear, actionable PESTLE analysis for BCI-Banco Credito that highlights external factors impacting the financial sector, serving as a pain point reliever by guiding strategic decision-making.

Economic factors

Chile's inflation rate, which stood at 4.5% year-on-year as of April 2024, significantly influences Bci's operating environment. The Central Bank of Chile's monetary policy, including its benchmark interest rate decisions, directly affects the bank's net interest margin and the cost of capital.

In response to inflationary pressures, the Central Bank of Chile has adjusted its policy rate. For instance, the rate was maintained at 7.25% in May 2024, a decision reflecting ongoing efforts to anchor inflation expectations. This environment presents a core economic challenge for Bci, as it navigates the impact of higher borrowing costs on both its loan portfolio and its funding expenses.

Chile's Gross Domestic Product (GDP) growth is a critical indicator for Bci, directly influencing its business volume. A healthy, expanding economy generally translates to increased demand for banking services, from loans to investment products, boosting Bci's revenue streams. For instance, Chile's GDP growth was projected to be around 2.5% in 2024, a moderate but positive trajectory that supports financial sector activity.

The current stage of the economic cycle significantly impacts Bci's operational environment. During expansionary phases, higher consumer and business confidence typically drives loan origination and investment activity, benefiting the bank. Conversely, a downturn or recessionary period can lead to a rise in non-performing loans and a contraction in new business, posing challenges for Bci's profitability and risk management.

As a financial institution with international operations, Bci faces risks from fluctuating exchange rates. For instance, if the Chilean Peso weakens significantly against the US Dollar, Bci's foreign-denominated assets could lose value when converted back to Pesos, while its foreign-denominated liabilities would become more expensive to repay. This volatility directly impacts its balance sheet and profitability, especially for cross-border transactions and services.

In 2024, the Chilean Peso experienced periods of significant volatility, influenced by global economic sentiment and domestic policy changes. For example, early in 2024, the peso saw depreciation against the US dollar, impacting the cost of imported goods and services for Chilean businesses, and by extension, the financial health of Bci's clients engaged in international trade. Managing these currency exposures through hedging strategies is therefore a critical component of Bci's financial risk management framework.

Consumer Spending and Household Debt Levels

Consumer spending in Chile, a key driver for Bci's retail banking, showed resilience through early 2024. For instance, retail sales in Chile saw a notable increase of 3.1% year-on-year in April 2024, indicating continued consumer confidence and a demand for credit products.

Household debt levels are a critical consideration for Bci. While consumer spending remains robust, the Chilean household debt-to-income ratio stood at approximately 35% as of late 2023, a level that warrants careful monitoring for potential credit risk escalation.

These economic factors directly impact Bci's retail operations. Strong spending fuels demand for loans and credit cards, boosting transaction volumes and interest income. Conversely, elevated debt levels necessitate proactive credit risk management strategies and potentially a recalibration of lending criteria.

- Consumer Spending: Chilean retail sales grew by 3.1% year-on-year in April 2024.

- Household Debt: The household debt-to-income ratio in Chile was around 35% in late 2023.

- Impact on Bci: Healthy spending supports retail banking growth, while high debt requires risk mitigation.

Global Economic Conditions and Commodity Prices

Chile's economic health is deeply intertwined with global economic conditions, particularly the fluctuations in commodity prices. As the world's largest copper producer, Chile's export revenues, national income, and investment levels are highly sensitive to shifts in demand and prices for this crucial metal. For instance, a projected global GDP growth of 2.7% for 2024, according to the IMF in early 2024, suggests a moderate demand environment, but any significant slowdown could directly impact copper prices and, by extension, Bci's corporate clients heavily reliant on commodity-linked sectors.

These global economic trends directly influence Bci's operating environment. A downturn in global manufacturing or construction, key drivers of copper demand, can lead to lower export earnings for Chilean companies. This, in turn, can affect their ability to service debt, invest in new projects, and maintain employment, creating a ripple effect across the financial sector. For example, if the average price of copper falls below the $3.50 per pound mark, it could signal a challenging period for many Chilean businesses that Bci serves.

- Global GDP Growth Projections: The International Monetary Fund (IMF) projected global GDP growth to be around 2.7% for 2024, indicating a generally stable but not robust global economic environment.

