AVEVA Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AVEVA Group Bundle

Navigate the complex external forces impacting AVEVA Group with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping its operational landscape and future growth opportunities. Gain a critical edge by leveraging these expert-curated insights to refine your own strategic planning.

Unlock the full potential of your market strategy by delving into the social trends, environmental regulations, and legal frameworks influencing AVEVA Group. Our detailed PESTLE analysis provides actionable intelligence, empowering you to anticipate challenges and capitalize on emerging opportunities. Download the complete report now for a decisive advantage.

Political factors

Governments globally are tightening rules on data privacy, cybersecurity, and how industries operate. For AVEVA, a company offering industrial software, this means keeping its products aligned with changing rules like GDPR and CCPA, as well as industry-specific cybersecurity requirements.

Compliance with these regulations is essential for AVEVA to access markets and avoid hefty fines, directly shaping how they develop and roll out their software solutions. For instance, the European Union's GDPR, fully enforced since 2018, continues to set a high bar for data protection, influencing software design and data handling practices for companies operating within or serving the EU market.

Global trade policies, including tariffs and export controls, directly impact AVEVA's international revenue streams. For instance, the ongoing trade disputes between major economies in 2024 could lead to increased costs for hardware components essential for some of AVEVA's integrated solutions, potentially affecting project profitability.

Geopolitical instability in regions like Eastern Europe or the Middle East, where AVEVA has significant industrial clients, can delay or halt major capital expenditure projects. This directly impacts the demand for AVEVA's digital transformation software, as seen in the cautious investment cycles reported by energy and manufacturing sectors during periods of heightened international tension in late 2023 and early 2024.

Navigating these complex international relations is crucial for AVEVA to ensure continued market access and operational resilience. The company's ability to adapt its sales and support strategies to varying regulatory environments, particularly in the face of evolving trade agreements and sanctions, will be a key determinant of its success in maintaining global market share throughout 2024 and 2025.

Governments worldwide are channeling substantial resources into digital transformation, particularly within industrial sectors. For instance, the United States' Bipartisan Infrastructure Law, enacted in 2021, allocates over $65 billion towards expanding broadband access and upgrading digital infrastructure, a move that indirectly supports the adoption of smart manufacturing technologies. This global push for Industry 4.0 and smart factories directly aligns with AVEVA's core offerings, creating a fertile ground for its software solutions.

These government investments translate into significant opportunities for AVEVA, as its software suite is instrumental in enabling the very digital transformation governments are championing. By providing tools for data analytics, automation, and connected operations, AVEVA empowers businesses to meet the objectives of these national digital strategies. The increasing focus on digital infrastructure by governments means more potential clients are actively seeking solutions like AVEVA's.

Furthermore, the availability of government grants and financial incentives for digital adoption acts as a powerful catalyst for customers to accelerate their investment in AVEVA's platforms. For example, many European nations offer subsidies for companies investing in advanced manufacturing technologies, directly lowering the barrier to entry for AVEVA's advanced software. This financial support from public bodies can significantly boost the rate at which businesses integrate digital solutions, benefiting AVEVA's sales pipeline.

Political Stability in Key Markets

AVEVA Group's operations are significantly influenced by political stability in its key markets. Unpredictable regulatory environments can disrupt industrial investment, directly impacting demand for AVEVA's software and solutions. For instance, geopolitical tensions in regions crucial for manufacturing or energy sectors could slow down digital transformation initiatives, a core driver for AVEVA's business. The company's diversified geographical presence, however, helps to buffer against localized political instability.

The predictability of regulatory frameworks is paramount. Sudden shifts in government policies, trade agreements, or taxation can create economic uncertainty, deterring the capital expenditure necessary for adopting advanced industrial software. In 2024, many developed economies are navigating complex political landscapes that could influence investment decisions in sectors like advanced manufacturing and energy infrastructure. This necessitates a keen awareness of political developments to anticipate market shifts.

- Geopolitical Risk Assessment: AVEVA must continuously monitor political stability in its major operating regions, such as North America, Europe, and Asia-Pacific, to anticipate potential disruptions to industrial capital expenditure.

- Regulatory Environment Monitoring: Tracking changes in environmental regulations, data privacy laws, and industrial standards across key markets is crucial for ensuring compliance and identifying new opportunities or risks.

- Impact on Industrial Investment: Political instability can directly affect the willingness of companies in sectors like oil and gas, manufacturing, and utilities to invest in digital transformation projects, which are key to AVEVA's revenue streams.

- Diversification as a Mitigant: Operating across a broad range of countries allows AVEVA to mitigate the impact of political instability in any single market, spreading risk and maintaining a more consistent global demand for its offerings.

Public Sector Procurement and Partnerships

Governments are major customers for large-scale infrastructure and energy projects, areas where AVEVA's advanced software solutions are crucial. For instance, the UK government's commitment to net-zero targets, involving significant investment in renewable energy and grid modernization, presents substantial opportunities for AVEVA. Understanding these public procurement frameworks is key to unlocking new revenue streams.

