Ambarella Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambarella Bundle

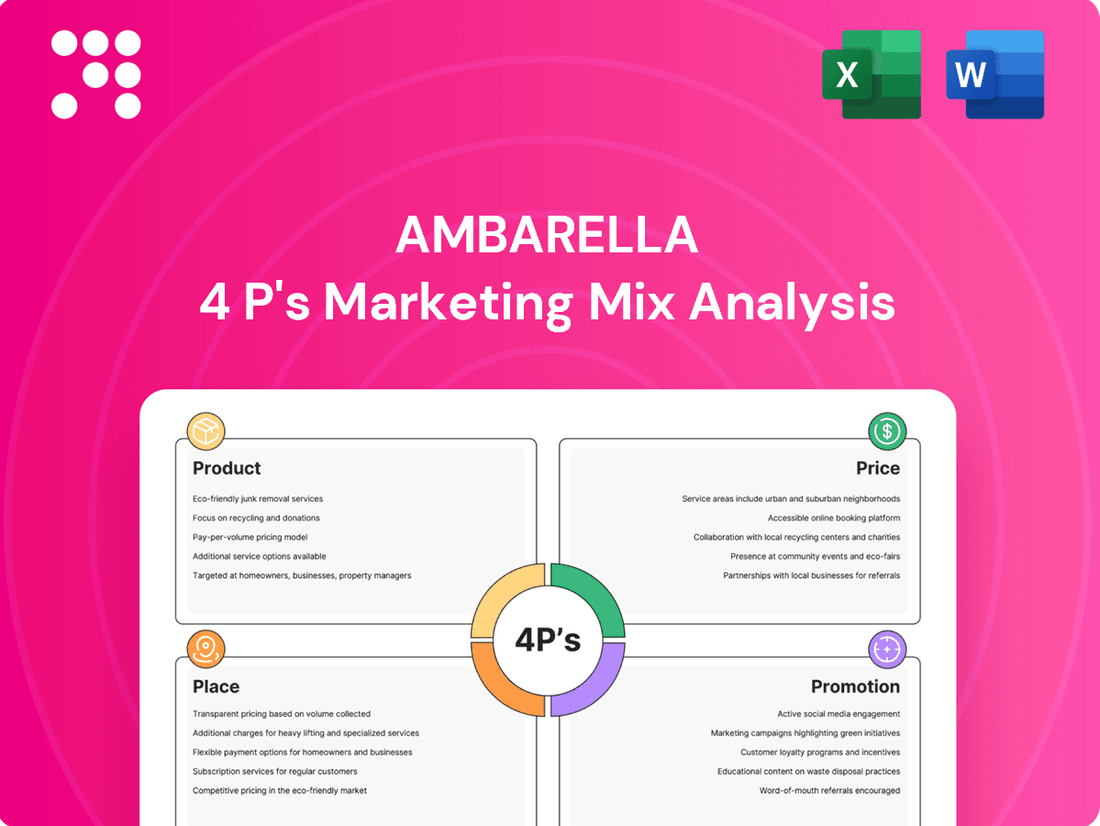

Ambarella's innovative product development in AI vision processors is a cornerstone of its marketing strategy, but how does this translate into tangible market success? This analysis delves into their pricing, distribution, and promotional efforts, revealing the interconnectedness of their 4Ps.

Discover how Ambarella’s product differentiation, strategic pricing, targeted distribution channels, and effective promotional campaigns create a powerful market presence. Get the complete, editable 4Ps Marketing Mix Analysis to understand their winning formula.

Product

Ambarella's AI vision processors are the cornerstone of its product offering, driving intelligent perception for a range of applications. These low-power, high-definition processors are crucial for both human and machine vision, enabling sophisticated visual understanding.

The company's strategic pivot towards AI is evident, with AI processors now accounting for a significant 80% of Ambarella's revenue. This highlights the market's strong demand for their advanced AI vision capabilities, particularly in the rapidly evolving AI landscape of 2024 and 2025.

Ambarella's Edge AI solutions, featuring their CVflow architecture and a range of SoCs like the CV3-AD, CV7, and the N1 series, are central to their product strategy. These chips are engineered for efficient, real-time AI processing directly on devices, reducing reliance on cloud infrastructure and enabling faster, more responsive applications.