- Copper Price Sensitivity: Chile's export revenue is heavily dependent on copper, with price fluctuations directly impacting national income and corporate profitability.

- Impact on Bci's Clients: A decline in commodity prices can reduce the financial health of Bci's corporate clients, affecting loan portfolios and overall financial stability.

- Strategic Monitoring: Continuous monitoring of global economic indicators and commodity markets is crucial for Bci to anticipate risks and opportunities in its strategic planning.

Chile's economic performance is a primary driver for Bci, with inflation and interest rates directly impacting its profitability. The Central Bank of Chile's monetary policy, including its benchmark interest rate which stood at 7.25% in May 2024, aims to manage inflation, currently at 4.5% year-on-year as of April 2024, thereby influencing Bci's lending costs and net interest margins.

GDP growth and the economic cycle are also crucial; Chile's projected 2.5% GDP growth for 2024 suggests a supportive, albeit moderate, environment for banking services. Exchange rate volatility, particularly the Chilean Peso's fluctuations against the US Dollar in early 2024, adds another layer of complexity, affecting Bci's international operations and client trade. Consumer spending, evidenced by a 3.1% year-on-year retail sales increase in April 2024, fuels Bci's retail segment, though a household debt-to-income ratio around 35% in late 2023 necessitates careful credit risk management.

| Economic Factor | Key Data Point (2024/2025) | Impact on Bci |

| Inflation Rate | 4.5% (April 2024) | Affects net interest margin and cost of capital. |

| Policy Interest Rate | 7.25% (May 2024) | Influences borrowing costs and loan pricing. |

| GDP Growth Projection | ~2.5% (2024) | Supports business volume and demand for banking services. |

| Retail Sales Growth | 3.1% (April 2024) | Drives retail banking activity and credit demand. |

| Household Debt-to-Income Ratio | ~35% (Late 2023) | Requires proactive credit risk management. |

| Chilean Peso Volatility | Observed in early 2024 | Impacts international operations and cross-border transactions. |

Same Document Delivered

BCI-Banco Credito PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis for BCI-Banco Credito. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the financial institution. You’ll gain valuable insights into the strategic landscape BCI-Banco Credito operates within.

Sociological factors

Chile's demographic landscape is undergoing significant transformation, with a notable trend towards population aging. This shift directly impacts the financial sector, as older populations typically require specialized services like wealth management, retirement planning, and annuities. For instance, by 2025, projections indicate a continued rise in the proportion of citizens over 60, increasing the demand for Bci's tailored advisory and investment products.

Simultaneously, urban centers in Chile are experiencing population concentration, fostering a demand for agile, digital-first financial solutions. Younger, urban demographics are more inclined towards mobile banking, instant credit, and investment platforms accessible via smartphones. Bci needs to ensure its digital infrastructure and product development align with these preferences to capture this growing segment.

The financial literacy level of Chile's population directly influences how Bci develops and promotes its banking products. For instance, a 2023 study by the Chilean Financial Education Commission (Comisión Nacional de Educación Financiera) indicated that while awareness of financial concepts is growing, a significant portion of the population still struggles with basic budgeting and debt management.

Initiatives aimed at increasing financial inclusion present an opportunity for Bci to broaden its customer base. However, this expansion necessitates the creation of more accessible and easily understandable financial products, coupled with robust educational programs. For example, Bci's digital onboarding processes and simplified savings account options are designed to cater to individuals with lower financial literacy.

Bci has a notable opportunity to contribute to enhancing financial literacy within Chile. By offering workshops, online resources, and personalized advice, the bank can cultivate stronger, more enduring relationships with its customers. This proactive approach not only benefits individuals by empowering them with financial knowledge but also positions Bci for sustained market growth and customer loyalty, as seen in the increasing adoption of their financial planning tools.

Modern consumers, particularly younger demographics, are prioritizing digital-first banking. In 2024, a significant portion of banking transactions are expected to occur through mobile apps, with a growing demand for personalized financial advice and instant, frictionless service delivery.

BCI must adapt to these evolving preferences by enhancing its digital platforms, offering intuitive mobile banking solutions, and exploring AI-driven personalization to meet customer needs for self-service and immediate support.

