Amdocs Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amdocs Bundle

Amdocs operates in a dynamic telecom software market, where buyer power is significant due to consolidation and the availability of alternative solutions. The threat of new entrants, while moderate, is influenced by high switching costs and the need for specialized expertise.

The complete report reveals the real forces shaping Amdocs’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Amdocs, a major player in software and services, benefits from limited bargaining power from its suppliers of generic goods and services. This is because there are many readily available alternatives for items like office supplies, utilities, and standard IT hardware. These are commoditized products, meaning they are easily replaceable, which significantly reduces the leverage any single supplier holds over Amdocs.

Suppliers of specialized technologies, like major cloud infrastructure providers and AI/ML platform developers, hold moderate bargaining power. Amdocs' strategic collaborations with these partners, such as integrating generative AI from providers like NVIDIA, highlight a dependence on their advanced solutions.

As Amdocs deepens its reliance on advanced technologies like AI and cloud-native architectures, suppliers of specialized software components and unique datasets are poised to see their bargaining power increase. These niche inputs, particularly those crucial for training telco-specific AI models, become more valuable as they are harder to replicate or substitute.

The difficulty in switching from these specialized suppliers, coupled with the critical nature of their offerings, strengthens their negotiating position. For instance, the global AI market was valued at approximately $150 billion in 2023 and is projected to grow significantly, indicating a rising demand for specialized AI components and data.

Elevated Power from Highly Skilled Talent

The persistent global shortage of skilled IT professionals, especially in cutting-edge fields like Artificial Intelligence and machine learning, significantly amplifies the bargaining power of these highly specialized individuals. Amdocs, like many technology firms, depends heavily on these experts to drive innovation and deliver its advanced solutions.

This scarcity of in-demand skills directly impacts Amdocs by potentially inflating recruitment expenses and increasing the costs associated with retaining key talent. For instance, in 2024, the demand for AI and ML engineers continued to outstrip supply, leading to salary increases in these specialized roles. Reports from early 2024 indicated that the average salary for an AI engineer could range from $150,000 to $200,000 annually, depending on experience and location.

- Talent Scarcity: A global deficit in AI and machine learning expertise empowers specialized IT professionals.

- Amdocs' Dependence: Amdocs requires these skilled individuals for developing and implementing its innovative offerings.

- Cost Implications: The limited availability of talent can drive up Amdocs' recruitment and retention expenditures.

- Market Trends: In 2024, AI engineer salaries saw significant upward pressure due to high demand and low supply.

Impact of Supplier Concentration

The bargaining power of suppliers for Amdocs is influenced by concentration in specific technology niches. While Amdocs benefits from a broad supplier network, a limited number of providers for critical, deeply integrated components could grant those suppliers increased leverage over pricing and contract terms. This is particularly relevant for specialized software platforms or hardware essential to Amdocs' service delivery.

In 2024, the telecommunications industry continued to see consolidation among key technology providers, potentially increasing the bargaining power of those remaining. For Amdocs, this means that suppliers of advanced cloud infrastructure or specialized AI development tools, if few in number, could command higher prices or dictate more favorable terms. This scenario would directly impact Amdocs' cost structure and its ability to negotiate competitive rates.

- Supplier Concentration Risk: Amdocs faces potential supplier power increases if critical technology inputs are sourced from a small number of providers.

- Impact on Pricing: A concentrated supplier base for essential components can lead to higher input costs for Amdocs.

- Negotiating Leverage: Suppliers of niche, highly integrated technologies may have significant leverage in negotiating contracts with Amdocs.

Suppliers of generic goods and services hold minimal bargaining power over Amdocs due to the wide availability of alternatives. However, providers of specialized technologies, such as major cloud infrastructure and AI platforms, possess moderate to high power, especially as Amdocs integrates advanced solutions like generative AI. This is further amplified by the global shortage of skilled IT professionals in fields like AI and machine learning, driving up recruitment and retention costs for Amdocs.

| Supplier Type | Bargaining Power Level | Key Factors | 2024 Data/Trend |

|---|---|---|---|

| Generic Goods/Services | Low | Many alternatives, commoditized products | Continued availability of standard IT hardware and office supplies. |

| Specialized Tech (Cloud, AI) | Moderate to High | Strategic importance, integration complexity, high development costs | Global AI market projected to reach over $200 billion by end of 2024. |

| Specialized Talent (AI/ML Engineers) | High | Scarcity of skills, critical for innovation | Demand for AI talent outstripped supply, leading to average salaries of $160,000-$220,000+ for experienced professionals in 2024. |