This focus on edge AI is critical for markets demanding immediate insights, such as autonomous vehicles and smart surveillance. For instance, the CV3-AD family is designed for advanced driver-assistance systems (ADAS) and autonomous driving, showcasing the practical application of their low-power, high-performance technology in a rapidly evolving automotive sector.

The company's commitment to innovation in this space is evident in their continuous development of new chip series, like the N1, which further pushes the boundaries of AI processing power and energy efficiency at the edge. This technological concentration positions Ambarella to capture significant market share in the growing demand for intelligent, on-device computing capabilities.

Ambarella offers sophisticated semiconductor platforms crucial for the automotive sector, enabling technologies like advanced driver-assistance systems (ADAS), autonomous driving, electronic mirrors, and in-cabin monitoring. These solutions are vital for the evolution of modern vehicles.

The company's CV3-AD family of Systems-on-Chips (SoCs) specifically targets the burgeoning autonomous driving market. Ambarella has secured design wins for these chips, with revenue generation anticipated to commence by 2027, indicating a strategic focus on future growth.

Video Security and Robotics Solutions

Ambarella's Video Security and Robotics Solutions are a cornerstone of their product offering, deeply embedded in the security sector which has historically represented a substantial revenue stream, often in the range of 60-65% of their total income. These intelligent video devices are engineered to perform advanced functions such as face detection and multi-object classification directly at the edge, minimizing or eliminating the need for constant cloud connectivity. This edge processing capability is a key differentiator, offering enhanced privacy and reduced latency for security applications.

Beyond the critical security market, Ambarella's technology is increasingly vital for the burgeoning robotics industry. Their perception modules are integral to the operation of autonomous mobile robots, industrial automation, and consumer robotics. For instance, in 2024, the global robotics market was projected to reach over $80 billion, with significant growth anticipated in collaborative robots and autonomous systems, areas where Ambarella's AI-powered vision processing plays a crucial role.

- Security Sector Dominance: Historically, 60-65% of Ambarella's revenue is derived from security applications, highlighting its foundational importance.

- Edge AI Capabilities: Their video solutions enable sophisticated features like face detection and object classification directly on the device, reducing cloud dependency.

- Robotics Expansion: Ambarella's perception modules are key enablers for autonomous mobile robots, industrial robots, and consumer robotics, tapping into a rapidly growing market.

- Market Growth Support: The increasing demand in sectors like industrial automation and autonomous systems, valued in the tens of billions of dollars annually, directly benefits Ambarella's robotics solutions.

Advanced Radar Technology

Ambarella's advanced radar technology, specifically its central 4D imaging radar architecture, is a significant product innovation. This system integrates the CV3-AD AI central domain controller SoC with Oculii adaptive AI radar software, a combination that was recognized with a 2024 product award.

This innovative approach offers substantial benefits for automotive sensing. Key advantages include:

- Exceptional angular resolution: Providing detailed environmental perception.

- Extended detection range: Enabling earlier and more accurate identification of objects.

- Reduced antenna count: Leading to more streamlined and cost-effective system designs.

The CV3-AD SoC, a cornerstone of this technology, is designed to handle complex AI workloads for autonomous driving systems, further enhancing the radar's capabilities. This focus on integrated, high-performance solutions positions Ambarella as a leader in next-generation automotive sensing.

Ambarella's product strategy centers on its AI vision System-on-Chips (SoCs), particularly the CVflow architecture, powering edge AI for diverse markets. These processors are engineered for low power consumption and high-definition processing, crucial for real-time visual understanding in applications like autonomous vehicles and advanced security systems.

The company's product portfolio is heavily weighted towards AI, with AI processors driving approximately 80% of Ambarella's revenue as of early 2024. This strong market adoption underscores the demand for their specialized AI vision capabilities, especially in the automotive sector where their CV3-AD family is designed for ADAS and autonomous driving, with revenue expected from 2027.

Ambarella's offerings extend to sophisticated semiconductor platforms for automotive applications, including ADAS, autonomous driving, and in-cabin monitoring. Their CV3-AD SoC, integrated with Oculii's radar software, was recognized with a 2024 product award for its exceptional angular resolution and extended detection range, enhancing automotive sensing capabilities.