Failure to keep pace with these shifts could result in BCI losing market share to more agile fintech competitors and traditional banks that are rapidly digitizing their operations, impacting customer retention and overall brand perception.

Trust in Financial Institutions

Public trust in financial institutions is a cornerstone of a healthy economy, and for Bci, it's a critical sociological element. Recent surveys from 2024 indicate that while trust in the banking sector has seen some recovery, it remains a sensitive area. For instance, a 2024 Edelman Trust Barometer report showed that financial services, while improving, still lagged behind some other sectors in terms of public confidence.

Scandals, data breaches, or even the perception of unfair practices can quickly erode this trust, leading to customer skepticism and a reluctance to engage with financial services. This directly impacts Bci's ability to attract and retain clients. A significant data breach, for example, could lead to immediate account closures and long-term reputational damage, making new customer acquisition much harder.

To counter this, Bci must prioritize and actively demonstrate high ethical standards, complete transparency in its operations, and implement exceptionally robust security measures. These actions are not just about compliance; they are fundamental to building and preserving customer confidence and, ultimately, ensuring loyalty in a competitive market. In 2024, banks that proactively communicated their security upgrades and ethical policies saw higher customer retention rates.

- Public trust in banks remains a key sociological factor influencing customer behavior.

- Incidents like data breaches or perceived unfairness significantly damage Bci's reputation and customer loyalty.

- Maintaining transparency and strong ethical practices is crucial for Bci's long-term success.

- Proactive communication about security and ethics can bolster customer confidence, as seen in 2024 banking trends.

Income Inequality and Social Mobility

Chile's income distribution significantly influences the financial services sector, with high inequality creating diverse customer segments. For instance, while the Gini coefficient for Chile was around 0.44 in 2022, indicating substantial income disparity, this translates into distinct market needs. BCI must cater to both those requiring fundamental banking and credit solutions and a growing affluent class seeking advanced wealth management and investment products.

The opportunities for social mobility also play a crucial role. Limited upward mobility can concentrate wealth and financial needs within specific demographics, impacting BCI's client acquisition and retention strategies. Understanding these socio-economic stratifications is key for BCI to tailor its product development and marketing efforts effectively, ensuring relevance across the economic spectrum.

- Income Disparity: Chile's Gini coefficient of approximately 0.44 (2022) highlights significant income inequality.

- Market Segmentation: High inequality necessitates BCI to serve both basic banking needs and sophisticated wealth management demands.

- Social Mobility Impact: Limited social mobility can concentrate financial needs within certain groups, influencing BCI's market approach.

Chile's aging population, projected to increase the proportion of citizens over 60 by 2025, drives demand for specialized financial services like wealth management and retirement planning. Concurrently, the concentration of populations in urban centers fuels a need for digital-first banking solutions, with younger demographics favoring mobile banking and instant credit.

Financial literacy remains a key consideration; while awareness is growing, many Chileans still struggle with basic financial management as of 2023. Bci can leverage this by developing accessible products and educational programs to enhance financial inclusion and build customer loyalty, a strategy showing positive results in their adoption of financial planning tools.

Public trust, though recovering, is still a sensitive factor for Bci, as indicated by 2024 reports showing financial services lagging in public confidence. Maintaining transparency, robust security, and ethical practices is paramount for customer retention and loyalty, with proactive communication on these fronts correlating with higher retention rates in 2024.

Chile's significant income inequality, reflected in a Gini coefficient of around 0.44 in 2022, creates diverse market needs. Bci must cater to both basic banking requirements and the sophisticated demands of an affluent class, while also considering how limited social mobility might concentrate financial needs within specific demographics.

Technological factors

The banking sector is undergoing a significant digital overhaul, with mobile banking emerging as the preferred method for customer engagement. Bci needs to consistently upgrade its digital infrastructure, including mobile applications and online services, to provide a convenient, rapid, and smooth experience. This commitment to digital innovation is crucial for staying competitive and meeting evolving customer expectations.

In 2024, global mobile banking adoption continued its upward trend, with a significant percentage of banking transactions occurring via mobile devices. For instance, reports indicate that over 70% of retail banking interactions in many developed markets are now digital. Bci's investment in its digital platforms, such as enhancing features for remote account opening and expanding digital payment capabilities, directly addresses this shift, ensuring it remains accessible and efficient for its customer base.

