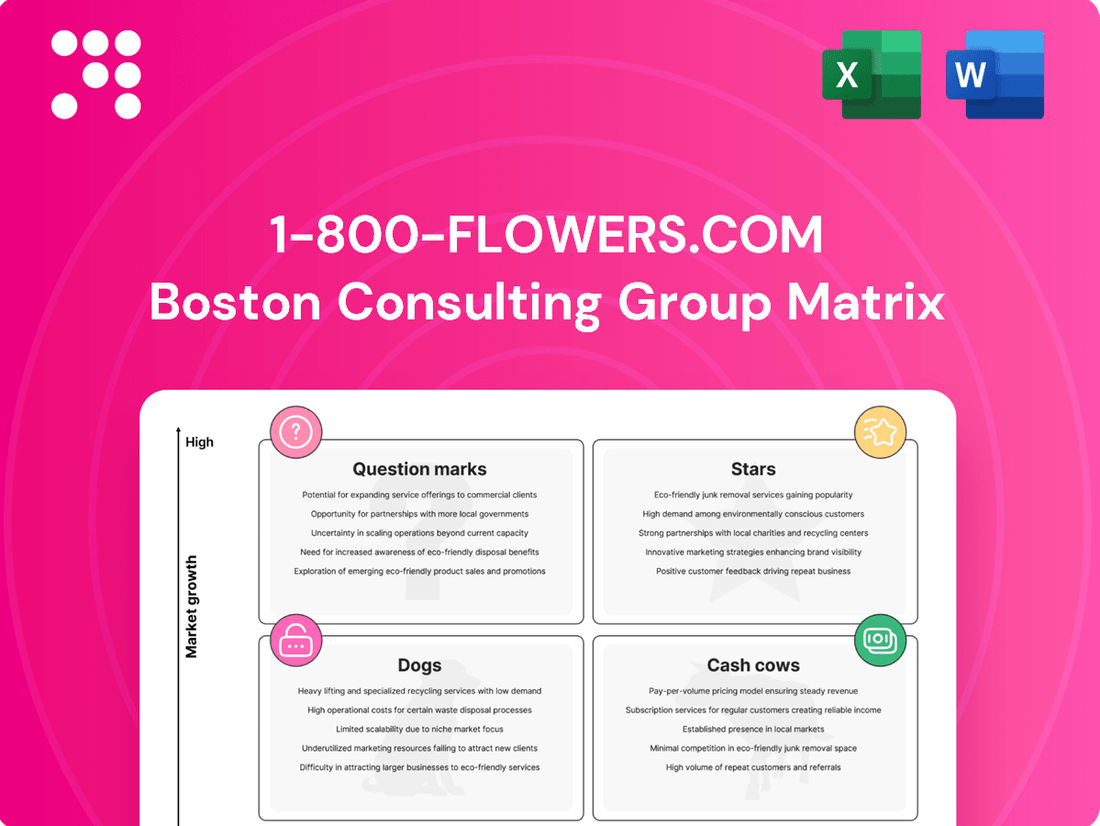

1-800-Flowers.com Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

1-800-Flowers.com Bundle

Curious about 1-800-Flowers.com's product portfolio? Understanding their position as Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic growth. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Harry & David, a prominent gourmet food and gift basket brand under the 1-800-Flowers.com umbrella, holds a significant position in the growing gourmet gifting market. Its premium product offerings and strong seasonal appeal, particularly during holidays, drive substantial revenue, solidifying its status as a key growth contributor.

Despite encountering some disruptions from a new order management system implementation that impacted sales, Harry & David's established brand recognition and market presence indicate its continued strength. This suggests it remains a Star in the BCG matrix, characterized by high market share in a market with robust growth potential.

Cheryl's Cookies, a key brand within 1-800-Flowers.com, commands a significant presence in the premium cookie and baked goods gift market. Its strategic collaborations, like the July 2024 exclusive collection with LoveShackFancy, highlight its commitment to innovation and reaching new customer segments. This brand's ability to secure high-profile partnerships and maintain strong sales in a growing niche positions it as a Star in the company's diversified portfolio.

1-800-Flowers.com's digital sales are booming, representing a significant growth engine. In Q3 2025, digital channels captured 68% of total revenue, a notable increase from 62% in Q3 2024. This strong performance underscores a dominant position within the burgeoning e-commerce gifting sector.

The company's commitment to digital innovation, including AI-powered recommendations, is a key driver for this success. These advancements not only attract new customers but also foster loyalty, reinforcing the digital segment as a Star performer within the BCG matrix.