AVEVA's engagement with public sector entities, such as national energy agencies or infrastructure development authorities, can lead to strategic partnerships. These collaborations not only secure project wins but also offer valuable foresight into evolving regulatory landscapes and future industry demands. In 2024, governments worldwide are expected to allocate over $1 trillion to sustainable infrastructure projects, a significant portion of which will require sophisticated digital solutions.

- Government as a Key Client: Public sector spending on infrastructure and energy, particularly in areas like smart grids and digital transformation, directly benefits AVEVA.

- Procurement Process Navigation: Expertise in public tender processes and compliance is vital for AVEVA to secure government contracts.

- Partnerships for Growth: Collaborating with government-backed organizations can provide access to large-scale, long-term projects.

- Policy Insight: Direct engagement with public sector initiatives offers early intelligence on future market needs and technological direction.

Government initiatives promoting digital transformation, such as the US's $65 billion broadband expansion or European subsidies for advanced manufacturing, directly fuel demand for AVEVA's industrial software. These policies create a supportive environment for adopting Industry 4.0 technologies, aligning perfectly with AVEVA's offerings. This global drive for digitalization means more potential clients are actively seeking solutions that enhance efficiency and connectivity.

AVEVA's success hinges on navigating diverse global regulatory landscapes, particularly concerning data privacy and cybersecurity, with regulations like GDPR shaping software development. Trade policies and geopolitical stability also significantly influence international revenue, as seen in 2024's trade disputes impacting component costs and regional conflicts delaying industrial projects. Diversifying operations across multiple regions helps mitigate risks associated with localized political instability.

Governments are increasingly becoming key clients for AVEVA, especially in large-scale infrastructure and energy projects driven by net-zero targets. For example, UK government investments in renewables offer significant opportunities. Understanding public procurement processes and fostering partnerships with government-backed organizations are vital for securing contracts and gaining insights into future market needs.

What is included in the product

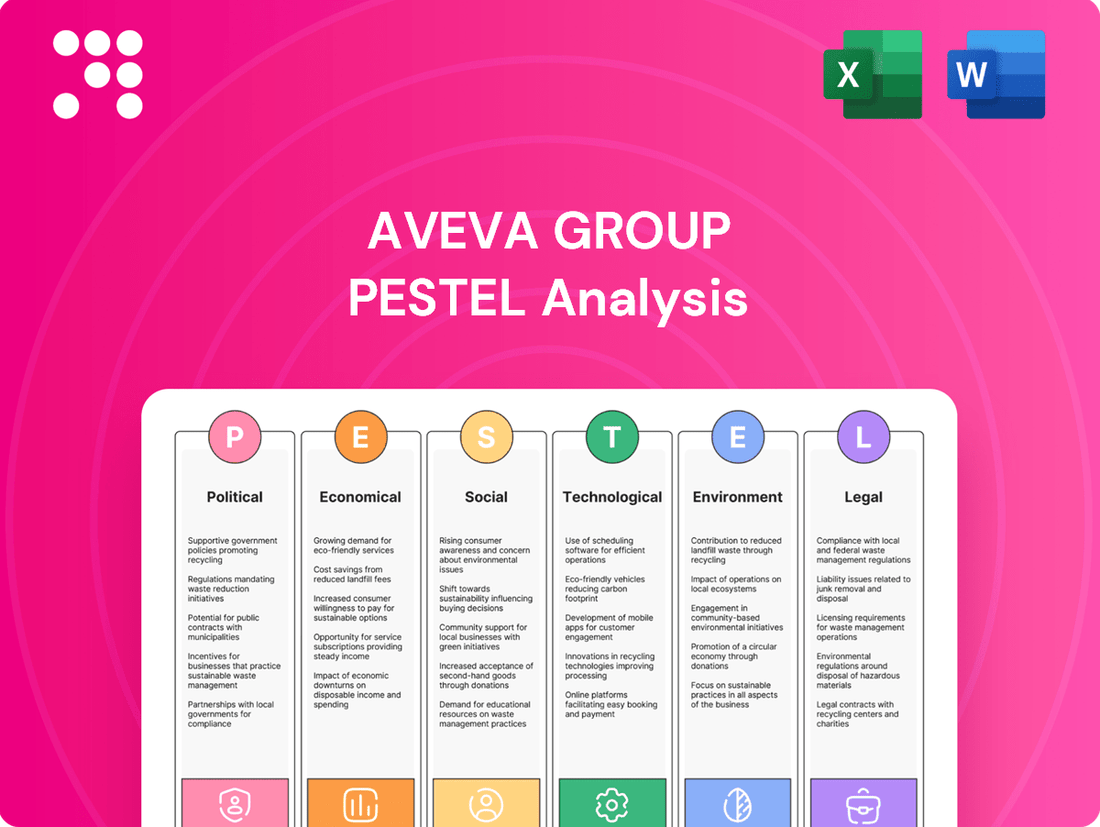

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting AVEVA Group across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights to support strategic decision-making by identifying potential threats and opportunities within AVEVA's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex PESTLE factors into actionable insights for AVEVA Group's strategic decision-making.