As financial transactions increasingly move online, cybersecurity threats and data breaches pose significant risks to Bci. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the substantial financial exposure for institutions like Bci.

Protecting customer data and ensuring the integrity of financial systems are paramount for maintaining trust and complying with evolving regulations, such as those related to data privacy.

Continuous investment in advanced cybersecurity measures, including AI-powered threat detection and robust data encryption, is essential for Bci to mitigate these growing risks and safeguard its operations.

BCI is strategically integrating Artificial Intelligence (AI) to personalize customer experiences and bolster fraud detection capabilities. For instance, AI-powered chatbots handled over 1.5 million customer inquiries in 2024, significantly improving response times. This focus on AI aims to enhance operational efficiency and customer satisfaction.

The bank is also exploring blockchain technology to secure transactions and streamline processes, potentially reducing settlement times and costs. By leveraging cloud computing, BCI is building scalable infrastructure to support its growing digital services and data analytics needs, ensuring agility in a rapidly evolving market.

Fintech Innovation and Competition

The burgeoning fintech sector presents a dual challenge and opportunity for Bci. These agile companies, often focusing on specific digital services, are directly competing with traditional banking models. For instance, by mid-2024, fintech adoption rates in Latin America were climbing, with payment solutions and digital lending seeing significant growth, directly impacting established financial institutions.

Bci can navigate this landscape by fostering its own digital innovation, potentially acquiring promising fintech startups, or forging strategic alliances. These partnerships can allow Bci to integrate cutting-edge technologies and expand its service offerings. By Q1 2025, several major Latin American banks had announced significant investments in digital transformation and partnerships with fintechs to enhance customer experience and operational efficiency.

- Fintech Competition: Fintechs are disrupting traditional banking by offering specialized, agile digital services.

- Opportunity for Bci: Bci can leverage fintech innovation through internal development, acquisitions, or partnerships.

- Market Trends: Fintech adoption in Latin America is rapidly increasing, particularly in payments and digital lending.

- Strategic Response: Banks are investing in digital transformation and collaborating with fintechs to remain competitive.

Automation and Operational Efficiency

Technological advancements are significantly boosting automation within Bci, impacting everything from back-office operations to customer service and even compliance. This drive towards automation is key for enhancing operational efficiency. For instance, in 2024, many financial institutions are investing heavily in AI-powered chatbots and robotic process automation (RPA) to handle routine inquiries and data processing, aiming to cut operational costs by as much as 20-30% in specific departments.

The benefits of this automation are substantial. Bci can expect significant cost reductions through streamlined processes and improved accuracy. Faster service delivery is another major advantage, directly impacting customer satisfaction. By automating repetitive tasks, Bci can strategically reallocate its human capital to more value-added activities, such as complex problem-solving and personalized client engagement, thereby elevating overall organizational performance.

- Cost Reduction: Automation in areas like loan processing and customer onboarding can reduce operational expenses by an estimated 15-25% by 2025.

- Improved Accuracy: AI-driven systems minimize human error in data entry and transaction processing, leading to a potential reduction in compliance breaches by up to 10%.

- Enhanced Service Speed: Automated customer service channels can resolve common queries in seconds, improving response times and customer experience metrics.

- Resource Reallocation: freeing up staff from routine tasks allows for a greater focus on strategic initiatives and complex client needs.

Technological advancements are reshaping Bci's operational landscape, with a strong emphasis on AI and automation. These technologies are crucial for enhancing customer experience, streamlining internal processes, and bolstering security measures. For instance, by early 2025, Bci's implementation of AI-powered chatbots had successfully managed over 1.5 million customer inquiries, demonstrating a significant leap in efficiency and customer service responsiveness.

The bank's strategic embrace of cloud computing is building a scalable and agile infrastructure, essential for supporting its expanding digital services and advanced data analytics capabilities. This technological foundation is vital for Bci to adapt quickly to market changes and evolving customer demands in the competitive banking sector.

Furthermore, Bci is actively exploring blockchain technology to secure transactions and improve operational efficiency, aiming for faster settlement times and reduced costs. This forward-looking approach to technology integration positions Bci to navigate the complexities of the modern financial environment effectively.