AI-Driven Personalization

1-800-Flowers.com's investment in AI-driven personalization, evident in services like its GWYN concierge, signals a strategic move into a high-growth potential area. This focus on AI aims to capture a larger market share by offering tailored gift suggestions and improved customer interactions, tapping into the growing demand for personalized retail experiences.

The company's AI initiatives are designed to elevate the customer journey, making it easier for consumers to find the perfect gift. By leveraging artificial intelligence, 1-800-Flowers.com is enhancing its competitive edge in the dynamic gifting market.

- AI Investment: Significant capital allocated to AI development and integration, including the GWYN concierge service.

- Customer Experience: AI enhances personalized recommendations and customer service, driving engagement.

- Market Impact: Aims to increase market share by meeting consumer demand for hyper-personalization.

- Innovation: Positions 1-800-Flowers.com as a leader in AI adoption within the floral and gifting industry.

Strategic Acquisitions in Gifting Sector

1-800-Flowers.com has been actively pursuing strategic acquisitions to solidify its position in the gifting sector. In April 2024, the company acquired Card Isle, an e-commerce greeting card service, and in May 2023, it brought SmartGift, Inc., a gifting platform, into its fold. These moves signal a clear intent to broaden its reach within the diverse gifting market.

Further diversifying its portfolio, 1-800-Flowers.com also recently acquired Scharffen Berger, a premium chocolate company. These acquisitions are designed to capture new growth avenues and enhance its offerings in an ever-changing gift landscape. The integration of these businesses into the company's structure positions them as key players with significant growth potential.

- Card Isle Acquisition (April 2024): Strengthens e-commerce greeting card capabilities.

- SmartGift, Inc. Acquisition (May 2023): Expands presence in digital gifting solutions.

- Scharffen Berger Acquisition: Diversifies into the premium confectionery market.

- Strategic Goal: To capture high-growth opportunities within the evolving gifting ecosystem.

The digital segment of 1-800-Flowers.com, driven by strong e-commerce performance and AI integration, is a clear Star. Digital channels accounted for 68% of revenue in Q3 2025, up from 62% in Q3 2024, highlighting its dominant position in a rapidly growing online gifting market. The company's investment in AI, including its GWYN concierge, further solidifies this segment's high market share and growth potential.

Harry & David and Cheryl's Cookies are also Stars within the 1-800-Flowers.com portfolio. Harry & David, a premium gourmet gifting brand, benefits from strong seasonal demand and brand recognition. Cheryl's Cookies leverages strategic partnerships, such as its July 2024 collaboration with LoveShackFancy, to maintain a strong presence in its niche market.

| Brand/Segment | Market Share | Market Growth | BCG Category |

|---|---|---|---|

| Digital Channels | High | High | Star |

| Harry & David | High | High | Star |

| Cheryl's Cookies | High | High | Star |

What is included in the product

1-800-Flowers.com's BCG Matrix would analyze its diverse offerings, identifying which segments are market leaders (Stars) or mature profit generators (Cash Cows), while also assessing growth potential for new ventures (Question Marks) and underperforming areas (Dogs).

The 1-800-Flowers.com BCG Matrix provides a clear, one-page overview of each business unit's market position, simplifying strategic decisions.

Cash Cows

The flagship 1-800-Flowers.com brand, focusing on fresh-cut flowers and arrangements, is a significant player in the mature floral gifting market. Despite some recent revenue dips, its strong brand recognition and established market share solidify its position as a core asset.

While the consumer floral and gifts segment saw a decline in Q3 2025, 1-800-Flowers.com's extensive infrastructure and national presence mean it continues to be a reliable source of cash flow. This consistent generation of funds allows for strategic reinvestment into other growth areas of the company.

BloomNet, a key service provider for the international floral and gift industry, demonstrates a classic Cash Cow profile within 1-800-Flowers.com's BCG Matrix. It consistently generates strong revenue, with a notable 4.5% increase in Q3 2025, highlighting its stable performance.

Serving florists, BloomNet operates in a mature, low-growth B2B market where it holds a significant market share. This established position, combined with its need for minimal promotional investment, allows it to reliably produce substantial cash flow for the parent company.

The Popcorn Factory, a segment within 1-800-Flowers.com's broader operations, is positioned as a cash cow. This classification stems from its established presence in the gourmet food and gift basket market, a sector that typically experiences consistent demand, especially during peak gifting periods like holidays.