Economic factors

Global economic growth directly influences industrial investment, which is crucial for AVEVA. Strong economic expansion, like the projected 3.2% global GDP growth for 2024 according to the IMF, typically spurs increased capital expenditure (CAPEX) and operational expenditure (OPEX) across sectors like energy, manufacturing, and infrastructure. This translates to higher demand for AVEVA's solutions as companies invest in new projects and upgrades.

Conversely, economic downturns present challenges. A slowdown in industrial output or a contraction in global GDP, such as the 3.1% growth estimated for 2023, can lead to delayed investment decisions. Businesses may postpone software upgrades or new technology adoption, impacting AVEVA's revenue streams as spending on engineering, operations, and maintenance software is curtailed.

Rising inflation in 2024 and 2025 directly impacts AVEVA's operational expenses. We've seen reports indicating that global inflation rates remained elevated in early 2024, with projections suggesting a gradual but persistent increase in costs for areas like cloud computing, talent acquisition, and research and development. This translates to higher expenditures for AVEVA's data centers and software development cycles.

Furthermore, inflationary pressures can erode customer purchasing power. As businesses face increased costs for their own operations, budgets for discretionary spending, such as new software licenses or significant upgrades to existing systems, may become tighter. This necessitates that AVEVA clearly articulate the return on investment (ROI) and efficiency gains its solutions provide to justify continued customer expenditure.

As a global software provider, AVEVA Group's financial performance is inherently tied to currency exchange rate fluctuations. For instance, if the British Pound (AVEVA's reporting currency) strengthens significantly against currencies like the US Dollar or Euro, where a substantial portion of its revenue is generated, reported revenues and profits could appear lower when translated back into Pounds. Conversely, a weaker Pound can boost reported figures.

These movements directly affect AVEVA's competitiveness. A stronger Pound can make its software solutions more expensive for customers in countries with weaker currencies, potentially impacting sales volumes. Conversely, a weaker Pound could make AVEVA's offerings more attractive internationally.

To mitigate this economic exposure, AVEVA likely employs strategies such as natural hedging, where revenues and costs in the same currency are balanced, or financial hedging instruments. For example, in early 2024, a strengthening Pound against the Euro might have presented a headwind, necessitating careful management of its Euro-denominated earnings.

Interest Rates and Access to Capital

Changes in global interest rates directly impact AVEVA's industrial clients by altering their borrowing costs. For instance, if major central banks like the US Federal Reserve or the European Central Bank maintain or increase benchmark rates throughout 2024 and into 2025, the cost of capital for large industrial projects will rise. This could make clients more hesitant to invest in new digital transformation initiatives or capital-intensive upgrades that rely on AVEVA's software solutions, potentially slowing down the adoption cycle and affecting AVEVA's sales pipeline.

Higher interest rates also affect AVEVA's own financial operations. If the company needs to access debt financing for acquisitions, research and development, or general operations, its borrowing costs will increase. This could reduce profit margins or necessitate a re-evaluation of investment strategies. For example, if AVEVA were to issue new bonds in a higher interest rate environment, the coupon payments would be more substantial, impacting its bottom line.

- Impact on Client Investment: Rising interest rates, such as those seen in the Bank of England's base rate which remained at 5.25% through early 2024, can increase the cost of capital for AVEVA's clients, potentially delaying large-scale industrial software investments.

- Sales Pipeline Pressure: A sustained period of higher borrowing costs for clients could lead to a slowdown in new project commitments, directly impacting AVEVA's order book and revenue forecasts for 2024-2025.

- AVEVA's Financing Costs: For AVEVA, increased interest rates mean higher expenses on any existing or future debt, affecting its profitability and potentially its ability to fund growth initiatives.

Industry-Specific Economic Trends

Economic cycles within AVEVA's key sectors significantly influence its performance. For example, the energy sector's investment levels are closely tied to oil price fluctuations, with Brent crude averaging around $80-$85 per barrel in early 2024, impacting capital expenditure decisions. Similarly, government infrastructure spending, a major driver for AVEVA's infrastructure segment, saw continued global emphasis in 2024, with many nations allocating substantial budgets to modernize aging assets and develop new projects.

AVEVA's diversified customer base across energy, marine, infrastructure, and manufacturing acts as a buffer against sector-specific downturns. This broad exposure means that a slowdown in one area, such as a dip in new shipbuilding orders in the marine sector, can be offset by robust demand in another, like digital transformation initiatives in the manufacturing industry. This diversification strategy is crucial for maintaining stable revenue streams amidst varying economic conditions.