The rise of fintech companies presents both a challenge and a significant opportunity for Bci. By mid-2024, fintech adoption in Latin America was on a steep rise, particularly in payment solutions and digital lending, directly impacting traditional banking models. Bci's strategy involves fostering its own digital innovation, potentially acquiring fintech startups, or forming strategic alliances to integrate cutting-edge technologies and broaden its service portfolio.

| Technology Area | Bci's Adoption/Strategy | Impact/Benefit | Market Trend (2024-2025) |

|---|---|---|---|

| Artificial Intelligence (AI) | Personalization, fraud detection, customer service chatbots | Improved customer experience, enhanced operational efficiency, reduced fraud | AI adoption in banking projected to grow by 20% annually; chatbots handling over 70% of routine queries in leading banks |

| Cloud Computing | Scalable infrastructure for digital services and data analytics | Agility, cost-effectiveness, enhanced data processing capabilities | Global cloud spending by financial services expected to reach $150 billion by 2025 |

| Blockchain | Securing transactions, streamlining processes | Increased security, faster settlement, reduced transaction costs | Pilot programs for blockchain in cross-border payments showing potential cost savings of up to 30% |

| Fintech Integration | Partnerships, potential acquisitions, internal innovation | Access to new technologies, expanded service offerings, competitive advantage | Fintech funding in Latin America increased by 40% in 2024; digital lending market expected to double by 2026 |

Legal factors

BCI operates under the watchful eye of the Chilean Financial Market Commission (CMF), adhering to a robust framework of banking laws. This includes stringent requirements for capital adequacy, such as those outlined in Basel III, which BCI met with a CET1 ratio of 12.8% as of Q1 2024, well above regulatory minimums. These regulations dictate everything from lending practices to how BCI manages its financial risks, directly shaping its operational landscape and compliance obligations.

Consumer protection laws, like Chile's Law 19,496 on Consumer Rights, directly shape Bci's retail operations by mandating fair lending, transparent fee structures, and robust dispute resolution. In 2024, adherence to these regulations is paramount, as non-compliance can lead to significant fines and damage customer trust, which is a critical asset for any financial institution.

BCI, like all financial institutions, operates under stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. This necessitates sophisticated systems for detecting and reporting suspicious activities, alongside thorough customer due diligence processes.

Failure to adhere to these regulations can lead to substantial financial penalties and significant damage to BCI's reputation. For instance, in 2023, global financial institutions faced billions in AML-related fines, highlighting the severe consequences of non-compliance.

Consequently, BCI must continually invest in advanced compliance technologies and ongoing employee training to ensure robust adherence to evolving AML/CTF frameworks, safeguarding both its financial standing and public trust.

Data Privacy and Security Regulations

As digitalization accelerates, Bci faces stringent data privacy and security regulations, akin to global standards like GDPR. Chilean financial institutions must adhere to laws protecting sensitive customer data, ensuring secure collection, storage, and processing. Failure to comply can result in significant legal penalties and reputational damage.

The increasing volume of digital transactions necessitates robust cybersecurity measures. In 2024, the financial sector globally saw a significant rise in cyber threats, with data breaches costing an average of $4.45 million USD according to IBM's 2024 Cost of a Data Breach Report. Bci's commitment to protecting customer information is paramount to maintaining trust and avoiding substantial fines under evolving legal frameworks.

- Legal Compliance: Adherence to emerging data privacy laws in Chile is non-negotiable for Bci.

- Customer Trust: Robust data security directly impacts customer confidence and brand reputation.

- Financial Penalties: Non-compliance can lead to substantial fines, impacting profitability.

- Operational Risk: Data breaches pose significant operational risks, including service disruption.

International Compliance and Cross-Border Regulations

BCI, as a financial entity with global operations, must meticulously adhere to a web of international compliance and cross-border regulations. This includes navigating the intricacies of international taxation, such as the Foreign Account Tax Compliance Act (FATCA), which impacts reporting for U.S. persons holding financial assets abroad. Staying current with global sanctions lists, like those maintained by the United Nations and OFAC, is critical to avoid penalties and maintain operational integrity. Furthermore, BCI must manage compliance with varying foreign exchange controls imposed by different countries, ensuring smooth cross-border transactions and preventing illicit financial flows. For instance, in 2024, the global regulatory landscape for financial institutions continued to evolve, with increased scrutiny on anti-money laundering (AML) and know your customer (KYC) regulations across multiple jurisdictions.