What is included in the product

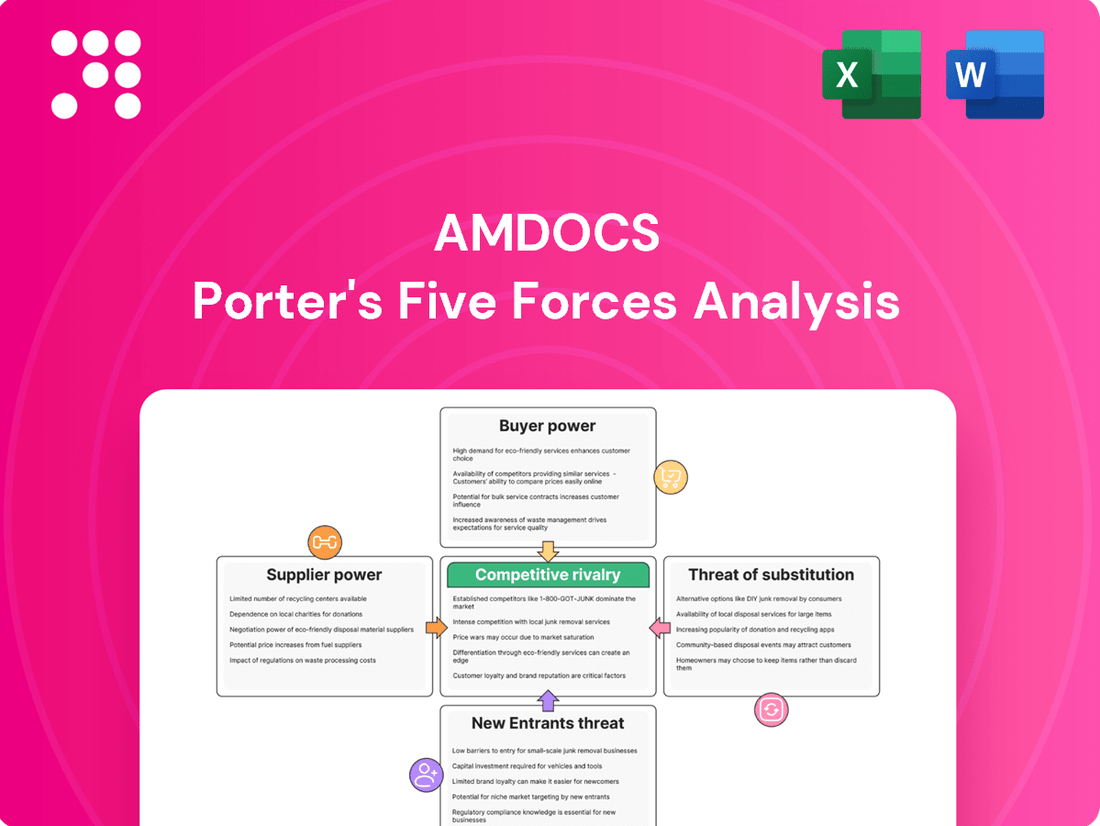

Amdocs' Porter's Five Forces analysis reveals the intensity of competition, buyer and supplier power, threat of new entrants, and the impact of substitutes, providing a comprehensive view of its market environment.

Instantly visualize competitive intensity across all five forces, allowing for rapid identification of strategic vulnerabilities and opportunities.

Customers Bargaining Power

Amdocs' customer base is dominated by large, global communications, media, and entertainment service providers. These major players, such as AT&T and Vodafone, represent significant purchasing power due to their sheer volume and the critical nature of Amdocs' software and services to their operations.

The substantial purchasing volume of these Tier-1 customers gives them considerable leverage when negotiating contracts. They often require highly customized solutions, further enhancing their bargaining position as Amdocs must invest resources to meet these bespoke needs.

In 2023, Amdocs reported that its top ten customers accounted for approximately 40% of its total revenue, underscoring the immense influence these large entities wield in pricing and contract terms.