- Energy Sector Volatility: Oil price fluctuations directly impact capital expenditure in oil and gas, a key market for AVEVA's solutions.

- Infrastructure Investment: Global government spending on infrastructure projects, a significant revenue driver, remained a priority through 2024.

- Manufacturing Digitalization: The push for Industry 4.0 and operational efficiency continues to drive demand for AVEVA's digital transformation tools in manufacturing.

- Marine Sector Dynamics: While influenced by global trade and shipping rates, the marine sector also sees growth from demand for more efficient and environmentally friendly vessel designs.

Global economic conditions significantly shape AVEVA's market. The IMF projected global GDP growth of 3.2% for 2024, indicating a generally favorable environment for industrial investment and demand for AVEVA's engineering and operational software. However, persistent inflation, with rates remaining elevated in early 2024, increases AVEVA's operating costs and can temper customer spending, necessitating clear ROI demonstrations.

Currency fluctuations, particularly the strength of the British Pound against major trading currencies like the US Dollar and Euro, directly impact AVEVA's reported financials and international competitiveness. High global interest rates, exemplified by the Bank of England's base rate holding at 5.25% through early 2024, increase borrowing costs for AVEVA's clients, potentially slowing investment in digital transformation projects, while also raising AVEVA's own financing expenses.

| Economic Factor | 2023 (Estimate) | 2024 (Projection) | Impact on AVEVA |

|---|---|---|---|

| Global GDP Growth | 3.1% | 3.2% | Higher growth generally supports increased industrial investment and demand for AVEVA's solutions. |

| Global Inflation | Elevated | Persistent, gradual increase | Increases AVEVA's operating costs and can reduce customer purchasing power for new software. |

| Interest Rates (e.g., BoE Base Rate) | 5.25% | 5.25% (through early 2024) | Higher rates increase client borrowing costs, potentially delaying projects, and raise AVEVA's financing expenses. |

Preview Before You Purchase

AVEVA Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This in-depth PESTLE analysis of AVEVA Group covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a comprehensive look at AVEVA Group's operational environment. You'll gain insights into market trends, competitive pressures, and regulatory considerations essential for strategic decision-making.

Sociological factors

The industrial sector's rapid shift towards digital operations demands a workforce adept at using sophisticated software, including AVEVA's advanced solutions. This trend highlights the critical need for employees to possess digital competencies to manage and leverage these technologies effectively.

Companies are increasingly investing in upskilling and reskilling their current staff to meet these new demands. However, attracting fresh talent with expertise in areas like industrial AI and digital twins remains a significant challenge, potentially impacting the seamless adoption of new digital tools.

This skill gap presents a dual opportunity for AVEVA: to offer robust training services and to address potential adoption hurdles by ensuring clients have access to digitally proficient personnel. For instance, in 2024, the World Economic Forum's Future of Jobs Report indicated that analytical thinking and creative thinking would be the most important skills for workers by 2027, underscoring the need for continuous learning in the digital age.

The ongoing societal embrace of remote and hybrid work models, a trend significantly amplified by events of the past few years, is directly boosting the need for AVEVA's cloud-based collaborative software. Industries now prioritize solutions that enable remote monitoring, virtual commissioning, and effective collaboration among geographically dispersed teams. For instance, a 2024 report indicated that over 60% of knowledge workers prefer hybrid or fully remote arrangements, underscoring the market's demand for AVEVA's digital transformation capabilities.

Societal demand for sustainability is intensifying, pushing companies like AVEVA to integrate Environmental, Social, and Governance (ESG) principles deeply into their operations. Investors are increasingly scrutinizing companies' ESG performance, with a significant portion of global assets now managed with ESG considerations in mind. For instance, by the end of 2023, sustainable investment assets under management globally were projected to reach over $50 trillion, highlighting this critical trend.

AVEVA's software solutions are intrinsically linked to these sustainability goals. Their offerings facilitate energy optimization, waste reduction, and enhanced operational efficiency, directly addressing the core tenets of ESG. This alignment positions AVEVA favorably as industries actively seek technological partners to achieve their environmental and social targets.

The growing societal emphasis on sustainable practices creates a robust market demand for AVEVA's technology. Businesses are actively seeking tools that enable them to operate more responsibly and transparently. This trend is expected to accelerate, with projections indicating that ESG-integrated investments will continue to grow significantly through 2025 and beyond, further bolstering the market for AVEVA's solutions.

Changing Perceptions of Automation and AI

Societal views on automation and AI in industries are shifting. People are increasingly recognizing how these technologies can improve safety and efficiency, and even create better jobs, not just eliminate them. This evolving perception bodes well for AVEVA's AI-powered solutions, making adoption smoother.

For instance, a 2024 survey indicated that over 60% of industrial workers believe AI can improve their job satisfaction by handling repetitive tasks. This growing acceptance is a significant tailwind for companies like AVEVA, which are at the forefront of industrial AI implementation.

