Alexander & Baldwin Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alexander & Baldwin Bundle

Discover how Alexander & Baldwin leverages its product portfolio, pricing strategies, distribution channels, and promotional efforts to maintain its market leadership. This analysis goes beyond the surface, offering actionable insights into their marketing success.

Unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for Alexander & Baldwin, perfect for business professionals and students seeking strategic depth. Gain a competitive edge by understanding their market approach.

Save valuable time and gain expert-level insights with our fully editable Alexander & Baldwin 4Ps Marketing Mix report. Elevate your understanding of their strategy for your own business planning or academic needs.

Product

Alexander & Baldwin's commercial real estate portfolio is their foundational product, encompassing a variety of income-generating properties. This includes vital grocery-anchored retail centers that serve as community hubs, essential industrial assets supporting local businesses, and long-term ground leases that provide stable revenue streams.

Their strategic focus is solely on the Hawaiian Islands, allowing them to deeply understand and cater to the specific demands of the local economy and population. As of the first quarter of 2024, Alexander & Baldwin's real estate segment reported total revenues of $70.5 million, with a significant portion derived from their diversified commercial holdings.

Alexander & Baldwin's grocery-anchored retail centers are a cornerstone of their real estate offerings, positioning them as Hawaii's leading owner in this sector. These centers, strategically located to serve local communities, focus on essential goods and services, ensuring a steady stream of shoppers and tenant demand. For instance, as of early 2024, their portfolio of these centers consistently demonstrated high occupancy rates, often exceeding 95%, reflecting the enduring appeal of necessity-based retail.

Alexander & Baldwin's industrial assets are a cornerstone of its real estate portfolio, specifically targeting Hawaii's need for warehousing, distribution, and logistics. These properties are vital for the state's economic infrastructure, ensuring the smooth flow of goods. As of the first quarter of 2024, Alexander & Baldwin reported approximately 3.9 million square feet of industrial space in its Hawaii portfolio, demonstrating a significant commitment to this sector.

Ground Leases

Alexander & Baldwin's ground lease portfolio is a key product, offering investors a unique real estate investment. These long-term agreements, often spanning decades, provide a predictable and stable revenue stream for the company. By utilizing their substantial land holdings, primarily in Hawaii, Alexander & Baldwin generates value through these specialized lease arrangements, minimizing direct operational burdens.

The company's strategy leverages its significant land assets, which are a core component of its product offering. This approach allows them to capitalize on their Hawaiian real estate, generating consistent income without the complexities of direct property development or management for the entire term. For instance, as of their Q1 2024 filings, Alexander & Baldwin reported continued strength in their land leasing segment, underscoring the stability of this product.

- Product Offering: Ground leases on extensive Hawaiian landholdings.

- Key Benefit: Stable, long-term income stream with limited operational responsibilities.

- Value Creation: Monetizing vast land assets through specialized leasing structures.

- Financial Impact: Contributes significantly to consistent revenue generation for Alexander & Baldwin.

Real Estate Development Projects

Alexander & Baldwin actively pursues real estate development, strategically expanding its portfolio beyond existing assets. This growth is driven by the entitlement and construction of new commercial spaces, notably industrial buildings, to enhance its gross leasable area. For instance, in the first quarter of 2024, the company reported progress on several development projects, aiming to add approximately 200,000 square feet of industrial space to its holdings by year-end.

These new developments are often secured with pre-leases, a testament to robust market demand and a key indicator of future net operating income. This strategy minimizes vacancy risk and ensures immediate revenue generation upon completion. The company's development pipeline for 2024 and 2025 includes several industrial and mixed-use projects across Hawaii, which are expected to contribute significantly to its long-term financial performance.

- Portfolio Expansion: Focus on adding new commercial and industrial properties.

- Strategic Development: Entitlement and construction of new leasable areas.

- Market Validation: Pre-leasing of new projects signals strong demand.

- Future Income Generation: Developments are designed to boost net operating income.