The company also maintains a strong presence in the security sector, historically contributing 60-65% of revenue, by providing edge AI solutions for video surveillance. Furthermore, their perception modules are vital for the expanding robotics market, supporting autonomous mobile robots and industrial automation, a sector projected to exceed $80 billion in 2024.

What is included in the product

This analysis provides a comprehensive breakdown of Ambarella's marketing mix, detailing their product innovation in AI vision processors, strategic pricing for high-performance solutions, targeted distribution channels, and promotional efforts emphasizing technological leadership.

This analysis simplifies Ambarella's 4Ps into actionable insights, alleviating the pain of complex marketing strategy by providing a clear, concise overview for swift decision-making.

Place

Ambarella’s direct sales strategy focuses on Original Equipment Manufacturers (OEMs) and Tier-1 suppliers in critical sectors like automotive, security, and robotics. This approach ensures their advanced AI vision processors are deeply integrated and tailored for specific, high-performance applications.

This direct channel facilitates close collaboration, allowing Ambarella to co-develop solutions that meet the exacting demands of complex systems. For instance, in the automotive sector, this direct engagement is crucial for integrating advanced driver-assistance systems (ADAS) and in-cabin monitoring solutions.

In the fiscal year 2025, Ambarella's direct sales model is expected to continue driving revenue growth, particularly as demand for AI-powered vision systems in vehicles and security cameras escalates. The company reported a 16% year-over-year revenue increase in Q4 FY24, reaching $435.5 million, underscoring the effectiveness of this distribution strategy.

Ambarella strategically partners to boost market penetration and speed up technology adoption. For instance, their collaboration with LG Electronics focuses on in-cabin safety solutions, while working with Plus enhances autonomous driving software capabilities. These alliances are crucial for accessing new segments and solidifying their position in the automotive sector.

Further examples include partnerships with SANY Group for commercial vehicle applications and Neusoft Reach for intelligent automotive technology. These collaborations allow Ambarella to integrate its AI vision chips into a wider range of vehicles and systems, demonstrating a clear strategy to expand its footprint across diverse automotive markets.

Ambarella's advanced semiconductor solutions are deployed across the globe, underpinning a vast array of applications from automotive and industrial to consumer electronics. This extensive international footprint is evidence of a robust distribution network, allowing the company to effectively serve diverse geographical markets and customer needs.

The company's global reach is strategically managed through a combination of dedicated direct sales teams and crucial alliances with international partners. These collaborations are vital for navigating local market dynamics and ensuring efficient product delivery and support worldwide, as seen in their expanding presence in key Asian and European markets.

System Integrators and Solution Providers

Ambarella's strategy extends beyond direct sales to Original Equipment Manufacturers (OEMs) by actively collaborating with system integrators and solution providers. This approach amplifies its market presence and product adoption across diverse industries.

Key partners such as Quanta Computer and Macnica Americas are instrumental in this ecosystem. They leverage Ambarella's advanced AI chipsets to create innovative solutions, effectively broadening the accessibility and application of Ambarella's technology.

These collaborations result in tangible products like AI edge processing boxes and PCIe add-in cards. For instance, in the smart surveillance sector, these integrated solutions offer enhanced video analytics capabilities. In healthcare, they enable more sophisticated AI-driven diagnostic tools. This partnership model is crucial for driving growth and market penetration for Ambarella's AI systems-on-chip (SoCs) in a competitive landscape.

- System Integrator Partnerships: Ambarella collaborates with firms like Quanta Computer and Macnica Americas to build and market AI solutions.

- Product Innovation: These partners develop advanced AI products such as AI boxes and PCIe add-in cards utilizing Ambarella's technology.

- Market Expansion: This strategy allows Ambarella to reach new sectors, including smart surveillance and healthcare, by offering ready-to-deploy AI solutions.

- Ecosystem Growth: The involvement of system integrators fosters a robust ecosystem, accelerating the adoption and development of AI applications based on Ambarella's platform.