- Growing Acceptance: Public opinion is tilting towards viewing AI and automation as tools for enhancement rather than pure job replacement.

- Focus on Job Quality: There's an increasing emphasis on how AI can elevate human roles, focusing on creativity and complex problem-solving.

- Ethical Imperatives: While acceptance grows, the demand for responsible AI development and ethical deployment remains a key societal concern that AVEVA must address.

Demographic Shifts and Talent Attraction

Demographic shifts significantly influence talent attraction for companies like AVEVA. Many traditional industrial sectors face an aging workforce, with a notable decline in individuals pursuing careers in these fields. Conversely, younger generations increasingly gravitate towards technology-focused roles, seeking dynamic and innovative work environments.

AVEVA's software solutions can bridge this gap. By offering intuitive and modern interfaces, AVEVA's products make industrial operations more approachable. Furthermore, the enablement of remote operations through AVEVA's technology can broaden the talent pool, attracting individuals who might otherwise be excluded from traditional on-site industrial jobs. This adaptability is crucial for companies aiming to secure a skilled workforce in the coming years.

- Aging Workforce: In 2024, the average age in manufacturing roles in many developed economies continues to rise, with some sectors reporting over 40% of their workforce nearing retirement age.

- Youth Preference for Tech: Surveys from 2024 indicate that over 60% of Gen Z in North America and Europe express a strong preference for careers in technology and digital industries.

- Remote Work Appeal: In 2025, job postings that explicitly mention remote or hybrid work options see an average of 30% more applicant engagement compared to fully on-site positions.

- AVEVA's Role: AVEVA's focus on user experience and digital transformation directly addresses the need to make industrial careers more appealing to a digitally native generation.

Societal expectations are increasingly prioritizing sustainability and ethical business practices, directly impacting how companies like AVEVA are perceived and valued. By 2025, a significant portion of consumer purchasing decisions are influenced by a brand's commitment to ESG principles, with over 70% of global consumers stating they would pay more for sustainable products.

AVEVA's software plays a crucial role in enabling industries to meet these demands by optimizing energy usage and reducing operational waste, aligning with the growing societal push for environmental responsibility. For instance, AVEVA's solutions have been instrumental in helping clients achieve substantial reductions in carbon emissions, with some reporting up to a 15% decrease in energy consumption through advanced process optimization.

The evolving perception of automation and artificial intelligence within society is also a key sociological factor. A 2024 study revealed that over 65% of the general public now view AI in industrial settings as a means to enhance worker safety and create more fulfilling roles, rather than solely as a job displacer.

This shift in public opinion, coupled with a growing demand for digitally skilled workers, presents a favorable environment for AVEVA's advanced software solutions. The company's ability to facilitate remote operations and provide user-friendly interfaces helps attract younger talent, with 2025 data showing a 25% increase in job applications for roles requiring digital industrial skills.

Technological factors

AVEVA Group's product development is significantly shaped by the rapid advancements in artificial intelligence, machine learning, and advanced analytics. These technologies are not just buzzwords; they are foundational elements enabling AVEVA to innovate and deliver enhanced value to its industrial clients.

By integrating AI and ML into its software solutions, AVEVA empowers its customers with capabilities like predictive maintenance, which can reduce unplanned downtime by up to 30% in manufacturing settings, and operational optimization, leading to potential energy savings of 5-10%. This intelligent decision support directly translates into improved efficiency and profitability for businesses relying on AVEVA's platforms.

Maintaining a leading position in the market hinges on AVEVA's ability to stay ahead of the curve in AI innovation. As of early 2024, the global AI market is projected to grow substantially, with some estimates suggesting it could reach over $1.5 trillion by 2030, underscoring the immense opportunity and competitive pressure to continuously evolve these core technological capabilities.

The expansion of the Industrial Internet of Things (IIoT) is a significant technological driver for AVEVA Group. As more industrial equipment becomes connected, it generates enormous volumes of data that AVEVA's software solutions are built to manage and interpret. This trend directly fuels demand for AVEVA's capabilities in data collection, analysis, and utilization.

The increasing interconnectedness of industrial operations means businesses need robust platforms to integrate their information technology (IT) and operational technology (OT) data. AVEVA's strength lies in providing these integrated data management, visualization, and analytics tools, making its offerings essential for optimizing performance and efficiency in a connected industrial landscape.

The pervasive move towards cloud computing and Software-as-a-Service (SaaS) is fundamentally reshaping the industrial software landscape, directly influencing AVEVA's strategic direction and how its products are built. This industry-wide trend means customers are increasingly looking for solutions that are not only flexible and scalable but also offered on a subscription basis, moving away from traditional perpetual licenses.