Alexander & Baldwin's product is its diversified Hawaiian real estate portfolio, primarily consisting of grocery-anchored retail centers, industrial properties, and long-term ground leases. This strategic focus on the Hawaiian Islands allows for deep market understanding and tailored offerings, as evidenced by their Q1 2024 real estate segment revenues of $70.5 million.

| Property Type | Key Characteristics | Q1 2024 Data/Significance | Strategic Value |

|---|---|---|---|

| Grocery-Anchored Retail | Community hubs, essential goods focus | High occupancy (>95%), leading Hawaii owner | Stable shopper traffic, tenant demand |

| Industrial Assets | Warehousing, distribution, logistics | Approx. 3.9 million sq ft in Hawaii | Supports state's economic infrastructure |

| Ground Leases | Long-term land leases | Generates stable, predictable revenue | Monetizes vast land holdings efficiently |

| Development Pipeline | New commercial/industrial space construction | ~200,000 sq ft new industrial space planned for 2024 | Expands portfolio, enhances future NOI |

What is included in the product

This analysis provides a comprehensive examination of Alexander & Baldwin's marketing mix, detailing their strategies for Product, Price, Place, and Promotion with actionable insights.

It offers a deep dive into Alexander & Baldwin's marketing positioning, grounded in actual brand practices and competitive context.

Simplifies Alexander & Baldwin's complex marketing strategy into actionable insights, alleviating the pain of information overload for busy executives.

Provides a clear, concise overview of Alexander & Baldwin's 4Ps, cutting through the noise to address the pain of understanding strategic marketing decisions.

Place

Alexander & Baldwin's (ALEX) 'place' strategy is uniquely concentrated in Hawaii, distinguishing it as the sole publicly traded REIT operating exclusively within the state. This singular focus allows for unparalleled expertise in understanding and capitalizing on the specific economic and demographic nuances of the Hawaiian islands. For instance, as of Q1 2024, ALEX's portfolio is heavily weighted towards Hawaii, with its land portfolio primarily consisting of agricultural lands and development projects across Maui, Kauai, and Oahu, demonstrating their deep commitment to this localized market.

Alexander & Baldwin's strategic distribution channels are anchored by its prime real estate holdings across Hawaii. These properties, including key retail and industrial sites in Kailua, Kapolei, and Maui, are situated to offer maximum accessibility for their target tenants and the communities they serve. As of early 2024, the company's diverse portfolio is designed to be central to Hawaii's business, retail, and industrial hubs, ensuring high visibility and customer traffic.

Alexander & Baldwin (ALEX) directly owns, operates, and manages its extensive portfolio of commercial properties, including retail centers and industrial spaces across Hawaii. This hands-on approach grants them complete control over property quality, tenant experience, and operational efficiency. For instance, in the first quarter of 2024, ALEX reported that its commercial real estate segment achieved an occupancy rate of 95.3%, a testament to their effective direct management in maintaining strong tenant relationships and property appeal.

Inventory Management and Occupancy

Alexander & Baldwin's approach to inventory management, particularly concerning its commercial real estate, centers on achieving and maintaining high occupancy rates. This strategy directly impacts their product offering, ensuring their leasable spaces are actively utilized.

The company has demonstrated success in this area, with recent reports showing leased occupancy rates consistently exceeding 95% across their diverse portfolio. This strong performance highlights effective management of their commercial inventory.

- High Occupancy Rates: Consistently above 95% leased occupancy across their commercial portfolio.

- Steady Rental Income: Maximizes revenue generation through efficient space utilization.

- Asset Optimization: Ensures their real estate assets are performing at peak capacity.

Development as a Growth Channel

Alexander & Baldwin leverages new development projects as a key 'place' strategy to expand its leasable area. These initiatives target high-demand submarkets, effectively creating new points of access for businesses seeking commercial space.

The company's commitment to development is evident in projects like the Komohana Industrial Park and the Maui Business Park. These developments are crucial for Alexander & Baldwin's future growth trajectory, directly addressing market demand for modern industrial and retail facilities.

- New development adds leasable area, expanding market reach.

- Projects like Komohana Industrial Park and Maui Business Park create new business access points.

- These developments are vital for meeting market needs and driving future growth.

Alexander & Baldwin's (ALEX) 'place' strategy is deeply rooted in its exclusive focus on Hawaii, making it a unique player in the REIT market. This specialization allows for a profound understanding of the local economic landscape and consumer behavior. As of the first quarter of 2024, ALEX's portfolio, including its significant land holdings for development, is concentrated across Maui, Kauai, and Oahu, underscoring its commitment to these Hawaiian islands.

ALEX strategically positions its commercial properties, such as retail centers and industrial sites in Kailua, Kapolei, and Maui, to maximize accessibility and visibility within Hawaii's key business districts. This deliberate placement ensures high traffic and convenience for both tenants and customers, as demonstrated by their strong occupancy rates in early 2024.