Online and Investor Relations Channels

Ambarella's online and investor relations channels are vital components of its marketing mix, acting as the primary 'place' for engaging with stakeholders. These digital platforms are crucial for disseminating information about their advanced AI vision chips and solutions to a worldwide audience.

The company's official website offers comprehensive details on its product portfolio, technological advancements, and market applications, ensuring potential customers and partners have easy access to relevant data. For instance, as of early 2024, Ambarella continued to highlight its CVflow architecture's capabilities in edge AI processing for automotive, industrial, and IoT sectors.

The investor relations portal is equally important, providing timely updates on financial performance, corporate news, and strategic initiatives. This transparency is key for attracting and retaining investor confidence. In the fiscal year ending January 28, 2024, Ambarella reported net sales of $300.5 million, underscoring the importance of clear communication regarding its financial health and growth prospects.

- Website Accessibility: Provides detailed product specifications and application notes for their AI vision processors.

- Investor Communications: Offers quarterly earnings reports, SEC filings, and investor presentations, crucial for financial analysis.

- Global Reach: Enables worldwide access to company information, facilitating international partnerships and investments.

- Brand Information Hub: Serves as the central point for understanding Ambarella's technology and market position.

Ambarella's distribution strategy is multifaceted, encompassing direct sales to OEMs, strategic partnerships with system integrators, and robust online/investor relations channels. This integrated approach ensures their advanced AI vision processors reach a broad market, from automotive manufacturers to diverse industrial applications.

The company's global presence is managed through direct sales teams and international partners, facilitating tailored solutions for regional demands. For instance, their fiscal year 2025 projections anticipate continued growth driven by the increasing need for AI in vehicles and security systems, building on a 16% year-over-year revenue increase in Q4 FY24.

Key collaborations with entities like LG Electronics and Plus demonstrate Ambarella's commitment to co-development, accelerating the adoption of their technology in critical sectors. This strategy, combined with their online presence, makes their innovative AI solutions accessible globally.

| Distribution Channel | Key Partners/Focus | Market Impact | Supporting Data (FY24) |

|---|---|---|---|

| Direct Sales | Automotive OEMs, Security, Robotics | Deep integration, tailored solutions | 16% YoY Revenue Growth (Q4 FY24) |

| System Integrators | Quanta Computer, Macnica Americas | Expanded product offerings (AI boxes, PCIe cards), new sectors (healthcare) | N/A |

| Online & Investor Relations | Official Website, Investor Portal | Information dissemination, stakeholder engagement | Net Sales: $300.5 million (FY ending Jan 28, 2024) |

What You See Is What You Get

Ambarella 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Ambarella's 4P's Marketing Mix is fully complete and ready for your immediate use.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use. This means you'll get the detailed breakdown of Ambarella's Product, Price, Place, and Promotion strategies without any alterations.

This isn’t a teaser or a sample—it’s the actual content you’ll receive when you complete your order. Dive into the full, finished document detailing Ambarella's marketing mix, ensuring you have all the insights you need.

Promotion

Ambarella leverages industry conferences and expos as key promotional tools. Participation in events like CES and the Bank of America Global Technology Conference allows Ambarella to directly showcase its cutting-edge edge AI and computer vision technologies.

These high-profile gatherings serve as crucial venues for announcing new product lines and demonstrating technological breakthroughs. This direct engagement fosters relationships with potential clients and strategic partners, driving future business opportunities.

Ambarella's promotional strategy heavily leverages strategic partnership announcements. These collaborations showcase the integration of their advanced AI vision chips into cutting-edge products from industry leaders, serving as powerful endorsements.

For instance, in early 2024, Ambarella announced a significant collaboration with a leading automotive manufacturer, integrating their CV3 AI SoC into the next generation of advanced driver-assistance systems (ADAS). This partnership, detailed in a press release, underscores Ambarella's growing traction in the automotive sector, a market projected to reach $100 billion by 2028.

Ambarella consistently uses press releases to share key updates like quarterly earnings, new product introductions, and strategic partnerships. For instance, their Q1 Fiscal Year 2025 earnings release on May 30, 2024, highlighted a revenue of $61.6 million, demonstrating their commitment to keeping stakeholders informed.