Large communication service providers (CSPs) possess significant financial clout and technical expertise, enabling them to explore developing their own Business Support Systems (BSS) and Operations Support Systems (OSS) solutions. This capability directly bolsters their bargaining power when negotiating with external vendors like Amdocs.

The pursuit of enhanced control over their technology stack and the ability to deeply customize solutions are key drivers for CSPs considering in-house development. This strategic move allows them to protect their intellectual property and tailor systems precisely to their unique operational needs, thereby increasing their leverage in vendor negotiations.

For instance, in 2024, major telecom operators continued to invest heavily in digital transformation, with many allocating substantial portions of their IT budgets towards in-house capabilities or strategic partnerships that mimic in-house control. This trend exerts pressure on traditional software vendors to offer more flexible and cost-effective solutions.

Customers are increasingly demanding cloud-native and AI-driven solutions, pushing Amdocs to innovate rapidly. This trend empowers buyers, as they can now leverage the availability of advanced, flexible software to modernize their operations and improve customer engagement. For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, indicating a strong customer preference for cloud-based services.

Potential for Vendor Lock-in Mitigation

While Amdocs strives for deep integration and long-term customer partnerships, the telecommunications industry is seeing a significant push towards open APIs and standardized architectures. This shift empowers customers by providing them with greater flexibility to integrate solutions from multiple vendors, directly enhancing their bargaining leverage.

This move towards interoperability means customers are less tethered to a single provider. For instance, a telecom operator might leverage open APIs to seamlessly integrate a new customer management system from a competitor alongside existing Amdocs billing solutions, reducing the perceived switching costs and strengthening their negotiation position for future contracts. This trend directly counters the potential for vendor lock-in, a key factor in customer bargaining power.

- Increased Flexibility: Customers can mix and match solutions from various vendors, reducing reliance on a single provider.

- Reduced Switching Costs: Open standards make it easier and less expensive for customers to change or supplement existing systems.

- Enhanced Negotiation Power: The ability to switch or integrate alternatives gives customers more leverage in pricing and contract terms.

- Industry Trend: Many telecommunications companies are prioritizing open architectures to foster innovation and avoid vendor lock-in, as evidenced by industry initiatives promoting interoperability.

Price Sensitivity and Cost Optimization Pressures

Communication service providers (CSPs) operate in a highly competitive and cost-conscious environment. This drives them to continuously seek ways to reduce their operational expenses. For Amdocs, this means customers will likely push for lower prices and require clear proof that their investments in Amdocs' solutions deliver a strong return on investment.

The intense competition within the telecom sector means CSPs are always looking for ways to optimize their spending. This price sensitivity directly translates into customer pressure on Amdocs regarding pricing structures and the demonstration of tangible value, such as improved efficiency or revenue growth, from Amdocs' offerings.

- Price Sensitivity: CSPs are under constant pressure to manage costs, making them highly sensitive to the pricing of software and services.

- ROI Demands: Customers expect Amdocs to clearly demonstrate the return on investment (ROI) for their purchases, often through metrics like cost savings or revenue uplift.

- Negotiation Power: Large CSPs, with significant spending power, can leverage their position to negotiate more favorable terms and pricing.

- Alternative Solutions: The availability of competing solutions, both from established players and emerging vendors, further empowers customers to demand competitive pricing.

Amdocs' customers, primarily large communication service providers, exert significant bargaining power due to their substantial purchasing volume and the critical nature of Amdocs' solutions. In 2023, the top ten Amdocs customers represented about 40% of total revenue, highlighting their leverage in negotiations. The increasing demand for cloud-native and AI-driven solutions, coupled with a trend towards open APIs, further empowers these customers by offering greater flexibility and reducing vendor lock-in. This allows them to negotiate more favorable terms and pricing, especially given the highly competitive and cost-conscious nature of the telecom industry.

| Customer Segment | Bargaining Power Factor | Impact on Amdocs | Supporting Data (2023/2024) |

|---|---|---|---|

| Tier-1 CSPs | High Purchasing Volume | Strong negotiation leverage on pricing and terms | Top 10 customers accounted for ~40% of revenue |

| CSPs | Demand for Customization & In-house Capabilities | Increased Amdocs' development costs; bolsters customer leverage | Major CSPs investing in digital transformation IT budgets |

| CSPs | Preference for Cloud-Native & Open APIs | Reduces switching costs, increases flexibility, enhances negotiation position | Global cloud market projected over $1.3 trillion by 2024 |

| CSPs | Price Sensitivity & ROI Focus | Pressure for lower prices and clear demonstration of value | Intense competition in telecom sector drives cost optimization |