The company's direct ownership and management of its Hawaiian real estate portfolio, including prime retail and industrial locations, ensures high operational standards and tenant satisfaction. This hands-on approach is reflected in their consistently high occupancy rates, with the commercial real estate segment reporting 95.3% occupancy in Q1 2024, a clear indicator of effective asset management and tenant retention.

| Property Type | Key Locations | Occupancy Rate (Q1 2024) | Strategic Advantage |

|---|---|---|---|

| Commercial Real Estate | Kailua, Kapolei, Maui | 95.3% | High accessibility and visibility in key Hawaiian hubs. |

| Land Holdings | Maui, Kauai, Oahu | N/A (Development Focus) | Exclusive concentration in Hawaii, enabling deep market expertise. |

Preview the Actual Deliverable

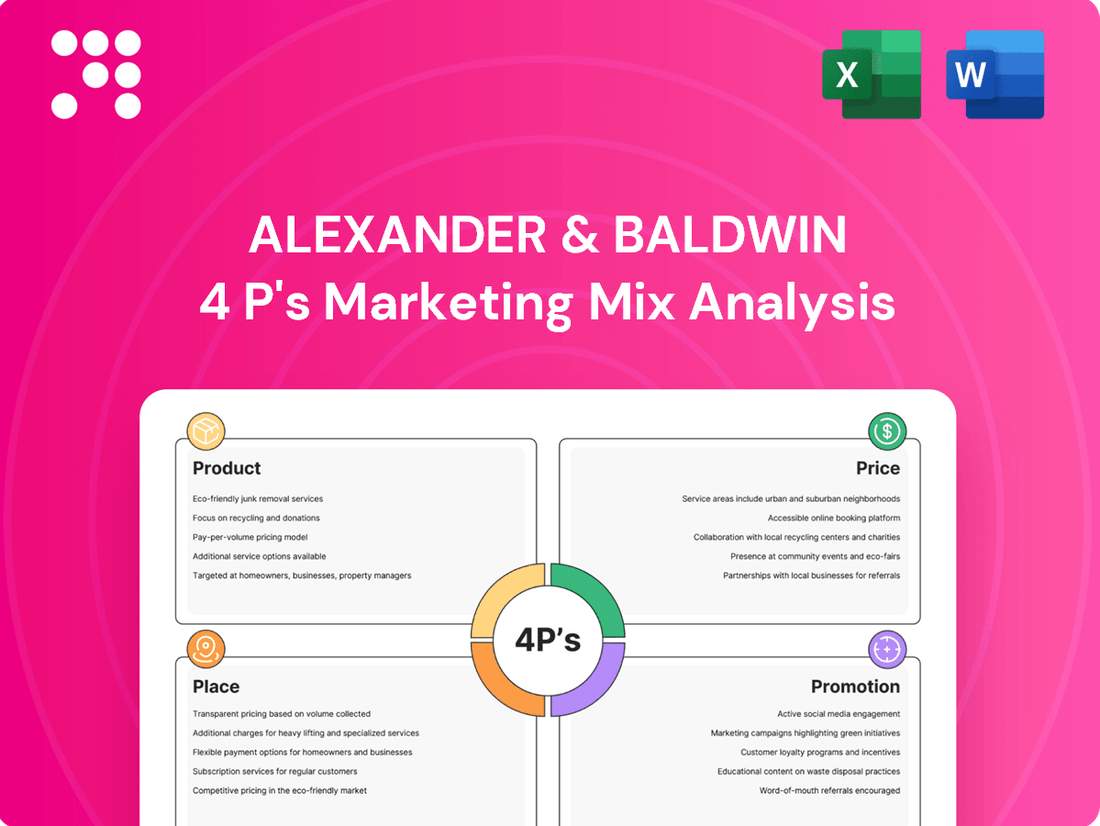

Alexander & Baldwin 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Alexander & Baldwin's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Alexander & Baldwin (ALEX) prioritizes clear communication with its investor base, a key element of its marketing mix. This includes a strong investor relations program featuring quarterly earnings calls and detailed SEC filings, ensuring transparency for financially-literate decision-makers. For instance, their Q1 2024 earnings report highlighted a 2.1% increase in total revenue compared to the prior year, demonstrating their commitment to keeping stakeholders informed.

Alexander & Baldwin (ALEX) utilizes public relations and news releases to strategically communicate key business milestones. For instance, in 2024, the company has issued releases detailing progress on its development projects and providing updates on its financial performance, including dividend declarations. These announcements are disseminated via platforms like PR Newswire, ensuring broad reach within the financial community.