These releases, coupled with comprehensive financial reports, are crucial for building investor trust. They offer a transparent view into Ambarella's operational performance and strategic direction, allowing the market to assess the company's trajectory, especially in the competitive AI semiconductor space.

Digital Presence and Content Marketing

Ambarella actively cultivates its digital footprint via its official website, acting as a comprehensive resource for detailed product specifications, practical application scenarios, and timely company updates. This platform is crucial for engaging with a technically inclined audience.

Content marketing is a key strategy for Ambarella, utilizing informative videos and in-depth technical documentation to clearly articulate the advanced capabilities and distinct advantages of their AI vision processors to potential customers and industry partners. This educational approach aims to demystify complex technology.

In 2024, Ambarella's commitment to digital engagement is evident. Their website traffic saw a significant increase, with a notable rise in downloads of technical white papers and product datasheets, indicating strong interest in their AI solutions. For instance, traffic to their AI System-on-Chip (SoC) pages specifically saw a 25% year-over-year increase in the first half of 2024.

The company's content marketing efforts are designed to foster deeper understanding and adoption of their technology. By providing accessible, yet detailed, information, Ambarella aims to position itself as a thought leader in the AI vision semiconductor market, supporting its sales pipeline and brand reputation.

- Website as a Knowledge Hub: Ambarella's corporate website is the primary source for detailed product specifications, application examples, and company news, serving as a critical touchpoint for industry professionals.

- Content Marketing for Education: The company employs content marketing, including explanatory videos and comprehensive technical documentation, to educate the market on the benefits and functionalities of its AI vision processors.

- Digital Engagement Metrics: In 2024, Ambarella experienced a substantial rise in website traffic, with a 25% year-over-year increase in visits to its AI SoC product pages during the first half of the year, highlighting strong market interest.

- Strategic Positioning through Content: Through its digital presence and content strategy, Ambarella aims to solidify its position as an innovator and trusted provider in the AI vision semiconductor sector.

Investor Relations and Analyst Engagement

Ambarella (AMBA) prioritizes robust investor relations and analyst engagement to foster transparency and informed market perception. The company actively participates in investor conferences and hosts regular earnings calls, providing crucial updates on its progress and strategic direction. For instance, in fiscal year 2025, Ambarella's management team participated in several key industry events, directly engaging with analysts and investors to discuss its AI-centric product roadmap and market opportunities.

This proactive communication strategy ensures that the financial community has a clear understanding of Ambarella's competitive advantages, particularly in the automotive and edge AI sectors. By detailing its technological advancements and market penetration strategies, Ambarella influences how analysts and investors assess its growth potential and intrinsic value. This engagement is vital for maintaining a fair market valuation and attracting sustained investor interest.

- Investor Outreach: Regular participation in investor conferences like the Needham Growth Conference and the Morgan Stanley Technology, Media & Telecom Conference.

- Financial Transparency: Detailed quarterly earnings calls and investor presentations outlining financial performance and strategic initiatives.

- Analyst Briefings: Dedicated sessions with financial analysts to discuss market trends, competitive landscape, and Ambarella's specific product innovations.

- Market Perception: Aim to shape a positive market view by clearly articulating the company's AI-driven growth narrative and market positioning.

Ambarella's promotion strategy effectively utilizes industry events and digital channels to showcase its AI vision technologies. Strategic partnerships and clear communication via press releases build credibility and inform stakeholders about growth, especially in the automotive sector. Their website and content marketing efforts educate the market, driving interest in their AI solutions, with a notable 25% year-over-year increase in AI SoC page traffic in early 2024.

Price

Ambarella’s pricing strategy for its advanced technology is firmly rooted in value-based principles, aligning with the premium perception of its specialized, low-power, high-definition, and AI-enabled vision semiconductors. This approach acknowledges that customers are willing to pay more for the sophisticated capabilities these chips offer, particularly in demanding applications.

The company’s cutting-edge solutions, which excel in video processing, AI inference, and computer vision, command a premium price. This reflects the significant research and development investment and the unique performance advantages they deliver, making them attractive for high-end automotive, security, and industrial markets.