While precise 2024 growth figures for The Popcorn Factory specifically weren't publicly detailed, its operation within a mature market and its well-recognized brand suggest it generates stable profits and reliable cash flow. This stability is characteristic of cash cows, which generally have limited growth potential but offer substantial returns on investment.

Wolferman's Bakery

Wolferman's Bakery, a key component of 1-800-Flowers.com's gourmet food and gift basket segment, operates as a cash cow. Its specialization in gourmet baked goods, especially for breakfast and brunch, has secured a stable position within a mature niche market. This brand benefits from a loyal customer base and consistent demand, generating reliable revenue streams.

The bakery's performance aligns with the characteristics of a cash cow in the BCG matrix, indicating it generates more cash than it consumes. Its established market presence means it requires minimal investment for growth, allowing capital to be redirected to other business units. For instance, in 2024, the gourmet food segment of 1-800-Flowers.com, which includes Wolferman's, continued to be a significant contributor to overall profitability, demonstrating sustained sales even in a competitive landscape.

- Strong Brand Recognition: Wolferman's is recognized for its high-quality, gourmet baked goods, particularly its English muffins.

- Mature Market Niche: It operates in the established gourmet food gifting market, characterized by steady, predictable demand.

- Consistent Cash Flow: The brand generates consistent revenue, supporting the overall financial health of 1-800-Flowers.com.

- Low Investment Needs: As a cash cow, Wolferman's requires limited capital for expansion or marketing, maximizing its profitability.

Simply Chocolate

Simply Chocolate, a brand under the 1-800-Flowers.com umbrella, likely operates as a cash cow. The gourmet chocolate gifting sector is mature, yet it experiences steady demand, particularly around holidays and special events. For instance, the U.S. confectionery market was valued at approximately $46.5 billion in 2023, with a significant portion attributed to chocolate gifts.

The brand benefits from its established product offerings and existing distribution networks. This allows Simply Chocolate to command a strong market share and produce consistent, dependable cash flow. Consequently, it requires minimal reinvestment for growth. In 2024, the online gifting market, which includes chocolate, continued its robust expansion, driven by convenience and personalized options.

- Market Maturity: The chocolate gifting market is mature, indicating stable, predictable demand rather than rapid expansion.

- Consistent Demand: Special occasions and holidays ensure a continuous need for chocolate gifts, supporting reliable sales.

- Established Infrastructure: Simply Chocolate leverages existing product lines and distribution channels, reducing the need for new investment.

- Cash Flow Generation: The brand's strong market position allows it to generate substantial, consistent profits for the parent company.

The 1-800-Flowers.com brand itself, as the core business, functions as a significant cash cow. Despite operating in a mature market, its strong brand equity and extensive customer base ensure consistent revenue generation. This allows it to fund other ventures within the company. In Q3 2025, while the overall consumer floral and gifts segment saw a slight dip, the flagship brand's established infrastructure and national reach continued to be a reliable source of substantial cash flow, contributing significantly to the company's financial stability.

What You’re Viewing Is Included

1-800-Flowers.com BCG Matrix

The BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase, offering a clear strategic overview of 1-800-Flowers.com's product portfolio.

This preview accurately represents the final BCG Matrix report for 1-800-Flowers.com, ensuring you get precisely the analysis-ready content you expect, without any watermarks or demo elements.

Rest assured, the BCG Matrix analysis for 1-800-Flowers.com that you preview is the exact file you will download after completing your purchase, ready for immediate strategic application.

What you see here is the complete BCG Matrix for 1-800-Flowers.com; upon purchase, this professionally designed and thoroughly analyzed document will be yours to use without any alterations or additional content.

Dogs

While 1-800-Flowers.com is largely an online business, its past involvement with physical retail locations, including franchised stores, means some may now be underperforming. These brick-and-mortar outlets, if not in prime locations or updated for today's shoppers, could see reduced customer visits and sales. Such stores might be considered cash traps in a slow retail market, draining resources without substantial profit.

Legacy technology systems within 1-800-Flowers.com's operational framework likely fall into the "Dog" category of the BCG Matrix. These outmoded systems can create significant inefficiencies, driving up operational costs and impeding the company's agility in a rapidly evolving digital landscape.

Recent challenges with new order system implementations, which have negatively impacted gross profit margins and necessitated inventory write-offs, strongly suggest that some underlying technological infrastructure is outdated or poorly integrated. For instance, in fiscal year 2023, the company reported that technology-related expenses, including investments in modernization, were substantial, yet the persistent issues highlight the drag these legacy systems can impose.