Preview Before You Purchase

Amdocs Porter's Five Forces Analysis

This preview showcases the comprehensive Amdocs Porter's Five Forces Analysis, detailing the competitive landscape within the telecommunications software and services industry. You are viewing the exact document you will receive immediately after purchase, ensuring full transparency and no hidden surprises. This professionally formatted analysis is ready for immediate use, providing valuable insights into Amdocs' strategic positioning.

Rivalry Among Competitors

Amdocs faces a fiercely competitive landscape in the OSS/BSS sector, with numerous established global players actively seeking market share. This intense rivalry is a defining characteristic of the industry, driving innovation and impacting pricing strategies.

Key competitors like Ericsson, Nokia, and Huawei are significant forces, offering comprehensive solutions that directly challenge Amdocs. These companies, along with specialized providers such as Netcracker Technology, Accenture, and Oracle, contribute to the crowded market and the constant pressure to differentiate.

The market is further intensified by the presence of other strong contenders like Comarch SA, CSG Systems International, and IBM. This broad base of competitors means Amdocs must continually adapt and demonstrate superior value to maintain its position and secure new business in a dynamic environment.

Amdocs thrives on intense competition by consistently innovating, especially in areas like cloud-native technology, 5G deployment, and AI-powered solutions. This drive for newness is crucial for staying ahead in the dynamic telecom software market.

The company's strategy hinges on differentiating its offerings, exemplified by its Customer Experience Suite (CES25). CES25 integrates cutting-edge generative AI and intelligent automation, directly addressing customer needs and reinforcing Amdocs' competitive edge.

This focus on advanced technology allows Amdocs to create unique value propositions, setting it apart from rivals who may not invest as heavily in these transformative areas. For instance, Amdocs' commitment to AI in customer experience solutions aims to provide superior service and operational efficiency for its clients.

Competitive rivalry in the telecommunications software sector is fierce, with companies like Amdocs actively pursuing strategic partnerships and acquisitions. This strategy allows them to quickly expand their service portfolios, reach new customer segments, and integrate innovative technologies. For instance, Amdocs' acquisition of Microsoft's Telco Solutions business in 2023 significantly bolstered its cloud-native capabilities and expanded its reach within the enterprise market.

Market Growth and Evolving Customer Needs

The market for Operations Support Systems (OSS) and Business Support Systems (BSS) is booming, driven by the widespread adoption of 5G, the expansion of the Internet of Things (IoT), and the ongoing digital transformation across industries. This surge in demand presents fertile ground for growth, but it also means more companies are vying for market share, leading to a more competitive landscape as they race to meet changing customer expectations and tap into emerging market segments.

The global OSS/BSS market was valued at approximately $35 billion in 2023 and is projected to reach over $50 billion by 2028, indicating robust growth. This expansion is largely attributed to the need for sophisticated systems that can manage complex network operations and deliver personalized digital services. Companies like Amdocs are navigating this dynamic environment by innovating their offerings to support these new technologies and customer demands.

- Growing Demand: The increasing complexity of telecom networks and the proliferation of digital services are key drivers for OSS/BSS solutions.

- Technological Advancements: 5G deployment and IoT integration necessitate advanced OSS/BSS capabilities for efficient management and billing.

- Competitive Landscape: The market's attractiveness draws in numerous players, intensifying rivalry as companies compete on innovation, pricing, and service quality.

- Customer Expectations: Evolving customer needs for seamless, personalized digital experiences push vendors to continuously enhance their platforms.

Global Presence and Regional Strengths

Competitive rivalry in the telecommunications software sector is intense and global. Amdocs, a major player, demonstrates this with significant operations in North America and Europe, while actively pursuing growth in the Asia-Pacific region. This broad geographic footprint means Amdocs competes with rivals who also possess strong regional advantages, intensifying the battle for market share across diverse territories.

The global nature of the industry means that competitors leverage their established regional strengths to win contracts worldwide. For instance, a company with deep roots and a strong track record in a particular market might use that success to gain traction in new, adjacent regions. This dynamic fuels the overall intensity of rivalry as companies vie for global dominance.