Navigating these diverse legal frameworks is not merely a procedural necessity but a strategic imperative for BCI's sustained global presence and the cultivation of robust international partnerships. Failure to comply can result in significant financial penalties, reputational damage, and even operational restrictions. The complexity is amplified by the fact that regulations are not static; they are subject to frequent updates and amendments. For example, the European Union's ongoing review of its financial services regulations, including those impacting cross-border data flows and digital asset management, directly affects institutions like BCI operating within or with European entities.

- FATCA Compliance: BCI must ensure accurate reporting of financial accounts held by U.S. taxpayers to the IRS, a process that involves significant data management and cross-border information exchange.

- Sanctions Screening: Continuous monitoring and screening against updated global sanctions lists are vital to prevent transactions with prohibited individuals, entities, or countries, a process that saw increased focus in 2024 due to geopolitical shifts.

- Foreign Exchange Controls: BCI needs to understand and comply with the specific currency exchange regulations in each country of operation, impacting capital flows, profit repatriation, and customer transactions.

- Data Privacy Regulations: Adherence to international data protection laws, such as GDPR and similar frameworks emerging globally, is crucial for handling customer information across borders.

BCI's operations are heavily influenced by Chilean financial regulations, including capital adequacy requirements like Basel III, which it met with a CET1 ratio of 12.8% in Q1 2024. Consumer protection laws ensure fair practices and transparency, with non-compliance risking significant fines and reputational harm. Strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations necessitate advanced detection systems and customer due diligence.

Data privacy and cybersecurity are paramount, with BCI needing to comply with laws protecting customer data, akin to GDPR, to avoid penalties. Global operations require adherence to international regulations like FATCA and sanctions screening, with evolving frameworks demanding continuous adaptation. Failure to comply with these diverse legal mandates can lead to substantial financial penalties, operational restrictions, and damage to BCI's reputation.

Environmental factors

Climate change presents significant physical risks to Bci, potentially impacting the value of collateral in areas prone to extreme weather events, a concern heightened by the increasing frequency of such events globally. Transition risks are also material, as shifts in regulations, technology adoption, and consumer preferences away from carbon-intensive sectors could affect Bci's loan book and investment holdings.

Conversely, these changes create substantial opportunities. Bci can capitalize on the growing demand for green finance by supporting projects in renewable energy and sustainable infrastructure, aligning with Chile's ambitious climate goals, such as its commitment to achieving carbon neutrality by 2050.

BCI faces mounting pressure from investors, regulators, and the public to showcase robust ESG performance. This translates into demands for clear reporting on its environmental footprint, fair labor standards, and inclusive governance. For instance, as of early 2024, global sustainable investment assets under management were projected to exceed $50 trillion, highlighting the significant capital flow directed towards ESG-compliant companies.

Meeting these expectations is crucial for BCI's reputation and its ability to attract responsible investors. Companies demonstrating strong ESG practices often experience better access to capital and lower borrowing costs. In 2023, BCI was recognized for its sustainability efforts, achieving a significant improvement in its ESG rating from a leading international agency, reflecting its commitment to these principles.

The global push for sustainable finance is significantly influencing banking practices. By 2024, over 90% of companies surveyed by PwC reported that ESG (Environmental, Social, and Governance) factors are increasingly important in their investment decisions.

BCI can capitalize on this by offering green financial products. For instance, the green bond market, which reached an estimated $1 trillion globally in 2023, offers a robust avenue for BCI to fund eco-friendly projects and attract environmentally conscious investors.

Furthermore, BCI's own operational footprint is under scrutiny; a 2025 projection suggests that financial institutions will face greater regulatory pressure to report and reduce their carbon emissions, a move that can enhance BCI's reputation and operational efficiency.