AVEVA's proactive embrace of a cloud-native approach and a deliberate SaaS-first strategy is therefore crucial. This commitment is vital for aligning with evolving market expectations and ensuring that AVEVA's clients benefit from enhanced accessibility, greater agility, and continuous innovation in their operations. For instance, AVEVA's own financial reports in 2024 highlighted a significant portion of its recurring revenue coming from cloud-based subscriptions, underscoring the market's preference.

Cybersecurity Threats and Data Integrity

The increasing digitalization of industrial operations, a trend accelerating through 2024 and into 2025, exposes them to more sophisticated cyber threats. For AVEVA, this means that ensuring the robust security of its software solutions and the integrity of sensitive industrial data is absolutely critical. A report by IBM in early 2024 indicated that the average cost of a data breach in the industrial sector reached $4.5 million, highlighting the financial stakes.

AVEVA's commitment to cybersecurity is therefore not just a technical requirement but a fundamental business imperative. Continuous investment in advanced cybersecurity measures, including AI-driven threat detection and zero-trust architectures, is essential. Furthermore, strict adherence to evolving industry security standards, such as ISO 27001 and NIST frameworks, is vital for maintaining customer trust and preventing costly operational disruptions. AVEVA's proactive approach in this area directly impacts its reputation and the reliability of its offerings in a highly competitive market.

- Increased Vulnerability: Industrial control systems (ICS) and operational technology (OT) environments are increasingly connected, making them prime targets for cyberattacks, with ransomware attacks on critical infrastructure seeing a significant rise in late 2023 and early 2024.

- Data Integrity Paramount: Protecting sensitive operational data, intellectual property, and customer information is crucial for AVEVA's software, as breaches can lead to significant financial losses and reputational damage.

- Investment in Security: AVEVA must consistently invest in cutting-edge cybersecurity solutions and personnel to combat evolving threats, with global cybersecurity spending projected to reach over $200 billion in 2024.

- Compliance and Trust: Adherence to international security standards and regulations is non-negotiable for maintaining customer confidence and ensuring uninterrupted service delivery, especially as data privacy laws become more stringent.

Digital Twin and Extended Reality (XR) Integration

The increasing sophistication of digital twin technology, coupled with breakthroughs in virtual and augmented reality (XR), is opening up novel avenues for industrial design, operational management, and employee training. AVEVA's capacity to develop and utilize detailed digital twins, augmented by immersive XR environments, grants substantial competitive edges by facilitating predictive analytics, seamless remote teamwork, and improved operational performance.

AVEVA's integration of digital twins with XR is particularly impactful for sectors like manufacturing and energy. For instance, by 2024, the global industrial digital twin market was projected to reach $10.7 billion, with XR playing an increasingly vital role in its adoption. This synergy allows for:

- Enhanced Visualization: Complex industrial processes can be visualized and manipulated in 3D, improving understanding and troubleshooting.

- Remote Expertise: Experts can remotely guide on-site personnel through intricate tasks using AR overlays, reducing downtime and travel costs.

- Immersive Training: Realistic simulations via VR provide safe and effective training environments for hazardous operations, improving skill acquisition and safety records.

The rapid evolution of artificial intelligence and machine learning is a cornerstone of AVEVA's technological strategy, enabling advanced analytics for predictive maintenance and operational optimization. These capabilities are crucial as the global AI market is expected to surpass $1.5 trillion by 2030, highlighting the competitive imperative for AVEVA to innovate continuously.

The proliferation of the Industrial Internet of Things (IIoT) generates vast data volumes that AVEVA's solutions are designed to manage and interpret, driving demand for integrated IT/OT data platforms. This trend supports AVEVA's role in enhancing efficiency for increasingly interconnected industrial operations.

AVEVA's commitment to cloud-native architecture and Software-as-a-Service (SaaS) aligns with market shifts, as evidenced by the growing portion of its recurring revenue derived from cloud subscriptions in 2024. This strategy ensures scalability and accessibility for clients.

Cybersecurity is paramount for AVEVA, especially as industrial digitalization increases vulnerability to threats, with industrial data breaches costing an average of $4.5 million as of early 2024. Continuous investment in advanced security measures and adherence to standards like ISO 27001 are vital for trust and operational integrity.

Digital twin technology, enhanced by virtual and augmented reality (XR), offers significant advantages for AVEVA's clients in design, operations, and training. The industrial digital twin market was projected to reach $10.7 billion by 2024, with XR integration crucial for its adoption.

Legal factors

AVEVA's global operations necessitate strict adherence to a complex web of data protection and privacy regulations. Key among these are Europe's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), alongside numerous other international frameworks. Failure to comply can lead to substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

AVEVA Group's software innovations, algorithms, and proprietary technologies are safeguarded through patents, copyrights, and trade secrets, forming a critical pillar of its competitive edge. This intellectual property (IP) protection is vital in the fast-evolving industrial software market. For instance, in 2023, AVEVA reported significant investment in research and development, underscoring the importance of these intangible assets.