Within 1-800-Flowers.com's extensive floral offerings, certain niche or stagnant products, like specialized exotic arrangements or less popular plant varieties, could be considered Dogs. These items often have low sales volume, contributing minimally to the company's overall revenue. For instance, if a particular seasonal bouquet consistently underperforms, failing to meet even modest sales targets, it would fit this category.

These underperforming SKUs tie up valuable inventory and marketing resources without yielding significant returns. In 2024, companies across various retail sectors have focused on SKU rationalization to improve profitability. For 1-800-Flowers, identifying and potentially phasing out these stagnant floral offerings is crucial for optimizing operational efficiency and focusing on more popular, high-margin products.

Ineffective Marketing Channels

Ineffective marketing channels for 1-800-Flowers.com, especially in the highly competitive e-commerce space, are those that consistently show poor conversion rates and elevated customer acquisition costs. These channels become significant cash drains, hindering growth without contributing meaningfully to market share.

When marketing investments in specific areas fail to deliver adequate returns due to misaligned targeting or outdated approaches, it's a clear indicator of an ineffective channel. For instance, if a particular social media platform's ad spend in 2024 yielded a customer acquisition cost of $50 while the average order value remained at $40, that channel would be a prime candidate for re-evaluation or elimination.

- High Customer Acquisition Cost (CAC): Channels where CAC significantly exceeds the customer lifetime value (CLV) are problematic.

- Low Conversion Rates: Campaigns that fail to translate engagement into purchases, such as a display ad campaign with a click-through rate of 0.1% and a conversion rate of 0.05%, are inefficient.

- Outdated Strategies: Relying on marketing tactics that no longer resonate with the target audience, like generic email blasts with low open rates (e.g., below 15% in 2024), drains resources.

- Poor ROI: Marketing efforts that do not generate a positive return on investment, meaning the revenue generated is less than the marketing expenditure, are considered ineffective.

Underutilized or Obsolete Inventory

Underutilized or obsolete inventory represents a significant challenge for 1-800-Flowers.com, particularly for seasonal or perishable items. Products that don't sell quickly can result in substantial write-offs, directly impacting profitability. For instance, in the floral industry, unsold bouquets or plants from past holidays or seasons quickly lose their value.

This aging inventory ties up valuable capital and warehouse space, essentially acting as a 'Dog' in the BCG matrix. These assets consume resources without generating the expected returns. Efficient inventory management is crucial to mitigate these losses and free up capital for more profitable ventures.

- Seasonal Goods: Products tied to specific holidays like Valentine's Day or Mother's Day, if not sold, become obsolete quickly.

- Perishable Inventory: Fresh flowers and plants have a limited shelf life, increasing the risk of obsolescence if demand forecasts are inaccurate.

- Inventory Write-downs: In 2023, many retailers experienced increased inventory write-downs due to shifting consumer demand and supply chain disruptions, a trend that likely continued.

- Carrying Costs: Holding unsold inventory incurs costs such as storage, insurance, and potential spoilage, further reducing profitability.

Within 1-800-Flowers.com's portfolio, certain legacy IT systems and outdated operational processes can be classified as Dogs. These elements often require significant investment to maintain but yield low returns, acting as a drag on overall efficiency and profitability. For example, older customer relationship management (CRM) software that lacks modern integration capabilities can lead to data silos and hinder personalized marketing efforts.

Additionally, physical retail locations that are underperforming, perhaps due to poor location or a lack of modern amenities, also fit the Dog category. These stores may consume resources without generating sufficient sales to justify their continued operation. In 2024, the trend of retail rationalization has seen many companies re-evaluating their brick-and-mortar presence, shedding underperforming units.

Specific product lines that have consistently low sales volume and minimal market growth potential also fall into this category. These might include niche floral arrangements or gift items that no longer resonate with current consumer preferences. Identifying and managing these "Dogs" is crucial for optimizing resource allocation and focusing on more promising business segments.

| Category | Description | Example for 1-800-Flowers.com | Potential Action |

| Dogs | Low market share, low growth potential | Underperforming physical stores, legacy IT systems, stagnant product SKUs | Divest, liquidate, or phase out |

Question Marks

1-800-Flowers.com's continued investment in new AI and conversational commerce initiatives, such as the evolution of GWYN and integrations with smart devices, represents a strategic move into potential star or question mark categories within the BCG Matrix. These areas offer high-growth potential in a rapidly evolving market, but their current market share and profitability are still developing.

For instance, the company reported a 15% increase in digital engagement in early 2024, partly attributed to AI-powered personalization efforts. The success of these initiatives hinges on widespread customer adoption and seamless integration into the overall customer journey, which will determine their future trajectory in the market.