This proactive communication strategy aims to cultivate investor confidence and attract potential business partners by highlighting the company's growth initiatives and financial stability. By consistently sharing significant developments, ALEX reinforces its market presence and fosters transparency, a crucial element for building long-term stakeholder relationships.

Alexander & Baldwin actively participates in key industry conferences, such as Nareit's REITweek Investor Conference, to foster direct engagement with financial professionals and investors. This strategic presence allows them to effectively communicate their robust portfolio, forward-looking strategic initiatives, and promising growth prospects to a targeted audience.

These presentations are crucial for bolstering Alexander & Baldwin's visibility and solidifying their credibility within the competitive real estate investment community. For instance, at the 2024 REITweek, companies often highlight key performance indicators and market outlooks, with many REITs reporting increased investor interest in diversified portfolios, a segment A&B operates within.

Digital Presence and Corporate Website

Alexander & Baldwin (ALEX) leverages its corporate website as a vital component of its marketing mix, offering a robust digital presence for stakeholders. This platform acts as a central repository for critical information, including detailed company profiles and financial reports, ensuring transparency and accessibility for investors and analysts. The investor relations section, a key feature, provides timely updates and essential documents, facilitating informed decision-making for a diverse financial audience.

The company's commitment to a strong online presence is evident in its user-friendly website design, which aims to engage a broad spectrum of financially literate individuals. This digital strategy is crucial for reaching potential investors, business partners, and academic researchers seeking comprehensive data. For instance, as of the first quarter of 2024, ALEX reported total revenues of $220.5 million, a figure readily available on their investor portal, underscoring the website's role in financial communication.

- Website Accessibility: Provides easy access to company profiles, financial documents, and news updates.

- Investor Relations Hub: Dedicated section for investors to find crucial company information and reports.

- Stakeholder Engagement: Serves as a primary platform for disseminating information and interacting with stakeholders.

- Digital Reach: Crucial for reaching a broad audience of informed decision-makers in the financial and business sectors.

Strategic Messaging of Hawaii Focus

Alexander & Baldwin's promotional efforts consistently highlight their distinct Hawaii-focused strategy, underscoring deep local market knowledge. This deliberate positioning serves as a key differentiator, emphasizing their competitive edge within a market characterized by significant entry barriers.

By foregrounding their extensive operational history and profound integration into Hawaii's economic fabric, the company cultivates investor confidence. This narrative appeals to those seeking stable, long-term growth opportunities within this specialized geographic niche. For instance, in early 2024, A&B reported significant progress in its diversified portfolio, with its Hawaii segment continuing to be a cornerstone of its financial performance, demonstrating the tangible benefits of their localized approach.

- Hawaii-Centric Strategy: Emphasizes deep local market expertise.

- Competitive Advantage: Highlights differentiation in a high-barrier market.

- Investor Appeal: Builds trust through long history and economic role.

- Niche Specialization: Targets investors seeking specialized growth.

Alexander & Baldwin's promotional activities are deeply rooted in showcasing their unique Hawaii-centric strategy. This focus highlights their specialized knowledge and competitive advantage in a market with high entry barriers, appealing to investors seeking niche growth opportunities.

Their communication efforts emphasize a long operational history and significant integration within Hawaii's economy, fostering investor confidence. This narrative, supported by financial performance data from their Hawaii segment, reinforces their specialized approach as a key strength.

The company actively engages with stakeholders through industry conferences and a robust corporate website, ensuring transparency and accessibility of information. This multi-channel approach aims to build trust and attract a broad range of financially literate decision-makers.

Alexander & Baldwin's investor relations program, including quarterly earnings calls and SEC filings, provides essential data for informed decision-making. For example, their Q1 2024 revenue of $220.5 million demonstrates their commitment to keeping stakeholders updated on financial performance.

| Promotional Activity | Key Focus | Data/Example |

|---|---|---|

| Hawaii-Centric Strategy | Local market expertise, competitive edge | Hawaii segment as a cornerstone of financial performance (early 2024) |

| Investor Relations | Transparency, stakeholder communication | Q1 2024 revenue: $220.5 million |

| Industry Conferences | Direct engagement, portfolio highlights | Participation in Nareit's REITweek Investor Conference |

| Corporate Website | Information repository, digital presence | Investor relations section with financial reports |

Price

Alexander & Baldwin's commercial real estate pricing hinges on its rental rates and leasing spreads. These spreads, representing the percentage change in rent for new or renewed leases, are a key indicator of market strength and pricing power.