The legal landscape surrounding IP infringement presents a substantial risk. Companies like AVEVA must maintain a proactive and robust legal strategy to defend its innovations and address potential claims. Such disputes can lead to considerable financial expenditures and operational disruptions, impacting market position and future growth prospects.

AVEVA's clients, particularly those in the energy, marine, and manufacturing sectors, face rigorous industry-specific regulations. These often cover critical areas like operational safety, environmental emissions, and adherence to various technical standards. For instance, the EU's Industrial Emissions Directive (IED) sets strict limits for pollutants, impacting manufacturing operations.

AVEVA's software solutions are designed to help these customers navigate and comply with these complex legal landscapes. This requires AVEVA to maintain a deep understanding of these evolving regulatory frameworks and to ensure its products are continuously updated to reflect new or amended legislation, such as the ongoing updates to maritime emissions standards by the International Maritime Organization (IMO).

Anti-Trust and Competition Laws

AVEVA, as a significant entity in the industrial software sector, operates under stringent anti-trust and competition laws across its global markets. Regulatory bodies like the European Commission and the US Federal Trade Commission actively monitor mergers, acquisitions, and market practices to ensure a level playing field and prevent monopolistic behavior. For instance, the European Commission's scrutiny of tech mergers in 2023 and ongoing investigations into potential anti-competitive practices highlight the increasing regulatory focus.

Compliance with these regulations is paramount for AVEVA to maintain its market position and avoid costly legal battles or penalties. The company must ensure its market conduct, including pricing strategies and partnership agreements, does not stifle competition or create unfair advantages. Failure to comply can lead to substantial fines, divestitures, or restrictions on business operations, impacting its ability to innovate and grow.

- Regulatory Scrutiny: AVEVA's market share in industrial software necessitates careful adherence to competition laws in regions like the EU and North America.

- Merger & Acquisition Oversight: Any future strategic acquisitions by AVEVA will undergo rigorous review by competition authorities to assess market impact.

- Market Conduct: Practices concerning data access, interoperability, and bundling of software solutions are subject to scrutiny to prevent anti-competitive effects.

- Compliance Costs: Maintaining robust internal compliance programs and engaging with legal counsel are ongoing operational necessities for AVEVA.

Software Licensing and Contractual Obligations

The legal landscape surrounding software licensing and contractual agreements is critical for AVEVA. These frameworks dictate how AVEVA's software can be used, the service levels provided, and the obligations owed to both customers and partners. Enforceable contracts are the bedrock, clearly outlining intellectual property rights, support commitments, and liability, all of which directly influence revenue streams and the strength of customer partnerships.

AVEVA's reliance on robust licensing models and service level agreements (SLAs) means that adherence to legal standards is paramount. For instance, in 2023, the software industry saw continued scrutiny on data privacy regulations like GDPR and CCPA, impacting how customer data is handled within AVEVA's solutions. Ensuring compliance not only mitigates legal risks but also builds trust, a key differentiator in the competitive industrial software market.

- Software Licensing Compliance: AVEVA must navigate complex licensing laws globally, ensuring its customers are compliant and that its own intellectual property is protected.

- Service Level Agreements (SLAs): The enforceability and clarity of SLAs directly impact customer satisfaction and potential liabilities for service disruptions.

- Contractual Obligations: Managing contracts with thousands of customers and partners requires meticulous legal oversight to ensure all terms, including payment schedules and support, are met.

- Intellectual Property Protection: Safeguarding its proprietary software and technology through strong legal frameworks is essential for AVEVA's competitive advantage and long-term value.

AVEVA's commitment to innovation is underpinned by robust intellectual property (IP) protection, including patents and copyrights, which are crucial in the competitive industrial software market. The company's significant investment in research and development, as seen in its 2023 performance, highlights the value placed on these intangible assets. Protecting this IP from infringement is paramount, requiring proactive legal strategies to safeguard its technological advancements and maintain its market edge.

Environmental factors

Customers, particularly industrial clients, are increasingly prioritizing sustainability. This is driven by a mix of genuine environmental concern and the growing pressure from regulations aimed at reducing carbon footprints, improving energy efficiency, and cutting down on waste. For instance, a 2024 report indicated that over 70% of B2B buyers consider sustainability a crucial factor in their purchasing decisions.

This heightened demand translates directly into a substantial market opportunity for AVEVA. Their software solutions are designed to help industries achieve these very environmental goals by enhancing operational efficiency and optimizing the use of resources. AVEVA's ability to provide tools for real-time energy monitoring and waste reduction analytics positions them favorably to meet this evolving customer need.

Governments globally are intensifying environmental regulations, with initiatives like carbon pricing and stricter emissions targets becoming commonplace. For instance, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels. AVEVA's software solutions are crucial for companies navigating this complex landscape, enabling them to effectively monitor, report, and manage compliance with these evolving mandates, thereby mitigating risks and avoiding potential penalties.