In 2024, the competitive landscape continues to evolve with major players like Amdocs, Oracle, and IBM actively bidding for large-scale digital transformation projects. These contracts, often worth hundreds of millions of dollars, are hotly contested. Amdocs reported strong revenue growth in its fiscal 2024 first quarter, reaching $1.14 billion, indicating its continued success in securing these key deals amidst fierce competition.

- Global Reach: Amdocs competes across North America, Europe, and Asia-Pacific, facing rivals with similar multi-regional presences.

- Regional Strengths: Competitors often capitalize on established relationships and market understanding within specific geographic areas.

- Contract Competition: The fight for large telecommunications software contracts is a primary driver of rivalry, with significant financial stakes.

- Market Share Battles: Companies actively seek to expand their market share by winning new clients and displacing incumbents in various global markets.

Competitive rivalry is a defining characteristic for Amdocs within the telecommunications software sector. The market is populated by numerous global and specialized players, including Ericsson, Nokia, Huawei, Netcracker Technology, Accenture, and Oracle, all vying for market share. This intense competition is fueled by the growing demand for advanced OSS/BSS solutions, driven by 5G adoption and digital transformation initiatives.

Amdocs actively differentiates itself through continuous innovation, particularly in cloud-native technologies, 5G, and AI-powered solutions, as seen with its Customer Experience Suite (CES25). The company's strategy also involves strategic partnerships and acquisitions, such as its 2023 acquisition of Microsoft's Telco Solutions business, to enhance its capabilities and market reach. In its fiscal 2024 first quarter, Amdocs reported $1.14 billion in revenue, underscoring its ability to secure significant contracts amid this competitive pressure.

| Key Competitors | Key Offerings | Market Focus |

| Ericsson | Network infrastructure, OSS/BSS, cloud services | Global telecommunications operators |

| Nokia | Network equipment, software, digital services | Telecommunications and IT industries |

| Huawei | Telecommunications equipment, consumer electronics, cloud | Global ICT infrastructure and smart devices |

| Netcracker Technology | BSS, OSS, SDN/NFV solutions | Service providers worldwide |

| Accenture | Consulting, technology services, operations | Broad range of industries, including telecommunications |

| Oracle | Cloud applications, infrastructure, database | Enterprise software and cloud services |

SSubstitutes Threaten

Large communications service providers increasingly consider in-house development as a significant substitute for solutions like those offered by Amdocs. This strategy allows them to gain complete control over their billing, CRM, and network management systems, fostering deep customization and retaining all intellectual property.

While the initial investment in internal development can be substantial, requiring significant capital and specialized talent, the long-term benefits of tailored solutions and reduced reliance on external vendors make it an attractive proposition. For instance, a major telecom operator might allocate hundreds of millions of dollars to build a proprietary platform, aiming for greater agility and unique competitive advantages.

Generic enterprise software solutions, especially those in customer relationship management like Salesforce, pose a threat. These platforms can be adapted by telecom companies, offering a substitute for Amdocs' specialized offerings. While not as precise, they might appeal to some customers seeking flexibility or lower costs.

The rise of robust open-source software for telecommunications and IT functions poses a significant threat. For instance, projects like ONAP (Open Network Automation Platform) are gaining traction, offering alternatives to proprietary network orchestration solutions. This trend allows companies to assemble best-of-breed solutions from various open-source components rather than relying on a single vendor's integrated suite.

Consulting and System Integrators Offering Custom Solutions

Consulting firms and system integrators represent a significant threat of substitutes for Amdocs. These companies specialize in developing custom software solutions or integrating various existing technologies to meet specific client needs. This can directly compete with Amdocs' offerings, particularly when clients require highly specialized functionalities not readily available in off-the-shelf packages.

For instance, a large telecommunications operator might opt for a bespoke customer relationship management (CRM) system built by a system integrator rather than adapting Amdocs' standard CRM suite. This is especially true if the operator has unique operational workflows or requires integration with a complex legacy IT infrastructure. The ability of these integrators to craft tailored solutions can be highly attractive to clients seeking a perfect fit.