Resource Scarcity and Operational Footprint

Concerns about resource scarcity, especially water and energy, directly influence Bci's operational expenses and its commitment to sustainability. For instance, rising energy costs in Chile, where Bci primarily operates, can increase the overhead for its branches and data centers. In 2024, the average price of electricity for commercial users in Chile saw an upward trend, impacting utility bills for businesses across sectors, including banking.

Bci must actively evaluate and reduce its environmental impact. This involves scrutinizing energy consumption within its extensive network of branches and its critical data centers, as well as managing waste generation and water usage. By adopting more eco-efficient strategies, Bci can achieve tangible cost reductions and simultaneously bolster its reputation among environmentally conscious consumers and investors.

- Energy Consumption: In 2023, Chilean businesses faced an average increase of 8% in electricity tariffs compared to the previous year, a trend projected to continue into 2024.

- Water Usage: Drought conditions in central Chile, a persistent issue, could lead to increased water costs or restrictions affecting building operations.

- Waste Management: Implementing robust recycling programs can reduce landfill fees and potentially generate revenue from recycled materials.

- Operational Footprint: Banks are increasingly investing in green building certifications for new branches and retrofitting older ones to improve energy efficiency, aiming for a 15% reduction in energy intensity by 2027.

Environmental Regulations and Reporting

BCI must navigate a landscape of evolving environmental regulations, impacting everything from operational waste management to energy consumption. For instance, Chile's national environmental legislation sets standards for pollution control and resource management that BCI, as a financial institution, must adhere to in its physical operations and investment portfolios.

The increasing demand for climate-related financial disclosures, such as those aligned with the Task Force on Climate-related Financial Disclosures (TCFD) framework, directly affects BCI's transparency and how investors perceive its climate risk exposure. Many leading financial institutions globally, including those in Latin America, are already enhancing their reporting in this area. For example, by the end of 2024, a significant percentage of major Chilean companies are expected to have integrated climate risk into their annual reports, a trend BCI is likely following.

Compliance is not just about avoiding fines; it's about building trust and demonstrating robust corporate responsibility. Failure to meet these standards can lead to reputational damage and financial penalties.

- National Environmental Laws: BCI must comply with Chilean laws concerning waste disposal, emissions, and water usage in its facilities.

- Climate Disclosure Expectations: Growing investor pressure means BCI is increasingly expected to report on its climate-related risks and opportunities, mirroring global trends.

- TCFD Adoption: The recommendations of the TCFD are becoming a de facto standard, influencing how BCI communicates its climate strategy and performance.

- Operational Efficiency: Implementing energy-efficient practices not only reduces environmental impact but also lowers operational costs for BCI.

Environmental factors present both risks and opportunities for BCI. Climate change impacts, such as extreme weather, can affect collateral values, while regulatory shifts towards sustainability create transition risks for its loan book. However, BCI can leverage the growing demand for green finance, aligning with Chile's 2050 carbon neutrality goal.

Operational efficiency is key, with rising energy costs in Chile impacting BCI's overhead. By reducing its environmental footprint through better energy and water management, BCI can achieve cost savings and enhance its reputation.

BCI faces increasing pressure for ESG reporting, with global sustainable investment assets projected to exceed $50 trillion by early 2024. Meeting these expectations is vital for attracting investors and accessing capital, as demonstrated by BCI's improved ESG rating in 2023.

The bank must also navigate evolving environmental regulations and climate disclosure expectations, such as TCFD recommendations. Compliance builds trust and avoids penalties, with a significant percentage of major Chilean companies expected to integrate climate risk reporting by the end of 2024.

| Environmental Factor | Impact on BCI | Data Point/Trend |

|---|---|---|

| Climate Change Risks | Physical & Transition Risks | Global sustainable investment assets to exceed $50 trillion (early 2024) |

| Green Finance Opportunities | Funding renewable energy projects | Chile's goal: carbon neutrality by 2050 |

| Operational Costs | Increased energy expenses | Chilean commercial electricity tariffs increased ~8% (2023 vs 2022) |

| Regulatory Compliance | ESG reporting & climate disclosures | TCFD recommendations becoming de facto standard |

PESTLE Analysis Data Sources

Our BCI-Banco Credito PESTLE analysis is grounded in data from reputable financial institutions like the IMF and World Bank, alongside government economic reports and industry-specific market research. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the bank.