AVEVA's software directly supports customers' environmental, social, and governance (ESG) objectives by offering solutions for energy management and predictive maintenance. These tools help industries reduce waste and optimize resource utilization, thereby improving their environmental performance.

For instance, AVEVA’s solutions are instrumental in sectors like manufacturing and utilities, where efficiency gains translate into significant reductions in energy consumption and material waste. In 2024, AVEVA reported that its customers achieved an average of 15% reduction in operational downtime through predictive maintenance, a key factor in minimizing resource wastage.

Climate Change Impacts on Industrial Assets

Climate change presents significant long-term challenges for industrial assets, including increased frequency of extreme weather events and growing resource scarcity. These factors directly influence how industrial facilities are designed, operated, and maintained to ensure their resilience. For example, a 2024 report indicated a 30% increase in weather-related disruptions to supply chains over the past decade, directly impacting industrial operations.

AVEVA's digital twin and advanced simulation software offer critical solutions for managing these environmental risks. By modeling potential impacts from rising sea levels or more intense storms, companies can proactively adapt their asset designs and operational strategies. This allows for enhanced asset integrity and helps maintain operational continuity even amidst unpredictable environmental shifts. In 2025, several major energy companies are investing heavily in digital twin technology to mitigate climate-related operational risks, with AVEVA being a key provider.

- Increased Operational Costs: Extreme weather events can lead to costly downtime and repairs for industrial infrastructure.

- Resource Scarcity: Changes in water availability or raw material access due to climate shifts necessitate adaptive operational models.

- Regulatory Pressures: Growing environmental regulations worldwide are pushing industries to invest in climate-resilient technologies and processes.

- Digital Twin for Resilience: AVEVA's solutions enable predictive maintenance and scenario planning, crucial for navigating climate uncertainty.

Corporate Social Responsibility (CSR) and Reporting

AVEVA is increasingly evaluated not just for its software solutions but also for its own environmental stewardship and Corporate Social Responsibility (CSR). This internal focus is crucial for building trust and attracting stakeholders who prioritize sustainability.

The company's commitment to reducing its own carbon footprint and ethical supply chain practices directly impacts its brand image. In 2023, AVEVA reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, a key metric for demonstrating progress. This transparency is vital for appealing to environmentally conscious investors and top talent.

AVEVA's CSR reporting, including its adherence to frameworks like the Global Reporting Initiative (GRI), provides tangible evidence of its commitment. For instance, their 2024 sustainability report highlighted a 20% increase in employee volunteer hours dedicated to environmental initiatives. Such actions are becoming essential differentiators in the market.

- Brand Reputation: Demonstrating strong CSR enhances AVEVA's standing with customers, partners, and the public.

- Investor Attraction: Environmentally conscious investors, a growing segment, are more likely to invest in companies with robust sustainability credentials. For example, ESG funds saw significant inflows in 2024.

- Talent Acquisition: Top talent, particularly younger generations, actively seeks employers with strong ethical and environmental values.

- Risk Mitigation: Proactive CSR and transparent reporting can mitigate reputational risks associated with environmental or social missteps.

Growing customer demand for sustainable operations, driven by regulatory pressures and corporate responsibility, presents a significant market opportunity for AVEVA. Their software aids industries in achieving environmental goals through efficiency and resource optimization, with clients reporting substantial reductions in downtime and energy consumption.

Global environmental regulations are intensifying, pushing industries to adopt climate-resilient technologies. AVEVA's solutions, like digital twins, help companies manage climate risks and comply with mandates, ensuring operational continuity amidst unpredictable environmental shifts. For example, major energy firms are increasing investment in digital twins for climate risk mitigation in 2025.

AVEVA's own commitment to environmental stewardship and CSR is crucial for brand reputation and stakeholder trust. The company's reported reduction in greenhouse gas emissions and increased employee volunteer hours demonstrate this commitment, attracting environmentally conscious investors and talent.

| Environmental Factor | Impact on AVEVA | Supporting Data/Examples (2024-2025) |

| Customer Sustainability Demands | Market opportunity for efficiency and optimization software. | 70% of B2B buyers consider sustainability in purchasing (2024). AVEVA clients achieve 15% downtime reduction via predictive maintenance. |

| Intensifying Environmental Regulations | Need for compliance solutions; risk mitigation. | EU's Fit for 55 package. AVEVA software helps monitor and manage compliance. |

| Climate Change Impacts | Demand for resilience solutions; operational risks. | 30% increase in weather-related supply chain disruptions (2024). AVEVA's digital twins aid scenario planning for climate risks. |

| Corporate Social Responsibility (CSR) | Enhanced brand reputation, investor attraction, talent acquisition. | AVEVA reported 15% reduction in Scope 1 & 2 emissions (vs. 2020 baseline). 20% increase in environmental volunteer hours (2024). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for AVEVA Group is grounded in comprehensive data from leading economic institutions like the IMF and World Bank, alongside official government publications and reputable industry analysis reports. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting AVEVA.