The market for IT consulting and system integration services is substantial. In 2024, the global IT services market, which encompasses these activities, was projected to reach over $1.3 trillion, indicating a vast landscape where substitute solutions are actively developed and deployed. This broad market size underscores the intensity of competition from these alternative service providers.

- Customization Advantage: Consulting firms can deliver highly tailored solutions, directly addressing unique client requirements that Amdocs' packaged software might not fully satisfy.

- Integration Expertise: System integrators excel at combining diverse software and hardware, offering clients a unified solution that may bypass the need for a single vendor like Amdocs.

- Niche Functionality: For clients with very specific or niche operational needs, bespoke development by these substitutes can be more efficient and cost-effective than adapting a broader platform.

- Market Size: The extensive global IT services market, valued in the trillions in 2024, highlights the significant capacity and reach of these substitute providers.

Emergence of New Business Models and Technologies

Disruptive technologies and novel business models represent a significant threat of substitutes for Amdocs' traditional offerings. For instance, specialized Software as a Service (SaaS) platforms tailored for Mobile Virtual Network Operators (MVNOs) are emerging. These can offer functionalities that bypass or simplify the need for comprehensive Operations Support Systems/Business Support Systems (OSS/BSS) suites.

Furthermore, artificial intelligence (AI) driven network automation tools, often developed by non-traditional telecom vendors, present another substitute. These agile, cloud-native solutions can provide more streamlined alternatives to Amdocs' established systems, potentially reducing the reliance on their integrated platforms.

Consider the rise of low-code/no-code platforms that enable faster development of customer-facing applications, potentially substituting some of the customizability Amdocs' BSS traditionally provides. In 2024, the adoption of such platforms across various industries saw a notable increase, indicating a growing market for flexible, rapid deployment solutions.

- Emerging SaaS platforms for MVNOs offer specialized, potentially lower-cost alternatives to comprehensive OSS/BSS.

- AI-driven network automation tools from new vendors can streamline operations, reducing reliance on traditional integrated solutions.

- The increasing adoption of low-code/no-code platforms in 2024 signifies a shift towards more agile and customizable application development, potentially substituting some BSS functionalities.

The threat of substitutes for Amdocs is multifaceted, encompassing in-house development, generic enterprise software, open-source solutions, and specialized consulting services. These alternatives offer varying degrees of customization, cost-effectiveness, and integration capabilities, directly challenging Amdocs' traditional business model.

In 2024, the global IT services market, a proxy for many of these substitute offerings, was estimated to exceed $1.3 trillion, highlighting the immense scale of competition. Furthermore, the increasing adoption of low-code/no-code platforms in the same year indicates a growing trend towards agile, internally developed solutions that can bypass the need for comprehensive vendor suites.

AI-driven network automation and specialized SaaS platforms for niche markets like MVNOs are also emerging as potent substitutes, offering streamlined and potentially more cost-efficient alternatives to integrated OSS/BSS solutions.

| Substitute Category | Key Characteristics | Market Context (2024 Data) |

| In-house Development | Full control, deep customization, IP retention | Significant capital allocation by major operators |

| Generic Enterprise Software (e.g., Salesforce) | Adaptability, potential cost savings, broader functionality | Widely adopted across industries |

| Open-Source Solutions (e.g., ONAP) | Flexibility, best-of-breed assembly, community support | Growing traction in network automation |

| Consulting Firms & System Integrators | Bespoke solutions, integration expertise, niche functionality | Global IT Services Market > $1.3 Trillion |

| Disruptive Technologies (SaaS, AI Automation, Low-code/No-code) | Agility, specialized functions, rapid deployment | Increased adoption of low-code/no-code platforms |

Entrants Threaten

The Business Support Systems (BSS) and Operations Support Systems (OSS) market, where Amdocs operates, necessitates substantial capital outlay. Developing sophisticated, scalable, and secure software capable of managing the intricate operations and high transaction volumes of major telecommunication companies requires immense investment in research and development (R&D) and infrastructure. For instance, in 2023, leading BSS/OSS vendors continued to invest heavily in areas like cloud-native architectures and AI-driven automation, with R&D spending often representing a significant percentage of revenue.

Entering the telecom software and services arena, where Amdocs operates, demands a significant investment in acquiring deep industry expertise. This includes understanding complex network technologies, evolving regulatory landscapes across various regions, and the intricate operational needs of telecommunications providers. Newcomers often struggle to match the nuanced knowledge that established players like Amdocs possess, which is crucial for developing relevant and competitive solutions.