In Q2 2025, the company achieved a robust 6.8% leasing spread. This figure demonstrates strong demand for their properties, enabling them to secure favorable rental increases compared to prior lease agreements.

Alexander & Baldwin's property valuation is intrinsically linked to its Net Operating Income (NOI), a crucial factor in setting rental prices. Strong NOI performance directly supports higher property values and informs their pricing strategy.

The company's ability to generate consistent NOI growth, exemplified by the 5.3% same-store NOI growth reported in Q2 2025, demonstrates effective property management and favorable market conditions. This financial health enables them to adjust rental rates, influencing the overall perceived value of their real estate portfolio.

Alexander & Baldwin's dividend policy is a key component of its shareholder return strategy. As a real estate investment trust (REIT), consistent dividend payouts are crucial for attracting and retaining investors, directly impacting the perceived value and attractiveness of its shares.

The company's commitment to regular distributions, exemplified by the $0.225 per share dividend declared for both the second and third quarters of 2025, signals financial stability and a dedication to returning capital to its owners. This predictable income stream is a significant factor for investors assessing the company's overall financial health and investment potential.

Funds From Operations (FFO) and Guidance

Alexander & Baldwin's (ALEX) Funds From Operations (FFO) is a key metric for understanding its financial health as a real estate investment trust (REIT). For 2025, the company has provided guidance indicating a positive outlook, projecting FFO per diluted share in the range of $1.80 to $1.90. This upward revision reflects management's confidence in their operational performance and ability to generate cash. Strong FFO is crucial as it directly supports ALEX's capacity to distribute dividends to shareholders and fund future growth initiatives, thereby underpinning its market pricing and valuation.

The company's focus on enhancing its FFO is a strategic element of its pricing and market positioning. Positive FFO trends generally translate to increased investor confidence, which can lead to a higher stock valuation. For instance, in the first quarter of 2024, ALEX reported FFO of $0.45 per share, demonstrating solid operational cash generation. This performance, coupled with the optimistic 2025 guidance, suggests that ALEX is effectively managing its portfolio to maximize returns, which is a critical factor in how the market prices its equity.

- FFO Guidance: Projected FFO per diluted share for 2025 is between $1.80 and $1.90.

- Q1 2024 FFO: The company reported $0.45 FFO per share in the first quarter of 2024.

- Dividend Support: Strong FFO directly enables ALEX to maintain and potentially grow its dividend payouts.

- Valuation Impact: Positive FFO performance and guidance are key drivers of investor confidence and equity valuation.

Balance Sheet and Capital Structure

Alexander & Baldwin's pricing strategy is underpinned by a strong balance sheet and prudent capital structure, reflecting disciplined financial management. This financial health provides a solid foundation for their market approach.

Key indicators of this stability include their net debt to adjusted EBITDA ratio and a significant portion of their debt being fixed-rate, which together contribute to a predictable and manageable cost of capital. For instance, as of the first quarter of 2024, Alexander & Baldwin reported a net debt to adjusted EBITDA ratio of 4.6x, demonstrating a manageable leverage level.

- Balance Sheet Strength: A healthy financial position supports investment and pricing flexibility.

- Liquidity: Adequate cash reserves ensure operational continuity and strategic opportunities.

- Debt Structure: A high percentage of fixed-rate debt (approximately 90% as of Q1 2024) insulates the company from interest rate volatility.

- Net Debt to Adjusted EBITDA: A ratio of 4.6x in Q1 2024 indicates controlled leverage.

This robust financial footing grants Alexander & Baldwin the flexibility to make strategic pricing decisions and pursue long-term value creation without undue financial strain.

Alexander & Baldwin's pricing strategy is deeply intertwined with its leasing spreads and property valuations, driven by Net Operating Income (NOI). The company's ability to achieve strong leasing spreads, such as the 6.8% recorded in Q2 2025, directly reflects its pricing power in the market. This strength is further supported by consistent NOI growth, with same-store NOI increasing by 5.3% in the same quarter, indicating effective property management and favorable market conditions that allow for competitive rental rates.

| Metric | Q2 2025 | Q1 2024 | 2025 Guidance |

| Leasing Spread | 6.8% | N/A | N/A |

| Same-Store NOI Growth | 5.3% | N/A | N/A |

| FFO per Diluted Share | N/A | $0.45 | $1.80 - $1.90 |

4P's Marketing Mix Analysis Data Sources

Our Alexander & Baldwin 4P's Marketing Mix Analysis is constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside insights from industry-specific publications and competitive landscape reviews. This ensures a comprehensive understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.