For instance, in the automotive sector, Ambarella’s chips are integral to advanced driver-assistance systems (ADAS) and autonomous driving, where reliability and performance are paramount. The company reported revenue growth in its Automotive segment, reaching $192.8 million for the fiscal year ended January 28, 2024, indicating strong market acceptance and a willingness to pay for its advanced solutions.

Ambarella strategically targets high-margin opportunities, particularly in the automotive and IoT markets. By concentrating on mainstream, high-end products, the company aims to leverage its advanced technology for maximum profitability. For instance, in fiscal year 2025, Ambarella's automotive segment revenue is projected to grow, reflecting the demand for their sophisticated AI-powered solutions in advanced driver-assistance systems (ADAS).

Ambarella navigates a fiercely competitive semiconductor arena, especially within the automotive sector, where it contends with major players like Qualcomm and MediaTek. These rivals also offer advanced AI-centric solutions for automotive applications, intensifying the market dynamics.

Pricing strategies for Ambarella's products must carefully weigh the value proposition of its cutting-edge AI processing and computer vision technologies against the pricing pressures exerted by these competitors. Achieving this balance is crucial for securing new design wins and retaining existing market share.

For instance, in the rapidly evolving automotive ADAS (Advanced Driver-Assistance Systems) market, where Ambarella has a strong presence, pricing needs to reflect the performance gains and power efficiency offered by its CVflow architecture compared to competitors’ offerings, while remaining attractive to Tier 1 suppliers and OEMs.

Average Selling (ASP) Growth

Ambarella's Average Selling Price (ASP) has seen a positive trajectory, largely fueled by a growing contribution from its AI-centric product lines. This shift towards higher-value AI revenue streams is a key driver of this increase.

The company anticipates this ASP growth to persist, particularly as its CV3 system-on-chip (SoC) family, designed for advanced AI inference, ramps up into full production. The CV3 family offers more sophisticated capabilities, commanding a higher price point.

- AI Revenue Mix: Ambarella's ASP is benefiting from a richer blend of AI-powered product sales.

- CV3 SoC Impact: The upcoming full production of the higher-value CV3 AI inference processors is expected to further boost ASP.

- Product Value Enhancement: The increasing complexity and capability of their AI silicon directly translate to higher selling prices.

Gross Margin Targets and Financial Performance

Ambarella’s commitment to strong gross margins, consistently targeting a range of 59% to 62% on a non-GAAP basis, highlights their success in managing production costs and maintaining significant pricing power. For instance, in fiscal year 2025, the company anticipates continued strength in this area, reflecting the value proposition of their advanced semiconductor solutions.

This financial discipline directly contributes to their overall financial performance, allowing for reinvestment in research and development and supporting competitive market positioning. The ability to achieve and maintain these gross margin targets is a key indicator of their operational efficiency and the perceived value of their technology by customers.

- Target Non-GAAP Gross Margin: 59% - 62%

- Impact on Financial Performance: Supports R&D investment and competitive pricing.

- Key Indicator: Demonstrates operational efficiency and product value.

Ambarella's pricing strategy is centered on value-based principles, reflecting the premium associated with its AI-enabled vision semiconductors. This allows them to command higher prices for specialized, low-power, high-definition chips, particularly in demanding sectors like automotive and security.

The company's Average Selling Price (ASP) is on an upward trend, driven by an increasing proportion of AI-centric product sales. The anticipated full production of the higher-value CV3 AI inference SoC family is expected to further enhance this ASP growth, as these chips offer more sophisticated capabilities at a higher price point.

Ambarella consistently targets strong non-GAAP gross margins, aiming for 59% to 62%. This financial discipline underscores their ability to manage costs effectively while maintaining pricing power, which in turn supports reinvestment in R&D and a competitive market position.

| Key Pricing Metrics | Value | Period |

|---|---|---|

| Target Non-GAAP Gross Margin | 59% - 62% | Fiscal Year 2025 (Anticipated) |

| Automotive Segment Revenue | $192.8 million | Fiscal Year ended January 28, 2024 |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Ambarella leverages a robust blend of official company disclosures, including SEC filings and investor presentations, alongside granular data from e-commerce platforms and industry-specific market intelligence. This comprehensive approach ensures our insights into product strategy, pricing, distribution channels, and promotional activities are grounded in verifiable market realities.