Furthermore, the telecom sector is built on long-term relationships and trust. Major operators typically prefer to work with vendors who have a proven track record and established partnerships. Amdocs, for instance, has cultivated these relationships over many years, making it difficult for new entrants to gain traction without demonstrating similar reliability and commitment. This existing network of trust acts as a substantial barrier.

Customer switching costs and vendor lock-in represent a significant threat to new entrants in the telecommunications software market. Existing communication service providers (CSPs) often rely on deeply integrated, legacy systems, making the process of migrating to a new vendor both costly and complex. For example, a major European CSP might spend tens of millions of dollars and several years to transition their billing systems, a process that deters them from easily switching providers.

Intellectual Property and Proprietary Technology

The threat of new entrants in Amdocs' space is significantly mitigated by the sheer weight of intellectual property and proprietary technology held by established players. Amdocs, for instance, has built a substantial portfolio of patents, unique algorithms, and specialized frameworks. These are crucial in complex areas such as telecommunications billing, enhancing customer experiences, and automating network operations.

Replicating this depth of technological innovation is a formidable challenge for newcomers. It requires not only substantial investment but also years of dedicated research and development to achieve comparable sophistication and efficiency.

- Amdocs' R&D investment in 2023 was approximately $1.2 billion, underscoring the continuous development of its proprietary technology.

- The company holds over 2,000 patents globally, protecting its core innovations in areas like cloud-native solutions and AI-driven customer engagement.

- New entrants would face considerable barriers in developing comparable AI and machine learning models that Amdocs utilizes for predictive analytics and service optimization.

Intense Competition from Established Players

The threat of new entrants in the telecommunications software market is significantly mitigated by the presence of powerful, established companies. Amdocs, for instance, operates in an arena already dominated by a few large, well-resourced players. These incumbents, including Amdocs itself, actively vie for market share through continuous innovation, forging strategic partnerships, and employing competitive pricing strategies. This creates a substantial barrier for any newcomers attempting to gain a foothold.

New entrants would find it incredibly challenging to compete against these entrenched rivals. The established companies possess significant market share, deeply ingrained brand recognition, and extensive customer relationships built over years. For example, as of early 2024, the top five global providers of telecommunications software held a combined market share exceeding 60%, making it difficult for a new entity to capture even a small percentage.

- Dominant Market Share: Established players like Amdocs command a substantial portion of the market, making it hard for new companies to penetrate.

- High Barriers to Entry: Significant capital investment in research and development, sales, and marketing is required to compete effectively.

- Brand Loyalty and Reputation: Existing customers often exhibit strong loyalty to established providers due to proven track records and integrated solutions.

- Economies of Scale: Larger players benefit from economies of scale in production and operations, allowing them to offer more competitive pricing.

The threat of new entrants in Amdocs' market is considerably low due to substantial capital requirements for R&D and infrastructure, coupled with the need for deep industry expertise. These factors, alongside established customer relationships and high switching costs for telecommunications providers, create formidable barriers.

Amdocs' significant investment in proprietary technology and its extensive patent portfolio further deter new competitors. The market is also characterized by dominant incumbents with strong brand recognition and economies of scale, making it difficult for newcomers to gain market share.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High R&D and infrastructure investment needed for sophisticated telecom software. | Significant financial hurdle for new companies. |

| Industry Expertise | Understanding complex network tech, regulations, and operator needs. | New entrants struggle to match incumbent knowledge. |

| Customer Relationships | Long-term trust and proven track records are crucial. | Difficult for new players to build credibility. |

| Switching Costs | High costs and complexity for CSPs to migrate from existing systems. | Discourages CSPs from adopting new vendors. |

| Proprietary Technology | Extensive patents and unique algorithms developed by incumbents. | Replication is a major challenge for newcomers. |

| Incumbent Dominance | Few large players hold significant market share and brand loyalty. | Makes market penetration extremely difficult. |

Porter's Five Forces Analysis Data Sources

Our Amdocs Porter's Five Forces analysis is built upon a robust foundation of industry-specific data, including financial reports from Amdocs and its competitors, market research from leading firms, and insights from technology trade publications.