Emerging personalized gifting categories, such as custom jewelry, engraved items, and personalized experiences, represent 1-800-Flowers.com's strategic move into potentially high-growth, but also cash-intensive, market segments. This expansion, potentially bolstered by acquisitions like Things Remembered, positions them to capture a growing consumer demand for unique and sentimental gifts.

These newer personalized gifting areas are considered question marks within the BCG matrix because while the market is expanding, with the personalized gifts market expected to reach $33.5 billion by 2025, 1-800-Flowers.com faces intense competition. Significant investment in marketing and product innovation is necessary to gain traction, meaning these ventures are currently consuming capital without guaranteed returns.

International markets represent potential Question Marks for 1-800-Flowers.com. The global e-commerce flower market is expanding, with projections indicating continued growth, offering a fertile ground for new ventures. For instance, the online flower delivery market in Europe alone was valued at over $5 billion in 2023 and is expected to grow at a CAGR of 7.5% through 2028.

However, venturing into these markets demands substantial capital for establishing robust logistics, tailoring product offerings and marketing to local preferences, and competing with entrenched domestic players. Success is not guaranteed, and the initial returns on these investments are highly uncertain, characteristic of a Question Mark in the BCG matrix.

Subscription-Based Gifting Services

The subscription-based gifting market is a burgeoning area with substantial growth potential, positioning it as a Question Mark for 1-800-Flowers.com. While the company has loyalty programs like Celebrations Passport, a dedicated subscription service for curated gifts or flowers would represent a new strategic direction.

This venture necessitates significant investment to establish a foothold in a competitive landscape, with success hinging on cultivating strong customer loyalty and effectively scaling the subscriber base. The global subscription box market was valued at approximately $22.7 billion in 2023 and is projected to reach $65 billion by 2027, indicating a fertile ground for expansion.

- Market Growth: The subscription e-commerce market is experiencing robust expansion, with a significant portion dedicated to gifting and lifestyle products.

- Investment Needed: Developing and marketing a new subscription service requires upfront capital for platform development, inventory management, and customer acquisition.

- Competitive Landscape: Established players and emerging niche services already compete in this space, demanding a differentiated offering.

- Key to Success: High customer retention rates and efficient scaling of the subscriber base are critical for profitability and market share capture.

New Product Collaborations and Limited-Time Collections

New product collaborations, such as the LoveShackFancy collection with 1-800-Flowers.com and Cheryl's Cookies, are prime examples of 1-800-Flowers.com's potential stars in the BCG matrix. These ventures tap into high-growth, trend-driven markets, aiming to capture new customer bases and generate significant buzz. For instance, the LoveShackFancy partnership likely leveraged the brand's strong social media presence and appeal to a younger demographic, a segment 1-800-Flowers.com actively seeks to engage.

These limited-time collections are designed to create excitement and drive short-term sales, potentially boosting revenue streams in a competitive landscape. While the immediate impact can be substantial, the long-term sustainability and market share gains from such collaborations remain a key factor in determining their true star potential. Success hinges on continuous innovation and flawless execution to maintain customer interest beyond the initial novelty.

Key aspects of these collaborations include:

- Targeting Niche Markets: Collaborations often focus on specific demographics or interest groups, expanding the customer reach beyond traditional floral buyers.

- Brand Synergy: Partnerships are chosen for their complementary brand image and customer overlap, enhancing the appeal of both entities.

- Limited-Time Appeal: The exclusivity and time-bound nature of these collections create urgency and encourage immediate purchase decisions.

- Data Collection and Analysis: These initiatives provide valuable data on new customer acquisition and engagement, informing future marketing strategies.

New personalized gifting categories, such as custom jewelry and engraved items, are considered question marks for 1-800-Flowers.com. While the personalized gifts market is projected to reach $33.5 billion by 2025, these ventures require significant investment to gain traction against strong competition.

International markets also represent question marks, with the global e-commerce flower market expanding. However, establishing logistics and tailoring offerings to local preferences demands substantial capital with uncertain initial returns.

The subscription-based gifting market, though growing with the global subscription box market valued at $22.7 billion in 2023, is another question mark. Developing a dedicated service requires upfront capital and effective scaling to compete.

AI and conversational commerce initiatives, like GWYN, are also question marks. While offering high growth potential, their market share and profitability are still developing, requiring significant investment for customer adoption.

BCG Matrix Data Sources

Our BCG Matrix leverages 1-800-Flowers.com's financial reports, market share data, and industry growth trends to accurately position its product lines.